Professional Documents

Culture Documents

The Non - Financial Factors Influencing The Performance of

Uploaded by

hadihadihaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Non - Financial Factors Influencing The Performance of

Uploaded by

hadihadihaCopyright:

Available Formats

European Journal of Business and Management www.iiste.

org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

1#5

The Non- Financial Factors Influencing The Performance of

Islamic Insurance In Kenya: A Case Study of Takaful Insurance

of Africa

N(BI) S*)EIM(N (+ME,

,epartment of Business (dministration' Jomo -en.atta *ni/ersit. of (gri0ulture and 1e02nolog. !. %. Bo3

#1$10-#0100 Mom4asa- -EN5(.

1el6 0712$157$78 071 2009707 Email6 :;uatmom4asa<:;uat.a0.;e' :;uatmom4asa<gmail.0om or

na4il.almafa=.<gmail.0om

ABSTACT

It 2as 4een two .ears sin0e t2e first Islami0 insuran0e 4egan operations in -en.a ma;ing t2e first of its ;ind in

t2e w2ole of east and 0entral (fri0a' alt2oug2 t2e growt2 potential and performan0e of Islami0 insuran0e a4road

2a/e 4een remar;a4le' in -en.a it 2as pro/en eit2er wise 2en0e t2e stud. was 0ondu0ted to determine' w2at are

t2e non-finan0ial fa0tors influen0ing t2e performan0e of Islami0 insuran0e in -en.a. (nd t2e independent

/aria4les> 4eing studied was6 legal and regulator. framewor;' unet2i0al pra0ti0es w2ile t2e dependent /aria4le

4eing studied was performan0e of Islami0 insuran0e.

12e first o4:e0ti/e of t2e stud. was t2e legal and regulator. framewor; and out of t2e se0ondar. findings it was

found out t2at t2e s2aria 4oards were 0onsidered to 2a/e a strong aut2orit. on t2e performan0e of Islami0

insuran0e and also it defines t2e e3tents and limits of its operations.

12e se0ond o4:e0ti/e of t2e stud. was' unet2i0al pra0ti0e 2as s2own t2at due to t2e fle3i4ilit. of t2e insuran0e

mar;et on allowing intermediaries to pla.s mat02 ma;ers some of t2e agents and 4ro;ers 2a/e used t2ese

a/enues to e3ploit 0ustomers 2en0e affe0ting t2e performan0e of t2e insuran0e 0ompan.>s.

Key!ords: Islami0 insuran0e' Non-finan0ial performan0e' 1a;aful

"# Introduction

Islami0 insuran0e also famousl. ;nown as 1a;aful is one of t2e fastest growing se0tor in t2e finan0ial mar;et in

t2e world ' w2i02 is largel. dri/en 4. t2e need of 2a/ing s2aria 0ompliant produ0ts in t2e mar;et t2at are free

from interest ?i4a"' gam4ling Ma.sir" and un0ertaint. @2arar".12e first modern da. e3periment wit2

Islami0 insuran0e started in Sudan' in 19A9 4. t2e faisal Islami0 4an;. (nwar' 200#" w2ere 4. t2e 4an; s2aria

super/isor 4oard appro/ed t2e endea/or and in Januar. 19A9 t2e Islami0 insuran0e 0ompan. was esta4lis2ed as a

pu4li0 0ompan. under t2e 0ompanies a0t 1925' 2en0e due to t2e imperati/e 0on0ept ta;aful grew re0ognition and

spread all o/er t2e world.

(00ording to (:mal' 2010"'In 200# t2e. were 1A9 ta;aful 0ompanies and in 2010 t2e num4er of ta;aful grew to

200 and t2e main spread of Islami0 finan0e and ta;aful 2as 4een in t2e Middle East and part of (sia' (fri0a and

Europe. In addition' ta;aful grew at a 0ompound annual growt2 rate of $9B o/er 2005 and 200# in terms of

glo4al premiums w2i02 was estimated t2at t2e glo4al premiums stood at 5.$ 4illion in 200# and #.9 4illion in

2010' 2en0e pro/ing enoug2 t2at t2e demand of an alternati/e mode of insuran0e is 2ig2l. demanded in t2e

mar;et(:mal '2010".

+owe/er' t2e e3isten0e of ta;aful is still in its tender stages of de/elopment 2en0e for t2e industr. to see more

growt2 and to t2ri/e it s2ould address t2e issues of 0apitali=ation' 0ompetition from 0on/entional insuran0e'

de/elopment of 2uman resour0e' re-ta;aful re-insuran0e" and 2a/ing s2aria 0ompliant a/enues for in/estment

funds (.u4' 200A". So as to 4e a4le to 0ontinue its e3pansion strategies wit2out fa0ing serious 0rises and

t2ere4. a0Cuiring greeter mar;et s2are.

