Professional Documents

Culture Documents

CustomsAct Chapter 15

Uploaded by

bdronok2009Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CustomsAct Chapter 15

Uploaded by

bdronok2009Copyright:

Available Formats

1

CHAPTER XV

SPECIAL PROVISIONS REGARDING BAGGAGE

AND GOODS IMPORTED OR EXPORTED BY POST

139. Declaration by passenger or crew of baggage.- The owner of any

baggage whether a passenger or a member of the crew shall, for the purpose of

clearing it, make a verbal or written declaration of its contents in such manner as

may be prescribed by rules to the appropriate officer and shall answer such

questions as the said officer may put to him with respect to his baggage and any

article contained therein or carried with him and shall produce such baggage and

any such article for examination.

140. Determination of rate of duty in respect of baggage.- The rate of

duty if any, applicable to baggage shall be the rate in force on the date on which

a declaration is made in respect of such baggage under section 139.

141. Bona fide baggage exempt from duty.- The appropriate officer

may, subject to the limitations, conditions and restriction specified in the rules,

pass free of duty any article in the baggage of a passenger or a member of the

crew in respect of which the said officer is satisfied that it is bona fide meant for

the use of such passenger or for making gift.

142. Temporary detention of baggage.- Where the baggage of

passenger contains any article which is dutiable or the import of which is

prohibited or restricted and in respect of which a true declaration has been made

under section 139, the appropriate officer may, at the request of the passenger,

detain such article for the purpose of being returned to him on his leaving

1

[Bangladesh].

143. Treatment of baggage of passengers or crew in transit.- Baggage

of passengers and members of the crew in transit in respect of which a

declaration has been made under section 139, may be permitted by the

appropriate officer, subject to such limitations, conditions and restrictions as may

be specified in the rules, to be so transited without payment of duty.

144. Label or declaration in respect of goods imported or exported

by post to be treated as entry.- In the case of goods imported or exported by

post, any label or declaration which contains the description, quantity and value

1

Subs. by Act XXII of 1980, s. 11 (1) (a), for "Pakistan", w.e.f. 1st July 1980.

2

thereof shall be deemed to be an entry for import or export, as the case may be,

for the purposes of this Act.

145. Rate of duty in respect of goods imported or exported by post.-

(1) The rate of duty, if any, applicable to any goods imported by post shall be

the rate in force on the date on which the postal authorities present to the

appropriate officer the declaration or label referred to in section 144 for the

purpose of assessing the duty thereon.

(2) The rate of duty, if any, applicable to any goods exported by the post

shall be the rate in force on the date on which the exporter delivers such goods to

the postal authorities for exportation.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ra 8353Document28 pagesRa 8353Zhai Soberano86% (7)

- ERP ChecklistDocument29 pagesERP Checklistbdronok2009100% (1)

- 6 Yu Oh vs. CADocument4 pages6 Yu Oh vs. CAEmmanuel C. DumayasNo ratings yet

- 677 SCRA 1 OCA v. MacarineDocument2 pages677 SCRA 1 OCA v. MacarineMylene Gana Maguen Manogan100% (1)

- UST Golden Notes - Negotiable InstrumentsDocument30 pagesUST Golden Notes - Negotiable InstrumentsJoshua L. De Jesus100% (2)

- CustomsAct Chapter 8Document4 pagesCustomsAct Chapter 8bdronok2009No ratings yet

- CustomsAct Chapter 9Document9 pagesCustomsAct Chapter 9bdronok2009No ratings yet

- CustomsAct Chapter 1Document5 pagesCustomsAct Chapter 1Sakib Ex-rccNo ratings yet

- Customs Act Chapter 19Document12 pagesCustoms Act Chapter 19bdronok2009No ratings yet

- WebsiteDocument7 pagesWebsitebdronok2009No ratings yet

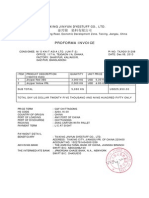

- Pi No - Txjy20131208Document1 pagePi No - Txjy20131208bdronok2009No ratings yet

- Attendance Sheet: Date Day In-Time Signature Out-Time SignatureDocument2 pagesAttendance Sheet: Date Day In-Time Signature Out-Time Signaturebdronok2009No ratings yet

- ERP SoftwareDocument9 pagesERP Softwarebdronok2009No ratings yet

- New Microsoft PowerPoint PresentationDocument1 pageNew Microsoft PowerPoint PresentationpaciilNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Get Kaisered V AKT Franchisel 120-Cv-01037-CFC-JLH - Doc 218 - Finalized SettlementDocument1 pageGet Kaisered V AKT Franchisel 120-Cv-01037-CFC-JLH - Doc 218 - Finalized SettlementFuzzy PandaNo ratings yet

- Affidavit of DesistanceDocument1 pageAffidavit of DesistanceLexa SpecterNo ratings yet

- 07 Nera Vs RimandoDocument4 pages07 Nera Vs RimandoKathNo ratings yet

- Police PowerDocument8 pagesPolice Powershirlyn cuyongNo ratings yet

- Ascaño, Jr. v. Jacinto, Jr. (Legal Ethics Review)Document4 pagesAscaño, Jr. v. Jacinto, Jr. (Legal Ethics Review)Danielle DacuanNo ratings yet

- United States v. Harold Lynch, 792 F.2d 269, 1st Cir. (1986)Document5 pagesUnited States v. Harold Lynch, 792 F.2d 269, 1st Cir. (1986)Scribd Government DocsNo ratings yet

- United States v. Hitson Simon A/K/A "Sacko", 995 F.2d 1236, 3rd Cir. (1993)Document17 pagesUnited States v. Hitson Simon A/K/A "Sacko", 995 F.2d 1236, 3rd Cir. (1993)Scribd Government DocsNo ratings yet

- Agra Et. Al Vs COADocument3 pagesAgra Et. Al Vs COACharisse MunezNo ratings yet

- People vs. Lol-Lo, G.R. No. L-17958Document2 pagesPeople vs. Lol-Lo, G.R. No. L-17958Dwyane Yra DinglasanNo ratings yet

- Prescriptive Period of The AdulteryDocument2 pagesPrescriptive Period of The AdulteryCielo MarisNo ratings yet

- Batla House Encounter Case JudgementDocument46 pagesBatla House Encounter Case JudgementSampath Bulusu67% (3)

- Sibley Lawsuit Against Portland Public SchoolsDocument11 pagesSibley Lawsuit Against Portland Public SchoolsStatesman JournalNo ratings yet

- Proclamation and Attachment Dr. Mohd. Asad MalikDocument9 pagesProclamation and Attachment Dr. Mohd. Asad MalikDeepanshu ShakargayeNo ratings yet

- Cir V Pascor RealtyDocument3 pagesCir V Pascor RealtyCharmaine MejiaNo ratings yet

- Maximilien RobespierreDocument26 pagesMaximilien RobespierreValpo ValparaisoNo ratings yet

- People v. HernandezDocument1 pagePeople v. HernandezAiress Canoy Casimero100% (1)

- Canlas vs. Tubil Full CaseDocument12 pagesCanlas vs. Tubil Full CaseMaritZi KeuNo ratings yet

- A. Douglas Thompson v. Richard Olson, Franklin Noiles, and Stephen Robinson, 798 F.2d 552, 1st Cir. (1986)Document10 pagesA. Douglas Thompson v. Richard Olson, Franklin Noiles, and Stephen Robinson, 798 F.2d 552, 1st Cir. (1986)Scribd Government DocsNo ratings yet

- LABOR Digest Termination CompleteDocument196 pagesLABOR Digest Termination Completeacolumnofsmoke100% (1)

- G.R. No. 200233 JULY 15, 2015 LEONILA G. SANTIAGO, Petitioner, People of The Philippines, RespondentDocument7 pagesG.R. No. 200233 JULY 15, 2015 LEONILA G. SANTIAGO, Petitioner, People of The Philippines, RespondentMaria AndresNo ratings yet

- Article 351. Premature Marriage Title Xiii. Crimes Against HonorDocument18 pagesArticle 351. Premature Marriage Title Xiii. Crimes Against HonorSanchinoDeeNo ratings yet

- Penalties in Criminal Law: PenaltyDocument16 pagesPenalties in Criminal Law: PenaltyBena Candao-Mabang100% (1)

- Examples:: Evidence - Judge Bonifacio - 3B 2009-2010 1Document72 pagesExamples:: Evidence - Judge Bonifacio - 3B 2009-2010 1rosebmendozaNo ratings yet

- Writing Assignment On MSC 207 Green Criminology and Crimes PDFDocument15 pagesWriting Assignment On MSC 207 Green Criminology and Crimes PDFzoweyNo ratings yet

- Until 1: Lab QuestionsDocument2 pagesUntil 1: Lab Questionsindy schalkNo ratings yet

- Policy Analysis-Final Paper08.13Document15 pagesPolicy Analysis-Final Paper08.13jamgarzNo ratings yet