Professional Documents

Culture Documents

Mrunal Disinvestment in India - Timeline, Criticism, Modi's New Policy

Uploaded by

harsha143saiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrunal Disinvestment in India - Timeline, Criticism, Modi's New Policy

Uploaded by

harsha143saiCopyright:

Available Formats

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 1/7

- Mrunal - http://mrunal.org -

[Disinvestment] Timeline, Methods, Pro & Anti Arguments,

Modi Policy on PSU reforms and Disinvestment

1. Prologue

2. Disinvestment Timeline in India

3. Two methods of disinvestment

4. Retail investors participation? Hardly!

5. Disinvestment: arguments in favor and against

6. Modi-Reform1: Disinvesting NHPC, Coal India, ONGC

7. Modi Reform2: Revive 5 and shut down 6

8. Mock Questions

Prologue

Combining Disinvestment theory and current affairs topics scattered around

1. Akshay Dhadda and Ashok Charans entries under the erstwhile write2win competition.

2. Sept.Week2: Disinterment in NHPC, Coal India and ONGC

3. Sept. Week3: Two Methods of disinvestment- benefits and limitations.

4. Sept. Week4: Government to shut down 5 PSUs and revive 6.

Disinvestment Timeline in India

Disinvestment: When Government sells its shares of a PSU, to private sector company

/ individual.

Privatization: when Government sells so many shares, that it no longer remains the

majority shareholder of the given PSU.

1991

Interim budget, Government announced 20% disinvestment in selected

PSUs.

Their shares were sold to Mutual funds and financial institutions (UTI,

EPFO, LIC etc.)

1992 Government decides to sells shares to FIIs, PSU employees and banks.

1993

Rangarajan Committee suggests:

1. 49% disinvestment in PSUs reserved for public sector

2. 74% disinvestment in all other PSUs

Government did not implement.

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 2/7

1996 Disinvestment commission under GV Ramakrishna. It was a non-statutory,

advisory body (similar to UPAs NAC).

1998-

2000

Vajpayee Government classifies PSUs into two parts

1. Strategic: arms-ammunition, railway, nuke energy etc.=> here we wont do

disinvestment

2. Non-strategic: those not in above category.=> here we will do

disinvestment in a phased manner. Hindustan Zinc, BALCO, Maruti

Disinvestment taken up.

To implement above policy, Department of disinvestment setup under Finance

ministry. (first there was disinvestment ministry, then department.not going into

all ball by ball commentary)

2004

UPA comes into power, Common Minimum program (CMP) updates

disinvestment policy

Sick PSUs will be revived

No disinvestment in profit making PSUs

PSUs will get commercial autonomy

2005

Whatever Money Government earns from selling its PSU shares- itll goto

National investment fund (NIF). Click me to read more about it.

2005-

09

Disinvestment remains stagnant because Left allies of the UPA Government

stonewall everything.

2009

onwards

UPA-2 without left parties. Government resumes disinvestment process.

All PSUs can be disinvested, but upper limit: 49%

Disinvestment Method: only public offer.

2013-

14

Chindu wanted to earn 40,000 crores via disinvestment of Indian Oil, BHEL,

NHPC, Neyveli lignite etc. but hardly managed to get ~16,000 crores. Main

reasons for #EPICFAIL:

1. Oil ministry, mining ministry, trade unions opposed the move, files were

delayed.

2. Lukewarm response from investors because sharemarket was down due to

internal & external factors.

2014

Modi cabinet approves disinvestment in NHPC, Coal India, ONGC

6 EPICFAIL PSUs will be closed down.

5 loss making but viable PSUs will be revived.

Two methods of disinvestment

IIP Via stock exchange

Via Institutional placement program. Directly selling

the shares to another company / institution / mutual fund

or other large player.

Directly selling shares on stock

exchange

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 3/7

Requires more clearances.

Faster, needs less

clearances.

SEBI requires in each PSU,

minimum 25% shares be

held by public.