12e -en.an insuran0e mar;et is among t2e largest and most de/eloped in (fri0a a00ording to t2e asso0iation on

-en.a insuran0e 2011"' t2e -en.a penetration mar;et in 2011 was $.02 per0ent as 0ompared to last .ear w2ere

it re0orded a penetration of 2.A per0ent ' 2en0e ma;ing -en.a an appealing mar;et for insuran0e 0ompanies to

in/est in . 12e insuran0e mar;et in -en.a is regulated 4. t2e 4. t2e I?(" Insuran0e regulator. aut2orit. w2i02

is a statutor. go/ernment agen0. esta4lis2ed under t2e insuran0e a0t 0ap 7#A t2e main duties of t2e regulator.

aut2orit. is to regulate ' super/ise and de/elop t2e insuran0e industr. in -en.a.

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

1#9

In addition ' at t2e end of 2011 t2ere were 75 operating insuran0e 0ompanies in -en.a ' w2ere 22 0ompanies

wrote of non Dlife insuran0e 4usiness onl. ' 9 wrote life insuran0e 4usiness onl. w2ile 17 were 0omposite w2ere

4. t2e wrote 4ot2 life and non-life 4usiness (sso0iation of -en.a insuran0e' 2011" .

12e Islami0 insuran0e in -en.a 2as reported tremendous growt2 and appetite for its s2aria 0omplaints produ0ts

despite 4eing in operation for :ust a s2ort w2ile in t2e mar;et. 12e Islami0 insuran0e does not appeal not :ust to

t2e Muslim population 4ut also to t2e non-Muslim w2o appre0iates s2aria-0ompliant produ0ts t2at are an

alternati/e to 0on/entional insuran0e.

1a;aful insuran0e of (fri0a ltd also ;nown as 1I( is t2e first s2aria- 0ompliant insuran0e 0ompan. in east and

0entral (fri0a' t2e 0ompan. was founded in 200# and was formall. li0ensed in 2011 and 0urrentl. it 2as 7

4ran02es all o/er -en.a spreading from Nairo4i till Mom4asa t2e rationale 4e2ind t2e foundation of 1a;aful is

to pro/ide ris; management and finan0ial se0urit. 4ased on et2i0al prin0iples and /alues 1a;aful (fri0a' 2011".

$# %iterature e&ie!

(00ording to Islami0 Einan0ial Ser/i0es Board and International (sso0iation of Insuran0e Super/isors 2009"'

t2e origin of 1a;aful 0an 4e tra0ed to se/eral pra0ti0es from an0ient (ra4 tri4al 0ustom and t2e 0ompanions of

t2e !rop2et' for instan0es under t2e 0ustom of (l-(Cila2' 4lood mone." F2ere4. it was mutuall. agreed among

t2e tri4es t2at if a person is ;illed unintentionall. 4. a person of a different tri4e' t2e a00user>s paternal tri4e will

ta;e t2e responsi4ilit. to ma;e a mutual 0ontri4ution for t2e purpose of pa.ing t2e 4lood mone. to t2e /i0tim>s

relati/es. +en0e t2is s.stem was a4le to 0reate a pool of funds w2ere 4. it would 4e 02anneled to t2e oppressed

/i0tim to 4e indemnified.

+en0e pra0ti0all. ta;aful 0on0ept is 4ased on t2e idea of mutual 0o-operation' responsi4ilit.' assuran0e'

prote0tion and assistan0e 4etween groups of parti0ipants.

Below is a s;et02 ela4orating t2e 0on0ept of 1a;aful

Eigure .16 Gon0ept of 1a;aful

Sour0e6 Mo2d' 2011"

$#" %egal and egulatory Frame!ork

@o/ernments all o/er t2e world 2a/e alwa.s felt t2e urge and t2e need to gi/e 4road guideline for t2e

de/elopment of insuran0e industr. 4e0ause insuran0e in/ol/es ta;ing mone. from mem4ers of t2e general pu4li0

w2ere 4. in return for a promise of pa.ment on t2e o00urren0es of some in0ident or some future e/ent 2en0e if

t2e. was no me02anism in pla0e to 02e0; t2is ;ind of s.stem t2en unet2i0al and unprin0ipled person mig2t 4e

tempted to 0olle0t premiums and di/ert t2em wit2out 4ot2ering to 2onor t2eir promises w2i02 t2e. first 2ad

2en0e leading to t2e pu4li0 to lose fait2 (li0e and )u0.' 2009"

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

1#A

1o address t2is situation t2e go/ernment of -en.a ena0ted t2e insuran0e (0t 0ap 7#A w2ere 4. all t2e insuran0e

0ompanies 2a/e to ad2ere to t2e legal regulation 4eing pla0ed 4. it t2e reason for t2e state regulation of t2e

insuran0e industr. is to maintain sol/en0.' eCuit.' 0ompeten0e and man. more.

Islami0 insuran0e in -en.a are not a separate entit. at all 4ut instead t2e. are still defined 4. t2e insuran0e a0t

0ap 7#A 4ut t2e. are also regulated 4. t2e s2aria ad/isor. 0oun0il ;now as S(G. In addition all Islami0

institution t2at offer s2aria produ0ts and ser/i0e to t2e pu4li0 must 4e regulated and go/erned 4. a religious

4oard t2at a0ts as an independent 4oard 0omprising of s02olars wit2 spe0iali=ed ;nowledge of Islami0

transa0tion and man. more.

(00ording to t2e institute of Islami0 4an;ing and insuran0e'2012" 12e role of t2e s2aria super/isor 4oard is to

re/iew t2e ta;aful operation' super/isor its de/elopment of Islami0 insuran0e produ0ts and determine t2e s2aria

0omplian0e of t2ese and in/estments mostl. t2e s2aria super/isor. 0arr. t2eir own independent audit and 0ertif.

t2at not2ing relating to an. of t2e operations in/ol/es an. element t2at is pro2i4ited 4. t2e s2aria 2en0e in a wa.

limiting t2e full potential of t2e performan0e of t2e 0ompan. for instan0e 4ased on t2e s2aria regulation Islami0

insuran0e are not allowed to insure an. organi=ation t2at sells al0o2ol or to4a00o as t2eir 0ore main 4usiness.

(not2er aspe0t of t2e legal and regulator. framewor; limiting t2e performan0e of Islami0 insuran0e in -en.a is

t2e issue of insuran0e premium finan0e' w2ere4. t2is is a fa0ilit. gi/en eit2er 4. a 4an; or an insuran0e

0ompan. w2ere 4. 0lients 0an 4e a4le to afford t2e insuran0e premiums 4. pa.ing in installments o/er a period

of a .ear w2ere 4. t2ese installments 2as a slig2t margin of interest w2i02 is in0urred 2en0e 4ased on t2e

fundaments of ta;aful an. issue relating of interest is pro2i4ited 2en0e limiting its performan0e.

12e 0ommer0ial insuran0e and 0ompan. law in -en.a and most of t2e 0ountries are mostl. fas2ioned and a

0ostumed on t2e western pattern of doing 4usiness 2en0e t2ese laws 0ontain pro/isions t2at limit t2e s0ope of

Islami0 insuran0e t2erefore 0reating a ne0essit. for spe0ial laws to 4e introdu0ed to aid t2is s2ort 0oming so as to

ena4le t2e Islami0 insuran0e to 0ompete side 4. side wit2 0on/entional insuran0e

Eor instan0e' a00ording to t2e -en.an insuran0e (0t Gap 7#A se0tion 1111"' its state t2at

H12e 2older of a poli0. of life assuran0e on 2is own life ma.' w2en effe0ting t2e poli0. or at an. time 4efore t2e

poli0. matures for pa.ment' nominate t2e person or persons to w2om t2e mone. se0ured 4. t2e poli0. s2all 4e

paid in t2e e/ent of 2is deat26 !ro/ided t2at' w2ere t2e nominee is a minor' t2e poli0.2older ma. appoint' in t2e

manner pres0ri4ed' an. person to re0ei/e t2e mone. se0ured 4. t2e poli0. in t2e e/ent of 2is deat2 during t2e

minorit. of t2e nomineeI

+en0e' Islami0 insuran0e pro2i4its t2e appointment of t2e nominee 4ut instead t2e 4enefit s2ould 4e distri4uted

4ased on t2e 0on0ept of Islami0 in2eritan0e ;nown as faraid2 Islami0 in2eritan0e" w2ere 4. ea02 mem4er of t2e

famil. is allo0ated a spe0ified portion w2i02 is gi/en upon deat2 w2ere as opposed to gi/ing t2e full amount to

one nominee (=aman' 2009"

$#$ 'nethical Practices Affecting Com(any Performance#

Intermediaries pla.s a /ital role in t2e insuran0e industr. in -en.a 4e0ause most of t2e insuran0e transa0tions

are mostl. done t2roug2 t2e intermediaries w2o are usuall. t2e agents and 4ro;er w2o 4id t2e 4u.er and t2e

insurer toget2er to form a mutual 0ontra0t

In 0ommer0ial insuran0e mar;et t2e intermediar. pla.s t2e role of t2e mar;et mar;er or mat02 ma;er w2ere4.

t2e. 2elp 4u.ers to identif. t2eir 0o/erage and ris; management needs and 4. mat02ing 4u.ers wit2 appropriate

insuran0e Gummins and ,o2ert. 2005"' in addition t2e intermediaries assist in s0anning t2e mar;et' negotiating

and anal.=ing w2i02 insuran0e 0ompan. 2as t2e finan0ial strengt2 to underwrite t2e ris; and 2elp t2eir 0lient

sele0t from 0ompeting offers.

+en0e no one 0an den. t2e /ital 0ontri4ution of t2e intermediaries in t2e insuran0e industr. in t2e part t2e. pla.

on pro/iding wide range of ser/i0es to t2e 0lient on t2e 4e2alf of t2e insurer 2en0e from t2e wide range of

ser/i0e 4eing offered 4. t2e intermediaries usuall. t2e. remunerate t2emsel/es from a s.stem ;now 0ommission

4ased pa. w2ere4. for instan0e if a 0lient pur02ase a motor insuran0e 0o/er and pa. premiums usuall. a portion

of it lets sa. 10B of t2e premiums goes to t2e 4ro;er and t2e rest goes to t2e insuran0e 0ompan..

+en0e' wit2 t2e premium-4ased 0ommission intermediaries 2a/e de/eloped some unet2i0al pra0ti0es in t2e

mar;et so as to 4e a4le to gain more 0ommission from t2e insurer 2en0e undermining t2e performan0e of

insuran0e 0ompan. in -en.a' a00ording to +enri' Eran0ois J G2eon 2009"' some 0riti0s 4elie/e t2at su02 wa.s

of rewarding insuran0e agents and 4ro;ers is one of t2e underl.ing 0ause of unet2i0al 4e2a/iors 4e0ause it leads

to rise of 0onfli0ts 4etween agents and 0lients interest.

12e 0ommission 4ased selling s.stem would generate a 4iases to o/er-sell produ0ts t2at e/en t2e 0lients are not

interested at all sin0e t2e mode of remuneration pus2es a 0ustomer to in/est irrespe0ti/e of t2e 4est 02oi0e of t2e

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

1##

0lient. In addition some of t2e unet2i0al pra0ti0es most 0ommonl. pra0ti0ed in t2e mar;et a00ording to (li0e

and )u0. 2009" are as follows-

1wisting- t2is is t2e a0t of ad/ising t2e poli0.2older to 0an0el t2eir insuran0e poli0. and 02ange insurers and

intermediaries wit2 t2e moti/e and aim of ma;ing additional sales were 4. t2is mig2t affe0t t2e 0ompan.

performan0e and also it losses t2e 0ustomer dis0ount w2ere t2e poli0. appli0a4le to an annual 4ases.

G2urning- t2is is t2e a0t w2ere 4. t2e intermediaries en0ourage poli0.2olders to in0rease appli0a4le poli0. limits

or 02ange 0o/ers wit2 t2e aim of 2a/ing in0reased 0ommission w2i02 is unet2i0al

,upli0ation of 0o/er D t2is is t2e a0t w2ere4. t2e intermediaries ma. ad/i0e t2e 0lient to ta;e poli0ies w2i02

0o/er needs t2at are alread. 0atered for 4. similar e3isting poli0ies wit2 t2e sole aim of in0reasing 0ommission.

Non-remittan0e of premiums Dt2is is t2e a0t w2ere4. t2e intermediaries 0olle0t premiums on 4e2alf of an insurer

and t2e. s2ould pass to t2e insurer in due time wit2out dela. 4ut mostl. .ou will find out t2at t2e intermediar.

mig2t sta. wit2 t2e premium wit2 it in su02 a long time 2en0e limiting t2e 0ompan. performan0es.

)#*ethodology And +ata +escri(tion

12e results of t2is stud. are 0learl. e3plained in t2is se0tion. Mi0rosoft e30el software 2as 4een used to o4tain

t2e test results. 12e software 2as 4een 02osen 4e0ause it>s one of t2e most 0on/enient and effi0ient data

management program w2i02 2as t2e following 4enefits to t2e resear02ers as 4eing user friendl.' effi0ient data

management and also good at reporting and deplo.ment of data into information.

In addition t2e resear02ers distri4uted 75 Cuestioners to its respondents 4. email and 2ard 0op. and out of t2e 75

Cuestioners issued to its respondents to 4e filled out $1 were returned full. filled out and 17 were not returned at

all

)#" ,ffects -f %egal And egulatory Frame!ork#

12e ta4le 4elow s2ows t2e effe0ts of legal and regulator. framewor; on 0ompan. performan0e.

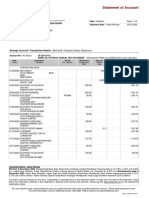

Ta.le ": ,ffects of legal and regulatory frame!ork

,ffects of legal and

regulatory frame!ork

Fre/uency Percentage 0

It redu0es fle3i4ilit. 12 $9B

It promotes sol/en0. 7 1$B

It limits 0ompetition 10 $2B

It promotes eCuit. 5 19B

12e respondent were as;ed to 0omment on t2e effe0ts of legal and regulator. framewor; on 0ompan.

performan0e and t2e result indi0ated t2at $9 per0ent of t2e respondent 0ommented t2at legal and regulator.

framewor; limits t2e fle3i4ilit. of 0ompan. performan0e' followed 4. $2 per0ent felt t2at t2e legal and

regulator. framewor; limits 0ompetition t2e 0ompan. performan0e. In addition' 19 per0ent of t2e respondent

0ommented t2at t2e effe0t of legal and regulator. framewor; is t2at it promotes eCuit. and similarl. 1$ per0ent

0ommented t2at it promotes sol/en0..

+en0e' t2e result implies t2at t2e legal and regulator. framewor; does to a large e3tent affe0t t2e Islami0

insuran0e 0ompan. 4e0ause it limits t2e fle3i4ilit. and 0ompetition of t2e 0ompan. 2en0e ma;ing it 2ard for

t2em to 0ompete in t2e mar;et.

)#$ ,1tent of legal and regulatory frame!ork

12e figure 4elow s2ows to w2at e3tent t2e legal and regulator. framewor; influen0es t2e performan0e of Islami0

insuran0e in -en.a.

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

1#9

Figure $: ,1tent of legal and regulatory frame!ork

12e respondents were as;ed to 0omment on t2e e3tent t2e legal and regulator. framewor; affe0ts t2e

performan0e of Islami0 insuran0e 0ompan.>s and ma:orit. of t2e respondent 95 per0ent" said t2at to a large

e3tent ' followed 4. 19 per0ent w2o were neutral and last 4ut not least 19 per0ent w2o said t2e e3tent of it is

minimal.

12e results impl. t2at to a large e3tent t2e legal and regulator. framewor; strongl. influen0e t2e performan0e of

Islami0 insuran0e in -en.a.

)#) ,ffects of 'nethical (ractices on com(any (erformance

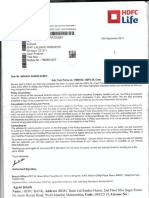

12e pie 02art 4elow s2ows t2e effe0ts of unet2i0al pra0ti0e on 0ompan. performan0e

Figure ): ,ffects of unethical (ractices on com(any (erformance#

12e respondent was as;ed to e3press t2eir opinion on t2e effe0ts of unet2i0al pra0ti0es on 0ompan. performan0e.

(nd Ma:orit. of t2e respondent 0ommented t2at 1AB"' of t2e effe0ts of unet2i0al pra0ti0es leads to dela.s in

pa.ment of 0laims wit2in t2e organi=ation followed 4. 29B w2o 0ommented t2at unet2i0al pra0ti0es destro.s

t2e 0ompan. reputation followed 4. 19B w2o 0ommented t2at it lowers t2e pu4li0 trust.

12is implies t2at unet2i0al pra0ti0es 2a/e a /er. 2uge impa0t on t2e 0ompan. performan0e and 0an negati/el.

affe0ts t2e 0ompan. image' reputation and' 0laims settlement.

)#2 +ifferent Ty(es -f 'nethical Practices Affecting Com(any Performance#

12e 4ar grap2 4elow s2ows t2e unet2i0al pra0ti0es affe0ting 0ompan. performan0e.

0

2

4

6

8

10

12

14

16

18

20

Large extent Neutral Minimal extent

Frequency 20 6 5

Percentage % 65% 19% 16%

55%

26%

19%

Effects of unethical practices on company

performance

Delays in ayment !" claims

Destr!ys t#e c!many reutati!n

L!$er t#e u%lic trust

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

190

Figure 2: +ifferent ty(es of unethical (ractices affecting com(any (erformance

12e respondents were as;ed to 0omment on t2e different t.pes of unet2i0al pra0ti0es t2at affe0t t2e 0ompan.

performan0e and 52B of t2e respondent 0ommented on non- remittan0e of premiums followed 4. 19B on t2e

dupli0ation of 0o/er ' followed 4. 2$B on twisting and last 4ut not least 10B on 02urning.

12is implies t2at non remittan0e of premium is a ma:or pra0ti0es t2at affe0ting 0ompan. performan0e 4e0ause if

a 0ompan. 0olle0ts inadeCuate premiums from t2e intermediaries it will mostl. fa0e diffi0ult. in pa.ing its

0laims on time.

2# Conclusion

12is paper attempted to fill t2e wide gap in Islami0 insuran0e literature 4. e3amining t2e non-finan0ial fa0tors

t2at influen0e t2e performan0e of Islami0 insuran0e in -en.a. In t2is stud.' t2ree fa0tors were 02osen and

anal.=ed as to determine t2eir influen0e on t2e insuran0e performan0e6 4elow are t2e fa0tors.

7.1 )egal and regulator. framewor;

7.2 *net2i0al pra0ti0es

12e results indi0ated t2at all t2e a4o/e fa0tors 2ad a 4ig influen0e on t2e Islami0 insuran0e performan0e in -en.a.

Euture ' to pro/ide an in-dept2 finding is t2at emplo.ee 0ompeten0. was 0onsidered to 2a/e a strong influen0e on

t2e performan0e of Islami0 insuran0e in -en.a ' followed 4. legal and regulator. framewor; and last 4ut not least

unet2i0al pra0ti0es.

12ese results' 0ommuni0ate a 0ru0ial indi0ator t2at 0ommer0ial insuran0e in -en.a s2ould fo0us on all t2e fa0tors

in order to grow and sta4ili=e t2e industr..

3 ecommendations

Erom t2e 0on0lusion of t2e stud.' t2e following re0ommendation 0an 4e reasona4l. forwarded for Islami0

insuran0e in -en.a.

3#" %egal and regulatory frame!ork

12e legal and regulator. framewor; was found to influen0e t2e performan0e of Islami0 insuran0e to a large e3tent

4. influen0e t2e fle3i4ilit. of its operations ' in/estment and man. more 2en0e to sol/e t2is issue re/iews of t2e

e3isting laws and guidelines go/erning t2e insuran0e industr. s2ould 4e re/iewed to allow growt2 of Islami0

insuran0e industr. :ust as t2e 0on/entional 0ounterpart.

3#$ 'nethical (ractices

*net2i0al pra0ti0es was found to influen0e t2e performan0e of Islami0 insuran0e to a /er. large e3tent 4.

influen0ing t2e pro0ess of its 0laims ' 0ompan. reputation and pu4li0 trust 2en0e in a endea/or to operate et2i0all.

' insuran0e pra0titioners s2ould o4ser/e utmost good fait2 and dis0lose all material fa0ts in respe0t of produ0ts at

t2e time of negotiating for a 0o/er .

In addition intermediaries s2ould use onl. t2e rig2t met2od in persuading 0lients to 4u. t2eir produ0ts and

ser/i0es. 12e. s2ould dis0lose all fa/ora4le and unfa/ora4le features of t2e produ0t at t2e earliest stage possi4le in

a 4id to ensure t2at a 0lient ma;es an informed de0ision

3#) Areas for further research

12is resear02 will 0ontri4ute to t2e e3isting literature regarding non-finan0ial fa0tors influen0e on t2e

performan0e of Islami0 insuran0e in -en.a. +owe/er furt2er resear02 s2ould 4e done on t2e finan0ial fa0tors t2at

influen0e t2e performan0e of Islami0 insuran0e and also to gi/e an in-dept2 0omparison wit2 t2e 0on/entional

insuran0e in -en.a.

0

5

10

15

20

&$isting '#urning Dulicati!n !"

c!(er

N!n)

remittance !"

remiums

Frequency

Percentage %

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.5' No.1$' 201$

191

eferencing

(nwar' +. 200#". Islamic Finance: A Guide for International Business and Investment. *nited -ingdom6 @MB.

(:mal' B. 2010". The growing importance of takaful insurance. (sia regional retrie/ed on %0to4er

10

t2

2012 from 2ttp688www.oe0d.org8insuran0e8insuran0e879119115.pdf

(.u4' M 200A". *nderstanding Islami0 finan0e6 )ondon6 !u4lis2er File. finan0e series

1a;aful (fri0a 2011". The takaful insurance of Africa. ?etrie/ed on No/em4er 20

t2

2012 from

2ttp688www.ta;afulafri0a.0om.

(sso0iation of -en.a insuran0e. 2011"' Insuran0e industr. annual report 2011 retri/ed on april 10

t2

201$ from

2ttp688www.a;insure.0om

Islami0 Einan0ial Ser/i0es Board and International (sso0iation of Insuran0e Super/isors. 2009". Issues in

Regulation and Supervision of Takaful6 Islami0 Insuran0e retrie/ed %0to4er 12

t2

2012 from

2ttp688www.ifs4.org8do0s8ta;afulK2009.pdf

Mo2d' E'2011" Fundamentals of Takaful6 IBEIM' retrie/ed on 2

nd

,e0em4er 2012 from

2ttp688www.islami04an;er.0om8ta;aful-2.4rid-model

(li0e' F. and )u0.' N. 2009". Fundamental of insurance: Nairo4i6 !u4lis2ed 4. 0ollege of insuran0e.

