Professional Documents

Culture Documents

Central Banking Recent Trends and Debates

Uploaded by

Asibul IslamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banking Recent Trends and Debates

Uploaded by

Asibul IslamCopyright:

Available Formats

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 1

Central Banking: Recent Trends and Debates

Central Bank Independence

The term autonomy, or independence, in context of Central Banks, refers to how freely the

monetary policy makers can conduct policies with little or no interference from the

government. Also referred to as the autonomy of Central Banks, the definition of

independence considers two important aspects. They are political independence and

economic independence, However, nowadays these aspects have more popular names: Goal

independence, Target independence and Instrumental in dependence.

1) Goal Independence: Allows the Central Bank to decide its own monetary goal and/or exchange

rate system, exclusive to the direct influence of the politicians. In the case of a floating

exchange rate system, the central bank solely concentrates on the monetary policy. Some

common monetary goals are maintaining price stability, controlling money supply or increasing

real growth in the economy

2) Target Independence: When the central bank is goal dependent, i.e. the state decides the

macroeconomic objectives, it lets the central bank set the target value to the goal and to come

up with the policy instruments with which it will achieve the target. For instance, if the state

wants to keep the inflation rate at a low level of 2 percent, it will probably adopt a contractual

monetary policy where the interest rate is set at a very high level.

3) Instrumental Independence: This is probably the least independent dimension among

the three that we have been discussing. The government consults the central bank and

sets the monetary target. The Central Bank is said to be instrumentally independent as it is

free to choose the policy tools to attain a macroeconomic goal. Besides that, it is both goal

dependent and target dependent on the government. The instruments applied by the bank are:

Open-market operations, discount lending and reserve require.

The Legal Measure: According to Cukierman, Webb, and Neyapti (1991), the legal measure of

independence of a central bank is based on four criteria.

I. Appointment of chief executive: A bank is viewed to be more independent if the chief

executive is appointed by the central bank and not the prime minister or the

finance minister, and has a long term of office.

II. Government involvement in policy decisions: the independence is greater as the policy

decisions are made with less and less participation of the government.

III. Goal of monetary policy: When price stability is given the maximum priority, a bank is said

to have a high level of independence.

IV. Government borrowing from central bank: Finally, the level of independence is greater if

more restrictions are placed on the ability of the government to borrow from the central

bank.

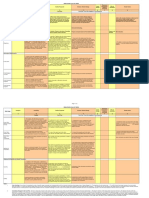

Developed Country vs. Developing Country

A developing country normally has comparatively low level of affluence and

more unemployment rate. In developing countries, there is low per capita income, poverty, less

education level and low capital formation. Such countries are fighting to get these things, but

might not have reached them. These countries are usually suffered from war, disease, poverty,

natural disasters, etc.

The developed/advanced countries have developed economies. They have technological

improvements, excellent roads, a steady government etc. This level of economic development

usually translates into a High GDP per capita (average income), Good education, Good health-care,

and Death &birth rate are almost the same.

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 2

Developed Country vs. Developing Country

Roles played by Central Bank in developing countries

In the developing countries, the central bank has to play a much wider role. Besides performing

the traditional functions, the central bank has to undertake responsibility of economic growth with

stability in these economies. Moreover, since the developing countries do not have well- organised

money and capital markets, the central bank has a crucial function to develop the banking and

financial system of the country. The central bank performs the following developmental and

promotional functions in the developing countries.

1. Traditional Functions: The central banks in the developing countries perform both traditional

and non-traditional functions. The traditional functions of the central bank are: having the

monopoly of note-issue; acting as banker to the government; serving as bankers' bank;

functioning as the lender of the last resort; controlling and regulating the credit; and

maintaining the external stability.

2. Economic Growth: The central banks in the developing countries should aim at promoting the

process of economic growth. Economic growth requires sufficient financial resources. The

central bank can ensure adequate monetary expansion in the country. Moreover, as a banker

to the government, the central bank can provide funds for initiating investment in the public

sector.

3. Internal Stability: Along with the objective of economic growth, the central bank should also

attempt to maintain internal price stability. The developing countries are susceptible to

inflationary pressures mainly due to supply -in elasticities in the short period. The central bank

should adopt such a monetary policy that can control inflationary tendencies and ensure price

stability.

4. Development of Banking System: The developing and underdeveloped countries do not have

well-developed banking system. In such an economy, the central bank should not only take

measures to develop an integrated commercial banking system, but also should not hesitate

undertaking directly the commercial banking functions.

