Professional Documents

Culture Documents

Chapter VII Taxable Bases and Rates

Uploaded by

Jasmin AlapagCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter VII Taxable Bases and Rates

Uploaded by

Jasmin AlapagCopyright:

Available Formats

Chapter 7: Taxable Bases and Tax Rates

TAX BASES

Compensation income, business and/or professional income, capital gains, passive income and other

income not subject to withholding taxes follow the global tax system

Allowable deductions as well as personal and additional exemptions are deducted from gross

income. The resulting figure is net taxable income

Noted: there are no deductions are allowed by law to be deducted from the gross compensation

income of an individual.

Gain from Sale of Property

Basis of taxes:

The cost, if acquired by purchase

The fair market value or value as of the date of acquisition if the it is acquired by inheritance

Fair market value or the value when it got into the hand of the donor, if its by donation or gift

Zonal Value at the time of transfer by way of purchase or donation

Whichever is the highest among the values above becomes the basis of the tax.

Nature of Asset or Property

a. Ordinary asset assets that are sold in the normal business. Examples is when Real Properties

are being sold by Real Estate developers. House and Lot becomes part of their inventory, then it

is subject to an ordinary asset. Cost is deducted to get the basis of computing tax.

b. Capital Asset in general, all real property not classified to be ordinary asset. Capital gains tax is

computed at 6% of the actual consideration, fair market value of the real property determined

by the commissioner, or which ever is higher.

Passive investment incomes

Incomes subject to withholding taxes are taxed on the gross amount, which means no

deductions of cost and expenses of sale.

TAX RATES

Graduated income tax rates on taxable income of individuals normally this is the rate being followed

by employees (no deductions are allowed except personal and additional exemptions) and also for self

employed individuals or businessman whom is allowed to have deductions related to their business or

profession.

Schedule

Not over P10,000 5%

Over P10,000 but not over P30,000 P500 + 10% in excess of P10,000

Over P30,000 but not over P70,000 P2,500 + 15% of the excesss over P30,000

Over P70,000 but not over P140,000 P8,500 + 20% in excess of P70,000

Over P140,000 but not over P250,000 P22,500 + 25% in excess of P140,000

Over P250,000 but not over P500,000 P50,000 + 30% in excess of P250,000

Over P500,000 P125,000 + 32% (beg yr 2000) in excess of P500,000

Note: This is the point of controversy in the congress were they are clamoring for ammendments

Compensation income of alien and Filipino employees of regional area headquarters, regional operating

headquarters, offshore banking units and foreign petroleum service contractors and sub-contractors,

are tax at the rate of 15% of gross income from sources within the Philippines.

Capital gains tax from shares of stocks

1. Shares of stocks of a domestic corporation listed and traded in a local stock exchange

Gross selling price P xxxx

Multiplied by rate of tax x of 1%

Stock transaction tax P xxxx

2. Unlisted shares of stocks (all normal corporations not traded in Phil Stock Exchange)

Gross selling price P xxxx

Less: Cost xxxx

Gain xxxx

Multiplied by rates of tax x 5%/10%

First P100,000 5% xxxx

In excess of P100,000 10% xxxx

Total tax xxxx

3. Share of stock of a foreign corporation held for more than 12 months

Gross selling price P500,000

Less: Cost 300,000

Gain P 200,000

Taxable gain (50%) P 100,000

Multiplied by rate of tax 5% - 3%

Ordinary income tax P 14,500

Interest Royalties Prizes and winnings:

Tax rates (20%) for interest from any currency bank deposit and yield or any other monetary benefit

from deposit substitutes and from trust funds and other similar arrangements, royalties prizes and other

winnings received by resident alien.

Exceptions

o Interest income from expanded foreign currency 7.5%

o Interest from long term deposit exempt

o Royalty on books as well as literary works and 10%

Musical composition

o Prizes amounting to less than P10,000 subject to graduated tax rate

o Winnings from PCS Lotto exempt

Cash and property dividends

Tax Rate: 10%

Sales of real property tax classified as capital asset

Tax Rate: 6% of cost or FMV or zonal Value (whicher is higher)

Noted: Zonal value and Fair market value is established by the commissioner of the Bureau of

Internal Revenue.

Sale of principal residence

Tax rate is 6%, but shall be exempt from 6% if proceeds of sale is fully utilized in acquiring or

constructing a new principal residence within 18 calendar months from the date of sale or disposition

and notified the commission within 30 days from the date of disposition of his intention to avail of the

tax exemption and it is availed only once every 10 years.

Regular corporate income tax (RCIT)

Tax rate: controversial 32%

Minimum Corporation income tax

The minimum tax of existing corporation for more than 3 years. The minimum tax is 2% of its

Gross Income (Gross Sales less Cost of Sales)

Domestice Corporations subject to preferential tax rates (Special rates)

a. Proprietary education institutions and hospital 10% except for those items in

letter d

b. Foreign currency deposit unit of a local uni or com bank 10%

c. Firms tax at special rate like PEZA SBCDA 5% final tax on gross income

d. Private education institutions exempt

Non stock non profit education institutions

e. Hospitals exempt

Inter corporate dividends / Resident foreign corporations

Not subject to tax

Resident foreign corporations

a. Internationsl carriers by air or water 2-1/2 % on Phil billings

b. Offshore banking units 10%

c. Regional operation headquarters 10% of their net taxable income

From sources w/in Phils

d. Foreign currency deposit unit in the phil of a foreign bank 10%

e. Branch of foreign corporations registered with PEZA, SBMA,

CDA, CJHHDA exempt

f. Qualified service contractor and sub-contractor engaged in petroleum 8%

Income of a domestic corporation or resident foreign corporation: 30%

Income of non resident foreign corporation subject 25% of its gross income

from sources w/in Philippines.

With Preferential rates:

a. Non resident cinematographic film owner 25% of gross income

b. Non-resident owner or lessor or vessel chartered by

Phil nationals 4-1/2% of gross rentals

c. Non resident owner or lessor of aircraft 7-1/2% of gross rentals or fees

d. Interest income on foreign loans 20%

e. Cash and/or property dividends 15%

Chapter 8: Ordinary Assets and Capital Assets and Tax Free Exchanges

You might also like

- Mabeza vs. NLRC labor case rulingDocument12 pagesMabeza vs. NLRC labor case rulingJasmin AlapagNo ratings yet

- Transpo Day 2 CasesDocument7 pagesTranspo Day 2 CasesJasmin AlapagNo ratings yet

- Transpo Day 2 CasesDocument7 pagesTranspo Day 2 CasesJasmin AlapagNo ratings yet

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin Alapag100% (2)

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin AlapagNo ratings yet

- Transpo Day 1 CasesDocument10 pagesTranspo Day 1 CasesJasmin AlapagNo ratings yet

- NIRC Sections Related To Gross IncomeDocument11 pagesNIRC Sections Related To Gross IncomeJasmin AlapagNo ratings yet

- PERSONS Complete DigestsDocument233 pagesPERSONS Complete DigestsJamie Del CastilloNo ratings yet

- Chapter V1 Cost and Deductions PART IDocument7 pagesChapter V1 Cost and Deductions PART IJasmin AlapagNo ratings yet

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin Alapag100% (2)

- Transpo Day 1 CasesDocument10 pagesTranspo Day 1 CasesJasmin AlapagNo ratings yet

- Chapter V1 Cost and Deductions PART IDocument8 pagesChapter V1 Cost and Deductions PART IJasmin AlapagNo ratings yet

- Chapter IX Accounting Method, Periods and Filing of ITRDocument4 pagesChapter IX Accounting Method, Periods and Filing of ITRJasmin AlapagNo ratings yet

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin AlapagNo ratings yet

- Chapter IX Accounting Method, Periods and Filing of ITRDocument4 pagesChapter IX Accounting Method, Periods and Filing of ITRJasmin AlapagNo ratings yet

- Tax Chapter 7Document5 pagesTax Chapter 7Jasmin AlapagNo ratings yet

- Chapter V1 Cost and Deductions PART IDocument7 pagesChapter V1 Cost and Deductions PART IJasmin AlapagNo ratings yet

- Chapter IX Accounting Method, Periods and Filing of ITRDocument4 pagesChapter IX Accounting Method, Periods and Filing of ITRJasmin AlapagNo ratings yet

- Cover SheetDocument1 pageCover SheetJasmin AlapagNo ratings yet

- Chapter IX Accounting Method, Periods and Filing of ITRDocument4 pagesChapter IX Accounting Method, Periods and Filing of ITRJasmin AlapagNo ratings yet

- Chapter IV Gross Income NotesDocument5 pagesChapter IV Gross Income NotesJasmin AlapagNo ratings yet

- Tax Rates Effective January 1, 1998 Up To PresentDocument8 pagesTax Rates Effective January 1, 1998 Up To PresentJasmin AlapagNo ratings yet

- Getz 1Document1 pageGetz 1Jasmin AlapagNo ratings yet

- A. What Is A "Common Carrier"?Document26 pagesA. What Is A "Common Carrier"?Jasmin AlapagNo ratings yet

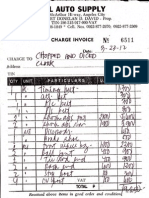

- Chopped and Diced Hot Rod Shop, Inc. Clark Freeport ZoneDocument6 pagesChopped and Diced Hot Rod Shop, Inc. Clark Freeport ZoneJasmin AlapagNo ratings yet

- Legal Brief For Assignment 2.docx Rev3Document5 pagesLegal Brief For Assignment 2.docx Rev3Jasmin AlapagNo ratings yet

- HK Tour PackageDocument1 pageHK Tour PackageJasmin AlapagNo ratings yet

- UntitledDocument1 pageUntitledJasmin AlapagNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Alternative Investment Funds: Meaning, Taxation, Regulations & ListDocument7 pagesAlternative Investment Funds: Meaning, Taxation, Regulations & Listsanket karwaNo ratings yet

- BONDSDocument5 pagesBONDSKyrbe Krystel AbalaNo ratings yet

- Micro Small Medium Enterprises PolicyDocument22 pagesMicro Small Medium Enterprises PolicySai PragnaNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- VCICPlayer HandbookDocument17 pagesVCICPlayer HandbookKarma TsheringNo ratings yet

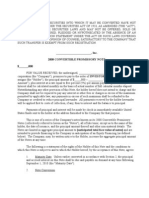

- Generic Convertible NoteDocument8 pagesGeneric Convertible Noteg4nz0100% (1)

- José Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1Document8 pagesJosé Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1karen hudes100% (1)

- Ras Gas ProjectDocument12 pagesRas Gas ProjectAritra MandalNo ratings yet

- Pakistan Derivative MarketDocument13 pagesPakistan Derivative MarketPratik ChourasiaNo ratings yet

- The Baby Boomer BustDocument13 pagesThe Baby Boomer BustPeter MaverNo ratings yet

- User Manual For Dealer TerminalDocument64 pagesUser Manual For Dealer TerminalBirender Pal SikandNo ratings yet

- SEBI's Disclosures and Investor Protection Guidelines Explained! Do You FeelDocument2 pagesSEBI's Disclosures and Investor Protection Guidelines Explained! Do You Feelabhisheksh100% (2)

- Financial Services Competency ModelDocument10 pagesFinancial Services Competency ModelDon CamNo ratings yet

- Global Water Intelligence: Volume 5 Issue 4 April 2004Document32 pagesGlobal Water Intelligence: Volume 5 Issue 4 April 2004Aravind NatarajanNo ratings yet

- Barai and Longueuil Arrest PRDocument5 pagesBarai and Longueuil Arrest PRAbsolute ReturnNo ratings yet

- AF301 Final Exam Semester 2, 2014Document8 pagesAF301 Final Exam Semester 2, 2014Anonymous 9dEMgo0No ratings yet

- Ashok Resume NewDocument3 pagesAshok Resume NewVishvajeet DasNo ratings yet

- Maggie Crisis ManagementDocument21 pagesMaggie Crisis ManagementAshif Khan100% (1)

- Tennis Trading The Ultimate GuideDocument32 pagesTennis Trading The Ultimate GuideGabi Luka100% (3)

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- Financial Management and Financial ObjectivesDocument78 pagesFinancial Management and Financial Objectivesnico_777No ratings yet

- Alternate Investment FundsDocument5 pagesAlternate Investment FundsJhansi DevarasettyNo ratings yet

- Ratio AnalysisDocument51 pagesRatio AnalysisSeema RahulNo ratings yet

- Zerify Answer To ComplaintDocument27 pagesZerify Answer To ComplaintYTOLeaderNo ratings yet

- Question Paper Code:: Reg. No.Document12 pagesQuestion Paper Code:: Reg. No.Saravana KumarNo ratings yet

- NPAs and SecuritizationDocument18 pagesNPAs and SecuritizationVikku AgarwalNo ratings yet

- Green Shoe OptionDocument15 pagesGreen Shoe OptionNadeem Ahmad100% (1)

- Wortham LabsDocument2 pagesWortham LabsDan LehrNo ratings yet

- Basic Financial StatementsDocument14 pagesBasic Financial StatementssajjadNo ratings yet

- Advanced Battery Technologies, Inc.: Here HereDocument35 pagesAdvanced Battery Technologies, Inc.: Here HerePrescienceIGNo ratings yet