Professional Documents

Culture Documents

Sapm Notes

Uploaded by

Anonymous OfY5upCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sapm Notes

Uploaded by

Anonymous OfY5upCopyright:

Available Formats

Market & Brokers

Primary Market

The primary market is that part of the capital markets that deals with the issuance of new

securities. Companies, governments or public sector institutions can obtain funding through the sale of a

new stock or bond issue.

This is typically done through a syndicate of securities dealers. The process of selling new issues

to investors is called underwriting.

(Underwriting refers to the process that a large financial service provider (bank, insurer,

investment house) uses to assess the eligibility of a customer to receive their products)

Features of primary markets are:

This is the market for new long term equity capital. The primary market is the market where the

securities are sold for the first time. Therefore it is also called the new issue market (NIM).

In a primary issue, the securities are issued by the company directly to investors.

The company receives the money and issues new security certificates to the investors.

Primary issues are used by companies for the purpose of setting up new business or for

expanding or modernizing the existing business.

The primary market performs the crucial function of facilitating capital formation in the

economy.

The new issue market does not include certain other sources of new long term external finance,

such as loans from financial institutions.

The financial assets sold can only be redeemed by the original holder

Methods of issuing securities in the primary market are:

Initial Public Offering

Right Issue

Preferential Issue

Initial Public Offering

An initial public offering (IPO) or stock market launch, is the first sale of stock by a company to

the public. It can be used by either small or large companies to raise expansion capital and

become publicly traded enterprises.

Right Issue

A rights issue is an issue of additional shares by a company to raise seasoned equity offering.

The rights issue is a special form of shelf offering or shelf registration.

With the issued rights, existing shareholders have the privilege to buy a specified number of

new shares from the firm at a specified price within a specified time. A rights issue is in contrast

to an initial public offering, where shares are issued to the general public through market

exchanges.

A Seasoned equity offering or secondary equity offering (SEO) is a new equity issue by an

already publicly-traded company.

Preferential Issue

A Preferential issue is an issue of stocks or of convertible securities through listed firms to a

select number of persons under Section 81 of the Companies Act, 1956 that is neither a public

issue nor a rights issue. This is a speedier path for a firm to increase equity funds.

Secondary Market

The secondary market, also called aftermarket, is the financial market in which previously

issued financial instruments such as stock, bonds, options, and futures are bought and sold.

Third Market

Third market in finance, refers to the trading of exchange-listed securities in the over-the-

counter (OTC) market.

These trades allow institutional investors to trade blocks of securities directly, rather than

through an exchange, providing liquidity and anonymity to buyers.

Fourth Market

Fourth market trading is direct institution-to-institution trading without using the service of

broker-dealers.

It is impossible to estimate the volume of fourth market activity because trades are not subject

to reporting requirements. Studies have suggested that several million shares are traded per day.

Brokers

A broker is an individual or party (brokerage firm) that arranges transactions between a buyer

and a seller, and gets a commission when the deal is executed.

A broker who also acts as a seller or as a buyer becomes a principal party to the deal.

Distinguish agent: one who acts on behalf of a principal.

A broker is the third -person facilitator between a buyer and a seller. An example would be a

real estate broker who facilitates the sale of a property.

Types of Broker

Commission Broker

A broker on the floor of an exchange who acts as agent for a particular brokerage house and

buys and sells stocks for the brokerage house on a commission basis.

Jobber

A jobber is a professional speculator. He works for a profit called Turn.

Floor Broker

The floor broker buys and sells shares for other brokers on the floor of the exchange.

Odd Lot Dealer

A dealer who buys and sells securities on his/her own account in portions smaller than 100

shares apiece. An odd-lot dealer may be a market maker for a given security on an exchange.

A member of an organized securities exchange that buys and sells in less than round lots. On

most exchanges, this dealer is the specialist in a particular stock.

Arbitrageur

An Arbitrageur is a specialist in dealing with securities in different exchanges at the same time.

He makes profit by the difference in prices prevailing in different centers of market.

Investment process

PORTFOLIO MANAGEMENT

Portfolio management is a complex process or activity that may be divided into seven broad

phases:

Specification of Investment Objectives and

Investment Constraints

In the first step of Portfolio Management process investor has to specify the investment

policy which summarizes the

objectives, Constraints and preferences of the investor

The investor policy may be summarized as follows:

Objectives

Return Requirements

Risk Tolerance

Constraints and Preferences

Liquidity

Investment Horizon

Taxes

Regulations

Unique Circumstances

Objectives

Most common investment objectives are:

Income: To provide a steady stream of income through regular interest and dividend

payment.

Growth: To increase the value of the principal amount through capital appreciation.

Stability: To protect the principal amount invested from the risk of loss.

Contd..

Specify your investment objectives in one of the following ways

Maximize the rate of return, for a given level of risk.

Minimize the risk exposure, for a given level of Return.

Risk you can bear depends on two key factors

1. Your Financial situation,

What is the position of your wealth?

what major expenses can be anticipated in the near future?

What is your earning capacity?

How much money you can loose without seriously hurting your standard of living?

2. Your temperament

Even though your financial situation permit you to absorb losses easilybut.

You may become extremely upset over small losses.

On the other hand, despite a not so strong financial position, you may can easily manage with losses.

Your risk tolerance level is set by either your financial situation or your financial temperament

,which ever is lower.

Constraints

Liquidity: It refers to the speed which an asset can be sold, with out suffering any losses.

Investment Horizon: It is the time when the investment or part thereof is planned to be

liquidated to meet a specific need.

Taxes: Post tax returns

Regulation: Individual investors are not much constrained by law, Institutional investors have

to conform to various regulation.

Unique Circumstances: Ageing parents, Children Education, Buying a house etc.

II Selection of Asset Mix

Based on your objectives and constraints, investor has to specify his asset allocation, that is he

has to decide hoe much of the portfolio has to be invested in each of the following asset categories:

Cash

Bonds

Stocks

Real Estate

Precious Metals

Other

A popular rule of thumb for asset allocation says that the percentage allocation to debt must

be equal to the age of the individual.

III Formulation of Portfolio Strategy

After choosing certain asset mix, appropriate portfolio strategy has to be formulated.

Two road choices are available

Active Strategy

Passive Strategy

Active Portfolio Strategy

An active portfolio strategy is followed by most investment professionals and aggressive investors

who strives to earn superior returns, after adjustment of risk.

An active portfolio management is an attempt to outperform the market on a risk adjusted

basis.

The goal active strategy is to earn a portfolio return that exceeds the return of a passive

benchmark

Four important aspect of active strategy

Market Timing: This involves departing from the normal (long run) asset mix to reflect ones

assessment of the prospect of various assets in the near future .

Sector Rotation: It essentially involves shifting the weightings for various industrial sectors

based on their assessed outlook.

With respect to bonds, sector rotation implies a shift in the composition of the bond portfolio

in terms of quality( as reflected in Credit rating), coupon rate, term to maturity and so on.

Security Selection: Security selection involve search for under priced security.

Passive Strategy

Passive strategy rest on the theory that the capital market is fairly efficient with respect to the

available information. Hence, the search for superior returns through an active strategy is considered

as futile.

Passive portfolio strategy is a long term buy and hold .

How passive strategy is implemented??????

1. Create a well diversified portfolio at a pre-determined level of risk.

2. Hold the portfolio relatively unchanged over time, unless it becomes inadequately diversified

or inconsistent with the investors risk-return preferences.

IV Selection of Securities

Selection of Bonds- on the basis of credit rating, yield to maturity, tax shield and liquidity.

Selection of stocks- on the basis of Fundamental Analysis and Technical Analysis.

V Portfolio Execution

Buying and selling of shares

VI Portfolio Revision

Irrespective of how well you have constructed your portfolio, it soon tends to become

inefficient and hence need to be monitored and revised periodically.

Portfolio revision if required because..

The asset allocation in the portfolio may have drifted away from the target.

The risk and return characteristics of various securities have altered.

The objectives and preferences of investors may have changed.

Portfolio revision always involves two things

Portfolio Rebalancing : It involves reviewing and revising the portfolio composition mix (i.e. ..

stock-bond mix)

Three basic policies with respect to portfolio rebalancing.

1. Buy and Hold Policy

2. Constant Mix Policy

3. Portfolio Insurance Policy

Portfolio Upgrading

Portfolio rebalancing involves shifting from stock to bonds or vice-versa, portfolio upgrading

calls for re-assessing the risk-return characteristics of various securities (stocks as well as bonds),

selling over-priced securities, and buying under-priced securities.

VII Performance Evaluation

1. Treynors Measure

2. Sharpe Measure

3. Jensen Measure

Beta

A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the

market as a whole.

Beta is calculated using regression analysis, and you can think of beta as the tendency of a

security's returns to respond to swings in the market.

The general rule for is as follows:

If = 1.0 then the investment has "normal" market risk

If < 1.0 then the investment has below normal market risk

(for example U.S. securities' = 0 or zero risk)

If > 1.0 then the investment has a greater than normal

market risk (higher risk)

Sharpes Measure

The Sharpes performance measure makes a measurement of the risk premium of portfolios.

Sharpes Index is given by the following equation:

St = Rt Rfr

SDt

St Sharpes Index

Rt Average Rate of Return of the portfolio t

RFr Risk less rate of return

SDt Standard Deviation of portfolio t

This figure graphical presentation of Sharpes Index. Larger the St the better the performance

of the portfolio.

Risk

St

Return

Treyners Measure

The relationship between a given market return and the funds return is given by

characteristic line.

The funds performance is measured in relation to the market performance.

The ideal funds return rises at a faster rate than the general market performance when the

market is moving upwards.

The rate of return of ideal fund declines slowly than the market return declines.

Tn = Portfolios Average Return- Riskless rate of Interest

Beta Coefficient of Portfolio

Jensens Performance Index

Jensen measures the absolute performance because a definite standard is set and against

that the performance is measured.

The standard is based on the predictive ability of the manager.

Successful prediction of a security price would enable the manager to earn high returns than

the ordinary investor expects to earn.

Basic model of Jensen

Rp= a + b (Rm- Rf)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sap Fi Ecc 6.0 Bootcamp - Day 1Document144 pagesSap Fi Ecc 6.0 Bootcamp - Day 1totoNo ratings yet

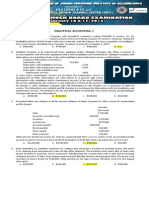

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- CIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFDocument29 pagesCIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFLuzuko Terence Nelani100% (8)

- Bonds Payable 4Document6 pagesBonds Payable 4charlene kate bunaoNo ratings yet

- Tax Homework Chapter 6Document4 pagesTax Homework Chapter 6RosShanique ColebyNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Fulbari - 6 Kavre: Cash Flow StatementDocument21 pagesFulbari - 6 Kavre: Cash Flow StatementSudeep RegmiNo ratings yet

- International Business Chap 12 SummaryDocument3 pagesInternational Business Chap 12 SummaryTam ThanhNo ratings yet

- Typical Account Titles UsedDocument3 pagesTypical Account Titles Usedwenna janeNo ratings yet

- Issue of Redemption of Debenture (Year)Document8 pagesIssue of Redemption of Debenture (Year)Arpan CHATTERJEENo ratings yet

- How To Calculate The Intrinsic Value of A Stock - The Motley FoolDocument5 pagesHow To Calculate The Intrinsic Value of A Stock - The Motley FoolEdgar NababanNo ratings yet

- Reading 50: Introduction To Alternative InvestmentsDocument68 pagesReading 50: Introduction To Alternative InvestmentsAlex PaulNo ratings yet

- GJ GL TB AjpDocument17 pagesGJ GL TB AjpseviraaawrNo ratings yet

- Application Summary FormDocument2 pagesApplication Summary Formjqm printingNo ratings yet

- Recognition and MeasurementDocument16 pagesRecognition and MeasurementajishNo ratings yet

- Abstract MPBConferencePaperDocument3 pagesAbstract MPBConferencePaperNalayiramNo ratings yet

- JGF SICAV Annual ReportDocument302 pagesJGF SICAV Annual ReportAlly Bin AssadNo ratings yet

- ACCTG A Final ExamDocument2 pagesACCTG A Final ExamheyheyNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- Poa T - 4Document2 pagesPoa T - 4SHEVENA A/P VIJIANNo ratings yet

- Fabm Analysis and Interpretation of Financial Statements 1Document4 pagesFabm Analysis and Interpretation of Financial Statements 1Mylen Noel Elgincolin Manlapaz0% (1)

- Bnesr 1 For Abm 12 Business Ethics and Social ResponsibilityDocument22 pagesBnesr 1 For Abm 12 Business Ethics and Social ResponsibilityPamela MorteNo ratings yet

- Analysis Solutions Acc 411Document13 pagesAnalysis Solutions Acc 411dre_emNo ratings yet

- 4.31 T.Y.B.Com BM-IV PDFDocument7 pages4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduNo ratings yet

- (Pg. 35) Mac Owens Insurance AgencyDocument5 pages(Pg. 35) Mac Owens Insurance Agencylafayete22No ratings yet

- 8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionDocument29 pages8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionParamithaNo ratings yet

- Bacc 402 Financial Stat 1Document9 pagesBacc 402 Financial Stat 1ItdarareNo ratings yet

- Lecture Notes On Revaluation and Impairment PDFDocument6 pagesLecture Notes On Revaluation and Impairment PDFjudel ArielNo ratings yet

- 1.0 Executive Summary: 1.1 ObjectivesDocument5 pages1.0 Executive Summary: 1.1 Objectivesethnan lNo ratings yet