Developed Country Developing Country

Also called industrialized countries & more

economically developed

Form of government(Democracy)

Free market economy

Lack of corruption

More dependent on manufacturing than

agriculture

Prevalent technology

Country with low standard of living

Also called third world countries

Undeveloped industry

Lack modern technology

Low level

o Education

o Healthcare

o Life expectancy

Good educational system; school

required

Schooling not available to all citizens of country

Widely available health care. Poor health care; not enough doctors.

Many manufacturing and service industries.

Farmers use technology.

Live by subsistence farming in rural areas. Few

businesses.

Participate in international trade Few items to trade

People mostly live in cities. People live mostly in rural areas.

United States, Japan, Germany, France Mexico, Brazil, South Africa, Thailand

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 3

5. Branch Expansion: In developing countries, the commercial banks generally concentrate their

branches in the urban areas. In order to extend credit facilities to the agricultural sector, the

central bank should prepare programme for branch expansion in the rural areas.

6. Development of Financial Institutions: Development of the leading sectors of the economy

such as agriculture, industry, foreign trade, etc. requires long-term finances. For this, the

specialised financial institutions should be established which provide term-loans to these

sectors.

7. Development of Banking Habits: Through its various credit control instruments (i.e., bank

rate, variable cash-reserve ratio, etc.) and by providing discounting facilities to the commercial

banks, the central bank exercises full control over the activities of commercial banks. This

creates public confidence in the banking system and helps in the development of banking

habits of the people.

8. Training Facilities: A major difficulty in developing the banking system in developing

countries is the lack of trained staff. The central bank can provide training facilities to meet the

personnel requirements of the banks.

9. Proper Interest Rate Structure: The central bank can help in establishing a suitable interest

rate structure to influence the direction of investment in the country. In underdeveloped

countries, a policy of low interest rate is necessary for encouraging investment and promoting

development activities. Again, by adopting different interest rates, the central bank can

increase productive investment and discourage unproductive investment.

10. Other Promotional Roles: The central bank can provide a number of other promotional

facilities. For example, (a) it can adopt policies to provide help to the various priority sectors,

such as agriculture;, cooperative sector, small scale sector, export sector, etc. (b) it can provide

guidelines to be followed by the planners about some definite patterns of economic and

investment policies; (c) it can publish information regarding the state of the economy and

promote research in money and banking.

In short, the central bank has to play not only regulatory, but also developmental role in the

developing countries. In the words of Planning Commission, the central bank has to take "a direct

and active role (a) in creating or helping to create the machinery needed for financing development

activities all over the country, and (b) in ensuring that the finance available flows in the directions

intended."

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 4

Information Sharing and Cooperation Between The Central Bank and The Government

In many countries the world over, the central bank has been given the mandate to preserve price

stability as its single or primary objective, and been granted autonomy from government to make

sure that short term political considerations do not interfere with achieving this objective. In

principle, there is a clear division of responsibilities and accountabilities between the central bank

on the one hand, and the government and the Minister of Finance on the other hand. Even so,

information sharing, cooperation and coordination between the central bank and the government

are important in a number of respects.

Clarity of framework and objectives: In general, a strong appreciation of the different objectives

and operating frameworks of the central bank, the fiscal authorities and development institutions

(where applicable) will be conducive to a fruitful dialogue among them, because information and

views are shared more easily when all parties understand and respect the others rights and

responsibilities.

Coordination of monetary and fiscal policy: If the fiscal authorities know the central banks

policy reaction function and its formal or informal analytical model, they can anticipate the

monetary policy response to a given fiscal action and adjust the action accordingly. In principle,

coordination between monetary and fiscal policy can thus be achieved without negotiations

between the monetary and the fiscal authorities, and the central bank can take advantage of being

the first mover (by establishing a credible reaction function), which is important to avoid

undermining its price stability objective.

Coordination in other areas: In some areas other than monetary policy, coordination between the

central bank and the government may need to be quite close. For example, this is the case for fiscal

agent functions of the central bank. In addition, the central banks financial sector regulatory

functions or advisory responsibilities (as well as its own participation in the financial system) allow

it to foster the development of the sector, which will require close coordination with the

government, for instance on legal reform.

