Professional Documents

Culture Documents

Michigan's Work Comp Rate Decreases 28% Since 2011 Pure Premium Reduction Has Saved State Job Providers $277 Million

Uploaded by

Michigan News0 ratings0% found this document useful (0 votes)

16 views7 pagesPure premium advisory rate for workers' comp insurance will drop by 6. Percent in 2015. Pure premium rate has decreased 27. Percent since 2011, saving employers $277 million. While Michigan's rate plummeted, the national average went up 10. Percent.

Original Description:

Original Title

Michigan's Work Comp Rate Decreases 28% Since 2011; Pure premium reduction has saved state job providers $277 million

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPure premium advisory rate for workers' comp insurance will drop by 6. Percent in 2015. Pure premium rate has decreased 27. Percent since 2011, saving employers $277 million. While Michigan's rate plummeted, the national average went up 10. Percent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views7 pagesMichigan's Work Comp Rate Decreases 28% Since 2011 Pure Premium Reduction Has Saved State Job Providers $277 Million

Uploaded by

Michigan NewsPure premium advisory rate for workers' comp insurance will drop by 6. Percent in 2015. Pure premium rate has decreased 27. Percent since 2011, saving employers $277 million. While Michigan's rate plummeted, the national average went up 10. Percent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

Michigan's Work Comp Rate Decreases 28% Since 2011; Pure premium

reduction has saved state job providers $277 million

Contact: Jason Moon 517-373-9280

Agency: Licensing and Regulatory Affairs

October 14, 2014 The Michigan Department of Licensing & Regulatory Affairs (LARA) today

announced the pure premium advisory rate for workers' compensation insurance will drop by an

average of 6.5 percent in 2015 and will decrease 6.3 percent annually from 2011-15. The pure

premium rate will decrease 27.7 percent since 2011, saving Michigan employers an estimated $277

million.[1]

The most recent comparison data shows that Michigans cumulative pure premium decrease of 22.7

percent from 2011-14 is best in the Midwest and second best in the nation. While Michigans rate

plummeted, the national average went up 10.8 percent.[2]

Michigans considerable reduction in workers comp costs is great news for our employers,

employees, job seekers and any company looking to move here, said Gov. Rick Snyder. These

significant savings are a real asset in terms of growing and retaining jobs, and give us an advantage

over competitor states in attracting new businesses.

The pure premium is a key factor in determining a job providers overall expenses for workers

compensation and is the portion of an employers insurance premium that pays for the anticipated

claims costs for work-related injuries. These rates are developed by comparing the losses (or

claims) for a particular industry to the payroll for that industry.

The states big drop in workers compensation rates gives our businesses more resources to start

and expand their operations, said Chuck Hadden, president and CEO of the Michigan

Manufacturers Association. Our companies invest this additional money into new equipment and

facilities, and put it directly into the pockets of their employees. My counterparts around the country

are envious of the work that Governor Snyder and the Workers Compensation Agency have done to

reduce costs for our job providers.

Greg Baise, president and CEO of the Illinois Manufacturers Association, recently told Watchdog.org

that high workers compensation rates are one reason Illinois employers are taking their businesses

and the jobs they provide to other states. Indiana and Michigan have more business-friendly

workers comp policies and the employment situations there reflect that.[3]

In late 2011, Gov. Snyder signed sweeping legislation reforming the state's workers' compensation

system. These improvements included defining disability and post-injury earning capacity, and have

played an underlying role in the reduction of costs for our employers. The changes stabilized the

100-year-old system, ensuring the promise of compensation for injured Michigan employees.

The 2011 reforms have served as an important foundation in our agencys cost containment efforts

for businesses and have allowed us to continue to protect Michiganders injured on the job, said

Michigan Workers Compensation (WCA) Director Kevin Elsenheimer. The WCA is focused on

continuing to improve our regulatory processes to protect Michigan workers and lower costs for

employers.

The WCAs emphasis on reducing costs for job providers has included the administering of a well-

developed fee schedule which controls medical costs for work-related injuries. A recent study shows

Michigans cost per claim (CPC) and medical CPC are the lowest in the region and among the

lowest in the country.[4]

The effective cost containment is in conjunction with the Reinventing Performance in Michigan

(RPM) initiative. Through a thorough review of all regulatory processes and extensive upgrades in

technology, the WCA is focused on reducing processing times for business customers.

Reviewed all forms, bulletins, guides and customer-facing material to ensure 100% utility.

Started eliminating the 30-year-old COBOL system allowing businesses to receive real time

data.

Replaced obsolete microfilm system with digital imaging.

Developed electronic mailbox and eliminated the requirement to mail or fax documents.

The independent Data Collection Agency Board develops and approves the annual rate by analyzing

historical loss information combined with regulatory reforms.

Michigan's injured workers and their employers are governed by the Workers' Disability

Compensation Act. The Act was first adopted in 1912 and provides compensation to workers who

suffer an injury on the job and protects employers' liability. The mission of the WCA is to efficiently

administer the Act and provide prompt, courteous and impartial service to all customers.

A work comp fact sheet follows this release.

[1] Compensation Advisory Organization of Michigan, Analysis of Premiums, 2014

[2] National Council on Compensation Insurance, Annual Statistical Bulletin, 2014

[3] Watchdog.org, August 4, 2014

[4] Workers Compensation Research Institute, 2014

For more information about LARA, please visit www.michigan.gov/lara

Follow us on Twitter www.twitter.com/michiganLARA

Like us on Facebook or find us on YouTube www.youtube.com/michiganLARA

FACT SHEET

WCA Workers Compensation Decreases

Michigans Workers Compensation (WC) system is a strategic asset to the state.

Michigans WC pure premium rate will drop by 27.7% since 2011, saving Michigan

businesses an estimated $277 million in WC insurance premiums. -Compensation Advisory

Organization of Michigan (CAOM), Analysis of Premiums)

The continued decreases in workers compensation insurance costs give Michigan a real

competitive edge over neighboring states in attracting and retaining businesses.

Greg Baise, president and CEO of the Illinois Manufacturers Association, said high workers

compensation rates are one reason Illinois employers are taking their businesses and the

jobs they provide to other states. Indiana and Michigan have more business-friendly

workers comp policies and the employment situations there reflect that. -Watchdog.org,

August 4, 2014

MIs pure premium advisory rates for workers' compensation insurance will drop by an

average of 6.5% in 2015 and will decrease by an average of 6.3% annually from 2011-15. -

CAOM

According to the most recent comparison data Michigans cumulative pure premium

decrease of 22.7% from 2011-14 is best in the Midwest and second best in the nation. While

Michigans rate went down 22.7%, the national average went up 10.8%. (National Council on

Compensation Insurance, 2014 Annual Statistical Bulletin) SEE TABLE BELOW

The pure premium is a key factor in determining a job providers overall expenses for

workers compensation and is the portion of an employers insurance premium that pays for

the anticipated claims costs for work-related injuries. Pure premium rates do not account for

administrative and other overhead costs that an insurer will incur and, consequently, an

insurer's rates are typically higher than the pure premium rates.

Pure premium rates represent the average risk of loss for a classification, not simply the

most hazardous aspect of an industry. These rates are developed by comparing the losses

(or claims) for a particular industry to the payroll for that industry.

MIs cost per claim (CPC) and medical CPC are also the lowest in the region and among the

lowest in the country. MIs rate of growth for medical CPC is also among lowest in the U.S.

(Workers Compensation Research Institute, 2014)

WC premiums are overhead costs and these savings can free up additional capital to hire

new employees and open additional facilities, and give companies one more reason to move

to MI.

In 2011, Governor Snyder signed sweeping legislation reforming the state's WC system.

These improvements included defining disability and post-injury earning capacity, and have

played an underlying role in the reduction of costs for our employers. The changes have

stabilized the 100-year-old system, ensuring the promise of compensation for injured

Michigan employees.

With the help of these legislative reforms, the Workers Compensation Agency (WCA) has

been squarely focused on containing costs for employers. Efforts include the administering of

a well-developed fee schedule which controls medical costs for work-related injuries.

