Professional Documents

Culture Documents

FRM Research Report VIC 10 2014

Uploaded by

ronmexico123456Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRM Research Report VIC 10 2014

Uploaded by

ronmexico123456Copyright:

Available Formats

1

October 6, 2014

Furmanite Corporation (NYSE: FRM) $7.09

Revenue growth will accelerate following the completion of a restructuring that has transformed the

company. Recent acquisitions also provide FRM with significant competitive advantages combined with

exposures to markets that are expected to grow rapidly as they benefit from the ongoing US shale oil

revolution.

Investment Thesis:

FRM trades at a discount to its competitor, Team Inc (TISI) but its growth will continue to accelerate and

it will improve its competitive profile relative to TISI as it has now completed a multi-year restructuring

that commenced in 2010. This should provide a catalyst for FRM to trade at a premium to its

competitors over the next several quarters as it gains market share from cross-selling opportunities

from its non-destructive testing (NDT) and inspections business that came with the ENGlobal acquisition.

FRM will grow revenues ~20% annually via organic growth and from tack-on acquisitions in a highly

fragmented market.

1) Newly completed global organizational concept following the completion of The Orange

Way restructuring will facilitate growth and higher margins: Historically FRM has

functioned as a group of smaller entities which impaired its ability to sell and provide

multiple service lines across a global service organization. The success of the restructuring is

evident as revenue growth has accelerated since the restructuring commenced in 2010,

after declining in 2009, and further accelerated since the completion of the restructuring in

2013. FY2014 revenue growth year-over year is expected to be better than 30%.

2) Acquisition of ENGlobal Gulf Coast operations will facilitate revenue growth as it expands

the services FRM offers and provides a significant opportunity to cross-sell the Technical

Services segment offerings to new NDT and Inspection clients.: In September 2013 with the

acquisition of ENGlobal Gulf Coast operations approximately 900 full-time professionals

transitioned to the Engineering & Project Solutions (E&PS) segment, a newly created

operating segment of FRM. The E&PS segment provides a new range of services including

project planning, project control, non-destructive testing and inspection, construction

management, mechanical integrity, field support, quality assurance and plant asset

management services to refining and petrochemical operators. The E&PS segment has the

ability to direct some business to FRMs legacy Technical Services segment and over time

will accelerate the organic growth opportunities.

3) Highly fragmented market facilitates growth both organically and via acquisitions. FRM

market share in the markets it operates is generally no more than 10-15% and provides a

significant opportunity to grow via acquisitions. FRM has completed 4 acquisitions since

2010, two of which were done in 2013. The acquisitions have fueled year-over-year top line

growth of ~33% in 2013 vs 2012 with ~10% coming from organic growth and the rest from

acquisitions. The company expects to continue growing organically at ~10-12% and will add

another ~10% from acquisitions.

2

Company Description and Background:

Summary:

Furmanite Corporation is a worldwide technical services firm with headquarters in Houston, Texas and it

is one of the worlds largest specialty technical services companies, and delivers a broad portfolio of

engineering solutions that keep facilities operating, minimizing downtime and maximizing profitability.

FRMs diverse global operations with ~3,000 employees in ~85 locations worldwide serves a broad array

of industrial sectors, including offshore drilling operations, pipelines, refineries and power generation

facilities, chemical and petrochemical plants, steel mills, automotive manufacturers, pulp and paper

mills, food and beverage processing plants, semi-conductor manufacturers and pharmaceutical

manufacturers.

Operating Segments:

FRM conducts its business through various wholly owned subsidiaries and affiliates, both domestic and

international. The company operates in two segments, the Technical Services operating segment which

is the legacy FRM business and the newly created Engineering & Project Solutions segment. With the

completion of the acquisition of ENGlobal Gulf Coast operations in late 2013 FRM now reports its

revenues for financial reporting purposes, in two operating segments that are mainly based on its

service and product offerings.

The Technical Services segment provides specialized technical services, which include on-line, off-line

and other services. Within technical services, on-line services include leak sealing, hot tapping, line

stopping, line isolation, composite repair, valve testing and certain non-destructive testing and

inspection services, while off-line services include on-site machining, heat treatment, bolting, valve

repair and other non-destructive testing and inspection services. Other services include smart shim

services, concrete repair, engineering services, valves and other products and manufacturing. These

services and products are provided primarily to electric power generating plants, the petroleum

industry, which include refineries and offshore drilling rigs (including subsea), chemical plants and other

process industries in the Americas (which includes operations in North America, South America and

Latin America), EMEA (which includes operations in Europe, the Middle East and Africa) and Asia-Pacific.

The Engineering & Project Solutions segment, which includes the companys Furmanite Technical

Solutions (FTS) division, provides project planning, professional engineering, downstream non-

destructive testing and inspection, construction management, mechanical integrity, field support,

quality assurance, and plant asset management services, as well as certain other inspection and project

management services. These services are provided to refining and petrochemical operators as well as

maintenance, and engineering and construction contractors serving the downstream and midstream oil

and gas markets, substantially all of which are in the Americas.

History & Restructuring:

FRMs operations were founded in Virginia Beach, Virginia in the 1920s as a manufacturer of leak sealing

kits. The company has grown via numerous acquisitions since its formation and significantly expanded

its service offerings both through geographic expansion and the addition of new techniques, processes

and services to become one of the largest industrial services companies performing leak sealing and on-

site machining in the world. In addition, FRM entered the non-destructive testing and inspection market,

introducing certain services based on customer demand, primarily within the Americas via an acquisition

of ENGlobal Gulf Coast operations in 2013. As a result of the acquisition, the Company has significantly

3

expanded its broad service offerings, greatly enhancing its engineering, design, and construction

management service capabilities. As such, the FRM will become a significantly more valuable resource to

its customers, providing increasingly comprehensive solutions to satisfy a wider range of its customers

needs.

In March 2010 current CEO Charlie Cox assumed the CEO role and embarked upon a restructuring of the

company that was focused on cost reduction and on integrating the 75 locations to function efficiently

across the various service lines. The result when completed in 2012 was a unified company with a global

footprint that is now capable of competing effectively. Today with the completion of the restructuring

complete the company is focused on leveraging its global footprint to drive growth both across its

service lines and geographically.

4

Multi-Year Growth driven by exposure to North American Oil & Gas Expansion Cycle:

Oil refineries and petrochemical plants account for 65% of FRMs revenues. These two industries are

expected to benefit from the US shale revolution and offer significant tailwinds to FRM for the next

several years.

FRM provides off-line services (~45-49% of revenues) including on-site machining, bolting, valve repair,

heat treating, ultrasonic, radiography, phased array, tube testing and repair on such systems and

equipment. These services tend to complement leak sealing and other on-line services since these off-

line services are usually performed while a plant or piping system is not operating. FRM also provides

on-line services (~31-36% of revenues) including leak sealing in valves, pipes and other components of

piping systems and related equipment typically used in flow-process industries. Other on-line services

provided include hot tapping, line stopping, line isolation, composite repair, valve testing, and visual

inspection. In addition, FRM provides other services including concrete repair, engineering services,

valve and other products and manufacturing. In performing these services, technicians generally work at

the customers location, frequently responding on an emergency basis.

FRMs on-line, leak sealing services are performed on a variety of flow-process industry machinery,

often in difficult situations. Many of the techniques and materials are proprietary and some are

patented. FRM believes these techniques and materials provide it with a competitive advantage over

other organizations that provide similar services. The Company holds over 120 trademarks and patents

for its techniques, products, materials and equipment and continues to develop new and update

existing patents, as it considers these efforts to be essential to its operations. The patents, which are

registered in jurisdictions around the world, expire at various dates through December 2023. The skilled

technicians work with equipment in a manner designed to enhance safety and efficiency in temperature

environments ranging from cryogenic to 2,400 degrees Fahrenheit and pressure environments ranging

5

from vacuum to 5,000 pounds per square inch. In many circumstances, employees are called upon to

custom-design tools, equipment or other materials to achieve the necessary repairs. These efforts are

supported by an internal quality control group as well as an engineering group and manufacturing group

that work with the on-site technicians in crafting these materials, tools and equipment.

Customers and Markets:

FRMs customer base includes petroleum refineries, chemical plants, mining operations, offshore energy

production platforms, subsea piping systems, steel mills, nuclear and conventional power stations, pulp

and paper mills, food and beverage processing plants and other flow-process facilities in more than 50

countries. Most of the revenues are derived from fossil and nuclear fuel power generation companies,

petroleum refiners and chemical producers. Other significant markets include offshore oil producers,

mining operations and steel manufacturers. As the worldwide industrial infrastructure continues to age,

additional repair and maintenance expenditures are expected to be required for the specialized services

provided by FRM. Other factors that may influence the markets served by FRM include regulations

governing construction of industrial plants and safety and environmental compliance requirements and

the worldwide economic climate. No single customer accounted for more than 10% of the Companys

consolidated revenues during any of the past three fiscal years.

With an over 85-year history, FRMs customer relationships are long-term and worldwide. All customers

are served from the worldwide headquarters in Houston, Texas and the Company has a substantial

presence in EMEA and Asia-Pacific. FRM currently operates over 25 offices in the United States (U.S.).

The worldwide operations are further supported by offices currently located in countries on six

continents in Aruba, Australia, Azerbaijan, Bahrain, Belgium, Canada, China, Denmark, France,

Germany, Malaysia, The Netherlands, New Zealand, Norway, Singapore, Sweden and the U.K. and by

licensee and agency arrangements which are based in Argentina, Brazil, Dominican Republic, Egypt,

Hungary, Italy, Japan, Mexico, Peru, Puerto Rico, Romania, South Africa, Thailand, Turkey and the United

Arab Emirates.

Revenues by major geographic region for 2013 were 68% for the Americas, 24% for EMEA and 8% for

Asia-Pacific.

FRMs leak sealing on-line and other specialty field services are marketed primarily through direct sales

calls on customers by salesmen and technicians based at the various operating locations, which are

situated to facilitate timely customer response, 24 hours a day and seven days a week. Customers are

usually billed on a time and materials basis for services typically performed pursuant to either job

quotation sheets or purchase orders issued under written customer agreements.

Furmanite has select master service customer agreements, which can provide coverage for multiple

years, and selected services with defined rates from which orders are then released with defined scopes

of work. Other customer arrangements are generally short-term in duration and specify the range of,

and rates for, the services to be performed. Furmanite typically provides various limited warranties,

depending upon the services furnished, and has had no material warranty costs during any of the years

ended December 31, 2013, 2012 or 2011. Furmanite generally competes on the basis of service, product

performance, technical know-how, engineering solutions and price on a localized basis with smaller

companies and the in-house maintenance departments of its customers or potential customers.

Furmanite believes it currently has an advantage over in-house maintenance departments because of

6

the ability of the Companys multi-disciplined technicians to use proprietary and patented techniques to

perform quality repairs on a timely basis while customer equipment remains in service.

Valuation:

FRM has underperformed for two reasons, both of which are short-term idiosyncratic issues that will be

corrected over the next few quarters. In both March 2014 and May 2014 FRM reported Q4 13 and Q1

14 earnings that missed expectations as a result of a combination of bad weather and poor margins in its

recently acquired E&PS segment. The weather adversely impacted revenues as work was delayed due

to the harsh winter weather. FRMs gross margins were negatively impacted as they had to maintain

and pay their personnel but were unable to fully utilize the personnel due to various projects being

delayed. This is a temporary issue and while it created a short-term challenge for FRM in the longer

term as access to skilled labor becomes an issue for competitors, FRM will be advantageously positioned

with resources that it can fully utilize. The operating leverage in this business in significant and can

benefit margins substantially over the long term. Additionally, with the increased headcount post the

ENGlobal acquisition and the temporary challenge of integrating the new segment, margins in that

segment have been dilutive to the overall companys margin. This also is a short term issue that is

expected to be corrected by Q4 14, in fact in their last earnings conference call the company reiterated

that the E&PS segment will not be a money loser by year end. Sequentially, as the margins in the E&PS

segment improve they will prove to be less of a drag on overall companys margin.

As a result of these temporary issues FRM currently trades at a discount to its peers Team Inc. (NYSE:

TISI) and Mistras Group, Inc. (NYSE: MG). FRM trades at a 2015 EV/EBITDA multiple of 6.5x versus 7.9x

and 7.3x for TISI and MG, respectively. Its 2015 P/E multiple is 13x versus 17.2x and 19.4x for TISI and

MG, respectively. While the discount may have been warranted in prior years it should not be the case

currently as FRM has completed its turnaround and now effectively competes against TISI and in fact

may be advantageously positioned given its global footprint and the cross selling opportunities

presented from its newly acquired E&PS segment.

7

FRM Relative Valuation

FRM Capital structure

Investors who have an investment horizon longer than a month or a quarter will be handsomely

rewarded in the next 6-12 months as FRM shows it can meet or beat its revenue guidance now that the

weather issues are behind it and more importantly as the E&PS segment gets to break-even and is no

longer dilutive to gross margins and EBITDA. In Q2 2014 FRM lost $0.5 million in the segment and I

expect them to break even in Q3 2014 but even if they meet managements targeted break even by Q4

2014 you can expect lots of tailwinds in 2015 and beyond.

FRM is a company that will benefit significantly from the ramp up in energy infrastructure spending on

energy and chemical facilities along the Gulf Coast and Canada over the next 5+ years and I can see

them almost doubling EPS by 2017 without any heroic assumptions. Longer term investors will do well

to buy this stock now when the mass seems to be avoiding small/mid cap companies amid the recent

sell-off.

There is also the potential for an activist to initiate a position in FRM and advocate for a sale of the

company. The current management team has been somewhat inept at setting and managing the

guidance they have provided to investors and analysts and has resulted in them missing their estimates

for several consecutive quarters. That combined with the plannned early retirement of the current CEO

Mr. Cox, who was integral in turning the company around over the last 5+ years provides an

extraordinary opportunity for a strategic acquirer to attempt an acquisition of the company. A strategic

acquisition should result in significant accretion to an acquirer.

Name Mkt Cap (MM) EV (MM) 2014 EV/EBITDA 2015 EV/EBITDA 2014 P/E 2015 P/E

Furmanite Corp (FRM) 268.36 294.98 7.3 5.5 24.5 15.6

Team Inc. (TISI) 775.29 820.04 8.6 7.2 27.2 18.7

Mistras Group Inc. (MG) 573.75 661.58 8.2 6.8 30.4 22.1

in million $

(except shares

price)

Share price 7.13 $

Shares outstanding 37.64

Equity market cap 268.36

Cash & equivalents 37.78

Debt 64.40

Enterprise value 294.98

8

FRM 2015 Valuation

Current share Price 7.13 $

Low Base High

FRM FRM FRM

93.2% 115.5% 137.8%

Share Price 13.78 $ 15.37 $ 16.96 $

Total Shares 37.63 37.63 37.63

Market Cap 518.37 578.25 638.12

Less Cash & equivalents ($50.73) ($50.73) ($50.73)

Add: Debt 41.31 41.31 41.31

Enterprise Value 508.95 $ 568.83 $ 628.70 $

508.95 $ 568.83 $ 628.70 $

EV 508.95 $ 568.83 $ 628.70 $

EBITDA 59.88 $ 59.88 $ 59.88 $

EV/EBITDA 8.5 9.5 10.5

P/E 20.5 21.0 23.0

EPS $0.77 $0.77 $0.77

FCF/sh $0.52 $0.52 $0.52

FCF Yield 7.3% 7.3% 7.3%

in Millions

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Akimbo User ManualDocument48 pagesAkimbo User ManualPretecsi SasNo ratings yet

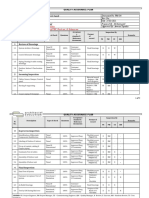

- Quality Control System Quality Control System: Qcs QcsDocument8 pagesQuality Control System Quality Control System: Qcs QcsRizqiNo ratings yet

- NATO 7.62mm Ball Cartridge SpecificationDocument31 pagesNATO 7.62mm Ball Cartridge Specificationrick.mccort2766No ratings yet

- GG Ifa CL Af CB FV v5 1 Protected enDocument118 pagesGG Ifa CL Af CB FV v5 1 Protected enAnilZapateNo ratings yet

- General Technical Requirements For Aluminium Constructionsps1005341-30201.Doc Conveyed Confidentially As Trade SecretDocument8 pagesGeneral Technical Requirements For Aluminium Constructionsps1005341-30201.Doc Conveyed Confidentially As Trade SecretHoangNo ratings yet

- Petron-Limay-Pep-Crude Oil Tank Construction by YokDocument49 pagesPetron-Limay-Pep-Crude Oil Tank Construction by YokTifano KhristiyantoNo ratings yet

- Almansoori Inspection Services: Lifting Equipment Thorough Examination ReportDocument4 pagesAlmansoori Inspection Services: Lifting Equipment Thorough Examination ReportRanjithNo ratings yet

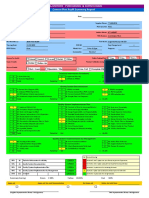

- SOP For QA Responsibilities in Injectable Area Inspection FormDocument11 pagesSOP For QA Responsibilities in Injectable Area Inspection FormSolomonNo ratings yet

- GameTime Playground Maintenance GuideDocument23 pagesGameTime Playground Maintenance GuideRoberts PrideNo ratings yet

- CSFP Export Certification SchemeDocument63 pagesCSFP Export Certification SchemeNeel Shah100% (1)

- Reverse Engineering PDFDocument130 pagesReverse Engineering PDFMohannadNo ratings yet

- Quality Plan and Checklist (HVAC) - Sandvik G BlockDocument3 pagesQuality Plan and Checklist (HVAC) - Sandvik G BlockParasNo ratings yet

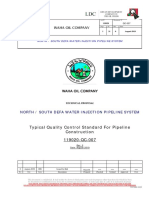

- 119020-QC-007-Typical Quality Control Standard For PPL Construction PDFDocument31 pages119020-QC-007-Typical Quality Control Standard For PPL Construction PDFMoaatazz NouisriNo ratings yet

- SCAT Chart Guide Systematic Cause AnalysisDocument1 pageSCAT Chart Guide Systematic Cause AnalysisJason Montplaisir100% (4)

- Jis G 4053-2008Document21 pagesJis G 4053-2008ali ahmadNo ratings yet

- PCPA Report-Large Roof Lamp With LEDDocument3 pagesPCPA Report-Large Roof Lamp With LEDawdhut kulkarniNo ratings yet

- STS Crane Rope Online Inspection System.Document47 pagesSTS Crane Rope Online Inspection System.Mouwadine MoussaNo ratings yet

- WI-NG-6460-002-065 Work Instruction For Circuit Breaker Fail Protection (5062) Rev00Document6 pagesWI-NG-6460-002-065 Work Instruction For Circuit Breaker Fail Protection (5062) Rev00Mohamed NasrNo ratings yet

- E3sconf Conmechydro2021 02068Document8 pagesE3sconf Conmechydro2021 02068ANIBAL NANo ratings yet

- Case Study #4: Time Allowed 60 MinutesDocument2 pagesCase Study #4: Time Allowed 60 MinutesYasirdz0% (1)

- T14.1 Quality Mangement SystemDocument28 pagesT14.1 Quality Mangement Systemmohammed dallyNo ratings yet

- 0008 - 001 Safety Requirements For ScaffoldsDocument16 pages0008 - 001 Safety Requirements For Scaffoldsshahid zaheerNo ratings yet

- Guidance On The Application of Good Distribution Practice For Medical DevicesDocument43 pagesGuidance On The Application of Good Distribution Practice For Medical DevicesDO KHNo ratings yet

- Software Quality Assurance FrameworkDocument128 pagesSoftware Quality Assurance FrameworkHarunrao100% (2)

- PCB Checking 3Document9 pagesPCB Checking 3Anurdha shammikaNo ratings yet

- AC232 - June 2018Document92 pagesAC232 - June 2018TomNo ratings yet

- Method Statement For Installation of Light Fittings Luminary's Exterior InteriorDocument8 pagesMethod Statement For Installation of Light Fittings Luminary's Exterior InteriorBfboys EdissonNo ratings yet

- Iec 62058-21-2008Document14 pagesIec 62058-21-2008gustavo.eletraenergyNo ratings yet

- 3 Is Learning Information Sheet in Technical Drafting Third Week 1Document11 pages3 Is Learning Information Sheet in Technical Drafting Third Week 1Cherie BalentozaNo ratings yet

- Visual Examination (After Bird Strike (Foreign Object Damage) ) P & WDocument17 pagesVisual Examination (After Bird Strike (Foreign Object Damage) ) P & WAnurag MishraNo ratings yet