Professional Documents

Culture Documents

Fs Analysis

Uploaded by

Rizza Richens0 ratings0% found this document useful (0 votes)

53 views8 pagesfinancial analysis

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinancial analysis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views8 pagesFs Analysis

Uploaded by

Rizza Richensfinancial analysis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

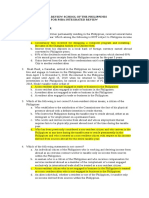

I.

ANALYSIS OF LIQUIDITY SHORT TERM SOLVENCY

2011 2010

Current Asset 75,316,642 55,370,899

Current Liabilities 45,629,278 33,214,548

CURRENT RATIO 1.65 times 1.67 times

Quick Asset 46,373,563 35879511

Current Liabilities 45,629,278 33,214,548

QUICK ASSET RATIO 1.01 times 1.08 times

Cash 24,603,213 8,018,807

Marketable securities 191,987 1,434,337

Cash Flow from Operating Activities 12,981,946 9,638,035

37,777,146 19,091,179

Current Liabilities 45,629,278 33,214,548

CASH FLOW LIQUIDITY RATIO 0.83 times 0.57 times

II. ANALYSIS OF ASSET LIQUIDITY AND ASSET MANAGEMENT EFFIENCY

Net sales 44,205,533 37,813,499

Average Accounts Receivable Balance 19002365

ACCOUNTS RECEIVABLE TURNOVER 2.33 times 2.30 times

Days 365 365

Receivable turnover 2.33 2.30

AVERAGE COLLECTION PERIOD 157 days 159 days

Cost of Goods Sold 26517732 23707381

Average Inventory balance 18138621 14368671

INVENTORY TURNOVER 1.46 times 1.65 times

Days 365 365

Inventory turnover 1.46 1.65

AVERAGE SALE PERIOD 250 days 221 days

Net sales 44,205,533 37,813,499

Average net PPE 4781730 4167989

FIXED ASSET TURNOVER 9.24 times 9.07 times

Net Sales 44,205,533 37,813,499

Average Total Asset 138147220.5 121675262

Total Asset Turnover 0.32 times 0.31 times

III. ANALYSIS OF LEVERAGE: DEBT FINANCING AND COVERAGE

Total Liabilities 82,576,667 56,205,134

Total Equity 72,042,512 65,470,128

DEBT-TO-EQUITY RATIO 114.62% 85.85%

Total Liabilities 82,576,667 56,205,134

Total Assets 154,619,179 121,675,262

DEBT RATIO 53.41% 46.19%

Operating Profit 33495805 29953295

Interest Expense 1879770 1539111

TIMES INTEREST EARNED 17.82 times 19.46 times

Operating Profit + Lease Payment 34919204 31193233

Interest Expense + Lease Payment 3303169 2779049

FIXED CHARGE COVERAGE 10.57 times 11.22 times

IV. OPERATING EFFICIENCY AND PROFITABILITY

Gross Profit 17,687,801 14106118

Net Sales 44,205,533 37,813,499

GROSS PROFIT MARGIN 40.01% 37.30%

Operating Profit 33495805 29953295

Net Sales 44,205,533 37,813,499

OPERATING PROFIT MARGIN 75.77% 79.21%

Net profit 7,140,308 5,458,134

Net sales 44,205,533 37,813,499

NET PROFIT MARGIN 16.15% 14.43%

Cash flow for operating activities 12,981,946 9,638,035

Net sales 44,205,533 37,813,499

CASH FLOW MARGIN 29.37% 25.49%

Net Income 8,090,583 6,288,054

Average Total Assets 154619179 121675262

RETURN ON INVESTMENT ON ASSET 5.23% 5.17%

Net income 8,090,583 6,288,054

Average Shareholders Equity 68756320 65470128

RETURN ON EQUITY 11.77% 9.60%

Return on equity 11.77% 9.60%

Return on Asset 5.23% 5.17%

FINANCIAL LEVERAGE INDEX 2.25 1.86

OTHER RATIOS USED TO MEASURE RETURNS ON INVESTMENT

Net Income 7,140,308 5,458,134

Weighted Average Number of Ordinary

Share Outstanding 13017387.5 13022771

BASIC EPS 0.55 0.42

Dividends Per Share 0.15 0.09

Market Value Per Share 0.15 0.19

DIVIDEND YIELD 100% 47.37%

Dividends Per Share 0.15 0.09

Earnings Per Share 0.55 0.42

DIVIDEND PAYOUT RATIO 35% 30%

I. ANALYSIS OF LIQUIDITY OR SHORT-TERM SOLVENCY

CURRENT RATIO

The Companys balance sheet remained strong with sufficient capacity to carry out its

aggressive growth plans in the following years. Strong cash inflows from the successful pre-

sales of various residential launches as well as proceeds from the P10.0 billion notes issued at

the start of 2011 brought Cash and Cash Equivalents to P24.8billion, with a corresponding

Current Ratio of 1.65 times. Total Borrowings stood at P34.53 billion as of December 2011from

P20.97 billion the previous year translating to a Debt-to-Equity Ratio of 0.55: 1 and a Net Debt-

to-Equity Ratio of 0.16: 1.

QUICK ASSET RATIO

The Ayala Lands quick asset ratio indicates drop in the year 2011 & 2010. Forecaster

strength fairly concerned about the alarming trends revealed in rising of the short term debts

and increasing of their land inventory. The figures also compare the relation of Ayala to its

competitors.

CASH-FLOW LQUIDITY RATIO

THE Ayala Land Corporation current ratio and acid test ratio both decline in the year

2011 and 2010 it can interpreted that there is a decline of liquidity. But the cash flow ratio

increase because of the improvement in short-term solvency. Also the firms cash flow from

operating activities turnaround from negative to positive figure, which means that there is a

stronger short-term solvency.

II. ANALYSIS OF ASSET LIQUIDITY AND ASSET MANAGEMENT EFFIENCY

ACCOUNTS RECEIVABLE TURNOVER

The Ayala land corporation converted 2.33 times in the year 2011 up from 2.30 times in

the year 2010. The turn over if receivable has been collected or improve this means that there

is a better quality receivable and firms collection and credit policies. Having a high turnover is

good because this mean that there is a collection of receivable but it could be unfavourable

because it may conclude that credit and collection policies are over provisional.

AVERAGE COLLECTION PERIOD

The Ayala land Corporation during the year 2011 the firm collected its receivables in

157 days on average, but on 2010 there is 159 days, so there for there is an improvement in

collection compare to the previous year.

INVENTORY TURNOVER

During 2010 there is a decrease in the inventory turnover, having high turnover is

favourable because it is a sign of efficient inventory management and profit for the firm. High

turnover could also mean other investment in inventories and lost orders. 2010 turnover could

mean that the company is carrying many inventories or it is out of date and inferior inventories

stock.

AVERAGE SALE PERIOD

The faster the inventory sale, the fewer funds are raise up in the inventory and there is a

chances of a more income generated. The average sale period decrease from 221 days for 2010

to 250 days in 2011, it can conclude that there is a effective and efficient control in inventories.

FIXED ASSET TURNOVER

For Ayala land Corporation its fixed assets turnover is improved compared to average

fixed asset. This occurrence should be further tested within the frame work company as well as

that of the industry.

TOTAL ASSET TURNOVER

For Ayala Land Corporation the total assets turnover has improved primarily because of

the improvement of fixed asset, accounts receivable turnover and inventory.

III. ANALYSIS OF LEVERAGE: DEBT FINANCING AND COVERAGE

DEBT RATIO

In 2011 and 2012 debt ratio indicates a high borrowed capital. Too much debt would

paralyzed in obtaining additional debt financing when the company needed it at most or that

credit is available only at very high interest and terms.

DEBT TO EQUITY RATIO

The Ayala Land Corporation ratio has increase between 2011 and 2010, it shows riskier

capital structure.

TIMES INTEREST EARNED

While Ayala Land Corporation increases the use of their debt in the current year to

corporation also enhance its capacity to cover interest payment from operating incomes.

FIXED CHARGE COVERAGE

Ayala Land Corporation experienced a decrease in the amount of the annual list

payment in the current year, so there is no more need to improve its fixed charge.

IV. OPERATING EFFICIENCY AND PROFITABILITY

GROSS PROFIT MARGIN

The gross profit margin of the Ayala land for both 2011 to 2010 have been stables in fact

there is a 2.99% increase in the gross profit margin which is consider a positive sign for the

company.

OPERATING PROFIT MARGIN

Ayala operating profit margin decrease by 3.44%, 2011 having a operating profit margin

of 75.77% and 79.21This is not good for a company because this indicates that company

doesnt have the ability to control it operating expense while increasing in sales. The sales do

increase but it increases with the operating expenses.

NET PROFIT MARGIN

Ayalas net profit margin slightly increased despite the increase in interest and tax

expenses and a reduction in interest revenue for marketable security investments.

CASH FLOW MARGIN

Cash flow margin of Ayala Land Corporation is high, so this means that there is a positive

generation of cash. Therefore there is a high ability to transform sales into cash to enable it to

service debt, payment dividends.

RETURN ON INVESTMENT ON ASSET/ RETURN ON EQUITY/ FINANCIAL LEVERAGE

INDEX

Ayala return on equity is higher that return on asset which result to a Financial leverage

index that is higher than 1. It indicates that Ayala Land use their financial leverage successfully

although their debt increased. The firm has generated enough operating return to more than

cover the interest payments on borrowed funds.

V. OTHER RATIOS USED TO MEASURE RETURNS ON INVESTMENT

BASIC EPS

The Ayala Land Corporation earnings for ordinary share show an increase, which is a

clear implication in the improvement on the investment return of ordinary shareholders.

DIVIDEND YIELD

2011 shows a low dividend yield that the investor would choose Ayala land Corporation,

as an investment for long term capital than for its dividend yield.

DIVIDEND PAYOUT RATIO

The Ayala Land Corporation paid out a total of P1.9 billion in cash dividends last year,

representing a dividend payout ratio of 35% of our net income in 2010 5%-points higher than

the 30% payout of the previous year. Together with net income growth resulting from margin

improvement and higher asset turnover as well as increased leverage, our return on equity

(ROE) increased to 12% in 2011, 2%-points higher than the 10% ROE recorded in 2010.

In Partial Fulfilment of

Requirements in

Financial Management

FINANCIAL STATEMENT ANALYSIS

AYALA LAND CORPORATION

Submitted by:

Ambat, Geri V.

Hernandez, Joanne D.

Nicomedez, Jenica L.

Pineda, Mary Claire F.

Submitted to:

Mr. Laynard Villanueva

March 31, 2014

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Paper LBO Model Example - Street of WallsDocument6 pagesPaper LBO Model Example - Street of WallsAndrewNo ratings yet

- Sheraton Yilan Investment Memorandum 2010Document3 pagesSheraton Yilan Investment Memorandum 2010Sky Yim100% (1)

- Ikea Service StrategyDocument17 pagesIkea Service StrategyRizza RichensNo ratings yet

- Advance Paper Corporation V Arma Traders Corporation G.R. 176897Document11 pagesAdvance Paper Corporation V Arma Traders Corporation G.R. 176897Dino Bernard LapitanNo ratings yet

- Business and Transfer Taxation by Valencia and Roxas-Solution ManualDocument4 pagesBusiness and Transfer Taxation by Valencia and Roxas-Solution ManualFiona Manguerra81% (32)

- Flow Bill Explanation (Papiamentu)Document2 pagesFlow Bill Explanation (Papiamentu)Shanon OsborneNo ratings yet

- RamayanaDocument4 pagesRamayanaRizza RichensNo ratings yet

- Chater 16Document10 pagesChater 16Rizza RichensNo ratings yet

- Catch Me If You CanDocument1 pageCatch Me If You CanRizza RichensNo ratings yet

- Title Synopsis Relation To GovernmentDocument2 pagesTitle Synopsis Relation To GovernmentRizza RichensNo ratings yet

- How To Make KeychainsDocument24 pagesHow To Make KeychainsRizza RichensNo ratings yet

- MeaningDocument2 pagesMeaningRizza RichensNo ratings yet

- SPJ FurnitureDocument1 pageSPJ FurnitureRizza RichensNo ratings yet

- Title Synopsis Relation To GovernmentDocument2 pagesTitle Synopsis Relation To GovernmentRizza RichensNo ratings yet

- List of FurnitureDocument2 pagesList of FurnitureRizza RichensNo ratings yet

- Adverbs of MannerDocument11 pagesAdverbs of MannerRizza RichensNo ratings yet

- Infinite LimitsDocument26 pagesInfinite LimitsRizza RichensNo ratings yet

- Iso CompaniesDocument7 pagesIso CompaniesRizza RichensNo ratings yet

- International Business: Gaurav DawarDocument22 pagesInternational Business: Gaurav Dawarsarathnair26No ratings yet

- Consumer Durable LoansDocument10 pagesConsumer Durable LoansdevrajkinjalNo ratings yet

- Risk and Managerial (Real) Options in Capital BudgetingDocument40 pagesRisk and Managerial (Real) Options in Capital BudgetingRaazia ImranNo ratings yet

- Lab 4Document32 pagesLab 4M Aiman Syafiq0% (1)

- Universiti Teknologi Mara Final Examination: Confidential LW/OCT2010/LAW585Document4 pagesUniversiti Teknologi Mara Final Examination: Confidential LW/OCT2010/LAW585AliceAinaaNo ratings yet

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonNo ratings yet

- F&A Best - SAPOSTDocument23 pagesF&A Best - SAPOSTsheikh arif khan100% (2)

- Assignment FA2 May 2012 QuestionDocument4 pagesAssignment FA2 May 2012 Questionsharvin_94No ratings yet

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- American National Insurance Company v. Fidelity Bank, N. A., 691 F.2d 464, 10th Cir. (1982)Document6 pagesAmerican National Insurance Company v. Fidelity Bank, N. A., 691 F.2d 464, 10th Cir. (1982)Scribd Government DocsNo ratings yet

- HAJI ALI IMPORT EXPORT-Exim-Islampur-395Document8 pagesHAJI ALI IMPORT EXPORT-Exim-Islampur-395Eva AkashNo ratings yet

- Benzonan Vs CADocument9 pagesBenzonan Vs CAL100% (1)

- Contingency Planning & Simulation Exercises Practical ApplicationsDocument11 pagesContingency Planning & Simulation Exercises Practical ApplicationsMustafa Shafiq RazalliNo ratings yet

- Cpa Review School of The Philippines For Psba Integrated ReviewDocument13 pagesCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagNo ratings yet

- Capital Budgeting Test Bank Part 2Document167 pagesCapital Budgeting Test Bank Part 2AnnaNo ratings yet

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaNo ratings yet

- Topic: Financial Management Function: Advantages of Profit MaximizationDocument4 pagesTopic: Financial Management Function: Advantages of Profit MaximizationDilah PhsNo ratings yet

- Multinational Corporations: Some of Characteristics of Mncs AreDocument7 pagesMultinational Corporations: Some of Characteristics of Mncs AreMuskan KaurNo ratings yet

- Altaf Ali - Cashier CVDocument3 pagesAltaf Ali - Cashier CVAzam Baig100% (2)

- Cash Flow statement-AFMDocument27 pagesCash Flow statement-AFMRishad kNo ratings yet

- Guideline For Synopsis, Thesis Submission MDMS Post Graduate CoursesDocument2 pagesGuideline For Synopsis, Thesis Submission MDMS Post Graduate Courses365mohiseenNo ratings yet

- PPP Program Philippines PDFDocument21 pagesPPP Program Philippines PDFJosielynNo ratings yet

- ICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicDocument12 pagesICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicOmarih K. HiramNo ratings yet

- MBA711 - Chapter11 - Answers To All Homework ProblemsDocument17 pagesMBA711 - Chapter11 - Answers To All Homework ProblemsGENIUS1507No ratings yet

- Course Outline S1 2022Document5 pagesCourse Outline S1 2022Woon TNNo ratings yet

- Meaning of Financial StatementsDocument2 pagesMeaning of Financial StatementsDaily LifeNo ratings yet