Professional Documents

Culture Documents

Tax Outline Index

Uploaded by

sflint0 ratings0% found this document useful (0 votes)

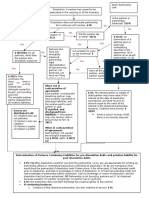

49 views8 pagesQuick Reference by topic for IRC and tax code.

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentQuick Reference by topic for IRC and tax code.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views8 pagesTax Outline Index

Uploaded by

sflintQuick Reference by topic for IRC and tax code.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 8

Term/Phrase Page

1014 (stepped-up basis, applies to transfer by bequest) 27, 59

1015 (carryover basis, applies to transfers by gift) 26

102 (gifts) 25

103 (excludes interest on debt obligations of states) 25

1031 (like-kind exchanges) 65-66

104 (damages in general) 23

1041 (gain/loss not recognized incident to spousal trans.) 58

108 (exclusions) 21

1221 (capital asset) 59

1222 (capital gains/losses) 59

1231 (quasi-capital gains & losses) 62

1239 (sale of depreciable property to related party) 64

1245 (recapture depreciation of personal property) 63

1250 (recapture depreciation of real property) 64

151 (personal exemption) 33

152 (dependency exemption) 33

162 (trade or business expenses) 43

164 (deductibility of state, local & foreign taxes) 32

167 (depreciation) 17, 38

170 (charitable contributions) 30

212 (expenses for production of income) 43

262 (personal, living & family expenses) 44

263 (capital expenditures) 44

71 (alimony) 35

72 (annuity exclusion) 19

7702 (see investment of life insurance) 28

83 (property transferred for services rendered) 9

30-day letter 2

401(K) 14

84-176, Revenue Ruling 22

90-day letter (deficiency notice) 2

99-7, Revenue Ruling (daily transportation expenses) 48

accelerated death benefits (of life insurance) 29

accessions to wealth 5

accounting methods 13

accrual-method 13

achievement award (see employee achievement award) 27

adjusted basis 7

adjusted gross income 2

alimony 35

alimony, basic requirements for taxable/deductible 35

allocation of basis 55

amount realized 6

annuities 19

annuity payment for damages (structured settlement) 24

appreciated property, contributions of 32

appreciation 6

automatic dividend rule 47

awards (see prizes) 27

away from home: for deducting meals & travel 49

bargain purchases 7

basic tax computations 2

basis (see specifics below) 7

basis, & depreciation 38

1

basis, adjusted 7

basis, allocation 55

basis, bequests 27, 59

basis, carryover (general rule of gifts) 26

basis, gifts 26, 58

basis, of property acquired by exercising option 55

basis, stepped-up (general rule of bequests) 27, 59

bequests, basis of 27

bequests, gifts 26

bequests, stepped-up basis 27, 59

Blair v. Commissioner 53

bonds & coupons on bonds, who is taxpayer 53

bonuses to employees 47

boot, received in an exchange 65

borrowing, general notes on 20

business & investment expenses 38

business vs. personal origination of lawsuit 45

buy-sell agreements 29

cancellation of indebtedness 20

cancellation of indebtedness: reduction of basis following 21

capital assets 59

capital assets, items that are not 62

capital expenditures 40

capital expenditures 44

capital expenditures vs. deductible repairs 40

capital gains & charitable contribution deduction 65

capital gains & losses 59

capital gains, policy considerations in taxation of 61

capital investments vs. ordinary & necessary expenses 18

capital losses 61

capital, recovery of 17

carrying charges, form of interest 50

carrying-on requirement 49

carryover basis (general rule of gifts) 26

cash value (of whole life insurance) 28

cash-method 13

casualty fire pot ( 1231) 63

Cesarini v. U.S. 5

charitable contributions & capital gains 65

charitable contributions & tax-exempt organizations 30

charitable transfer (exception to prizes) 27

charitable transfer (general rules of) 30

child support, not alimony 35

child tax credits 3

children, taxation of income of minors 53

clothing, deductible for trade or business 46

commuting expenses 47

commuting, daily transportation expenses 48

compensation for services rendered 8

compensation for services rendered (property) 9

computations, basic tax 2

computations, realized gain or loss 55

consideration vs. gift 58

constructive receipt 15

contributions of appreciated property 32

2

copyright, not capital asset 59, 62

cost recovery, depreciation 38

court, choice of 2

Crane v. Commissioner 40, 56

credits, child 3

credits, personal 36

custodial parents (dependency exemption) 33

damages, in general 23

damages, other than punitives, not included in gross income 24

damages, taxation of 23

Davis v. U.S. (overturned by 1041) 58

death benefits, accelerated (of life insurance) 29

debt, cancellation of 20

declining-balance method (depreciation) 38

deductions, itemized 3

deductions, standard 3

deferred compensation 13

deferred compensation (qualified) arrangements 10, 14

deferred compensation, non-qualified, contractual 15

deficiency notice (90-day letter) 2

dependency exemption 33

dependent-care services, tax credit 36

depreciation 17

depreciation & basis 38

depreciation of intangible property 39

depreciation vs. expensing 39

depreciation, business & investment expenses 38

depreciation, of improvements 39

depreciation, of like-kind exchanges 66

discharge of indebtedness 20

discounts, employee 7

dividend vs. salary 46

dividend, stock: distribution not taxable event 5

dividends, taxable w/o regard to cost basis 17

division of property, not alimony 35

divorce, economics of 35

divorce/marriage transfers 58

divorced parents (dependency exemption) 33

donor's intent (gifts, Duberstein ) 25

Duberstein v. Commissioner 25

earned-income credit 36

Eisner v. Macomber 5, 54

Elliotts, Inc. v. Commissioner 47

embezzled funds, as income to embezzler 15

employee achievement award (exception to prizes) 27

employee discounts 7

employees, gifts to 26

employment-related expenses, personal tax credit 36

exchanges, like-kind 65

exclusion ratio (of an annuity) 19

exemption, dependency 33

exemption, personal 33

expected return (of an annuity) 19

expenses, capitalized 42

expensing in lieu of depreciation 39

3

family partnership 53

Farid-Es-Sultaneh v. Commissioner 58

filing status 34

filing status & personal exemptions 33

Fire pot ( 1231) 63

FMV or basis, which to use in gifting property 58

foreign, local & state taxes 32

forfeiture, substantial risk of 10

forum, choice of 2

gain 6

gain, illegal 15

gift vs. contractual consideration 58

gifts 25, 58

gifts, basis of 26, 58

gifts, bequests/inheritances 26, 59

gifts, of income from property 26

gifts, to employees 26

Gilmore v. U.S. 45

Glenshaw Glass Co. 5

gross income 1, 5

gross income from sales 6

gross income restriction (dependency exemption) 34

group term insurance 28

Hampton Pontiac v. U.S. 18

Hantzis v. Commissioner 49

Harris v. U.S. 25

Haverly v. U.S. 32

head of household, filing status 34

Helvering v. Horst 53

Helvering v. Welch 46

Hirsch v. Commissioner 22

Horst v. Helvering 53

household & dependent care services, tax credit 36

Idaho Power v. Commissioner 41

illegal gain 15

improvements, depreciation of 39

imputed income 24

imputed interest 50

in lieu of (test for taxation of damages) 23

Inaja v. Commissioner 56

incentive stock options 11

income from dealings in property 54

income from property, as gifts 26

income from property, who is taxpayer 53

income, adjusted gross 2

income, gross 1, 5

income, of minor children, taxation of 53

income, taxable 1, 2

indebtedness, qualified real property business 22

INDOPCO v. Commissioner 42

inheritances, gifts 26

injuries, damages for business & personal 24

injuries, damages for personal injuries 24

insolvency exception to cancellation of indebtedness 21

insolvency, definition 21

4

insurance, group term 28

insurance, life 27

insurance, term 28

insurance, whole life 28

intangible property, depreciation of 39

intent of donor (gifts, Duberstein ) 25

interest income & deductions 50

interest, forms of 50

interest, imputed 50

interest, personal 51

interest, state & local obligatons 25

interest, taxable w/o regard to cost basis 17

internal revenue service 1

International Freighting Corp., Inc. v. Commr. 54

inventories 43

inventory, not capital asset 59, 62

investment (of life insurance) 28

investment (of life insurance) taxation of 29

IRA contributions, tax credit for 14

IRA, Roth 13

IRA, traditional 14

itemized deductions 3

itemized deductions, reduction of 4

James v. U.S. 15

Kemon v. Commissioner 62

Kenseth v. Commissioner 44

key person insurance 29

Kirby Lumber Co. v. U.S. 20

letter rulings 1

liabilities giving rise to deductions 22

liability insurers, payments by 9

life insurance proceeds 27

life insurance trust 29

life insurance, taxation of (combine insure & invest) 29

life insurance, term insurance 28

life insurance, transfer for value 29

life insurance, whole 28

like-kind exchanges 65

like-kind exchanges, depreciation of 66

like-kind property 66

limitations, statute of 2

loan-forgiveness programs 23

LoBue v. Commissioner 9

local & state obligations, interest on 25

local, state & foreign taxes 32

long-term/short-term, capital 60

loss 6

lost payments vs. discharge of indebtedness 22

lower of basis or FMV rule 58

Lucas v. Earl 52

lunches, daily: not deductible 48

Macomber 5, 54

marriage/divorce transfers 58

Midland v. Empire 41

minor children, taxation of their income 53

5

mortality gain (annuities) 20

mortality loss (annuities) 20

mortgaged property, transfers involving 56

Moss v. Commissioner 48

moving expenses, carrying-on requirement 50

Mt. Morris Drive-in Theatre Co. 41

multiple support agreements (dependency exemption) 34

Nahey v. Commissioner 61

net-operating carryover 21

non-qualified stock options 10, 11

non-qualified, contractual (deferred compensation) 15

non-recognition transaction & disallowance of losses 65

obligation of payor 9

Old Colony Trust Co. v. Commissioner 8

opportunity cost 12

option, basis of property acquired by exercising 55

ordinary & necessary 46

organizational expenditures, depreciation 40

origination of expenses (business vs. personal) 45

paintings, as capital asset 59

Parker v. Delaney 56

payor, obligation of 9

personal exemption 33

personal exemptions 2

personal exemptions & filing status 33

personal exemptions phase-outs 4

personal injuries, damages for 24

personal interest 51

personal service income, who is taxpayer 52

personal tax credits 36

personal, living & family expenses 44

Pevsner v. Commissioner 45-46

phase-outs, personal exemptions 4

Plainfield-Union test 40

Plainfield-Union v. Commissioner 40

Poe v. Seaborn 52

points, form of interest 50

prizes 27

prizes, exceptions to 27

production of income, expenses for 43

progressive rate system 1

property acquired by bequest, basis of 59

property acquired by gift, basis of 58

property acquired by inheritance, basis of 59

property as compensation for services rendered 9

property as compensation, income & basis 12

property, analysis of transaction 54

property, basis of that acquired by exercising option 55

property, contributions of appreciated 32

property, income from dealings in 54

property, income from, who is taxpayer 53

property, like-kind 66

property, sale of depreciable to related party 64

property, transfers involving mortgaged 56

proportional rate system 1

6

purchase price, reduction of (cancellation of indebtedness) 22

QDRO (qualified domestic relations order) 15, 36

qualified (deferred compensation) arrangments 10, 14

qualified domestic relations order (QDRO) 15, 36

qualified real property business indebtedness 22

Rail Joint v. Commissioner 22

rail-joint principle 22

rate systems 1

Raytheon Production Corp. v. Commissioner 23

realization 5, 7

realization, computation of gain or loss 55

realization, has sale/exchange occurred? 54

reasonableness of compensation to employee 47

recapture of depreciation 63

recognition 7

recovery of capital 17

reduction of basis following cancellation of indebtedness 21

reduction of itemized deductions 4

reduction of purchase price (cancellation of indebtedness) 22

Regenstein v. Edwards 41

regressive rate system 1

rehabilitation, general plan of 41

related party, sale of depreciable property to 64

rent, taxable w/o regard to cost basis 17

repairs, deductible vs. capital expenditures 40

Revenue Ruling 84-176 22

Revenue Ruling 90-16 56

Revenue Ruling 99-7 (daily transportation expenses) 48

Robertson v. Commissioner 49

roll-overs, tax-free 14, 66

Roth IRA 13

rulings, letter 1

Sager Glove Corp. v. Commissioner 23

salary vs. dividend 46

salary, as trade or business expense 46

salary, reasonableness 47

sale of depreciable property to related party 64

sale-or-exchange requirement (capital gains) 61

securities, held for sale to customers in business 62

seeking employment, costs of, carrying-on requirement 50

services rendered, compensation for 8

services rendered, compensation for (property) 9

spouse-to-spouse (or former spouse) transfers 58

standard deductions 3

start-up & expansion costs, carrying-on requirement 50

state & local obligations, interest on 25

state, local & foreign taxes 32

statute of limitations 2

stepped-up basis (general rule of bequests) 27, 59

stock dividend: distribution not taxable event 5

stock option plan: compensation for services 9

stock options, incentive 11

stock options, non-qualified 10

stocks, as capital asset 59

straight-line depreciation 17, 38

7

structured settlement (annuity payment for damages) 24

substantial risk of forfeiture 10

substantially vested (property) 10

substantiation requirements of contributions 31

Tank Truck Rentals 50

tax controversies 2

tax rate (tax rate system) 1

taxable income 1, 2

taxes, state, local & foreign 32

tax-exempt organizations 30

tax-free exchanges 65

taxpayer, who is 51

temporary business, away from home 49

term insurance 28

time-value of money 13

tracing, re: interest 51

trade or business expenses 43

traditional IRA 14

transfer for value (of life insurance policy) 29

transfers involving mortgaged property 56

travel & entertainment 47

treasure trove 5

Turner v. Commissioner 27

uniform, deductible 46

voluntary payment 8

wasting investment requirement 17

Welch v. Helvering 46

whole life insurance 28

Wilcox , overruled by James 16

Wild v. Commissioner 45

Williams v. Commissioner 24

windfall ($$ in piano example) 5

Woodsam v. Commissioner 56

worker's comp, not included in gross income 24

Yeager v. Commissioner 44

8

You might also like

- Chapter 1 Fundamentals of Taxation by Cruz, Deschamps, Miswander, Prendergast, Schisler, and TroneDocument25 pagesChapter 1 Fundamentals of Taxation by Cruz, Deschamps, Miswander, Prendergast, Schisler, and TroneReese Parker100% (4)

- Income Tax OutlineDocument44 pagesIncome Tax OutlineMatt PriceNo ratings yet

- Family Law - Stein Fall 2011 Outline FINALDocument93 pagesFamily Law - Stein Fall 2011 Outline FINALbiglank99No ratings yet

- Antitrust - Longwell - Spring 2012Document29 pagesAntitrust - Longwell - Spring 2012fshahkNo ratings yet

- Torts Outline, ZeilerDocument126 pagesTorts Outline, ZeilersbrouNo ratings yet

- Federal Income Tax (Wells)Document30 pagesFederal Income Tax (Wells)Bear100% (2)

- Evidence Outline Long FinalDocument28 pagesEvidence Outline Long FinalvasNo ratings yet

- Corporations - Loewenstein - Spring 2007 - Alexande - Grade 97Document45 pagesCorporations - Loewenstein - Spring 2007 - Alexande - Grade 97a thaynNo ratings yet

- AnimalLaw Wagman spr04Document25 pagesAnimalLaw Wagman spr04Katie SperawNo ratings yet

- Standard Test Chart Deal I MBC ADocument16 pagesStandard Test Chart Deal I MBC ADevorah GillianNo ratings yet

- Energy Regulation OutlineDocument10 pagesEnergy Regulation OutlinedboybagginNo ratings yet

- Law of Alternative Dispute ResolutionDocument11 pagesLaw of Alternative Dispute Resolutionmacdaddy23100% (1)

- Corporations OutlineDocument84 pagesCorporations OutlinegsdqNo ratings yet

- Antitrust Outline For ExamDocument26 pagesAntitrust Outline For ExamBusiness Compliance Property ManagementNo ratings yet

- CoL Outline FINAL PRINTDocument27 pagesCoL Outline FINAL PRINTseabreeze100% (1)

- Remedies EssayDocument17 pagesRemedies EssayTony ZhouNo ratings yet

- MBCADocument172 pagesMBCAlissettm08No ratings yet

- Professor Jose Gabilondo Federal Income Tax Florida International University College of LawDocument89 pagesProfessor Jose Gabilondo Federal Income Tax Florida International University College of Lawjfeyg100% (1)

- Wills, Trusts, and Estates Class Notes C 1 I E P Class NotesDocument67 pagesWills, Trusts, and Estates Class Notes C 1 I E P Class Notesaeshelt2No ratings yet

- White Collar Crime Outline - Prof. Ken Levy, Fall 2013Document22 pagesWhite Collar Crime Outline - Prof. Ken Levy, Fall 2013logan doopNo ratings yet

- Constitutional Law II Outline: Instructor: BeeryDocument22 pagesConstitutional Law II Outline: Instructor: BeeryBrian Brijbag100% (1)

- Antitrust Exam ConsolidationDocument21 pagesAntitrust Exam Consolidationmab2140No ratings yet

- Family Law OutlineDocument18 pagesFamily Law OutlineBill TrecoNo ratings yet

- Mergers and Acquisitions OutlineDocument1 pageMergers and Acquisitions OutlineMa FajardoNo ratings yet

- Remedies Hutchinson - 2012Document57 pagesRemedies Hutchinson - 2012LegaleLegalNo ratings yet

- Fedincometaxoutline 19Document17 pagesFedincometaxoutline 19ashajimerNo ratings yet

- Lethal Autonomous Weapons SystemsDocument7 pagesLethal Autonomous Weapons SystemsDorjee SengeNo ratings yet

- Civ Pro Outline (Wasserman)Document109 pagesCiv Pro Outline (Wasserman)Sarah EunJu LeeNo ratings yet

- Con Law II Outline-2Document13 pagesCon Law II Outline-2Nija Anise BastfieldNo ratings yet

- Business Organizations Outline - Docx FINALDocument67 pagesBusiness Organizations Outline - Docx FINALHan FangNo ratings yet

- Fall 2020 Barzuza CorporationsDocument12 pagesFall 2020 Barzuza Corporationsa thaynNo ratings yet

- Criminal Law OutlineDocument25 pagesCriminal Law OutlinechristiandemeNo ratings yet

- Labor Law OutlineDocument21 pagesLabor Law OutlinejazzieycpNo ratings yet

- Rosenbaum FrankfordDocument334 pagesRosenbaum FrankfordJorge Luis Rivera AgostoNo ratings yet

- Corporations, Kraakman, Fall 2012Document61 pagesCorporations, Kraakman, Fall 2012Chaim SchwarzNo ratings yet

- Corporations OutlineDocument4 pagesCorporations OutlineKeith DyerNo ratings yet

- US Taxation - Outline: I. Types of Tax Rate StructuresDocument12 pagesUS Taxation - Outline: I. Types of Tax Rate Structuresvarghese2007No ratings yet

- UPA DissolutionDocument1 pageUPA DissolutionNiraj ThakkerNo ratings yet

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdDocument153 pagesArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoNo ratings yet

- Antitrust Kesselman Fall 2020Document101 pagesAntitrust Kesselman Fall 2020Rhyzan CroomesNo ratings yet

- Pro Resp Law ChartDocument22 pagesPro Resp Law ChartGud104No ratings yet

- BusinessBeatBasics PDFDocument255 pagesBusinessBeatBasics PDFKhristopher J. BrooksNo ratings yet

- Federal Income Taxation OutlineDocument87 pagesFederal Income Taxation OutlineSaul100% (1)

- Attack SheetDocument3 pagesAttack SheettoddmbakerNo ratings yet

- Agency OutlineDocument41 pagesAgency OutlineNana Mireku-BoatengNo ratings yet

- Tax Answers - Chapter 3Document4 pagesTax Answers - Chapter 3Jonathan VelaNo ratings yet

- Outline Laura Civil Procedure.Document97 pagesOutline Laura Civil Procedure.Mike Binka KusiNo ratings yet

- Con Law Outline (Adler)Document59 pagesCon Law Outline (Adler)Alena Shautsova50% (2)

- Int TaxDocument24 pagesInt TaxDane4545No ratings yet

- Fall Civ Pro I OutlineDocument31 pagesFall Civ Pro I OutlineNicole AlexisNo ratings yet

- Authority: Actual Apparent Inherent Ratification EstoppelDocument6 pagesAuthority: Actual Apparent Inherent Ratification EstoppelBrick295No ratings yet

- 36.1 Basic Concepts: Chapter 36 - AntitrustDocument11 pages36.1 Basic Concepts: Chapter 36 - AntitrustpfreteNo ratings yet

- Con Law Short OutlineDocument17 pagesCon Law Short OutlineJennifer IsaacsNo ratings yet

- Business Associations OutlineDocument170 pagesBusiness Associations OutlineDave JohnsonNo ratings yet

- Exam Outline - ArcaroDocument43 pagesExam Outline - Arcarojuniper19No ratings yet

- PL OutlineDocument83 pagesPL OutlinejwwisnerNo ratings yet

- Dressler Outline - Internet PDFDocument37 pagesDressler Outline - Internet PDFskjdnaskdjnNo ratings yet

- Federal Income Tax OutlineDocument14 pagesFederal Income Tax OutlineAllison HannaNo ratings yet

- Prof Resp OutlineDocument77 pagesProf Resp OutlineChirag Patel100% (1)

- MBE & MEE Essentials: Governing Law for UBE Bar Exam ReviewFrom EverandMBE & MEE Essentials: Governing Law for UBE Bar Exam ReviewNo ratings yet

- Airtel Stock PitchDocument7 pagesAirtel Stock PitchSubhankar BarikNo ratings yet

- 2.4 Ishares Product List PDFDocument12 pages2.4 Ishares Product List PDFVijay YadavNo ratings yet

- RSM 332 Lec1Document16 pagesRSM 332 Lec1Bella ChungNo ratings yet

- Tidjane Thiam - WikipediaDocument7 pagesTidjane Thiam - WikipediaEvanora JavaNo ratings yet

- Types of Banking Organisation and StructuresDocument4 pagesTypes of Banking Organisation and Structuresaakash patilNo ratings yet

- Asset Privatization Trust Vs SandiganbayanDocument13 pagesAsset Privatization Trust Vs Sandiganbayandarts090No ratings yet

- Income and Changes in Retained Earnings: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesDocument57 pagesIncome and Changes in Retained Earnings: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesRosenna99No ratings yet

- MENTORING 6, DAY 25: 19 Jul 2022Document25 pagesMENTORING 6, DAY 25: 19 Jul 2022lakshmipathihsr64246No ratings yet

- A Study On Consumer Perception While Availing Home Loan From Public Sector and Private Sector BanksDocument89 pagesA Study On Consumer Perception While Availing Home Loan From Public Sector and Private Sector BanksPratiksha Mishra67% (3)

- Mergers & Acquistions RJR Nabisco Case: Academic Group 4Document7 pagesMergers & Acquistions RJR Nabisco Case: Academic Group 4Girish ShenoyNo ratings yet

- Angel BrokingDocument105 pagesAngel BrokingPankaj SolankiNo ratings yet

- Terp Construction CorpDocument11 pagesTerp Construction CorpCyruz TuppalNo ratings yet

- Case 3 Nurul Diana IntanDocument14 pagesCase 3 Nurul Diana IntanNur FahanaNo ratings yet

- Annex 9 - Tantular Trial - VERDICTDocument476 pagesAnnex 9 - Tantular Trial - VERDICTAdhie SoekamtiNo ratings yet

- Asset Quality, Credit Delivery and Management FinalDocument21 pagesAsset Quality, Credit Delivery and Management FinalDebanjan DasNo ratings yet

- HOME - PSE - SEC Form 17C - Board Resolution - New Directors and Officers - AGM 2021Document6 pagesHOME - PSE - SEC Form 17C - Board Resolution - New Directors and Officers - AGM 2021kjcnawkcna calkjwncaNo ratings yet

- Order in The Matter of M/s Bishal Agri-Bio Industries Limited (BABIL)Document29 pagesOrder in The Matter of M/s Bishal Agri-Bio Industries Limited (BABIL)Shyam SunderNo ratings yet

- Jurnal Profita Putri DwiDocument25 pagesJurnal Profita Putri Dwiputri dwiNo ratings yet

- 205B - Company Law and Secretarial Practice-IDocument21 pages205B - Company Law and Secretarial Practice-IArchana100% (1)

- Madhucon Projects Result UpdatedDocument14 pagesMadhucon Projects Result UpdatedAngel BrokingNo ratings yet

- Business Name RegistrationDocument14 pagesBusiness Name RegistrationEdrey QuerimitNo ratings yet

- General Power of Attorney Final (NEW)Document4 pagesGeneral Power of Attorney Final (NEW)udNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- BASFINE - Banks HomeworkDocument5 pagesBASFINE - Banks HomeworkDanaNo ratings yet

- Digital Guidebook 21 Tabs SlidesManiaDocument87 pagesDigital Guidebook 21 Tabs SlidesManiaFort Specter PedrosaNo ratings yet

- Western Maharashtra Development Corporation Vs Bajaj AutoDocument6 pagesWestern Maharashtra Development Corporation Vs Bajaj AutoGirish Premani100% (1)

- Sources and Raising of LT FinanceDocument52 pagesSources and Raising of LT FinanceAshutoshNo ratings yet

- f10 Claim FormDocument2 pagesf10 Claim Formiceslurpie100% (1)

- Commodity Market QuestionnaireDocument86 pagesCommodity Market Questionnairearjunmba119624100% (1)

- FIN 360 Mock ExamDocument1 pageFIN 360 Mock ExamSkrybeNo ratings yet