Hence Government using

this method to quickly

comply with SEBI norms.

Friendly to institutional investors (Mutual funds,

pension /insurance funds etc.)

Friendly to retail investors.

Retail investors participation? Hardly!

So, In theory, disinvestment via stock exchange = retail investors should be able to

purchase those sarkaari shares.

But, after disinvestment, the market price and issue price of the company shares start

converging.

Therefore, a retail investor cannot reap the benefit (by selling it to third party at higher

price). Hell have to wait for medium to long term before company share prices begin to

rise again.

But retail investors dont like to wait that long, hence disinvestment doesnt generate

interest of retail investors.

Solution: ETF exchange traded funds. Click me to learn more about it.

Disinvestment: arguments in favor and against

Against In Favour

Socialist / leftist ideology: private

sector cannot achieve equal distribution

of resources for all classes.

Private enterprises only focus on profit

maximization. They wont cater poor

people.

Therefore Government needs to control

all or some industrial sectors.

Such Government controlled units

cannot compete in free market

economy due to political interference

and price control mechanisms.

Ultimately more public money is

wasted in running these loss making

entities.

Governments dividend income will

decline. (Because theyll have less

shares).

Consequently, Fiscal deficit will

increase.

Whatever dividend Government

earned so far- compared to that,

Government has spent far more

crores rupees to revive these PSUs.

There is no point in throwing good

money after bad money.

A survey indicated 0.5% retail

participation (i.e. Aam Admi

investment) in equity market.

Absurd logic, that just because

corporates will benefit, we shouldnt

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 4/7

Meaning, only Large corporates and

financial institutions will benefit from

this drive.

Itll not help in financial inclusion

begin disinvestment.

Government already taken plenty of

initiatives on financial inclusion

front.

The funds received from disinvestment are

used to finance fiscal deficit. This is unhealthy

practise, like selling family gold to buy daily

dose of desi liquor.

Need amendments in FRBM act to ensure

this doesnt happen.

After disinvestment employees of PSUs

will loss their jobs

If board of directors have many private

sector experts- they may approve plans

to reduce staff strength, to increase

profitability.

Overstaffing = One of the main

reasons why PSUs dont make

optimum profit. At some point weve

to swallow the bitter pill.

Besides, such employees are given

attractive VRS offers.

Disinvestment would lead to private

monopolies

Dragging the logic too far. Unlikely to

happen in todays world. CCI is always

watching and punishing the firms that try to

create monopoly or oligopoly.

Allegations that PSEs are sold cheap to

preferred parties e.g. BALCO

That used to happen in 90s era, when

Government sold shares to specific

private companies at an arbitrary

price.

But, Unlikely to happen if shares

directly sold via stock exchange. +

CAG, Media very active these days.

To complete the disinvestment targets,

Government asks one PSUs to buy

shares of another PSU.

e.g. ordering LIC to buy ONGCs

sharesIski topi uske sir pe. In such

cases, disinvestment doesnt decrease

Government control over those

companies.

Need for a clear policy on disinvestment to

stop this practice.

Speed of Disinvestment

Should India adopt rapid pace of disinvestment/privatization or move with a slow pace? Taking

example of disinvestment process of other countries:

Disinvestment Speed

1993: Czech Republic disinvested ~1000 state owned enterprises.

Russia did same.

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 5/7

Rapid speed Results were disappointing in both the cases.

Hence rapid approach= not recommended for India

Slow speed

China- after more Open Door Policy in 1978.

But speed too slow- thousands of enterprises still under Government

ownership.

Middle

speed

Most suitable for India

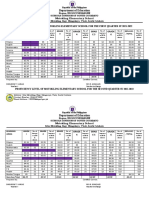

Modi PSU-reform1: Disinvesting NHPC, Coal India, ONGC

Data not important except for random GK in non-UPSC exams & interviews

Org underMinistrygovt.shareholding

Approved

disinvestment

Issues

NHPC Power 86% 11.36%

Has 20 hydroelectric

power stations.

Unable to recover dues

from electricity utility

companies=> company

making huge losses.

Hence it share price

wont fetch truckload of

cash to Government.

Coal

India

Ltd

coal ~90% 10%

Labour union strike may

bring down share price.

So Government maynot

earn truckload of cash

from selling these coal

India shares.

ONGC petroleum ~69% 5%

Maharatna PSU

If Government clears the

gas price policy, ONGCs

share prices will go up

(And after that

Government should sell

it- to earn truckload of

cash).

Note: in PSUs, Government owns the shares, in the name of President of India.

Modi PSU-reform2: Revive 5 and shut down 6

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 6/7

2014, Sep. week2: Union Government finished reviewing 11 PSUs: 5 worth savings and 6

worth closing.

Names not important except for random GK in bank exams

6 epicfails beyond saving 5 worth saving

1. Hindustan Photo Films

2. HMT Bearings

3. HMT Watches

4. HMT Chinar Watches

5. Hindustan Cables.

6. Tungabhadra Steel Products Ltd

1. HMT Machine

Tools

2. Heavy

Engineering

Corporation

3. NEPA

4. Nagaland Paper

& Pulp Co

5. Triveni

Structurals

These will be given 1000 crore rupees to give VRS to employees

then shut down operations. Total employees ~3600

October week2: HMT watches in news, because theyve tied up with flipkart.com to sell

away the remaining stock of wrist watches.

Mock Questions

MCQs:

10/15/2014 Mrunal Disinvestment in India: Timeline, Criticism, Modi' s new Policy

http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-anti-arguments-modi-policy.html/print/ 7/7

1. Non-UPSC exams: Trivial fact based questions- In September 2014, Government

approved closing down Which of the following companies? How many crores does

Government want to make from disinvestment?

2. CSAT: assertion-reasoning, cause consequences type. Which of the statements are

correct about disinvestment process in India / NIF etc.

Mains: Answer following in 200 words each:

1. Outline the main objectives and achievements of the policy of disinvestment in India?

[Mains 2002]

2. The Public sector undertakings have lost relevance in the post 1991 Indian economy. Do

you agree? Justify your stand.

3. Public sector undertakings in India, have often been criticized for their poor efficiency

and low profitability. Examine the reasons and suggest remedies.

Published on 13/10/2014 @ 7:16 pm under Category: Economy

URL to article: http://mrunal.org/2014/10/disinvestment-india-timeline-methods-pro-

anti-arguments-modi-policy.html

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Cointelpro: FBI Domestic Intelligence Activities COINTELPRO Revisited - Spying & DisruptionDocument6 pagesCointelpro: FBI Domestic Intelligence Activities COINTELPRO Revisited - Spying & DisruptionDarkk SunnNo ratings yet

- Kerala Panchayath Building RulesDocument1 pageKerala Panchayath Building Rulesjincy syajuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Excessive DelegationDocument13 pagesExcessive DelegationAkshar Haritwal77% (22)

- Positive ChristianityDocument7 pagesPositive ChristianityJeanne J. Nunez100% (1)

- Swamys Handbook For Central Govt Employees PDFDocument4 pagesSwamys Handbook For Central Govt Employees PDFSauravDagur0% (1)

- Vision Ias Geography Xaam - inDocument81 pagesVision Ias Geography Xaam - inharsha143sai100% (2)

- Emotional Freedom e BookDocument6 pagesEmotional Freedom e Bookgabriel castro100% (1)

- Credit InstrumentsDocument7 pagesCredit Instrumentsharsha143saiNo ratings yet

- Interpretive Theories - Dworkin Sunstein and ElyDocument26 pagesInterpretive Theories - Dworkin Sunstein and ElyChristopher J. Lin100% (1)

- Doctrine of Purposeful HesitationDocument3 pagesDoctrine of Purposeful HesitationLen Vicente - Ferrer100% (1)

- Marcos, Jr. V RepublicDocument3 pagesMarcos, Jr. V RepublicevgciikNo ratings yet

- Criminal Investigation and Detection Group Criminal Investigation and Detection Group Region Iii Criminal Investigation and Detection Group BulacanDocument2 pagesCriminal Investigation and Detection Group Criminal Investigation and Detection Group Region Iii Criminal Investigation and Detection Group BulacanTarlac CidgNo ratings yet

- CPT Economics MCQDocument57 pagesCPT Economics MCQharsha143sai100% (1)

- Woman EmpowermentDocument16 pagesWoman Empowermentremya chandranNo ratings yet

- Chapter 8: Confederation To ConstitutionDocument36 pagesChapter 8: Confederation To ConstitutionJoe ShmoeNo ratings yet

- Physical GeographyDocument20 pagesPhysical Geographydivyamittalias100% (3)

- Southeast Mindanao V Balite PortalDocument2 pagesSoutheast Mindanao V Balite PortalGracia SullanoNo ratings yet

- An Indian Pilgrim PDFDocument150 pagesAn Indian Pilgrim PDFsoceeNo ratings yet

- An Entrance To The Vedanta - 2Document31 pagesAn Entrance To The Vedanta - 2harsha143saiNo ratings yet

- National Food Security ActDocument2 pagesNational Food Security Actharsha143saiNo ratings yet

- Nationalmanufacturingpolicy 120303185940 Phpapp01Document11 pagesNationalmanufacturingpolicy 120303185940 Phpapp01harsha143saiNo ratings yet

- Data GDPDocument4 pagesData GDPharsha143saiNo ratings yet

- IASbabas Daily Current Affairs 6th May 2016Document6 pagesIASbabas Daily Current Affairs 6th May 2016harsha143saiNo ratings yet

- Credit CreationDocument9 pagesCredit CreationGautam SinghNo ratings yet

- 14th Finance CommissionDocument5 pages14th Finance CommissionSarfaraj KhanNo ratings yet

- Chapter - 4: Unit 1 Meaning and Types of MarketsDocument58 pagesChapter - 4: Unit 1 Meaning and Types of Marketsharsha143saiNo ratings yet

- India's Foreign Trade: Direction and Composition of Trade: Presented by Range Gowda I PH.D (Agril. Economics)Document44 pagesIndia's Foreign Trade: Direction and Composition of Trade: Presented by Range Gowda I PH.D (Agril. Economics)harsha143saiNo ratings yet

- IASbabas Daily Current Affairs 14th May 2016Document4 pagesIASbabas Daily Current Affairs 14th May 2016harsha143saiNo ratings yet

- IASbabas Daily Current Affairs 4th May 2016Document6 pagesIASbabas Daily Current Affairs 4th May 2016harsha143saiNo ratings yet

- IASbabas Daily Current Affairs 5th May 2016Document7 pagesIASbabas Daily Current Affairs 5th May 2016harsha143saiNo ratings yet

- Pranjal PatilDocument3 pagesPranjal Patilharsha143saiNo ratings yet

- IASbaba Press Information Bureau PIB - 2nd May To 8th May 2016Document20 pagesIASbaba Press Information Bureau PIB - 2nd May To 8th May 2016harsha143saiNo ratings yet

- Mrunal (GS3) Space-Tech - Thirty Meter Telescope, InO, ToPSDocument6 pagesMrunal (GS3) Space-Tech - Thirty Meter Telescope, InO, ToPSharsha143saiNo ratings yet

- (WWW - Entrance Exam - Net) General Knowledge RRB IDocument6 pages(WWW - Entrance Exam - Net) General Knowledge RRB IKomala RajagopalNo ratings yet

- Control SensesDocument7 pagesControl Sensesharsha143saiNo ratings yet

- India Crisis OpportunityDocument8 pagesIndia Crisis Opportunityharsha143saiNo ratings yet

- Mrunal (Banking) Prime Minister's Jan Dhan Yojana - Features, BenefitsDocument8 pagesMrunal (Banking) Prime Minister's Jan Dhan Yojana - Features, Benefitsharsha143saiNo ratings yet

- Mrunal Banking - P.J Nayak Committee On GovtDocument9 pagesMrunal Banking - P.J Nayak Committee On Govtharsha143saiNo ratings yet

- Gandhi in The 21st Century Search For An Alternative Development ModelDocument3 pagesGandhi in The 21st Century Search For An Alternative Development Modelharsha143saiNo ratings yet

- Ethics For Civil ServicesDocument4 pagesEthics For Civil Servicesamarsinha1987No ratings yet

- Procter & Gamble Manufacturing Company v. Dennis Fisher, 449 U.S. 1115 (1981)Document3 pagesProcter & Gamble Manufacturing Company v. Dennis Fisher, 449 U.S. 1115 (1981)Scribd Government DocsNo ratings yet

- An Africa ThunderstormDocument2 pagesAn Africa Thunderstormanitha100% (1)

- Towards Bureaucractic Reform - BingDocument32 pagesTowards Bureaucractic Reform - Bingmrchinaeyes7878No ratings yet

- Fidelity CEO William Foley Aware of Federal ViolationsDocument2 pagesFidelity CEO William Foley Aware of Federal ViolationsAdrian LoftonNo ratings yet

- Gwa 1st 2nd Quartersy2021 2022finalDocument2 pagesGwa 1st 2nd Quartersy2021 2022finalJorell Jun de la PeñaNo ratings yet

- Zambia Weekly - Week 47, Volume 1, 26 November 2010Document8 pagesZambia Weekly - Week 47, Volume 1, 26 November 2010Chola MukangaNo ratings yet

- As 4538.2-2000 Guide To The Sampling of Alumina Preparation of SamplesDocument5 pagesAs 4538.2-2000 Guide To The Sampling of Alumina Preparation of SamplesSAI Global - APACNo ratings yet

- Oglesby v. Sanders - Document No. 3Document1 pageOglesby v. Sanders - Document No. 3Justia.comNo ratings yet

- The Imperial Ideal - W.F. MonypennyDocument8 pagesThe Imperial Ideal - W.F. MonypennyPedro FariaNo ratings yet

- Jurisprudence PossessionDocument64 pagesJurisprudence PossessionGuevarra AngeloNo ratings yet

- An Act Strengthening The Juvenile Justice System in The Philippines, Amending For The Purpose, Otherwise Known As The "Juvenile Justice and Welfare Act of 2006" and Appropriating Funds ThereforDocument3 pagesAn Act Strengthening The Juvenile Justice System in The Philippines, Amending For The Purpose, Otherwise Known As The "Juvenile Justice and Welfare Act of 2006" and Appropriating Funds ThereforGee AbanNo ratings yet

- Government and Citizens in A Globally Interconnected World of StatesDocument18 pagesGovernment and Citizens in A Globally Interconnected World of StatesLeslie Joy Brier100% (1)

- Corruption in Indonesia: Panca Permasih Ningrum Agam Jayantara Lolita Putri RamadhanieDocument15 pagesCorruption in Indonesia: Panca Permasih Ningrum Agam Jayantara Lolita Putri RamadhaniePancaNo ratings yet

- Cooperative Society ActDocument9 pagesCooperative Society Actazaudeen100% (1)

- Last Leaf Woksheet PDFDocument2 pagesLast Leaf Woksheet PDFKM DaetNo ratings yet

- Sgif Eligibility From 2022-2023Document2 pagesSgif Eligibility From 2022-2023Venkat Ulise25% (4)

- 2022-Election-Guidelines-fin (3) (Edited)Document5 pages2022-Election-Guidelines-fin (3) (Edited)lielNo ratings yet

- GradationList AAO of 18Document90 pagesGradationList AAO of 18Kausik DattaNo ratings yet