Professional Documents

Culture Documents

Finals Tax Cases

Uploaded by

rethiram0 ratings0% found this document useful (0 votes)

64 views18 pagesPetitioner is engaged in a public utility business, transporting passengers and cargoes by motor trucks, over its authorized lines in Mindanao. The City Assessor assessed a realty tax on several equipment and machineries of Mindanao Bus Company. The bus company appealed the assessment to the Board of tax Appeals on the ground that the same are not realty.

Original Description:

Original Title

finals tax cases.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPetitioner is engaged in a public utility business, transporting passengers and cargoes by motor trucks, over its authorized lines in Mindanao. The City Assessor assessed a realty tax on several equipment and machineries of Mindanao Bus Company. The bus company appealed the assessment to the Board of tax Appeals on the ground that the same are not realty.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views18 pagesFinals Tax Cases

Uploaded by

rethiramPetitioner is engaged in a public utility business, transporting passengers and cargoes by motor trucks, over its authorized lines in Mindanao. The City Assessor assessed a realty tax on several equipment and machineries of Mindanao Bus Company. The bus company appealed the assessment to the Board of tax Appeals on the ground that the same are not realty.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 18

I. MINDANAO BUS COMPANY V.

CITY ASSESSOR AND TREASURER

6 SCRA 197

FACTS:

Petitioner is engaged in a public utility business, solely engaged in transporting passengers and cargoes by motor

trucks, over its authorized lines in Mindanao. It owns a main office and branch offices. To be found in their offices are

machineries and equipment, which were assessed by the City Assessor as real properties.

HELD:

Movable equipments to be immobilized in contemplation of law must first be essential and principal elements of an industry

or works without which such industry or works would be unable to function or carry on the industrial purpose for

which it was established. We may here distinguish

those movables, which are essential and principal elements of an industry, from those which may not be so considered

immobilized by destination because they are merely incidental, not essential and principal.

In the case at bar, the tools and equipments in question are by their nature not essential and principal elements of

petitioners business of transporting passengers and cargoes by motor trucks. They are merely incidentals.

Mindanao Bus Company vs City Assessor

Posted on June 24, 2013

Mindanao Bus Company vs City Assessor

116 PHIL 501

GR No. L-17870

September 29, 1962

FACTS

The City Assessor of Cagayan de Oro City assessed a realty tax on several equipment and machineries of Mindanao Bus Co. These

equipment were placed on wooden or cement platforms and can be moved around in the bus companys repair shop. The bus company

appealed the assessment to the Board of Tax Appeals on the ground that the same are not realty. The Board of Tax Appeals of the

City, however, sustained the city assessor. Thus, the bus company appealed to the Court of Tax Appeals, which likewise sustained the

city assessor.

HELD

Art. 415 of the NCC classifies the following as immovable property:

xxx

(5) Machinery, receptacles, instruments or implements intended by the owner pf the tenement for an industry or works

which may be carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry

or works;

Note that the stipulation expressly states that the equipment are placed on wooden or cement platforms. They can be moved around

and about in petitioner's repair shop.

Before movables may be deemed immobilized in contemplation of Article 415 (5), it is necessary that they must first be essential

and principal elements of an industry or works without which such industry or works would be unable to function or carry on the

industrial purpose for which it was established.

In this case, the tools and equipment in question are by their nature, not essential and principal elements of Mindanao Bus Co.s

business of transporting passengers and cargoes by motor trucks. They are merely incidentals acquired as movables and used

only for expediency to facilitate and/or improve its service. Even without such tools and equipments, its business may be carried on.

Aside from the element of essentiality the Art.415 (5) also requires that the industry or works be carried on in a building or on a

piece of land. A sawmill would also be installed in a building on land more or less permanently, and the sawing is conducted in the

land/building.

However, in the instant case, the equipments in question are destined only to repair or service the transportation business, which is

not carried on in a building or permanently on a piece of land, as demanded by law. The equipments in question are not absolutely

essential to the petitioner's transportation business, and petitioner's business is not carried on in a building, tenement or on a

specified land.

As such, the equipments in question are not deemed real property because the transportation business is not carried on in a building

or permanently on a piece of land, as demanded by law.

The transportation business could be carried on without the repair or service shop, if its rolling equipment is repaired or serviced in

another shop belonging to another.

Therefore, the imposition of realty tax on the maintenance and repair equipment was not proper because the properties involved were

not real property under Article 415 (5).

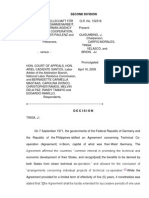

EN BANC

G.R. No. L-17870 September 29, 1962

MINDANAO BUS COMPANY, Petitioner, vs. THE CITY ASSESSOR & TREASURER and the BOARD OF TAX APPEALS of

Cagayan de Oro City, Respondents.

Binamira, Barria and Irabagon for petitioner.

Vicente E. Sabellina for respondents.

LABRADOR, J .:chanrobles virtual law library

This is a petition for the review of the decision of the Court of Tax Appeals in C.T.A. Case No. 710 holding that the petitioner

Mindanao Bus Company is liable to the payment of the realty tax on its maintenance and repair equipment hereunder referred

to.chanroblesvirtualawlibrarychanrobles virtual law library

Respondent City Assessor of Cagayan de Oro City assessed at P4,400 petitioner's above-mentioned equipment. Petitioner appealed

the assessment to the respondent Board of Tax Appeals on the ground that the same are not realty. The Board of Tax Appeals of the City

sustained the city assessor, so petitioner herein filed with the Court of Tax Appeals a petition for the review of the

assessment.chanroblesvirtualawlibrarychanrobles virtual law library

In the Court of Tax Appeals the parties submitted the following stipulation of facts:

Petitioner and respondents, thru their respective counsels agreed to the following stipulation of facts:chanrobles virtual law library

1. That petitioner is a public utility solely engaged in transporting passengers and cargoes by motor trucks, over its authorized lines in the

Island of Mindanao, collecting rates approved by the Public Service Commission;chanrobles virtual law library

2. That petitioner has its main office and shop at Cagayan de Oro City. It maintains Branch Offices and/or stations at Iligan City, Lanao;

Pagadian, Zamboanga del Sur; Davao City and Kibawe, Bukidnon Province;chanrobles virtual law library

3. That the machineries sought to be assessed by the respondent as real properties are the following:

(a) Hobart Electric Welder Machine, appearing in the attached photograph, marked Annex "A";chanrobles virtual law library

(b) Storm Boring Machine, appearing in the attached photograph, marked Annex "B";chanrobles virtual law library

(c) Lathe machine with motor, appearing in the attached photograph, marked Annex "C";chanrobles virtual law library

(d) Black and Decker Grinder, appearing in the attached photograph, marked Annex "D";chanrobles virtual law library

(e) PEMCO Hydraulic Press, appearing in the attached photograph, marked Annex "E";chanrobles virtual law library

(f) Battery charger (Tungar charge machine) appearing in the attached photograph, marked Annex "F"; andchanrobles virtual law library

(g) D-Engine Waukesha-M-Fuel, appearing in the attached photograph, marked Annex "G".

4. That these machineries are sitting on cement or wooden platforms as may be seen in the attached photographs which form part of this

agreed stipulation of facts;chanrobles virtual law library

5. That petitioner is the owner of the land where it maintains and operates a garage for its TPU motor trucks; a repair shop; blacksmith

and carpentry shops, and with these machineries which are placed therein, its TPU trucks are made; body constructed; and same are

repaired in a condition to be serviceable in the TPU land transportation business it operates;chanrobles virtual law library

6. That these machineries have never been or were never used as industrial equipments to produce finished products for sale, nor to repair

machineries, parts and the like offered to the general public indiscriminately for business or commercial purposes for which petitioner

has never engaged in, to date.

