Professional Documents

Culture Documents

Interest

Uploaded by

Jollybelleann MarcosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest

Uploaded by

Jollybelleann MarcosCopyright:

Available Formats

Accounting 490 Professor Jeff Harkins

10/8/2014

The Time Value of Money

Interest, the time value of money, imlicitly !erives from an in!ivi!ual"s reference for

current consumtion over future consumtion# Peole refer current consumtion

$ecause eole have resent %ants an! nee!s an! $ecause there is a risk that they might

not $e aroun! in the future if they forego consumtion to!ay# Ho%ever, eole %ill

forego consumtion to!ay, if they are re%ar!e! for !oing so# &he re%ar!, %hich %e %ill

call interest, must reim$urse the in!ivi!ual %ho sacrifices to!ay"s consumtion for the

uncertainty associate! %ith the !eferral of resent consumtion# &he mo!el for evaluating

the resent an! future values of monetary transactions is $uilt from this $asic nee! for a

re%ar! to sacrifice to!ay"s consumtion#

'n accounting an! finance, the time value of money is use! to measure an! evaluate many

$usiness an! economic transactions, inclu!ing(

accounts an! notes receiva$le

accounts an! notes aya$le

long)term caital assets

stocks, $on!s an! other securities

long)term leases

ensions an! retirement lans

investment analysis

!ereciation

$usiness com$inations

caital $u!geting !ecisions

mergers an! ac*uisitions

't is imortant that stu!ents of $usiness, esecially accounting an! finance stu!ents, $e

comforta$le %ith techni*ues for evaluating financial transactions using time value of

money techni*ues#

Future Values and Present Values

+or an intro!uction to the $asic structure an! techni*ue of !etermining the time value of

money, consi!er that you have !eosite! ,1,000 in a savings account at the $ank to!ay

an! that you %ill leave the money %ith the $ank for one year# -ou might ask yourself if

you %oul! $e %illing to leave the money %ith the $ank for the year, then at the en! of the

year, %ith!ra% the fun!s .,1,000/, %ith no a!!itional comensation# 'f not, %hy not0

1eflecting on your resonse may hel you to un!erstan! the intro!uctory aragrah#

2o, you ro$a$ly e3ect to receive more than ,1,000 from the $ank at the en! of the year#

&here are many %ays to vie% the su$tleties of this event# 4ne ersective !irects you to

recogni5e that the $ank is $orro%ing your money for one year ) an! $ecause they are

6using7 your money, you e3ect to receive 6rent7 for the use of the fun!s for the year#

Another %ay of thinking a$out this transaction is to consi!er that you are 6investing7 your

fun!s in a relatively lo%)risk investment .the savings account/ an! that you e3ect to

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

receive a 6return7 on your investment# 'n either case, you e3ect a re%ar! for lacing

your fun!s at the !isosal of the $ank, thus the $ank ays you a fee, calle! 6interest7# &he

interest fee or 6rent7 is usually *uote! as a 6rate7 or interest rate an! refers to the

ercentage ayment that %ill $e ai! on the rincial for a erio! of time# >nless state!

other%ise, the conventional means of *uoting interest rates is to state the interest rate for

an annual erio! or one year# &hus, if our ,1,000 !eosite! at the $ank earne! interest at

9?, it %oul! $e assume! that the $ank is aying us ,90 for use of the money !eosite! for

one year#

&o lace the a$ove scenario into a more structure! argument an! contemorary synta3, if

%e !eosit ,1,000 to!ay .the resent value/ %hich %ill earn 9? er year .the

comoun!ing rate of interest er erio!/; the fun!s on !eosit in one year .the future

value/ total ,1,090# &his 6future value7 is calculate! as follo%s(

Future value (FV) = Present value (PV) + [Present value (PV) * Interest rate ( r )]

or

FV = PV + [PV * r]

or

FV @ ,1,000 A B,1,000 C #09D

@ ,1,090

Euose %e !eci!e! to leave the fun!s on !eosit for t%o years instea! of one year# &his

coul! $e calculate! as follo%s(

FV = PV + [PV * r] + {[PV + (PV * r)] * r

@ ,1,000 A B,1,000C#09D A FB,1,000 A .,1,000 C #09/D C #09G

@ ,1,000 A B,90D A B,1,090 C #09D

@ ,1,000 A ,90 A ,98#10

@ ,1,188#10

'f you are comforta$le %ith alge$ra, you might notice that the right han! si!e of the

rece!ing e*uation can $e simlifie! $y factoring#

Hegin %ith(

FV = PV + [PV * r] + {[PV + (PV * r)] * r

Ilear the $rackets, %hich ro!uces(

FV = PV + PVr + PVr + PVr

!

&hen factor the term P< from the restate! e*uation an! collect terms(

FV = PV ("+ r + r + r

!

)

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

FV = PV ("+ !r + r

!

)

&hen re!uce the result to its simlest form(

FV = PV ("+ r )

!

'f %e su$stitute the information from our earlier e3amle for ,1,000 earning 9? interest

comoun!e! annually for t%o erio!s, %e get the result(

FV = PV ("+ r )

!

FV = #"$%%% ("+ &%' )

!

FV = #"$%%% ("&%' )

!

FV = #"$%%% ("&"((")

FV = #"$"((&("

&his is e*uivalent to the e3ten!e! calculations ren!ere! a$ove#

As you might have susecte!, the calculation of the future value of a resent amount is a

geometric series an! the formula can $e generali5e! as follo%s(

FV = PV (" + r)

n

%here(

FV = Future value of a )resent amount

PV = Present value of amount

r = Interest rate )er )eriod

n = *um+er of ,om)oundin- )eriods

&his generali5e! form serves as the $asis of all calculations involving the time value of

money# +or instance, suose that %e %ere intereste! in !etermining the resent value of

an amount %e %ante! or e3ecte! to receive in the future# Hy solving the future value

e*uation for the unkno%n P<, %e can !etermine the resent value#

Ionsi!er that you %ant to $uy a car in 4 years an! you %ant to ay cash for the vehicle#

-ou e3ect the car to cost ,10,000# 'f you coul! earn 8? er year on a Iertificate of

Jeosit at the local $ank, ho% much %oul! you have to !eosit to!ay in or!er to

accumulate the ,10,0000

Ke can solve this ro$lem $y maniulating the e*uation for future value#

Ke kno% that(

FV = PV (" + r)

n

#"%$%%% = PV (" + &%()

.

#"%$%%% = PV ("&%()

.

PV = #"%$%%%/("&%()

.

PV = #"%$%%%/("&%()

.