Development role of the central bank. The single most important contribution central banks can

make in industrialized and developing economies alike is to provide an environment of

monetary stability, which in turn is conducive to economic growth and development. At the

margins of this principle, central banks in some industrialized countries are making an effort to

focus their activities ever more on this core responsibility. Central banks have played an important

role in developing the financial sectors capability central banks in developing countries often

prefer to limit their development functions to the financial sector, where they are best placed to

contribute to infrastructure building and human capital formation.

Macroeconomic management challenges: In low-income countries the dependence on selected

commodity exports can make them highly susceptible to terms-of-trade shocks, the predominant

role of the primary sector can lead to large fluctuations in output, demand and government

revenues (in part simply as a result of fluctuations in the weather), and the volatility of aid flows

can be a further huge challenge in trying to stabilize output (Bevan 2005). In addition, if market

imperfections are such that monetary policy can have permanent effects on real variables, the

central bank may be subject to yet more political pressures than in more advanced emerging

market economies or industrialized countries.

Oil and other resource revenues: An important aspect of policy coordination in a number of

developing countries concerns the management of oil and other resource revenues. For oil-

exporting countries, two approaches may be used. One is to budget at a conservative, normal oil

price. This reduces the danger of large budget deficits if prices decline suddenly. Proper governance

arrangements for such resource funds are essential but can be difficult to devise and implement.

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 5

Importance of Central Bank Autonomy

Both price and financial sector stability are important for achieving sustainable real economic

growth. Inflationparticularly variable inflationover a certain threshold impedes sustainable

economic growth. The effectiveness of the price mechanism to allocate scarce resources is impinged

by the noise created by inflation. Investment and savings decisions are distorted, as people are

trying to protect themselves against inflation. Moreover, inflation redistributes wealthmainly from

the poor to the wealthy owning land, real estate, or stocks.

Furthermore, although governments may be tempted to use the inflation tax, high inflation also

affects the budget negatively due to higher interest rates and lags in tax collection. Although it is

tempting to use inflationwhich now is generally accepted to be primarily a monetary

phenomenonto solve short-term problems, it will hamper sustainable real economic growth by

postponing addressing the underlying structural challenges.

It is the prerogative of the state to conduct monetary policy, but it may not be credible if done by

the government. In the short run, the government has many competing objectives, including being

reelected. Even if the government states that it will pursue price stability, the general public knows

that it has incentives to compromisethe so-called time-inconsistency problem (Kydland and

Prescott, 1977). The public will accordingly require a risk-premium in the form of higher interest

rates, which impede sustainable economic growth. The delegation of authority to conduct monetary

policy to an autonomous and accountable central bank with clearly defined objectives can enhance

both credibility and flexibility. In addition to price stability, financial sector stabilitythat is a

sound and stable financial system including an efficient payment systemis also important for a

market economy to realize its full potential. An autonomous and accountable central bank may

help prevent that undue influence adversely affects the financial sector.

EB-609(Central Banking: Regulation and Supervision)

23

rd

Batch, MBA (Evening) Program

Page 6

Aspects of The Financial Autonomy of Central Banks

This note began with the modern triangle of central banking (an autonomous central bank

pursuing price stability in a transparent manner and being held to account for its performance)

and then discussed practical aspects of the interaction between the central bank and government

in this type of arrangement. The remainder of the note summarizes aspects of the financial

relationship between the central bank and government that have a bearing on the policy autonomy

of the central bank.

Three aspects of the financial autonomy of central banks may be distinguished: (

1) the ability to set the terms and conditions on the items in the central banks balance sheet

this is essential for the conduct of monetary policy;

2) having the means to bear any losses that arise from central bank operations and having

appropriate rules to allocate profits (including rules that govern the accumulation of capital

and reserves); and

3) the ability to cover operating expenses, and in particular to set salaries (typically the single

largest component of operating costs) in a manner that allows the central bank to attract and

retain the professional talent it requires.

Concerning the first aspect, monetary policy autonomy may be at risk if the central bank can be

obliged to lend to the government or provide it with implicit or explicit subsidies in other ways, for

example by supporting the price of government debt. Where financial markets are well developed,

this risk is the principal reason why lending to government is typically prohibited when the central

bank law is modernized.

At the same time, practical experience shows that it can be very difficult to convince governments,

particularly in low-income countries, to agree to a reform of the central bank law that includes the

wholesale prohibition of lending to government. To address this problem, great efforts have been

made to draft central bank laws that limit government access to or facilitate a gradual weaning of

the government off central bank credit, but not much is known about how effective such provisions

are in practice.