Institute of Islami0 4an;ing and insuran0e' 2012". S2aria super/isor. 4oard6 S(B" retrie/ed 1#

No/em4er 2012 from 2ttp688 www.islami0- 4an;ing.0om8ta;afulKs2aria2Ksuper/isor.K4oard.asp3.2tm

12e insuran0e a0t 0ap 7#A retrie/ed on 15 No/em4er 2012 from

2ttp688www.;en.alaw.org8;lr8fileadmin8pdfdownloads8(0ts8Insuran0eK(0tKKGapK7#AK.pdf

(=aman' I.2009". omination and !i"ah Issues in the Takaful Industr#: IS?( s2aria 0onferen0e retrie/ed

from 21 No/em4er 2012 2ttp688www.isra.0om.

Gummins' and ,o2ert.' 2005". The economics of insurance intermediaries6 F2arton S02ool

*ni/ersit. of !enns.l/ania retrie/ed on No/em4er 20 2012 from

2ttp6884eta.i4awest.0om8pdf8F2artonB20paperB200505.pdf

+enri'G. Eran0ois' and G2eon'2009". The insurance "usiness and its image in societ#6 1raditional issue and new

02allenges retrie/ed on 20 No/em4er 2012 from

2ttp688www.insead.edu8fa0ult.resear028resear028do0.0fmLdidM2019

You might also like

- AP Newsletter Q3 2019Document43 pagesAP Newsletter Q3 2019hadihadihaNo ratings yet

- Address Your Challenges Efficiently With An Ifrs17 Service BureauDocument6 pagesAddress Your Challenges Efficiently With An Ifrs17 Service BureauhadihadihaNo ratings yet

- Department of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomDocument20 pagesDepartment of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomhadihadihaNo ratings yet

- Gunnar Benktander and Jan Ohlin University of Stockholm: D - o - 2 M oDocument14 pagesGunnar Benktander and Jan Ohlin University of Stockholm: D - o - 2 M ohadihadihaNo ratings yet

- Are PDFDocument60 pagesAre PDFhadihadihaNo ratings yet

- BaselDocument49 pagesBaselhadihadihaNo ratings yet

- Are PDFDocument60 pagesAre PDFhadihadihaNo ratings yet

- Sponsorship OpportunitesDocument9 pagesSponsorship OpportuniteshadihadihaNo ratings yet

- Department of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomDocument20 pagesDepartment of Actuarial Mathematics and Statistics, Heriot-Watt University, Edinburgh EHI4 4AS, United KingdomhadihadihaNo ratings yet

- Edu 2014 Exam at Study Note Basics ReinDocument52 pagesEdu 2014 Exam at Study Note Basics ReinNguyễn Bá Khánh TùngNo ratings yet

- Negotiable Instruments-Forgery Insurance-Definition of Forgery AsDocument6 pagesNegotiable Instruments-Forgery Insurance-Definition of Forgery AshadihadihaNo ratings yet

- Risks: The Effects of Largest Claim and Excess of Loss Reinsurance On A Company's Ruin Time and ValuationDocument27 pagesRisks: The Effects of Largest Claim and Excess of Loss Reinsurance On A Company's Ruin Time and ValuationhadihadihaNo ratings yet

- Employment and Salary Trends in The Gulf 2015Document16 pagesEmployment and Salary Trends in The Gulf 2015mtnazeerNo ratings yet

- Toxic Employee Attitudes Howto Keep Negativity From Infecting Your Workplace HandoutDocument25 pagesToxic Employee Attitudes Howto Keep Negativity From Infecting Your Workplace HandouthadihadihaNo ratings yet

- Te Insurance Sector in The Middle EastDocument43 pagesTe Insurance Sector in The Middle EasthadihadihaNo ratings yet

- Surplus Distribution Issues In: Takaful and RetakafulDocument13 pagesSurplus Distribution Issues In: Takaful and RetakafulhadihadihaNo ratings yet

- Operational Issues and Shariah Harmonisation in TakafulDocument17 pagesOperational Issues and Shariah Harmonisation in TakafulhadihadihaNo ratings yet

- The Surplus Declaration ProcessDocument2 pagesThe Surplus Declaration ProcesshadihadihaNo ratings yet

- ReTakaful RohailAliKhanDocument20 pagesReTakaful RohailAliKhanhadihadihaNo ratings yet

- Cyber Liability Higher EducationDocument15 pagesCyber Liability Higher EducationhadihadihaNo ratings yet

- Misr Insurance Co Annual Report 30 June 2010Document60 pagesMisr Insurance Co Annual Report 30 June 2010hadihadihaNo ratings yet

- Arig Annual Report 2010 - EnglishDocument73 pagesArig Annual Report 2010 - EnglishhadihadihaNo ratings yet

- Re Insurance 1111 WebDocument32 pagesRe Insurance 1111 WebhadihadihaNo ratings yet

- Arab Insurance Marktets Review 2010Document5 pagesArab Insurance Marktets Review 2010hadihadihaNo ratings yet

- Tax Law1Document56 pagesTax Law1hadihadihaNo ratings yet

- Arab Insurance Marktets Review 2010Document5 pagesArab Insurance Marktets Review 2010hadihadihaNo ratings yet

- Misr Insurance Co Annual Report 30 June 2010Document60 pagesMisr Insurance Co Annual Report 30 June 2010hadihadihaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PitchBook PE Breakdown 3Q2010Document6 pagesPitchBook PE Breakdown 3Q2010ddavidson55142No ratings yet

- List BancNet Member BanksDocument2 pagesList BancNet Member BanksTara NahNo ratings yet

- Consumer Affairs DirectoryDocument45 pagesConsumer Affairs Directorynavin.aherNo ratings yet

- Registered Mutual Funds As On Oct 12 2023Document13 pagesRegistered Mutual Funds As On Oct 12 2023bnrathod0902No ratings yet

- Insurance BrokersDocument1 pageInsurance BrokersmcmirandoNo ratings yet

- W AsiaDocument6 pagesW Asiaapi-213954485No ratings yet

- D.E. 441 JPMorgan Chase 80 Billing EntriesDocument5 pagesD.E. 441 JPMorgan Chase 80 Billing Entrieslarry-612445No ratings yet

- Statement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, SelangorDocument5 pagesStatement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, Selangorputri nurishaNo ratings yet

- DS NHDL 311213Document29 pagesDS NHDL 311213Khiem NguyenNo ratings yet

- HSBC Hedge Weekly (2006 - 2007 - 2008)Document46 pagesHSBC Hedge Weekly (2006 - 2007 - 2008)GeorgeNo ratings yet

- MYPF Pref Database 15may'13Document319 pagesMYPF Pref Database 15may'13Fiachra O'DriscollNo ratings yet

- KPERS PE DataDocument3 pagesKPERS PE DatadavidtollNo ratings yet

- Abn Amro Bank NVDocument19 pagesAbn Amro Bank NVabrilliantineNo ratings yet

- Active Shareholder Ownership RecordsDocument4,063 pagesActive Shareholder Ownership RecordsssdebNo ratings yet

- Ij:Ip: HL.L - :T:.::::,:, - I:-, T:-S'a'::' ..:-' J IDocument6 pagesIj:Ip: HL.L - :T:.::::,:, - I:-, T:-S'a'::' ..:-' J Iabhinay dubeyNo ratings yet

- Total Retail Bond Trading 1503Document260 pagesTotal Retail Bond Trading 1503Sorken75No ratings yet

- Rab 2020 Kembang AyunDocument79 pagesRab 2020 Kembang AyunArie Ikhwan SaputraNo ratings yet

- Etf Guide PDFDocument2 pagesEtf Guide PDFFalconsNo ratings yet

- Washington State Investment Board Portfolio Overview by Strategy December 31, 2015Document7 pagesWashington State Investment Board Portfolio Overview by Strategy December 31, 2015FortuneNo ratings yet

- Alfred TsaiDocument17 pagesAlfred TsaisarmadfunsolNo ratings yet

- First Half 2015 Insurance ReviewDocument8 pagesFirst Half 2015 Insurance ReviewExcessCapitalNo ratings yet

- Foreign Banks in IndiaDocument3 pagesForeign Banks in IndiaNamita SardaNo ratings yet

- List of Top BanksDocument2 pagesList of Top BanksAnonymous QjsvRdNo ratings yet

- List of Banks in Indonesia with CodesDocument4 pagesList of Banks in Indonesia with CodesMas ChitozNo ratings yet

- Mobile Banking Codes PaybillDocument2 pagesMobile Banking Codes PaybillMauriceNo ratings yet

- 09.07.2021 Tvbatr2a - Ssi List-TürkçeDocument1 page09.07.2021 Tvbatr2a - Ssi List-Türkçemarinetest.helperNo ratings yet

- 2017 IPE Top 400 Asset Managers 2017Document3 pages2017 IPE Top 400 Asset Managers 2017WendyNo ratings yet

- Mutual FundDocument2 pagesMutual Fundkum_praNo ratings yet

- HSBC Bank: HSBC Bank Deposit Slip (Client Copy) Date of Deposition: Deposit Slip No: 5002722571Document2 pagesHSBC Bank: HSBC Bank Deposit Slip (Client Copy) Date of Deposition: Deposit Slip No: 5002722571paralakhemundi FKLNo ratings yet

- Score and Certified BanksDocument340 pagesScore and Certified BanksDaysiHuancaTiconaNo ratings yet