The effective cost containment is in conjunction with Reinventing Performance in MI (RPM)

initiative, where the WCA has reviewed all forms, bulletins, guides and customer-facing

material to ensure 100% utility.

WCA has made extensive technology upgrades to the workers compensation system that

will allow businesses to save time and money.

o Eliminating 30-year old COBOL system allowing businesses to receive real time

data.

o Replaced obsolete microfilm system with digital imaging

o Developed electronic mailbox and eliminated the requirement to mail or fax

documents

State *

2011

Rate

Chang

e

2012

Rate

Chang

e

2013

Rate

Chang

e

2014

Rate

Chang

e

Cumu

l

2011-

14

Avg

Ann

2011-

14

2015

Rate

Chang

e

Cumu

l

2011-

15

Avg

Ann

2011

-15

Montana -28.0% 0.0% -6.2% -3.6%

-

34.9%

-

10.2

%

n/a n/a n/a

Michigan -1.9% -7.4% -7.2% -8.3%

-

22.7%

-6.2% -6.5%

-

27.7%

-

6.3%

Kentucky -7.5% -7.9% -9.0% n/a

-

22.5%

-8.1% n/a n/a n/a

West Virginia -7.6% -7.6% -7.2% n/a

-

20.8%

-7.5% n/a n/a n/a

Arkansas -5.8% -4.1% -8.3% -1.4%

-

18.3%

-4.9% n/a n/a n/a

Tennessee 1.2% -4.7% -1.6% -12.9%

-

17.3%

-4.6% n/a n/a n/a

Oklahoma 1.7% -1.7% -0.3% -14.6%

-

14.9%

-3.9% n/a n/a n/a

Alabama -12.4% -9.2% 4.0% 3.3%

-

14.5%

-3.9% n/a n/a n/a

Pennsylvania 0.9% -5.7% -4.0% -5.2%

-

13.4%

-3.5% n/a n/a n/a

Illinois -7.4% 3.5% -4.7% -4.5%

-

12.8%

-3.4% n/a n/a n/a

Maine 0.4% -7.0% 1.3% -7.7%

-

12.7%

-3.3% n/a n/a n/a

South Dakota 1.2% -0.2% -3.9% -8.3%

-

11.0%

-2.9% n/a n/a n/a

Alaska -2.5% 2.7% -4.7% -2.6% -7.1% -1.8% n/a n/a n/a

Minnesota -1.7% -2.7% -0.8% -2.0% -7.0% -1.8% n/a n/a n/a

Oregon -1.8% 1.9% 1.4% -7.6% -6.2% -1.6% n/a n/a n/a

Virginia -12.4% 10.5% -6.4% 4.1% -5.7% -1.5% n/a n/a n/a

Georgia -3.7% 3.0% -6.5% 2.3% -5.1% -1.3% n/a n/a n/a

Nebraska -4.5% 4.9% -0.5% -4.8% -5.1% -1.3% n/a n/a n/a

Texas 0.0% -0.3% -3.8% 0.1% -4.0% -1.0% n/a n/a n/a

New

Hampshire

-2.9% 6.7% -0.2% -6.5% -3.3% -0.8% n/a n/a n/a

Utah 1.5% -1.6% -2.0% n/a -2.1% -0.7% n/a n/a n/a

Massachusett

s

0.0% 0.0% 0.0% -1.8% -1.8% -0.5% n/a n/a n/a

Vermont -2.6% 4.1% -3.4% 1.2% -0.9% -0.2% n/a n/a n/a

Kansas -2.5% -0.5% 1.4% 0.9% -0.7% -0.2% n/a n/a n/a

South

Carolina

-3.7% 3.0% 0.2% n/a -0.6% -0.2% n/a n/a n/a

North Carolina 0.6% 0.0% -1.4% 0.3% -0.5% -0.1% n/a n/a n/a

Wisconsin 0.0% -1.4% -1.7% 3.2% 0.0% 0.0% n/a n/a n/a

Indiana 1.7% 2.6% 4.4% -7.7% 0.5% 0.1% n/a n/a n/a

Nevada -3.9% 1.0% 1.1% 3.2% 1.3% 0.3% n/a n/a n/a

Louisiana 4.2% 6.0% -1.5% -5.1% 3.2% 0.8% n/a n/a n/a

Missouri -4.4% -3.0% 2.1% 11.6% 5.7% 1.4% n/a n/a n/a