The second aspect of financial autonomy concerns an adequate level of central bank capital in

relation to the risks the central bank is expected to absorb, as well as clear and consistent

provisions on accounting for valuation changes, on the creation of reserves, and on the transfer of

a central bank surplus (or loss) to the government.

In many cases, the costs of providing services to government can be covered by pricing them,

which also addresses the problem of implicit subsidies and competitive distortions. However, in

practice it may be hard to agree on terms with the government, or the central bank law may

restrict the pricing of some or all services to government. To illustrate, in a 2004 survey, half of the

emerging market economies and a third of the industrialized economy central banks did not price

services to the national government at all.

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Grow Your Small Savings To One Crore PDFDocument12 pagesGrow Your Small Savings To One Crore PDFqwqNo ratings yet

- Absolute Return Investing Strategies PDFDocument8 pagesAbsolute Return Investing Strategies PDFswopguruNo ratings yet

- Economics A Crash CourseDocument203 pagesEconomics A Crash CourseTriono100% (1)

- Design StagesDocument2 pagesDesign StagesHaneefa ChNo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- Dr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryFrom EverandDr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryRating: 4 out of 5 stars4/5 (1)

- 3 Chapter 3 Financial Institutions and Their Operations Lecture NotesDocument133 pages3 Chapter 3 Financial Institutions and Their Operations Lecture NotesAnimaw Yayeh100% (4)

- Chapter - Money Creation & Framwork of Monetary Policy1Document6 pagesChapter - Money Creation & Framwork of Monetary Policy1Nahidul Islam IUNo ratings yet

- Chapter 3 - Financial AnalysisDocument39 pagesChapter 3 - Financial AnalysisHeatstroke0% (1)

- Iso 15686 5 2017Document15 pagesIso 15686 5 2017Kassahun AberaNo ratings yet

- Lyryx Labs Assignments PDFDocument244 pagesLyryx Labs Assignments PDFss100% (1)

- Role of Central BankDocument2 pagesRole of Central BankHarvir Singh100% (1)

- Ashraf Sir AssignmentDocument12 pagesAshraf Sir AssignmenthimelNo ratings yet

- Assignment: Monetry PolicyDocument11 pagesAssignment: Monetry PolicyR AhulNo ratings yet

- Baking CH 2Document5 pagesBaking CH 2Endalkachew BefirdeNo ratings yet

- Overview of Central BanksDocument6 pagesOverview of Central BanksMehwish AsimNo ratings yet

- Central BankDocument17 pagesCentral BankSania ZaheerNo ratings yet

- Term Paper of FM&INSDocument13 pagesTerm Paper of FM&INSKetema AsfawNo ratings yet

- Central BankDocument6 pagesCentral BankAsifur RahmanNo ratings yet

- MD Naimur Rahman 32025Document4 pagesMD Naimur Rahman 32025Naeem UR RahmanNo ratings yet

- Role of Banks in The Development of EconomyDocument25 pagesRole of Banks in The Development of EconomyZabed HossenNo ratings yet

- Economic Policy - Monetary PolicyDocument17 pagesEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaNo ratings yet

- Waris AssignmntDocument4 pagesWaris AssignmntSameerNo ratings yet

- Types of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andDocument3 pagesTypes of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andShafeeq GigyaniNo ratings yet

- Introduction To Monetary PolicyDocument6 pagesIntroduction To Monetary Policykim byunooNo ratings yet

- Price Stability:: Objectives of Monetary PolicyDocument9 pagesPrice Stability:: Objectives of Monetary Policyroa99No ratings yet

- Hid - Chapter 3 2015Document91 pagesHid - Chapter 3 2015hizkel hermNo ratings yet

- Role of Central BankDocument6 pagesRole of Central BankWajeeha RizwanNo ratings yet

- Chapter Five - Central BankDocument31 pagesChapter Five - Central BankAidrouz LipanNo ratings yet

- What Is Monetary Policy?: Key TakeawaysDocument5 pagesWhat Is Monetary Policy?: Key TakeawaysNaveen BhaiNo ratings yet

- Central BankDocument9 pagesCentral BanksakibNo ratings yet

- Monetary and Fiscal Policies in Developing CountriesDocument10 pagesMonetary and Fiscal Policies in Developing CountriesJackie Lou DimatulacNo ratings yet

- Functions of Central Bank in An EconomyDocument4 pagesFunctions of Central Bank in An EconomyShafiq MirdhaNo ratings yet

- Central Banking and Functions of Central BankDocument82 pagesCentral Banking and Functions of Central Bankjoshjeth100% (1)

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Reporting Prof 3Document23 pagesReporting Prof 3lucanas.johnrille.ocloNo ratings yet

- Zangi TestDocument20 pagesZangi TestEng Hinji RudgeNo ratings yet

- Central Banking and Moneytary PolicyDocument16 pagesCentral Banking and Moneytary PolicyNahidul Islam IUNo ratings yet

- Lecture 2 - Central Bank and Its FunctionsDocument20 pagesLecture 2 - Central Bank and Its FunctionsLeyli MelikovaNo ratings yet

- Answer 8: Difference Between Central Bank and Commercial Banks in IndiaDocument8 pagesAnswer 8: Difference Between Central Bank and Commercial Banks in IndiaEsha WaliaNo ratings yet

- Written Assignment Unit 5Document5 pagesWritten Assignment Unit 5Mandella HarveyNo ratings yet

- Espana Boulevard, Sampaloc, Manila, Philippines 1015 Tel. No. 406-1611 Loc.8241 - Telefax: 731-5738 - Website: WWW - Ust.edu - PHDocument6 pagesEspana Boulevard, Sampaloc, Manila, Philippines 1015 Tel. No. 406-1611 Loc.8241 - Telefax: 731-5738 - Website: WWW - Ust.edu - PHNica SalazarNo ratings yet

- Central BankDocument6 pagesCentral BankMd Shahbub Alam SonyNo ratings yet

- Central BankDocument6 pagesCentral Bank0115Nurul Haque EmonNo ratings yet

- Financial and Fiscal PolicyDocument7 pagesFinancial and Fiscal PolicyLeonardo BanayNo ratings yet

- Chapter Six Cont'dDocument48 pagesChapter Six Cont'dUmutoni ornellaNo ratings yet

- UNEC TheoryofbankingDocument24 pagesUNEC TheoryofbankingTaKo TaKoNo ratings yet

- The Evolution of Central BankingDocument6 pagesThe Evolution of Central Bankingdamenegasa21No ratings yet

- Principles of Economics IiDocument2 pagesPrinciples of Economics Iiinnies duncanNo ratings yet

- Monetary Policy New 1Document15 pagesMonetary Policy New 1Abdul Kader MandolNo ratings yet

- Banking CH 2 Central BankingDocument10 pagesBanking CH 2 Central BankingAbiyNo ratings yet

- Monetary Policy-1Document4 pagesMonetary Policy-1PETER MUSISINo ratings yet

- Q4 Financial Intermediary': Types 1. Depository IntermederiesDocument10 pagesQ4 Financial Intermediary': Types 1. Depository IntermederiesUsman MalikNo ratings yet

- Chapter 6 BDocument25 pagesChapter 6 Bbirook27No ratings yet

- Chapter Two-Central BankDocument7 pagesChapter Two-Central BankTanmoy SahaNo ratings yet

- The Impact of Monetary Policy On EconomyDocument12 pagesThe Impact of Monetary Policy On EconomyNeha ZainabNo ratings yet

- Reserve Bank of IndiaDocument25 pagesReserve Bank of IndiaUdayan SamirNo ratings yet

- Monetary Policy RefernceDocument17 pagesMonetary Policy RefernceMaria Cristina ImportanteNo ratings yet

- Lesson 5 - Central Vs Commercial BanksDocument4 pagesLesson 5 - Central Vs Commercial BanksHamna RazaNo ratings yet

- Chapter 2Document8 pagesChapter 2Muhammed YismawNo ratings yet

- Note Monitary PolicyDocument7 pagesNote Monitary PolicyPark Min YoungNo ratings yet

- Tutorial 3 AnswersDocument10 pagesTutorial 3 Answerskung siew houngNo ratings yet

- Meaning of Monetary PolicyDocument11 pagesMeaning of Monetary PolicysirsintoNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicyGc Abdul RehmanNo ratings yet

- Monday, September 17, 2018 6:53 PM: Unfiled Notes Page 1Document2 pagesMonday, September 17, 2018 6:53 PM: Unfiled Notes Page 1Asibul IslamNo ratings yet

- Image 002Document2 pagesImage 002ThaoVũNo ratings yet

- Central Banking PresentationDocument39 pagesCentral Banking PresentationAsibul IslamNo ratings yet

- Fukushu N4Document3 pagesFukushu N4Asibul IslamNo ratings yet

- AdsDocument6 pagesAdsShubho PuNo ratings yet

- Test 1 PDFDocument2 pagesTest 1 PDFAsibul IslamNo ratings yet

- Cid99 HW Solutions9Document6 pagesCid99 HW Solutions9Asibul IslamNo ratings yet

- GGGGDocument8 pagesGGGGSapnaDeepNo ratings yet

- Introduction To The Management of Working CapitalDocument20 pagesIntroduction To The Management of Working CapitalAsibul IslamNo ratings yet

- Bank Fund PresentationDocument11 pagesBank Fund PresentationAsibul IslamNo ratings yet

- 34 BCS Priliminary ResultDocument59 pages34 BCS Priliminary ResultAsibul IslamNo ratings yet

- Caligulas Economic ImpactDocument1 pageCaligulas Economic Impactbog macNo ratings yet

- TOC - Indian Retail BankingDocument9 pagesTOC - Indian Retail Bankings_arora_7412No ratings yet

- Lesson 26 ActivityDocument5 pagesLesson 26 ActivityRandy WangNo ratings yet

- ECON 305 Lecture 1Document26 pagesECON 305 Lecture 1Kevin BaoNo ratings yet

- Banking and Financial Institution 1ST Term MT ReviewerDocument16 pagesBanking and Financial Institution 1ST Term MT ReviewerAly JoNo ratings yet

- The Wall Street Journal-231102Document32 pagesThe Wall Street Journal-231102Josué MachacaNo ratings yet

- Gui Me inDocument30 pagesGui Me inThùy LinhNo ratings yet

- Personal Financial Literacy Modlue 4 Regular NotesDocument7 pagesPersonal Financial Literacy Modlue 4 Regular NotesSania SharpeNo ratings yet

- General KnowledgeDocument104 pagesGeneral Knowledgepun33t100% (1)

- Regression of Usa GDP On Inflation, Unemployment and Net ExportDocument13 pagesRegression of Usa GDP On Inflation, Unemployment and Net ExportIsmayil ƏsədovNo ratings yet

- Parkin Economics 14EDocument1 pageParkin Economics 14E邱珮甄No ratings yet

- LessonPlan PDFDocument9 pagesLessonPlan PDFvlabrague6426No ratings yet

- Introduction To Macroeconomics: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityDocument23 pagesIntroduction To Macroeconomics: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois Universitymimi96No ratings yet

- THE ECONOMIC CONTRIBUTION AND CHALLENGES OF SAVING AND CREDIT INSTITUTIONS ch1,2,3 by TekluDocument18 pagesTHE ECONOMIC CONTRIBUTION AND CHALLENGES OF SAVING AND CREDIT INSTITUTIONS ch1,2,3 by TekluAbiotNo ratings yet

- Barclays - Global Economics Weekly PDFDocument44 pagesBarclays - Global Economics Weekly PDFRishabh VakhariaNo ratings yet

- Unit Andscope OF Financial Administration: 1 NatureDocument11 pagesUnit Andscope OF Financial Administration: 1 Natureahmednor2012No ratings yet

- Principles of EconomicsDocument367 pagesPrinciples of EconomicsHafiza ZahidNo ratings yet

- CRS - Former Presidents' Pensions, Office Allowances, and Other Federal BenefitsDocument27 pagesCRS - Former Presidents' Pensions, Office Allowances, and Other Federal BenefitsZenger NewsNo ratings yet

- Summary of Dabur'S Chairman'S Message, Management Discussion and Analysis and Director'S ReportDocument4 pagesSummary of Dabur'S Chairman'S Message, Management Discussion and Analysis and Director'S ReportAnchitLPNo ratings yet

- Journalism (Mass Communication) Solved Mcqs Paper 2015-16: (B) BannerDocument32 pagesJournalism (Mass Communication) Solved Mcqs Paper 2015-16: (B) BannerMuzammil RehmanNo ratings yet

- Gold Prices Research PaperDocument5 pagesGold Prices Research PaperYoung PoetsNo ratings yet

- Pest AnanlysisDocument6 pagesPest AnanlysismzsaeedNo ratings yet

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet