Professional Documents

Culture Documents

Boulevard Holdings: Q3 Report

Uploaded by

BusinessWorldOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boulevard Holdings: Q3 Report

Uploaded by

BusinessWorldCopyright:

Available Formats

A S 0 9 4 0 0 6 3 0 9

B O U L E V A R D H O L D I N G S , I N C.

1 7 0 4 P E A K T O W E R , 1 0 7 L . P .

L E V I S T E S T. , S A L C E D O V I L L A G E

M A K A T I C I T Y

Licensing Unit

Forwarded to:

Corporate and Partnership Registration Division

Green Lane Unit

Financial Analysis and Audit Division

Document I.D.

Received by Corporate Filing and Records Division (CFRD)

Contact Person's Address

1704 PEAK TOWER, 107 L.P. LEVISTE ST., SALCEDO VILLAGE, MAKATI CITY

Assigned Processor

MAURO B. BADIOLA mbb@boulevardholdings.com (632) 8436460

Name of Contact Person Email Address Facsimile Number/s

(632)8436460

Company's Email Address Company's Telephone Number/s Company's Facsimile Number/s

CONTACT PERSON INFORMATION

COVER SHEET

To be Accomplished by CRMD Personnel

COMPANY REGISTRATION AND MONITORING DEPARTMENT

SEC 17 Q (Q1- FY 5-31-15)

Nature of Application SEC Registration Number

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

COMPANY INFORMATION

www.boulevardholdings.com (632)753-1405

17 Q1 FY 5-31-15 8/31/2014

1

SECURITIES AND EXCHANGE COMMISSION

SEC FORM 17-Q

QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION

CODE AND SRC RULE 17(2)(b) THEREUNDER

1. For the quarterly period ended August 31, 2014

2. SEC Identification No AS094-006309

3. BIR Tax Identification No. 004-451-425-000

4. Exact name of issuer as specified in its charter BOULEVARD HOLDINGS, INC.

5. Province, Country or other jurisdiction of incorporation or organization:

Makati City, Philippines

6. Industry Classification Code: ( ) (SEC Use only)

7. 1704 Peak Tower, 107 L.P. Leviste St., Salcedo Village, Makati City

Address of principal office Postal Code 1227

8 (632) 753-1405

Issuers telephone number, including area code

9. Not applicable

Former name, former address, and former fiscal year, if changed since last report

10. Securities registered pursuant to Section 8 & 12 of the SRC, or Sec 4 and 8 of the RSA

a) Authorized Capital Stock Title of Each Class

Common shares, .10 par value 12,000,000,000 shares

Php1,200,000,000

b) Issued and Outstanding

Common shares, .10 par value 12,000,000,000 shares

Amount P1,005,792,017

c) Amount of Debt Outstanding P190,993,529

11. Are any or all of these securities listed on a Stock Exchange

Yes ( / ) No ( )

If yes, state the name of such stock exchange and the classes of securities listed therein:

17 Q1 FY 5-31-15 8/31/2014

2

Stock Exchange : Philippine Stock Exchange

Securities : common shares

12. Check whether the issuer:

a. (a) has filed all report to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or

section 11 of the Revised Securities Act (RSA) Rule 11(a)-1 thereunder, and Section 26 and 141 of

the Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter

period that the registrant was required to file such reports):

Yes ( / ) No ( )

a. (b) has been subject to such filing requirements for the past ninety (90) days

Yes ( / ) No ( )

17 Q1 FY 5-31-15 8/31/2014

3

TABLE OF CONTENTS

Page No.

PART 1 - FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Statements of Financial Position as at August 31,

2014 and May 31, 2014

4

Consolidated Statements of Income for the Three Months Period

Ended August 31, 2014 and 2013

5

Consolidated Statements of Comprehensive Income for the Three

Months Period Ended August 31, 2014 and 2013

6

Consolidated Statements of Changes in Equity for the Three

Months Period Ended August 31, 2014 and 2013

7

Consolidated Statements of Cash Flows for the Three Months

Period Ended August 31, 2014 and 2013

8

Notes to Consolidated Financial Statements

9

Item 2. Managements Discussion and Analysis of Financial Condition and

Results of Operations (MD&A)

54

PART II OTHER INFORMATION

Item 3. Three Months Period Ended August 31, 2014 Developments 56

Item 4. Other Notes to Three Months Period Ended August 31, 2014 Operations

and Financials

57

Item 5. Financial Soundness Indicators 63

Signature 64

17 Q1 FY 5-31-15 8/31/2014

4

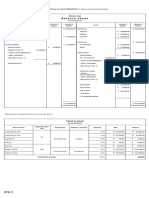

PART I - FINANCIAL INFORMATION

EXHIBIT A

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

August 31, 2014 May 31, 2014

Unaudited Audited

ASSETS

Current Assets

Cash (Note 4) P1,912,035 P 2,480,684

Trade and other receivables -net (Note 5) 47,642,792 48,001,276

Inventories (Note 6) 1,234,709 1,348,123

Prepayments and other current assets (Note 7) 35,035,413 33,871,699

Total Current Assets 85,824,949 85,701,782

Noncurrent Assets

Investments properties (Note 8) 926,062,539 926,514,072

Property and equipment - net (Note 9) 390,159,647 382,392,268

Deferred income tax assets-net 3,306,774 3,266,193

Other noncurrent assets- net (Note 10) 519,656,687 471,142,744

Total Noncurrent Assets 1,839,185,647 1,783,315,277

TOTAL ASSETS P1,925,010,596 P1,869,017,059

LIABILITIES AND EQUITY

Current Liabilities

Trade and other payables (Note 11) P172,548,166 P170,408,314

Income tax payable 9,165,731 9,153,668

Customers' deposits 169,000 169,000

Total Current Liabilities 181,882,897 179,730,982

Noncurrent Liability

Retirement benefits obligation (Note 12) 9,110,632 9,392,486

Equity Attributable to Equity Holders of the Parent

Capital stock - P0.10 par value (Note 22)

Authorized - 12,000,000,000 common shares

Issued and subscribed - 12,000,000,000 common shares

as at August 31, 2014 and May 31, 2014 1,200,000,000 1,200,000,000

Additional paid-in capital 612,094,337 612,094,337

Cumulative translation adjustments 103,077,170 104,047,657

Remeasurement loss on retirement benefits liability Note 2 (160,048) (160,048)

Subscription receivables (291,311,975) (348,686,975)

Retained earnings 17,474,332 19,736,804

1,641,173,816 1,587,031,775

Non-controlling interests 92,843,251 92,861,816

Total Equity 1,734,017,067 1,679,893,591

TOTAL LIABILITIES AND EQUITY P1,925,010,596 P1,869,017,059

See accompanying Notes to Consolidated Financial Statements.

17 Q1 FY 5-31-15 8/31/2014

5

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

August 31, 2014 August 31, 2013

REVENUES (Note 13)

Services P8,905,370 P16,102,074

Sales 4,174,876 7,030,413

13,080,246 23,132,487

COSTS AND EXPENSES

Cost of sales and services (Note 13) 5,726,374 8,035,104

General, administrative and selling (Note 14) 9,698,156 11,260,554

15,424,530 19,295,658

OTHER INCOME (CHARGES)

Rentals (Note 8) 260,071 198,378

Net interest cost on retirement benefit cost (226,671) (222,226)

Bank charges (19,811) (5,345)

Foreign exchange gains net 14,255 15,826

Interest income 906 1,316

28,750 (12,051)

INCOME (LOSS) BEFORE INCOME TAX (2,315,534) 3,824,778

Provision for income tax 34,497 1,859,984

NET INCOME (P2,315,534) P1,964,794

ATTRIBUTABLE TO

Equity holders of the Parent (P2,331,466) P988,281

Non-controlling interests (18,565) 976,513

(P2,350,031) P1,964,794

LOSS PER SHARE (P 0.0002) (P0.0010)

See accompanying Notes to Consolidated Financial Statements

17 Q1 FY 5-31-15 8/31/2014

6

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME

UNAUDITED

Three Months Period Ended

August 31, 2014 August 31, 2013

NET INCOME (LOSS) (P2,350,031) P1,964,794

Cumulative translation adjustments (970,487) 5,519,509

TOTAL COMPREHENSIVE INCOME (P3,320,518) P7,484,303

ATTRIBUTABLE TO

Equity holders of the parent: (P3,301,953) P6,507,790

Non-controlling interest (18,565) 976,513

(P3,320,518) P7,484,303

See accompanying Notes to Consolidated Financial Statements

17 Q1 FY 5-31-15 8/31/2014

7

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

THREE MONTHS PERIOD ENDED AUGUST 31, 2014 and 2013

Attributable to Equity Holders of the Parent

Additional

Remeasurement

Capital Paid In

Cumulative

loss on

retirement Non-

Stock Capital Subscription Translation Retained benefits Controlling Total

(Note 22) (Note 22) receivables Adjustments Earnings liability Interests Equity

Balance as of May 31, 2013 878,389,356

505,566,933

104,104,326 32,199,421

94,168,653 1,614,428,689

Use of APIC for the period

(482,796)

(482,796)

Deposit for future subscription

49,359,442

49,359,442

Translation adjustment

5,519,509

5,519,509

Net income for the period

988,281

988,281

Non-controlling interests

976,513 976,513

Balance as of August 31, 2013 878,389,356

505,084,137 49,359,442 109,623,835 33,187,702 95,145,166 1,670,789,638

Balance as of May 31, 2014 1,200,000,000

612,094,337

(348,686,975) 104,047,657 19,736,804 (160,048) 92,861,816 1,679,893,591

Use of APIC for the period

-

Deposit for future subscription

-

Translation adjustment

6,552,942

6,552,942

Net income for the period

(2,262,472)

(2,262,472)

Subscription receivable

57,375,000

57,375,000

Non-controlling interests

(18,565) (18,565)

Balance as of August 31, 2014 1,200,000,000

612,094,337

(291,311,975) 110,600,599 17,474,332 (160,048) 92,843,251 1,741,540,496

See accompanying Notes to Consolidated Financial Statements.

17 Q1 FY 5-31-15 8/31/2014

8

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Three Months Period Ended

August 31, 2014 August 31, 2013

CASH FLOWS FROM OPERATING ACTIVITIES

Income before income tax (P2,262,472) P3,824,778

Adjustment for:

Depreciation and amortization 2,184,154 2,034,418

Interest and other financing charges 19,811 1,316

Interest income (906) (5,345)

Operating income before working capital changes (59,413) 5,855,167

Decrease (increase) in:

Trade and other receivables 358,484 (7,165,410)

Inventories (113,414) (214,647)

Prepayment and other current assets 1,163,714 (2,564,487)

Increase (decrease) in:

Trade and other payables 1,857,998 (4,864,942)

Income tax payable 12,063 1,859,984

Customers' deposits (4,000)

Net cash flows generated from operations 3,219,432 (7,098,335)

Interest received 906 5,345

Interest paid (19,811) (1,316)

Net cash flows from operating activities 3,200,527 (7,094,306)

CASH FLOWS FROM INVESTING ACTIVITIES

Decrease (increase) in

Acquisition of additional property and equipment 9,500,000 (41,937,232)

Deferred tax asset 40,581

Other non current assets 44,065,243 (5,780,200)

Net cash flows used in investing activities 53,605,824 (47,717,432)

CASH FLOWS FROM FINANCING ACTIVITIES

Deposit for future subscriptions (57,375,000) 49,359,442

Additional paid-in capital (482,796)

Net cash flows from (used in) financing activities (57,375,000) 48,876,646

NET INCREASE IN CASH (568,649) (5,935,092)

CASH AT BEGINNING OF YEAR 2,480,684 8,239,553

CASH AT END OF YEAR P1,912,035 P2,304,461

See accompanying Notes to Consolidate Financial Statements

17 Q1 FY 5-31-15 8/31/2014

9

BOULEVARD HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Corporate Information and Status of Operations

Corporate Infor mation

Boulevard Holdings, Inc. (the Parent Company) was incorporated with the Philippine Securities and

Exchange Commission (SEC) on July 13, 1994 primarily to invest in, purchase, or otherwise acquire

and own, hold, use, develop, sell, assign, among others, real and personal property of every kind and

description. The Parent Company has investments in companies involved in the development of

leisure, hotel and tourist estates, as well as residential and office condominiums, operation and

management of hotels and resorts, travel related and other allied businesses and services in the

Philippines and abroad.

On April 29, 2014, the Board of Directors (BOD) of the Parent Company approved the resolution for the

amendment of the Parent Companys Articles of Incorporation specifying the principal office of the

Parent Company from Metro Manila to 1704 Peak Tower, 107 L. P. Leviste St., Salcedo Village,

Makati City. The change of the address was approved by the SEC on September 10, 2014.

The registered office address of the Parent Company is 1704 Peak Tower, 107 L. P. Leviste Street,

Salcedo Village, Makati City.

Segment Information

The Parent Company and Subsidiaries (collectively referred to as the Group) operates primarily in

segments of providing world-class hotel and resort amenities and investment holding (see Note 21).

Status of Operations of Subsidiaries

a. Askar Ltd. has a previous lease agreement with Grand International Airways (GIA), an affiliate,

involving two aircrafts the former owns. The agreement was for a period of thirty-six (36) months

which ended on August 1, 2000 and required the lessee to pay the lessor a monthly rental of

US$90,000 for each aircraft. Askar did not renew its lease agreement with GIA on expiry date as

the latter has indefinitely suspended its operations due to operational and financial difficulties and

has not resumed its operations as at August 31, 2014.

b. Infocast has not yet started commercial operations and its business prospects are uncertain.

c. Fridays Holdings, Inc. (FHI) owns and operates Fridays Boracay Beach Resort, a luxury resort

situated in Boracay Island that offers 52 rooms and facilities and amenities such as restaurants,

function halls and other tourist-oriented activities. The Parent Company effectively owns 77.00% of

FHI through Crown One Land, Inc. (COLI).

On February 14, 2014, a dispute arose between FHI and the heir of a lessor regarding the possession

of the land where the resort is located. Stipulation of the lease contract states the transfer of

ownership of the land upon consummation. The lease contract was consummated on February 14,

2014. However, as an act of dishonoring the contract, the heir of the lessor barricaded a portion of

FHIs beach resort in defense that the contract was void at the very beginning.

To counter this action, FHI filed a criminal case for usurpation of property as well as a civil case for

17 Q1 FY 5-31-15 8/31/2014

10

forcible entry with a TRO to remove the barricades built.

As at August 31, 2014, the criminal and civil case is still pending with the courts.

On July 18, 2014, the Municipal Circuit Trial Court of Buruanga-Malay issued a Writ of Preliminary

Injunction, ordering the lessor to vacate the premises. Subsequently, on September 29, 2014, the

property subject of litigation has been successfully registered under the name of its rightful owner,

Fridays Holdings, Inc. with the Provincial Register of Deeds of Aklan.

d. COLI is engaged in the real estate business and currently owns 44% of FHI. COLIs assets only

relate to its investment in FHI. The Parent Company controls the financial and operating policies of

COLI by virtue of a shareholders agreement by the minority shareholders in favor of the Parent

Company, and that majority of the Board of Directors (BOD) of COLI are the same as that of the

Parent Company.

e. FPGI is currently constructing a luxurious native style boutique resort in the exclusive Boquete

Island in Puerto Galera, Oriental Mindoro, aiming to replicate the success of the original Fridays

Resort in Boracay. Effective June 1, 2008, the Parent Company recognized its 45.46% investment

in FPGI by contributing parcels of land previously classified as investment property in the Parent

Company statement of financial position amounting to P=50.00 million. The contribution of

minority shareholders amounting to P=61.21 million also represents parcels of land. The Parent

Company controls the financial and operating policies of FPGI by virtue of a shareholders

agreement by the minority shareholders in favor of the Parent Company, and that majority of the

BOD of FPGI are also the BOD of the Parent Company.

2. Basis of Preparation, Statement of Compliance and Summary of Significant Accounting and

Financial Reporting Policies

Basis of Preparation

The consolidated financial statements have been prepared on the historical cost basis. The consolidated

financial statements are presented in Philippine peso, which is the Groups functional and presentation

currency. All amounts are rounded to the nearest peso, except as otherwise indicated.

Statement of Compliance

The consolidated financial statements have been prepared in compliance with the Philippine Financial

Reporting Standards (PFRS).

Basis of Consolidation

The consolidated financial statements comprise the financial statements of the Parent Company and the

following subsidiaries as at August 31, 2014 and May 31, 2014:

Financial Percentage of Ownership

Country of Reporting 2014 2013

Subsidiary Incorporation Period Direct Indirect Direct Indirect

Askar

(a), (c)

British Virgin

Islands May 31 100.00 100.00

Infocast

(b), (c)

Canada December 31* 100.00 100.00

FHI

(e)

Philippines June 30 55.00 22.00 55.00 22.00

COLI

(d), (e)

Philippines December 31* 50.00 50.00

FPGI

(d), (e)

Philippines April 30 45.46 45.46

* for consolidation purposes, additional financial information of Infocast and COLI were prepared as of the same date as the

financial statements of the Parent Company

17 Q1 FY 5-31-15 8/31/2014

11

(a)

No longer operating

(b)

Pre-operating stage

(c)

Foreign subsidiaries

(d)

Parent Company exercises power to govern the financial and operating policies by virtue of a shareholders agreement by the minority

shareholders in favor of the Parent Company

(e)

Majority of the BOD subsidiarys are also BOD of the Parent Company

An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement

with the investee and has the ability to affect those returns through its power over the investee. Thus, the

principle of control sets out the following three elements of control:

! Power to direct relevant activities

! Exposure or rights to variable returns

! Link between power and exposure

Subsidiaries are consolidated from the date on which control is transferred to the Group and cease to be

consolidated from the date on which control is transferred out of the Group.

Subsidiaries

Subsidiaries are entities over which the Parent Company has control.

Subsidiaries are fully consolidated from the date of acquisition, being the date on which the Parent

Company obtains control, and continue to be consolidated until the date that such control ceases. The

financial statements of the subsidiaries are prepared with different reporting year not longer than three (3)

months as the Parent Company, using uniform accounting policies for like transactions and other events

in similar circumstances.

All intra-group balances, transactions, income and expenses and profits and losses resulting from intra-

group transactions are eliminated in full.

Non-controlling Interest

Non-controlling interest represents interest in a subsidiary that is not owned, directly or indirectly, by the

Parent Company. Profit or loss and each component of other comprehensive income are attributed to the

equity holders of the Parent Company and to the non-controlling interest. Total comprehensive income

is attributed to the equity holders of the Parent Company and to the non- controlling interests even if this

results in the non-controlling interest having a deficit balance.

Non-controlling interest represents the portion of profit or loss and the net assets not held by the Group.

Transactions with non-controlling interest are accounted for using the entity concept method, whereby

the difference between the consideration and the book value of the share of the net assets acquired is

recognized as an equity transaction.

A change in the ownership interest of a subsidiary, without a change of control, is accounted for as

an equity transaction. If the Group loses control over a subsidiary, it:

! Derecognizes the assets (including goodwill) and liabilities of the subsidiary;

! Derecognizes the carrying amount of any non-controlling interest;

! Derecognizes the cumulative translation differences, recorded in equity;

! Recognizes the fair value of the consideration received;

! Recognizes the fair value of any investment retained;

17 Q1 FY 5-31-15 8/31/2014

12

! Recognizes any surplus or deficit in profit or loss; and

! Reclassifies the Parent Companys share of components previously recognized in other comprehensive

income to profit or loss.

Summary of Significant Accounting and Financial Reporting Policies

The accounting policies adopted are consistent with those of the previous financial year except for the

adoption of the following new and amended PFRS, Philippine Accounting Standards (PAS) and

Philippine Interpretations which were adopted at June 1, 2013:

! PFRS 1, First-time Adoption of PFRS - Government Loans

The amendments to PFRS 1 require first-time adopters to apply the requirements of PAS 20,

Accounting for Government Grants and Disclosure of Government Assistance, prospectively to

government loans existing at the date of transition to PFRS. However, entities may choose to apply

the requirement of PAS 39, Financial Instruments: Recognition and Measurement, and PAS 20 to

government loans retrospectively if the information needed to do so had been obtained at the time of

initially accounting for those loans. These amendments are not relevant to the Group.

! PFRS 7, Financial Instruments: Disclosures - Offsetting Financial Assets and Financial

Liabilities (Amendments)

These amendments require an entity to disclose information about rights of set-off and related

arrangements (such as collateral agreements). The new disclosures are required for all recognized

financial instruments that are set off in accordance with PAS 32. These disclosures also apply to

recognized financial instruments that are subject to an enforceable master netting arrangement or

similar agreement, irrespective of whether they are set-off in accordance with PAS 32. The

amendments require entities to disclose, in a tabular format unless another format is more

appropriate, the following minimum quantitative information.

This is presented separately for financial assets and financial liabilities recognized at the end of the

reporting period:

a) The gross amounts of those recognized financial assets and recognized financial liabilities;

b) The amounts that are set off in accordance with the criteria in PAS 32 when determining the net

amounts presented in the statement of financial position;

c) The net amounts presented in the statement of financial position;

d) The amounts subject to an enforceable master netting arrangement or similar agreement that

are not otherwise included in (b) above, including:

i. Amounts related to recognized financial instruments that do not meet some or all of the

offsetting criteria in PAS 32; and

ii. Amounts related to financial collateral (including cash collateral); and

e) The net amount after deducting the amounts in (d) from the amounts in (c) above.

The amendments to PFRS 7 are to be retrospectively applied and are effective for annual periods

beginning on or after January 1, 2013. The amendments affect disclosures only and have no

impact on the Groups financial position or performance.

! PFRS 10, Consolidated Financial Statements

PFRS 10 replaces the portion of PAS 27, Consolidated and Separate Financial Statements, that

addresses the accounting for consolidated financial statements. It also includes the issues raised in

SIC 12, Consolidation - Special Purpose Entities. PFRS 10 establishes a single control model that

applies to all entities including special purpose entities. The changes introduced by PFRS 10 will

require management to exercise significant judgment to determine which entities are controlled, and

therefore, are required to be consolidated by a parent, compared with the requirements that were in

PAS 27. The standard becomes effective for annual periods beginning on or after January 1, 2013.

17 Q1 FY 5-31-15 8/31/2014

13

Disclosures related to the Parent Company and its subsidiaries are in Notes 1 and 2 to the consolidated

financial statements.

! PFRS 11, Joint Arrangements

PFRS 11 replaces PAS 31, Interests in Joint Ventures, and SIC 13, Jointly Controlled

Entities - Non-Monetary Contributions by Venturers. PFRS 11 removes the option to account for

jointly controlled entities using proportionate consolidation. Instead, jointly controlled entities that

meet the definition of a joint venture must be accounted for using the equity method. The standard

becomes effective for annual periods beginning on or after January 1, 2013, and will not have an

impact since the Group is not engaged in any joint venture agreements.

! PFRS 12, Disclosure of Interests in Other Entities

PFRS 12 includes all of the disclosures related to consolidated financial statements that were

previously in PAS 27, as well as all the disclosures that were previously included in PAS 31 and PAS

28, Investments in Associates. These disclosures relate to an entitys interests in subsidiaries, joint

arrangements, associates and structured entities. A number of new disclosures are also required. The

standard becomes effective for annual periods beginning on or after January 1, 2013. Disclosures

related to the Parent Company and its subsidiaries are in Notes 1 and 2 to the consolidated financial

statements.

! PFRS 13, Fair Value Measurement

PFRS 13 establishes a single source of guidance under PFRSs for all fair value measurements. PFRS

13 does not change when an entity is required to use fair value, but rather provides guidance on how

to measure fair value under PFRS. PFRS 13 defines fair value as an exit price. PFRS 13 also

requires additional disclosures.

As a result of the guidance in PFRS 13, the Group re-assessed its policies for measuring fair values,

in particular, its valuation inputs such as non-performance risk for fair value measurement of

liabilities. The Group has assessed that the application of PFRS 13 has not materially impacted the

fair value measurements of the Group. Additional disclosures, where required, are provided in the

individual notes relating to the assets and liabilities whose fair values were determined. Fair value

disclosures are provided in Note 20.

! PAS 1, Presentation of Financial Statements - Presentation of Items of Other Comprehensive Income

(OCI) (Amendments)

The amendments to PAS 1 changes the grouping of items presented in OCI. Items that can be

reclassified (or recycled) to profit or loss at a future point in time (for example, upon derecognition

or settlement) will be presented separately from items that will never be recycled. The amendments

affect presentation only and have no significant impact on the Groups financial position or

performance.

! PAS 19, Employee Benefits (Revised)

The revised standard includes a number of amendments that range from fundamental changes such as

removing the corridor mechanism and the concept of expected returns on plan assets to simple

clarifications and rewording. The revised standard also requires new disclosures such as, among

others, a sensitivity analysis for each significant actuarial assumption, information on asset-liability

matching strategies, duration of the defined benefit obligation, and disaggregation of plan assets by

nature and risk. On January 1, 2013, the Group adopted the revised standards retrospectively, with

permitted exception on sensitivity disclosures for the defined benefit obligation for the comparative

period which have not been provided. For defined benefit plans, the Revised PAS 19 requires all

actuarial gains and losses to be recognized in OCI and unvested past service costs previously

recognized over the average vesting period to be recognized immediately in profit or loss when

17 Q1 FY 5-31-15 8/31/2014

14

incurred.

Prior to adoption of the Revised PAS 19, the Group recognized actuarial gains and losses as income

or expense when the net cumulative unrecognized gains and losses at the end of the previous period

exceeded ten percent (10%) of the higher of the defined benefit obligation and the fair value of the

plan assets and recognized unvested past service costs as an expense on a straight-line basis over the

average vesting period until the benefits become vested. Upon adoption of the Revised PAS 19, the

Group changed its accounting policy to recognize all actuarial gains and losses in OCI and all past

service costs in profit or loss in the period they occur.

The Revised PAS 19 replaced the interest cost and expected return on plan assets with the concept

of net interest on defined benefit liability or asset which is calculated by multiplying the net defined

benefit liability or asset by the discount rate used to measure the employee benefit obligation, each

as at the beginning of the annual period, taking account of any changes in the net defined benefit

liability or asset during the period.

The Revised PAS 19 also amended the definition of short-term employee benefits and requires

employee benefits to be classified as short-term based on expected timing of settlement rather than the

employees entitlement to the benefits. In addition, the Revised PAS 19 modifies the timing of

recognition for termination benefits. The modification requires the termination benefits to be

recognized at the earlier of when the offer cannot be withdrawn or when the related restructuring costs

are recognized.

Changes to definition of short-term employee benefits and timing of recognition for termination

benefits do not have any impact on the Groups financial position and financial performance.

Change of presentation

Upon adoption of the Revised PAS 19, the presentation of the income statement was updated to

reflect these changes. Net interest is now shown under the finance income/expense line item

(previously under personnel expenses under general and administrative expenses). This presentation

better reflects the nature of net interest since it corresponds to the compounding effect of the long-

term net defined benefit liability (net defined benefit asset). In the past, the expected return on plan

assets reflected the individual performance of the plan assets, which were regarded as part of the

operating activities.

! PAS 27, Separate Financial Statements (as revised in 2011)

As a consequence of the issuance of the new PFRS 10, Consolidated Financial Statements, and

PFRS 12 what remains of PAS 27 is limited to accounting for subsidiaries, jointly controlled entities,

and associates in the separate financial statements. The adoption of the amended PAS 27 will not

have a significant impact on the separate financial statements of the Group.

! PAS 28, Investments in Associates and Joint Ventures (as revised in 2011)

As a consequence of the issuance of the new PFRS 11, and PFRS 12, Disclosure of Interests in

Other Entities, PAS 28 has been renamed PAS 28, Investments in Associates and Joint Ventures,

and describes the application of the equity method to investments in joint ventures in addition to

associates. The amendment will not have a significant impact on the Group since it does not have

any investments in associates and joint ventures.

! Philippine Interpretation IFRIC 20, Stripping Costs in the Production Phase of a Surface Mine This

interpretation applies to waste removal (stripping) costs incurred in surface mining activity, during

the production phase of the mine. The interpretation addresses the accounting for the benefit from the

17 Q1 FY 5-31-15 8/31/2014

15

stripping activity. This new interpretation is not relevant since the Group is not engaged in mining

operations.

Annual Improvements to PFRSs (2009-2011 cycle)

The Annual Improvements to PFRSs (2009-2011 cycle) contain non-urgent but necessary amendments to

PFRSs. The amendments are effective for annual periods beginning on or after June 1, 2013 and are

applied retrospectively. Earlier application is permitted.

! PFRS 1, First-time Adoption of PFRS - Borrowing Costs

The amendment clarifies that, upon adoption of PFRS, an entity that capitalized borrowing costs in

accordance with its previous generally accepted accounting principles, may carry forward, without

any adjustment, the amount previously capitalized in its opening statement of financial position at the

date of transition. Subsequent to the adoption of PFRS, borrowing costs are recognized in accordance

with PAS 23, Borrowing Costs. The amendment is not applicable to the Group as it is not a first-time

adopter of PFRS.

! PAS 1, Presentation of Financial Statements - Clarification of the Requirements for

Comparative Information

The amendments clarify the requirements for comparative information that are disclosed

voluntarily and those that are mandatory due to retrospective application of an accounting policy,

or retrospective restatement or reclassification of items in the consolidated financial statements.

An entity must include comparative information in the related notes to the consolidated financial

statements when it voluntarily provides comparative information beyond the minimum required

comparative period. The additional comparative period does not need to contain a complete set of

consolidated financial statements.

On the other hand, supporting notes for the third balance sheet (mandatory when there is a

retrospective application of an accounting policy, or retrospective restatement or reclassification of

items in the financial statements) are not required. The amendments affect disclosures only and will

not have an impact on the Groups financial position or performance.

! PAS 16, Property, Plant and Equipment - Classification of Servicing Equipment

The amendment clarifies that spare parts, stand-by equipment and servicing equipment should be

recognized as property, plant and equipment when they meet the definition of property, plant and

equipment and should be recognized as inventory if otherwise. The amendment will not have any

significant impact on the Groups financial position or performance.

! PAS 32, Financial Instruments: Presentation - Tax Effect of Distribution to Holders of Equity

Instruments

The amendment clarifies that income taxes relating to distributions to equity holders and to

transaction costs of an equity transaction are accounted for in accordance with PAS 12, Income

Taxes. The Group expects that this amendment will not have a significant impact on its financial

position or performance.

! PAS 34, Interim Financial Reporting - Interim Financial Reporting and Segment Information for

Total Assets and Liabilities

The amendment clarifies that the total assets and liabilities for a particular reportable segment need to

be disclosed only when the amounts are regularly provided to the chief operating decision maker and

there has been a material change from the amount disclosed in the entitys previous annual financial

statements for that reportable segment. The amendment affects disclosures only and will not have an

impact on the Groups financial position or performance.

17 Q1 FY 5-31-15 8/31/2014

16

Future Changes in Accounting Policies

The Group did not early adopt the following standards and Philippine Interpretation that will become

effective subsequent to May 31, 2014:

Effective subsequent to May 31, 2014:

! PAS 36, Impairment of Assets - Recoverable Amount Disclosures for Non-Financial Assets

(Amendments)

These amendments remove the unintended consequences of PFRS 13 on the disclosures required

under PAS 36. In addition, these amendments require disclosure of the recoverable amounts for the

assets or cash-generating units (CGUs) for which impairment loss has been recognized or reversed

during the period. These amendments are effective retrospectively for annual periods beginning on

or after January 1, 2014 with earlier application permitted, provided PFRS 13 is also applied. The

amendments affect disclosures only and have no impact on the Groups financial position or

performance.

! Investment Entities (Amendments to PFRS 10, PFRS 12 and PAS 27)

These amendments are effective for annual periods beginning on or after January 1, 2014. They

provide an exception to the consolidation requirement for entities that meet the definition of an

investment entity under PFRS 10. The exception to consolidation requires investment entities to

account for subsidiaries at fair value through profit or loss. It is not expected that this amendment

would be relevant to the Group since none of the entities in the Group would qualify to be an

investment entity under PFRS 10.

! Philippine Interpretation IFRIC 21, Levies (IFRIC 21)

IFRIC 21 clarifies that an entity recognizes a liability for a levy when the activity that triggers

payment, as identified by the relevant legislation, occurs. For a levy that is triggered upon reaching a

minimum threshold, the interpretation clarifies that no liability should be anticipated before the

specified minimum threshold is reached. IFRIC 21 is effective for annual periods beginning on or

after January 1, 2014. The Group does not expect that IFRIC 21 will have a material financial

impact in future consolidated financial statements.

! PAS 39, Financial Instruments: Recognition and Measurement - Novation of Derivatives and

Continuation of Hedge Accounting (Amendments)

These amendments provide relief from discontinuing hedge accounting when novation of a

derivative designated as a hedging instrument meets certain criteria. These amendments are

effective for annual periods beginning on or after January 1, 2014. Adoption of this standard will

have no impact on the Groups financial position or performance since it has neither derivatives nor

hedge accounting transactions.

! PAS 32, Financial Instruments: Presentation - Offsetting Financial Assets and Financial

Liabilities

The amendments clarify the meaning of currently has a legally enforceable right to set-off and also

clarify the application of the PAS 32 offsetting criteria to settlement systems (such as central clearing

house systems) which apply gross settlement mechanisms that are not simultaneous. The

amendments to PAS 32 are to be retrospectively applied for annual periods beginning on or after

January 1, 2014. The amendments affect presentation only and have no impact on the Groups

financial position or performance.

! PAS 19, Employee Benefits - Defined Benefit Plans: Employee Contributions (Amendments) The

17 Q1 FY 5-31-15 8/31/2014

17

amendments apply to contributions from employees or third parties to defined benefit plans.

Contributions that are set out in the formal terms of the plan shall be accounted for as reductions to

current service costs if they are linked to service or as part of the remeasurements of the net defined

benefit asset or liability if they are not linked to service. Contributions that are discretionary shall

be accounted for as reductions of current service cost upon payment of these contributions to the

plans. The amendments to PAS 19 are to be retrospectively applied for annual periods beginning

on or after July 1, 2014. It is expected that this amendment will not have a significant impact in the

Groups financial position or performance.

Annual Improvements to PFRSs (2010-2012 cycle)

The Annual Improvements to PFRSs (2010-2012 cycle) contain non-urgent but necessary amendments

to the following standards:

! PFRS 2, Share-based Payment - Definition of Vesting Condition

The amendment revised the definitions of vesting condition and market condition and added the

definitions of performance condition and service condition to clarify various issues. This amendment

shall be prospectively applied to share-based payment transactions for which the grant date is on or

after July 1, 2014. This amendment does not apply to the Group as it has no share-based payments.

! PFRS 3, Business Combinations - Accounting for Contingent Consideration in a Business

Combination

The amendment clarifies that a contingent consideration that meets the definition of a financial

instrument should be classified as a financial liability or as equity in accordance with PAS 32.

Contingent consideration that is not classified as equity is subsequently measured at fair value through

profit or loss whether or not it falls within the scope of PFRS 9 (or PAS 39, if PFRS 9, Financial

Instruments, is not yet adopted). This amendment does not apply to the Group as it has no share-based

payments.

! PFRS 8, Operating Segments - Aggregation of Operating Segments and Reconciliation of the

Total of the Reportable Segments Assets to the Entitys Assets

The amendments require entities to disclose the judgment made by management in aggregating

two or more operating segments. This disclosure should include a brief description of the operating

segments that have been aggregated in this way and the economic indicators that have been assessed

in determining that the aggregated operating segments share similar economic characteristics. The

amendments also clarify that an entity shall provide reconciliations of the total of the reportable

segments assets to the entitys assets if such amounts are regularly provided to the chief operating

decision maker. These amendments are effective for annual periods beginning on or after July 1,

2014 and are applied retrospectively. The amendments affect disclosure only and will not have a

significant impact on the Groups financial position or performance.

! PFRS 13, Fair Value Measurement - Short-term Receivables and Payables

The amendment clarifies that short-term receivables and payables with no stated interest rates can be

held at invoice amounts when the effect of discounting is immaterial. The Group does not expect

that the amendment will have material financial impact in future consolidated financial statements.

! PAS 16, Property, Plant and Equipment - Revaluation Method - Proportionate Restatement of

Accumulated Depreciation

The amendment clarifies that, upon revaluation of an item of property, plant and equipment, the

carrying amount of the asset shall be adjusted to the revalued amount, and the asset shall be treated in

one of the following ways:

17 Q1 FY 5-31-15 8/31/2014

18

a. The gross carrying amount is adjusted in a manner that is consistent with the revaluation of the

carrying amount of the asset. The accumulated depreciation at the date of revaluation is adjusted

to equal the difference between the gross carrying amount and the carrying amount of the asset

after taking into account any accumulated impairment losses.

b. The accumulated depreciation is eliminated against the gross carrying amount of the asset.

The amendment is effective for annual periods beginning on or after July 1, 2014. The amendment

shall apply to all revaluations recognized in annual periods beginning on or after the date of initial

application of this amendment and in the immediately preceding annual period. The amendment has

no impact on the Groups financial position or performance.

! PAS 24, Related Party Disclosures - Key Management Personnel

The amendments clarify that an entity is a related party of the reporting entity if the said entity, or any

member of a group for which it is a part of, provides key management personnel services to the

reporting entity or to the parent company of the reporting entity. The amendments also clarify that a

reporting entity that obtains management personnel services from another entity (also referred to as

management entity) is not required to disclose the compensation paid or payable by the management

entity to its employees or directors. The reporting entity is required to disclose the amounts incurred

for the key management personnel services provided by a separate management entity. The

amendments are effective for annual periods beginning on or after July 1, 2014 and are applied

retrospectively. The amendments affect disclosures only and have no impact on the Groups financial

position or performance.

! PAS 38, Intangible Assets - Revaluation Method - Proportionate Restatement of Accumulated

Amortization

The amendments clarify that, upon revaluation of an intangible asset, the carrying amount of the asset

shall be adjusted to the revalued amount, and the asset shall be treated in one of the following ways:

a. The gross carrying amount is adjusted in a manner that is consistent with the revaluation of the

carrying amount of the asset. The accumulated amortization at the date of revaluation is adjusted

to equal the difference between the gross carrying amount and the carrying amount of the asset

after taking into account any accumulated impairment losses.

b. The accumulated amortization is eliminated against the gross carrying amount of the asset.

The amendments also clarify that the amount of the adjustment of the accumulated amortization

should form part of the increase or decrease in the carrying amount accounted for in accordance with

the standard.

The amendments are effective for annual periods beginning on or after July 1, 2014. The

amendments shall apply to all revaluations recognized in annual periods beginning on or after the

date of initial application of this amendment and in the immediately preceding annual period. The

amendments have no impact on the Groups financial position or performance.

Annual Improvements to PFRSs (2011-2013 cycle)

The Annual Improvements to PFRSs (2012-2013 cycle) contain non-urgent but necessary amendments to

the following standards:

! PFRS 1, First-time Adoption of Philippine Financial Reporting Standards - Meaning of

Effective PFRSs

The amendment clarifies that an entity may choose to apply either a current standard or a new standard

that is not yet mandatory, but that permits early application, provided either standard is applied

consistently throughout the periods presented in the entitys first PFRS financial statements. This

17 Q1 FY 5-31-15 8/31/2014

19

amendment is not applicable to the Group as it is not a first-time adopter of PFRS.

! PFRS 3, Business Combinations - Scope Exceptions for Joint Arrangements

The amendment clarifies that PFRS 3 does not apply to the accounting for the formation of a joint

arrangement in the financial statements of the joint arrangement itself. The amendment is effective for

annual periods beginning on or after July 1, 2014 and is applied prospectively. This amendment is not

applicable since the Group is not engaged in any joint arrangements.

! PFRS 13, Fair Value Measurement - Portfolio Exception

The amendment clarifies that the portfolio exception in PFRS 13 can be applied to financial assets,

financial liabilities and other contracts. The amendment is effective for annual periods beginning on

or after July 1, 2014 and is applied prospectively. The amendment has no significant impact on the

Groups financial position or performance.

! PAS 40, Investment Property

The amendment clarifies the interrelationship between PFRS 3, Business Combination, and PAS 40

when classifying property as investment property or owner-occupied property. The amendment stated

that judgment is needed when determining whether the acquisition of investment property is the

acquisition of an asset or a group of assets or a business combination within the scope of PFRS 3. This

judgment is based on the guidance of PFRS 3. This amendment is effective for annual periods

beginning on or after July 1, 2014 and is applied prospectively. The amendment has no significant

impact on the Groups financial position or performance.

To be determined

! PFRS 9, Financial Instruments

PFRS 9, as issued, reflects the first and third phases of the project to replace PAS 39 and applies to

the classification and measurement of financial assets and liabilities and hedge accounting,

respectively. Work on the second phase, which relate to impairment of financial instruments, and the

limited amendments to the classification and measurement model is still ongoing, with a view to

replace PAS 39 in its entirety. PFRS 9 requires all financial assets to be measured at fair value at

initial recognition. A debt financial asset may, if the fair value option (FVO) is not invoked, be

subsequently measured at amortized cost if it is held within a business model that has the objective to

hold the assets to collect the contractual cash flows and its contractual terms give rise, on specified

dates, to cash flows that are solely payments of principal and interest on the principal outstanding.

All other debt instruments are subsequently measured at fair value through profit or loss. All equity

financial assets are measured at fair value either through other comprehensive income (OCI) or profit

or loss. Equity financial assets held for trading must be measured at fair value through profit or loss.

For liabilities designated as at FVPL using the fair value option, the amount of change in the fair

value of a liability that is attributable to changes in credit risk must be presented in OCI. The

remainder of the change in fair value is presented in profit or loss, unless presentation of the fair

value change relating to the entitys own credit risk in OCI would create or enlarge an accounting

mismatch in profit or loss. All other PAS 39 classification and measurement requirements for

financial liabilities have been carried forward to PFRS 9, including the embedded derivative

bifurcation rules and the criteria for using the FVO. The adoption of the first phase of PFRS 9 will

have an effect on the classification and measurement of the Groups financial assets, but will

potentially have no impact on the classification and measurement of financial liabilities.

On hedge accounting, PFRS 9 replaces the rules-based hedge accounting model of PAS 39 with a

more principles-based approach. Changes include replacing the rules-based hedge effectiveness test

with an objectives-based test that focuses on the economic relationship between the hedged item and

17 Q1 FY 5-31-15 8/31/2014

20

the hedging instrument, and the effect of credit risk on that economic relationship; allowing risk

components to be designated as the hedged item, not only for financial items, but also for non-

financial items, provided that the risk component is separately identifiable and reliably measurable;

and allowing the time value of an option, the forward element of a forward contract and any foreign

currency basis spread to be excluded from the designation of a financial instrument as the hedging

instrument and accounted for as costs of hedging. PFRS 9 also requires more extensive disclosures

for hedge accounting.

PFRS 9 currently has no mandatory effective date. PFRS 9 may be applied before the completion of

the limited amendments to the classification and measurement model and impairment methodology.

The Group will not adopt the standard before the completion of the limited amendments and the

second phase of the project.

! Philippine Interpretation IFRIC 15, Agreements for the Construction of Real Estate

This interpretation covers accounting for revenue and associated expenses by entities that undertake

the construction of real estate directly or through subcontractors. The interpretation requires that

revenue on construction of real estate be recognized only upon completion, except when such

contract qualifies as construction contract to be accounted for under PAS 11, Construction

Contracts, or involves rendering of services in which case revenue is recognized based on stage of

completion. Contracts involving provision of services with the construction materials and where the

risks and reward of ownership are transferred to the buyer on a continuous basis will also be

accounted for based on stage of completion. The SEC and the Financial Reporting Standards Council

(FRSC) have deferred the effectivity of this interpretation until the final Revenue standard is issued

by the International Accounting Standards Board (IASB) and an evaluation of the requirements of the

final Revenue standard against the practices of the Philippine real estate industry is completed but

will have not have a significant impact since the Group is not engaged in the construction of real

estate.

Except for the Revised PAS 19, the Group does not expect any significant impact in the consolidated

financial statements when it adopts the above standards and interpretations. The revised, amended and

additional disclosures or accounting changes provided by the standards and interpretations will be

included in the Groups consolidated financial statements in the year of adoption, if applicable.

Summary of Significant Accounting and Financial Reporting Policies

Presentation of Income

The Group has elected to present all items of recognized income and expense in two statements: a

statement displaying components of profit or loss, and a second statement beginning with profit or loss and

displaying components of other comprehensive income.

Cash

Cash in the consolidated statement of financial position comprise of cash on hand and cash in banks,

which earn interest at their respective bank deposit rates.

Financia l Instruments - Initial Recognition

Financial instruments within the scope of PAS 39 are recognized in the consolidated statement of financial

position when the Group becomes a party to the contractual provisions of the instrument. Purchases or

sales of financial assets that require delivery of assets within a time frame established by regulation or

convention in the marketplace (regular way trades) are recognized on the trade date (i.e., the date that the

Group commits to purchase or sell the asset). Financial instruments are recognized initially at fair value.

Directly attributable transaction costs are included in the initial measurement of all financial instruments,

except for financial instruments measured at fair value through profit or loss (FVPL).

17 Q1 FY 5-31-15 8/31/2014

21

Financial Assets

Financial assets within the scope of PAS 39 are classified as financial assets at FVPL, loans and

receivables, AFS financial assets, held-to-maturity (HTM) investments or as derivatives designated as

hedging instruments in an effective hedge, as appropriate.

As at August 31, 2014 and May 31, 2014, the Groups financial assets are of the nature of loans and

receivables. There were no financial assets at FVPL, AFS financial assets, HTM investments and

derivative designated as hedging instruments in an effective hedge.

Financial Liabilities

Financial liabilities within the scope of PAS 39 are classified as either financial liabilities at FVPL,

derivatives designated as hedging instruments in an effective hedge or loans and borrowings, as

appropriate.

Financial instruments are classified as liabilities or equity in accordance with the substance of the

contractual arrangement. Interest, dividends, gains and losses relating to a financial instrument or a

component that is a financial liability, are reported as expense or income. Distributions to holders of

financial instruments classified as equity are charged directly to equity, net of any related income tax.

The Groups financial liabilities are of the nature of loans and borrowings. As at August 31, 2014 and

May 31, 2014, the Group has no outstanding financial liabilities at FVPL and derivatives designated as

hedging instruments in an effective hedge.

Financial Instruments - Subsequent Measurement

The subsequent measurement of financial instruments depends on their classification as follows:

Loans and Receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are

not quoted in an active market.

Loans and receivables are recognized initially at fair value, which normally pertains to the billable

amount. After initial measurement, loans and receivables are subsequently measured at amortized cost

using the effective interest rate method (EIR), less allowance for impairment losses. Amortized cost is

calculated by taking into account any discount or premium on acquisition and fees that are an integral part

of the EIR. The EIR amortization, if any, is included in the Interest income in the consolidated

statement of income. The losses arising from impairment of receivables are recognized in the

consolidated statement of income. The level of allowance for impairment losses is evaluated by

management on the basis of factors that affect the collectibility of accounts (see accounting policy on

Impairment of Financial Assets Carried at Amortized Cost).

Loans and receivables are classified as current when they are expected to be realized within twelve (12)

months from the reporting date or within the normal operating cycle, whichever is longer. Otherwise,

these are classified as noncurrent assets.

The Groups loans and receivables include cash, trade and other receivables, and other noncurrent assets

under Other noncurrent assets (see Notes 4, 5 and 11).

Loans and Borrowings

Financial liabilities are classified in this category if these are not designated as at FVPL upon inception

of the liability or not as derivatives designated as hedging instruments in an effective hedge.

17 Q1 FY 5-31-15 8/31/2014

22

After initial recognition, loans and borrowings are subsequently measured at amortized cost using the

EIR method. Gains and losses are recognized in the consolidated statement of income when the

liabilities are derecognized as well as through the EIR amortization process.

Amortized cost is calculated by taking into account any discount or premium on acquisition and fees or

costs that are an integral part of the EIR. The EIR amortization is included in Interest expense in the

consolidated statement of income.

Loans and borrowings are included under current liabilities if it will be settled within twelve (12)

months after the end of the reporting period. Otherwise, these are classified as noncurrent liabilities.

The Groups loans and borrowings include trade and other payables (see Note 11).

Offsetting Financial Instruments

Financial assets and financial liabilities are offset and the net amount reported in the Groups statement of

financial position if, and only if, there is a currently enforceable legal right to offset the recognized

amounts and there is an intention to settle on a net basis, or to realize the asset and settle the liability

simultaneously. This is not generally the case with master netting agreements, and the related assets and

liabilities are presented gross in the Group statement of financial position.

Determination of Fair Value of Financial Instruments

Fair Value Measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The fair value measurement is based on

the presumption that the transaction to sell the asset or transfer the liability takes place either:

! In the principal market for the asset or liability, or

! In the absence of a principal market, in the most advantageous market for the asset or liability.

The principal or the most advantageous market must be accessible to the Company. The fair value of an

asset or a liability is measured using the assumptions that market participants would use when pricing the

asset or liability, assuming that market participants act in their economic best interest.

Financial instruments recognized at fair value are analyzed based on:

! Level 1 - Quoted prices in active markets for identical asset or liability

! Level 2 - Those involving inputs other than quoted prices included in Level 1 that are observable

for the asset or liability, either directly (as prices) or indirectly (derived from prices)

! Level 3 - Those with inputs for asset or liability that are not based on observable market data

(unobservable inputs)

When fair values of listed equity and debt securities as well as publicly traded derivatives at the end of

the reporting date are based on quoted market prices or binding dealer price quotations without any

deduction for transaction costs, the instruments are included within Level 1 of the hierarchy.

For all other financial instruments, fair value is determined using other valuation techniques. Other

valuation techniques include net present value techniques, comparison to similar instruments for which

market observable prices exist, option pricing models and other relevant valuation models. For these

financial instruments, inputs into models are market observable and are therefore included within

Level 2.

17 Q1 FY 5-31-15 8/31/2014

23

Instruments included in Level 3 include those for which there is currently no active market.

Further details as to how they are measures are provided in Note 20.

Impair ment of Financial Assets

The Group assesses at each end of the reporting period whether there is any objective evidence that a

financial asset or a group of financial assets is impaired.

A financial asset or a group of financial assets is deemed to be impaired if, and only if, there is objective

evidence of impairment as a result of one or more events that has occurred after the initial recognition of

the asset (an incurred loss event) and that loss event has an impact on the estimated future cash flows

of the financial asset or the group of financial assets that can be reliably estimated. Evidence of

impairment may include indications that the debtors or a group of debtors is experiencing significant

financial difficulty, default or delinquency in interest or principal payments, the probability that they will

enter bankruptcy or other financial reorganization and where observable data indicate that there is a

measurable decrease in the estimated future cash flows, such as changes in arrears or economic

conditions that correlate with defaults.

Financial Assets Carried at Amortized Cost

For financial assets carried at amortized cost, the Group first assesses individually whether objective

evidence of impairment exists individually for financial assets that are individually significant, or

collectively for financial assets that are not individually significant. If the Group determines that no

objective evidence of impairment exists for an individually assessed financial asset, whether significant

or not, it includes the asset in a group of financial assets with similar credit risk characteristics and

collectively assesses them for impairment. Assets that are individually assessed for impairment and for

which an impairment loss is, or continues to be, recognized are not included in a collective assessment

of impairment.

If there is objective evidence that an impairment loss has been incurred, the amount of the loss is

measured as the difference between the assets carrying amount and the present value of estimated future

cash flows (excluding future expected credit losses that have not yet been incurred). The present value of

the estimated future cash flows is discounted at the financial assets original EIR. The carrying amount of

the asset is reduced through the use of an allowance account and the amount of the loss is recognized in

profit or loss. Loans and receivables, together with the associated allowance, are written off when there is

no realistic prospect of future recovery. If, in a subsequent year, the amount of the estimated impairment

loss decreases because of an event occurring after the impairment was recognized, the previously

recognized impairment loss is reversed to the extent that the carrying value of the asset does not exceed

its amortized cost at the reversal date.

Derecognition of Fina ncial Instruments

Financial Assets

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial

assets) is derecognized when:

! the rights to receive cash flows from the asset have expired;

! the Group retains the right to receive cash flows from the asset, but has assumed an obligation to pay

them in full without material delay to a third party under a pass-through

arrangement; or

! the Group has transferred its rights to receive cash flows from the asset and either: (a) has transferred

substantially all the risks and rewards of the asset; or (b) has neither transferred nor retained

17 Q1 FY 5-31-15 8/31/2014

24

substantially all the risks and rewards of the asset, but has transferred control of the asset.

Where the Group has transferred its rights to receive cash flows from an asset and has neither

transferred nor retained substantially all the risks and rewards of the asset nor transferred control of the

asset, the asset is recognized to the extent of the Groups continuing involvement in the asset.

Continuing involvement that takes the form of a guarantee over the transferred asset is measured at the

lower of the original carrying amount of the asset and the maximum amount of consideration that the

Group could be required to repay.

Financial Liabilities

A financial liability is derecognized when the obligation under the liability is discharged, cancelled or

has expired.

Where an existing financial liability is replaced by another from the same lender on substantially different

terms, or the terms of an existing liability are substantially modified, such an exchange or modification is

treated as a derecognition of the original liability and the recognition of a new liability, and the difference

in the respective carrying amounts is recognized in the consolidated statement of income.

Invent ories

Inventories are valued at the lower of cost and net realizable value (NRV). Cost is determined using the

first-in, first-out method. NRV of saleable merchandise is the estimated selling price in the ordinary

course of business, less the estimated costs necessary to make the sale. NRV of general, operating and

engineering supplies is the estimated current replacement cost.

Prepayments and Other Current Assets

Prepayments and other current assets include input valued-added tax (VAT), creditable withholding

taxes (CWT) and various prepayments which the Company expects to realize or consume within twelve

(12) months after the end of the reporting period.

Input VAT

Input VAT represents VAT imposed on the Company by its suppliers and contractors for the

acquisition of goods and services required under Philippine taxation laws and regulations. Input VAT

representing claims for refund from the taxation authorities is recognized as a current asset and is stated

at its NRV.

Investment Properties

Investment properties are measured initially at cost, including transaction costs. The carrying amount

includes the cost of replacing part of an existing investment property at the time that cost is incurred i f

the recognition criteria are met and excludes the costs of day-to-day servicing of an investment

property. Subsequent to initial recognition, investment properties, except land, are carried at cost less

accumulated depreciation and accumulated impairment losses. Land is carried at cost less any

impairment in value, if any.

Depreciation is computed using the straight-line method over the estimated useful lives of the

investment properties, except land. Investments in depreciable condominium units classified as

investment properties are depreciated over twenty-five (25) years.

Investment properties are derecognized when either they have been disposed of or when the

investment property is permanently withdrawn from use and no future economic benefit is expected

from its disposal. Any gains or losses on the retirement or disposal of an investment property are

recognized i n the consolidated statement income in the year of retirement or disposal.

17 Q1 FY 5-31-15 8/31/2014

25

Transfers are made to investment property when, and only when, there is a change in use, evidenced

by ending of owner-occupation, commencement of an operating lease to another party or ending of

construction or development. Transfers are made from investment property when, and only when,

there is a change in use, evidenced by commencement of owner- occupation or commencement of

development with a view to sale.

For a transfer from investment property to owner-occupied property or inventories, the deemed cost

of property for subsequent accounting is its fair value at the date of change i n use. I f the property

occupied by the Group as an owner-occupied property becomes an investment property, the Group

accounts for such property in accordance with the policy stated under property and equipment up to

the date of change in use. For a transfer from inventories to investment property, any difference

between the fair value of the property at that date and its previous carrying amount is recognized in

the consolidated statement of income. When the Group completes the construction or development

of a self-constructed investment property, any difference between the fair value of the property at

that date and its previous carrying amount is recognized i n the consolidated statement of income.

Property and Equipment

Property and equipment, except land, are stated at cost, excluding the costs of day-to-day servicing, less

accumulated depreciation and amortization and accumulated impairment losses. Such cost includes the

cost of replacing part of such property and equipment when that cost is incurred and if the recognition

criteria are met. Land is measured at cost less any impairment in value.

The initial cost of property and equipment consists of its purchase price, including import duties, taxes

and any directly attributable costs of bringing the asset to the location and condition necessary for it to

be capable of operating in the manner intended by the Group. Expenditures incurred after the property

and equipment have been put into operation, such as repairs and maintenance and overhaul costs, are

normally charged to the consolidated statement of income in the period in which costs are incurred.

Each part of an item of property and equipment with a cost that is significant in relation to the total cost of

the item shall be depreciated separately.

Depreciation is computed on a straight-line basis over the estimated useful lives of the property and

equipment as follows:

Asset Years

Condominium units and improvements 25

Building and building equipment 2-10

Office equipment 5

Transportation equipment 5

Furniture and fixtures 1-7

Machinery and equipment 3-5

Glassware 5

Construction in progress is stated at cost. This includes cost of construction, property and equipment

and other direct costs. Construction in progress is not depreciated until such time that the relevant

assets are completed and becomes available for use.

The assets useful lives and depreciation method are reviewed periodically to ensure that the values,

periods and method of depreciation and amortization are consistent with the expected pattern of economic

benefits from items of property and equipment at each end of the reporting period.

17 Q1 FY 5-31-15 8/31/2014

26

Depreciation of property and equipment begins when it becomes available for use, i.e., when it is in the

location and condition necessary for it to be capable of operating in the manner intended by management.

Depreciation ceases when the assets are fully depreciated or at the earlier of the date that the item is

classified as held for sale (or included in the disposal group that is classified as held for sale) in

accordance with PFRS 5, Noncurrent Assets Held for Sale and Discontinued Operations, and the date the

item is derecognized.

An item of property and equipment is derecognized upon disposal or when no future economic benefits

are expected from its use or disposal. Any gain or loss arising on derecognition of the asset (calculated as

the difference between the net disposal proceeds and the carrying amount of the asset) is included in the

consolidated statement of income in the year the asset is derecognized.

Impairments or losses of items of property and equipment, related claims for or payments of

compensation from third parties and any subsequent purchase or construction of replacement assets are

separate economic events and are accounted for separately.

Fully depreciated assets are retained in the books when still in use. When assets are sold or retired, the

cost and the related accumulated depreciation and amortization and any impairment value are eliminated

from the accounts and any gain or loss resulting from their disposal is included in the consolidated

statement of income.

Other Noncurrent Assets

Other noncurrent assets include various deposits, long-term receivables and miscellaneous assets, which

are stated at net realizable value. These are classified as noncurrent since the Group expects to utilize

the assets beyond twelve (12) months from the end of the reporting period.

Deposits for Future Stock Subscriptions

This represents advance payments for subscription of future issuance of shares which shall be

reclassified to the corresponding investment account upon issuance.

Impair ment of Nonfinancial Assets

Inventories

The Group assesses the inventories for impairment by comparing the assets carrying value with its

NRV. If the asset is impaired, its carrying value is reduced to NRV and an impairment loss is

recognized in the comprehensive statement of income.

Prepayments and Other Current and Noncurrent Assets, Excluding Other Noncurrent Receivables The

Group provides allowance for impairment losses on prepayments and other current and noncurrent assets,