Professional Documents

Culture Documents

USDA Producción de Carne

Uploaded by

NuevosVientos0 ratings0% found this document useful (0 votes)

32 views7 pagesProyección 2014/2015

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProyección 2014/2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views7 pagesUSDA Producción de Carne

Uploaded by

NuevosVientosProyección 2014/2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY

USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT

POLICY

Date:

GAIN Report Number:

Approved By:

Prepared By:

Report Highlights:

Argentine beef exports in 2015 are forecast at 210,000 tons carcass weight equivalent, an increase from the 2014

estimate, but still an insignificant volume for what Argentina has historically exported. Most traders expect the

government to continue limiting beef exports to try to maintain control of domestic beef prices. Beef production

and consumption are projected to remain unchanged.

Ken Joseph

Melinda Sallyards

2014

Livestock and Products Annual

Argentina

9/10/2014

Required Report - public distribution

Commodities:

Production:

Argentine beef production for 2015 is forecast at 2.82 million tons carcass weight equivalent (cwe),

practically unchanged from the previous two years. The cattle stock continues to recover at a slow pace,

after the strong drop in 2010 due to the combination of a strong drought and low profitability. The

number of cattle for slaughter in 2014 and 2015 is 12.8 million head, similar to 2013. The average

carcass weight is also forecast to remain practically unchanged as the business continues to encourage

the slaughter of young, light steers and heifers.

Most analysts agree that high inflation and increasing production costs, plus government limitations on

beef exports, have discouraged cattlemen to expand their herds in the past several years. An extremely

rainy season which began in February 2014 (and is forecast to continue through the end of the year), is

also negatively affecting Buenos Aires, the main cattle producing province. Cow calf operations in the

central and southeastern part of the province are having severe problems with flooded pastures and

difficult-to-inhibited access to the ranches due to the terrible conditions of muddy roads. Many cows

and especially newly born calves have died under these conditions and will condition future pregnancies

for the 2015 calf crop. As a fortunate counterbalance, the rest of the cattle production areas, especially

in the central-north parts of the country, have enjoyed a mild and short winter and are expected to

increase production. The Argentine cattle industry continues to be very dependent on weather.

Both feeder and fed cattle prices are currently very good and they are expected to continue that way in

2015. Contacts indicate that a combination of limited supplies, higher demand, and a change in

administration (there will be presidential elections in October 2015) could trigger some cattle retention.

Cattle prices in the last year increased 80-90 percent, while inflation and production costs only 40

percent. This has allowed cattle producers to recover much needed profitability.

The Argentine cattle sector has gone through great production improvements in the past several years.

Although there are many cattlemen who have their cows and bulls together all year around, there are

many producers who have weaning ratios of over 85 percent. The use of improved genetics (either

through artificial insemination or bulls), better nutritional management and smaller herds than 4-5 years

ago, are resulting in heavier weaning weights and better quality calves which are more efficient in

converting feed into meat. Breeding specialists indicate that the size of commercial cows has increased

somewhat. British breeds (Angus and Hereford) are predominant in the temperate central area, while

the hotter northern area is fully dominated by Brahman crosses, especially Braford and Brangus cattle.

The argentine cattle/beef market continues to encourage the slaughter of young, light steers and heifers.

This is primarily because beef prices in the domestic market are very good (even compared to export

prices), the governments limitation to export, the better conversion that young cattle have vis--vis

older and heavier animals, and the particular demand of local consumers which want beef cuts from

Meat, Beef and Veal

Animal Numbers, Cattle

small animals. The cattle herd nowadays has a small number of steers (half of what there was in 2007),

and a large proportion of cows and calves. Approximately one third of male and female calves weaned

in autumn are slaughtered in spring with a live weight of 270-330 kilos. While a regulation that

prohibits the slaughter of animals weighing less than 300 kilos exists on the books, implementation is

irregular and infrequent.

Based on official data, Argentina has some 204,000 cattle operations. Roughly 152,000 ranches

account for 11.2 million head (with an average of 75 head); 41,000 operations own 20 million head

(with an average of 490 head); and 10,000 operations have 20.5 million head (with an average of 2,050

head). The cattle herd continues to move slowly to the newer production areas which are primarily the

northeastern and northwestern parts of the country. The very productive subtropical pastures allow

cattlemen to expand their operations. There is very good technology available, but many cattlemen are

slow to adopt it. Although there are is still a lot of cattle in the provinces of Buenos Aires, Cordoba and

Santa Fe, row crop production is expected to continue to take over pasturelands in the future.

