Professional Documents

Culture Documents

Top SCM Softwares

Uploaded by

Sachin PanpatilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top SCM Softwares

Uploaded by

Sachin PanpatilCopyright:

Available Formats

SPECI AL SUPPLEMENT

September, 2003

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 1

T

s 3

he supply chain management

(SCM) software market experienced

its first revenue decline ever last year

according to Boston-based AMR

Research. One reason for the 6 per-

cent drop in sales was clearly the

slumping economy that severely

impacted the supply-chain intensive

manufacturing sector. AMR Vice

President of Research Larry Lapide

also attributes much of the sales

decline to buyers desperately seeking

immediate returns from their technol-

ogy investments, through lower cost

and easier to implement solutions.

Cautious users shied away from

big, expensive planning purchases in

favor of incremental improvements

from smaller execution applications,

says Lapide.

AMR divides the SCM market into

two broad types of applications: (1)

supply chain planning (SCP), which

includes demand planning, forecast-

ing, production scheduling and other

long-term planning; and (2) supply

chain execution (SCE), which

includes applications for management

of transportation (TMS), warehousing

(WMS), inventory management and

order management.

Planning users have become

somewhat disillusioned with the SCP

visionary approach to supply chain

problems, says Lapide. While these

users are receiving benefits, they are

not as great as expected. Plus the

solutions are taking much longer than

the promised six-to-nine month imple-

mentation horizon.

According to Lapide, more than

half of all SCP implementations have

taken more than one year to yield any

benefit. As a result, these applications

have lost their momentum in the mar-

ketplace. A 17 percent sales drop in

SPECI AL SUPPLEMENT

The supply chain management

software market suffered

a slight dip in 2002, reports

AMR Research, while buyers

scrambled to find quick returns

from lower cost, faster to

implement solutions.

By Thomas A. Foster,

contributing editor

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 3

2002 has cut the Supply Chain

Planning portion of the SCM mar-

ket to only 36 percent.

SCE has now become the larg-

er portion of the market compris-

ing 64 percent of total sales. SCE

application sales in 2002 actually

eked out a one percent sales

increase. The relative success of

SCE is due to the simple fact that

these applications produce definite

and measurable savings within six

to nine months, says Lapide.

They also are usually lower cost

applications, at least to license.

Not all types of execution soft-

ware showed positive growth, how-

ever. Inventory management appli-

cations grew by 2 percent in 2002

while WMS sales were relatively

flat. TMS sales actually declined 18

percent. Looking five years out,

however, Lapide is optimistic about

specific SCE applications, which he

projects will grow at double-digit,

compound annual growth rates

(CAGR). The fastest growing SCE

applications will be order manage-

ment (11 percent), inventory man-

agement (11 percent), and TMS

(12 percent).

Enter the ERP Vendors

The biggest shift in the SCM

space has been the growth in mar-

ket share for the major enterprise

resource planning (ERP) vendors.

Market leadership changed hands

in 2002 as SAP overtook i2

Technologies in SCM revenue with

a sales growth of 10 percent.

When the SCP market over-

heated in the late 1990s, all of the

ERP vendors jumped in, says

Lapide. While this sector has

slowed, the ERP vendors continue

to gain momentum within their

installed bases.

The analyst says that users

integration concerns about best-of-

breed applications have helped the

ERP vendors sell themselves as an

easier-to-implement choice for

SCM applications, especially plan-

ning solutions.

The SCM market has tradition-

ally been a highly fragmented one,

especially in the SCE space, where

the top 10 vendors represent only

34 percent of total SCE revenue.

SAP stands out as the execution

leader, but mainly because of its

huge installed based of ERP users,

who often find the easy-to-add

WMS module adequate for their

needs. Overall, however, the ERP

vendors have yet to gain as much

ground in the SCE segment.

The WMS and TMS applica-

tions from the ERP players lack

much of the functionality of the

best-of- breed vendors, says

Lapide, adding that the ERP com-

panies are likely to put more

emphasis on these applications in

the future.

In 2002, however, best-of-breed

SCE vendors enjoyed double-digit

sales growth, while most of the

market remained flat. Lapide says

that the top best-of-breed compa-

nies are likely to grow their market

share because of their leadership

in the so-called wireless supply

chain. This technology involves

tracking goods as they move along

a supply chain using radio frequen-

cy identification (RFID), global

positioning system (GPS), wireless

fidelity (WiFi), and bar-coding

technologies.

An Established Market

Despite the disappointing

results in 2002, Lapide says SCM

has established itself as a $5 billion

market that will get back on the

growth curve in 2003. AMR proj-

ects a CAGR of 8 percent over the

next five years. SCP revenue will

continue to be the smaller share of

this market and will only grow at 5

percent over the next five years. It

will be overshadowed by SCE rev-

enue, which will grow significantly

faster at 10 percent.

Companies are no longer buy-

ing suites of SCP applications, but

rather single applications to

address specific supply chain prob-

lems, says Lapide. Users will be

most interested in using SCM

applications to improve operational

efficiencies in customer fulfillment

activities and to reduce inventory

and supply chain costs.

s 4

SPECI AL SUPPLEMENT

The relative success of SCE is due to the simple fact

that these applications produce definite and measurable

savings within six to nine months,

Larry Lapide

AMR, Vice President of Research

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 4

s 9

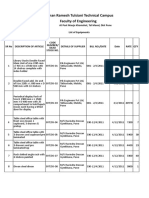

2002 Revenue Rank/

Company Name

SCM vendors ranked by 2002

SCM revenue (incl. est. 03 growth)

1 SAP 511 516 9% 10% 1%

2 i2 Technologies 434 399 7% -49% -8%

3 Manugistics 226 228 4% -10% 1%

4 Manhattan Associates* 176 197 4% 13% 12%

5 IBS 161 164 3% -2% 2%

6 J.D. Edwards 140 145 3% 15% 4%

7 Swisslog 114 119 2% 30% 5%

8 Aspen Technology 98 99 2% 8% 1%

9 Retek 77 81 1% 7% 5%

10 RedPrairie 75 81 1% 23% 8%

11 Vastera 74 86 2% 21% 15%

12 EXE Technologies 73 74 1% -24% 3%

13 PeopleSoft 69 80 1% -5% 16%

14 Descartes 56 58 1% -13% 3%

15 Vertex Interactive 47 45 1% -9% -4%

16 Pitney Bowes Supply Chain Solutions 44 49 1% 7% 12%

17 Microsoft Great Plains Business Solutions 39 41 1% 8% 5%

18 TXT e-solutions 36 37 1% 74% 5%

19 Integrated Warehousing Solutions 35 37 1% 6% 5%

20 ILOG 34 36 1% -27% 5%

21 Industri-Matematik International (IMI) 34 30 1% -10% -13%

22 Irista 34 34 1% 6% 0%

23 NxTrend Technology 32 35 1% 14% 8%

24 Oracle 32 50 1% 12% 55%

25 Catalyst International 32 32 1% -3% 1%

26 JDA 32 33 1% -5% 5%

27 G-Log 32 35 1% 125% 12%

28 BRAIN 31 31 1% 9% 0%

29 Optum 31 31 1% -11% 0%

30 NextLinx 31 31 1% 41% 0%

31 LIS 31 33 1% 3% 8%

32 Adexa 30 29 1% -27% -5%

33 Xelus 30 30 1% 5% 0%

34 QAD 29 30 1% -5% 1%

R

e

v

e

n

u

e

,

2

0

0

2

(

$

M

)

R

e

v

e

n

u

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

R

e

v

e

n

u

e

S

h

a

r

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

G

r

o

t

h

R

a

t

e

F

o

r

e

c

a

s

t

,

2

0

0

2

2

0

0

3

G

r

o

t

h

R

a

t

e

,

2

0

0

1

2

0

0

2

SPECI AL SUPPLEMENT

continued on page s10

*Does not include Logistics.com.

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 9

s 10

SPECI AL SUPPLEMENT

2002 Revenue Rank/

Company Name

SCM vendors ranked by 2002

SCM revenue (incl. est. 03 growth)

R

e

v

e

n

u

e

,

2

0

0

2

(

$

M

)

R

e

v

e

n

u

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

R

e

v

e

n

u

e

S

h

a

r

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

G

r

o

t

h

R

a

t

e

F

o

r

e

c

a

s

t

,

2

0

0

2

2

0

0

3

G

r

o

t

h

R

a

t

e

,

2

0

0

1

2

0

0

2

35 Demand Management 28 28 1% 1% 0%

36 Provia Software 28 30 1% 8% 8%

37 HighJump Software 28 36 1% 22% 30%

38 Logility 28 31 1% -7% 10%

39 Vcommerce 28 30 1% 452% 10%

40 Software Solutions Unlimited 25 25 <.5% 9% 0%

41 Yantra 25 28 <.5% 25% 10%

42 IFS 25 26 <.5% 2% 5%

43 Mincom 24 24 <.5% 1% 0%

44 Intentia International 24 24 <.5% 10% 2%

45 SoftBrands Manufacturing 22 22 <.5% 0% 0%

46 MARC 22 24 <.5% 23% 8%

47 SupplySolution 22 22 <.5% 83% 0%

48 Tecsys 22 22 <.5% 4% 0%

49 Fulfillment Chain 22 22 <.5% 13% 0%

50 Exact Software 21 22 <.5% 4% 5%

51 Acsis 20 23 <.5% 22% 15%

52 SynQuest 20 0 0% 38% 0%

53 ecVision 19 19 <.5% 300% 0%

54 infor:swan business solutions 18 18 <.5% 1% 3%

55 ClearOrbit 18 19 <.5% 11% 8%

56 WorldChain 18 20 <.5% 100% 15%

57 Prophet 21 17 19 <.5% 7% 8%

58 Finmatica 17 19 <.5% 18% 10%

59 Schneider Logisitcs 17 19 <.5% 13% 12%

60 V3 Systems 16 18 <.5% 100% 10%

61 PipeChain 16 18 <.5% 33% 13%

62 daly.commerce 16 16 <.5% 3% 2%

63 Baan 15 16 <.5% -28% 5%

64 TMW Systems 14 17 <.5% 14% 19%

65 MA-system 14 14 <.5% 17% 0%

66 SofTechnics 14 15 <.5% 27% 5%

67 BridgePoint 14 15 <.5% 150% 12%

68 Transentric 13 14 <.5% 0% 9%

continued on page s12

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 10

s 12

SPECI AL SUPPLEMENT

SCM vendors ranked by 2002

SCM revenue (incl. est. 03 growth)

R

e

v

e

n

u

e

,

2

0

0

2

(

$

M

)

R

e

v

e

n

u

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

R

e

v

e

n

u

e

S

h

a

r

e

F

o

r

e

c

a

s

t

,

2

0

0

3

(

$

M

)

G

r

o

t

h

R

a

t

e

F

o

r

e

c

a

s

t

,

2

0

0

2

2

0

0

3

G

r

o

t

h

R

a

t

e

,

2

0

0

1

2

0

0

2

69 RiverOne 13 14 <.5% 100% 10%

70 Geac 13 13 <.5% -16% 2%

71 Vizional Technologies 12 12 <.5% 100% 0%

72 Logistics.com 12 15 <.5% 50% 25%

73 Webplan 11 11 <.5% 0% 0%

74 AquiTec International 11 11 <.5% 30% 0%

75 Verticalnet 11 6 <.5% 22% -50%

76 Gemmar Systems International (GSI) 11 11 <.5% 10% 0%

77 Evant (formerly NONSTOP Solutions) 11 12 <.5% 50% 10%

78 Genco Distribution System 10 12 <.5% 11% 20%

79 Precision Software 10 11 <.5% 10% 15%

80 Greycon 10 10 <.5% 10% 1%

81 Syngistix 10 10 <.5% 20% 5%

82 Ross Systems 9 11 <.5% -26% 20%

83 Cambar Software 9 9 <.5% 0% 0%

84 GT Nexus 9 10 <.5% 0% 10%

85 Nistevo 9 10 <.5% 29% 11%

86 Rely Software 9 10 <.5% 200% 8%

87 Arzoon 9 10 <.5% 60% 12%

88 Profile Systems 8 8 <.5% 8% 0%

89 Syncra Systems 8 8 <.5% 100% 5%

90 Elogex 8 8 <.5% 200% 12%

91 GAINSystems 8 10 <.5% 27% 32%

92 Demantra 7 7 <.5% 53% 0%

93 Interlink Technologies 7 8 <.5% 5% 5%

94 Propack Data 7 7 <.5% 48% 0%

95 Cayenta 7 7 <.5% 12% 0%

96 Prescient Systems 6 7 <.5% 80% 15%

97 Viewlocity** 6 23 <.5% 68% 273%

98 Radcliffe Systems 6 6 <.5% 20% 0%

99 Zethcon 6 7 <.5% 20% 17%

100 Vigilance 6 6 <.5% 60% 0%

2002 Revenue Rank/

Company Name

**Includes SynQuest and Tilion in 2003 revenue Source: AMR Research, 2003

LMx0309s_software.qxd 8/29/2003 10:25 AM Page 12

You might also like

- AMR - The Product Lifecycle Management Market Sizing Report 20072012 08-07-16 - tcm641-67669Document40 pagesAMR - The Product Lifecycle Management Market Sizing Report 20072012 08-07-16 - tcm641-67669Mani ChawlaNo ratings yet

- Fleet Management Market by SolutionsDocument6 pagesFleet Management Market by SolutionsRajni GuptaNo ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- Sap SDDocument44 pagesSap SDdbedada100% (3)

- ERP Cloud ScenarioDocument13 pagesERP Cloud ScenarioSonal Gupta100% (1)

- Assignment 1Document3 pagesAssignment 1Umair ShabbirNo ratings yet

- NGN Oss/bss 2013-2018Document8 pagesNGN Oss/bss 2013-2018Kabir Ahmad0% (1)

- 1905 - Market Share Analysis - ERP Software, Worldwide, 2018Document12 pages1905 - Market Share Analysis - ERP Software, Worldwide, 2018Rufus Shinra RaidNo ratings yet

- 5.20.2016 Board Deck v5Document60 pages5.20.2016 Board Deck v5Zerohedge100% (2)

- Revenue Assurance and Cost Management: Wedo Technologies: A Stratecast Report FeaturingDocument18 pagesRevenue Assurance and Cost Management: Wedo Technologies: A Stratecast Report Featuringrakesh4scribeNo ratings yet

- Sdad 11 12 Onlinepdf FinalDocument154 pagesSdad 11 12 Onlinepdf FinalMitsuo SakamotoNo ratings yet

- Publisher: Renub Research Published: September, 2010Document32 pagesPublisher: Renub Research Published: September, 2010arjun_scribdNo ratings yet

- Hexa Reports: Lidar Market Share, Size, Trends and Growth, by Product Analysis, Application and Segment Forecasts To 2022Document4 pagesHexa Reports: Lidar Market Share, Size, Trends and Growth, by Product Analysis, Application and Segment Forecasts To 2022api-291837085No ratings yet

- (Group1) Samsung Electronics - SCMDocument6 pages(Group1) Samsung Electronics - SCMRobert DangNo ratings yet

- The Gartner Supply Chain Top 25 For 2017Document19 pagesThe Gartner Supply Chain Top 25 For 2017MagnetisingNo ratings yet

- SAP For Logistics Service Provider ManagingDocument16 pagesSAP For Logistics Service Provider ManagingSuryanarayana TataNo ratings yet

- Investors Presentation: Roy Porat, CEO - Moshe Eisenberg, CFODocument22 pagesInvestors Presentation: Roy Porat, CEO - Moshe Eisenberg, CFOotteromNo ratings yet

- Assignment 2 Group Business ReportDocument17 pagesAssignment 2 Group Business ReportKamakhya GuptaNo ratings yet

- Critical Success Factors For Integration of CAD/CAM Systems With ERP SystemsDocument21 pagesCritical Success Factors For Integration of CAD/CAM Systems With ERP SystemsNurulHidayahNo ratings yet

- The Future of ERPDocument20 pagesThe Future of ERPSushmita VermaNo ratings yet

- 50 Critical ERP Statistics - 2020 Market Trends Data and AnalysisDocument8 pages50 Critical ERP Statistics - 2020 Market Trends Data and AnalysisMarc TayNo ratings yet

- Individual Project: Electronic Arti Cle Surveillance and Resource Management SystemDocument10 pagesIndividual Project: Electronic Arti Cle Surveillance and Resource Management SystemZawyar ur RehmanNo ratings yet

- Magic Quadrant For Network Performance Monitoring and Diagnostics - 2016Document28 pagesMagic Quadrant For Network Performance Monitoring and Diagnostics - 2016hoainamcomit100% (1)

- AMR ERP Market Sizing 2006-2011Document36 pagesAMR ERP Market Sizing 2006-2011nitish_bharatiNo ratings yet

- Astra Microwave Products LTD: Exponential Growth On The Way!Document5 pagesAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152No ratings yet

- Free Weekly Newsletter June 18, 2010Document12 pagesFree Weekly Newsletter June 18, 2010ValuEngine.comNo ratings yet

- Meter Data ManagementDocument26 pagesMeter Data ManagementnelsdainNo ratings yet

- Project - India Auto ELECTRONICSDocument12 pagesProject - India Auto ELECTRONICSramesh aluruNo ratings yet

- MES Product Survey 2013 FlyerDocument4 pagesMES Product Survey 2013 FlyerysgadreNo ratings yet

- Manufacturing Analytics Market Key Players, Size, Trends, Opportunities and Growth Analysis - Facts and TrendsDocument2 pagesManufacturing Analytics Market Key Players, Size, Trends, Opportunities and Growth Analysis - Facts and Trendssurendra choudharyNo ratings yet

- Business Case SCMDocument20 pagesBusiness Case SCMsreeks456100% (1)

- Gaining Insight Into Indian Automation Sector: MarketDocument3 pagesGaining Insight Into Indian Automation Sector: Market04422236558No ratings yet

- 2022-PM-Digital Procurement - Pankaj Singh TomarDocument7 pages2022-PM-Digital Procurement - Pankaj Singh Tomarpankaj tomarNo ratings yet

- SAP-SD OVERVIEW - Demo - RajDocument305 pagesSAP-SD OVERVIEW - Demo - RajRahul Mohapatra71% (7)

- CMMS Software Market 2017-2022Document8 pagesCMMS Software Market 2017-2022rafik1995No ratings yet

- 2016 Manufacturing SupplyChain Logistics TransportationManagement Trends PDFDocument65 pages2016 Manufacturing SupplyChain Logistics TransportationManagement Trends PDFKumar K KumarNo ratings yet

- BL May99Document4 pagesBL May99api-3826900100% (2)

- Benchmark Report Telco GrowthDocument78 pagesBenchmark Report Telco Growthdaba1987No ratings yet

- Software Defined Data Center (SDDC) MarketDocument19 pagesSoftware Defined Data Center (SDDC) MarketMarketsandMarketsNo ratings yet

- Goldman Sachs Samsung ProjectionsDocument147 pagesGoldman Sachs Samsung ProjectionsccabrichNo ratings yet

- NXP Company Presentation April 2014Document130 pagesNXP Company Presentation April 2014Marivir GonzalesNo ratings yet

- TMF Frameworx 12.5 OverviewDocument2 pagesTMF Frameworx 12.5 OverviewlostinsandNo ratings yet

- MSCC Corporate PresentationDocument21 pagesMSCC Corporate PresentationAmir GorenNo ratings yet

- Final ProjectDocument12 pagesFinal ProjectelizabthomasNo ratings yet

- Global and Indian Telecom OSS - BSS MarketDocument5 pagesGlobal and Indian Telecom OSS - BSS MarketRAJESH KUMAR CHHATARNo ratings yet

- The IDC Study Now 1699965546Document7 pagesThe IDC Study Now 1699965546SURYA KANT PRASADNo ratings yet

- OND'13 Performance SlidesDocument4 pagesOND'13 Performance SlidesAbhishek DadaryaNo ratings yet

- Crompton Greaves FinalDocument39 pagesCrompton Greaves Finalchetanogra11No ratings yet

- Scope and Impact of Industry On Indian EconomyDocument66 pagesScope and Impact of Industry On Indian Economysomiya kausualNo ratings yet

- Smac ReportDocument52 pagesSmac ReportphamfanggleNo ratings yet

- TMForum-Telco Revenue Growth BenchmarkDocument86 pagesTMForum-Telco Revenue Growth BenchmarkHasan Mukti100% (1)

- SPJ ERP SeminarDocument28 pagesSPJ ERP Seminarapi-3806209100% (1)

- ERP Unit 4Document44 pagesERP Unit 4Sudhakar BolledduNo ratings yet

- Advanced Driver Assistance SystemsDocument11 pagesAdvanced Driver Assistance SystemsVinit DawaneNo ratings yet

- Setting The Context: Ranbir Pratik Pradhan, 1811041 Flextronics International, Ltd. Technology and Operations StrategyDocument4 pagesSetting The Context: Ranbir Pratik Pradhan, 1811041 Flextronics International, Ltd. Technology and Operations StrategyMadhusudhan KmsNo ratings yet

- Cae Software PDFDocument9 pagesCae Software PDFShyam KrishnanNo ratings yet

- KPMG IT SpendingDocument36 pagesKPMG IT Spendingankit191188No ratings yet

- Forrester 2020 B2B & B2C Commerce WavesDocument7 pagesForrester 2020 B2B & B2C Commerce WavesAxel KruseNo ratings yet

- PWC Global Software 100Document44 pagesPWC Global Software 100y_f2000No ratings yet

- Robotic Process Automation (RPA) in the Financial Sector: Technology - Implementation - Success For Decision Makers and UsersFrom EverandRobotic Process Automation (RPA) in the Financial Sector: Technology - Implementation - Success For Decision Makers and UsersNo ratings yet

- Classic Cover LetterDocument1 pageClassic Cover LetterSachin PanpatilNo ratings yet

- Guiter Scale and CordDocument10 pagesGuiter Scale and CordSachin Panpatil100% (1)

- Supply Chain Cycle Sub Process: Ordering and InvoicingDocument1 pageSupply Chain Cycle Sub Process: Ordering and InvoicingSachin PanpatilNo ratings yet

- World Class WarehousingDocument84 pagesWorld Class WarehousingSachin Panpatil89% (9)

- Getting Smart About SCMDocument4 pagesGetting Smart About SCMSachin PanpatilNo ratings yet

- SCM in Automotive IndustryDocument2 pagesSCM in Automotive IndustrySachin PanpatilNo ratings yet

- Advantages of Partnering WellDocument17 pagesAdvantages of Partnering WellSachin PanpatilNo ratings yet

- Knife Throw ExcelDocument2 pagesKnife Throw ExcelSachin PanpatilNo ratings yet

- Marathi Booklist For AllDocument4 pagesMarathi Booklist For AllSachin PanpatilNo ratings yet

- Vels Revised Thinking Processes1Document19 pagesVels Revised Thinking Processes1Sachin PanpatilNo ratings yet

- Safety OrientationDocument57 pagesSafety Orientationpramodbk_bgkNo ratings yet

- Best Practices For Inventory ReductionDocument36 pagesBest Practices For Inventory ReductionSachin Panpatil50% (2)

- Final 1Document51 pagesFinal 1jansky37No ratings yet

- Worksheet 2.1Object-Oriented Paradigm IntroductionDocument9 pagesWorksheet 2.1Object-Oriented Paradigm IntroductionLorena FajardoNo ratings yet

- CS101 Lecture 1 2019Document39 pagesCS101 Lecture 1 2019Shaheer QaziNo ratings yet

- Getting Started With Mathematica - Raspberry Pi ProjectsDocument14 pagesGetting Started With Mathematica - Raspberry Pi ProjectsHans Sebastian Navarrete LopezNo ratings yet

- Blockchain Technology PPT Project Final EditDocument17 pagesBlockchain Technology PPT Project Final EditHACKERS HOVELNo ratings yet

- Live Worksheets Maker 2Document2 pagesLive Worksheets Maker 2ingrid jamiNo ratings yet

- FiletypeDocument13 pagesFiletypeNeikos TenkoseiNo ratings yet

- 11g R2 RAC - SERVER POOLS - ORACLE IN ACTION PDFDocument16 pages11g R2 RAC - SERVER POOLS - ORACLE IN ACTION PDFbugzbinnyNo ratings yet

- PREFACE of Operating SystemsDocument4 pagesPREFACE of Operating SystemsAMIT RADHA KRISHNA NIGAMNo ratings yet

- 50 TOP SAP ABAP Multiple Choice Questions and Answers PDF - SAP ABAP Interview Questions and AnswersDocument10 pages50 TOP SAP ABAP Multiple Choice Questions and Answers PDF - SAP ABAP Interview Questions and Answersneschet0% (1)

- Ict 2 GuideDocument3 pagesIct 2 GuideTusiimeNo ratings yet

- Gaussian EleminationDocument7 pagesGaussian EleminationMuhammad RahmandaniNo ratings yet

- FSE Chapter 3Document32 pagesFSE Chapter 3Ermi TilaNo ratings yet

- Developer PorttfolioDocument1 pageDeveloper PorttfolioBachelor Gaming CommunityNo ratings yet

- Exadata Health Resource Usage 2021227Document111 pagesExadata Health Resource Usage 2021227ganurajNo ratings yet

- Dead Stock RegisterDocument92 pagesDead Stock RegisterRahil PatilNo ratings yet

- SACS TrainingDocument4 pagesSACS Trainingasma100% (1)

- Simatic Wincc v75 Sp1 Architectures enDocument56 pagesSimatic Wincc v75 Sp1 Architectures enGian Paolo Berardi GiampietroNo ratings yet

- Career Cert Paths Poster PDFDocument1 pageCareer Cert Paths Poster PDFI_ggizNo ratings yet

- Mi Band 2 - User Guide (English)Document3 pagesMi Band 2 - User Guide (English)Diep Tu KhuongNo ratings yet

- CX ManualDocument9 pagesCX Manualramlijavier75% (4)

- Automated Faculty Evaluation System Using PHP and mySQLDocument7 pagesAutomated Faculty Evaluation System Using PHP and mySQLHasnat Akbar100% (1)

- Release Information CODESYS - V3.5 SP6 Patch 4Document15 pagesRelease Information CODESYS - V3.5 SP6 Patch 4Ana Maria CNo ratings yet

- WLD 900 Installation and User's GuideDocument10 pagesWLD 900 Installation and User's GuideveerabossNo ratings yet

- Case Study - 05172021Document3 pagesCase Study - 05172021Rose CaveroNo ratings yet

- AraMDK 0.2Document107 pagesAraMDK 0.2Carlos David ChanchiNo ratings yet

- Ms-Access and PowerpointDocument33 pagesMs-Access and PowerpointRhen Tomboc Olasiman-MateoNo ratings yet

- Liverpool & Data Analysis PDFDocument1 pageLiverpool & Data Analysis PDFJan Toronell100% (1)

- Mobile S ManualDocument228 pagesMobile S ManualhenryvipxNo ratings yet

- Documentation of The Library Wagosyslog: Release 1.0.1.0Document25 pagesDocumentation of The Library Wagosyslog: Release 1.0.1.0MarcioWatanabeNo ratings yet