Professional Documents

Culture Documents

State Immunity From Suit

Uploaded by

Glo Allen Cruz100%(2)100% found this document useful (2 votes)

2K views18 pagesLaw, Political Law

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLaw, Political Law

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

2K views18 pagesState Immunity From Suit

Uploaded by

Glo Allen CruzLaw, Political Law

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 18

1 | P a g e

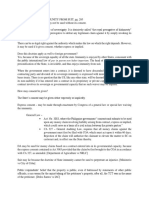

State Immunity From Suit:

A Basic Guide

By Atty. Alexis F. Medina

1

San Sebastian College-Recoletos, Institute of Law

Sections 3, Article XVI of the Constitution provides:

The State may not be sued without its consent.

STATE IMMUNITY DOCTRINE

IN GENERAL

Doctrine of state immunity from suit

Nothing is better settled than the general rule that a sovereign state and its

political subdivisions cannot be sued in the courts except when it has given its consent.

(Republic v. Sandoval, 19 March 1993)

The Republic cannot be proceeded against unless it allows itself to be sued.

Neither can a department, bureau, agency, office, or instrumentality of the government

where the suit, may result "in adverse consequences to the public treasury, whether in

the disbursements of funds or loss of property. Such a doctrine was reiterated in the

following cases: Republic v. Villasor, Sayson v. Singson, Director of the Bureau of

Printing v. Francisco, and Republic v. Purisima. (Santiago v. Republic, G.R. No. L-48214,

19 December 1978)

Logical/practical basis

There can be no legal right as against the authority that makes the law on which

the right depends. (Department of Agriculture v. National Labor Relations Commission,

G.R. No. 104269. November 11, 1993; Republic v. Villasor, G.R. No. L-30671 28

November 1973; Professional Video v. Technical and Educational Skills Development

Authority [Tesda], G.R. No. 155504, June 26, 2009)

1

Atty. Alexis F. Medina. AB Political Science, University of the Philippines (UP), Diliman; Order

of the Purple Feather, UP, College of Law; Valedictorian, San Sebastian College, Manila, Institute

of Law; Associate, Ponce Enrile Reyes & Manlastas Law Offices (Pecabar); Member, Alpha Phi

Beta Fraternity, UP College of Law.

2 | P a g e

The loss of governmental efficiency and the obstacle to the performance of its

multifarious functions would be far greater in severity than the inconvenience that may

be caused private parties, if such fundamental principle is to be abandoned.

(Department of Agriculture v. National Labor Relations Commission, G.R. No. 104269.

November 11, 1993)

It also rests on reasons of public policy that public service would be hindered,

and the public endangered, if the sovereign authority could be subjected to law suits at

the instance of every citizen and consequently controlled in the uses and dispositions of

the means required for the proper administration of the government. (Republic v.

Sandoval 19 March 1993; Professional Video v. Technical and Educational Skills

Development Authority [Tesda], G.R. No. 155504, June 26, 2009)

State immunity as the royal prerogative of dishonesty

The doctrine of state immunity from suit is also called "the royal prerogative of

dishonesty" because it grants the state the prerogative to defeat any legitimate claim

against it by simply invoking its non-suability. (Department of Agriculture v. NLRC 11

November 1993)

APPLICATION OF THE STATE IMMUNITY DOCTRINE

TO THE PHILIPPINE STATE

How to apply the state immunity doctrine to specific cases involving

the Philippine State

Step 1. Determine if the suit qualifies as a suit against the State.

Step 2. If it is a suit against the State, determine if there is an express

consent to be sued.

Step 3. If there is no express consent, determine if there is an implied

consent to be sued.

Step 4. Even if there is no consent, express or implied, determine if the

case falls under the exceptions to the general rule of state immunity from suit.

Step 5. Even if the State can be sued, determine if it is liable.

3 | P a g e

Step 6. If the State is liable, determine if there can be execution against

it.

Step 7. If execution is not allowed, determine how recovery can be

made against the State.

Step 1: Determine if the suit qualifies as a suit against the State

Some instances of a suit against the State:

(1) When the Republic is sued by name;

(2) When the suit is against an unincorporated government agency;

(3) When the suit is on its face against a government officer but the case is

such that ultimate liability will belong not to the officer but to the government. (Republic

v. Sandoval 19 March 1993) When the complaint is filed against officials of the state for

acts allegedly performed by them in the discharge of their duties, the suit is regarded as

one against the state where satisfaction of the judgment against the officials will require

the state itself to perform a positive act, such as the appropriation of the amount

necessary to pay the damages awarded against them. (Shauf v. Court of Appeals, G.R.

No. 90314, November 27, 1990, 191 SCRA 713; Professional Video v. Technical and

Educational Skills Development Authority [Tesda], G.R. No. 155504, June 26, 2009)

Cases when the state immunity doctrine does not apply

1) Relief does not requires action by the State

The principle of state immunity from suit does not apply when the relief

demanded by the suit requires no affirmative official action on the part of the

State nor the affirmative discharge of any obligation which belongs to the State

in its political capacity, even though the officers or agents who are made

defendants claim to hold or act only by virtue of a title of the state and as its

agents and servants. (Republic v. Sandoval 19 March 1993)

2) When the act of the public officer is ultra vires, or in bad

faith, or with malice or gross negligence

When the public official has committed an ultra vires act or where there is

a showing of bad faith, malice or gross negligence, the public officer can be held

personally liable even if such acts are claimed to have been performed in

connection with official duties. (Wylie v. Rarang 209 SCRA 357) A public officer is

by law not immune from damages in his/her personal capacity for acts done in

bad faith which, being outside the scope of his authority, are no longer protected

by the mantle of immunity for official actions. (Vinzons-Chato v. Fortune

Tobacco, 19 June 2007)

4 | P a g e

Step 2: Determine if there is an EXPRESS CONSENT to be sued

1) UNINCORPORATED GOVT AGENCIES:

First View:

The State consents to be sued on money claims involving liability

arising from contract under Act 3083. But the claim must be filed with

the Commission on Audit, under CA 327 and PD 1445.

Express consent may be made through a general law or a special law. In

this jurisdiction, the general law waiving the immunity of the state from suit is

found in Act No. 3083, where the Philippine government "consents and submits

to be sued upon any money claim involving liability arising from contract, express

or implied, which could serve as a basis of civil action between private parties."

Act No. 3083, aforecited, gives the consent of the State to be "sued upon

any moneyed claim involving liability arising from contract, express or implied, . .

." Pursuant, however, to Commonwealth Act ("C.A.") No. 327, as amended by

Presidential Decree ("P.D.") No. 1445, the money claim should first be brought to

the Commission on Audit.

"(C)laimants have to prosecute their money claims against the

Government under Commonwealth Act 327, stating that Act 3083 stands now

merely as the general law waiving the State's immunity from suit, subject to its

general limitation expressed in Section 7 thereof that 'no execution shall issue

upon any judgment rendered by any Court against the Government of the

(Philippines), and that the conditions provided in Commonwealth Act 327 for

filing money claims against the Government must be strictly observed.'

"(Department of Agriculture v. NLRC, 11 November 1993)

Note however that State consent to be sued under Act 3083

extends only to liabilities arising from contract, not torts. Also, the State

consenting to be sued is the Philippine State, not any foreign State.

Second View:

However, in the following cases, the Supreme Court did not cite

any express consent to be sued on money claims arising from contract.

Instead, the Supreme Court used as basis in dismissing the cases the

lack of implied State consent when unincorporated government

agencies entered into contracts in the exercise of their sovereign or

governmental functions. However, the Supreme Court ruled that the

money claims may still be filed with the Commission on Audit, pursuant

to Act No. 327.

5 | P a g e

In Mobil Philippines Corp. v. Customs Arrastre Services (G.R. No. L-

23139, 17 December 1966), the Supreme Court ruled that the Bureau of

Customs cannot be sued for recovery of money and damages involving arrastre

services, considering that said arrastre function may be deemed proprietary,

because it is a necessary incident of the primary and governmental function of

the Bureau of Customs. The Court ruled that the fact that a non-corporate

government entity performs a function proprietary in nature does not necessarily

result in its being suable. If said non-governmental function is undertaken as an

incident to its governmental function, there is no waiver thereby of the sovereign

immunity from suit extended to such government entity. The Supreme Court

ruled that the plaintiff should have filed its present claim to the General Auditing

Office, it being for money under the provisions of Commonwealth Act 327, which

state the conditions under which money claims against the Government may be

filed.

In Professional Video v. Technical and Educational Skills Development

Authority [Tesda], G.R. No. 155504, June 26, 2009, the Supreme Court ruled

that TESDA cannot be sued for recovery of sum of money and damages on a

contract for the supply of PVC cards to be used as ID of TESDA trainees who

passed TESDAs National Skills Certification Program the program that

immediately serves TESDAs mandated function of developing and establishing a

national system of skills standardization, testing, and certification in the country.

TESDA performs governmental functions, and the issuance of certifications is a

task within its function of developing and establishing a system of skills

standardization, testing, and certification in the country. From the perspective of

this function, the core reason for the existence of state immunity applies i.e.,

the public policy reason that the performance of governmental function cannot

be hindered or delayed by suits, nor can these suits control the use and

disposition of the means for the performance of governmental functions. Here,

however, the Supreme Court did not make any mention of the remedy of filing a

claim with the Commission on Audit.

2) INCORPORATED GOVT AGENCIES

Express consent based on their charter. An unincorporated

government agency may be sued if its charter expressly provides

that it can sue and be sued.

An incorporated agency has a charter of its own that invests it with

a separate juridical personality, like the Social Security System, the

University of the Philippines, and the City of Manila. By contrast, the

unincorporated agency is so called because it has no separate juridical

personality but is merged in the general machinery of the government,

like the Department of Justice, the Bureau of Mines and the Government

Printing Office.

6 | P a g e

If the agency is incorporated, the test of its suability is found in its

charter. The simple rule is that it is suable if its charter says so, and this is

true regardless of the functions it is performing. Municipal corporations,

for example, like provinces and cities, are agencies of the State when they

are engaged in governmental functions and therefore should enjoy the

sovereign immunity from suit. Nevertheless, they are subject to suit even

in the performance of such functions because their charter provides that

they can sue and be sued.

State immunity from suit may be waived by general or special law.

The special law can take the form of the original charter of the

incorporated government agency. Jurisprudence is replete with examples

of incorporated government agencies which were ruled not entitled to

invoke immunity from suit, owing to provisions in their charters

manifesting their consent to be sued. These include the National Irrigation

Administration, the former Central Bank, and the National Power

Corporation. In SSS v. Court of Appeals, the Court through Justice

Melencio-Herrera explained that by virtue of an express provision in its

charter allowing it to sue and be sued, the Social Security System did not

enjoy immunity from suit. (German Agency For Technical Cooperation v.

Court of Appeals, G.R. No. 152318, 16 April 2009)(emphasis supplied)

A GOCC with original charter is not immune from suit,

whether or not it performs governmental functions.

A government-owned and controlled corporation "has a personality of its

own distinct and separate from that of the government. Accordingly, it may sue

and be sued and may be subjected to court processes just like any other

corporation. (Santiago v. Republic, G.R. No. L-48214, 19 December 1978;

National Shipyard and Steel Corporation v. Court of Industrial Relations, 118 Phil.

782)

A GOCC with original charter may be even be sued for torts.

A government owned or controlled corporation with an original

charter, whether or not it perform a governmental function, has a

personality of its own, distinct and separate from that of the Government.

If the charter provision says that it can 'sue and be sued in any court,'

without qualification on the cause of action, thus it can include a tort

claim. (See Rayo v. Court of First Instance of Bulacan, 110 SCRA 457

[1981])

7 | P a g e

3) LOCAL GOVTS:

Express consent under the Local Government Code and/or

charter

One of the corporate powers of local government units is to sue

and be sued. (See Section 22, Local Government Code)

Municipal corporations, for example, like provinces and cities, are

agencies of the State when they are engaged in governmental functions

and therefore should enjoy the sovereign immunity from suit.

Nevertheless, they are subject to suit even in the performance of

such functions because their charter provides that they can sue

and be sued. (German Agency For Technical Cooperation v. Court of

Appeals, G.R. No. 152318, 16 April 2009)(emphasis supplied)

Step 3. Determine if there is an IMPLIED CONSENT to be sued

Implied consent, on the other hand, is conceded when the State itself

1) commences litigation, thus opening itself to a counterclaim

2) or when it enters into a contract.

Not all contracts entered into by the government operate as a waiver of

its non-suability. Distinguish

a) sovereign and governmental acts (jure imperii) and

b) private, commercial and proprietary acts (jure gestionis). The State

immunity now extends only to acts jure imperii.

(see Department of Agriculture v. National Labor Relations Commission, G.R. No.

104269. November 11, 1993)

A State may be said to have descended to the level of an individual and

can thus be deemed to have tacitly given its consent to be sued only when it

enters into business contracts. It does not apply where the contracts relates to

8 | P a g e

the exercise of its sovereign functions. (Department of Agriculture v. National Labor

Relations Commission, G.R. No. 104269. November 11, 1993)

Step 4. Determine if the case falls under the exceptions to the general

rule of state immunity from suit

GENERAL RULE:

The state may not be sued without its consent.

EXCEPTIONS:

In these cases, the State may still be sued even if it has no

consent

1) a public officer may be sued to compel him to do an act

required by law;

2) a public officer may be sued to restrain him from enforcing a

law claimed to be unconstitutional;

3) a public officer may be sued to compel an officer to pay

damages from an already appropriate assurance fund or a revenue officer

to refund tax overpayments from a fund already available for such

purpose;

4) an action may be filed to secure a judgment that the officer

impleaded may satisfy himself without the government itself having to do

a positive act to assist him;

5) where the government itself has violated its own laws, the

aggrieved party may directly implead the government even without first

filing his claim with the Commission on Audit, as the doctrine of state

immunity cannot be used as an instrument for perpetrating an injustice.

(Sanders v. Veridiano, 10 June 1988)

The doctrine of state immunity from suit cannot serve as an

instrument for perpetrating an injustice.

9 | P a g e

In Amigable vs. Cuenca, the Supreme Court, in effect, shred the protective

shroud which shields the State from suit, reiterating the decree in the landmark case

of Ministerio vs. CFI of Cebu

[

that the doctrine of governmental immunity from suit

cannot serve as an instrument for perpetrating an injustice on a citizen. It is just as

important, if not more so, that there be fidelity to legal norms on the part of officialdom

if the rule of law were to be maintained. (EPG Construction v. Vigilar, 16 March 2001)

Amigable filed in the court a complaint against the Republic of the Philippines

and Nicolas Cuenca, in his capacity as Commissioner of Public Highways for the recovery

of ownership and possession of the 6,167 square meters of land traversed by the Mango

and Gorordo Avenues. She also sought the payment of compensatory damages in the

sum of P50,000.00 for the illegal occupation of her land, moral damages in the sum of

P25,000.00, attorney's fees in the sum of P5,000.00 and the costs of the suit. The

government contended that the suit was premature because no claim having been filed

first before the Office of the Auditor General. Nevertheless, the Supreme Court ruled

that the government should pay Amigable just compensation for the land, plus damages

in the form of legal interest on the price of the land from the time it was taken up to the

time that payment is made by the government, and attorneys fees. Citing Ministerio vs.

Court of First Instance of Cebu,

the Supreme Court declared that where the government

takes away property from a private landowner for public use without going through the

legal process of expropriation or negotiated sale, the aggrieved party may properly

maintain a suit against the government without thereby violating the doctrine of

governmental immunity from suit without its consent. The doctrine of governmental

immunity from suit cannot serve as an instrument for perpetrating an

injustice on a citizen. When the government takes any property for public use, which

is conditioned upon the payment of just compensation, to be judicially ascertained, it

makes manifest that it submits to the jurisdiction of a court. There is no thought then

that the doctrine of immunity from suit could still be appropriately invoked. (Amigable

vs. Cuenca , G.R. No. L-26400 29 February 1972) (emphasis supplied)

In Republic v. UniMex Micro-Electronics (G.R. Nos. 166309-10, March 9, 2007),

the Supreme Court ordered the Bureau of Customs to pay the value of the goods that

were lost in the BOCs custody, declaring that the situation does not allow us to reject

respondents claim on the mere invocation of the doctrine of state immunity. Succinctly,

the doctrine must be fairly observed and the State should not avail itself of this

prerogative to take undue advantage of parties that may have legitimate claims against

it. Citing Department of Health v. C.V. Canchela & Associates, the Supreme Court

declared that it cannot sanction an injustice so patent in its face, and allow itself to be

an instrument in the perpetration thereof. Justice and equity now demand that the

States cloak of invincibility against suit and liability be shredded.

Step 5. Determine if the State is liable

10 | P a g e

When the State waives its immunity, all it does, in effect, is to give the other

party an opportunity to prove, if it can, that the State has a liability. (Department of

Agriculture v. National Labor Relations Commission, G.R. No. 104269. November 11,

1993)

There seems to be a failure to distinguish between suability and liability

and a misconception that the two terms are synonymous. Suability depends on

the consent of the state to be sued, liability on the applicable law and the

established facts. The circumstance that a state is suable does not necessarily

mean that it is liable; on the other hand, it can never be held liable if it does not

first consent to be sued. Liability is not conceded by the mere fact that the state

has allowed itself to be sued. When the state does waive its sovereign immunity,

it is only giving the plaintiff the chance to prove, if it can, that the defendant is

liable. (United States v. Guinto, G.R. No. 76607, 26 February 1990)

Liability of the state for acts of special agents

"Article 2180. The obligation imposed by Article 2176 is demandable not

only for one's own acts or omissions, but also for those of persons for whom one

is responsible.

xxx

"Employers shall be liable for the damages caused by their employees

and household helpers acting within the scope of their assigned tasks, even

though the former are not engaged in any business of industry.

"The State is responsible in like manner when it acts though a

special agent, but not when the damage has been caused by the official to

whom the task was done properly pertains, in which case what is provided in

Article 2176 shall be applicable. (Article 2180, New Civil Code)

It is a well-entrenched rule in this jurisdiction, embodied in Article 2180 of

the Civil Code of the Philippines, that the State is liable only for torts caused by

its special agents, specially commissioned to carry out the acts complained of

outside of such agent's regular duties (Merritt vs. Insular Government, supra;

Rosete vs. Auditor General, 81 Phil. 453). There being no proof that the making

of the tortious inducement was authorized, neither the State nor its funds can be

made liable therefor. (Republic v. Palacio, 29 May 1968)

The private respondent invokes Article 2180 of the Civil Code which holds the

government liable if it acts through a special agent. The argument, it would seem, is

11 | P a g e

premised on the ground that since the officers are designated "special agents," the

United States government should be liable for their torts.

There seems to be a failure to distinguish between suability and liability

and a misconception that the two terms are synonymous. Suability depends on

the consent of the state to be sued, liability on the applicable law and the

established facts. The circumstance that a state is suable does not necessarily

mean that it is liable; on the other hand, it can never be held liable if it does not

first consent to be sued. Liability is not conceded by the mere fact that the state

has allowed itself to be sued. When the state does waive its sovereign immunity,

it is only giving the plaintiff the chance to prove, if it can, that the defendant is

liable.

The said article establishes a rule of liability, not suability. The

government may be held liable under this rule only if it first allows itself to be

sued through any of the accepted forms of consent.

Moreover, the agent performing his regular functions is not a special

agent even if he is so denominated, as in the case at bar. No less important, the

said provision appears to regulate only the relations of the local state with its

inhabitants and, hence, applies only to the Philippine government and not to

foreign governments impleaded in our courts. (United States v. Guinto, G.R.

No. 76607, 26 February 1990)

Step 6. Determine if the State funds or property can be subject to

execution

Consent to be sued does not mean consent to execution.

Even though the rule as to immunity of a state from suit is relaxed, the power of

the courts ends when the judgment is rendered. (City of Caloocan v. Allarde, G.R. No.

107271, September 10, 2003

When the State gives its consent to be sued, it does not thereby necessarily

consent to an unrestrained execution against it. In Republic vs. Villasor this Court, in

nullifying the issuance of an alias writ of execution directed against the funds of the

Armed Forces of the Philippines to satisfy a final and executory judgment, has explained,

thus The universal rule that where the State gives its consent to be sued by private

parties either by general or special law, it may limit claimant's action "only up to the

completion of proceedings anterior to the stage of execution" and that the power of the

Courts ends when the judgment is rendered. (Department of Agriculture v. National

Labor Relations Commission, G.R. No. 104269. November 11, 1993)

12 | P a g e

The universal rule that where the State gives its consent to be sued by private

parties either by general or special law, it may limit claimant's action "only up to the

completion of proceedings anterior to the stage of execution" and that the power of the

Courts ends when the judgment is rendered. (The Commissioner of Public Highways v.

San Diego, G.R. No. L-30098, February 18, 1970)

In Republic vs. Villasor this Court, in nullifying the issuance of an alias writ of

execution directed against the funds of the Armed Forces of the Philippines to satisfy a

final and executory judgment, has explained, thus The universal rule that where the

State gives its consent to be sued by private parties either by general or special law, it

may limit claimant's action "only up to the completion of proceedings anterior to the

stage of execution" and that the power of the Courts ends when the judgment is

rendered, since government funds and properties may not be seized under writs of

execution or garnishment to satisfy such judgments, is based on obvious considerations

of public policy. Disbursements of public funds must be covered by the correspondent

appropriation as required by law. (Department of Agriculture v. National Labor Relations

Commission, G.R. No. 104269. November 11, 1993)

RULES ON EXECUTION AGAINST THE STATE

1. EXECUTION AGAINST UNINCORPORATED GOVT

AGENCIES

RULE:

Public funds cannot be the object of garnishment.

Funds and properties of unincorporated government

agencies are exempt from execution and garnishment.

Public funds cannot be the object of a garnishment proceeding even if the

consent to be sued had been previously granted and the state liability adjudged.

(Republic v. Villasor, G.R. No. L-30671 28 November 1973)

In Republic vs. Villasor this Court, in nullifying the issuance of an alias

writ of execution directed against the funds of the Armed Forces of the

Philippines to satisfy a final and executory judgment, has explained, thus The

universal rule that where the State gives its consent to be sued by private parties

either by general or special law, it may limit claimant's action "only up to the

completion of proceedings anterior to the stage of execution" and that the power

of the Courts ends when the judgment is rendered. (Department of Agriculture v.

National Labor Relations Commission, G.R. No. 104269. November 11, 1993)

Even assuming that TESDA entered into a proprietary contract with

PROVI and thereby gave its implied consent to be sued, TESDAs funds are still

13 | P a g e

public in nature and, thus, cannot be the valid subject of a writ of garnishment

or attachment. Under Section 33 of the TESDA Act, the TESDA budget for the

implementation of the Act shall be included in the annual General Appropriation

Act; hence, TESDA funds, being sourced from the Treasury, are moneys

belonging to the government, or any of its departments, in the hands of public

officials. Public funds cannot be the object of garnishment proceedings even if

the consent to be sued had been previously granted and the state liability

adjudged. Disbursements of public funds must be covered by the corresponding

appropriation as required by law. The functions and public services rendered by

the State cannot be allowed to be paralyzed or disrupted by the diversion of

public funds from their legitimate and specific objects, as appropriated by law.

(Professional Video v. Technical and Educational Skills Development Authority

[Tesda], G.R. No. 155504, June 26, 2009)

All government funds deposited with it by any agency or instrumentality

of the government, whether by way of general or special deposit, remain

government funds, since such government agencies or instrumentalities do not

have any non-public or private funds of their own. (The Commissioner of Public

Highways v. San Diego, G.R. No. L-30098, February 18, 1970)

The rule is and has always been that all government funds deposited in

the PNB or any other official depositary of the Philippine Government by any of

its agencies or instrumentalities, whether by general or special deposit, remain

government funds and may not be subject to garnishment or levy, in the

absence of a corresponding appropriation as required by law. (City of Caloocan

v. Allarde, G.R. No. 107271, September 10, 2003

Reason for the rule

That government funds and properties may not be seized under

writs of execution or garnishment to satisfy such judgments, is based on

obvious considerations of public policy. Disbursements of public funds

must be covered by the correspondent appropriation as required by law.

The functions and public services rendered by the State cannot be

allowed to be paralyzed or disrupted by the diversion of public funds from

their legitimate and specific objects, as appropriated by law. (Department

of Agriculture v. National Labor Relations Commission, G.R. No. 104269.

November 11, 1993; The Commissioner of Public Highways v. San Diego,

G.R. No. L-30098, February 18, 1970)

2. EXECUTION AGAINST INCORPORATED GOVT

AGENCIES

GEN. RULE:

14 | P a g e

Funds and properties of incorporated government agencies

may be subject to execution.

In Philippine National Railways v. Union de Maquinistas, et al., then

Justice Fernando, later Chief Justice, said. "The main issue posed in this

certiorari proceeding, whether or not the funds of the Philippine National

Railways, could be garnished or levied upon on execution was resolved in two

recent decisions, the Philippine National Bank v. Court of Industrial Relations [81

SCRA 314] and Philippine National Bank v. Hon. Judge Pabalan [83 SCRA 595].

This Court in both cases answered the question in the affirmative. There was no

legal bar to garnishment or execution. The argument based on non-suability of a

state allegedly because the funds are governmental in character was

unavailing.So it must be again."

In support of the above conclusion, Justice Fernando cited the Court's

holding in Philippine National Bank v. Court of Industrial Relations, to wit: "The

premise that the funds could be spoken of as public in character may be

accepted in the sense that the People's Homesite and Housing Corporation was a

government-owned entity. It does not follow though that they were exempt from

garnishment. National Shipyard and Steel Corporation v. Court of Industrial

Relations is squarely in point. As was explicitly stated in the opinion of then

Justice, later Chief Justice, Concepcion: "The allegation to the effect that the

funds of the NASSCO are public funds of the government, and that, as such, the

same may not be garnished, attached or levied upon, is untenable for, as a

government- owned and controlled corporation, the NASSCO has a personality of

its own, distinct and separate from that of the Government. It has-pursuant to

Section 2 of Executive Order No. 356, dated October 23, 1950, pursuant to

which the NASSCO has been established- all the powers of a corporation under

the Corporation Law. (Philippine National Railways v. Court of Appeals, G.R. No.

L-55347 October 4, 1985)

EXCEPTION TO THE GEN. RULE:

Public funds of local governments are not subject to

execution

The funds of the Municipality of San Miguel, Bulacan, in the hands of the

provincial and municipal treasurers of Bulacan and San Miguel, respectively, are

public funds which are exempt from execution for the satisfaction of the money

judgment in Civil Case No. 604-B. Well settled is the rule that public funds are

not subject to levy and execution. The reason for this is that they are held in

trust for the people, intended and used for the accomplishment of the purposes

for which municipal corporations are created, and that to subject said properties

and public funds to execution would materially impede, even defeat and in some

instances destroy said purpose." And, in Tantoco vs. Municipal Council of Iloilo,

49 Phil. 52, it was held that "it is the settled doctrine of the law that not only the

15 | P a g e

public property but also the taxes and public revenues of such corporations

Cannot be seized under execution against them, either in the treasury or when in

transit to it. Judgments rendered for taxes, and the proceeds of such judgments

in the hands of officers of the law, are not subject to execution unless so

declared by statute." Moreover, under Presidential Decree No. 477, known as

"The Decree on Local Fiscal Administration", Section 2 (a), there must be a

corresponding appropriation in the form of an ordinance duly passed by the

Sangguniang Bayan before any money of the municipality may be paid out.

(Municipality of San Miguel Bulacan v. Fernandez, G.R. No. L-61744, 25 June

1984)

EXCEPTION TO THE EXCEPTION:

Public funds of local government units may subject to

execution if there is already a corresponding appropriation as

required by law

However, the rule is not absolute and admits of a well-defined

exception, that is, when there is a corresponding appropriation as

required by law. Otherwise stated, the rule on the immunity of public

funds from seizure or garnishment does not apply where the funds

sought to be levied under execution are already allocated by law

specifically for the satisfaction of the money judgment against the

government. In such a case, the monetary judgment may be legally

enforced by judicial processes.

Thus, in the similar case of Pasay City Government, et al. vs. CFI

of Manila, Br. X, et al., where petitioners challenged the trial courts order

garnishing its funds in payment of the contract price for the construction

of the City Hall, we ruled that, while government funds deposited in the

PNB are exempt from execution or garnishment, this rule does not apply

if an ordinance has already been enacted for the payment of the Citys

obligations.

In the instant case, the City Council of Caloocan already approved

and passed Ordinance No. 0134, Series of 1992, allocating the amount of

P439,377.14 for respondent Santiagos back salaries plus interest. Thus

this case fell squarely within the exception. For all intents and purposes,

Ordinance No. 0134, Series of 1992, was the "corresponding

appropriation as required by law." The sum indicated in the ordinance for

Santiago were deemed automatically segregated from the other

budgetary allocations of the City of Caloocan and earmarked solely for

the Citys monetary obligation to her. The judgment of the trial court

could then be validly enforced against such funds. (City of Caloocan v.

Allarde, G.R. No. 107271, September 10, 2003)

16 | P a g e

Step 7. If execution is not allowed, determine how recovery can be

made against the State.

Money claims against unincorporated government agencies must

be filed with the Commission on Audit

The claims of private respondents, i.e., for underpayment of wages, holiday pay,

overtime pay and similar other items, arising from the Contract for Security Services,

clearly constitute money claims. Act No. 3083, aforecited, gives the consent of the State

to be "sued upon any moneyed claim involving liability arising from contract, express or

implied, . . ." Pursuant, however, to Commonwealth Act ("C.A.") No. 327, as amended

by Presidential Decree ("P.D.") No. 1445, the money claim should first be brought to the

Commission on Audit. (Department of Agriculture v. National Labor Relations

Commission, G.R. No. 104269. November 11, 1993)

Act 3083, the general law waiving its immunity from suit "upon any money claim

involving liability arising from contract express or implied," imposed the limitation in Sec.

7 thereof that "no execution shall issue upon any judgment rendered by any Court

against the Government of the (Philippines) under the provisions of this Act;" and that

otherwise, the claimant would have to prosecute his money claim against the State

under Commonwealth Act 327. (Belleng v. Republic, L-19856, Nov. 16, 1963 [9 SCRA

6])

Claimants have to prosecute their money claims against the Government under

Commonwealth Act 327, stating that Act 3083 stands now merely as the general law

waiving the State's immunity from suit, subject to the general limitation expressed in

Section 7 thereof that "no execution shall issue upon any judgment rendered by any

Court against the Government of the (Philippines),

and that the conditions provided in

Commonwealth Act 327 for filing money claims against the Government must be strictly

observed. (Carabao Inc. v. Agricultural Productivity Commission, G.R. No. L-29304, 30

September 1970; see also Mobil Philippines Explorers v. Customs Arrastre Service, G.R.

No. L-26994, 28 November 1969)

It is apparent that respondent Singson's cause of action is a money claim against

the government, for the payment of the alleged balance of the cost of spare parts

supplied by him to the Bureau of Public Highways. Assuming momentarily the validity of

such claim, mandamus is not the remedy to enforce the collection of such claim against

the State but a ordinary action for specific performance. Actually, the suit disguised as

one for mandamus to compel the Auditors to approve the vouchers for payment, is a

17 | P a g e

suit against the State, which cannot prosper or be entertained by the Court except with

the consent of the State. In other words, the respondent should have filed his claim with

the General Auditing Office, under the provisions of Com. Act 327, which prescribe the

conditions under which money claim against the government may be

filed.

Commonwealth Act No. 327 provided: "In all cases involving the settlement of

accounts or claims, other than those of accountable officers, the Auditor General shall

act and decide the same within sixty days, exclusive of Sundays and holidays, after their

presentation. If said accounts or claims need reference to other persons, office or

offices, or to a party interested, the period aforesaid shall be counted from the time the

last comment necessary to a proper decision is received by him."

Thereafter, the

procedure for appeal is indicated: "The party aggrieved by the final decision of the

Auditor General in the settlement of an account or claim may, within thirty days from

receipt of the decision, take an appeal in writing: (a) To the President of the United

States, pending the final and complete withdrawal of her sovereignty over the

Philippines, or (b) To the President of the Philippines, or (c) To the Supreme Court of

the Philippines if the appellant is a private person or entity." (Sayson v. Singson, G.R.

No. L-30044, 19 December 1973)

Note however that in Amigable vs. Cuenca (G.R. No. L-26400 29 February 1972)

the Supreme Court ruled that a suit for recovery of possession and damages against an

unincorporated agency (Public Works Commission) can propsper even in the absence of

a prior claim before the Auditor General, declaring that where the government takes

away property from a private landowner for public use without going through the legal

process of expropriation or negotiated sale, the aggrieved party may properly maintain a

suit against the government without thereby violating the doctrine of governmental

immunity from suit without its consent. The doctrine of governmental immunity

from suit cannot serve as an instrument for perpetrating an injustice on a

citizen.

The State must appropriate money to satisfy judgment against it

Although the Government, as plaintiff in expropriation proceedings, submits itself

to the jurisdiction of the Court and thereby waives its immunity from suit, the judgment

that is thus rendered requiring its payment of the award determined as just

compensation for the condemned property as a condition precedent to the transfer to

the title thereto in its favor, cannot be realized upon execution. It is incumbent upon the

legislature to appropriate any additional amount, over and above the provisional deposit,

that may be necessary to pay the award determined in the judgment, since the

Government cannot keep the land and dishonor the judgment.

Judgments against the State or its agencies and instrumentalities in cases where

the State has consented to be sued, operate merely to liquidate and establish the

plaintiff's claim; such judgments may not be enforced by writs of execution or

garnishment and it is for the legislature to provide for their payment through the

corresponding appropriation, as indicated in Act 3083. (The Commissioner of Public

Highways v. San Diego, G.R. No. L-30098, February 18, 1970)

18 | P a g e

Even though the rule as to immunity of a state from suit is relaxed, the power of

the courts ends when the judgment is rendered. Although the liability of the state has

been judicially ascertained, the state is at liberty to determine for itself whether to pay

the judgment or not, and execution cannot issue on a judgment against the state. Such

statutes do not authorize a seizure of state property to satisfy judgments recovered, and

only convey an implication that the legislature will recognize such judgment as final and

make provision for the satisfaction thereof. (City of Caloocan v. Allarde, G.R. No.

107271, September 10, 2003)

You might also like

- Outline in Constitutional Law 1 (Cruz)Document8 pagesOutline in Constitutional Law 1 (Cruz)Arvin Antonio Ortiz93% (42)

- Session 3 - State Immunity From SuitDocument64 pagesSession 3 - State Immunity From SuitRon Ico RamosNo ratings yet

- Doctrine of State Immunity From SuitDocument7 pagesDoctrine of State Immunity From SuitHeehyo Song100% (1)

- Merritt Vs Government of The Philippine IslandsDocument1 pageMerritt Vs Government of The Philippine IslandsprincessF0717100% (1)

- Constitutional Law 1 (Case Digest 4) Doctrine of State ImmunityDocument31 pagesConstitutional Law 1 (Case Digest 4) Doctrine of State ImmunityAnthony Rupac Escasinas100% (9)

- State ImmunityDocument43 pagesState ImmunityRheyz Pierce A. CampilanNo ratings yet

- ALTOM TRANSPORT, INC. v. WESTCHESTER FIRE INSURANCE COMPANY Et Al ComplaintDocument209 pagesALTOM TRANSPORT, INC. v. WESTCHESTER FIRE INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- D CONSTITUTIONAL LAW The Philippines As A StateDocument13 pagesD CONSTITUTIONAL LAW The Philippines As A StateSunjeong Macho100% (1)

- Co Kim Cham Vs Valdez Tan KehDocument1 pageCo Kim Cham Vs Valdez Tan KehJeremy King100% (1)

- Wylie Vs RarangDocument12 pagesWylie Vs Raranglovekimsohyun89No ratings yet

- Chapter 4 - Doctrine of State ImmunityDocument2 pagesChapter 4 - Doctrine of State ImmunityAaron Te100% (4)

- Department of Agriculture Vs NLRCDocument3 pagesDepartment of Agriculture Vs NLRCrodel_odzNo ratings yet

- Holy See Vs RosarioDocument1 pageHoly See Vs Rosariopot999No ratings yet

- Doctrine of State ImmunityDocument19 pagesDoctrine of State ImmunityDale ContarNo ratings yet

- Magallona vs. Ermita DigestDocument2 pagesMagallona vs. Ermita DigestAliya Safara Ambray100% (3)

- Constitutional Law 1 File No 2Document22 pagesConstitutional Law 1 File No 2Seit DyNo ratings yet

- Crimes Against PersonsDocument42 pagesCrimes Against Personsafro yow100% (1)

- Constitutional Law 1Document321 pagesConstitutional Law 1germaine_ruña100% (3)

- Suability DOA Vs NLRCDocument4 pagesSuability DOA Vs NLRCVon Ember Mc MariusNo ratings yet

- Module 2 Doctrine of Non-Suability of StateDocument7 pagesModule 2 Doctrine of Non-Suability of StateJulius Carmona GregoNo ratings yet

- Political LawDocument364 pagesPolitical LawJingJing Romero100% (99)

- Constitutional Law 1 - File No. 2Document22 pagesConstitutional Law 1 - File No. 2priam gabriel d salidaga78% (9)

- DOCTRINE OF STATE IMMUNITY Review MaterialDocument8 pagesDOCTRINE OF STATE IMMUNITY Review MaterialCyrusNo ratings yet

- Doctrine of State ImmunityDocument8 pagesDoctrine of State ImmunitySesshy TaishoNo ratings yet

- Succession+ +Main+ReviewerDocument112 pagesSuccession+ +Main+Reviewerramas_kramNo ratings yet

- State Immunity NotesDocument34 pagesState Immunity NotesBo Dist50% (2)

- 005200.1 - A105 Standard Form of Agreement - DRAFTDocument18 pages005200.1 - A105 Standard Form of Agreement - DRAFTWestmere Fire DistrictNo ratings yet

- Doctrine of State ImmunityDocument5 pagesDoctrine of State ImmunityMeah BrusolaNo ratings yet

- Sanders vs. Veridiano Case DigestsDocument4 pagesSanders vs. Veridiano Case DigestsBrian Balio50% (2)

- State Immunity From SuitDocument18 pagesState Immunity From SuitNufa AlyhaNo ratings yet

- Hurt and Grievous HurtDocument32 pagesHurt and Grievous HurtShikhar AgarwalNo ratings yet

- Board of Assessment Appeals V MeralcoDocument2 pagesBoard of Assessment Appeals V MeralcoGlo Allen CruzNo ratings yet

- Merritt Vs Government of The Philippine Islands 2Document2 pagesMerritt Vs Government of The Philippine Islands 2RR FNo ratings yet

- 136 Scra 487 - Us Vs RuizDocument7 pages136 Scra 487 - Us Vs RuizMj Garcia100% (1)

- Insurance Midterms Case DoctrinesDocument7 pagesInsurance Midterms Case DoctrinesXShannevie Krista Maceda VillartaNo ratings yet

- STATCON Case DigestsDocument235 pagesSTATCON Case Digestsjunneau81% (27)

- 13.mollaneda Vs Umacob GR No. 140128 June 6, 2001Document2 pages13.mollaneda Vs Umacob GR No. 140128 June 6, 2001Winnie Ann Daquil Lomosad100% (1)

- Medical MalpracticeDocument18 pagesMedical MalpracticeGlo Allen Cruz0% (1)

- Almodiel V NLRC. 1993. My DigestDocument3 pagesAlmodiel V NLRC. 1993. My DigestRicky James Laggui Suyu100% (1)

- 13 128385-1993-Department - of - Agriculture - v. - National - Labor20181114-5466-1anm1pg PDFDocument8 pages13 128385-1993-Department - of - Agriculture - v. - National - Labor20181114-5466-1anm1pg PDFJM CamposNo ratings yet

- Baranda To Republic Vs IACDocument5 pagesBaranda To Republic Vs IACThrees SeeNo ratings yet

- State Immunity - Power Point PresentationDocument34 pagesState Immunity - Power Point PresentationKatrina Montes100% (10)

- 1.pvta Vs Cir 65 Scra 416 - Consti 1Document1 page1.pvta Vs Cir 65 Scra 416 - Consti 1MarkAnthonyTanCalimagNo ratings yet

- Government vs. Monte de PiedadDocument2 pagesGovernment vs. Monte de PiedadMark Soriano Bacsain100% (3)

- Government of Philippines Islands vs. El Monte de Piedad December 13, 1916 CASE DIGESTDocument2 pagesGovernment of Philippines Islands vs. El Monte de Piedad December 13, 1916 CASE DIGESTShe100% (1)

- Memory Aid For Constitutional Law I PDFDocument6 pagesMemory Aid For Constitutional Law I PDFVeen Galicinao Fernandez100% (2)

- State Immunity From Suit:: A Basic GuideDocument17 pagesState Immunity From Suit:: A Basic GuideYet Barreda BasbasNo ratings yet

- Succession Uribe AudioDocument20 pagesSuccession Uribe AudioGlo Allen Cruz100% (1)

- Case Digest Republic Vs FelicianoDocument1 pageCase Digest Republic Vs FelicianoYakumaNo ratings yet

- State Immunity From Suit:: A Basic GuideDocument16 pagesState Immunity From Suit:: A Basic GuideJezen Esther PatiNo ratings yet

- San Miguel Corp Employees Union v. San Miguel Packaging ProductsDocument3 pagesSan Miguel Corp Employees Union v. San Miguel Packaging ProductsGlo Allen CruzNo ratings yet

- Succession UribeDocument143 pagesSuccession UribeGlo Allen CruzNo ratings yet

- Lawyers League For A Better Philippines VsDocument2 pagesLawyers League For A Better Philippines Vsfjl300No ratings yet

- ACCFA v. FLUDocument2 pagesACCFA v. FLUJoaquin Javier Balce100% (1)

- Constitutional LawDocument91 pagesConstitutional Lawblacksand8No ratings yet

- Digest Const ImmunityDocument25 pagesDigest Const ImmunitySapphireNo ratings yet

- Topic Outline of Doctrine of State Immunity On Suits - Dano Charrise PDFDocument2 pagesTopic Outline of Doctrine of State Immunity On Suits - Dano Charrise PDFCharrise DanoNo ratings yet

- Article XviDocument4 pagesArticle XviALBERT JOHN ZAMARNo ratings yet

- Dept. of Agriculture v. NLRC PDFDocument8 pagesDept. of Agriculture v. NLRC PDFcarla_cariaga_2No ratings yet

- 128385-1993-Department of Agriculture v. National Labor20160322-9941-N9xdh7Document8 pages128385-1993-Department of Agriculture v. National Labor20160322-9941-N9xdh7Ariel MolinaNo ratings yet

- Department of Agriculture V NLRCDocument9 pagesDepartment of Agriculture V NLRCChriscelle Ann PimentelNo ratings yet

- Doctrine of StateDocument3 pagesDoctrine of StateElmer UrmatamNo ratings yet

- Immunity From SuitsDocument4 pagesImmunity From Suitsferosiac0% (1)

- Module 6Document3 pagesModule 6Dianalyn QuitebesNo ratings yet

- Immunity From Suit: Imperium or An Equal Has No Dominion Over An Equal, Which Is The Basis of TheDocument12 pagesImmunity From Suit: Imperium or An Equal Has No Dominion Over An Equal, Which Is The Basis of ThePatricia RodriguezNo ratings yet

- In Summary - Chapter 4: The Doctrine of State Immunity: Political Law September 23, 2017Document23 pagesIn Summary - Chapter 4: The Doctrine of State Immunity: Political Law September 23, 2017Ghatz CondaNo ratings yet

- State Immunity From SuitDocument5 pagesState Immunity From SuitAIL REGINE REY MABIDANo ratings yet

- Department of Agriculture Vs NLRC GR No. 104269 Nov 11, 1993Document6 pagesDepartment of Agriculture Vs NLRC GR No. 104269 Nov 11, 1993Lourd CellNo ratings yet

- 1.university of The Philippines v. Dizon, 679 SCRA 54 (2012)Document14 pages1.university of The Philippines v. Dizon, 679 SCRA 54 (2012)Maeralin Rose SagunNo ratings yet

- Department of Agriculture Vs NLRC GR No. 104269 Nov 11, 1993Document6 pagesDepartment of Agriculture Vs NLRC GR No. 104269 Nov 11, 1993Lourd CellNo ratings yet

- 18 - Department of Agriculture v. NLRCDocument3 pages18 - Department of Agriculture v. NLRCAngelo Raphael B. DelmundoNo ratings yet

- Article Xvi General ProvisionsDocument45 pagesArticle Xvi General Provisions'Bernan Esguerra BumatayNo ratings yet

- Political Law Pre Week NotesDocument32 pagesPolitical Law Pre Week NotesPeter AllanNo ratings yet

- No.4-SEPARATION OF POWERSDocument17 pagesNo.4-SEPARATION OF POWERSrejine mondragonNo ratings yet

- POLITICAL AND PUBLIC INTERNATIONAL LAW by Atty. Loanzon Lecture Jan 2022Document8 pagesPOLITICAL AND PUBLIC INTERNATIONAL LAW by Atty. Loanzon Lecture Jan 2022Janice CabalagNo ratings yet

- Elements of Literature in Gift of The Magi - Catherine MickDocument21 pagesElements of Literature in Gift of The Magi - Catherine MickGlo Allen CruzNo ratings yet

- Study On Sexual OrientationDocument9 pagesStudy On Sexual OrientationGlo Allen CruzNo ratings yet

- Same Sex Cohabitation StudyDocument37 pagesSame Sex Cohabitation StudyGlo Allen CruzNo ratings yet

- Philippine EconomyDocument1 pagePhilippine EconomyGlo Allen CruzNo ratings yet

- New Testament Teachings Regarding Same-Sex Sexual Activity-Homosexuality Is Not A ChoiceDocument15 pagesNew Testament Teachings Regarding Same-Sex Sexual Activity-Homosexuality Is Not A ChoiceGlo Allen CruzNo ratings yet

- Study On Sexual OrientationDocument9 pagesStudy On Sexual OrientationGlo Allen CruzNo ratings yet

- Study On Sexual OrientationDocument9 pagesStudy On Sexual OrientationGlo Allen CruzNo ratings yet

- LEME Hospital Liabalities REPORTDocument23 pagesLEME Hospital Liabalities REPORTGlo Allen CruzNo ratings yet

- Group 3 Medical EvidenceDocument2 pagesGroup 3 Medical EvidenceGlo Allen CruzNo ratings yet

- Study On Sexual OrientationDocument9 pagesStudy On Sexual OrientationGlo Allen CruzNo ratings yet

- Journal of BisexualityDocument8 pagesJournal of BisexualityGlo Allen CruzNo ratings yet

- Torres Vs CADocument10 pagesTorres Vs CAGlo Allen CruzNo ratings yet

- Manual BodyDocument100 pagesManual BodyGlo Allen CruzNo ratings yet

- Philippine Mining LawDocument28 pagesPhilippine Mining LawGlo Allen Cruz100% (1)

- Laurel V GarciaDocument1 pageLaurel V GarciaGlo Allen CruzNo ratings yet

- AdinaDocument1 pageAdinaGlo Allen CruzNo ratings yet

- Intro Manual Judicial WritingDocument10 pagesIntro Manual Judicial WritingGlo Allen CruzNo ratings yet

- Book Review Final (Adina)Document1 pageBook Review Final (Adina)Glo Allen CruzNo ratings yet

- Why Pro On The RH BillDocument2 pagesWhy Pro On The RH BillGlo Allen CruzNo ratings yet

- 2012 Civil Law SyllabusDocument39 pages2012 Civil Law SyllabusTiofilo VillanuevaNo ratings yet

- Oposa Factoran JR FullDocument14 pagesOposa Factoran JR FullGlo Allen CruzNo ratings yet

- Stegner V StegnerDocument3 pagesStegner V StegnerLizzette Dela PenaNo ratings yet

- The Foreign Sovereign Immunities Act: A Guide For Judges: Federal Judicial Center International Litigation GuideDocument156 pagesThe Foreign Sovereign Immunities Act: A Guide For Judges: Federal Judicial Center International Litigation GuideНаталья ШмыгалеваNo ratings yet

- Mortgage On Condominium Units CasesDocument34 pagesMortgage On Condominium Units CasesKatherine OlidanNo ratings yet

- Panera BreadDocument2 pagesPanera BreadSharky Roxas100% (1)

- United States of America Ex Rel. Gerardo Catena v. Albert Elias, Superintendent of Youth Reception and Correction Center at Yardville, N. J, 449 F.2d 40, 3rd Cir. (1971)Document16 pagesUnited States of America Ex Rel. Gerardo Catena v. Albert Elias, Superintendent of Youth Reception and Correction Center at Yardville, N. J, 449 F.2d 40, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Data Protection 4pm Tuesday 28 February: For The Education SectorDocument18 pagesData Protection 4pm Tuesday 28 February: For The Education SectorAmitNo ratings yet

- EDCA Publishing v. Santos, 184 SCRA 614 (1990) .Document3 pagesEDCA Publishing v. Santos, 184 SCRA 614 (1990) .Angela AquinoNo ratings yet

- National Housing Authority vs. Almeida G.R. No. 162784, June 22, 2007 (FULL CASE)Document7 pagesNational Housing Authority vs. Almeida G.R. No. 162784, June 22, 2007 (FULL CASE)Sharliemagne B. BayanNo ratings yet

- Statement On Foresic Audit Report For Ministry of Education and Ministry of Medical ServicesDocument6 pagesStatement On Foresic Audit Report For Ministry of Education and Ministry of Medical ServicesH.E. President Uhuru KenyattaNo ratings yet

- Polity Notes On Age Limits in Indian ConstitutionDocument4 pagesPolity Notes On Age Limits in Indian Constitutionvirender_ajaykumarNo ratings yet

- BALLB (Syllabus)Document112 pagesBALLB (Syllabus)Taabish KhanNo ratings yet

- Asma Jilani Vs Government of The PunjabDocument124 pagesAsma Jilani Vs Government of The PunjabKaren MalsNo ratings yet

- Legal Research Methodology Prof Amar P GargDocument40 pagesLegal Research Methodology Prof Amar P GargAnael ArnavNo ratings yet

- Universal Jurisdiction PDFDocument3 pagesUniversal Jurisdiction PDFNovie AmorNo ratings yet

- Research Proposal On Evolution of Surrogacy LawsDocument11 pagesResearch Proposal On Evolution of Surrogacy LawsAbhay GuptaNo ratings yet

- Oblicon Case Digest 5Document15 pagesOblicon Case Digest 5LAWRENCE EDWARD SORIANONo ratings yet

- Ethical Aspects of SFMDocument21 pagesEthical Aspects of SFMKaneNo ratings yet

- 85-Year-Old Tewksbury Woman Accuses Town, Police of Civil Rights ViolationsDocument37 pages85-Year-Old Tewksbury Woman Accuses Town, Police of Civil Rights ViolationsEric LevensonNo ratings yet

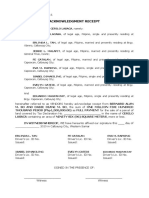

- Acknowledgment Receipt: Eduardo MagpantayDocument2 pagesAcknowledgment Receipt: Eduardo MagpantayAnirtsNo ratings yet

- Williams v. Illinois, 132 S. Ct. 2221 (2012)Document98 pagesWilliams v. Illinois, 132 S. Ct. 2221 (2012)Scribd Government DocsNo ratings yet

- Belcodero V CADocument2 pagesBelcodero V CACai CarpioNo ratings yet

- Physical Therapy Org. vs. Municipal BoardDocument5 pagesPhysical Therapy Org. vs. Municipal BoardMermerRectoNo ratings yet

- Schmoller - The Mercantilism SystemDocument116 pagesSchmoller - The Mercantilism Systemtangerina65No ratings yet