Professional Documents

Culture Documents

5-14 Lawson PowerPoint Judicial and Non-Judicial Foreclosures

Uploaded by

Cairo AnubissCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5-14 Lawson PowerPoint Judicial and Non-Judicial Foreclosures

Uploaded by

Cairo AnubissCopyright:

Available Formats

Insuring after Judicial and

Non-Judicial Foreclosures

Montana Land Title Association

Spring Education Seminar

May 2014

David E. Lawson, Underwriter

Fidelity National Title Group

NOTE: deed of trust (DOT) is used to refer to Trust Indenture, Deed of Trust,

or Mortgage, as applicable.

IDENTIFYING MATTERS THAT

MIGHT SURVIVE FORECLOSURE

UCC WITH PURCHASE MONEY PRIORITY ON FIXTURES

Ineffective limited Subordination Agreements are common.

SIMULTANEOUS DOT WITHOUT SUBORDINATION

Title insurer relied only on instructions from the lenders.

Consult with your underwriter

Sellers purchase money DOT will have priority

JUDGMENT JUNIOR IN TIME ARISING FROM

FORECLOSURE OF A PRIOR ENCUMBRANCE

IDENTIFYING MATTERS THAT

MIGHT SURVIVE FORECLOSURE

GOVERNMENTAL CODE VIOLATIONS AND

LIENS RELATING TO CODE VIOLATIONS

GOVERNMENTAL CRIMINAL FORFEITURE RIGHTS

Unless the government formally authorized the foreclosure.

EASEMENTS AND AGREEMENTS

If required by building permits or needed to use the property

even though recorded later.

Non-compliance with local codes if treated as extinguished?

Contact your underwriter if you have any questions.

IDENTIFYING MATTERS THAT

MIGHT SURVIVE FORECLOSURE

LEASES TO PARTIES UNRELATED TO THE BORROWER.

Often no notice given to lessees; or notice given but lender

relies on the lease attornment & nondisturbance provisions

to treat the lease as surviving.

A lease is part of the cash flow & gives value to the property

HOA LIENS:

Unless they clearly create a lien only upon recording or

upon delinquency, or CCR contains a provision granting the

priority to this type of lender.

Priority may hinge on a legal interpretation of the precise

CCR wording. Maybe as of date of CCR recording?

IDENTIFYING MATTERS THAT

MIGHT SURVIVE FORECLOSURE

CAUTION: COPING WITH HOA LIENS

If a lien clearly has priority or priority is questionable then

just show the HOA lien and require a release.

If lender has priority, will HOA recognize lien extinguished?

Does HOA understand priority?

Requesting unnecessary release - often provokes objection

or attempt to collect the entire lien.

Consider showing the lien and using the following:

Note: Said lien appears to have been extinguished by the

foreclosure of a deed of trust. This exception will be removed

if the association claiming the lien confirms their records show

the lien on the land was extinguished by foreclosure.

RECORDING SEQUENCE vs LOAN

MODIFICATIONS AND SUBORDINATIONS

Recording sequence only benefits a BFP without

knowledge of another unrecorded document.

Loan modifications frequently cause a lender to

lose its original priority, but not always.

Assume the foreclosing lenders priority was

altered - as of date of most recent modification.

If junior lender forecloses, dont assume it gained

priority because of prior lenders later modification.

Lender might argue about priority or assert partial

priority.

RECORDING SEQUENCE vs LOAN

MODIFICATIONS AND SUBORDINATIONS

Subordination Agreements:

Some are limited in scope and not fully effective.

If initially effective, a Subordination might lose

effectiveness when senior loan is later modified.

Subordinations to any future modifications or

advances are not always treated by the Courts as

effective.

PARTIES WHO DID NOT RECEIVE NOTICE

If lender intentionally does not provide notice to a

junior party - the junior partys interest will survive.

If failure to provide notice is unintentional, it is

possible in some instances to re-foreclose.

Terry L. Bell Generations Trust v. Flathead Bank of

Bigfork Montana Supreme Court - 2013 MT 152:

first trustees sale was invalid and ineffectual (as to

only Bell), the second foreclosure action was

appropriate the first foreclosure proceeding did

not result in a merger of title and extinguishment of

Flathead Banks trust deeds.

SPECIAL RISKS IN JUDICIAL

FORECLOSURES

Notice by publication

Default orders

Orders determining priority contrary to

apparent priority rights

Lack of a recorded lis pendens

Foreclosures of smaller encumbrances

n History of claims - challenges to foreclosures

when significant equity or value is lost

FEDERAL REDEMPTION RIGHTS

FOLLOWING ANY FORECLOSURE

IRS: 120 days, or such longer period as is

allowed in the foreclosure.

n Possible to obtain a waiver of redemption right,

but if equity IRS will often require payment.

Other agencies of the United States: one

year, even for Trustees Sales

n Examples: J unior SBA loan, or J udgment in

favor of the U.S. or one of its agencies

JUDICIAL FORECLOSURE

REDEMPTION RIGHTS

Read the Order - what redemption period applies?

Conventional Mortgage 1 year from the date of sale.

If Small Tract Financing Act trust indenture or DOT

used then not entitled to any right of redemption.

n But recent foreclosure orders sometimes grant a

30 day redemption right upon request of lender.

First State Bank of Forsyth v. Chunkapura, 226 Mont. 54, 57,

734 P.2d 1203, 1205 (1987).

Steven L. Cavanaugh v. Citimortgage, Inc., et al 2013 MT 349

JUDICIAL FORECLOSURE

REDEMPTION RIGHTS

EXTENSION OF THE REDEMPTION PERIOD by the

Servicemembers Civil Relief Act:

Period of military service not included in computing

redemption period

Redemption period extended for the length of

service plus 90 days

JUDICIAL FORECLOSURE

REDEMPTION RIGHTS

ASSIGNMENT OF REDEMPTION RIGHTS

General rule - assume redemption rights of the

owner or any other party cannot be assigned

independently of the assignors interest in the

property since redemption rights apply to the

successors in interest.

Issue has been a source of litigation in other states.

Montana has court decisions on limited issues, but

still room for additional litigation.

JUDICIAL FORECLOSURE

REDEMPTION RIGHTS

WHO MAY REDEEM

Debtor, debtor's spouse, debtor's successor in

interest in all or any part of the property.

Any stockholder of judgment debtor corporation.

J unior lien holder on any part of the property sold.

Any stockholder of a junior corporation lien holder.

Effect of redemption by debtor or debtor's spouse

Debtor redeems: effect of the sale is terminated.

Spouse redeems: spouse becomes the owner of the

debtor's interest. All junior liens are revived.

JUDICIAL FORECLOSURE

REDEMPTION RIGHTS

Possession of lands during redemption period.

Debtor if personally occupying as a home for the

debtor and family.

Otherwise the purchaser or assignee

CAN YOU INSURE PRIOR TO

REDEMPTION RIGHTS EXPIRING?

Complex topic - obtain your underwriters approval.

Purchaser at a sheriffs sale acquires most of the

rights of the borrower

That interest is not fee simple

Does not fall within the chain of title without

recording the Certificate of Sale.

Subject to extinguishment upon redemption.

CAN YOU INSURE PRIOR TO

REDEMPTION RIGHTS EXPIRING?

If the purchaser at the Sheriffs Sale does not want to

wait out the redemption period before selling:

Can assign the Certificate of Sale.

BUT if sale price exceeds the foreclosure bid amount,

a redemptioner is not obligated to pay the mark-up.

A lender to the holder (or assignee) of a Certificate of

Sale will have its lien extinguished by a redemption,

without any obligation on redemptioner to pay any

amount to the lender.

EQUITABLE REDEMPTION

Refers to purchase at or after foreclosure

by an affiliate or relative of the borrower,

or later repurchase by the borrower,

relative or affiliate.

J unior parties can assert their lien or

interest is revived in the same manner as

in a redemption from a judicial foreclosure,

even if title is acquired by an LLC or in

another manner than previously held.

SUBDIVISION COMPLIANCE ISSUES

Lender failed to require creation of mortgage lot by

borrower:

Recourse - court order to require county and

department of revenue to allow mortgage lot

Conveyance of road right of way by borrower

without a partial release:

Lender has rights to foreclose on original boundaries.

Adjustments of boundaries by COS:

Lender has rights to foreclose on original boundaries.

Trustees deed often not recordable - original legal

description not conforming to most recent survey.

SUBDIVISION COMPLIANCE ISSUES

In most instances a lender cannot foreclose

additional land acquired by borrower and added to

the original parcel by recorded survey.

ALTA policies, other than ALTA Homeowners, do

not insure against loss from subdivision non-

compliance except to the extent a notice of

violation has been recorded.

SUBDIVISION COMPLIANCE ISSUES

CONDOMINIUMS:

Underlying platted lots within a condo cannot be

encumbered and foreclosed as independent

parcels. They are common elements owned in

undivided interests by the existing unit owners,

even if designated for future unit development.

Carefully review Declaration to determine the

nature of areas designated for future units.

Portions of common elements in which declarant

has rights to create additional units are not

capable of being owned, encumbered or

conveyed separately from other existing units.

MINOR DEFECTS IN FORECLOSURES

STRICT COMPLIANCE WITH CODE REQUIRED:

Any variation should be run by your underwriter.

SUCCESSOR TRUSTEE:

No powers until appointment is recorded.

MERS:

Challenges in other states can occur here, too.

Assume it can only assign the DOT.

MCA 71-1-110. The assignment of a debt secured by mortgage carries

with it the security.

MCA 71-1-303. "Beneficiary" means the person named in a trust

indenture as the person for whose benefit a trust indenture is given or the

person's successor in interest

MINOR DEFECTS IN FORECLOSURES

SCRIVENERS ERRORS:

Errors in legal descriptions and names are

commonly encountered.

If the legal description is still adequate to

describe the property, usually not a critical defect.

Name discrepancies often not a problem as long

as notice was given to the right parties.

If uncertain, consult your underwriter.

CLAIMS - FAILURE TO SURRENDER

POSSESSION

Major title claim risk - challenge by a party who

remains in possession after foreclosure.

May assert lack of sufficient notice, invalidity in

the foreclosure.

May assert common law challenges or rights.

Might have issues of competency impairing their

understanding of the foreclosure.

In general, confirm all parties whose interests were

foreclosed have surrendered possession.

SHOULD YOU INSURE A BIDDER AT

A FORECLOSURE SALE?

Purchaser at a trustees sale - not entitled to the

statutory protections of a Bona Fide Purchaser.

If there are foreclosure defects or the borrower

has equitable or contractual claims against the

lender, the sale can be set aside.

Insuring a resale is much less risky if the

purchaser is a bona fide purchaser for fair

market value. Protections exist under MCA 71-1-

318(2) and MCA 70-21-304

Consult with your underwriter.

SHOULD YOU INSURE A BIDDER AT

A FORECLOSURE SALE?

Sometimes you might receive approval only if you

show an exception in the policy for any challenge

to or defects in the foreclosure. Below is a sample

exception which can be considered:

Right of any party interested to sue or petition to have

set aside, modified, or contest a judicial or non-judicial

foreclosure or forfeiture, or any deed pursuant thereto,

through which title to the land described herein is

derived; and any liens, encumbrances and/or ownership

interests which may exist as a result of any acts or

omissions of the foreclosing parties, or as a result of

such suit or petition.

CONSTRUCTION LIEN RIGHTS

RESALES BY INVESTORS

Many investors fix up the properties or

repair damage caused by the foreclosed

borrower.

Be aware It is important to determine if

construction lien rights exist if providing

extended coverage or ALTA Homeowners

coverage.

INSURING AFTER A DEED IN LIEU OF

FORECLOSURE HELD IN ESCROW

Clogging the Equity of Redemption Doctrine:

Legal argument: a debtor cannot contractually give

up rights of redemption prior to a final default and

intent to surrender title.

A deed in lieu deposited into escrow at the time a

Contract for Deed is common practice.

Sometimes a lender will require deposit of a deed

in lieu to be recorded upon default.

A deed in escrow prior to the final default might be

construed as only a security document.

INSURING AFTER A DEED IN LIEU OF

FORECLOSURE HELD IN ESCROW

MCA 71-1-209 allows a BFP to rely on a previously

recorded deed in lieu. Policies have a duty of defense.

There can be grounds to challenge a deed in lieu

recorded without the grantors consent.

Remember, we do not know all off-record rights of

the grantor to challenge the deed.

Bankruptcy could invalidate or void the deed.

If requested to rely on a newly recorded deed in lieu

executed earlier, contact your underwriter.

Option: obtain from the grantor a new estoppel

affidavit or written consent to recording the deed.

NEW FRAUD TRENDS - FICTITIOUS

FORECLOSURES & DEEDS IN LIEU

A new wave of fraud involving purported assignments

to fictitious lenders using names similar to national

lenders. In most instances they insert the word

Northwest or Southwest before the lender name,

such as Northwest Wells Fargo Mortgage.

The schemes are complex, appointing a new trustee,

holding a foreclosure, purchase by a fraudulent

affiliate (often a land trust) who tries to resell or

borrow. In other situations we see a deed in lieu to

the fictitious assignee, who attempts to resell.

Probably the borrowers are in on the scam.

NEW FRAUD TRENDS - FICTITIOUS

FORECLOSURES & DEEDS IN LIEU

National Recovery REO Services, Inc. is often

involved, being given a POA by the new assignee.

These fraudsters go to great lengths to give the

appearance of legitimate transactions, taking steps

spread out over several months. We have seen the

them go so far as to hire a legitimate attorney to

obtain relief from a bankruptcy stay when a title

company told them they violated it.

*** Keep an eye out for anything out of the

ordinary. Contact your underwriter if you see

anything suspicious.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Article 9 of The U.C.CDocument20 pagesArticle 9 of The U.C.CCairo Anubiss0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Fraud Upon The Court (Disqualification of Judges)Document4 pagesFraud Upon The Court (Disqualification of Judges)Cairo Anubiss100% (4)

- Us Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionDocument4 pagesUs Bank Admits, in Writing From Their Corporate Office, That The Borrower Is A Party To An MBS TransactionMike Maunu100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Removal of Corporate TrusteeDocument39 pagesRemoval of Corporate TrusteeCairo AnubissNo ratings yet

- Bankers AcceptancesDocument36 pagesBankers AcceptancesAlexhCreditorNo ratings yet

- Pledge and Mortgage CasesDocument9 pagesPledge and Mortgage CasesGuiller C. MagsumbolNo ratings yet

- Secured Transactions Bar Review NotesDocument51 pagesSecured Transactions Bar Review NotesCJVNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Wills and Succession Sat 8 12Document5 pagesWills and Succession Sat 8 12Jevi RuiizNo ratings yet

- Bankers Bible (How To Screw People)Document75 pagesBankers Bible (How To Screw People)Cairo AnubissNo ratings yet

- 11 Civ 8500 Keenan ComplaintDocument114 pages11 Civ 8500 Keenan Complaintjhaines6No ratings yet

- Succession DigestDocument4 pagesSuccession DigestHenson Montalvo100% (1)

- Digest 838-844 SuccessionDocument8 pagesDigest 838-844 SuccessionJenifer PaglinawanNo ratings yet

- RFBT Intellectual Property Code PDFDocument4 pagesRFBT Intellectual Property Code PDFARISNo ratings yet

- Wamu 2005 Ar-14 424 B5Document39 pagesWamu 2005 Ar-14 424 B5Cairo AnubissNo ratings yet

- New Robo-Signers 2015Document3 pagesNew Robo-Signers 2015Cairo AnubissNo ratings yet

- SECURITIZED MORTGAGE TRUSTS (Highly Confedential) (Pandoras Box?)Document148 pagesSECURITIZED MORTGAGE TRUSTS (Highly Confedential) (Pandoras Box?)Cairo Anubiss100% (2)

- Vasvari PaperDocument54 pagesVasvari PaperCairo AnubissNo ratings yet

- A Practitioners Guide To Exchange Offers and Consent SolicitationDocument95 pagesA Practitioners Guide To Exchange Offers and Consent SolicitationCairo AnubissNo ratings yet

- Payment, Default, and Pass Through MortgagesDocument20 pagesPayment, Default, and Pass Through MortgagesCairo AnubissNo ratings yet

- The OCC's Asset Management Conflicts of Interest 2015Document96 pagesThe OCC's Asset Management Conflicts of Interest 2015Cairo AnubissNo ratings yet

- Talush Vs Deutcsh Partial-Summary-JudgmentDocument322 pagesTalush Vs Deutcsh Partial-Summary-JudgmentCairo AnubissNo ratings yet

- Pending RI Superior Court Civil Cases Before 2005Document540 pagesPending RI Superior Court Civil Cases Before 2005Cairo AnubissNo ratings yet

- 5 Breach of Fiduciary Duty in Business LitigationDocument21 pages5 Breach of Fiduciary Duty in Business LitigationCairo AnubissNo ratings yet

- California Judicial Ethics Guide - Judge Are To Follow ThisDocument44 pagesCalifornia Judicial Ethics Guide - Judge Are To Follow This83jjmackNo ratings yet

- California Attorneys - Free Expert Advice and Support For The New Homeowner Bill of Rights in California-This Is September 2013 NewsletterDocument53 pagesCalifornia Attorneys - Free Expert Advice and Support For The New Homeowner Bill of Rights in California-This Is September 2013 Newsletter83jjmackNo ratings yet

- Pros & Cons of LitigationDocument8 pagesPros & Cons of LitigationCairo AnubissNo ratings yet

- Unaudited JP Morgan ChaseDocument78 pagesUnaudited JP Morgan ChaseCairo AnubissNo ratings yet

- SAVE OUR HOMES - Protect Lawyers of IntegrityDocument15 pagesSAVE OUR HOMES - Protect Lawyers of IntegritySharing LightsNo ratings yet

- Mortgage Fraud RICO Case (Use To Sue Banks For RICO Crimes) .Document83 pagesMortgage Fraud RICO Case (Use To Sue Banks For RICO Crimes) .Cairo Anubiss100% (1)

- Snyder - Nonjudicial Foreclosure Under DeedDocument10 pagesSnyder - Nonjudicial Foreclosure Under DeedCairo AnubissNo ratings yet

- Supreme Court of The United StatesDocument19 pagesSupreme Court of The United StatesSamuel J. TassiaNo ratings yet

- Protective JurisdictionDocument50 pagesProtective JurisdictionCairo AnubissNo ratings yet

- Abrogating The Holder in Due Course DoctrineDocument46 pagesAbrogating The Holder in Due Course DoctrineCairo AnubissNo ratings yet

- Lie of The CenturyDocument7 pagesLie of The CenturyCairo AnubissNo ratings yet

- Deed of Assignment and Transfer of RightsDocument2 pagesDeed of Assignment and Transfer of RightsKrizza BatulanNo ratings yet

- Zabkan Villas PropertiesDocument4 pagesZabkan Villas PropertiesSAMIA CYBER KAWANGWARE SOKONI ARCADE ROOM 25No ratings yet

- HSBC (M) Trustee BHD V Kong Kim Hoh & Ors (1999)Document15 pagesHSBC (M) Trustee BHD V Kong Kim Hoh & Ors (1999)Ain SuhanaNo ratings yet

- Supreme Court of the Philippines upholds donation mortis causa designationDocument3 pagesSupreme Court of the Philippines upholds donation mortis causa designationJosef QuebecNo ratings yet

- Property Reviewer Part 1Document14 pagesProperty Reviewer Part 1Kean Fernand BocaboNo ratings yet

- Contract of Lease DraftDocument3 pagesContract of Lease DraftAbz ManansalaNo ratings yet

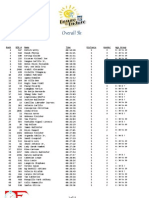

- Ensure To Endure Run 2012 5k OverallDocument11 pagesEnsure To Endure Run 2012 5k OverallDavesNo ratings yet

- Prince V United LabDocument5 pagesPrince V United LabJVMNo ratings yet

- Absolute Deed of Assignment FormatDocument2 pagesAbsolute Deed of Assignment FormatNeil CruzperoNo ratings yet

- 1 Introduction SV PDFDocument82 pages1 Introduction SV PDFReneTorresLópezNo ratings yet

- PRE FINALS CASE DIGEST - SUCCESSION Module 9 To Module 11Document29 pagesPRE FINALS CASE DIGEST - SUCCESSION Module 9 To Module 11Jandi YangNo ratings yet

- CONSIDERING THE FUTURE OF THE PROFESSION-Artículo en Ingles PDFDocument40 pagesCONSIDERING THE FUTURE OF THE PROFESSION-Artículo en Ingles PDFJOHN EMERSON TORRES AVILANo ratings yet

- Family Law 2 Notes 310321Document9 pagesFamily Law 2 Notes 310321Nagawa joviaNo ratings yet

- Figure E8.1: Dynamics of Structures, Fourth Edition Anil K. Chopra All Rights ReservedDocument15 pagesFigure E8.1: Dynamics of Structures, Fourth Edition Anil K. Chopra All Rights ReservedBara' alsayedNo ratings yet

- GR L-38338Document3 pagesGR L-38338James PerezNo ratings yet

- Test Bank For International Business Law and Its Environment 10th Edition Richard SchafferDocument36 pagesTest Bank For International Business Law and Its Environment 10th Edition Richard Schafferpeckish.tigress.rr97100% (46)

- Prepared By: Mark Price 25 Wall ST Apt 3 01604Document4 pagesPrepared By: Mark Price 25 Wall ST Apt 3 01604jamesNo ratings yet

- TC Suntrust Mortgage RVW 5093 - TaskDocument14 pagesTC Suntrust Mortgage RVW 5093 - TaskJoeben CañazaresNo ratings yet

- The Post-Sale Confusion DoctrineDocument35 pagesThe Post-Sale Confusion DoctrineRebecca LongNo ratings yet

- Contract of Lease - 168 CLOSS TRADINGDocument6 pagesContract of Lease - 168 CLOSS TRADINGWinnie UyNo ratings yet

- 2023 Jennifer B DeGrazia Revocable TrustDocument15 pages2023 Jennifer B DeGrazia Revocable Trustsweaty-in-azNo ratings yet

- TO Intellectual Property Rights (Iprs)Document27 pagesTO Intellectual Property Rights (Iprs)chirag agrawalNo ratings yet

- KlikBCA Individual Save PageDocument1 pageKlikBCA Individual Save Pageriska ikaNo ratings yet