The Court of Tax Appeals having sustained the respondent city assessor's ruling, and having denied a motion for reconsideration,

petitioner brought the case to this Court assigning the following errors:

1. The Honorable Court of Tax Appeals erred in upholding respondents' contention that the questioned assessments are valid; and that

said tools, equipments or machineries are immovable taxable real properties.chanroblesvirtualawlibrarychanrobles virtual law library

2. The Tax Court erred in its interpretation of paragraph 5 of Article 415 of the New Civil Code, and holding that pursuant thereto the

movable equipments are taxable realties, by reason of their being intended or destined for use in an

industry.chanroblesvirtualawlibrarychanrobles virtual law library

3. The Court of Tax Appeals erred in denying petitioner's contention that the respondent City Assessor's power to assess and levy real

estate taxes on machineries is further restricted by section 31, paragraph (c) of Republic Act No. 521; andchanrobles virtual law library

4. The Tax Court erred in denying petitioner's motion for reconsideration.

Respondents contend that said equipments, tho movable, are immobilized by destination, in accordance with paragraph 5 of Article

415 of the New Civil Code which provides:

Art. 415. - The following are immovable properties:

x x x x x x x x xchanrobles virtual law library

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be

carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works. (Emphasis ours.)

Note that the stipulation expressly states that the equipment are placed on wooden or cement platforms. They can be moved around

and about in petitioner's repair shop. In the case of B. H. Berkenkotter vs. Cu Unjieng, 61 Phil. 663, the Supreme Court said:

Article 344 (Now Art. 415), paragraph (5) of the Civil Code, gives the character of real property to "machinery, liquid containers,

instruments or implements intended by the owner of any building or land for use in connection with any industry or trade being carried

on therein and which are expressly adapted to meet the requirements of such trade or industry."chanrobles virtual law library

If the installation of the machinery and equipment in question in the central of the Mabalacat Sugar Co., Inc., in lieu of the other of

less capacity existing therein, for its sugar and industry, converted them into real property by reason of their purpose, it cannot be said

that their incorporation therewith was not permanent in character because, as essential and principle elements of a sugar central, without

them the sugar central would be unable to function or carry on the industrial purpose for which it was established. Inasmuch as the

central is permanent in character, the necessary machinery and equipment installed for carrying on the sugar industry for which it has

been established must necessarily be permanent. (Emphasis ours.)

So that movable equipments to be immobilized in contemplation of the law must first be "essential and principal elements" of an

industry or works without which such industry or works would be "unable to function or carry on the industrial purpose for which it was

established." We may here distinguish, therefore, those movable which become immobilized by destination because they are essential

and principal elements in the industry for those which may not be so considered immobilized because they aremerely incidental, not

essential and principal. Thus, cash registers, typewriters, etc., usually found and used in hotels, restaurants, theaters, etc. are merely

incidentals and are not and should not be considered immobilized by destination, for these businesses can continue or carry on their

functions without these equity comments. Airline companies use forklifts, jeep-wagons, pressure pumps, IBM machines, etc. which are

incidentals, not essentials, and thus retain their movable nature. On the other hand, machineries of breweries used in the manufacture of

liquor and soft drinks, though movable in nature, are immobilized because they are essential to said industries; but the delivery trucks and

adding machines which they usually own and use and are found within their industrial compounds are merely incidental and retain their

movable nature.chanroblesvirtualawlibrarychanrobles virtual law library

Similarly, the tools and equipments in question in this instant case are, by their nature, not essential and principle municipal

elements of petitioner's business of transporting passengers and cargoes by motor trucks. They are merely incidentals - acquired as

movables and used only for expediency to facilitate and/or improve its service. Even without such tools and equipments, its business may

be carried on, as petitioner has carried on, without such equipments, before the war. The transportation business could be carried on

without the repair or service shop if its rolling equipment is repaired or serviced in another shop belonging to

another.chanroblesvirtualawlibrarychanrobles virtual law library

The law that governs the determination of the question at issue is as follows:

Art. 415. The following are immovable property:

x x x x x x x x xchanrobles virtual law library

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be

carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works; (Civil Code of the

Phil.)

Aside from the element of essentiality the above-quoted provision also requires that the industry or works be carried on in a

building or on a piece of land. Thus in the case of Berkenkotter vs. Cu Unjieng, supra, the "machinery, liquid containers, and instruments

or implements" are found in a building constructed on the land. A sawmill would also be installed in a building on land more or less

permanently, and the sawing is conducted in the land or building.chanroblesvirtualawlibrarychanrobles virtual law library

But in the case at bar the equipments in question are destined only to repair or service the transportation business, which is not

carried on in a building or permanently on a piece of land, as demanded by the law. Said equipments may not, therefore, be deemed real

property.chanroblesvirtualawlibrarychanrobles virtual law library

Resuming what we have set forth above, we hold that the equipments in question are not absolutely essential to the petitioner's

transportation business, and petitioner's business is not carried on in a building, tenement or on a specified land, so said equipment may

not be considered real estate within the meaning of Article 415 (c) of the Civil Code.chanroblesvirtualawlibrarychanrobles virtual law

library

WHEREFORE, the decision subject of the petition for review is hereby set aside and the equipment in question declared not

subject to assessment as real estate for the purposes of the real estate tax. Without costs.chanroblesvirtualawlibrarychanrobles virtual law

library

So ordered.

Bengzon, C.J., Padilla, Bautista Angelo, Reyes, J.B.L., Paredes, Dizon and Makalintal, JJ., concur.

Regala, Concepcion and Barrera JJ., took no part.

II. MANILA ELECTRIC CO. V. CENTRAL BOARD OF ASSESSMENT APPEALS

114 SCRA 273

FACTS:

Petitioner owns two oil storage tanks, made of steel plates wielded and assembled on the spot. Their bottoms

rest on a foundation consisted of compacted earth, sand pad as immediate layer, and asphalt stratum as top layer. The

tanks merely sit on its foundation.

The municipal treasurer of Batangas made an assessment for realty tax on the two tanks, based on the report of the Board

of Assessors. MERALCO wished to oppose this assessment as they averred that the tanks are not real properties.

HELD:

While the two storage tanks are not embodied in the land, they may nevertheless be considered as

improvements in the land, enhancing its utility and rendering it useful to the oil industry.

For purposes of taxation, the term real property may include things, which should generally be considered

as personal property. it is familiar phenomenon to see things classified as real property for purposes

of taxation which on general principle may be considered as personal

property.

III. CALTEX PHILS. V. CENTRAL BOARD OF ASSESSMENT APPEALS

114 SCRA 296

FACTS:

The City Assessor characterized the items in gas stations of petitioner as taxable realty. These items included

underground tanks, elevated tank, elevated water tanks, water tanks, gasoline pumps, computing pumps, etc. These

items are not owned by the lessor of the land wherein the

equipment are installed. Upon expiration of the lease agreement, the equipment should be returned in good

condition.

HELD:

The equipment and machinery as appurtenances to the gas station building or shed owned by Caltex and

which fixtures are necessary to the operation of the gas station, for without them the gas station would be

useless, and which have been attached and fixed permanently to the gas station site or embedded therein,

are taxable improvements and machinery within the meaning of the Assessment Law and the Real

Property Tax Code.

IV. Republic of the Philippines

SUPREME COURT

Manila

FIRST DIVISION

G.R. No. L-59463 November 19, 1982

PROVINCE OF NUEVA ECIJA, plaintiff-appellant,

vs.

IMPERIAL MINING COMPANY, INC., defendant-appellee.

Isabelo Tadianan counsel for appellant.

Romeo Derez counsel for respondent.

PLANA, J .:

This is an appeal from the decision of the Court of First Instance of Nueva Ecija, Branch VIII, in Civil Case No. C-4 for collection of real

property tax, which has been certified to this Court by the Court of Appeals as a case involving purely a question of law. The legal issue

is whether defendant-appellee Imperial Mining Company, Inc. (IMC), lessee of some parcels of mineral land (placer mining claims) in

Carranglan, Nueva Ecija, is liable for real property tax thereon, although the said mineral land forms part of the public domain.

The antecedent facts are simple. In 1968, IMC leased from the Government thru the Department of Agriculture and Natural Resources

placers mining claims (192 hectares) with the right to explore, develop, mine, extract and dispose of mineral products. In the lease

contract, it was stipulated that "the Lessee shall pay real estate tax on all buildings and other improvements built on the land leased." The

contract however was silent on the obligation of the lessee to pay realty tax on the mineral land itself, as distinguished from the

improvements thereon.

In 1974, the Provincial Assessor of Nueva Ecija declared the leased property in the name of IMC; and subsequently, IMC was assessed

for real property tax.

In September, 1976, the Province of Nueva Ecija instituted the instant suit for the collection of real property tax on the mineral land in

question covering 1970-1976 in the amount of P38,836.22. The defendant resisted, maintaining that the mineral land subject of the

assessment was owned by the Government and therefore exempt from real estate tax. After trial, the Court of First Instance dismissed the

complaint in reliance upon the terms of the lease contract and the provisions of Section 87 of the old Mining Act (Commonwealth Act

137) which did not subject leased mineral lands to the payment of real estate tax. The trial court observed that the Real Property Tax

Code of 1974 (Presidential Decree 464) which took effect on June 1, 1974 did not change the rule.

Hence, this appeal.

When IMC in 1968 obtained a lease on the mineral land in question, the law governing real property taxation was the former Assessment

Law, Commonwealth Act 470, and the basis of realty taxation thereunder was ownership or interest tantamount to ownership. A mere

lessee of mineral land was therefore not liable for the payment of realty tax thereon. This was recognized in the Mining Act then in force,

Commonwealth Act 137, under which leased mineral land was not subject to real estate tax. (Sec. 87.). The lease contract of IMC was

executed in accordance with these laws. The absence of a stipulation therein making the lessee liable for realty tax on the leased mineral

land was just a recognition of the real property tax principle then prevailing; it was not a contractual commitment or guarantee by the

Department of Agriculture and Natural Resources that with respect to the leased mineral land, IMC would permanently be exempt from

real property taxation. That agency could not have made that commitment because it was not authorized to do so; and it could not bind

the lawmaking body by stipulating in effect against amendment of the law on real property taxation.

In 1974, a new Real Property Tax Code came into being when Presidential Decree 464 was issued. It changed the basis of real property

taxation. It adopted the policy of taxing real property on the basis of actual use, even if the user is not the owner.

Actual use - shall refer to the purpose for which the property is principally or predominantly utilized by the person in

possession of the property. [Sec. 3(a).]

Actual Use of Real Property as Basis for Assessment.-Real property shall be assessed on the basis of its actual use

regardless of where located and whoever uses it. (Section 19. Emphasis supplied.)

The above policy declaration is given substance in various provisions of the new law. Thus, Section 40 of Presidential Decree 464

specifies the exemptions from real property tax.

SEC. 40. Exemption from Real Property Tax. The exemption shall be as follows:

a) Real property owned by the Republic of the Philippines or any of its political subdivisions and

any government owned corporation so exempt by its charter: Provided, however, That this

exemption shall not apply to real property of the abovenamed entities the beneficial use of which

has been granted, for consideration or otherwise, to a taxable person.

xxx xxx xxx

e) Land acquired by grant, purchase or lease from the public domain for conversion into dairy

farms for a period of five years from the time of such conversion . . .

Incidentally, Presidential Decree 939 was subsequently enacted exempting from real property tax "pasture and/or grazing lands acquired

by grant, purchase or lease from the public domain actually used for livestock production, for a period of five years . . .

The foregoing exemptions make it very clear that leased lands of the public domain would otherwise be subject to real property tax; if

that were not so, there would have been no need to specifically exempt some of them from real property tax.

Presidential Decree 464 also prescribes the classification of real property for assessment purposes, specifically including mineral land:

"For purposes of assessment, real property shall be classified as residential, agricultural, commercial or industrial and also as mineral in

the case of lands." (Section 18.) And for purposes of real property taxation, the assessment levels to be applied as regards mineral lands

are laid down:

Mineral Lands - For purposes of taxation, mineral lands not covered by lease shall be appraised at fifty per cent of

their market value to be determined by the Secretary of Finance upon consultation with the Director of

Mines; Provided however, that mineral lands covered by leases shall be declared for taxation purposes either by the

owner of the land or lessee and the assessment level thereof shall be maintained at the current level of fifty per cent.

[Sec. 20 (b). Emphasis supplied.]

It is true that Presidential Decree 464 recognizes and respects real property tax exemption "under other laws", and one such law, with

respect to mineral land, is Presidential Decree 463, the Mineral Resources Development Decree of 1974, which provides:

SEC. 53. Tax Exemptions. Machineries, equipment, tools for production, plants to convert mineral ores into

saleable form, spare parts, supplies, materials, accessories, explosives, chemicals and transportation and

communication facilities imported by and for the use of new mines and old mines which resume operation, when

certified as such by the Secretary (of Natural Resources) upon recommendation of the Director (of Mines), are

exempt from the payment of customs duties and all taxes except income tax for a period starting from the first date of

actual commercial production of saleable mineral products.

xxx xxx xxx

All mining claims, improvements thereon and mineral products derived therefrom shag likewise be exempt from the

payment of an taxes, except income tax, for the same period provided for in the first paragraph of this section.

It does not appear however that IMC was entitled to tax exemption, including exemption from real property tax, under Section 53 of

Presidential Decree 463 during the period here in question.

We therefore conclude that under the provisions of Presidential Decree 464, IMC is subject to the payment of real property tax on the

mineral land leased by it. Since the said law took effect on June 1, 1974, and assessment in pursuance thereof was made after January 1,

1974, the liability of IMC for real property tax on the mineral land leased by it should start on January 1, 1975 pursuant to Section 24 of

P.D. 464:

Date of Effectivity of Assessment or Reassessment.-All assessment or reassessment made after the first day of

January of any year shall take effect on the first day of January of the succeeding year.

Wherefore, the decision of the lower court dismissing the complaint in Civil Case No. C-4 is hereby modified as regards the real property

tax liability of defendant-appellee under P.D. 464. The records of the case are ordered remanded to the trial court for further proceedings

to determine the amount of real property tax due from IMC in accordance with this decision. Costs against defendant-appellee.

SO ORDERED.

Teehankee (Chairman), Melencio-Herrera, Vasquez, Relova, and Gutierrez, Jr., JJ., concur.

V. Republic of the Philippines

SUPREME COURT

Manila

THIRD DIVISION

G.R. No. 90639 February 21, 1990

TESTATE ESTATE OF CONCORDIA T. LIM, plaintiff-appellant,

vs.

CITY OF MANILA, JESUS I. CALLEJA, in his capacity as City Treasurer of Manila, NICOLAS CATIIL, in his capacity as

City Assessor of Manila, and/or GOVERNMENT SERVICE INSURANCE SYSTEM, defendants-appellees.

Melquiades P. De Leon for plaintiff-appellant.

GUTIERREZ, JR., J .:

This is an appeal from the decision of the Regional Trial Court of Manila, Branch 29 dismissing a complaint for a "sum of money and/or

recovery of real estate taxes paid under protest" which was certified and elevated to this Court by the Court of Appeals as a case

involving pure questions of law.

On February 13, 1969, the late Concordia Lim obtained a real estate loan from the defendant-appellee Government Service Insurance

System (GSIS) in the amount of P875,488.54, secured by a mortgage constituted on two (2) parcels of land formerly covered by Transfer

Certificates of Title Nos. 64075 and 63076 (later changed to TCT Nos. 125718 and 125719) registered in Manila with a three-story

building thereon and located on No. 810 Nicanor Reyes St. (formerly Morayta), Sampaloc, Manila. When Lim failed to pay the loan, the

mortgage was extrajudicially foreclosed and the subject properties sold at public auction. The GSIS, being the highest bidder, bought the

properties. Upon Lim's failure to exercise her right of redemption, the titles to the properties were consolidated in favor of the GSIS in

1977.

However, pursuant to Resolution No. 188 of the Board of Trustees of the GSIS dated March 29, 1979, the estate of Lim, through

Ernestina Crisologo Jose (the administratrix) was allowed to repurchase the foreclosed properties. On April 11, 1979, a Deed of Absolute

Sale was executed. (Exhibit B, Table of Exhibits, pp. 3-5)

The defendant City Treasurer of Manila required the plaintiff-appellant to pay the real estate taxes due on the properties for the years

1977, 1978 and the first quarter of 1979 in the amount of P67,960.39, before the titles could be transferred to the plaintiff-appellant. The

latter paid the amount under protest.

On July 11, 1979, the plaintiff-appellants counsel sent a demand letter requesting the GSIS to reimburse the taxes paid under protest. The

GSIS refused.

On September 6, 1979, a demand letter was sent to the City Treasurer of Manila to refund the amount but the latter also refused.

On March 14, 1980, the plaintiff filed an action before the trial court for a sum of money for the refund or reimbursement of the real

estate taxes paid under protest.

During the pendency of the case, the plaintiff-appellant admitted that the foreclosed properties had been sold, through the administratrix,

to another person. (2nd par. of Plaintiffs Manifestation dated December 21, 1981, Records, p. 105; TSN, March 4, 1982, p. 37)

After trial, the lower court dismissed the complaint for lack of jurisdiction. It ruled that the case involves a protested action of the City

Assessor which should have been flied before the Local Board of Assessment Appeals of Manila (citing Section 30 of the Real Property

Tax Code [P.D. No. 464]) in line with the principle that all administrative remedies must first be exhausted. The lower court also cited by

way of obiter dictum, the case of City of Baguio v. Busuego, 100 SCRA 116 (1980) wherein this Court ruled that while the GSIS may be

exempt from the payment of real estate tax, the exemption does not cover properties the beneficial use of which was granted to other

taxable persons. This ruling supports the lower court's view that the tax had attached to the subject properties for the years 1977, 1978

and first quarter of 1979. The lower court further stated that the plaintiff-appellant had assumed liability for the real estate taxes because

of the provision in the Deed of Sale with the GSIS that: "any and all the taxes, ... relative to the execution and/or implementation of this

Deed, ... shall be for the account of and paid by the VENDEE" (Exhibit B, Table of Exhibits, p. 5)

Hence, this appeal raising several issues that can be summed up into the following: (1) whether or not the trial court has jurisdiction over

the action for refund of real estate taxes paid under protest; (2) whether or not plaintiff-appellant has the right to recover; and (3) whether

or not the plaintiff-appellant has personality to sue.

The plaintiff-appellant argues that the lower court has jurisdiction over a complaint for refund as well as for reimbursement of the real

estate taxes erroneously collected by the City of Manila from it and paid under protest.

The records show that the subject properties were leased to other persons during the time when GSIS held their titles, as was the case

during the ownership of the late Concordia Lim.

However, the real estate taxes later assessed on the said properties for the years 1977, 1978 and the first quarter of 1979 were charged

against the plaintiff-appellant even if the latter was not the beneficial user of the parcels of land.

In real estate taxation, the unpaid tax attaches to the property and is chargeable against the taxable person who had actual or beneficial

use and possession of it regardless of whether or not he is the owner. (Sections 3(a) and 19 of P.D. No. 464; Province of Nueva Ecija v.

Imperial Mining Co., Inc., 118 SCRA 632 [1982]). Raising doubts on the validity of the imposition and collection of the real property

tax for the designated periods before the title to the properties may be transferred, the plaintiff-appellant paid under protest. This step was

taken in accordance with the provision of Section 62 of P.D. No. 464, which states:

Sec. 62. Payment under protest. (a) When a taxpayer desires for any reason to pay his tax under protest, he shall

indicate the amount or portion thereof he is contesting and such protest shall be annotated on the tax receipts by

writing thereon the words paid under protest.' Verbal protest shall be confirmed in writing, with a statement of the

ground, therefor, within thirty days. The tax may be paid under protest, and in such case it shall be the duty of the

Provincial, City or Municipal Treasurers to annotate the ground or grounds therefor on the receipt.

(b) In case of payments made under protest, the amount or portion of the tax contested shall be held in trust by the

treasurer and the difference shall be treated as revenue.

(c) In the event that the protest is finally decided in favor of the government, the amount or portion of the tax held in

trust by the treasurer shall accrue to the revenue account, but if the protest shall be decided finally in favor of the

protestant, the amount or portion of the tax protested against may either be refunded to the protestant or applied as

tax credit to any other existing or future tax liability of the said protestant. (Emphasis Supplied)

The Court rules that the plaintiff-appellant correctly filed the action for refund/reimbursement with the lower court as it is the courts

which have jurisdiction to try cases involving the right to recover sums of money.

Section 30 of the Real Property Tax Code is not applicable because what is questioned is the imposition of the tax assessed and who

should shoulder the burden of the tax. There is no dispute over the amount assessed on the properties for tax purposes. Section 30

pertains to the administrative act of listing and valuation of the property for purposes of real estate taxation. It provides:

Section 30. Local Board of Assessment Appeals Any owner who is not satisfied with the action of the provincial or

city assessor in the assessment of his property may, within sixty days from the date of receipt by him of the written

notice of assessment as provided in this Code, appeal to the Board of Assessment Appeals of the province or city by

filing with it a petition under oath using the form prescribed for the purpose, together with copies of the tax

declarations and such affidavit or documents submitted in support of the appeal.

In further support of the conclusion that the lower court has jurisdiction to try the instant case, we note Section 64 of the Real Property

Tax Code which provides that a "court shall entertain a suit assailing the validity of a tax assessed" after the taxpayer shall have paid

under protest.

The issue on the existence or non-existence of the appellant's right to recover the amounts paid hinges on the basic question of the

validity of the tax imposition. If the imposition is valid and in accordance with law, then there is no right to recover. Otherwise, the

amounts paid must be refunded by the respondent City Treasurer of Manila acting in his official capacity. (Sec. 62 [c], PD 464)

The opinion of the lower court that the ruling in City of Baguio v. Busuego, supra justifies the imposition of the tax on plaintiff-appellant

is erroneous. The facts in that case are different from those in the case at bar. It was shown that Busuego purchased, by way of

installment, a parcel of land and building within a housing project of the GSIS. In a Contract to Sell with the GSIS, he agreed to: (1) the

delivery of the possession of the properties to him pending the full payment of the price although the title remained with the GSIS; and

(2) his liability to pay and shoulder all taxes and assessments on the lot and building or improvements thereon during the term of the

contract to sell.

Despite the tax exemption enjoyed by the GSIS, the realty tax liability imposed on the purchaser was held to be valid on the basis of the

contractual obligation that he entered into and the fact that beneficial use had been given to him.

The instant case does not present a similar contractual stipulation. The contract here which is alleged to include the condition that the

buyer shall shoulder the taxes is a Contract of Sale. In the Busuego case, there was merely a Contract to Sell for the duration of which the

party who shall be liable for the taxes about to be due is the buyer as per agreement. In the case at bar, what was assumed by the vendee

was the liability for taxes and other expenses "relative to the execution and/or implementation" of the Deed of Absolute Sale "including

among others, documentation, documentary and science stamps, expenses for registration and transfer of titles ... " This clause was

stipulated for the purpose of clarifying which of the parties should bear the costs of execution and implementation of the sale and to

comply with Article 1487 of the Civil Code which states:

ART. 1487 The expenses for the execution and registration of the sale shall be borne by the vendor, unless there is

a stipulation to the contrary.

Moreover, the taxes mentioned in the clause here refer to those necessary to the completion of the sale and accruing after the making of

such sale on April 11, 1990 such as documentary stamp tax and capital gains tax.

In the Busuego case, the assumption by the vendee of the liability for real estate taxes prospectively due was in harmony with the tax

policy that the user of the property bears the tax. In the instant case, the interpretation that the plaintiff-appellant assumed a liability for

overdue real estate taxes for the periods prior to the contract of sale is incongruent with the said policy because there was no immediate

transfer of possession of the properties previous to full payment of the repurchase price.

The facts of the case constrain us to rule that the plaintiff-appellant is not liable to pay the real property tax due for the years 1977, 1978

and first quarter of 1979. The clause in the Deed of Sale cannot be interpreted to include taxes for the periods prior to April 11, 1979, the

date of repurchase.

To impose the real property tax on the estate which was neither the owner nor the beneficial user of the property during the designated

periods would not only be contrary to law but also unjust. If plaintiff-appellant intended to assume the liability for realty taxes for the

prior periods, the contract should have specifically stated "real estate taxes" due for the years 1977,1978 and first quarter of 1979. The

payments made by the plaintiff-appellant cannot be construed to be an admission of a tax liability since they were paid under protest and

were done only in compliance with one of the requirements for the consummation of the sale as directed by the City Treasurer of Manila.

Hence, the tax assessed and collected from the plaintiff-appellants is not valid and a refund by the City government is in order.

The Court rules, however, that the plaintiff-appellant is not entitled to a reimbursement from the respondent GSIS because: (1) the GSIS

is exempt from payment of the real property tax under Sec. 33 of the Revised Charter of the GSIS; and (2) the tax should be based on

"actual use" of the property. Section 40 of the Real Property Tax Code supports the view that not even the GSIS is liable to pay real

property tax on public land leased to other persons. Section 40 provides:

Sec. 40. Exemption from Real Property Tax. The exemption shall be as follows:

(a) Real property owned by the Republic of the Philippines or any of its political subdivisions and any government

owned corporation so exempt by its charter: Provided, however, That this exemption shall not apply to real property

of the abovenamed entities the beneficial use of which has been granted, for consideration or otherwise, to a taxable

person.

In fact, if there is anyone liable the law and applicable jurisprudence point to the lessees of land owned by the government-owned and

controlled corporations. (Province of Nueva Ecija v. Imperial Mining Co., Inc., supra) In this case, the Court can only declare the non-

liability of a right to a refund. We cannot rule on the liability of the lessees whose Identities are not even clear because they were never

impleaded.

The contention of the plaintiff-appellant that the respondent GSIS is liable to reimburse the tax because the latter allegedly failed to

exercise its claim to the tax exemption privilege is without merit. The exemption is explicitly granted by law and need not be applied for.

Regarding the issue on the existence of the personality to sue, the plaintiff-appellant asserts that since it was the one which paid under

protest the amount of P67,960.39 as real property tax, then it is the real party in interest to sue for refund.

The lower court, noting the transfer of the title to the properties to a third person, ruled that assuming arguendo that there is a right to

seek recovery, the subsequent sale "must have included the tax" and "as such all the credits including the taxes that were paid was (sic)

transfered already to the buyer." It ruled that plaintiff-appellant had no personality to sue and the right of action must be between the

subsequent buyer and the plaintiff-appellant. The Court finds that the above ruling and the facts on which it is based are not sufficiently

supported by the records of the case. The evidence merely shows an admission of a subsequent sale of the properties by the plaintiff-

appellant, nothing more.

WHEREFORE, IN VIEW OF THE FOREGOING, the judgment appealed from is hereby REVERSED and SET ASIDE. The defendants

appellees City of Manila, the City Treasurer and City Assessor of Manila are hereby ordered to refund to the TESTATE ESTATE OF

CONCORDIA LIM, through administratrix ERNESTINA CRISOLOGO-JOSE, the amount of P67,960.39 as real estate taxes paid under

protest.

SO ORDERED.

Fernan, C.J. (Chairman), Feliciano, Bidin and Cortes, JJ., concur.

THI RD DI VI SI ON

EMERLINDA S. TALENTO, G.R. No. 180884

in her capacity as the Provincial

Treasurer of the Province of Bataan,

Petitioner, Present:

Ynares-Santiago, J. (Chairperson),

- versus - Austria-Martinez,

Carpio Morales,

*

Chico-Nazario, and

Reyes, JJ.

HON. REMIGIO M. ESCALADA, JR.,

Presiding Judge of the Regional Trial

Court of Bataan, Branch 3, and Promulgated:

PETRON CORPORATION,

Respondents. June 27, 2008

x ---------------------------------------------------------------------------------------- x

DECI SI ON

YNARES-SANTIAGO, J .:

The instant petition for certiorari under Rule 65 of the Rules of Court assails the November 5, 2007 Order

[1]

of the Regional Trial

Court of Bataan, Branch 3, in Civil Case No. 8801, granting the petition for the issuance of a writ of preliminary injunction filed by

private respondent Petron Corporation (Petron) thereby enjoining petitioner Emerlinda S. Talento, Provincial Treasurer of Bataan, and

her representatives from proceeding with the public auction of Petrons machineries and pieces of equipment during the pendency of the

latters appeal from the revised assessment of its properties.

The facts of the case are as follows:

On June 18, 2007, Petron received from the Provincial Assessors Office of Bataan a notice of revised assessment over its

machineries and pieces of equipment in Lamao, Limay, Bataan. Petron was given a period of 60 days within which to file an appeal with

the Local Board of Assessment Appeals (LBAA).

[2]

Based on said revised assessment, petitioner Provincial Treasurer of Bataan issued a

notice informing Petron that as of June 30, 2007, its total liability is P1,731,025,403.06,

[3]

representing deficiency real property tax due

from 1994 up to the first and second quarters of 2007.

On August 17, 2007, Petron filed a petition

[4]

with the LBAA (docketed as LBAA Case No. 2007-01) contesting the revised

assessment on the grounds that the subject assessment pertained to properties that have been previously declared; and that the assessment

covered periods of more than 10 years which is not allowed under the Local Government Code (LGC). According to Petron, the possible

valid assessment pursuant to Section 222 of the LGC could only be for the years 1997 to 2006. Petron further contended that the fair

market value or replacement cost used by petitioner included items which should be properly excluded; that prompt payment of discounts

were not considered in determining the fair market value; and that the subject assessment should take effect a year after or on January 1,

2008. In the same petition, Petron sought the approval of a surety bond in the amount of P1,286,057,899.54.

[5]

On August 22, 2007, Petron received from petitioner a final notice of delinquent real property tax with a warning that the

subject properties would be levied and auctioned should Petron fail to settle the revised assessment due.

[6]

Consequently, Petron sent a letter

[7]

to petitioner stating that in view of the pendency of its appeal

[8]

with the LBAA, any action

by the Treasurers Office on the subject properties would be premature. However, petitioner replied that only Petrons payment under

protest shall bar the collection of the realty taxes due,

[9]

pursuant to Sections 231 and 252 of the LGC.

With the issuance of a Warrant of Levy

[10]

against its machineries and pieces of equipment, Petron filed on September 24,

2007, an urgent motion to lift the final notice of delinquent real property tax and warrant of levy with the LBAA. It argued that the

issuance of the notice and warrant is premature because an appeal has been filed with the LBAA, where it posted a surety bond in the

amount of P1,286,057,899.54.

[11]

On October 3, 2007, Petron received a notice of sale of its properties scheduled on October 17, 2007.

[12]

Consequently,

on October 8, 2007, Petron withdrew its motion to lift the final notice of delinquent real property tax and warrant of levy with the

LBAA.

[13]

On even date, Petron filed with the Regional Trial Court of Bataan the instantcase (docketed as Civil Case No. 8801)

for prohibition with prayer for the issuance of a temporary restraining order (TRO) and preliminary injunction.

[14]

On October 15, 2007, the trial court issued a TRO for 20 days enjoining petitioner from proceeding with the public auction of

Petrons properties.

[15]

Petitioner thereafter filed an urgent motion for the immediate dissolution of the TRO, followed by a motion to

dismiss Petrons petition for prohibition.

On November 5, 2007, the trial court issued the assailed Order granting Petrons petition for issuance of writ of preliminary

injunction, subject to Petrons posting of a P444,967,503.52 bond in addition to its previously posted surety bond of P1,286,057,899.54,

to complete the total amount equivalent to the revised assessment of P1,731,025,403.06. The trial court held that in scheduling the sale

of the properties despite the pendency of Petrons appeal and posting of the surety bond with the LBAA, petitioner deprived Petron of the

right to appeal. The dispositive portion thereof, reads:

WHEREFORE, the writ of preliminary injunction prayed for by plaintiff is hereby GRANTED and

ISSUED, enjoining defendant Treasurer, her agents, representatives, or anybody acting in her behalf from proceeding

with the scheduled public auction of plaintiffs real properties, or any disposition thereof, pending the determination

of the merits of the main action, to be effective upon posting by plaintiff to the Court of an injunction bond in the

amount of Four Hundred Forty Four Million Nine Hundred Sixty Seven Thousand Five Hundred Three and 52/100

Pesos (P444,967,503.52) and the approval thereof by the Court.

Defendants Urgent Motion for the Immediate Dissolution of the Temporary Restraining Order dated October

23, 2007 is hereby DENIED.

SO ORDERED.

[16]

From the said Order of the trial court, petitioner went directly to this Court via the instant petition for certiorari under Rule 65

of the Rules of Court.

The question posed in this petition, i.e., whether the collection of taxes may be suspended by reason of the filing of an appeal

and posting of a surety bond, is undoubtedly a pure question of law. Section 2(c) of Rule 41 of the Rules of Court provides:

SEC. 2. Modes of Appeal.

(c) Appeal by certiorari. In all cases when only questions of law are raised or involved, the appeal

shall be to the Supreme Court by petition for review on certiorari under Rule 45. (Emphasis supplied)

Thus, petitioner resorted to the erroneous remedy when she filed a petition for certiorari under Rule 65, when the proper mode

should have been a petition for review on certiorari under Rule 45. Moreover, under Section 2, Rule 45 of the same Rules, the period to

file a petition for review is 15 days from notice of the order appealed from. In the instant case, petitioner received the questioned order of

the trial court on November 6, 2007, hence, she had only up to November 21, 2007 to file the petition. However, the same was filed only

on January 4, 2008, or 43 days late. Consequently, petitioners failure to file an appeal within the reglementary period rendered the order

of the trial court final and executory.

The perfection of an appeal in the manner and within the period prescribed by law is mandatory. Failure to conform to the

rules regarding appeal will render the judgment final and executory and beyond the power of the Courts review. Jurisprudence mandates

that when a decision becomes final and executory, it becomes valid and binding upon the parties and their successors in interest. Such

decision or order can no longer be disturbed or reopened no matter how erroneous it may have been.

[17]

Petitioners resort to a petition under Rule 65 is obviously a play to make up for the loss of the right to file an appeal via a petition

under Rule 45. However, a special civil action under Rule 65 can not cure petitioners failure to timely file a petition for review on

certiorari under Rule 45 of the Rules of Court. Rule 65 is an independent action that cannot be availed of as a substitute for the lost

remedy of an ordinary appeal, including that under Rule 45, especially if such loss or lapse was occasioned by ones own neglect or error

in the choice of remedies.

[18]

Moreover, even if we assume that a petition under Rule 65 is the proper remedy, the petition is still dismissible.

We note that no motion for reconsideration of the November 5, 2007 order of the trial court was filed prior to the filing of the

instant petition. The settled rule is that a motion for reconsideration is a sine qua non condition for the filing of a petition for certiorari.

The purpose is to grant the public respondent an opportunity to correct any actual or perceived error attributed to it by the re-examination

of the legal and factual circumstances of the case. Petitioners failure to file a motion for reconsideration deprived the trial court of the

opportunity to rectify an error unwittingly committed or to vindicate itself of an act unfairly imputed. Besides, a motion for

reconsideration under the present circumstances is the plain, speedy and adequate remedy to the adverse judgment of the trial court.

[19]

Petitioner also blatantly disregarded the rule on hierarchy of courts. Although the Supreme Court, Regional Trial Courts, and

the Court of Appeals have concurrent jurisdiction to issue writs of certiorari, prohibition, mandamus, quo warranto, habeas corpus and

injunction, such concurrence does not give the petitioner unrestricted freedom of choice of court forum. Recourse should have been

made first with the Court of Appeals and not directly to this Court.

[20]

True, litigation is not a game of technicalities. It is equally true, however, that every case must be presented in accordance with

the prescribed procedure to ensure an orderly and speedy administration of justice.

[21]

The failure therefore of petitioner to comply with

the settled procedural rules justifies the dismissal of the present petition.

Finally, we find that the trial court correctly granted respondents petition for issuance of a writ of preliminary

injunction. Section 3, Rule 58, of the Rules of Court, provides:

SEC. 3. Grounds for issuance of preliminary injunction. A preliminary injunction may be granted by the

court when it is established:

(a) That the applicant is entitled to the relief demanded, and the whole or part of such relief consists in

restraining the commission or continuance of the acts complained of, or in the performance of an act or acts, either

for a limited period or perpetually;

(b) That the commission, continuance or non-performance of the act or acts complained of during the

litigation would probably work injustice to the applicant; or

(c) That a party, court, or agency or a person is doing, threatening, or attempting to do, or is procuring

or suffering to be done, some act or acts probably in violation of the rights of the applicant respecting the subject of

the action or proceeding, and tending to render the judgment ineffectual.

The requisites for the issuance of a writ of preliminary injunction are: (1) the existence of a clear and unmistakable right that

must be protected; and (2) an urgent and paramount necessity for the writ to prevent serious damage.

[22]

The urgency and paramount necessity for the issuance of a writ of injunction becomes relevant in the instant case considering

that what is being enjoined is the sale by public auction of the properties of Petron amounting to at least P1.7 billion and which properties

are vital to its business operations. If at all, the repercussions and far-reaching implications of the sale of these properties on the

operations of Petron merit the issuance of a writ of preliminary injunction in its favor.

We are not unaware of the doctrine that taxes are the lifeblood of the government, without which it can not properly perform its

functions; and that appeal shall not suspend the collection of realty taxes. However, there is an exception to the foregoing

rule, i.e., where the taxpayer has shown a clear and unmistakable right to refuse or to hold in abeyance the payment of taxes. In the

instant case, we note that respondent contested the revised assessment on the following grounds: that the subject assessment pertained to

properties that have been previously declared; that the assessment covered periods of more than 10 years which is not allowed under the

LGC; that the fair market value or replacement cost used by petitioner included items which should be properly excluded; that prompt

payment of discounts were not considered in determining the fair market value; and that the subject assessment should take effect a year

after or on January 1, 2008. To our mind, the resolution of these issues would have a direct bearing on the assessment made by

petitioner. Hence, it is necessary that the issues must first be passed upon before the properties of respondent is sold in public auction.

In addition to the fact that the issues raised by the respondent would have a direct impact on the validity of the assessment

made by the petitioner, we also note that respondent has posted a surety bond equivalent to the amount of the assessment due. The Rules

of Procedure of the LBAA, particularly Section 7, Rule V thereof, provides:

Section 7. Effect of Appeal on Collection of Taxes. An appeal shall not suspend the collection of the

corresponding realty taxes on the real property subject of the appeal as assessed by the Provincial, City or Municipal

Assessor, without prejudice to the subsequent adjustment depending upon the outcome of the appeal. An appeal may

be entertained but the hearing thereof shall be deferred until the corresponding taxes due on the real property subject

of the appeal shall have been paid under protest or the petitioner shall have given a surety bond, subject to the

following conditions:

(1) the amount of the bond must not be less than the total realty taxes and penalties due as assessed by

the assessor nor more than double said amount;

(2) the bond must be accompanied by a certification from the Insurance Commissioner (a) that the

surety is duly authorized to issue such bond; (a) that the surety bond is approved by and registered with said

Commission; and (c) that the amount covered by the surety bond is within the writing capacity of the surety

company; and

(3) the amount of the bond in excess of the surety companys writing capacity, if any, must be covered

by Reinsurance Binder, in which case, a certification to this effect must likewise accompany the surety bond.

Corollarily, Section 11 of Republic Act No. 9282,

[23]

which amended Republic Act No. 1125 (The Law Creating the Court of

Tax Appeals) provides:

Section 11. Who may Appeal; Mode of Appeal; Effect of Appeal; -

x x x x

No appeal taken to the Court of Appeals from the Collector of Internal Revenue x x x shall suspend the

payment, levy, distraint, and/or sale of any property for the satisfaction of his tax liability as provided by existing

law. Provided, however, That when in the opinion of the Court the collection by the aforementioned government

agencies may jeopardize the interest of the Government and/or the taxpayer the Court at any stage of the processing

may suspend the collection and require the taxpayer either to deposit the amount claimed or to file a surety bond for

not more than double the amount with the Court.

WHEREFORE, in view of all the foregoing, the instant petition is DISMISSED.

SO ORDERED.

CONSUELO YNARES-SANTIAGO

Associate Justice

WE CONCUR:

MA. ALICIA AUSTRIA-MARTINEZ

Associate Justice

CONCHITA CARPIO MORALES MINITA V. CHICO-NAZARIO

Associate Justice Associate Justice

RUBEN T. REYES

Associate Justice

ATTESTATI ON

I attest that the conclusions in the above decision were reached in consultation before the case was assigned to the writer of the

opinion of the Courts Division.

CONSUELO YNARES-SANTIAGO

Associate Justice

Chairperson, Third Division

CERTI FI CATI ON

Pursuant to Section 13, Article VIII of the Constitution and the Division Chairpersons Attestation, it is hereby certified that the

conclusions in the above Decision were reached in consultation before the case was assigned to the writer of the opinion of the Courts

Division.

REYNATO S. PUNO

Chief Justice

*

In lieu of Associate Justice Antonio Eduardo B. Nachura.

[1]

Rollo, pp. 49-63. Penned by Judge Remigio M. Escalada, Jr.

[2]

Id. at 203-204.

[3]

Id. at 205-226.

[4]

Id. at 228-250.

[5]

Id. at 248 and 254-255.

[6]

Id. at 265.

[7]

Id. at 288-289. Dated September 12, 2007.

[8]

Incidentally, Petrons appeal in LBAA Case No. 2007-01 was dismissed on December 10, 2007 on the ground of forum shopping

(Rollo, pp. 436-440). On January 17, 2008, Petron appealed to the Central Board of Assessment Appeals. (Rollo, p. 468)

[9]

Id. at 291-292.

[10]

Id. at 339-340.

[11]

Id. at 293-297.

[12]

Id. at 348.

[13]

Id. at 349-351.

[14]

The Complaint was subsequently amended. (Rollo, pp. 64-80)

[15]

Rollo, pp. 352-361.

[16]

Id. at 63.

[17]

Lapu-Lapu Development and Housing Corporation v. Group Management Corporation, G.R. No. 141407, September 9, 2002, 388

SCRA 493, 506-507.

[18]

Chua v. Santos, G.R. No. 132467, October 18, 2004, 440 SCRA 365, 374.

[19]

Serra v. Heirs of Primitivo Hernaez, G.R. No. 142913, August 9, 2005, 466 SCRA 120, 127.

[20]

Zamboanga Barter Goods Retailers Association, Inc. v. Lobregat, G.R. No. 145466, July 7, 2004, 433 SCRA 624, 628-629.

[21]

Mindanao Savings and Loan Association, Inc. v. Vda. De Flores, G.R. No. 142022, September 7, 2005, 469 SCRA 416, 423.

[22]

Manila International Airport Authority v. Court of Appeals, G.R. No. 118249, February 14, 2003, 397 SCRA 348, 359.

[23]

An Act Expanding the Jurisdiction of the Court of Tax Appeals (CTA), Elevating its Rank to the Level of a Collegiate Court with

Special Jurisdiction and Enlarging its Membership, Amending for the Purpose Certain Sections of Republic Act No. 1125, as mended,

otherwise known as the Law Creating the Court of Tax Appeals, and for other purposes.

Republic of the Philippines

SUPREME COURT

Manila

FIRST DIVISION

G.R. No. L-29772 September 18, 1980

CITY OF BAGUIO, plaintiff-appellee,

vs.

FERNANDO S. BUSUEGO, defendant-appellant.

TEEHANKEE, J .:

In line with the fundamental rule that tax-exempting provisions of law are to be construed in strictissimi juris, the Court hereby affirms

the decisions of the Baguio City Court and Court of First Instance adjudging the defendant-appellant, an installment purchaser of a parcel

of land and its building and improvements within a housing project belonging to the Government Service Insurance System (GSIS) liable

to pay realty taxes thereon from the time possession of such property was transferred to him, although pending full payment of the

purchase price the seller GSIS as a government corporation exempt from the payment of taxes retains ownership and title over the

property.

This tax collection suit instituted by the City of Baguio, against appellant Fernando S. Busuego, originated in the City Court and was

subsequently elevated to the Court of First Instance. In both courts, the case was submitted for consideration on the following stipulation

of facts:

1. That on August 11, 1959 defendant and the Government Service Insurance System, a government corporation,

executed, by and between themselves, a "Contract to Sell" over the property described in the complaint; a copy of the

same is attached as Annex "A" to defendant's Memorandum in support of Motion to Dismiss and is hereby

reproduced by reference and made an integral part hereof;

1

2. That the agreed purchase price for the property has not yet been fully paid and the GSIS has up to the present time,

title of the property in question (per T.C.T. #T-3978 Reg. of Deeds of Baguio City), although the defendant is using

the same;

3. That under Commonwealth Act No. 186, the GSIS as well as its property are exempt from payment of all types

and kinds of taxes;

4. That the property involved in this case has been consistently assessed by the City of Baguio in the name of the

GSIS;

5. That the unpaid z taxes, per records of the City Treasurer's Office, on the property for the period from 1962 to

1966 amounts to 1,656.00;

6. That demands were made on the defendant for payment of the aforesaid taxes but said defendant refused and failed

to pay the same;

7. That under the Contract to Sell (Annex "A"), the title remains the GSIS until full payment of purchase price

although actually the possession has already been transferred to the herein defendant (vendee);

8. That defendant has paid the amount of P287.80 for realty taxes due for the year 1963; that demands for refund

were made by defendant on plaintiff, and

9. That defendant contracted to pay his counsel the amount of P1,500.00 as attorney's fees in this case.

On the basis of the above stipulation of facts, the city court rendered judgment in favor of plaintiff sentencing defendant to pay the sum

of P1,656.00.00 with legal interest from the filing of complaint on August 18, 1966 the same is fully paid. Upon appeal, the court of first

instance, concluding that the contract entered into by the parties was a perfected contract of sale, likewise held that defendant as owner

was liable for the realty taxes on the property, and, therefore, likewise ordered defendant to pay the same amount as adjudged by the city

court representing taxes for the period from 1962 to 1966, with legal interest from August 18, 1966, deducting therefrom the amount of

P287.00 realty taxes for the year 1963 which he had already paid.

Paragraph 2 of the contract entered into by the GSIS and the defendant-appellant manifests the latter's willingness at the signing thereof

to pay and shoulder all taxes and assessments on the subject property and insurance thereon during the term of the said contract.

However, appellants purchaser after having voluntarily paid taxes due on the property in the amount of P287.00 for the year 1963 backed

out of his undertaking upon discovering that section 28(c) of Commonwealth Act 186

2

exempts the GSIS from the payment of taxes. His

theory is that while title to the property has not passed to him, per paragraph 4 of the contract, and ownership remains with the seller,

there could not be any obligation to pay taxes on the property that should be assumed by him as purchaser, since the owner-seller, in

whom title remains, is exempt from taxes.

We affirm. The court of first instance may have erred in pronouncing the "Contract to Sell" as a perfected contract of sale, contrary to its

very terms that title remained with the seller who undertook to execute a final deed of absolute sale and deliver to the purchaser title to

the property only after completion of the stipulated payments,

3

but this is not decisive of the issue.

