Professional Documents

Culture Documents

Bravado Working (WIP) 2

Uploaded by

Kian TuckOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bravado Working (WIP) 2

Uploaded by

Kian TuckCopyright:

Available Formats

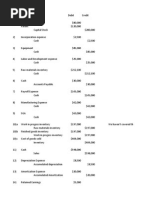

June 2009 P2 Q 1 (without note 4)

Working

1)Fair value of identifiable net assets ($ m)

Others 400

Less : Share capital (220) Dr Land 40

Retained earnings (136) Cr FV adj 40

Other component of equity (4)

increase in the value of non-depreciable land 40

Goodwill calculation - Message Total

$m

Consideration transferred 300

NCI at fair value 86

386

Share of net assets at fair value (400)

Bargain purchase (14)

Bargain purchase of $14m is recognised to consolidated statement of profit or loss

2)Fair value of identifiable net assets ($ m)

Others 176

Less : Share capital (100) Dr PPE 14

Retained earnings (55) Cr FV adj 14

Other component of equity (7) Dr RE (Mixted) 2

increase in the value of PPE 14 Cr PPE 2

Dr RE (Mixted) 0.6

Cr DTL 0.6

Goodwill calculation - Mixted Total

$m

Consideration transferred

6% 10

6% - gain on remeasurement 5 Dr Inv in mixted 5

64% 118 Cr RE (B) 5

Contingent consideration 12

Dr Inv in mixted 12

NCI at fair value 53 Cr Cont liab 12

198

Share of net assets at fair value (176) Dr FV adj 3

Deferred tax (176-166)x30% 3 Cr DT 3

Goodwill 25

3) Investment in associate as at 31 May 2009

$m

Cost of investment (9+11) 20 Dr Inv in clarity 2.5

Share of post acquisition profit (10 x 25%) 2.5 Cr RE (B) 2.5

22.5 Dr AFS R 1

Note : $1m of AFS reserve reclassified to consolidated SPL and to Group RE Cr RE (B) 1

4) Inventories

Selling price of units 1,450

Less selling costs (10)

NRV at finished products 1,440

Less conversion costs (500)

NRV at 1st stage 940

Write down

200,000 units x (1,500 1,440) 12 Dr RE (B) 18

100,000 units x (1,000 940) 6 Cr Inventory 18

18

5) Reclassification of loan to director

Dr Loan to director 1

Cr Cash and cash equivalent 1

6) Group retained earning

$m

Bravado 240.0

Adjustments :-

Bargain purchase realised (W1) 14.0

Gain on remeasurement (W2) 5.0

Associate profit (W3) 2.5

AFS reserves realised (W3) 1.0

Inventory write down (W4) (18.0)

244.5

Message ($150m-$136m) x 80% 11.2

Mixted ($80m-$55m -2+0.6) x 70% 16.5

272.2

7) Non controlling interest

Message $m

FV at date of acquistion 86.0

Post acq reserves ($150m-$136m) x 20% 2.8

Mixted

FV at date of acquistion 53.0

Post acq reserves ($80m-$55m -2+0.6) x 70% 7.1

148.9

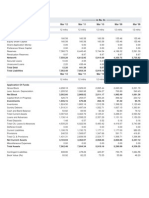

Bravado Group - Consolidated Statement of Financial Position as at 31st May 2009

$m

Non current assets (265+230+161+40 w1+14 -2 w2) 708.0

Goodwill 25.0

Investment in associate 22.5

AFS investment (51+6+5) 62.0

817.5

Current assets

Inventories (135+55+73-18 w4) 245.0

Trade receivables (91+45+32) 168.0

Loan to directors w5 1.0

Cash and cash equivalents (102+100+8-1 w5) 209.0

1,440.5

Share capital 520.0

Retained earnings (W6) 272.2

Other components of equity (12-1) 11.0

803.2

Non controlling interest (W7) 148.9

Total equity 952.1

Non current liabilities

Long term borrowing (120+15+5) 140.0

Deferred tax (25+9+3+3-0.6 w2) 39.4

Current liabilities

Trade and other payable (115+30+60+12 w2) 217.0

Current tax payable (60+8+24) 92.0

2,392.6

You might also like

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Company ValuationDocument55 pagesCompany ValuationAli Jumani100% (1)

- Medieval Adventures CompanyDocument6 pagesMedieval Adventures Companylouiegoods24100% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Solution To Ch12 P10 Build A ModelDocument2 pagesSolution To Ch12 P10 Build A Modelscuevas_10100% (7)

- Exhibits Radio OneDocument4 pagesExhibits Radio Onefranky1000No ratings yet

- Principles of Group Accounting under IFRSFrom EverandPrinciples of Group Accounting under IFRSRating: 3 out of 5 stars3/5 (1)

- Kohler DCFDocument1 pageKohler DCFJennifer Langton100% (1)

- Ch13 P11 Build A Model 1Document24 pagesCh13 P11 Build A Model 1walabuNo ratings yet

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- Ch. 13 - 13ed Corporate Valuation - MasterDocument56 pagesCh. 13 - 13ed Corporate Valuation - MasterBudiman SutantoNo ratings yet

- Break Even AnalysisDocument6 pagesBreak Even AnalysishmarcalNo ratings yet

- Corporate Valuation, Value-Based Management and Corporate GovernanceDocument56 pagesCorporate Valuation, Value-Based Management and Corporate GovernanceDavut AbdullahNo ratings yet

- Radio One - Exhibits1-4Document8 pagesRadio One - Exhibits1-4meredith12120% (1)

- Chap 9 - 12 SolutionsDocument51 pagesChap 9 - 12 SolutionsSasank Tippavarjula81% (16)

- Finnegan's Garden Case Study Solution - Strategic Management AccountingDocument13 pagesFinnegan's Garden Case Study Solution - Strategic Management AccountingPiotr Bartenbach33% (3)

- Bravado Working (WIP)Document4 pagesBravado Working (WIP)Kian TuckNo ratings yet

- p2 PointsDocument11 pagesp2 PointsKian TuckNo ratings yet

- Tugas Akl 2Document7 pagesTugas Akl 2Kukuh HariyadiNo ratings yet

- 3-6int 2004 Dec ADocument12 pages3-6int 2004 Dec AsyedtahaaliNo ratings yet

- P2 Q1Document5 pagesP2 Q1Chris100% (1)

- P2i Ask Groups Approach Q and S 2012Document12 pagesP2i Ask Groups Approach Q and S 2012hassanatcamsNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- DipIFR Answers June-2015Document7 pagesDipIFR Answers June-2015Soňa SlovákováNo ratings yet

- CH 7 Vol 1 Answers 2014Document18 pagesCH 7 Vol 1 Answers 2014Jamie Catherine GoNo ratings yet

- Supporting ComputationDocument7 pagesSupporting ComputationKarlovy DalinNo ratings yet

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- 5 15Document8 pages5 15Indra PramanaNo ratings yet

- j14 F7int AnsDocument10 pagesj14 F7int AnsSajidZiaNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Chapter 8 Equity Valuation Assignment Chapter 8Document4 pagesChapter 8 Equity Valuation Assignment Chapter 8mehandiNo ratings yet

- 04sol-Investments WB 1stDocument21 pages04sol-Investments WB 1stNJ SyNo ratings yet

- Jocatt - Answering SchemeDocument3 pagesJocatt - Answering SchemeIvan Kolesnikov100% (2)

- Long-Term Financial Planning: Plans: Strategic, Operating, and Financial Pro Forma Financial StatementsDocument50 pagesLong-Term Financial Planning: Plans: Strategic, Operating, and Financial Pro Forma Financial StatementsSyed MohdNo ratings yet

- Campbell Soup FInancialsDocument39 pagesCampbell Soup FInancialsmirunmanishNo ratings yet

- Ifrint 2022 Jun ADocument10 pagesIfrint 2022 Jun AKareem KhaledNo ratings yet

- 1 Cash Balance After Reversing CheckDocument24 pages1 Cash Balance After Reversing CheckiambopolsNo ratings yet

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDocument8 pagesExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- F7uk 2011 Dec AnsDocument10 pagesF7uk 2011 Dec Ansahsan_zeb_1No ratings yet

- Complete Equity Method Workpaper Entries - Year 2010Document14 pagesComplete Equity Method Workpaper Entries - Year 2010jeankoplerNo ratings yet

- F7 June 2013 BPP Answers - LowresDocument16 pagesF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- Advanced Accounting Chapter 1 Problems 5-7Document2 pagesAdvanced Accounting Chapter 1 Problems 5-7Mitch Boehm0% (1)

- June 11 DipIFR AnswersDocument10 pagesJune 11 DipIFR AnswersjaimaakalikaNo ratings yet

- CH 7 Answers Vol 1 FinaccDocument18 pagesCH 7 Answers Vol 1 FinaccJully Gonzales100% (1)

- 1 TM C StockvalueDocument1 page1 TM C StockvalueshajiNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- FSA Hw2Document13 pagesFSA Hw2Mohammad DaulehNo ratings yet

- Dipifr 2003 Dec ADocument11 pagesDipifr 2003 Dec AAhmed Raza MirNo ratings yet

- Bài Tập TCDNDocument9 pagesBài Tập TCDNQuyên NguyễnNo ratings yet

- Chapter 1 Solutions To Suggested Homework ProblemsDocument5 pagesChapter 1 Solutions To Suggested Homework ProblemsZeren BegumNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Good Possibility StocksDocument373 pagesGood Possibility Stockskarkas1No ratings yet

- Module A (June 2013) - AnswerDocument16 pagesModule A (June 2013) - Answer徐滢No ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- F18Document10 pagesF18Access MaterialsNo ratings yet

- DipIFR 2012 Dec AnswersDocument7 pagesDipIFR 2012 Dec AnswersRicardo Augusto Rodriguez MiñanoNo ratings yet

- j16 Hybrid F7 Q PDFDocument7 pagesj16 Hybrid F7 Q PDFTareq ChowdhuryNo ratings yet

- CF5e PPT Ch12Document52 pagesCF5e PPT Ch12Thang NguyenNo ratings yet

- Netscape Valuation For IPO... PV of FCFsDocument1 pageNetscape Valuation For IPO... PV of FCFsJunaid EliasNo ratings yet

- 2.0 FIN Plan & Forecasting v1Document62 pages2.0 FIN Plan & Forecasting v1Omer CrestianiNo ratings yet

- Solution of Amalgamation - Home AssignmentDocument32 pagesSolution of Amalgamation - Home Assignmentlucky_mugal786No ratings yet

- BPP Revision Kit Sample Answers 1Document8 pagesBPP Revision Kit Sample Answers 1Kian TuckNo ratings yet

- 181-IfRS 3, The First YearDocument23 pages181-IfRS 3, The First YearKian TuckNo ratings yet

- Revision Set 5 AnswerDocument8 pagesRevision Set 5 AnswerKian TuckNo ratings yet

- F3.ffa Examreport d14Document4 pagesF3.ffa Examreport d14Kian TuckNo ratings yet

- Ethic QsDocument2 pagesEthic QsKian TuckNo ratings yet

- Proposed Lesson Plan For ACCA F7 Jan 2016 IntakeDocument1 pageProposed Lesson Plan For ACCA F7 Jan 2016 IntakeKian TuckNo ratings yet

- TangierDocument4 pagesTangierKian TuckNo ratings yet

- Scott 062006Document6 pagesScott 062006Kian TuckNo ratings yet

- Practice Anwer PPE BeckerDocument2 pagesPractice Anwer PPE BeckerKian TuckNo ratings yet

- PolestarDocument3 pagesPolestarKian TuckNo ratings yet

- Activity-Based Costing - Student Accountant Magazine - Students - ACCA PDFDocument5 pagesActivity-Based Costing - Student Accountant Magazine - Students - ACCA PDFKian TuckNo ratings yet

- ACCA P2 Revision Mock June 2013 QUESTIONS Version 5 FINAL at 24 Feb 2013 PDFDocument10 pagesACCA P2 Revision Mock June 2013 QUESTIONS Version 5 FINAL at 24 Feb 2013 PDFPiyal HossainNo ratings yet

- Soalan Assignment 3Document2 pagesSoalan Assignment 3Nodiey YanaNo ratings yet

- Balance Sheet of NHPC: - in Rs. Cr.Document10 pagesBalance Sheet of NHPC: - in Rs. Cr.Priscilla LaraNo ratings yet

- IAS 20 Government GrantsDocument1 pageIAS 20 Government Grantsm2mlckNo ratings yet

- Financial Accounting Ch04Document57 pagesFinancial Accounting Ch04b2dm2k100% (1)

- Sametra Billiot, AC550 Wk7 HomeworkDocument4 pagesSametra Billiot, AC550 Wk7 HomeworkSametra BilliotNo ratings yet

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- Tata Motors Ratio Analysis 1235110826059887 1Document14 pagesTata Motors Ratio Analysis 1235110826059887 1Hari OmNo ratings yet

- Assignment 2Document3 pagesAssignment 2Maham SohailNo ratings yet

- 6-8 Jack and Jill Answer KeyDocument2 pages6-8 Jack and Jill Answer KeyAngelica Macaspac100% (1)

- Balance Sheet of Hero MotocorpDocument3 pagesBalance Sheet of Hero MotocorpanshusehgalNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- WiproDocument12 pagesWiproPrabhat PareekNo ratings yet

- Ias and IfrsDocument2 pagesIas and IfrsE-kel Anico JaurigueNo ratings yet

- Exercise 7.3Document5 pagesExercise 7.3Craig GrayNo ratings yet

- K Mart (Ratio Analysis)Document2 pagesK Mart (Ratio Analysis)Akela TanhaNo ratings yet

- Asset ImpairmentDocument12 pagesAsset Impairmentkumar.rmsNo ratings yet

- Adjustment Prepaid ExpensesDocument12 pagesAdjustment Prepaid ExpensesverawatidahlaniNo ratings yet

- Bawany Air Products LTDDocument1 pageBawany Air Products LTDDostmuhammad01No ratings yet

- Dispensers of California (Jeff)Document9 pagesDispensers of California (Jeff)Jeffery KaoNo ratings yet

- Financial Accounting I Assignment #1Document8 pagesFinancial Accounting I Assignment #1Sherisse' Danielle WoodleyNo ratings yet

- Research Paper - RatiosDocument1 pageResearch Paper - RatiosPamela WilliamsNo ratings yet

- Asia Amalgamated Holdings Corporation Financials - RobotDoughDocument6 pagesAsia Amalgamated Holdings Corporation Financials - RobotDoughKeith LameraNo ratings yet

- Spark Organization ACC 322 Accounting Case Memo Write UpDocument2 pagesSpark Organization ACC 322 Accounting Case Memo Write Upalka murarkaNo ratings yet