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

PV = #"%$%%%/"&01%.(('

PV = #2$03%&0%

&he result is that if you !eosit ,9,:L0#:0 to!ay in an interest)$earing investment that

earns 8? annually for four years, you %oul! accumulate ,10,000 $y the en! of four years#

'f you %ish to evaluate this, you might consi!er revie%ing the ta$le that reflects the

e3ten!e! form of calculation#

4ate Interest 5ate Interest 6arned 7alan,e

1/1/-ear1 Jeosit 9,:L0#:0

12/:1/-ear1 8? L88#02 9,9:8#:2

12/:1/-ear2 8? 8:L#09 8,L9:#:9

12/:1/-ear: 8? 88L#89 9,2L9#28

12/:1/-ear4 8? 940#94 10,000#00

As may $e o$vious, %e coul! simly restate the future value e*uation to solve for the

resent value, %hich %oul! ro!uce(

FV = PV (" + r)

n

PV = FV /(" + r)

n

&he term, (" + r)

n

, is usually referre! to as a time value of money factor an! is the

varia$le that relates the future value to the resent value# -ou are ro$a$ly familiar %ith

ta$les of resent value factors an! future value factors# &he e*uations a$ove reflect the

information containe! in the ta$les; that is, the ta$les reresent the calculation of the

factor for various com$inations of interest rates an! time periods# +urther, our formulas

tell us that the resent value factors are !irectly relate! to the future value factors# &he

relationshi is evi!ent ) the factor for the future value ta$le, (" + r)

n

, is the inverse of the

factor foun! in resent value ta$les "/(" + r)

n

&o affirm that this is the case, consi!er the factors use! to solve the revious ro$lem# 'f

%e %ante! to kno% the future value of ,9,:L0#:0 !eosite! in an interest $earing

investment, earning 8? er year for four years, %e %oul! use the future value e*uation, as

follo%s(

FV = PV (" + r)

n

FV = #2$03%&0% (" + &%()

.

FV = #2$03%&0% (" + &%()

.

FV = #2$03%&0% ("&01%.((')

FV = #"%$%%%&%%

&he factor for this future value calculation is ."&01%.(('/# +rom the resent value

calculation, the factor %as ."/"&01%.(('/, the inverse of the future value factor# +rom this

simle e3amle, you coul! reare a full set of resent an! future value ta$les, for as many

com$inations of interest rates an! time erio!s as you %oul! like# 4f course, since you

can calculate any factor .%ith a calculator/, the ta$les may not $e a necessity, $ut a

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

convenience# &o ermit you to ractice %ith resent an! future value factors, you shoul!

sit !o%n %ith a calculator an! the attache! &a$les 1 an! 2 an! verify the construction of

fe% num$ers on the ta$les# &he ta$les are inclu!e! in the aen!i3#

T8o 9on,e)ts of Interest: ;im)le and 9om)ound

Menerally, there are t%o concets of interest( simle interest an! comoun! interest# &he

!istinction is simle, really# Eimle interest refers to situations %hen interest is earne! on a

rincial amount only# &his usually occurs %hen the interest is remitte! to .or %ith!ra%n

$y/ the erson entitle! to receive the interest# Iomoun! interest !escri$es situations

%here interest is earne! on the original rincial amount as %ell as any interest earne! an!

accumulate! %ith the original rincial# 4ur e3amle of the ,1,000 on !eosit for t%o

years is an e3amle of comoun! interest# Ha! the ,90 interest earne! in the first year

$een %ith!ra%n from the $ank .an! all interest for all su$se*uent years/, then the e3amle

%oul! have converte! to a simle interest e3amle# &he focus of our stu!y from this oint

on %ill $e on comoun! interest situations ) %hich as you %ill !iscover, is the heart of the

time value of money calculation an! the key to resolving many 6comle37 accounting,

finance an! investment ro$lems#

Hefore %e lea into the nuances of resent an! future value ro$lems, consi!er the matter

of 6comoun!ing#7 1ecall that unless state! other%ise, you shoul! assume that interest is

comoun!e! an! ai! annually# Ho%ever, most $anks an! savings an! loans comany

transactions, mortgage comany transactions, cororation $on! an! other monetary

transactions are $ase! uon comoun! interest an!/or !ivi!en!s for erio!s other than

one year .*uarterly, monthly, %eekly, even !aily/# Khen this situation arises, it is easy to

convert an annual interest rate to the aroriate interest rate er comoun!ing erio!#

Khen the state! annual interest rate is comoun!e! on any $asis other than annually,

simly !ivi!e the state! annual interest rate $y the num$er of times the interest is

comoun!e! !uring the year to !etermine the interest rate er comoun!ing erio!# +or

e3amle, if the annual interest rate is 12? an! the interest is comoun!e! *uarterly .every

three months/, the comoun!ing rate is :? or 12?/4#

't may $e o$vious to you, $ut %hen interest is comoun!e! more than once a year, the

actual or effective interest rate %ill al%ays $e greater than the stated annual interest rate

.sometimes calle! the nominal or face rate/# &his concet is of some significance to

$usiness eole, investors an! consumers# +or e3amle, suose a $ank offers to len! you

, 10,000 for one year at an annual rate of 10?# 'f the interest is comoun!e! annually,

the interest accrue! is ,1,000# Ho%ever, if the interest is comoun!e! an! ai! *uarterly

.every three months/, the interest amount ai! each *uarter e*uals ,2L0, $ut $ecause of

the fact that the !e$tor must ay the amounts every three months, rather than at the en! of

the year, the cost of the sacrifice .loss of the use of the money/ increases the effective cost

of the !e$t to the $orro%er# Hecause the cre!itor enNoys the use of the money in four

installments !uring the year, instea! of having to %ait until the en! of the year .an! the

fun!s can $e reinveste!/, the cre!itor .$ank/ enNoys a higher rate of return# 2ote that you

can use your kno%le!ge of future value to !etermine the !ifference $et%een the rates of

return for the t%o otions#

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

+or the annual ayment, the 6effective interest rate7 is the same as the annual or state!

rate, i#e#, 10?# Hut, for the *uarterly comoun!ing of interest, the 6effective interest rate7

or 6yiel!7 is 10#:8?, calculate! $y !etermining the future value at the en! of the year of

four *uarterly ayments of ,2L0 an! comaring that to the amount of the loan# &he

calculations are resente! in the sche!ule $elo%(

Interest Paid

"%</. = !&3<

9om)oundin-

Periods Fa,tor at !&3< Future Value

, 2L0 : 1#09889 289#22

, 2L0 2 1#0L08: 282#88

, 2L0 1 1#02L00 2L8#2L

, 2L0 0 1#00000 2L0 #00

Totals , 1,000 1,0:8 #1:

Jivi!ing the 6-iel!7 calculation .,1,0:8#1:/ $y the loan rincial .,10,000/ ro!uces an

6effective interest rate7 of 10#:8?#

Ioinci!entally, the formula for calculating the effective rate %hen interest is calculate!

more fre*uently than annually is(

=ield or 6ffe,tive 5ate = (" + r )

n

>"

%here(

r = ,om)oundin- rate )er )eriod

n = num+er of ,om)oundin- )eriods for the year

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

?nnuities

4ften, $usiness transactions involve e*ual erio!ic ayments; e#g#, mortgages, $on!s,

consumer loans, life insurance contracts, leases, the Ihristmas savings clu$# +or e3amle,

suose that you are intereste! in urchasing a ne% stereo for your aartment# -ou %ant

to $e a$le to ay cash an! you are %illing to save ,L0 er month for one year to save for

the stereo# 'f you ut your money in a savings account earning 8? er year, comoun!e!

monthly, ho% much %oul! you $e a$le to sen! for the stereo at the en! of the year0

Future Value of an ?nnuity

4ne %ay %e coul! solve this ro$lem %oul! $e to think of the savings amounts of ,L0 er

month as t%elve .12/ future value ro$lems# 't %oul! take a fe% minutes, $ut this

techni*ue %oul! certainly rovi!e an ans%er# Oet"s assume that %e starte! saving at the

en! of January an! %e lan to urchase the ne% stereo !uring the 6after Ihristmas7 an!

6inventory clearance7 sales that occur right after the first of the year# &he calculations are

resente! in the sche!ule $elo%(

4ate of

4e)osit

4e)osit or

Present Value

Interest 5ate

1< Per =ear

Interest Fa,tor

("+r)

n

Future Value

1/:1/PP ,L0#00 #L? er month 1#0L8:9L8 , L2#81

2/28/PP ,L0#00 #L? er month 1#0L11401 L2#L8

:/:1/PP ,L0#00 #L? er month 1#04L9108 L2#:0

4/:0/PP ,L0#00 #L? er month 1#0409090 L2#04

L/:1/PP ,L0#00 #L? er month 1#0:LL294 L1#98

8/:0/PP ,L0#00 #L? er month 1#0:0:99L L1#L2

9/:1/PP ,L0#00 #L? er month 1#02L2L1: L1#28

8/:1/PP ,L0#00 #L? er month 1#0201L0L L1#01

9/:0/PP ,L0#00 #L? er month 1#01L09L1 L0#9L

10/:1/PP ,L0#00 #L? er month 1#01002L0 L0#L0

11/:0/PP ,L0#00 #L? er month 1#00L0000 L0#2L

12/:1/PP ,L0#00 #L? er month 1 #0000000 L0 #00

12 #::LL82: ,818 #98

&here are a coule of oints to note( first, $y saving ,L0 er month, you %ill accumulate

,818#98 in t%elve months; secon!, $y e3amining the ta$le carefully, %e coul! take

a!vantage of a shortcut# 'f %e 6factore!7 the ,L0#00 monthly saving from the calculations

.it is the same amount each month, %e coul! simly a!! u the interest factors for each

month an! multily that total $y the 6uniform savings amount .an annuity/ to fin! the total

amount save!; e#g#, ,L0#00 C 12#::LL82: @ ,818#98# +urther, $y constructing a ta$le for

several com$inations of interest rates an! comoun!ing erio!s, %e coul! re!uce the

calculations for the 6future value of an annuity7 to a formula aroach# +rom out e3amle

a$ove, %e can state that(

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

Future value of ordinary annuity (FVoa) = ?nnuity amount (?) * Fa,tor (F)

or

FVoa = ? * Fr$n

%here(

A is the amount of uniform ayment each erio!

+r,n is the comoun!e! interest factor for the interest rate er erio! BrD an!

num$er of time erio!s BnD

Eetting u the revious e3amle, %e get(

FVoa = ? * Fr$n

FVoa = #3% * F &%3$ "!

FVoa = #3% * "!&00331!0

FVoa = #1"1&2(

An!, in fact, that is recisely %hat a future value of an annuity ta$le rovi!es ) an array of

various com$inations of comoun!ing erio!s an! interest rates# 't %oul! $e useful to

e3amine &a$le : in the aen!i3 an! use the ta$le to solve the follo%ing ro$lem(

'n or!er to accumulate fun!s for the construction of a ne% $uil!ing, a comany

invests ,L0,000 a year for L years# &he fun!s %ill earn 9? annually# Ho% much

money %ill the comany have at the en! of the five years0

>sing the factors from &a$le :, the solution is straightfor%ar!# Ke kno% the

annuity amount, A, is ,L0,000# An! %e kno% the annual interest rate is 9? an!

that there are five .L/ comoun!ing erio!s# >sing the Future Value of an

Annuity Table, %e !etermine that the interest comoun!ing factor is L#98491# 'f

%e su$stitute these items into our formula for the future value of an annuity, %e

o$tain the result that the comany %ill have ,299,2:L#L0 at the en! of the fifth

year, as follo%s(

+<oa @ A C +r,n

+<oa @ ,L0,000 C L#98491

+<oa @ ,299,2:L#L0

-ou might %ant to affirm the calculation an! your un!erstan!ing of the

relationshis $et%een the future value of a rincial amount an! the future value of

an annuity $y turning to &a$le 1 an! summing the factors un!er the 9? interest

column for L erio!s .this is looking at the ro$lem as five in!ivi!ual future value

ro$lems, rather than an annuityQ/ He careful no% ) %e have assume! that the first

ayment is $eing !eosite! $y the comany at the en! of the first year, thus, %hen

%e o$tain the !ata from &a$le 1, %e must $e sure to recogni5e that the last !eosit

is ma!e at the en! of the five year erio! an! earns no interest# &his articular

transaction is usually not reflecte! in a future value of a rincial amount ta$le#

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

't is usually a goo! i!ea to !ra% a icture of the ro$lem $efore you $egin to

consult ta$les an! erform calculations# 't !oesn"t take long an! it can rovi!e a

schematic or frame%ork for the ro$lem)solving tasks# 4ne e3amle of such a

schematic is(

,L0,000 ,L0,000 ,L0,000 ,L0,000 ,L0,000

&ime 1 2 : 4 L

2otice that the num$er of !eosits is five.L/, $ut that the num$er of comoun!ing

erio!s is four.4/, $ecause the first !eosit is ma!e at the en! of the first erio!#

&his kin! of annuity e3amle is usually referre! to as an 6or!inary annuity7 or an

6annuity in arrears7# 't is ossi$le to reare a ta$le for annuity ayments %hich

occur at the $eginning of the first erio!# &his tye of annuity ta$le is usually

calle! an 6annuity in a!vance7 or an 6annuity !ue7# Ke %ill return to this issue

shortly#

Hack to the ro$lem, your results shoul! $e(

4e)osit *um+er 9om)oundin- Periods Interest Fa,tor

1 4 1#411L8

2 : 1#29L0:

: 2 1#18810

4 1 1#09000

L 0 1#00000

&otal L#98491

'f your results %ere the same as mine, you %ill note that the factor calculate! from

&a$le 1 is e*ual to the factor e3tracte! from &a$le :# A nice result to kno%Q 'f you

%ere har!)resse!, you %oul!n"t really nee! a future value of an annuity ta$le, you

coul! simly e3tract %hat you nee!e! from a future value ta$le#

Just to satisfy your curiosity, the future value of an ordinary annuity table factors can $e

calculate! $y formula# &he formula is !erive! from the sum of a uniform set of geometric

series an! is state! as follo%s(

FVoa = [( " + r )

n

>"] / r

%here(

+<oa @ +uture value of an or!inary annuity

r @ interest rate er comoun!ing erio!

n @ num$er of annuity ayments

'f you are face! %ith a future value of an annuity !ue .annuity in a!vance/; that is, the

terms of the annuity re*uire or rovi!e for a ayment at the $eginning a erio!, the

formula for this interest factor is(

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

FVad = {[( " + r )

n

>"] / r * (" + r)

%here(

+<a! @ +uture value of an annuity !ue

r @ interest rate er comoun!ing erio!

n @ num$er of annuity ayments

'f you e3amine this formula carefully, you %ill notice that the only !ifference is to a!! the

term . 1 A r / to the calculation# &his term a!Nusts the or!inary annuity formula for the one

a!!itional comoun!ing erio! that results from moving the annuity ayments from the

en! of the comoun!ing erio! to the $eginning of the comoun!ing erio!#

4ne final oint a$out future value annuities# 'f you are using a future value of an

ordinary annuity table (annuity in arrears), $ut you are confronte! %ith a future value

of an annuity due (annuity in advance) ro$lem, you can a!Nust the factors in the

or!inary annuity ta$le for use in annuity !ue .in a!vance/ ro$lems# All you must !o is

increase the num$er of comoun!ing erio!s $y one an! su$tract the num$er one .1/ from

the factor# &hink a$out it ) the or!inary annuity ta$le rovi!es an interest factor for the

final comoun!ing erio! of one .1/; there is no interest earne! on the final !eosit or

ayment# 'f %e a!vance all the ayments $y one erio!, %e a!! one comoun!ing erio!

of earne! interest, relacing the erio! for %hich no interest %as earne!#

An!, if you have an annuity due ta$le, $ut are trying to solve an annuity in a!vance

.ordinary annuity/ ro$lem, simly su$tract one comoun!ing erio! an! a!! the integer

1 to the factor that you e3tract from the ta$le#

Present Value of an ?nnuity

As you might e3ect, Nust as the resent value of rincial amounts are relate! to future

value of rincial amounts are relate! an! that future value of annuities an! future value of

single rincial amounts are relate!, it follo%s that the resent value of an annuity an! the

resent value of a rincial amount are relate!# &he rimary formula involving the resent

value of an annuity is(

Present value of ordinary annuity (PVoa) = ?nnuity amount (?) * Fa,tor (F)

or

PVoa = ? * Fr$n

%here(

A is the amount of uniform ayment each erio!

+r,n is the comoun!e! interest factor for the interest rate er erio! BrD an!

num$er of time erio!s BnD

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

&he interest factor .+/ is !erive! $y the formula, %hich can $e comute! $y calculators

%ith e3onent functions, or foun! in ta$les(

PVoa = [ " > { " / ( " + r ) n ] / r

As an e3amle of solving for the resent value of an annuity, suose you %ere given the

choice of receiving ,8,000 a year for five years or receiving ,2L,000 to!ay# Khat %oul!

you !o0 Kell, for the sake of analysis, let"s suose that your time reference rate for

money is 10? .reflecting your feelings a$out resent versus future consumtion, risk,

inflation an! other uncertainties a$out the future/ an! that you can earn this in a money

market fun!# Khat you %ant to $e a$le to !o is to comare the t%o cash flo%s to see if

you have a reference for one or the other# 'f %e e3amine Nust the total aggregate cash

flo%s, it is evi!ent that the choice is !ifficult#

Ke can take ,2L,000 to!ay, $ut if %e take the ,8,000 er year for five years, %e receive a

total of ,40,000# &he ro$lem is that the t%o cash flo%s are not comara$le, are they0

&he ,2L,000 is a resent value# &he five ,8,000 ayments are an annuity an! the

aggregate of ,40,000 is not comara$le to the ,2L,000# Hut, if our concerns a$out risk

are reflecte! roerly in our time reference rate of 10? an! the money market fun! that

%e coul! invest in reflects an aroriate return/risk relationshi .10?/, %e coul!

evaluate the resent value of those future cash flo%s an! comare them %ith the value of

the otion of having the ,2L,000 to!ay# 4f course, one %ay of evaluating the t%o cash

flo%s %oul! $e to convert the t%o cash ayoffs to future values an! comare them .given

the material resente! earlier, %e alrea!y kno% ho% to !o that/# Hut that %oul! involve

t%o calculations( first evaluating the future value of the ,2L,000, then evaluating the

future value of the annuity of five ,8,000 ayments# As you %ill see, $y simly

!etermining the resent value of annuity, the calculation an! analysis can $e comlete! in

one ste# Mo to &a$le 4, Present <alue of an 4r!inary Annuity an! e3tract the interest

factor for an interest rate of 10? over five comoun!ing erio!s an! insert it into the

formula a$ove# &hen comlete the calculation an! comare the result %ith the ,2L,000

otion# -our calculation shoul! $e as follo%s(

PVoa = ? * Fr$n

PVoa = #($%%% * 0&2'%2'

PVoa = #0%$0!1&0!

Khen %e comare the resent value of the annuity %ith the resent value of the ,2L,000

cash ayment, it shoul! $e evi!ent that the annuity is %orth more to us# Hut may$e you

are still some%hat sketical# Ke can confirm this fin!ing $y restating the ro$lem Nust a

$it# Euose that you have Nust %on a lottery an! you get your choice of t%o ri5e

otions ) one, you %in a ,2L,000 !eosit, %hich %ill earn 10? annually# -ou may not

%ith!ra% any fun!s from this account for L years, at %hich time the total fun! is yours#

&he alternate ri5e is a five)year annuity of ,8,000# &he annuity is also !eosite! in a fun!

%hich %ill earn 10? er year# At the en! of five years, the total fun! is yours to kee#

Khich lan %oul! you refer0 Oet"s comute the future values of $oth otions#

Plan 1

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

FV = PV (" + r)

n

FV = #!3$%%% (" + &"%)

3

FV = #!3$%%% ("&"%)

.

FV = #!3$%%% ("&.1.")

FV = #01$1%!&3%

&he results reort that the future value of ,2L,000 !eosite! in an interest)$earing

investment earning 10? er year is ,:8,802#L0#

Plan 2

FVoa = ? * [( " + r )

n

>"] / r

FVoa = #($%%% [(" + &"%)3 > "] / &"%

FVoa = #($%%% [("&"%)3 > "] / &"%

FVoa = #($%%% ["&1"%3" > "] / &"%

FVoa = #($%%% [&1"%3"] / &"%

FVoa = #($%%% * 1&"%3"

FVoa = #.($(.%&(%

't seems aarent that, %hen assesse! as a future value comarison, the L)ayment annuity

is the referre! lan# +irst, Nust to confirm the vali!ity of the future value ta$les, go to

&a$le : an! i!entify the factor for a L)erio! annuity earning 10? er erio!# &he factor

is 8#10L1, consistent %ith the formula $ase! calculation#

+inally to affirm the relationshi $et%een resent value an! future value concets, consi!er

the resent value of ,48,840#80 to $e receive! in five years# >tili5ing the resent value of

a future amount formula, the resent value is(

PV = FV * " / (" + r)

n

PV = #.($(.%&(% * " / ( " + &"% )

3

PV = #.($(.%&(% * " / ( "&1"%3" )

PV = #.($(.%&(% * &1!%'!"0!

PV = #0%$0!1&!'

2otice that, e3cet for the effects of roun!ing, this result is the e*uivalent of the

calculation use! to !etermine the resent value of the L)erio!, 10? annuity at the

$eginning of this e3ercise# Please consi!er the factors that make this the case# 'n any

event, it is evi!ent that the $est otion, un!er the circumstances, %oul! $e to select the

five year annuity of ,8,000 rather than the ,2L,000 to!ay#

As you revie% the a$ove material, lease ay attention to the fact that the ro$lems %ere

solve! in a variety of %ays ) using the $asic formulas, using factors from ta$les, converting

a resent value ro$lem to future value, converting an annuity to a rincial)tye ro$lem#

Ruite often, it is the ingenuity of the ro$lem solver that sees the most efficient an!

effective %ay of resolving the choices, comarisons an! calculations involving the time

value of money# Khile learning to use time value of money techni*ues, it may $e ru!ent

to use the formulas, ta$les an! various aroaches to the ro$lem#

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

+ollo%ing are some e3amles to revie% $efore you launch into the assigne! ro$lem set#

6@am)le ": Finan,in- the )ur,hase of a ne8 ,ar

Euose that you are intereste! in urchasing a ne% car# -ou an! the !ealer have agree!

uon a rice of ,18,000 .four)%heel !rive, short)$e!, e3ten!e! ca$ ickuQ/# 2o% all you

nee! is the money# &he !ealer suggests that you contact the local $ank# &he local $anker

offers you the follo%ing terms(

Jo%n ayment ,:,000

Annual interest rate 12?

+inancing erio! 4 years

&he terms seeme! reasona$le to you an! you left the $ank to try to figure out %here to

get the !o%n ayment# &he $anker kne% that you %ere a recent $usiness stu!ent an! he

assume! that you %ere familiar %ith the techni*ues for calculating loan ayments# Khen

you arrive! home, you reali5e! that you !i!n"t kno% ho% much the loan ayments %oul!

$e#

5eAuired:

a# Ialculate the monthly ayment that %oul! $e re*uire! to service the loan use! to

finance the urchase of the car#

$# Jetermine the total amount of interest that %oul! $e ai! on this loan#

c# Jetermine the effective cost of the loan#

;olution:

a# Khile %e coul! use ta$les to assist us %ith this art of the ro$lem, the ta$le set

inclu!e! %ith this material !oes not inclu!e interest factors e*uivalent to forty)eight

erio!s an! 1? er erio!# Ionse*uently, the formula aroach %ill $e use! to !eal

%ith the issues#

&he ro$lem is !efine! as a 6loan amorti5ation7 tye an! is common in consumer

len!ing, mortgages, $on!s an! other tyes of installment !e$t# &he ro$lem of

!etermining the 6monthly ayment7 or the 6annuity ayment7 is easily resolve! using

the resent value of an or!inary annuity format, as follo%s(

PVoa = ? * Fr$n

+irst, recogni5e that the e*uation can $e restate! to solve for the annuity ayment .A/#

? = PVoa / Fr$n

? = #"3$%%% / Fr$n

&he interest factor .F/ is !erive! $y the formula for the resent value annuity

F = [ " > { " / ( " + r )

n

] / r

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

F = [ " > { " / ( " + &%" )

.(

] / &%"

F = [ " > { " / ( "&%" )

.(

] / &%"

F = [ " > { " / "&1"!!!1" ] / &%"

F = [ " > { &1!%!1%." ] / &%"

F = [ &02'20'3' ] / &%"

F = 02&'20'3'

Hy su$stituting the factor into the rimary annuity e*uation, the loan ayment

.annuity/ is !etermine! to $e #0'3&%" er month#

? = #"3$%%% / 02&'20'3'

? = #0'3&%"

$# &his four year .48 month loan/ %ill incur a total interest e3ense of #0$'1%&.( ,

!etermine! as follo%s(

Total ,ash )ayments (0'3&%" * .() #"($'1%&.(

Bess: Total amount finan,ed "3$%%% &%%

Total interest e@)ense #0$'1% &.(

c# &he effective interest rate is "!&1(!3 < !etermine! as follo%s(

=ield or 6ffe,tive 5ate = (" + r )

n

>"

=ield or 6ffe,tive 5ate = (" + &%" )

"!

>"

=ield or 6ffe,tive 5ate = ("&%" )

"!

>"

=ield or 6ffe,tive 5ate = ("&"!1(!3) >"

=ield or 6ffe,tive 5ate = &"!1(!3

=ield or 6ffe,tive 5ate = "!&1(!3 <

6@am)le !: ?,,umulatin- a 5etirement Fund

Jason, age 20, %ants to retire at age 4L# He %ants to accumulate a retirement fun! of

,800,000# 'f he lans to !eosit e*ual monthly amounts, starting one month from

to!ay, in an 'n!ivi!ual 1etirement Account .'1A/ %hich %ill earn 8? er year, ho%

much shoul! he lan to !eosit each month0 Ho% much %ill Jason have earne! on his

savings0

;olution:

&his is an a!atation of the future value of an or!inary annuity an! the solution

re*uires a calculator, unless you have an e3tensive ta$le set#

FVoa = ? * [( " + r )

n

>"] / r

? = FVoa / [( " + r )

n

>"] / r

? = #1%%$%%% / [( " + &%%3 )

0%%

>"] / &%%3

? = #1%%$%%% / [( "&%%3 )

0%%

>"] / &%%3

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

? = #1%%$%%% / [.&.1.'1'3 >"] / &%%3

? = #1%%$%%% / [0&.1.'1'3] / &%%3

? = #1%%$%%% / 1'!&''

? = #(13&("

'f Jason saves ,88L#81 a month for 2L years .:00 months/ an! the fun!s earn 8?er

year .#L? er month/, Jason %ill have a fun! of ,800,000#

&otal fun! accumulation ,800,000

&otal !eosits .,88L#81 C :00/ ,2L9,94:

&otal interest ,:40,94:

Jason %ill earn ,:40,94: over the 2L year erio!, if the fun! earns interest at 8? er

year#

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

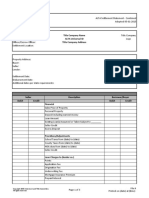

?))endi@: Time Value of Money Formulas and Interest Fa,tor Ta+les

Time Value of Money and Interest Fa,tors

Time Value 9on,e)t ;ym+ol Ceneral Formula Fa,tor or Ta+le Formula

Eimle 'nterest E' P< C rC n n/a

Sffective 'nterest S'

.1 A r /

n

)1

n/a

Present value of single amount P< +< C + 1 / B.1 A r /

n

D

+uture value of single amount +< P< C + .1 A r /

n

Present value of or!inary annuity P<oa A C + r,n B 1 ) F 1 / . 1 A r /

n

G D / r

Present value of annuity !ue P<a! A C + r,n BB 1 ) F 1 / . 1 A r /

n

G D / r D C .1 A

r/

+uture value of or!inary annuity +<oa A C + r,n B. 1 A r /

n

)1D / r

+uture value of annuity !ue +<a! A C + r,n FB. 1 A r /

n

)1D / rG C .1 A r/

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

Ta+le ": Future Value of #"

[FV = PV ("+r)

n

]

(n) Interest Rates

Periods 8% 9% 10% 11% 12% 15%

1 1.08000 1.09000 1.10000 1.11000 1.12000 1.15000

2 1.16640 1.18810 1.21000 1.23210 1.25440 1.32250

3 1.25971 1.29503 1.33100 1.36763 1.40493 1.52088

4 1.36049 1.41158 1.46410 1.51807 1.57352 1.74901

5 1.46933 1.53862 1.61051 1.68506 1.76234 2.01136

6 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306

7 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002

8 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902

9 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788

10 2.15892 2.36736 2.59374 2.83942 3.10585 4.04556

11 2.33164 2.58043 2.85312 3.15176 3.47855 4.65239

12 2.51817 2.81267 3.13843 3.49845 3.89598 5.35025

13 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279

14 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571

15 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706

16 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762

17 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126

18 3.99602 4.71712 5.55992 6.54355 7.68997 12.37545

19 4.31570 5.14166 6.11591 7.26334 8.61276 14.23177

20 4.66096 5.60441 6.72750 8.06231 9.64629 16.36654

21 5.03383 6.10881 7.40025 8.94917 10.80385 18.82152

22 5.43654 6.65860 8.14028 9.93357 12.10031 21.64475

23 5.87146 7.25787 8.95430 11.02627 13.55235 24.89146

24 6.34118 7.91108 9.84973 12.23916 15.17863 28.62518

25 6.84848 8.62308 10.83471 13.58546 17.00000 32.91895

26 7.39635 9.39916 11.91818 15.07986 19.04007 37.85680

27 7.98806 10.24508 13.10999 16.73865 21.32488 43.53532

28 8.62711 11.16714 14.42099 18.57990 23.88387 50.06561

29 9.31727 12.17218 15.86309 20.62369 26.74993 57.57545

30 10.06266 13.26768 17.44940 22.89230 29.95992 66.21177

31 10.86767 14.46177 19.19434 25.41045 33.55511 76.14354

32 11.73708 15.76333 21.11378 28.20560 37.58173 87.56507

33 12.67605 17.18203 23.22515 31.30821 42.09153 100.69983

34 13.69013 18.72841 25.54767 34.75212 47.14252 115.80480

35 14.78534 20.41397 28.10244 38.57485 52.79962 133.17552

36 15.96817 22.25123 30.91268 42.81808 59.13557 153.15185

37 17.24563 24.25384 34.00395 47.52807 66.23184 176.12463

38 18.62528 26.43668 37.40434 52.75616 74.17966 202.54332

39 20.11530 28.81598 41.14479 58.55934 83.08122 232.92482

40 21.72452 31.40942 45.25926 65.00087 93.05097 267.86355

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

Table 2: Present Value of 1

[PV = V ! (1 " r )

n

#

(n) Interest Rates

Period

s

8% 9% 10% 11% 12% 15%

1 .92593 .91743 .90909 .90090 .89286 .86957

2 .85734 .84168 .82645 .81162 .79719 .75614

3 .79383 .77218 .75132 .73119 .71178 .65752

4 .73503 .70843 .68301 .65873 .63552 .57175

5 .68058 .64993 .62092 .59345 .56743 .49718

6 .63017 .59627 .56447 .53464 .50663 .43233

7 .58349 .54703 .51316 .48166 .45235 .37594

8 .54027 .50187 .46651 .43393 .40388 .32690

9 .50025 .46043 .42410 .39092 .36061 .28426

10 .46319 .42241 .38554 .35218 .32197 .24719

11 .42888 .38753 .35049 .31728 .28748 .21494

12 .39711 .35554 .31863 .28584 .25668 .18691

13 .36770 .32618 .28966 .25751 .22917 .16253

14 .34046 .29925 .26333 .23199 .20462 .14133

15 .31524 .27454 .23939 .20900 .18270 .12289

16 .29189 .25187 .21763 .18829 .16312 .10687

17 .27027 .23107 .19785 .16963 .14564 .09293

18 .25025 .21199 .17986 .15282 .13004 .08081

19 .23171 .19449 .16351 .13768 .11611 .07027

20 .21455 .17843 .14864 .12403 .10367 .06110

21 .19866 .16370 .13513 .11174 .09256 .05313

22 .18394 .15018 .12285 .10067 .08264 .04620

23 .17032 .13778 .11168 .09069 .07379 .04017

24 .15770 .12641 .10153 .08170 .06588 .03493

25 .14602 .11597 .09230 .07361 .05882 .03038

26 .13520 .10639 .08391 .06631 .05252 .02642

27 .12519 .09761 .07628 .05974 .04689 .02297

28 .11591 .08955 .06934 .05382 .04187 .01997

29 .10733 .08216 .06304 .04849 .03738 .01737

30 .09938 .07537 .05731 .04368 .03338 .01510

31 .09202 .06915 .05210 .03935 .02980 .01313

32 .08520 .06344 .04736 .03545 .02661 .01142

33 .07889 .05820 .04306 .03194 .02376 .00993

34 .07305 .05340 .03914 .02878 .02121 .00864

35 .06763 .04899 .03558 .02592 .01894 .00751

36 .06262 .04494 .03235 .02335 .01691 .00653

37 .05799 .04123 .02941 .02104 .01510 .00568

38 .05369 .03783 .02674 .01896 .01348 .00494

39 .04971 .03470 .02430 .01708 .01204 .00429

40 .04603 .03184 .02210 .01538 .01075 .00373

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

Table $: uture %&ount of an 'rdinar( %nnuit( of 1

[FVa = (" + r )

n

>" / r]

(n) Interest Rates

Periods 8% 9% 10% 11% 12% 15%

1 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000

2 2.08000 2.09000 2.10000 2.11000 2.12000 2.15000

3 3.24640 3.27810 3.31000 3.34210 3.37440 3.47250

4 4.50611 4.57313 4.64100 4.70973 4.77933 4.99338

5 5.86660 5.98471 6.10510 6.22780 6.35285 6.74238

6 7.33592 7.52334 7.71561 7.91286 8.11519 8.75374

7 8.92280 9.20044 9.48717 9.78327 10.08901 11.06680

8 10.63663 11.02847 11.43589 11.85943 12.29969 13.72682

9 12.48756 13.02104 13.57948 14.16397 14.77566 16.78584

10 14.48656 15.19293 15.93743 16.72201 17.54874 20.30372

11 16.64549 17.56029 18.53117 19.56143 20.65458 24.34928

12 18.97713 20.14072 21.38428 22.71319 24.13313 29.00167

13 21.49530 22.95339 24.52271 26.21164 28.02911 34.35192

14 24.21492 26.01919 27.97498 30.09492 32.39260 40.50471

15 27.15211 29.36092 31.77248 34.40536 37.27972 47.58041

16 30.32428 33.00340 35.94973 39.18995 42.75328 55.71747

17 33.75023 36.97371 40.54470 44.50084 48.88367 65.07509

18 37.45024 41.30134 45.59917 50.39593 55.74972 75.83636

19 41.44626 46.01846 51.15909 56.93949 63.43968 88.21181

20 45.76196 51.16012 57.27500 64.20283 72.05244 102.44358

21 50.42292 56.76453 64.00250 72.26514 81.69874 118.81012

22 55.45676 62.87334 71.40275 81.21431 92.50258 137.63164

23 60.89330 69.53194 79.54302 91.14788 104.60289 159.27638

24 66.76476 76.78981 88.49733 102.17415 118.15524 184.16784

25 73.10594 84.70090 98.34706 114.41331 133.33387 212.79302

26 79.95442 93.32398 109.18177 127.99877 150.33393 245.71197

27 87.35077 102.72314 121.09994 143.07864 169.37401 283.56877

28 95.33883 112.96822 134.20994 159.81729 190.69889 327.10408

29 103.96594 124.13536 148.63093 178.39719 214.58275 377.16969

30 113.28321 136.30754 164.49402 199.02088 241.33268 434.74515

31 123.34587 149.57522 181.94343 221.91317 271.29261 500.95692

32 134.21354 164.03699 201.13777 247.32362 304.84772 577.10046

33 145.95062 179.80032 222.25154 275.52922 342.42945 644.66553

34 158.62667 196.98234 245.47670 306.83744 384.52098 765.36535

35 172.31680 215.71076 271.02437 341.58955 431.66350 881.17016

36 187.10215 236.12472 299.12681 380.16441 484.46312 1014.34568

37 203.07032 258.37595 330.03949 422.98249 543.59869 1167.49753

38 220.31595 282.62978 364.04343 470.51056 609.83053 1343.62216

39 238.94122 309.06646 401.44778 523.26673 684.01020 1546.16549

40 259.05652 337.88245 442.59256 581.82607 767.09142 1779.09031

2489981:1#!oc; &he &ime <alue of =oney

Accounting 490 Professor Jeff Harkins

10/8/2014

Table ): Present Value of an 'rdinar( %nnuit( of 1

PVa = [ " > { "/( "+ i )

n

/ i ]

(n) Interest Rates

Periods 8% 9% 10% 11% 12% 15%

1 .92593 .91743 .90909 .90090 .89286 .86957

2 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571

3 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323

4 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498

5 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216

6 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448

7 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042

8 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732

9 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158

10 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877

11 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371

12 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062

13 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315

14 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448

15 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737

16 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424

17 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716

18 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797

19 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823

20 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933

21 10.01680 9.29224 8.64869 8.07507 7.56200 6.31246

22 10.20074 9.44243 8.77154 8.17574 7.64465 6.35866

23 10.37106 9.58021 8.88322 8.26643 7.71843 6.39884

24 10.52876 9.70661 8.98474 8.34814 7.78432 6.43377

25 10.67478 9.82258 9.07704 8.42174 7.84314 6.46415

26 10.80998 9.92897 9.16095 8.48806 7.89566 6.49056

27 10.93516 10.02658 9.23722 8.54780 7.94255 6.51353

28 11.05108 10.11613 9.30657 8.60162 7.98442 6.53351

29 11.15841 10.19828 9.36961 8.65011 8.02181 6.55088

30 11.25778 10.27365 9.42691 8.69379 8.05518 6.56598

31 11.34980 10.34280 9.47901 8.73315 8.08499 6.57911

32 11.43500 10.40624 9.52638 8.76860 8.11159 6.59053

33 11.51389 10.46444 9.56943 8.80054 8.13535 6.60046

34 11.58693 10.51784 9.60858 8.82932 8.15656 6.60910

35 11.65457 10.56682 9.64416 8.85524 8.17550 6.61661

36 11.71719 10.61176 9.67651 8.87859 8.19241 6.62314

37 11.77518 10.65299 9.70592 8.89963 8.20751 6.62882

38 11.82887 10.69082 9.73265 8.91859 8.22099 6.63375

39 11.87858 10.72552 9.75697 8.93567 8.23303 6.63805

40 11.92461 10.75736 9.77905 8.95105 8.24378 6.64178

2489981:1#!oc; &he &ime <alue of =oney

You might also like

- Sources of ErrorDocument1 pageSources of ErrorJollybelleann MarcosNo ratings yet

- Law On SalesDocument26 pagesLaw On SalesJollybelleann Marcos100% (1)

- History of Manila Electric CompanyDocument6 pagesHistory of Manila Electric CompanyJollybelleann MarcosNo ratings yet

- 100 Islands Equipment RentalsDocument2 pages100 Islands Equipment RentalsJollybelleann MarcosNo ratings yet