The use of grain supplementation is expected to increase in 2014 and 2015 as world feed grain prices

have dropped significantly. At current cattle and grain prices, the feedlot business is very profitable.

This is expected to increase the production of custom feedlots and the use of grains in ranches. There

are strong indications that Argentina will soon be declared eligible to export beef to the EU under the

High Quality (grain-fed) Beef 481 quota. The first shipments are expected for early 2015. Although the

government restricts beef exports, there is a lot of enthusiasm of using this quota which allows the

export of a larger number of cuts paying no tax (against exports under the Hilton Quota which usually

use 5-7 cuts and pay a 20 percent import duty). This quota is expected to encourage the production of

heavier steers for this market which most contacts expect will pay a premium. Although returns

nowadays are very good, many feedlots near Buenos Aires city are having serious production

difficulties due to the excess rain and muddy conditions.

Argentina is recognized by the World Organization for animal Health as being free of foot and mouth

disease (FMD) with vaccination and having a negligible risk to BSE. Therefore, it has access to most

markets, with exports to more than 80 countries in 2013. The Animal and Plant Health Service

(APHIS) of the United States announced on August 29, 2014, that Patagonia, the most southern part of

the country, was now eligible to export fresh (and frozen) beef to the US. It also announced that it was

opening a period for comments on a proposed rule to accept Argentine fresh beef from the rest of the

country. Thirteen years ago, the United States closed the market for the importation of Argentine fresh

beef due to a widespread FMD outbreak.

Argentina has large dairy and poultry industries. The local pork sector has been expanding quite

significantly over the past five years, although some frozen pork is still imported to meet a growing

domestic demand. The different livestock industries have plenty of resources to produce and expand in

the future, as Argentina has millions of hectares of pastureland and is one of the worlds top producers

and exporters of grains and oilseeds.

Consumption:

Domestic beef demand for 2015 is forecast at 2.6 million tons (cwe), practically unchanged from 2014,

as production and exports are also expected to remain at somewhat similar levels. This volume

represents an annual per capita consumption of 63 kg.

Consumption of other meats continues to grow. Poultry consumption in 2014 is estimated at 42-44 kg

per capita. Consumption doubled over the past ten years primarily thanks to very competitive prices

vis--vis beef. Consumption of pork has also grown rapidly over the past few years, with per capita

consumption estimated at 12-14 kg. Increased domestic production, improved quality, better

distribution and some marketing have positioned pork as one of the preferred meats. Practically all

supermarket and butcheries nowadays currently sell a variety of pork cuts at prices which on average are

10-15 percent less expensive than beef. Pork still has room to continue growing. Ideally, the local meat

sector envisions a mix of per capita consumption of about 50 kg of beef, 40 kg of poultry and 25 kg of

pork.

Until the mid-1990s, practically all beef consumed in Argentina was grass-fed. Grain high prices and

good crop returns since then have more than tripled the countrys crop area. Several million hectares of

good pastureland were turned into crop land. Therefore, in order to maintain cattle and beef production

producers intensified their cattle production on fewer hectares. Today most of the beef consumed in

Argentina is grain-fed beef. Most consumers have practically not noticed the shift from grass-fed to

grain-fed beef.

The most popular beef cuts are short ribs and flank for the weekend barbecues. Round cuts are also

demanded to prepare sliced, breaded beef (milanesas), which are very popular. Ground beef is also

widely consumed and prepared in many different ways.

Only 30 percent of the total beef is sold through supermarkets. The rest is sold through small

independent butcheries which normally have better prices and a more personal service. Butcheries

usually receive half carcasses, while most supermarkets receive cuts in trays directly from meat packers.

Trade:

Argentine beef exports for 2015 are forecast at 210,000 tons cwe, 20,000 tons cwe more than what is

expected to be shipped in 2014. Trade contacts expect beef exports to continue to be limited by the

government as a way of trying to take pressure off domestic prices, especially in a year with presidential

elections. However, the government also needs to collect as much revenues as possible, since the local

economy is expected to continue under pressure in 2015.

Despite the good situation of the international beef market, with strong demand and good prices, local

exporters in many cases prefer to sell domestically as current prices in dollar terms are many times

better than those of the export market. With inflation running high from 2007 through the present day

(private source 2014 inflation estimates range from 35 to 40 percent), and a steady devaluation of the

peso, Argentina has lost export competitiveness. In addition, beef exports are taxed 15 percent. At

current local market prices, meat packers sell half carcass at the equivalent of US$4,700-5,000 per ton,

bone-in and fat-in. As a point of comparison, exports of chilled, boneless forequarter cuts to Chile are

currently sold at US$5,800 per ton.

Most people in the sector are looking forward to a significant change in policies come December 2015,

when a newly-elected president is sworn in. The few presidential candidates are all aware of the

difficulties the cattle/beef sector is in. In general, they indicate that they will phase down or eliminate

export taxes, free exports, allow the market to operate freely and combat inflation. In addition, many

economists are expecting a peso devaluation over the next few months as the country is spending at a

higher rate than what it is adding to its reserves, and has difficulties obtaining credit from international

sources, due to the recent debt default. If these measures are taken, Argentina would be in a position to

start increasing beef exports and reaching levels more in line with its past export performance

(nowadays, beef exports account for seven percent of total beef production, while in the period 1995-

2005 they averaged 15 percent). However, the cattle production cycle takes several years. The most

rapid way of increasing beef exports is to lower somewhat the high domestic consumption (at a time

where other meats are now good alternatives) and to provide cattlemen with signals to add more weight

on their steers and heifers than current practice.

Argentina in the first seven months of 2014 exported 88,000 tons product weight (pw) of beef, for a

value of US$618 million. Approximately 43 percent of the volume was frozen, boneless beef, with the

main destinations being the Russian Federation, Israel and China. Frozen beef exports during the same

period in 2012 and 2013 were smaller. This is explained by larger shipments to Russia and China.

Boneless, chilled exports in the first seven months of 2014 accounted for 40 percent of the total, with

the EU and Chile being the major destinations. The balance was thermo-processed beef, which

continues to drop year after year. The highest FOB prices are obtained by exports of high value chilled

cuts to the EU and Russia and top sirloin cap to Brazil. Then follow exports to Chile and Israel. The

lowest average prices are exports of frozen beef to Russia and China.

The EU continues to be the main market (in value) for Argentine beef. Most beef exports go under the

30,000 ton Hilton Quota of chilled high value cuts. Exports in 2014 and, especially 2015, are expected

to increase because the Hilton Quota for the period 2014/15 was distributed by the Argentine

Government in a timely manner (the 2013/14 quota was not totally fulfilled) and because Argentina is

expected sometime soon to be eligible for additional exports under the 481 Quota of grain-fed beef.

Local traders indicate that once the EU officially announces Argentinas access, they will need to work

on the approval of local feedlots. The first shipments of beef under the 481 Quota are expected to take

place in the first semester of 2015. However, meat packers are not very enthusiastic about the

performance in 2015 due to the governments export limitation.

Chile continues to be an important market for Argentine traders, although exports in 2015 are forecast to

remain stable. Chile normally buys chilled, boneless forequarters and round cuts from steers or heifers.

Since May 2014, Russia has increased beef imports from Argentina, totaling 12,152 tons pw in the first

seven months of the year, double the volume exported during the same period in 2013. Of that total,

11,950 tons were frozen, boneless beef for industry use at an average FOB price of US$3,532 per ton

and 202 tons of chilled, boneless high quality beef cuts at an average price of US$11,700 per ton.

Although exports of chilled cuts are very small, Argentine product which now has 120 days shelf life is

slowly increasing in importance and is especially focused on restaurants. From Argentinas perspective,

it is difficult to measure the impact of the recent ban imposed by Russia on beef imports from the US,

EU and other countries. Despite limited beef exports, if prices increase, some product could shift from

other markets to attend the Russian market. However, Post does not expect a significant trade impact as

Russia has authorized over 50 additional meat plants in Brazil, which could supply greater volumes of

beef (and other meats) than Argentina. Also Argentina is receiving pressure from the EU not to increase

food sales to Russia due to the current conflict.

Argentine beef exports to China resumed in late 2012 and are projected to continue their rapid growth.

In 2013 Argentina exported directly to Chinese ports 11,300 tons pw of frozen, boneless beef, and in

January-July 2014, 9,000 tons, more than double of the volume exported in the same period last year.

Shin shank, brisket and round cuts are the main products shipped. If exports to the Russian Federation

grow, most likely the Chinese market could be negatively affected as these two markets purchase

similar cuts.

In addition to the APHIS August 28, 2014 decision announcing that the Patagonia region was now

eligible to export fresh beef to the United States, APHIS also opened a 60-day comment period on a

proposed rule to allow as eligible Argentine fresh beef from the rest of the country. The United States

market has been closed to Argentine fresh beef due to the 2001 FMD outbreak in Argentina. The

United States grants Argentina a quota for fresh (and frozen) beef of 20,000 tons pw, which prior to the

closing was fulfilled primarily with manufacturing frozen beef. The United States imports thermo-

processed beef (primarily frozen cooked beef) from Argentina. However, in the past two years,

shipments have dropped dramatically because the very few local plants which produce these products

prefer to export from their sister plants in Brazil. There is currently only one plant that continues to

export small volumes.

Policy:

The cattle/beef sector does not expect any changes in policy before the current government departs in

December 2015. The main tool which the government has used with significant impact on the sector is

the limitation of beef exports every time that the price of cattle increased in a significant way. Beef

exports continue to be taxed 15 percent.

Production, Supply and Demand Data Statistics:

AnimalNumbers,CattleArgentina 2013 2014 2015

MarketYearBegin:Jan2013 MarketYearBegin:Jan2014 MarketYearBegin:Jan2015

USDAOfficial NewPost USDAOfficial NewPost USDAOfficial NewPost

Total Cattle Beg. Stks 51,095 51,095 51,745 51,545

51,695

Dairy Cows Beg. Stocks 2,100 2,100 2,100 2,100

2,100

Beef Cows Beg. Stocks 20,900 20,900 21,500 21,300

21,300

Production (Calf Crop) 14,200 14,000 14,300 13,700

13,900

Total Imports 0 0 0 0

0

Total Supply 65,295 65,095 66,045 65,245

65,595

Total Exports 0 0 0 0

0

Cow Slaughter 3,400 3,400 3,600 3,600

3,700

Calf Slaughter 3,900 3,900 4,000 3,900

3,900

Other Slaughter 5,600 5,600 5,600 5,300

5,200

Total Slaughter 12,900 12,900 13,200 12,800

12,800

Loss 650 650 600 750

650

Ending Inventories 51,745 51,545 52,245 51,695

52,145

Total Distribution 65,295 65,095 66,045 65,245

65,595

1000 HEAD, PERCENT

Meat,BeefandVealArgentina 2013 2014 2015

MarketYearBegin:Jan2013 MarketYearBegin:Jan2014 MarketYearBegin:Jan2015

USDAOfficial NewPost USDAOfficial NewPost USDAOfficial NewPost

Slaughter (Reference) 12,900 12,900 13,200 12,800

12,800

Beginning Stocks 0 0 0 0

0

Production 2,850 2,850 2,900 2,820

2,820

Total Imports 0 0 0 0

0

Total Supply 2,850 2,850 2,900 2,820

2,820

Total Exports 186 186 200 190

210

Human Dom. Consumption 2,664 2,664 2,700 2,630

2,610

Other Use, Losses 0 0 0 0

0

Total Dom. Consumption 2,664 2,664 2,700 2,630

2,610

Ending Stocks 0 0 0 0

0

Total Distribution 2,850 2,850 2,900 2,820

2,820

1000 HEAD, 1000 MT CWE, PERCENT, PEOPLE, KG

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Name:: Read The PassageDocument1 pageName:: Read The PassageamalNo ratings yet

- Patiala Ki RaoDocument24 pagesPatiala Ki RaoMahavirSinghNo ratings yet

- 2018 ASHRAE® Handbook - Refrigeration (SI Edition) Table: Table 10. Change in Respiration Rates With TimeDocument2 pages2018 ASHRAE® Handbook - Refrigeration (SI Edition) Table: Table 10. Change in Respiration Rates With TimeAlexis AlvarezNo ratings yet

- Detailed Lesson Plan in ScienceDocument4 pagesDetailed Lesson Plan in ScienceJether Marc Palmerola GardoseNo ratings yet

- Afforestation, Reforestation and Forest Restoration in Arid and Semi-Arid TropicsDocument260 pagesAfforestation, Reforestation and Forest Restoration in Arid and Semi-Arid TropicsSergio Serch Alberto LagunesNo ratings yet

- Watershed ManagementDocument9 pagesWatershed ManagementShweta ShrivastavaNo ratings yet

- Design Engineering Workshop - Computer - EngineeringDocument15 pagesDesign Engineering Workshop - Computer - EngineeringsugneshhirparaNo ratings yet

- Laportea Aestuans NPADocument1 pageLaportea Aestuans NPAcandide GbaguidiNo ratings yet

- Export Products and AgricultureDocument31 pagesExport Products and AgricultureTariq Hasan60% (5)

- Analysis of Maize Value Addition Among Entrepreneurs in Taraba State, NigeriaDocument9 pagesAnalysis of Maize Value Addition Among Entrepreneurs in Taraba State, NigeriaIJEAB JournalNo ratings yet

- Snap Hydroponics BrochureDocument2 pagesSnap Hydroponics BrochureEduardson Justo100% (1)

- DAO96-40 (IRR of RA 7940) Pursuant to PD No. 705, as amended, and E.O. No. 192 dated 10 June 1987, and in consonance with the sustainable development thrust of the Government, a Log Control and Monitoring System in the DENR is hereby adopted and the following guidelines are hereby issued for the information of all concerned.Document726 pagesDAO96-40 (IRR of RA 7940) Pursuant to PD No. 705, as amended, and E.O. No. 192 dated 10 June 1987, and in consonance with the sustainable development thrust of the Government, a Log Control and Monitoring System in the DENR is hereby adopted and the following guidelines are hereby issued for the information of all concerned.Mditsa1991100% (4)

- Alwyn H. Gentry, USA - Research - 002 PDFDocument2 pagesAlwyn H. Gentry, USA - Research - 002 PDFKarlos RamirezNo ratings yet

- E5 01A ThemeContentsDocument24 pagesE5 01A ThemeContentsmohammadNo ratings yet

- Groundwork 4 TranslationDocument285 pagesGroundwork 4 TranslationMohamed AzabNo ratings yet

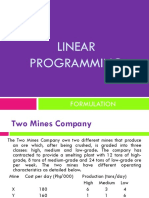

- LINEAR PROGRAMMING Formulation ExampleDocument40 pagesLINEAR PROGRAMMING Formulation ExampleAlyssa Audrey JamonNo ratings yet

- Biotechnology in AquacultureDocument2 pagesBiotechnology in AquacultureNehaNo ratings yet

- Schemes OdishaDocument296 pagesSchemes Odishamahima patraNo ratings yet

- Soil RajeshDocument15 pagesSoil RajeshMir'atun Nissa QuinalendraNo ratings yet

- Hydroponic GardeningDocument12 pagesHydroponic GardeningDilip Sankar Parippay Neelamana100% (1)

- Unit 7: Change and DevelopmentDocument4 pagesUnit 7: Change and DevelopmentIulian ComanNo ratings yet

- Case StudyDocument15 pagesCase StudyJaimell LimNo ratings yet

- San Isidro Farmer's AssociationDocument6 pagesSan Isidro Farmer's Associationauhsoj raluigaNo ratings yet

- Sina Elusakin: (Industrial and General Insurance PLC Nigeria)Document30 pagesSina Elusakin: (Industrial and General Insurance PLC Nigeria)selusakinNo ratings yet

- Presentation 2Document16 pagesPresentation 2Tarun Bhasker ChaniyalNo ratings yet

- B.SC - II Sem IV SyllabusDocument174 pagesB.SC - II Sem IV SyllabusSumit WaghmareNo ratings yet

- Deforestation ReportDocument10 pagesDeforestation ReportElina KarshanovaNo ratings yet

- Activity Sheets in Science Week 8 Quarter 2Document7 pagesActivity Sheets in Science Week 8 Quarter 2Vivian PesadoNo ratings yet

- Strawberry IrrigationDocument5 pagesStrawberry IrrigationrafaelNo ratings yet

- Agam Eco.Document16 pagesAgam Eco.priya19990No ratings yet