Professional Documents

Culture Documents

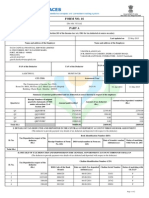

Part 1 - Utah Withholding Tax Schedule: See Illustration Instructions

Uploaded by

chumleycat0 ratings0% found this document useful (0 votes)

51 views2 pagesTax form for the state of Utah for 2013

Original Title

Utah 2013 TC-40W

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax form for the state of Utah for 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views2 pagesPart 1 - Utah Withholding Tax Schedule: See Illustration Instructions

Uploaded by

chumleycatTax form for the state of Utah for 2013

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Your last name

Enter total income tax withholding from all lines 7.

Enter this total on form TC-40, page 2, line 33.

First W-2 or 1099 Second W-2 or 1099

Your social security number

Do not send W-2s or 1099s.

Submit this page ONLY if data entered.

Attach completed schedule to your 2013 Utah income tax return.

* See illustration instructions *

1

2

3

4

5

6

7

IMPORTANT

Do not send your W-2s and 1099s with your return.

only

Instead,

enter W-2 and 1099 information below, but if there is Utah

withholding on the form.

Use additional TC-40W forms if you have more than four W-2s

and/or 1099s with Utah withholding tax.

Enter mineral production withholding from TC-675R in Part 2 of

TC-40; enter pass-through entity withholding in Part 3 of TC-40W.

Line explanations:

/

(14 characters, ending in WTH, no hyphens)

/

1 Employer payer ID number (from W-2 box b or 1099)

2 Utah withholding ID number (from W-2 box 15 or 1099)

3 Employer payer name and address (from W-2 box c or 1099)

4 Enter X if reporting Utah withholding from form 1099

5 Employees SSN (from W-2 box a or 1099)

6 Utah wages/income (from W-2 box 16 or 1099)

7 Utah withholding tax (from W-2 box 17 or 1099)

Third W-2 or 1099 Fourth W-2 or 1099

1

3

4

5

6

7

.00

Rev. 12/13

Part 1 - Utah Withholding Tax Schedule

TC-40W

14 characters, no hyphens

2

14 characters, no hyphens

40309

.00

.00

.00

.00

1

2

3

4

5

6

7

1

3

4

5

6

7

14 characters, no hyphens

2

14 characters, no hyphens

.00

.00

.00

.00

Clear form

Your last name

Enter total mineral production withholding tax from all lines 5. Enter this total on form TC-40, page 2, line 36.

2 Producers name from box 1 of TC-675R

2

1 Producers EIN from box 2 of TC-675R

1

1

Your social security number

Do not send TC-675Rs or Utah Schedules K-1.

Use additional forms TC-40W, Part 2 or Part 3 if needed.

Submit this page ONLY if data entered.

Attach completed schedule to your 2013 Utah income tax return.

Part 3 - Utah Pass-through Entity Taxpayer Withholding - Utah Schedule K-1

Part 2 - Utah Mineral Production Withholding Tax - TC-675R

Enter total pass-through withholding tax from all lines 3. Enter on TC-40, page 2, line 35.

Do not send Utah Schedule(s) K-1 with return. Enter information below. Use additional TC-40Ws if needed.

3 Producers Utah withholding ID # from box 3 of TC-675R

3

4 Pass-through entity EIN, if credit from partnership or S corporation

(enter EIN from Utah Schedule K-1)

Do not send TC-675Rs or Utah Schedules K-1 with return. Enter TC-675R or Schedule K-1 information below. Use additional TC-40Ws if needed.

First TC-675R or Utah Schedule K-1

<14 characters, no hyphens

Second TC-675R or Utah Schedule K-1

Third TC-675R or Utah Schedule K-1 Fourth TC-675R or Utah Schedule K-1

First Utah Schedule K-1 Second Utah Schedule K-1

Third Utah Schedule K-1 Fourth Utah Schedule K-1

5 Utah mineral production withholding tax from box 6 of TC-675R or

from Utah Schedule K-1

* See illustration instructions *

Rev. 12/13

Mineral Production and Pass-through Withholding Tax

TC-40W

2

3

4

5

1

<14 characters, no hyphens

2

3

4

5

1

<14 characters, no hyphens

2

3

4

5

1

<14 characters, no hyphens

2

3

4

5

(14-characters, ending in WMP, no hyphens)

1 Pass-through entity EIN from Utah Schedule K-1 box A

2 Name of pass-through entity from Utah Schedule K-1 box B

3 Utah withholding tax paid by pass-through entity

2

1

3

2

1

3

2

1

3

40310

.00 .00

.00 .00

.00

.00

.00

.00

.00

.00

Line explanations:

Line explanations:

You might also like

- Marylynn Huggins - Clifden Ut State Tax Return 2013Document4 pagesMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- 2013 Pennsylvania ReturnDocument2 pages2013 Pennsylvania ReturnVictoriaChristianDukesNo ratings yet

- Selection 26 144Document1 pageSelection 26 144Anonymous fu1jUQNo ratings yet

- TAX Return ProjectDocument17 pagesTAX Return Projectqlcjung09No ratings yet

- Selection-26 - 55 PDFDocument1 pageSelection-26 - 55 PDFAnonymous fu1jUQNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- Tax InfoDocument5 pagesTax InfoAdoumbia100% (1)

- TurboTax Federal Free Edition 2015Document4 pagesTurboTax Federal Free Edition 2015SandeepNo ratings yet

- Us Tax ReturnDocument41 pagesUs Tax Returnapi-208686780No ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- Perry Tax Return 2010Document38 pagesPerry Tax Return 2010Rick DunhamNo ratings yet

- Release NotesDocument12 pagesRelease NotesCharles De Saint AmantNo ratings yet

- US Internal Revenue Service: Iw2 - 1999Document12 pagesUS Internal Revenue Service: Iw2 - 1999IRSNo ratings yet

- ahojDocument3 pagesahojxabehe6146No ratings yet

- US Internal Revenue Service: Iw2w3 - 2001Document12 pagesUS Internal Revenue Service: Iw2w3 - 2001IRSNo ratings yet

- I Pay Statements ServncoDocument2 pagesI Pay Statements ServncoPablito Padilla100% (2)

- IRS Form Break Down Estate PDFDocument8 pagesIRS Form Break Down Estate PDFSylvester MooreNo ratings yet

- Apps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FRDocument2 pagesApps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FRPramod KumarNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- 2015 Two BrothersDocument43 pages2015 Two BrothersAnonymous Wu0bxv6p7No ratings yet

- US Internal Revenue Service: Iw2cw3cDocument4 pagesUS Internal Revenue Service: Iw2cw3cIRSNo ratings yet

- StatementDocument2 pagesStatementLuis HarrisonNo ratings yet

- Publix Dividend and Tax FormDocument1 pagePublix Dividend and Tax FormAdam Clifton0% (1)

- F 4852Document2 pagesF 4852GoodinespressurewashingNo ratings yet

- US Internal Revenue Service: p393 - 1994Document4 pagesUS Internal Revenue Service: p393 - 1994IRSNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- US Internal Revenue Service: f8881 - 2004Document2 pagesUS Internal Revenue Service: f8881 - 2004IRSNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument3 pagesIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンNo ratings yet

- Barack Obama Foundation Tax-Exempt Application June 21 2014Document51 pagesBarack Obama Foundation Tax-Exempt Application June 21 2014Jerome CorsiNo ratings yet

- BARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFDocument51 pagesBARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFJerome Corsi100% (1)

- Barack Obama Foundation Form 1023 June 21 2014Document51 pagesBarack Obama Foundation Form 1023 June 21 2014Jerome CorsiNo ratings yet

- Blank 4506TDocument2 pagesBlank 4506TRoger PeiNo ratings yet

- Submitting Form W-2 and W-2c Information 18071Document3 pagesSubmitting Form W-2 and W-2c Information 18071JNo ratings yet

- Form A1-R 2010Document1 pageForm A1-R 2010Lisa Rowland AlexanderNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- US Internal Revenue Service: p393 - 1995Document4 pagesUS Internal Revenue Service: p393 - 1995IRSNo ratings yet

- Amadues CodeDocument287 pagesAmadues Codeelango_per4757No ratings yet

- Scan 0001Document11 pagesScan 0001Kimmie3050% (2)

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- US Internal Revenue Service: f8881 - 2005Document2 pagesUS Internal Revenue Service: f8881 - 2005IRSNo ratings yet

- All Withholding Is A Gift!Document8 pagesAll Withholding Is A Gift!Tom Harkins100% (2)

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- US Internal Revenue Service: f8586 - 2001Document2 pagesUS Internal Revenue Service: f8586 - 2001IRSNo ratings yet

- US Internal Revenue Service: f8586 - 2000Document2 pagesUS Internal Revenue Service: f8586 - 2000IRSNo ratings yet

- Print The Form: Laura R Bellcase 2301 Fairhaven Lane CROFTON, MD 21114Document2 pagesPrint The Form: Laura R Bellcase 2301 Fairhaven Lane CROFTON, MD 21114QehcNo ratings yet

- FORMSDocument13 pagesFORMSمحمد مرتضیٰNo ratings yet

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- US Internal Revenue Service: p393 - 1996Document4 pagesUS Internal Revenue Service: p393 - 1996IRSNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Chase 1099int 2013Document2 pagesChase 1099int 2013Srikala Venkatesan100% (1)

- Wage and Tax Statement Wage and Tax StatementDocument3 pagesWage and Tax Statement Wage and Tax StatementNathan VosNo ratings yet

- Document 932023 103600 AM Pd1VYJRDDocument4 pagesDocument 932023 103600 AM Pd1VYJRDBoeroNo ratings yet

- Tax Form 2013 (Trinidad)Document5 pagesTax Form 2013 (Trinidad)Natasha ThomasNo ratings yet

- Form 4852Document1 pageForm 4852Dawn Simpson100% (1)

- Casino Accounting and Financial Management: Second EditionFrom EverandCasino Accounting and Financial Management: Second EditionNo ratings yet

- United States v. Robert Kelvin Souders, 110 F.3d 74, 10th Cir. (1997)Document4 pagesUnited States v. Robert Kelvin Souders, 110 F.3d 74, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- How To Terminate Your Social Security Number - Decrypted Matrix - of - The MindDocument5 pagesHow To Terminate Your Social Security Number - Decrypted Matrix - of - The MindSuzie Bassy100% (1)

- United States v. Will, 449 U.S. 200 (1980)Document27 pagesUnited States v. Will, 449 U.S. 200 (1980)Scribd Government Docs0% (1)

- Luna v. United States of America - Document No. 2Document2 pagesLuna v. United States of America - Document No. 2Justia.comNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument14 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Pedro Larios-Quixan, A077 007 158 (BIA June 28, 2011)Document8 pagesPedro Larios-Quixan, A077 007 158 (BIA June 28, 2011)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Ogunde v. Woloszynowski, 4th Cir. (1999)Document4 pagesOgunde v. Woloszynowski, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Health Care Reform Bill Summary Explains Key ProvisionsDocument7 pagesHealth Care Reform Bill Summary Explains Key Provisionsg2gusc38No ratings yet

- UnpublishedDocument4 pagesUnpublishedScribd Government DocsNo ratings yet

- Case Summary of Marbury V MadisonDocument2 pagesCase Summary of Marbury V MadisonGilly Mae Gallego RPhNo ratings yet

- What Are The Branches of GovernmentDocument3 pagesWhat Are The Branches of GovernmentGrant NaillingNo ratings yet

- COHEN v. PBPP Et Al - Document No. 4Document2 pagesCOHEN v. PBPP Et Al - Document No. 4Justia.comNo ratings yet

- Civil Rights Act 1964Document2 pagesCivil Rights Act 1964Hammad Khan LodhiNo ratings yet

- IRS EIN NoticeDocument2 pagesIRS EIN NoticeslyakhNo ratings yet

- AFGE Council 238 Unfair Labor Practice 19 - 0606 - Filed 2019-06-25 Against EPADocument1 pageAFGE Council 238 Unfair Labor Practice 19 - 0606 - Filed 2019-06-25 Against EPAAntony TNo ratings yet

- United States v. Monwazee Boston, 4th Cir. (2011)Document4 pagesUnited States v. Monwazee Boston, 4th Cir. (2011)Scribd Government DocsNo ratings yet

- Federal Agency MascotsDocument16 pagesFederal Agency MascotsFedSmith Inc.No ratings yet

- Feb 2017 Final ReportDocument64 pagesFeb 2017 Final ReportSHADACNo ratings yet

- United States v. Clevon Murray, 4th Cir. (2014)Document3 pagesUnited States v. Clevon Murray, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Kenneth Herbert Hanna v. United States, 394 U.S. 1015 (1969)Document3 pagesKenneth Herbert Hanna v. United States, 394 U.S. 1015 (1969)Scribd Government DocsNo ratings yet

- Heckler v. Campbell, 461 U.S. 458 (1983)Document16 pagesHeckler v. Campbell, 461 U.S. 458 (1983)Scribd Government DocsNo ratings yet

- Owsley Stanley v. United States, 400 U.S. 936 (1970)Document3 pagesOwsley Stanley v. United States, 400 U.S. 936 (1970)Scribd Government DocsNo ratings yet

- Marriage Fraud Conspiracy IndictmentDocument65 pagesMarriage Fraud Conspiracy Indictmentinforumdocs100% (2)

- United States v. Khasan Dancy, 3rd Cir. (2011)Document5 pagesUnited States v. Khasan Dancy, 3rd Cir. (2011)Scribd Government DocsNo ratings yet

- Piatek v. American Income Life Insurance Company Et Al - Document No. 3Document2 pagesPiatek v. American Income Life Insurance Company Et Al - Document No. 3Justia.comNo ratings yet

- Hernan Gaztambide-Barbosa v. Jaime Torres-Gaztambide, Etc., 902 F.2d 112, 1st Cir. (1990)Document7 pagesHernan Gaztambide-Barbosa v. Jaime Torres-Gaztambide, Etc., 902 F.2d 112, 1st Cir. (1990)Scribd Government DocsNo ratings yet

- Glenn Hubert Newport III (01.25.1952) - Report of Birth, Child Born Abroad of American Parent or Parents.Document3 pagesGlenn Hubert Newport III (01.25.1952) - Report of Birth, Child Born Abroad of American Parent or Parents.Lucas Daniel SmithNo ratings yet

- Marbury Vs Madison Final EssayDocument7 pagesMarbury Vs Madison Final EssayjudiiNo ratings yet

- United States v. Carl Akins, 4th Cir. (2013)Document4 pagesUnited States v. Carl Akins, 4th Cir. (2013)Scribd Government DocsNo ratings yet

- 001-0 Complaint - 140723Document40 pages001-0 Complaint - 140723Anonymous GF8PPILW5No ratings yet