Professional Documents

Culture Documents

Settlement of Cases

Uploaded by

s4sahithOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Settlement of Cases

Uploaded by

s4sahithCopyright:

Available Formats

Settlement of Cases

STUDY NOTE - 29

SETTLEMENT OF CASES

This Study Note includes

• Provisions under the Income Tax Act relating to Settlement of Cases

SETTLEMENT OF CASES [SEC. 245A TO 245L]

INCOME-TAX SETTLEMENT COMMISSION [Sec. 245B]

(1) The Central Government shall constitute a Commission to be called the Income-tax Settle-

ment Commission for the settlement of cases under this Chapter.

(2) The Settlement Commission shall consist of a Chairman [and as many Vice-Chairmen and

other members as the Central Government thinks fit] and shall function within the De-

partment of the Central Government dealing with direct taxes.

(3) The Chairman [, Vice-Chairman] and other members of the Settlement Commission shall

be appointed by the Central Government from amongst persons of integrity and outstand-

ing ability, having special knowledge of, and, experience in, problems relating to direct

taxes and business accounts:

Provided that, where a member of the Board is appointed as the Chairman [, Vice-Chairman]

or as a member of the Settlement Commission, he shall cease to be a member of the Board.

JURISDICTION AND POWERS OF SETTLEMENT COMMISSION. [Sec. 245BA]

(1) Subject to the other provisions of this Chapter, the jurisdiction, powers and authority of

the Settlement Commission may be exercised by Benches thereof.

(2) Subject to the other provisions of this section, a Bench shall be presided over by the Chair-

man or a Vice-Chairman and shall consist of two other Members.

(3) The Bench for which the Chairman is the Presiding Officer shall be the principal Bench

and the other Benches shall be known as additional Benches.

(4) Notwithstanding anything contained in sub-sections (1) and (2), the Chairman may

authorise the Vice-Chairman or other Member appointed to one Bench to discharge also

the functions of the Vice-Chairman or, as the case may be, other Member of another Bench.

(5) Notwithstanding anything contained in the foregoing provisions of this section, and sub-

ject to any rules that may be made in this behalf, when one of the persons constituting a

Bench (whether such person be the Presiding Officer or other Member of the Bench) is

unable to discharge his functions owing to absence, illness or any other cause or in the

372 Applied Direct taxation

event of the occurrence of any vacancy either in the office of the Presiding Officer or in the

office of one or the other Members of the Bench, the remaining two persons may function

as the Bench and if the Presiding Officer of the Bench is not one of the remaining two

persons, the senior among the remaining persons shall act as the Presiding Officer of the

Bench :

Provided that if at any stage of the hearing of any such case or matter, it appears to the Presid-

ing Officer that the case or matter is of such a nature that it ought to be heard of by a Bench

consisting of three Members, the case or matter may be referred by the Presiding Officer of

such Bench to the Chairman for transfer to such Bench as the Chairman may deem fit.

[(5A)Notwithstanding anything contained in the foregoing provisions of this section, the Chair-

man may, for the disposal of any particular case, constitute a Special Bench consisting of

more than three Members.]

(6) Subject to the other provisions of this Chapter, the places at which the principal Bench and

the additional Benches shall ordinarily sit shall be such as the Central Government may,

by notification in the Official Gazette, specify [and the Special Bench shall sit at a place to

be fixed by the Chairman.]

[Vice-Chairman to act as Chairman or to discharge his functions in certain circumstances.[Sec

245BB]

(1) In the event of the occurrence of any vacancy in the office of the Chairman by reason of his

death, resignation or otherwise, the Vice-Chairman or, as the case may be, such one of the

Vice-Chairmen as the Central Government may, by notification in the Official Gazette,

authorise in this behalf, shall act as the Chairman until the date on which a new Chair-

man, appointed in accordance with the provisions of this Chapter to fill such vacancy,

enters upon his office.

(2) When the Chairman is unable to discharge his functions owing to absence, illness or any

other cause, the Vice-Chairman or, as the case may be, such one of the Vice-Chairmen as

the Central Government may, by notification in the Official Gazette, authorise in this be-

half, shall discharge the functions of the Chairman until the date on which the Chairman

resumes his duties.]

[Power of Chairman to transfer cases from one Bench to another.[Sec 245BC]

On the application of the assessee or the [Chief Commissioner or Commissioner] and after

notice to them, and after hearing such of them as he may desire to be heard, or on his own

motion without such notice, the Chairman may transfer any case pending before one Bench,

for disposal, to another Bench.]

[Decision to be by majority.[Sec 245BD]

If the Members of a Bench differ in opinion on any point, the point shall be decided according

to the opinion of the majority, if there is a majority, but if the Members are equally divided,

they shall state the point or points on which they differ, and make a reference to the Chairman

who shall either hear the point or points himself or refer the case for hearing on such point or

points by one or more of the other Members of the Settlement Commission and such point or

Applied Direct taxation 373

Settlement of Cases

points shall be decided according to the opinion of the majority of the Members of the Settle-

ment Commission who have heard the case, including those who first heard it.]

Application for settlement of cases. [Sec 245C]

(1) An assessee may, at any stage of a case relating to him, make an application in such form

and in such manner as may be prescribed, and containing a full and true disclosure of his

income which has not been disclosed before the [Assessing] Officer, the manner in which

such income has been derived, the additional amount of income-tax payable on such in-

come and such other particulars as may be prescribed, to the Settlement Commission to

have the case settled and any such application shall be disposed of in the manner herein-

after provided :

Provided that no such application shall be made unless—

(i) the additional amount of income-tax payable on the income disclosed in the application ex-

ceeds three lakh rupees; and

(ii) such tax and the interest thereon, which would have been paid under the provisions of this Act

had the income disclosed in the application been declared in the return of income before the

Assessing Officer on the date of application, has been paid on or before the date of making the

application and the proof of such payment is attached with the application.

(1A) For the purposes of sub-section (1) of this section, the additional amount of income-tax

payable in respect of the income disclosed in an application made under sub-section (1) of

this section shall be the amount calculated in accordance with the provisions of sub-sec-

tions (1B) to (1D).

(1B) Where the income disclosed in the application relates to only one previous year,—

(i) if the applicant has not furnished a return in respect of the total income of that year, then, tax shall

be calculated on the income disclosed in the application as if such income were the total income;

(ii) if the applicant has furnished a return in respect of the total income of that year, tax shall be

calculated on the aggregate of the total income returned and the income disclosed in the application

as if such aggregate were the total income.

[(1C) The additional amount of income-tax payable in respect of the income disclosed in the

application relating to the previous year referred to in sub-section (1B) shall be,—

(a) in a case referred to in clause (i) of that sub-section, the amount of tax calculated

under that clause;

(b) in a case referred to in clause (ii) of that sub-section, the amount of tax calculated

under that clause as reduced by the amount of tax calculated on the total income

returned for that year;

(1D) Where the income disclosed in the application relates to more than one previous year, the

additional amount of income-tax payable in respect of the income disclosed for each of the

years shall first be calculated in accordance with the provisions of sub-sections (1B) and

(1C) and the aggregate of the amount so arrived at in respect of each of the years for which

the application has been made under sub-section (1) shall be the additional amount of

income-tax payable in respect of the income disclosed in the application.

374 Applied Direct taxation

(2) Every application made under sub-section (1) shall be accompanied by such fees as may

be prescribed.

(3) An application made under sub-section (1) shall not be allowed to be withdrawn by the

applicant.

(4) An assessee shall, on the date on which he makes an application under sub-section (1) to the Settle-

ment Commission, also intimate the Assessing Officer in the prescribed manner of having made

such application to the said Commission.

Case Law:

1) Application must disclose undisclosed income: The requirement is that there must be an

income disclosed in a return furnished and undisclosed income disclosed to the Commis-

sion by a petition under section 245C – CIT v. Damani Bros. 259 ITR 475/126 Taxman 321

PROCEDURE FOR RECEIPT OF APPLICATION [Sec. 245D]

(1) On receipt of an application under section 245C, the Settlement Commission shall, within

seven days from the date of receipt of the application, issue a notice to the applicant re-

quiring him to explain as to why the application made by him be allowed to be proceeded

with, and on hearing the applicant, the Settlement Commission shall, within a period of

fourteen days from the date of the application, by an order in writing, reject the applica-

tion or allow the application to be proceeded with:

(2) A copy of every order under sub-section (1) shall be sent to the applicant and to the Com-

missioner.

(2A) Where an application was made under section 245C before the 1st day of June, 2007, but

an order under the provisions of sub-section (1) of this section, as they stood immediately

before their amendment by the Finance Act, 2007, has not been made before the 1st day of

June, 2007, such application shall be deemed to have been allowed to be proceeded with if

the additional tax on the income disclosed in such application and the interest thereon is

paid on or before the 31st day of July, 2007.

Explanation.—In respect of the applications referred to in this sub-section, the 31st day of

July, 2007 shall be deemed to be the date of the order of rejection or allowing the applica-

tion to be proceeded with under sub-section (1).

(2B) The Settlement Commission shall,—

(i) in respect of an application which is allowed to be proceeded with under sub-section (1),

within thirty days from the date on which the application was made; or

(ii) in respect of an application referred to in sub-section (2A) which is deemed to have been

allowed to be proceeded with under that sub-section, on or before the 7th day of August,

2007,

call for a report from the Commissioner, and the Commissioner shall furnish the report

within a period of thirty days of the receipt of communication from the Settlement Com-

mission.

Applied Direct taxation 375

Settlement of Cases

(2C) Where a report of the Commissioner called for under sub-section (2B) has been furnished

within the period specified therein, the Settlement Commission may, on the basis of the

report and within a period of fifteen days of the receipt of the report, by an order in writ-

ing, declare the application in question as invalid, and shall send the copy of such order to

the applicant and the Commissioner:

(2D) Where an application was made under sub-section (1) of section 245C before the 1st day of

June, 2007 and an order under the provisions of sub-section (1) of this section, as they

stood immediately before their amendment by the Finance Act, 2007, allowing the appli-

cation to have been proceeded with, has been passed before the 1st day of June, 2007, but

an order under the provisions of sub-section (4), as they stood immediately before their

amendment by the Finance Act, 2007, was not passed before the 1st day of June, 2007, such

application shall not be allowed to be further proceeded with unless the additional tax on

the income disclosed in such application and the interest thereon, is, notwithstanding any

extension of time already granted by the Settlement Commission, paid on or before the

31st day of July, 2007.

(3) The Settlement Commission, in respect of—

(i) an application which has not been declared invalid under sub-section (2C); or

(ii) an application referred to in sub-section (2D) which has been allowed to be further

proceeded with under that sub-section,

may call for the records from the Commissioner and after examination of such records,

if the Settlement Commission is of the opinion that any further enquiry or investiga-

tion in the matter is necessary, it may direct the Commissioner to make or cause to be

made such further enquiry or investigation and furnish a report on the matters cov-

ered by the application and any other matter relating to the case, and the Commis-

sioner shall furnish the report within a period of ninety days of the receipt of commu-

nication from the Settlement Commission:

(4) After examination of the records and the report of the Commissioner, if any, received

under—

(i) sub-section (2B) or sub-section (3), or

(ii) the provisions of sub-section (1) as they stood immediately before their amendment

by the Finance Act, 2007,

and after giving an opportunity to the applicant and to the Commissioner to be heard,

either in person or through a representative duly authorised in this behalf, and after

examining such further evidence as may be placed before it or obtained by it, the

Settlement Commission may, in accordance with the provisions of this Act, pass such

order as it thinks fit on the matters covered by the application and any other matter

relating to the case not covered by the application, but referred to in the report of the

Commissioner.

(4A) The Settlement Commission shall pass an order under sub-section (4),—

(i) in respect of an application referred to in sub-section (2A) or sub-section (2D), on or

before the 31st day of March, 2008;

376 Applied Direct taxation

(ii) in respect of an application made on or after the 1st day of June, 2007, within twelve

months from the end of the month in which the application was made.

(5) Subject to the provisions of section 245BA, the materials brought on record before the

Settlement Commission shall be considered by the Members of the concerned Bench be-

fore passing any order under sub-section (4) and, in relation to the passing of such order,

the provisions of section 245BD shall apply.

(6) Every order passed under sub-section (4) shall provide for the terms of settlement includ-

ing any demand by way of tax, penalty or interest, the manner in which any sum due

under the settlement shall be paid and all other matters to make the settlement effective

and shall also provide that the settlement shall be void if it is subsequently found by the

Settlement Commission that it has been obtained by fraud or misrepresentation of facts.

(6A) Where any tax payable in pursuance of an order under sub-section (4) is not paid by the

assessee within thirty-five days of the receipt of a copy of the order by him, then, whether

or not the Settlement Commission has extended the time for payment of such tax or has

allowed payment thereof by instalments, the assessee shall be liable to pay simple interest

at one & one-fourth percent on the amount remaining unpaid from the date of expiry of

the period of thirty-five days aforesaid.

(7) Where a settlement becomes void as provided under sub-section (6), the proceedings with

respect to the matters covered by the settlement shall be deemed to have been revived

from the stage at which the application was allowed to be proceeded with by the Settle-

ment Commission and the income-tax authority concerned, may, notwithstanding any-

thing contained in any other provision of this Act, complete such proceedings at any time

before the expiry of two years from the end of the financial year in which the settlement

became void.

(8) For the removal of doubts, it is hereby declared that nothing contained in section 153 shall

apply to any order passed under sub-section (4) or to any order of assessment, reassess-

ment or recomputation required to be made by the Assessing Officer in pursuance of any

directions contained in such order passed by the Settlement Commission and nothing

contained in the proviso to sub-section (1) of section 186 shall apply to the cancellation of

the registration of a firm required to be made in pursuance of any such directions as afore-

said.

Case laws:

1). Effect of omission of sub-section (1A) of section 245D: Where the applications of the respon-

dents were not proceeded with only because of the objection raised by the Commissioner un-

der sub-section (1A), having regard to the fact that the said sub-section (1A) was removed from

the statute book subsequent to 1991, there was no reason why the Settlement Commission

could not have entertained fresh applications under section 245C and this would not be a case

of review at all - CIT v. Bhaskar Picture Palace 113 Taxman 109.

2). Power to over-rule objections is procedural: Amendment of section 245D with effect from 1-

4-1979 empowering Settlement Commission to overrule objections of Commissioner was pro-

cedural and an order passed by Commissioner under section 245D prior to aforesaid amend-

Applied Direct taxation 377

Settlement of Cases

ment without giving applicant an opportunity of hearing was a nullity being passed in viola-

tion of principles of natural justice and after amendment of section 245D with effect from 1-4-

1979 assessee was entitled to be heard on objections of Commissioner.R.B. Shreeram Durga Prasad

and Fatechand Nursing Das v. Settlement Commission (IT & WT) 176 ITR 169/43 Taxman 34.

PROVISIONAL ATTACHMENT TO PROTECT REVENUE [Sec. 245DD]

If during the pendency of any proceedings the Commission is of the opinion that for the pur-

pose of protecting the interests of the revenue, it is necessary to do so, it may attach provision-

ally for six months any property belonging to the applicant in the manner provided in the

Second Schedule to the Act. Such attachment shall not extend in any case more than two years.

REOPENING OF COMPLETED PROCEEDINGS [Sec. 245E]

If the Commission is of the opinion that for the proper disposal of the case pending before it, it

is necessary or expedient to reopen any proceedings connected with the case but which has

been completed by any income-tax authority before the application was made, it may, with the

concurrence of the applicant reopen such proceedings and pass such orders thereon as it thinks

fit. However, no proceeding shall be reopened by the Commission under this provision if the

period between the end of the assessment year to which such a proceeding relates and the date

of application for settlement u/s. 245C exceed nine years.

Case Law:

1) Others/matters relating to jurisdiction of Settlement Commission: Failure on the part of the

petitioner to deduct tax at source does not come within purview of section 245C(1). Section

245E contemplates reopening of completed proceedings not for benefit of assessee but in the

interest of the revenue -CIT v. Paharpur Cooling Towers (P.) Ltd. 85 Taxman 357.

EXCLUSIVE JURISDICTION OF THE COMMISSION OVER THE ADMITTED APPLICA-

TIONS [Sec. 245F]

After an application made u/s. 245C has been allowed to be proceeded with, the Commission

will have exclusive jurisdiction over the case till an order u/s. 245D(4) has been made. During

this period the Commission will have all the powers vested in an income-tax authority under

the Act. However, in the absence of any express direction to the contrary by the Settlement

Commission nothing contained in sec. 245F shall effect the operation of any other provisions of

the Act requiring the applicant to pay tax on the basis of Self Assessment in relation to the

matters before the Settlement Commission.

Case Law:

1)A final decision, however wrong, is still final and its binding force does not depend upon its correct-

ness Capital Cables (India) (P.) Ltd. v. Income-tax Settlement Commission 267 ITR 528/139 Taxman

332

INSPECTION ETC. REPORTS [Sec. 245G]

No persons shall be entitled to inspect or obtain copies of any reports made by any income-tax

authority to the Settlement Commission but the Commission may in its discretion furnish cop-

ies thereof to any such person or an application made to in this behalf. However, for the

378 Applied Direct taxation

purposes of enabling any person whose case is under consideration to rebut any evidence on

record against him in any such report, the Commission shall furnish him a certified copy of

any such report if the applicant makes an application in this behalf. The copies will be sup-

plied to the applicant on payment of the prescribed fee.

IMMUNITY FROM PROSECUTION AND PENALTY [Sec. 245H]

If the Commission is satisfied that any person who made the application for settlement has

cooperated with the Commission in the proceedings before it and has made a full and true

disclosure of his income and the manner in which such income has been derived, it may grant

immunity from prosecution under the Income-tax Act or under the Indian Penal Code or un-

der any other Central Act as also the imposition of any penalty under the Income-tax Act with

respect to the case covered by the settlement. However, w.e.f. 1.6.2007 no such immunity shall

be granted by the Commission in cases where the proceedings for prosecution for any such

offence have been instituted before the date of receipt of the application under Section 245C.

An immunity granted by the Commission shall stand withdrawn if the applicant fails to pay

the sum specified in the order of settlement within the time specified in such order or within

such further time as may be allowed by the Commission or fails to comply with any other

condition subject to which the immunity was granted. The immunity may also be withdrawn

if the Commission is satisfied that the applicant has, in the course of proceedings, concealed

any particular material to the settlement or had given false evidence. Once the immunity

granted is withdrawn, the assessee may be tried for offence with respect to which the immu-

nity was granted or for any other offences of which he appears to have been guilty in connec-

tion with the Settlement and shall also become liable to imposition of any penalty under this

Act to which such person would have been liable, had not such immunity been granted.

POWER OF SETTLEMENT COMMISSION TO SEND A CASE BACK TO THE ASSESS-

MENT OFFICER IF THE ASSESSEE DOES NOT COOPERATE [Sec. 245HA]

W.e.f. 1.6.2002 the power of Settlement Commission of sending the case back to the Assessing

officer for non-cooperation of the applicant has been withdrawn and thereby requiring the

Settlement Commission is required to decide the Settlement application admitted by it.

Credit for tax paid in case of abatement of proceedings [Sec. 245HAA]

Where an application made under section 245C on or after the 1st day of June, 2007, is rejected under

sub-section (1) of section 245D, or any other application made under section 245C is not allowed to be

proceeded with under sub-section (2A) of section 245D or is declared invalid under sub-section (2C) of

section 245D or has not been allowed to be further proceeded with under sub-section (2D) of section

245D or an order under sub-section (4) of section 245D has not been passed within the time or period

specified under sub-section (4A) of section 245D, the Assessing Officer shall allow the credit for the tax

and interest paid on or before the date of making the application or during the pendency of the case before

the Settlement Commission.

Applied Direct taxation 379

Settlement of Cases

ORDER OF THE SETTLEMENT COMMISSION TO BE CONCLUSIVE [Sec. 245-I]

Order passed by the Commission u/s. 245D(4) is conclusive as to the matter stated therein and

no matter covered by such order shall be reopened in any proceeding under this Act or under

any other law for the time being in force save as provided under Chapter XIXA. The order of

the Commission can only be challenged through a written petition under Article 226 of the

Constitution of India in a High Court or through Special Leave Petition under Article 136 in the

Supreme Court on the ground that while making such order, principles of the natural justice

has been violated or mandatory procedural requirements of law were not complied with or if it

is found that there is no nexus between the reasons given and the decision taken.

PAYMENT OF THE SUMS DUE UNDER ORDER OF SETTLEMENT [Sec. 245J]

Any sum specified in an order of settlement passed u/s. 245D(4) may be recovered and any

penalty for default in making payment of such sum may be impose and recovered in accor-

dance with the provisions of Chapter XVII by the Assessing officer having jurisdiction over the

person who made the application for settlement u/s. 245C.

BAR ON SUBSEQUENT APPLICATION FOR SETTLEMENT IN CERTAIN CASES

[Sec. 254K]

In cases where an order has been passed u/s. 245D(4) providing for the imposition of penalty

on the ground of concealment of particulars of income or after passing the order u/s.245D(4),

such person is convicted of any offence under Chapter XXII of the Income-tax Act in relation to

that case of the case of such person is sent back to the Assessing officer u/s. 245BA, he shall not

be entitled to apply for Settlement u/s. 245C in relation to any other matter.

PROCEEDINGS BEFORE THE COMMISSION TO BE JUDICIAL PROCEEDINGS [Sec.

245L]

Any proceedings under chapter XIXA before the Commission shall be deemed to be a judicial

proceeding within the meaning of sec. 193 and 228, and for the purposes of sec. 196 of the

Indian Penal Code.

ADVANCE RULING

Finance Act, 1993 inserted a chapter XIX-B in the Income-tax Act, 1961 to provide provisions of

Advance Rulings to avoid dispute in respect of assessment of Income-tax liability in the case of

non-resident. W.e.f. 1.10.1998, the scheme has been extended to cover notified resident appli-

cants also. The chapter XIX-B contains sections 245N to 245V.

‘Advance Ruling’ means a determination by the Authority for Advance Rulings, in relation to

(i) a transaction which has been undertaken or is proposed to be undertaken by a non-resident

or by a resident with a non-resident, including a determination of a question of law or of fact,

and (ii) issues relating to computation of income pending before the income-tax authority or

the tribunal including a determination of a question of a law or of fact. [Sec. 245N(a)]

380 Applied Direct taxation

An application may be made by (i) non-resident, (ii) a resident entering into transaction with a

non-resident, or (iii) a resident of the notified class or category i.e. a public sector company or

a person indulging in a transaction with a non-resident. [Sec. 245N(b)]

Application for advance ruling should be in the prescribed form as below duly verified, along

with a payment of fee of Rs. 2,500 shall be submitted to the authority for advance rulings.

Form No. Classes of assessees

34C Non- resident desires of obtaining an advance ruling.

34D Resident persons seeking advance ruling in relation to a transaction with a non-

resident.

34E Resident person of notified class or category.

The application for advance rulings should be in quadruplicate and the applicant may with-

draw such application within 90 days from the date of application. [Sec. 245Q]

An advance ruling shall not be allowed where (i) question of law or fact is already pending

either before any income-tax authority or the Appellate Tribunal (except in case of a resident

applicant of notified class or category) or any court, (ii) a transaction, which is designed for the

avoidance of income-tax; or (iii) determination of the fair market value of any property. How-

ever, no application shall be rejected unless an opportunity has been given to the applicant of

being her and if the application is rejected, reasons for such rejection shall be given in the order.

[Sec. 245R]

The Authority shall pronounce the advance ruling within six months after the receipt of the

application. [Sec. 245R(6)]

In case an application for advance ruling has been made, in respect of an issue by a resident

applicant, no Income-tax authority or the Appellate Tribunal shall give a decision on the same

issue. [Sec. 245RR]

The advance ruling shall be binding only on the applicant who has sought it in respect of the

specific transaction covered thereunder, on the Commissioner and the income-tax authorities

subordinate to him, having jurisdiction over the applicant. The advance ruling will continue

to remain in force unless there is a change either in law or in fact on the basis of which the

advance ruling was pronounced. [Sec. 245S]

Case Laws:

i) Settlement Commission cannot be equated with CBDT for exercise of power of relaxation

under section 119(2)(a) - CIT v. Anjum M.H. Ghaswala 119 Taxman 352/ 252 ITR 1.

ii) Commission is not bound to proceed with any application filed under section 245C - CIT

v. Hindustan Bulk Carriers 259 ITR 449/126 Taxman 321.

Applied Direct taxation 381

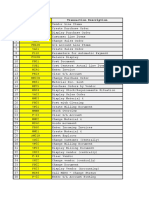

You might also like

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocument23 pagesOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 55261rmo 88-2010Document0 pages55261rmo 88-2010johnnayelNo ratings yet

- Social Engineering FundamentalsDocument13 pagesSocial Engineering FundamentalsPonmanian100% (1)

- Appeals & Revision in Income TaxDocument9 pagesAppeals & Revision in Income TaxTarun BhatiaNo ratings yet

- 34 - Appeal To CITDocument9 pages34 - Appeal To CITsanjay panjwaniNo ratings yet

- Study Note 2.1 Page (60-79)Document20 pagesStudy Note 2.1 Page (60-79)s4sahith88% (8)

- Appeal Before The Commissioner of IncomeDocument10 pagesAppeal Before The Commissioner of IncomemarlinahmurungiNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Income Tax Authority: Chapter-Xiii (Section 116 To 138)Document46 pagesIncome Tax Authority: Chapter-Xiii (Section 116 To 138)Satish BhadaniNo ratings yet

- The Harm Principle and The Tyranny of THDocument4 pagesThe Harm Principle and The Tyranny of THCally doc100% (1)

- Grounds of AppealDocument12 pagesGrounds of AppealIRTribunalNo ratings yet

- Appeals Proceedings and Revision Under Income Tax ActDocument8 pagesAppeals Proceedings and Revision Under Income Tax ActmanikaNo ratings yet

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- People v. JaranillaDocument2 pagesPeople v. JaranillaReinerr NuestroNo ratings yet

- FLEXI READING Implementing GuidelinesDocument94 pagesFLEXI READING Implementing GuidelinesMay L BulanNo ratings yet

- Hip Self Assessment Tool & Calculator For AnalysisDocument14 pagesHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)

- 5.public Sector AuditDocument15 pages5.public Sector AuditMtanaNo ratings yet

- Nirc Tax CodeDocument203 pagesNirc Tax CodeLeah MarshallNo ratings yet

- Fleeting Moments ZineDocument21 pagesFleeting Moments Zineangelo knappettNo ratings yet

- 5 Brothers 1 Mother AlphaDocument4 pages5 Brothers 1 Mother Alphavelo67% (3)

- Pyp As Model of TD LearningDocument30 pagesPyp As Model of TD Learningapi-234372890No ratings yet

- Tax BodyDocument22 pagesTax BodyShrey SrivastavaNo ratings yet

- Taxation Model Answer-2018Document29 pagesTaxation Model Answer-2018poornashree.0229No ratings yet

- Model Que AnsDocument29 pagesModel Que AnsAishwarya B.ANo ratings yet

- PART IV Income TaxDocument9 pagesPART IV Income TaxRahil SattarNo ratings yet

- ITAT Appeal Procedure FunctionsDocument4 pagesITAT Appeal Procedure FunctionsRuhul AminNo ratings yet

- Settlement Commission: Dr. P. Sree Sudha, LL.D Associate ProfessorDocument20 pagesSettlement Commission: Dr. P. Sree Sudha, LL.D Associate ProfessorBharath SimhaReddyNaiduNo ratings yet

- Rmo 62-99Document6 pagesRmo 62-99Klaters BokuNo ratings yet

- Declaration and Payment of DividendDocument10 pagesDeclaration and Payment of DividendSidharthNo ratings yet

- Assessment and Payment of Tax, Interest and Penalties and Making RefundsDocument9 pagesAssessment and Payment of Tax, Interest and Penalties and Making RefundsMd Nazir HussainNo ratings yet

- Section 137 To 146aDocument11 pagesSection 137 To 146aSher DilNo ratings yet

- Notes in Taxation IIDocument6 pagesNotes in Taxation IIJoe BuenoNo ratings yet

- Income Tax ProjectDocument17 pagesIncome Tax ProjectRajeev RajNo ratings yet

- Penalty & Appeal (Chapter 19)Document13 pagesPenalty & Appeal (Chapter 19)Fahim Shahriar MozumderNo ratings yet

- Appeal and RevisionDocument22 pagesAppeal and RevisionAnsh PatelNo ratings yet

- BOCW Welfare Cess Rules, 1998Document10 pagesBOCW Welfare Cess Rules, 1998EricKankarNo ratings yet

- Taxation Unit 3rd,, Material Related To Taxation LawDocument52 pagesTaxation Unit 3rd,, Material Related To Taxation LawARBAZ KHANNo ratings yet

- The Building and Other Construction Workers Cess Rules, 1998Document11 pagesThe Building and Other Construction Workers Cess Rules, 1998shanti raj kumarNo ratings yet

- Tribunal Authorities Bill, 2014Document12 pagesTribunal Authorities Bill, 2014Live LawNo ratings yet

- Taxation Law SummerDocument6 pagesTaxation Law SummerAnita Solano BoholNo ratings yet

- Taxation (NIRC Sec 1-36Document11 pagesTaxation (NIRC Sec 1-36Angie Louh S. DiosoNo ratings yet

- PBMA Act - 2011Document20 pagesPBMA Act - 2011greydavid949No ratings yet

- uNIVERSITY Income Tax AppealDocument9 pagesuNIVERSITY Income Tax AppealMamta GuptaNo ratings yet

- 51920bosfinal p8 PartII Maynov19 Cp12Document18 pages51920bosfinal p8 PartII Maynov19 Cp12Jayanth RamNo ratings yet

- Volume 18Document938 pagesVolume 18Joseph Saidi TemboNo ratings yet

- uNIVERSITY Income Tax AppealDocument9 pagesuNIVERSITY Income Tax AppealMamta GuptaNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- 31183sm DTL Finalnew-May-Nov14 Cp23Document4 pages31183sm DTL Finalnew-May-Nov14 Cp23gvcNo ratings yet

- The County Government of Kiambu Finance Bill.Document71 pagesThe County Government of Kiambu Finance Bill.Kiambu County Government -Kenya.No ratings yet

- Internal Revenue Service Act, 1986Document7 pagesInternal Revenue Service Act, 1986MENSAH PAULNo ratings yet

- Amendments Nov2011Document5 pagesAmendments Nov2011CA Sushant LohaniNo ratings yet

- Return of Income - S 114 To 119Document4 pagesReturn of Income - S 114 To 119khanNo ratings yet

- Rmo 5-2009Document0 pagesRmo 5-2009Peggy SalazarNo ratings yet

- Contract Labour Regulation and Abolition Karnataka Rules 1974Document22 pagesContract Labour Regulation and Abolition Karnataka Rules 1974Rishabh ShahNo ratings yet

- Guidelines For Appointment of Standing CounselsDocument16 pagesGuidelines For Appointment of Standing CounselsGanesh AnantharamNo ratings yet

- Labor LawsDocument14 pagesLabor LawsGãurãv SãndhãlNo ratings yet

- The Companies (Fees) Rules, 2005 SI 57Document8 pagesThe Companies (Fees) Rules, 2005 SI 57Allen AdekeNo ratings yet

- Minimum Wages Central Rules 19501Document30 pagesMinimum Wages Central Rules 19501Latest Laws TeamNo ratings yet

- Rmo 22 01Document20 pagesRmo 22 01Maria Leonora Bornales100% (1)

- B&ocw Cess Act & RulesDocument5 pagesB&ocw Cess Act & RulesRaghu RamNo ratings yet

- 31180sm DTL Finalnew-May-Nov14 Cp20Document17 pages31180sm DTL Finalnew-May-Nov14 Cp20gvcNo ratings yet

- Draft Regulations - The Local Audit (Smaller Authorities) Regulations 2014Document8 pagesDraft Regulations - The Local Audit (Smaller Authorities) Regulations 2014ajomcoukNo ratings yet

- Unit 2 - Appeal and RevisionDocument12 pagesUnit 2 - Appeal and RevisionRakhi Dhamija50% (2)

- Provision Related To Advance Payment of TaxDocument8 pagesProvision Related To Advance Payment of TaxBISHWAJIT DEBNATHNo ratings yet

- IRDADocument5 pagesIRDAtahirhotagiNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- The Air (Prevention and Control of Pollution) (Union Territories) Rules, 1983Document32 pagesThe Air (Prevention and Control of Pollution) (Union Territories) Rules, 1983Manik ShankarNo ratings yet

- Penal Provisions STDocument8 pagesPenal Provisions STKunalKumarNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Study Note 8, Page 565-646Document82 pagesStudy Note 8, Page 565-646s4sahithNo ratings yet

- Study Note 9.2, Page 673-680Document8 pagesStudy Note 9.2, Page 673-680s4sahithNo ratings yet

- NewDocument2 pagesNews4sahithNo ratings yet

- Study Note 9.1, Page 647-672Document26 pagesStudy Note 9.1, Page 647-672s4sahithNo ratings yet

- Study Note - 7.3, Page 535-541Document7 pagesStudy Note - 7.3, Page 535-541s4sahith100% (1)

- Study Note - 7.2 Page (509-522)Document14 pagesStudy Note - 7.2 Page (509-522)s4sahithNo ratings yet

- Study Note - 7.4, Page 542-564Document23 pagesStudy Note - 7.4, Page 542-564s4sahithNo ratings yet

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- Study Note 1.4, Page 47 59Document13 pagesStudy Note 1.4, Page 47 59s4sahithNo ratings yet

- Study Note 7.1, Page 470 508Document39 pagesStudy Note 7.1, Page 470 508s4sahithNo ratings yet

- Study Note 5.2 (353-378)Document26 pagesStudy Note 5.2 (353-378)s4sahith100% (1)

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- Study Note 7.2, Page 523-534Document12 pagesStudy Note 7.2, Page 523-534s4sahithNo ratings yet

- Study Note 4.5, Page (290-327)Document38 pagesStudy Note 4.5, Page (290-327)s4sahith100% (1)

- Study Note 5.1 (328-352)Document25 pagesStudy Note 5.1 (328-352)s4sahithNo ratings yet

- Study Note 4.2, Page 169-197Document29 pagesStudy Note 4.2, Page 169-197s4sahith0% (1)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Study Note 2.2 Page (80-113)Document34 pagesStudy Note 2.2 Page (80-113)s4sahithNo ratings yet

- Study Note 4.1, Page 143-168Document26 pagesStudy Note 4.1, Page 143-168s4sahith40% (5)

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- Study Note-1.3, Page 33-46Document14 pagesStudy Note-1.3, Page 33-46s4sahithNo ratings yet

- Studdy Note 6Document54 pagesStuddy Note 6s4sahithNo ratings yet

- Studdy Note 5Document22 pagesStuddy Note 5s4sahithNo ratings yet

- Studdy Note 9Document19 pagesStuddy Note 9s4sahithNo ratings yet

- Study Bote-1.1, Page 1-11Document11 pagesStudy Bote-1.1, Page 1-11s4sahithNo ratings yet

- Studdy Note 8Document59 pagesStuddy Note 8s4sahithNo ratings yet

- Studdy Note 7Document42 pagesStuddy Note 7s4sahith100% (1)

- Front PageDocument2 pagesFront Pages4sahithNo ratings yet

- O.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BDocument3 pagesO.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BRavvoNo ratings yet

- Fundamentals of Accounting For Microfina PDFDocument42 pagesFundamentals of Accounting For Microfina PDFEmilenn Kate Sacdalan-PateñoNo ratings yet

- Kubota Utility Vehicle Rtv900 Workshop ManualDocument17 pagesKubota Utility Vehicle Rtv900 Workshop Manualbrianwong090198pni0% (1)

- Was Poll Tax The Most Important Reason For Margaret Thatchers Downfall?Document5 pagesWas Poll Tax The Most Important Reason For Margaret Thatchers Downfall?wendyfoxNo ratings yet

- FIRST YEAR B.TECH - 2020 Student List (MGT and CET) PDFDocument128 pagesFIRST YEAR B.TECH - 2020 Student List (MGT and CET) PDFakashNo ratings yet

- Athenian Democracy DocumentsDocument7 pagesAthenian Democracy Documentsapi-2737972640% (1)

- Introduction To Marketing - KotlerDocument35 pagesIntroduction To Marketing - KotlerRajesh Patro0% (1)

- Social Media and The Transformation of Chinese Nationalism'Document4 pagesSocial Media and The Transformation of Chinese Nationalism'mbadaroNo ratings yet

- Kincade 2010Document12 pagesKincade 2010varghees johnNo ratings yet

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawaneNo ratings yet

- Andres Felipe Mendez Vargas: The Elves and The ShoemakerDocument1 pageAndres Felipe Mendez Vargas: The Elves and The ShoemakerAndres MendezNo ratings yet

- Formation Burgos RefozarDocument10 pagesFormation Burgos RefozarJasmine ActaNo ratings yet

- Molina V Pacific PlansDocument31 pagesMolina V Pacific Planscmv mendozaNo ratings yet

- NPD and VMSDocument4 pagesNPD and VMSK V S MadaanNo ratings yet

- Veneranda Dini Anggraeni 201071058 Grammer Mini TestDocument18 pagesVeneranda Dini Anggraeni 201071058 Grammer Mini TestAyu DaratistaNo ratings yet

- The Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORDocument11 pagesThe Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORFeroze KareemNo ratings yet

- Essential Intrapartum and Newborn CareDocument25 pagesEssential Intrapartum and Newborn CareMaria Lovelyn LumaynoNo ratings yet

- Accomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersDocument6 pagesAccomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersMarianne Hilario100% (1)

- Competition Law Final NotesDocument7 pagesCompetition Law Final NotesShubham PrakashNo ratings yet

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarNo ratings yet