Professional Documents

Culture Documents

Clarkson Template

Uploaded by

Jeffery KaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clarkson Template

Uploaded by

Jeffery KaoCopyright:

Available Formats

Financial Statements

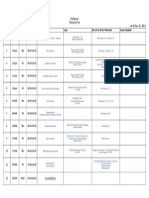

CLARKSON LUMBER COMPANY

INCOME STATEMENTS ($1,000s)

Net sales

Cost of goods sold

Beginning inventory

Purchases

Ending inventory

Total cost of goods sold

GROSS PROFIT

Operating expense

Earnings before interest and taxes

Interest expense

Net income before taxes

Provision for income taxes

Net income

1st Qtr.

1993

1994

1995

1996

-------------- -------------- -------------- -------------$2,921

$3,477

$4,519

$1,062

330

337

432

587

2,209

2,729

3,579

819

-------------- -------------- -------------- -------------$2,539

$3,066

$4,011

$1,406

337

432

587

607

-------------- -------------- -------------- -------------$2,202

$2,634

$3,424

$799

719

843

1095

263

622

717

940

244

-------------- -------------- -------------- -------------97

126

155

19

23

42

56

13

-------------- -------------- -------------- -------------$74

$84

$99

$6

14

16

22

1

-------------- -------------- -------------- -------------$60

$68

$77

$5

Page 1

Financial Statements

BALANCE SHEETS ($1000s)

Cash

Accounts receivable, net

Inventory

Current assets

Property, net

Total assets

Notes payable, bank

Notes payable, Mr. Holtz

Notes Payable, trade

Accounts payable

Accrued expenses

Term loan, current portion

Current liabilities

Term loan

Note payable, Mr. Holtz

Total liabilities

Net worth

Total liabilities and net worth

1st Qtr.

1993

1994

1995

1996

-------------- -------------- -------------- -------------$43

$52

$56

$53

306

411

606

583

337

432

587

607

-------------- -------------- -------------- -------------$686

$895

$1,249

$1,243

233

262

388

384

-------------- -------------- -------------- -------------$919

$1,157

$1,637

$1,627

$0

0

0

213

$60

100

0

340

$390

100

127

376

$399

100

123

364

42

45

75

67

20

20

20

20

-------------- -------------- -------------- -------------$275

$565

$1,088

$1,073

140

120

100

100

0

100

0

0

-------------- -------------- -------------- -------------$415

$785

$1,188

$1,173

504

372

449

454

-------------- -------------- -------------- -------------$919

$1,157

$1,637

$1,627

Page 2

Financial Statements

1993

1994

1995 AVERAGE

Comps

Low Profit

--------------

Percent of Sales

COGs

Operating Expense

Cash

A/R

Inventory

Net Fixed Assets

Total Assets

76.90%

22.00%

1.30%

13.70%

12.00%

12.10%

39.10%

Percent of Assets

Current Liab.

Long Term Liab.

Equity

52.70%

34.80%

12.50%

Return on Sales

Return on Assets

Return On Equity

-0.70%

-1.80%

-14.30%

Days Receivables

Days Payables (Purchases)

Days Payables (excluding notes)

Inventory Turnover (Year End)

Inventory Turnover (Avg. Inv.)

Page 3

Financial Statements

High Profit

-------------- -------------75.10%

20.60%

1.10%

12.40%

11.60%

9.20%

34.30%

29.20%

16.00%

54.80%

4.30%

12.20%

22.10%

Page 4

Clarkson Lumber Company

PRO FORMA INCOME STATEMENT

Net sales

Cost of goods sold

Beginning inventory

Purchases

% of sales

1996

-------------- -------------$5,500 Forecast

587 1995 Ending Inventory

--------------

Ending inventory

12.32%

Total cost of goods sold

75.64%

677 $5,550*12.32%. The 12.32% is average INV/Sales over the la

-------------$4,160 $5,550*75.64%. The 75.645% is average COGS/Sales over th

Gross profit

Purchase discounts

2% of Purchases. Remember some purchases have been m

Operating expense

Interest expense

New bank loan

Existing fixed rate debt

10%xRemaining Balance on the term loan

--------------

Net income before taxes

Provision for income taxes

See FN C in Exhibit 1 of the case

--------------

Net income

PRO FORMA BALANCE SHEET

1996

-------------Cash

Accounts receivable, net

Inventory

-------------Current assets

Property, net

-------------Total assets

Notes payable, bank

Notes payable, Mr. Holtz

Notes Payable, trade

Accounts payable

Accrued expenses

Long-term debt, current portion

Current liabilities

Long-term debt (term loan)

Total liabilities

Net worth

Plug

=10/365*Purchases (Assuming all discounts taken)

20

-------------80

--------------

Last Years NW plus this years RE. So will depend on NI for t

-------------Total liabilities and net worth

verage INV/Sales over the last three years

average COGS/Sales over the last three years

me purchases have been made in the first quarter without the discount.

l discounts taken)

E. So will depend on NI for this year

You might also like

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- A Tale of Two Hedge FundsDocument17 pagesA Tale of Two Hedge FundsS Sarkar100% (1)

- Clarkson Lumber SolutionDocument8 pagesClarkson Lumber Solutionpawangadiya1210No ratings yet

- Case: Blaine Kitchenware, IncDocument5 pagesCase: Blaine Kitchenware, IncWilliam NgNo ratings yet

- Clarkson Lumber WAC AnalysisDocument6 pagesClarkson Lumber WAC Analysismehreen samiNo ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymalishka1025No ratings yet

- Wilson Lumber Company1Document5 pagesWilson Lumber Company1fica037No ratings yet

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Clarkson Lumber Case QuestionsDocument2 pagesClarkson Lumber Case QuestionsJeffery KaoNo ratings yet

- OM Scott Case AnalysisDocument20 pagesOM Scott Case AnalysissushilkhannaNo ratings yet

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- SUN Brewing (A)Document6 pagesSUN Brewing (A)Ilya KNo ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Obscurity: Undesirability: P/E: Screening CriteriaDocument21 pagesObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnNo ratings yet

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- Group 3 - Clarkson Write UpDocument7 pagesGroup 3 - Clarkson Write UpCarlos Eduardo Ventura GonçalvesNo ratings yet

- ClarksonDocument2 pagesClarksonYang Pu100% (3)

- Blaine Kitchenware financial analysis and capital structure optimizationDocument11 pagesBlaine Kitchenware financial analysis and capital structure optimizationBala GNo ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncChrisNo ratings yet

- CooperDocument4 pagesCooperrishitapNo ratings yet

- Winfield Refuse. - Case QuestionsDocument1 pageWinfield Refuse. - Case QuestionsthoroftedalNo ratings yet

- Clarkson Lumber CaseDocument27 pagesClarkson Lumber CaseGovardan SureshNo ratings yet

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocument13 pagesWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezNo ratings yet

- Sun Brewing Case ExhibitsDocument26 pagesSun Brewing Case ExhibitsShshankNo ratings yet

- Clarkson Lumbar CompanyDocument41 pagesClarkson Lumbar CompanyTheOxyCleanGuyNo ratings yet

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- Surecut Shears, Inc.Document2 pagesSurecut Shears, Inc.RAHUL SHARMANo ratings yet

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Case QuestionsDocument8 pagesCase QuestionsUsman ShakoorNo ratings yet

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- Sure Cut SheersDocument7 pagesSure Cut SheersEdward Marcell Basia67% (3)

- Group 5 PresentationDocument73 pagesGroup 5 PresentationSourabh Arora100% (4)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- Stuart Daw questions costing approach transaction basisDocument2 pagesStuart Daw questions costing approach transaction basisMike ChhabraNo ratings yet

- 03 Statement of Cash Flow A IIIDocument6 pages03 Statement of Cash Flow A IIIMilton StevensNo ratings yet

- Chesapeake Energy 10-K 1998Document151 pagesChesapeake Energy 10-K 1998SteveNo ratings yet

- Chesapeake Energy 10-K 2000Document421 pagesChesapeake Energy 10-K 2000SteveNo ratings yet

- Financial Accounting 1 Unit 6Document27 pagesFinancial Accounting 1 Unit 6chuchuNo ratings yet

- Unit 7Document29 pagesUnit 7FantayNo ratings yet

- Final Accounts - Principles of AccountingDocument9 pagesFinal Accounts - Principles of AccountingAbdulla MaseehNo ratings yet

- FA 1 Chaapter 4Document10 pagesFA 1 Chaapter 4Hussen AbdulkadirNo ratings yet

- SEC Filings - Microsoft - 0001032210-98-000519Document18 pagesSEC Filings - Microsoft - 0001032210-98-000519highfinanceNo ratings yet

- Statement of Cash Flows - Three Examples - Blank FormatDocument3 pagesStatement of Cash Flows - Three Examples - Blank FormatAditya ShuklaNo ratings yet

- CotterDocument4 pagesCotterJeffery KaoNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- KW Report Instructions 2015v2Document3 pagesKW Report Instructions 2015v2Jeffery KaoNo ratings yet

- Personal Code of Ethics SyllabusDocument2 pagesPersonal Code of Ethics SyllabusJeffery KaoNo ratings yet

- Memory AssignmentDocument1 pageMemory AssignmentJeffery KaoNo ratings yet

- Team 7 Agreement on Support, Respect, Accountability & CollaborationDocument1 pageTeam 7 Agreement on Support, Respect, Accountability & CollaborationJeffery KaoNo ratings yet

- Questionnaire For Marketing Research & Analysis Final Term-JeffDocument11 pagesQuestionnaire For Marketing Research & Analysis Final Term-JeffJeffery KaoNo ratings yet

- Lehigh SteelDocument6 pagesLehigh SteelJeffery KaoNo ratings yet

- Final PresentationDocument23 pagesFinal PresentationJeffery KaoNo ratings yet

- EvaluationDocument18 pagesEvaluationJeffery KaoNo ratings yet

- Flow Diagram: SHOULDICE HOSPITAL - Simplified ProcessDocument1 pageFlow Diagram: SHOULDICE HOSPITAL - Simplified ProcessJeffery KaoNo ratings yet

- Corporate Finance II: Professor Tomonori ItoDocument1 pageCorporate Finance II: Professor Tomonori ItoJeffery KaoNo ratings yet

- Janime Segments BiplotDocument1 pageJanime Segments BiplotJeffery KaoNo ratings yet

- HRM Final Cheat Sheet (All)Document3 pagesHRM Final Cheat Sheet (All)Jeffery KaoNo ratings yet

- Rosetta StoneDocument2 pagesRosetta StoneJeffery KaoNo ratings yet

- Rosetta StoneDocument2 pagesRosetta StoneJeffery KaoNo ratings yet

- Idterm Ourse Valuation: More Case DiscussionDocument1 pageIdterm Ourse Valuation: More Case DiscussionJeffery KaoNo ratings yet

- Eskimo WorkbookDocument2 pagesEskimo WorkbookJeffery KaoNo ratings yet

- MBAA 602 Financial & Managerial Accounting OverviewDocument4 pagesMBAA 602 Financial & Managerial Accounting OverviewuglaysianNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Rock ShoesDocument22 pagesRock ShoesJeffery KaoNo ratings yet

- Cheat Sheet - AccountingDocument2 pagesCheat Sheet - AccountingJeffery KaoNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- CORP Cheat SheetDocument2 pagesCORP Cheat SheetJeffery KaoNo ratings yet

- CORP Cheat SheetDocument2 pagesCORP Cheat SheetJeffery KaoNo ratings yet

- Jeffery Kao - ICS Resume-RevisedDocument1 pageJeffery Kao - ICS Resume-RevisedJeffery KaoNo ratings yet