Mississippi -9.8% 10.0% 3.1% 3.8% 6.2% 1.5% n/a n/a n/a

Arizona -2.8% 5.2% 2.9% 3.2% 8.6% 2.1% n/a n/a n/a

Dist. of

Columbia

6.2% 0.4% 1.9% n/a 8.7% 2.8% n/a n/a n/a

Idaho 3.7% 2.9% 3.4% -0.9% 9.3% 2.3% n/a n/a n/a

Countrywide 0.0% 8.4% 2.2% n/a 10.8% 3.5% n/a n/a n/a

Maryland 5.7% 1.4% 2.9% 1.4% 11.8% 2.8% n/a n/a n/a

Iowa 4.7% 4.4% 7.0% -2.0% 14.6% 3.5% n/a n/a n/a

Hawaii 0.0% 3.6% 4.2% 6.2% 14.6% 3.5% n/a n/a n/a

Colorado 3.3% 3.7% 4.3% 3.0% 15.1% 3.6% n/a n/a n/a

Connecticut 3.3% 3.7% 4.3% 3.0% 15.1% 3.6% n/a n/a n/a

California 0.0% -0.4% 7.6% 7.6% 15.3% 3.6% n/a n/a n/a

Rhode Island 3.6% 5.3% 6.5% n/a 16.2% 5.1% n/a n/a n/a

New York 9.1% 0.0% 9.5% n/a 19.5% 6.1% n/a n/a n/a

New Mexico 4.2% 7.4% 4.0% 4.0% 21.0% 4.9% n/a n/a n/a

New Jersey 3.9% 6.9% 8.3% 3.6% 24.6% 5.7% n/a n/a n/a

Florida 7.8% 8.9% 5.6% 0.7% 24.8% 5.7% n/a n/a n/a

Delaware 12.6% 21.7% 14.0% n/a 56.2%

16.0

%

n/a n/a n/a

*Rate Change Statistics obtained from 2014 NCCI Annual Statistical Bulletin

[1] Compensation Advisory Organization of Michigan, Analysis of Premiums, 2014

[2] National Council on Compensation Insurance, Annual Statistical Bulletin, 2014

[3] Watchdog.org, August 4, 2014

[4] Workers Compensation Research Institute, 2014

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

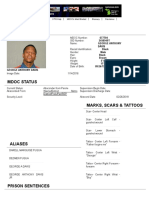

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- Cheat Sheet - Logistics Term & Salary DetailsDocument4 pagesCheat Sheet - Logistics Term & Salary Detailstaseenzaheer33No ratings yet

- Ucsp Week 7Document10 pagesUcsp Week 7EikaSoriano100% (1)

- Abm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaDocument13 pagesAbm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Attorney-Client Privilege Under Indian Evidence Act, 1872.Document17 pagesAttorney-Client Privilege Under Indian Evidence Act, 1872.kashvi vachhaniNo ratings yet

- NCERT Solutions For Class 6 History Chapter 7 Ashoka The Emperor Who Gave Up WarDocument3 pagesNCERT Solutions For Class 6 History Chapter 7 Ashoka The Emperor Who Gave Up Warunofficialbyakugun050100% (1)

- 40 Days of ProsperityDocument97 pages40 Days of ProsperityGodson100% (3)

- Auditors' Report On LADWP TrustsDocument88 pagesAuditors' Report On LADWP TrustsLos Angeles Daily NewsNo ratings yet

- The True Meaning of Lucifer - Destroying The Jewish MythsDocument18 pagesThe True Meaning of Lucifer - Destroying The Jewish MythshyperboreanpublishingNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ac3 Permanent File ChecklistDocument4 pagesAc3 Permanent File ChecklistAndrew PanganibanNo ratings yet

- Maximo Application Suite (MAS) Level 2 - Application Performance Management (APM)Document13 pagesMaximo Application Suite (MAS) Level 2 - Application Performance Management (APM)ikastamobebeNo ratings yet

- Prodman Part IIDocument14 pagesProdman Part IIVladimir Sabarez LinawanNo ratings yet

- ColumbusDocument2 pagesColumbusAbraham Morales MorenoNo ratings yet

- The Defense of The Faith Cornelius Van TilDocument8 pagesThe Defense of The Faith Cornelius Van TilEmanuel Gutiérrez100% (1)

- Ramya Pabbisetti: Consultant, OAS - UHG - IIM IndoreDocument2 pagesRamya Pabbisetti: Consultant, OAS - UHG - IIM IndoreJyotirmoy GhoshNo ratings yet

- Arthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Document357 pagesArthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Awan_123No ratings yet

- De Thi Anh Ngu STB Philosophy 2022Document4 pagesDe Thi Anh Ngu STB Philosophy 2022jhsbuitienNo ratings yet

- WSP Install GuideDocument176 pagesWSP Install GuideStefano EsmNo ratings yet

- Deped Format of A Project Proposal For Innovation in SchoolsDocument6 pagesDeped Format of A Project Proposal For Innovation in SchoolsDan Joven BriñasNo ratings yet

- Workweek Plan Grade 6 Third Quarter Week 2Document15 pagesWorkweek Plan Grade 6 Third Quarter Week 2Lenna Paguio100% (1)

- Schiffman CB10 PPT 09Document39 pagesSchiffman CB10 PPT 09chawla_sonam0% (1)

- Sociology: Caste SystemDocument21 pagesSociology: Caste SystemPuneet Prabhakar0% (1)

- Link Between Competitive Advantage and CSRDocument14 pagesLink Between Competitive Advantage and CSRManish DhamankarNo ratings yet

- Golden Rule of InterpretationDocument8 pagesGolden Rule of InterpretationPawanpreet SinghNo ratings yet

- Divine Siblings The Pre-Christian Ancest PDFDocument27 pagesDivine Siblings The Pre-Christian Ancest PDFGabriel Leal100% (1)

- Eugene Cheng - Fulfilling The Duty of Full and Frank Disclosure in The Arrest of ShipsDocument26 pagesEugene Cheng - Fulfilling The Duty of Full and Frank Disclosure in The Arrest of ShipsVũ LýNo ratings yet

- 2014 15 Senior Curriculum Volume 2Document230 pages2014 15 Senior Curriculum Volume 2Kabyajyoti patowaryNo ratings yet

- Major Petroleum CompaniesDocument75 pagesMajor Petroleum CompaniesShaho Abdulqader MohamedaliNo ratings yet

- Aicp Exam (58qs)Document61 pagesAicp Exam (58qs)Ann PulidoNo ratings yet

- Manual de DestilacionDocument173 pagesManual de DestilacionchispanNo ratings yet

- Eir SampleDocument1 pageEir SampleRayrc Pvt LtdNo ratings yet

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (1)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceFrom EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceRating: 5 out of 5 stars5/5 (22)

- 12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerFrom Everand12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerNo ratings yet

- Coaching and Mentoring: Practical Techniques for Developing Learning and PerformanceFrom EverandCoaching and Mentoring: Practical Techniques for Developing Learning and PerformanceRating: 3.5 out of 5 stars3.5/5 (4)

- The 5 Languages of Appreciation in the Workplace: Empowering Organizations by Encouraging PeopleFrom EverandThe 5 Languages of Appreciation in the Workplace: Empowering Organizations by Encouraging PeopleRating: 4.5 out of 5 stars4.5/5 (46)

- The Five Dysfunctions of a Team SummaryFrom EverandThe Five Dysfunctions of a Team SummaryRating: 4.5 out of 5 stars4.5/5 (59)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Way of the Shepherd: Seven Secrets to Managing Productive PeopleFrom EverandThe Way of the Shepherd: Seven Secrets to Managing Productive PeopleRating: 5 out of 5 stars5/5 (113)