- The Alphabet in Binary CodeDocument1 pageThe Alphabet in Binary CodeJollybelleann MarcosNo ratings yet

- Financial Accounting TestbankDocument34 pagesFinancial Accounting Testbankemilio_ii71% (14)

- Sources of ErrorDocument1 pageSources of ErrorJollybelleann MarcosNo ratings yet

- How DecisionTools Suite Guides Unilever's Innovation DecisionsDocument8 pagesHow DecisionTools Suite Guides Unilever's Innovation DecisionsJollybelleann Marcos100% (3)

- Auditing in A CIS EnvironmentDocument15 pagesAuditing in A CIS EnvironmentJollybelleann Marcos100% (2)

- Duck K KKKKK KKKKKDocument65 pagesDuck K KKKKK KKKKKJollybelleann MarcosNo ratings yet

- Sales Chapter 1Document14 pagesSales Chapter 1Jollybelleann MarcosNo ratings yet

- How DecisionTools Suite Guides Unilever's Innovation DecisionsDocument8 pagesHow DecisionTools Suite Guides Unilever's Innovation DecisionsJollybelleann Marcos100% (3)

- The Countries: Defining The "Quick Facts"Document3 pagesThe Countries: Defining The "Quick Facts"Jollybelleann MarcosNo ratings yet

- Nfjpia1415 Nmyc WaiverDocument1 pageNfjpia1415 Nmyc WaiverJollybelleann MarcosNo ratings yet

- Duck PointersDocument17 pagesDuck Pointersalvin_348100% (1)

- QuestionDocument1 pageQuestionJollybelleann MarcosNo ratings yet

- Feasibility Study PASS College: Page 1 of 13Document13 pagesFeasibility Study PASS College: Page 1 of 13Jollybelleann MarcosNo ratings yet

- TestbankDocument14 pagesTestbankJollybelleann Marcos0% (1)

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- Risk and Rates of ReturnDocument22 pagesRisk and Rates of ReturnJollybelleann MarcosNo ratings yet

- Emerging Asia SWOT ReportDocument90 pagesEmerging Asia SWOT ReportHY LohNo ratings yet

- Finman Chap7Document80 pagesFinman Chap7Jollybelleann MarcosNo ratings yet

- Finman Chap7Document80 pagesFinman Chap7Jollybelleann MarcosNo ratings yet

- Calculating WACC and Capital Budgeting DecisionsDocument57 pagesCalculating WACC and Capital Budgeting DecisionsJollybelleann MarcosNo ratings yet

- Finman Chap7Document80 pagesFinman Chap7Jollybelleann MarcosNo ratings yet

- Finman Chap5Document79 pagesFinman Chap5Jollybelleann MarcosNo ratings yet

- Finman Chap3Document66 pagesFinman Chap3Jollybelleann MarcosNo ratings yet

- NFJPIA Constitution and By-Laws GuideDocument20 pagesNFJPIA Constitution and By-Laws GuideJollybelleann MarcosNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- An Internship Report On Kumari Bank, NepalDocument33 pagesAn Internship Report On Kumari Bank, NepalAmul Shrestha63% (8)

- HW 1-SolnDocument8 pagesHW 1-SolnZhaohui ChenNo ratings yet

- Chapter 3 SlidesDocument27 pagesChapter 3 SlidesEmily AirhartNo ratings yet

- ObliCon CasesDocument188 pagesObliCon CasesConnieAllanaMacapagaoNo ratings yet

- Collector of Internal Revenue v. Club Filipino, Inc. de CebuDocument2 pagesCollector of Internal Revenue v. Club Filipino, Inc. de CebuJosephine Redulla LogroñoNo ratings yet

- Meaning and Scope of Credit TransactionsDocument2 pagesMeaning and Scope of Credit TransactionsZhaira AbainzaNo ratings yet

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- Hydro Power Tariff MethodologyDocument12 pagesHydro Power Tariff MethodologyAnonymous sENwj8nwq100% (3)

- Santhosh ProjectDocument60 pagesSanthosh Project2562923100% (1)

- BCRDocument13 pagesBCRAnca MahaleanNo ratings yet

- MMW Chapter 2 BonifacioDocument9 pagesMMW Chapter 2 BonifacioAbigail ConstantinoNo ratings yet

- Mind MapsDocument12 pagesMind MapsLoueli IleuolNo ratings yet

- Fa 6 Ans Key Q.P Code 75847 PDFDocument16 pagesFa 6 Ans Key Q.P Code 75847 PDFAmar ChapniyaNo ratings yet

- Castillo vs. Pasco 11 SCRA 103Document5 pagesCastillo vs. Pasco 11 SCRA 103jackNo ratings yet

- Microfinance Overview, Concepts, Principles, Characteristics & Best PracticesDocument43 pagesMicrofinance Overview, Concepts, Principles, Characteristics & Best PracticesAbrar HussainNo ratings yet

- GLEC Gyan Kosh PDFDocument39 pagesGLEC Gyan Kosh PDFMihir VoraNo ratings yet

- 1913 IRS 1040 FormDocument4 pages1913 IRS 1040 Formfredlox100% (4)

- 13-Interest Rate Risk ManagementDocument13 pages13-Interest Rate Risk ManagementSANCHI610No ratings yet

- HSBC BANKING SERVICESDocument10 pagesHSBC BANKING SERVICESSakshi GargNo ratings yet

- This Report Is Dedicated To My Parents & Teachers For Their Love, Affection and GuidanceDocument47 pagesThis Report Is Dedicated To My Parents & Teachers For Their Love, Affection and Guidance037-061No ratings yet

- ACC030 Comprehensive Project April2018 (Q)Document8 pagesACC030 Comprehensive Project April2018 (Q)Fatin AkmalNo ratings yet

- Altbach Et Al 2009, Trends in Global Higher Education (Executive Summary)Document22 pagesAltbach Et Al 2009, Trends in Global Higher Education (Executive Summary)Melonie A. FullickNo ratings yet

- JBIC Loan Agreement for Catanduanes Circumferential Road ProjectDocument63 pagesJBIC Loan Agreement for Catanduanes Circumferential Road ProjectJo Cawaling SanchezNo ratings yet

- Land Settlement Statement FormDocument3 pagesLand Settlement Statement FormASDFGHJKNo ratings yet

- Banking Terminology - A To ZDocument29 pagesBanking Terminology - A To ZSandip Tech0% (1)

- 2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Document17 pages2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Alfred GarciaNo ratings yet

- 3 Vitug MadarangDocument16 pages3 Vitug MadarangStrawberryNo ratings yet

- Party PalaceDocument14 pagesParty PalaceWorld Of your ChoiceNo ratings yet

- Asian Financial Crisis ReportDocument12 pagesAsian Financial Crisis ReportNeha KumariNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet