Professional Documents

Culture Documents

Time Value of Money Outline

Uploaded by

Emman Lubis0 ratings0% found this document useful (0 votes)

245 views14 pagesTime Value of Money

Excerpts from Financial Management by Ma. Elenita Cabrera

For NU students and faculty

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTime Value of Money

Excerpts from Financial Management by Ma. Elenita Cabrera

For NU students and faculty

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

245 views14 pagesTime Value of Money Outline

Uploaded by

Emman LubisTime Value of Money

Excerpts from Financial Management by Ma. Elenita Cabrera

For NU students and faculty

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

1 Time Value of Money

August 16, 2014

2 The Concept of Time Value of Money and Interest

3 Introduction

4 The Concept of Interest

Time Value of Money (TVM) is described as the idea that money available at the present time is worth more than the same

amount in the future due to its potential earning capacity. This core principle of nance holds that, provided money can earn

interest, any amount of money is worth more the sooner it is received.

Principal is dened as

The money borrowed or land

Interest is dened as

The cost of using money over time or as economist refers to the time value of money

Interest Expense is cost of the excess resources to the borrower for the use of the money.

Interest Revenue benet of the excess resources to the lender of the money.

5 Simple Interest

Simple interest is determined by multiplying the interest rate by the principal by the number of periods.

Example 1: ABC Corporation deposits !10,000 in a bank at 10 percent interest a year. Using simple interest, how much is

the interest and the future value of the deposit after 1 year?

Answer:

Principal (beginning balance)!10,000.00

Interest for 1 year at10 percent

(10% xP10,000) 1,000.00

Future value at the end of year 1 !11,000.00

6 Simple Interest

Example 2: ABC Corporation deposits !10,000 in a bank at 7 percent interest a year. Using simple interest, how much is the

total interest and the future value of the deposit after 2 years?

Answer:

Principal (beginning balance)!10,000.00

Interest for 2 years at 7 percent

(7% x 2 years x P10,000) 1,400.00

Future value at the end of year 1 !11,400.00

7 Compound Interest

7 Compound Interest

Compound interest is the interest paid on both the principal ,and the amount of interest accumulated in prior periods. The

process of determining future value when compound interest is applied is called compounding.

Formula

Annual Compounding : FVn = PV (1 + i) n

Intraperiod Compounding :

8 Compound Interest

Example 3: ABC Corporation deposits !10,000 in a bank at 10 percent interest a year. How much is the total interest and the

future value of the deposit after 2 years if interest is compounded annually?

Answer:

Principal (beginning balance)!10,000.00

Interest for year 1 at 10 percent

(10% x P10,000) 1,000.00

Future value at the end of year 1 !11,000.00

Interest for year 2 at 10 percent

(10% x P11,000, Principal plus interest) 1,100.00

Future value at the end of year 2 !12,100.00

9 Compound Interest

Answer: (Formula Approach)

Substitute:

FVn = PV (1 + i) n

FV2 = !10,000 (1 + 0.10) 2

FV2 = !10,000 (1.2100)

FV2 = !12,100

10 Compound Interest

Example 4: Using the same data in Example 3 only that interest is compounded semi-annually. Calculate the Future value

and total interest for Year 2.

Given:

Principal = !10,000.00

Annual Interest = 10 percent

Principal = !10,000.00

Annual Interest = 10 percent

Compounding = Semi-annual

Years Calculated = 2 years

11 Compound Interest

Answer:

Principal (beginning balance)!10,000.00

Interest for 1st half of year 1 at 10 percent

(5% x P10,000) 500.00

Future value at the 1st half of year 1 !10,500.00

Interest for 1st half of year 1 at 10 percent

(10% x P10,500, Principal plus interest) 525.00

Future value at the end of year 1 !11,025.00

Interest for 1st half of year 1 at 10 percent

(5% x P11,025) 551.25

Future value at the 1st half of year 2 !11,576.25

Interest for 1st half of year 2 at 10 percent

(5% x P11,576.2, Principal plus interest) 578.81

Future value at the end of year 2 !12,155.06

12 Compound Interest

Answer: (Formula Approach)

Substitute:

FV2 = !10,000(1.05)4

FV2 = !10,000(1.215506)4

FV2 = !12,155.06

13 Simple Interest vs Compound Interest

Simple interest is determined by multiplying the interest rate by the principal by the number of periods.

13 Simple Interest vs Compound Interest

Simple interest is determined by multiplying the interest rate by the principal by the number of periods.

Example 1: ABC Corporation deposits !10,000 in a bank at 10 percent interest a year. Using simple interest, how much is

the interest and the future value of the deposit after 1 year?

Answer:

Principal (beginning balance)!10,000.00

Interest for 1 year at10 percent

(10% xP10,000) 1,000.00

Future value at the end of year 1 !11,000.00

14 Future Value

(By Using A Table)

Formula:

FVn = PV (FVIFi,n)

15 Future Value

(By Using A Table)

Answer:

Principal (beginning balance)!10,000.00

Interest for 1st half of year 1 at 10 percent

(5% x P10,000) 500.00

Future value at the 1st half of year 1 !10,500.00

Interest for 1st half of year 1 at 10 percent

(10% x P10,500, Principal plus interest) 525.00

Future value at the end of year 1 !11,025.00

Interest for 1st half of year 1 at 10 percent

(5% x P11,025) 551.25

Future value at the 1st half of year 2 !11,576.25

Interest for 1st half of year 2 at 10 percent

(10% x P11,576.2, Principal plus interest) 578.81

Future value at the end of year 2 !12,155.06

16 Future Value

Annual Compounding

16 Future Value

Annual Compounding

Example 5: Calculate Example 3 using FVIF table. Calculate the Future value 2 Years. (Note: answer in Example 3 is FV =

!12,100)

Given:

Principal = !10,000.00

Annual Interest = 10 percent

Compounding = Annual

Years Calculated = 2 years

17 Future Value

(By Using A Table)

Subtitute:

FVn = PV (FVIFi,n)

FV2 = !10,000 (1.2100)

FV2 = !12,100

18 Compound Interest

Example 7: Calculate using FVIF table the Future value 2 Years. (Note: answer in Example 3 is FV = !12,155)

Given:

Principal = !10,000.00

Annual Interest = 10 percent

Compounding = Semi-annual

Years Calculated = 2 years

19 Future Value

(By Using A Table)

Subtitute:

FV4 = PV (FVIFi,n)

FV4 = !10,000 (1.2155)

FV4 = !12,155

20 Future Value

(By Using A Table)

20 Future Value

(By Using A Table)

Example 8: Calculate using the below data and the FVIF table. Calculate the future value in 2 Years.

Given:

Principal = !10,000.00

Annual Interest = 12 percent

Compounding = Quarterly

Years Calculated = 2 years

21 Future Value

(By Using A Table)

Subtitute:

FV8 = PV (FVIFi,n)

FV8 = !10,000 (1.2668)

FV8 = !12,668

22 Nominal and E!ective Rate

Nominal interest rate is the stated rate or face value rate.

E"ective interest rate is the true interest rate which defers from nominal rate depending on the frequency of compounding.

Also called the annual percentage rate (APR).

Formula

where: i = interest and m = number of compounding

Note: If compounding is annual then APR = Nominal Rate

23 Nominal and E!ective Rate

Example 8: Using the information in Example 8 calculate the E"ective Rate being used.

Given:

Principal = !10,000.00

Annual Interest = 12 percent

Compounding = Quarterly

Years Calculated = 2 years

24 Nominal and E!ective Rate

Years Calculated = 2 years

24 Nominal and E!ective Rate

Answer:

25 Future Values and

Present Values

26 DETERMINATION OF THE FUTURE VALUE OF A STREAM OF PAYMENTS

Future Value Determination Involving Stream of Unequal Payments

27 Future Value Determination Involving Stream of Unequal Payments

Example 9 : ABC Corporation deposits today !10,000; !15,000 in the beginning of Year 2; !15,000 in the beginning of Year

3 and !20,000 in the end of Year 3 in a bank at 10 percent interest a year. How much is the value of ABCs deposit after

three years?

Given

Beg. Year 1 = !10,000 ; Beg. Year 2 = !15,000

Beg. Year 3 = !15,000 ; End. Year 3 = !20,000

Nominal Rate = 10%

28 Future Value Determination Involving Stream of Unequal Payments

Solution:

Beg. Year 1 = !10,000 x (1+0.10)3-0 = !10,000 x 1.1331 =

!13,331

Beg. Year 2 = !15,000 x (1+0.10)3-1 = !15,000 x 1.210 =

!18,150

Beg. Year 3 = !15,000 x (1+0.10)3-2 = !15,000 x 1.10 =

!16,500

End. Year 3 = !20,000 x (1+0.10)3-3 = !20,000 x 1 = !20,000

Future Value of the Deposits !67,981

29 Future Value Determination Involving Stream of Equal Payments

A stream of equal payments made at regular time intervals is an annuity, sometimes called a xed annuity.

Two Types of Annuity

Ordinary annuity - payments or receipts occur at the end of each period. Also called a regular or deferred annuity

Annuity due - payments or receipts occur at the beginning of each period

30 Ordinary Annuity (Formula)

Ordinary annuity

30 Ordinary Annuity (Formula)

Ordinary annuity

FVOAn = A (FVIFAi,n)

FVOAn = future value of an ordinary annuity

A = the amount of the xed annuity payment

FVIFAi,n = future value interest factor of an annuity for interest rate (i), and time period (n)

31 Ordinary Annuity

Example 10 : Crystal Corporation deposits !1,000 at the end of each of three consecutive years in a bank account paying

10 percent interest compounded annually.

Given

A = !1,000

i = 10%

n = 3

32 Ordinary Annuity

(Long Method)

Solution:

End Year 1 = !1,000 x (1+0.10)2-0 = !1,000 x 1.210 = !1,210

End Year 2 = !1,000 x (1+0.10)2-1 = !1,000 x 1.100 = !1,100

End Year 3 = !1,000 x (1+0.10)2-2 = !1,000 x 1.000 = !1,000

Future Value of the Deposits !3,310

33 Ordinary Annuity

(Formula Method)

Solution:

FVOAn = A (FVIFAi,n)

FVOAn = !1,000 (FVIFA0.10,3)

FVOAn = !1,000 (3.3100)

FVOAn = !3,310

34 Annuity Due (Formula)

Annuity Due

FVADn = A (FVIFAi,n) (1 + i)

FVADn = future value of an annuity due

A = the amount of the xed annuity payment

FVADn = future value of an annuity due

A = the amount of the xed annuity payment

FVIFAi,n = future value interest factor of an annuity for interest rate (i), and time period (n)

35 Annuity Due

Example 11 : Instead of depositing !1,000 at the end of each year for three consecutive years, the rm makes deposits at

the beginning of each year. Interest is compounded annually at 10 percent. How much will the rm have in account after

three years?

Given

A = !1,000

i = 10%

n = 3

36 Annuity Due

(Long Method)

Solution:

Beg. Year 1 = !1,000 x (1+0.10)3-0 = !1,000 x 1.331= !1,331

Beg. Year 2 = !1,000 x (1+0.10)3-1 = !1,000 x 1.210= !1,210

Beg. Year 3 = !1,000 x (1+0.10)3-2 = !1,000 x 1.100= !1,100

Future Value of the Deposits !3,641

37 Annuity Due

(Formula Method)

Solution:

FVADn = A (FVIFAi,n)(1 + i)

FVADn = !1,000 (FVIFA0.10,3)(1 + 0.10)

FVADn = !1,000 (3.3100)(1.10)

FVADn = !3,641

38 Annuity Due

(Shortcut Method)

Solution:

FVADn = A (FVIFADi,n)

FVADn = !1,000 (FVIFAD0.10,3)

FVADn = !1,000 (3.6410)

FVADn = !3,641

FVADn = !1,000 (3.6410)

FVADn = !3,641

39 Present Value

Present value is the current value of a future amount of money, or series of payments, evaluated at an appropriate discount

rate.

A discount rate, sometimes called the required rate of return or hurdle rate, is the rate of interest that is used to nd present

values

Discounting is the process of determining the present value of a future amount.

40 Discounting

Formula Method

PVIF Table

41 Present Value

Example 12 : JGC Company expects to receive !1,000 ve years from now and wants to know what this money is worth

today. The value today of !1,000 to be received ve years from now discounted at 10 percent is?

Given

FV5 = !1,000

i = 10%

n = 5

42 Present Value

Solution:

PV = FVn (PVIFi,n)

PV = (!1,000) (0.6209)

PV = !620.90

43 Present Value Determination Involving Stream of Unequal Payments

Example 13 : MNM Company, expects to receive payments of !1,000, !1,500, and !2,000 at the end of one, two and three

years, respectively. The present value of this stream of payments discounted at 10 percent is computed as follows.

Given

FV1 = !1,000 ; FV2 = !1,500 ; FV3 = !2,000

i = 10% n = 5

44 Present Value Determination Involving Stream of Unequal Payments

Solution:

44 Present Value Determination Involving Stream of Unequal Payments

Solution:

End Year 1 = !1,000 x [1/(1+0.10)1] = !1,000 x 0.9091 =

! 909.10

End Year 2 = !1,000 x [1/(1+0.10)2] = !1,500 x 0.8264 =

!1,239.60

End Year 3 = !1,000 x [1/(1+0.10)3] = !2,000 x 0.7513 =

!1,502.60

Present Value of Future Deposits !3,651.30

45 Present Value Determination Involving Stream of Equal Payments

Present Value of an Annuity

PVOAn = A(PVIFAi,n)

where:

Present Value Interest Factor of an Annuity

PVIFAi,n = # PVIFi,n

46 Present Value Interest Factor of an Annuity

Example 14 : Find the Present Value Interest Factor of an Annuity for the following:

a.) i = 10% n= 3 years

b.) i = 3% n= 5 years

47 Present Value Determination Involving Stream of Equal Payments

Example 15 : Summer Corporation expects to receive !1,000 at year's end for the next three years. The present value of this

annuity discounted at 10 percent is computed as follows.

Given

FV5 = !1,000

i = 10%

n = 3

48 Present Value Determination Involving Stream of Equal Payments Value

Solution:

PV = A (PVIFi,n)

PV = (!1,000) (2.4868)

PV = !2,486.80

49 PRESENT VALUE OF A PERPETUITY

PV = !2,486.80

49 PRESENT VALUE OF A PERPETUITY

Perpetuity is an annuity with an innite life; that is, the payments continue indenitely.

50 PRESENT VALUE OF A PERPETUITY

Example 16 : Honey Dew Corporation wants to deposit an amount of money in a bank account that will allow it to withdraw

P1,000 indenitely at the end of each year without reducing the amount of the initial deposit. If a bank guarantees to pay the

rm 10 percent interest on its deposits, the amount of money the rm has to deposit is?

Given

A = !1,000

i = 10%

51 PRESENT VALUE OF A PERPETUITY

Solution:

52 Growth Rate

Another application of the time value of money concept is calculating the compound annual growth or interest rate (i), of a

stream of payments or receipts. The equation below shows how to compute this rate when the growth rate is constant.

Formula:

53 Growth Ratw

Example 17 : Sugar Company has steadily increased its dividends per share from !1.00 in 2007 to !1.36 in 2011. The

annual compound growth rate of these dividend payments over the four years is Given

FVn = !1.36

PV = !1.00

54 Growth Rate

Solution:

FVIF = 1.36

Answer: 8%

55 Net Present Value

56 The Concept of Net Present Value in Business

55 Net Present Value

56 The Concept of Net Present Value in Business

The net present value (NPV) or net present worth (NPW) of a time series of cash ows, both incoming and outgoing, is

dened as the sum of the present values (PVs) of the individual cash ows of the same entity.

Formula:

NPV = # PVinow - # PVoutow

Usage:

Capital Budgeting; Feasibility Study; Project Analysis

57 The Concept of Net Present Value in Business

If the Net Present Value of any project analysed is positive. Then the project is considered a protable project.

The greater the Net Present Value the better

58 Net Present Value

Example 18 : ABC Corporation invests today !1,000,000 for an equipment that is forecasted to earn !400,000 in Year 1;

!450,000 in Year 2 and !500,000 in Year 3. It is expected that the equipment will not be able to be used after 3 years. What

is the:

Net present Value if the hurdle rate is 20% and should they continue the purchase.

Net present Value if the bank interest rate is 10% and should they continue the purchase.

59 Net Present Value

Solution: Scenario A

Investment =-1,000,000 x [1/(1+0.15)0] = -!1,000,000 x 1.0 =

(!1,000,000)

Inow Yr1 = !400,000 x [1/(1+0.15)1] = !400,000 x 0.8333=

!333,320

Inow Yr2 = !450,000 x [1/(1+0.15)2] = !450,00 x 0.6944

= !312,480

Inow Yr3 = !500,000 x [1/(1+0.15)3] = !500,000 x 0.5787=

!289,350

Present Value of Future Deposits (!64,850)

Decision is to not purchase the equipment

Decision is to not purchase the equipment

60 Net Presnt Value

Solution: Scenario B

Investment =-1,000,000 x [1/(1+0.20)0] = -!1,000,000 x 1.0 =

(!1,000,000)

Inow Yr1 = !400,000 x [1/(1+0.20)1] = !400,000 x 0.9091=

!363,640

Inow Yr2 = !450,000 x [1/(1+0.20)2] = !450,00 x 0.8264

= !371,880

Inow Yr3 = !500,000 x [1/(1+0.20)3] = !500,000 x 0.7513

= !375,650

Present Value of Future Deposits !111,170

Decision is to purchase the equipment

61

You might also like

- Far 1 - Accounting Cycle Exercise ProblemsDocument8 pagesFar 1 - Accounting Cycle Exercise ProblemsCha Eun WooNo ratings yet

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- ACCTG 101 Chapter 1 11Document60 pagesACCTG 101 Chapter 1 11Jemalyn TarucNo ratings yet

- Budgeting AnswerDocument7 pagesBudgeting AnsweraddsNo ratings yet

- W7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDocument8 pagesW7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDanica VetuzNo ratings yet

- Quiz-Review CfasDocument5 pagesQuiz-Review CfasMa Louise Ivy RosalesNo ratings yet

- ABM PM 2nd QTR SLM Week12Document9 pagesABM PM 2nd QTR SLM Week12ganda dyosaNo ratings yet

- Week 2 - Lesson 2 The Accounting ProcessDocument16 pagesWeek 2 - Lesson 2 The Accounting ProcessRose RaboNo ratings yet

- FABM Chapter 1Document71 pagesFABM Chapter 1LeteSsieNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Classification of PartnersDocument2 pagesClassification of Partnersarnel barawedNo ratings yet

- Chapter 1 QuestionsDocument2 pagesChapter 1 QuestionsstudentoneNo ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- Adjusting Entries ProblemDocument3 pagesAdjusting Entries Problemsamplenow100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument20 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionFebby Grace Villaceran Sabino0% (2)

- Motivation (15 Mins) : Teacher TipsDocument22 pagesMotivation (15 Mins) : Teacher TipsInsatiable CleeNo ratings yet

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Quizzes - Chapter 5 - Analysis and Interpretation of Financial StatementsDocument5 pagesQuizzes - Chapter 5 - Analysis and Interpretation of Financial StatementsAmie Jane MirandaNo ratings yet

- Fabm 1 Reviewer Q1Document8 pagesFabm 1 Reviewer Q1raydel dimaanoNo ratings yet

- 1st Prelim ExamDocument15 pages1st Prelim ExamoshNo ratings yet

- CONCEPTUAL FRAMEWORK - Presentation and Disclosure Concepts of CapitalDocument4 pagesCONCEPTUAL FRAMEWORK - Presentation and Disclosure Concepts of CapitalAllaine ElfaNo ratings yet

- EXAMPLE OF INCOME STATEMENT Bella EnterpriseDocument2 pagesEXAMPLE OF INCOME STATEMENT Bella EnterprisemarivicNo ratings yet

- 2.1 The Business Environment: Chapter 2: Financial Institutions, Intruments, and MarketsDocument12 pages2.1 The Business Environment: Chapter 2: Financial Institutions, Intruments, and MarketsIan BucoyaNo ratings yet

- Learning Activity Sheet Business FinanceDocument9 pagesLearning Activity Sheet Business FinanceVon Violo BuenavidesNo ratings yet

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- Management Science - HomeworkDocument15 pagesManagement Science - HomeworkVinaNo ratings yet

- Problems Problem 2-1 Multiple Choice (ACP)Document2 pagesProblems Problem 2-1 Multiple Choice (ACP)Jao FloresNo ratings yet

- O Variations in Accounting Methods o TimingDocument8 pagesO Variations in Accounting Methods o TimingAeris StrongNo ratings yet

- Fabm 1 ReviewDocument28 pagesFabm 1 ReviewDia Did L. RadNo ratings yet

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- CFAS ReviewerDocument17 pagesCFAS ReviewerJoshua Vladimir RodriguezNo ratings yet

- Mock Departmental Examination 2015 (BSA 1-5 & BSA 1-15)Document14 pagesMock Departmental Examination 2015 (BSA 1-5 & BSA 1-15)Edison San Juan100% (1)

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Financial Accounting and Reporting-Preliminary ExamDocument7 pagesFinancial Accounting and Reporting-Preliminary Examromark lopezNo ratings yet

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- The Statement of Comprehensive Income: Lesson 1Document8 pagesThe Statement of Comprehensive Income: Lesson 1Kim CortezNo ratings yet

- First Grading Examination - Key AnswersDocument12 pagesFirst Grading Examination - Key AnswersAmie Jane MirandaNo ratings yet

- 3 RdquarterDocument7 pages3 RdquarterRylan Yani OlshpNo ratings yet

- PESTLE Factors On Bakery BusinessDocument5 pagesPESTLE Factors On Bakery Businessrahulsharma2k22emba17No ratings yet

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and Principlesdane alvarezNo ratings yet

- Assets, Expenses and Drawing Accounts Are Debited For IncreasesDocument6 pagesAssets, Expenses and Drawing Accounts Are Debited For Increasesdanica gomezNo ratings yet

- Acctg 7 Chap 5 Answer KeyDocument16 pagesAcctg 7 Chap 5 Answer KeyErian G. RetorianoNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Adjusting Entries Prob 3 4Document4 pagesAdjusting Entries Prob 3 4Jasmine ActaNo ratings yet

- Module 1 Introduction To AccountingDocument8 pagesModule 1 Introduction To AccountingShårmāinë Iniégø DimâänōNo ratings yet

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- APJARBA 2015-1-003 Status and Prospects For Development of Flower Shop Business in Batangas CityDocument12 pagesAPJARBA 2015-1-003 Status and Prospects For Development of Flower Shop Business in Batangas CityLUIS ANTONIO DE LEONNo ratings yet

- Cfas - Chapter 4 - Exercise 1Document8 pagesCfas - Chapter 4 - Exercise 1BlueBladeNo ratings yet

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- Business FInance Week 3 and 4Document68 pagesBusiness FInance Week 3 and 4Jonathan De villa100% (1)

- Financial Statement ExampleDocument21 pagesFinancial Statement ExampleLucky MehNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Provisions, Cont. Liability, & Cont. AssetsDocument40 pagesProvisions, Cont. Liability, & Cont. Assetsyonas alemuNo ratings yet

- Luyong - 4TH Q - Fabm1Document3 pagesLuyong - 4TH Q - Fabm1Jonavi LuyongNo ratings yet

- Certified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasDocument63 pagesCertified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasAllen CarlNo ratings yet

- Time Value of MoneyDocument34 pagesTime Value of MoneyJerchelleNo ratings yet

- E Time Value of Money AutosavedDocument56 pagesE Time Value of Money AutosavedChariz AudreyNo ratings yet

- BUSINESS FINANCE 12 - Q1 - W6 - Mod6Document15 pagesBUSINESS FINANCE 12 - Q1 - W6 - Mod6LeteSsie100% (3)

- Modeli Ocene Performansi Portfolija Investicionih Fondova - Šarpov, Trejnorov I Jensenov IndeksDocument26 pagesModeli Ocene Performansi Portfolija Investicionih Fondova - Šarpov, Trejnorov I Jensenov IndeksJingyin YanNo ratings yet

- On The American Option Problem: University of AarhusDocument13 pagesOn The American Option Problem: University of AarhusLarry RichardsNo ratings yet

- Presentation The Vega Trap Dan Passarelli PDFDocument45 pagesPresentation The Vega Trap Dan Passarelli PDFabiel_guerraNo ratings yet

- Interpreting Normalized Profitability MetricsDocument3 pagesInterpreting Normalized Profitability MetricsBramJanssen76No ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument18 pagesChapter 02 - How To Calculate Present ValuesNguyễn T.Thanh HươngNo ratings yet

- PhD-Syllabus ORDocument12 pagesPhD-Syllabus ORNeha SharmaNo ratings yet

- Qualifiers List AUG 2020 Pagesx2 - 0Document4 pagesQualifiers List AUG 2020 Pagesx2 - 0Sk Arif AhmedNo ratings yet

- ESFOS Draft Agenda June 28 18Document13 pagesESFOS Draft Agenda June 28 18AlexandreLegaNo ratings yet

- DSC1630 2024 TL Sol01 S1Document24 pagesDSC1630 2024 TL Sol01 S1katlego preciousNo ratings yet

- Excel Assignment SOMSDocument5 pagesExcel Assignment SOMSAditi AgrawalNo ratings yet

- Here's How Traders Can Use Delta and Gamma For Options TradingDocument3 pagesHere's How Traders Can Use Delta and Gamma For Options TradingGagandeep Singh LoteyNo ratings yet

- Topic Two Financial Mathematics/Time Value of MoneyDocument43 pagesTopic Two Financial Mathematics/Time Value of Moneysir bookkeeperNo ratings yet

- Compound Interest and Present ValueDocument27 pagesCompound Interest and Present ValueAnnie VNo ratings yet

- 3rd Sem - B Com - C A Unit 1Document25 pages3rd Sem - B Com - C A Unit 1sarath cmNo ratings yet

- APM Capital Asset Pricing ModelDocument15 pagesAPM Capital Asset Pricing Modelnida buttNo ratings yet

- BSM and BinominalDocument72 pagesBSM and BinominalANISH NARANGNo ratings yet

- Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading (2020)Document20 pagesPortfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading (2020)monica maNo ratings yet

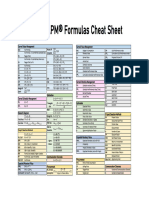

- PMP Formulas Cheat Sheet StatementDocument1 pagePMP Formulas Cheat Sheet StatementdercoconsultoresNo ratings yet

- (Quantitative Perspectives On Behavioral Economics and Finance) James Ming Chen (Auth.) - Finance and The Behavioral Prospect - Risk, Exuberance, and Abnormal Markets-Palgrave Macmillan (2016)Document350 pages(Quantitative Perspectives On Behavioral Economics and Finance) James Ming Chen (Auth.) - Finance and The Behavioral Prospect - Risk, Exuberance, and Abnormal Markets-Palgrave Macmillan (2016)van tinh khuc100% (1)

- CFA Level II: DerivativesDocument48 pagesCFA Level II: DerivativesCrayonNo ratings yet

- 1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European OptionsDocument15 pages1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European Optionshenry37302No ratings yet

- ProjectDocument19 pagesProjectAnju VijayNo ratings yet

- Chapter 2Document14 pagesChapter 2Kumar ShivamNo ratings yet

- Capital Asset Pricing and Arbitrage Pricing Theory: Bodie, Kane, and Marcus 9 EditionDocument54 pagesCapital Asset Pricing and Arbitrage Pricing Theory: Bodie, Kane, and Marcus 9 EditionDilla Andyana SariNo ratings yet

- Valuing Stock Options: The Black-Scholes-Merton ModelDocument22 pagesValuing Stock Options: The Black-Scholes-Merton ModelLeidy ArenasNo ratings yet

- Roa Roe 5 VariabelDocument7 pagesRoa Roe 5 VariabelRahmat Rahmat25No ratings yet

- Monthly Return DataDocument3 pagesMonthly Return DataSubrata Chanda UthpalNo ratings yet

- Efficient Frontier, CML, SML, RISKDocument8 pagesEfficient Frontier, CML, SML, RISKKhadija AbubakarNo ratings yet

- Ya Dut Iya Sir: Compount InterestDocument6 pagesYa Dut Iya Sir: Compount InterestadiNo ratings yet