- Home Price per Square Foot AnalysisDocument7 pagesHome Price per Square Foot AnalysisJeffery KaoNo ratings yet

- Lipman Bottle JeffDocument3 pagesLipman Bottle JeffJeffery KaoNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Group Accounts Consolidation Questions BankDocument43 pagesGroup Accounts Consolidation Questions BankAli Sheikh93% (14)

- Chapter 6: Overview of Hard OR MethodologyDocument10 pagesChapter 6: Overview of Hard OR MethodologyriyantonoNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeDocument16 pagesFundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeGladys Angela ValdemoroNo ratings yet

- Kieso IFRS TestBank Ch09Document47 pagesKieso IFRS TestBank Ch09Ivern BautistaNo ratings yet

- Hill Connect Quiz 3 Managerial AccountigDocument17 pagesHill Connect Quiz 3 Managerial AccountigHrushikeshNo ratings yet

- Merchandising Accounts BasicsDocument17 pagesMerchandising Accounts BasicsshawtyNo ratings yet

- Grade 11 Unit 7Document3 pagesGrade 11 Unit 7Nipuni PereraNo ratings yet

- Financial Reporting & Ratio Analysis GuideDocument36 pagesFinancial Reporting & Ratio Analysis GuideHARVENDRA9022 SINGHNo ratings yet

- Assignment1 10%Document3 pagesAssignment1 10%Felicia ChinNo ratings yet

- Cma FormatDocument14 pagesCma FormatMahesh ShindeNo ratings yet

- Cost Accounting - ch11Document61 pagesCost Accounting - ch11Nur RezzaNo ratings yet

- Fin Acc Exam CompilationDocument27 pagesFin Acc Exam CompilationRiza100% (1)

- FAR-03-Inventories-2nd Sem AY2324Document5 pagesFAR-03-Inventories-2nd Sem AY2324Nanase SenpaiNo ratings yet

- Prelim Cost AcctngDocument2 pagesPrelim Cost AcctngAnonymous JgyJLTqpNS0% (1)

- Sole Trader: Final Accounts - The Income StatementDocument12 pagesSole Trader: Final Accounts - The Income StatementAnisahNo ratings yet

- Accounting policies, estimates and errors quizDocument2 pagesAccounting policies, estimates and errors quizkim cheNo ratings yet

- Chapter 7 ExtraDocument8 pagesChapter 7 ExtraMai Lâm LêNo ratings yet

- Toaz - Info Intermediate Accountingdocx PRDocument14 pagesToaz - Info Intermediate Accountingdocx PRGabby OperarioNo ratings yet

- MAS 3 - Standard Costing For UploadDocument9 pagesMAS 3 - Standard Costing For UploadJD SolañaNo ratings yet

- Entrep Module 4Document30 pagesEntrep Module 4Gio Rico Naquila EscoñaNo ratings yet

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument39 pagesLiquidity of Short-Term Assets Related Debt-Paying AbilityFahad BataviaNo ratings yet

- Chapter 16 - Management of Current AssetsDocument7 pagesChapter 16 - Management of Current Assetslou-924No ratings yet

- Ifsa 3Document36 pagesIfsa 3Avinash DasNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Aec 102 Pre Final Exam 1 22 23 PsbaDocument10 pagesAec 102 Pre Final Exam 1 22 23 PsbaMikha Ella BasaNo ratings yet

- FALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233Document4 pagesFALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233ھاشم عمران واھلہNo ratings yet

- This Study Resource Was: For The Next 6 ItemsDocument9 pagesThis Study Resource Was: For The Next 6 ItemsJames CastañedaNo ratings yet

- Null 1Document95 pagesNull 1Rameen ChNo ratings yet

- Advanced Management AccountingDocument14 pagesAdvanced Management AccountingZain ul AbidinNo ratings yet