What is determinative was its rulings on the merits (not on the nomenclature or classification of the contract), wherein it correctly held

that purchaser-appellant agreed to the contractual stipulation "to pay and shoulder all taxes and assessments on the lot and building or

improvements thereon and insurance during the term of the contract. In view of his acceptance of this condition, he is now estopped to

deny his liability to pay the taxes. And, on the other hand, when the GSIS sold the property and imposed said condition, the agency

although exempt from the payment of taxes clearly indicated that the property became taxable upon its delivery to the purchaser" and that

"the sole determinative factor for exemption from realty taxes is the "use" to which the property is devoted. And where "use" is the test,

the ownership is immaterial. (Martin on the Rev. Adm. Code, 1961, Vol. II, p. 487, citing Apostolic Prefect of Mt. Province vs. Treasurer

of Baguio City, 71 Phil. 547). In the instant case, although the property was still in the name of the GSIS pending the payment of the full

price its use and possession was already transferred to the defendant." Such contractual stipulation that the purchaser on installments pay

the real estate taxes pending completion of payments, although the seller who retained title is exempt from such taxes, is valid and

binding, absent any law to the contrary and none has been cited by appellant.

Thus, the delivery of possession by the seller GSIS to the purchaser was clearly with the intention of passing to the latter the possession,

use of and control over said property, and all the other attributes of ownership, short of the naked ownership such that it included in said

transfer the incidental obligation to pay the taxes thereon, for nothing more was left to the GSIS except its right to receive full payment of

the purchase price. The fact that in the contract to sell the GSIS, although aware of its own exemption from taxation stipulated and

exacted from the purchaser the payment of taxes amounts to an interpretation on its part that such an immunity was not to be transmitted

to a private person who becomes the beneficial owner and user of the property.

4

Verily, this interpretative regulation by the

administrative agency officially charged with the duty of administering and enforcing Commonwealth Act 186 which contains the tax-

exempting provision at issue carries great weight in determining the operation of said provision.

The position taken by the GSIS is but in conformity with Section 40(a) of Presidential Decree No. 464 entitled The Real Property Tax

Code promulgated on May 20, 1974 which reads as follows:

Sec. 40., Exemptions from Real Property Tax. The exemptions shall be as follows:

(a) Real property owned by the Republic of the Philippines or any of its political subdivisions and any government-

owned corporation so exempt by its charter; Provided, however, That this exemption shall not apply to real property

of the above-named entitles the beneficial use of which has been granted, for consideration or otherwise, to a taxable

person.

Thus under this provision, while the GSIS may be exempt from real estate tax

5

the exemption does not cover property belonging to it

"where the beneficial use thereof has been granted for consideration or otherwise to a taxable person." There can be no doubt that under

the provisions of the contract in question, the purchaser to whose possession the property had been transferred was granted beneficial use

thereof. It follows on the strength of the provision sec. 40(a) of PD 464 that the said property is not exempt from the real property tax.

While this decree just cited was still inexistent at the time the taxes at issue were assessed on the herein appellant, indeed its above

quoted provision sheds light upon the legislative intent behind the provision of Commonwealth Act 186, pertaining to exemption of the

GSIS from taxes.

The end result is but in consonance with the established rule in taxation that exemptions are held strictly against the taxpayer and

liberally in favor of the taxing authority.

6

ACCORDINGLY, the appealed judgment is hereby affirmed, without pronouncement as to costs.

Makasiar, Fernandez, Guerrero and Melencio-Herrera, JJ., concur.

Footnotes

1 Pertinent portions of the "Contract to Sell" read:

2 The PURCHASER agrees to pay and shoulder all taxes and assessments on the lot and building

or improvements thereon and insurance during the term of this contract.

3. Possession of the building, the improvements thereon and the parcel of land hereinabove contracted to be sold will

be delivered to the PURCHASER by the CORPORATION, or its duly authorized representative, after the approval of

the application by the Board of Trustees, the signing of this contract, and the payment of the down payment of (15%

for Member, 25% for Non-Member) P8,250.00 in the Office of the CORPORATION at Manila.

4. After completion of the payments herein stipulated, and the payment of all other charges, assessments, taxes,

incharges, due and payable by the PURCHASER, the CORPORATION agrees to execute a final deed of absolute

sale in favor of the PURCHASER and to deliver to him a Torrens Title to the said parcel of land. All for expenses

execution of the deed of absolute sale, registration. notarization, documentary stamps shall be borne and paid for in

advance by the PURCHASER.

2 Said provision reads: "Sec. 28(c) Except as otherwise herein provided, the GSIS, all benefits granted under this

Act, and its forms and documents required of the members shall be exempt from all types of taxes, documentary

stamps, duties and contributions, fiscal or municipal, direct or indirect, established or to be established.

3 Roque vs. Lapuz, G.R. No. L-32811, March 31, 1980. See also Luzon Brokerage Bldg. Co. Inc. vs. Maritime Bldg.

Co. inc. et al., 43 SCRA 93 (1972) Resolution on the Motion for consideration 46 SCRA 381 (1973) and Resolution

on Second Motion for Reconsideration, Nov. 16, 1978, 86 SCRA 305.

4 Accord with this interpelation was expressed in an Opinion of the Government Corporate Counsel No. 18, series of

1977 where the question was squarely raised as to whether awardees of GSIS property should pay realty taxes on the

lots possessed by them under conditional contracts of sale. The said counsel therein opined that it "would be

incongruous to hold that just because the GSIS is exempt from the real estate tax, the awardees should also be exempt

therefrom ... A contrary view will unjustly deprive the government of real estate taxes rightfully due to it.

5 This Court is aware of the provision of Section 23 of PD 1177 which provides:

"Sec. 23. Tax and Duty Exemptions. All units of government, including government-owned or controlled

corporations, shall pay income taxes, customs duties and other taxes and fees as are imposed under revenue laws:

provided, that organizations otherwise exempted by law from the payment of such taxes/duties may ask for a subsidy

from the General Fund in the exact amount of taxes/duties due: provided, further, that a procedure shall be

established by the Secretary of Finance and the Commissioner of the Budget, whereby such subsidies shall

automatically be considered as both revenue and expenditure of the General Fund."

Although the Court is not making the conclusion that the GSIS is no longer exempt from taxation, it takes note of the

apparent tendency of the lawmakers to now disfavor tax exemptions.

6 Central Azucarera Don Pedro v. Court of Tax Appeals, G.R. L-23236 and 23254, May 31, 1967, 20 SCRA 344,

Republic Flour Mills v. Com. of Internal Revenue, G.R. No. L-25602, Feb. 18, 1970, 31 SCRA 520, Commissioner

of Customs v. Philippine Acetylene Co. and STA, G.R. No. L-22443, May 29, 1971, 39 SCRA 70.

Republic of the Philippines

SUPREME COURT

Manila

SECOND DIVISION

G.R. No. L-39086 June 15, 1988

ABRA VALLEY COLLEGE, INC., represented by PEDRO V. BORGONIA, petitioner,

vs.

HON. JUAN P. AQUINO, Judge, Court of First Instance, Abra; ARMIN M. CARIAGA, Provincial Treasurer, Abra; GASPAR

V. BOSQUE, Municipal Treasurer, Bangued, Abra; HEIRS OF PATERNO MILLARE,respondents.

PARAS, J .:

This is a petition for review on certiorari of the decision * of the defunct Court of First Instance of Abra, Branch I, dated June 14, 1974,

rendered in Civil Case No. 656, entitled "Abra Valley Junior College, Inc., represented by Pedro V. Borgonia, plaintiff vs. Armin M.

Cariaga as Provincial Treasurer of Abra, Gaspar V. Bosque as Municipal Treasurer of Bangued, Abra and Paterno Millare, defendants,"

the decretal portion of which reads:

IN VIEW OF ALL THE FOREGOING, the Court hereby declares: