Professional Documents

Culture Documents

Index Number Formation in The Chittagong Stock Exchange

Uploaded by

SakibSourovOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index Number Formation in The Chittagong Stock Exchange

Uploaded by

SakibSourovCopyright:

Available Formats

Index Number formation in the Chittagong Stock Exchange

Indroduction :

The Chittagong Stock Exchange (CSE) is a not-for-profit organization, formed and registered with the

registrar of Joint Stock Companies and Firms in Bangladesh on April 1, 1995 as a public company

limited by guarantee with an Authorized capital of 150,000,000 divided into 500 shares of Tk.

300,000 each. The Exchange members are not its beneficiaries since they are not involved in profit

sharing and taking dividend. All its surpluses are spent on the development of capital market in the

country. The principal activities of the Exchange are to conduct, regulate and control the trade.

Starting from a rental building, the exchange currently owns a two-storey building measuring 28,000

square feet. It is the second stock exchange of Bangladesh that started its journey with the aim of

offering the investors a transparent and efficient capital market. On October 10, 1995 CSE

introduced a fully automated screen based trading system replacing the obsolete setup enabling its

trade operations from three major cities in Bangladesh.

Indexes Used in Chittagong Stock Exchange :

At present CSE is managing several indices which are listed below:

(1) CSE All Share Price Index (CASPI)

(2) CSE Selective Categories Index (CSCX)

(3) CSE 30 Index (CSE selective Index) and

(4) Sector Wise Indices: General Insurance , Textiles & Clothing , Pharmacy & Chemicals , Foods &

Allied , Cement Eng. & Electrical , Leather & Footwear, Services & Property, Papers & Printing,

Energy, Mutual Funds, Bank, Ceramic, ICT, Leasing & Finance, Life Insurance, Telecommunication,

Miscellaneous .

All the indices of the Chittagong Stock Exchange Ltd (CSE) are calculated and maintained following

Laspayers Method which was considered as the most transparent and scientific at the time of its

inception. Now it is required to adopt a modern and internationally accepted calculation

methodology to provide a more sensitive, investable, tradable and transparently managed Index.

The enhanced CSE indices will provide a platform for a wider range of investable and appealing

opportunities. The constituents will be free float adjusted with only the investable portion included

in the index calculation. Globally, the free-float Methodology of index construction is considered to

be an industry best practice and all major indexes like MSCI, FTSE and S&P have adopted the same.

MSCI, a leading global index, shifted all its indices to the Free-float Methodology in 2002.

Descriptions of the Index numbers used in Chittagong Stock Exchange :

(1) CSE All Share Price Index (CASPI) - Value Weighted Method

A good market representative index should involve:

Scientific calculation formulas with clear adjustment procedure

Logical scrip selection criteria

Distinct base date

Meaningful base value

The only index the CSE has been maintaining since 10th October 1995 is a ALL SHARE PRICE INDEX

using Chained Paasche method (A value weighted Index) developed by economist

Hermann Paasche It faces question of clarity. This index was subject to unusual ups and downs

and without a distinct base value. Therefore in need of a clean slate CSE finds the date 1 January

2000 is the best date to start new Indices.

Paasche Index =

An All Share Price Index with new formula and base date 30th December 1999 (the last day of the

year) and new base index of 1000 replaced the previous one and a completely new Selective Index

incorporating 30 scrip / chit with base date 30th December 1999 and base index 1000.

After intensive study CSE board of directors found out that Laspayers Method (Another Value

weighted Index) to calculate index is regarded as the most transparent and scientific method.

Laspeyres Index =

The following conditions is followed while calculating the All Share Price Index:

All Share Price Index does not necessarily mean that all the listed stocks should be considered for

calculating the index. Inactive stocks not being traded for consecutive six months will not be

considered in the calculation.

Only the active scrip will be considered for calculating the index.

Mutual Funds and Debt securities will not be considered in calculating index.

A newly listed scrip will be included in the index after five consecutive trading days.

Only normal trades should be considered in calculating index.

All share price index will be calculated only once in a day - after the trading hour in the on line

system.

No changes in number of shares will be allowed during Vector session.

Index committee will review the index - its criteria, performance, calculation method after every six

month.

Index Base Date is 30th December 1999

Base Day index 1000

(2) CSE Selective Categories Index (CSCX) - Value Weighted Method

At the beginning of new millennium a selective Index will be introduced, which is found to be very

popular in almost all the developed exchanges worldwide. Here the selection criteria play a very

important role in forming an index.

Criteria for a Selective Index

It provides a discussion about the important criterion for an index, which is to be used as a

benchmark of performance. The criterion is that the movement of the index fully represents the

aggregate movement of the index's constituent assets and that the index's returns are realizable by

an investor who has held a portfolio identical to the asset mix of the index. Value-Weighted Index

satisfies the

above criterion.

Selection of stocks for the benchmark index should be such that it represents the whole market. In

addition it will be guaranteed that the constituent stocks have high percentage coverage of the

market in terms of market value. This will make it difficult if not possible for a few investors to

manipulate the movement of the index.

Chittagong Stock Exchange (CSE) launched a new index named CSCX (CSE Selective Categories' Index)

comprised A, B & G category companies from 14th February 2004 to replace the earlier CSE Trade

Volume Weighted Index.

The Base Date of this index is 15th April 2001 (when A, B & Z category were introduced) and Base

Value is set to 1000. The new index includes all but not the Z category companies. This also excludes

the companies/scrip which are debt securities, mutual funds, suspended for indefinite period and

non-traded for preceding six months of review meeting. The index will be reviewed in the Index

Committee Meeting after every six months like other two indices of CSE.

This index was disseminated on line to all the Brokers' Work Stations (BWSs) during trading sessions

and after every three minutes the index value had been refreshed.

The construction principle of this index is based on Laspeyres method like other two CSE indices ,

CSE all Share Price Index and CSE- 30 Index. It may be mentioned here that the base value of these

two indices was also set to 1000 with a base date 30th December 1999.

(3) CSE 30 Index (CSE selective Index)

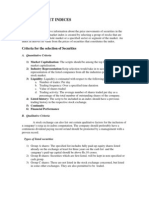

CRITERIA FOR CSE-30 INDEX

After revision done in the Listing & Index Committee Meeting held on 28th Apr 2009 by CSE board,

two layer methods are followed for selection of listed companies in the CSE-30 Index. In the first

layer method, basic criteria are considered for primary selection.

BASIC CRITERIA

Must be listed with the Chittagong Stock Exchange Limited.

In case of IPO/New Issue, this should be on listing either with DSE or CSE for a minimum period of 2

years or remained in Commercial Production in Bangladesh for the minimum same period prior to its

listing.

Companies that did not hold their Annual General Meetings regularly will not be considered.

Minimum market capitalization must be Tk. 200 million and at least two times of paid-up capital.

Must have at least 20% free floating share capital. Free floating share capital shall mean the share

capital which will exclude Government's holding (other than ICB), Sponsors/Directors & their

Associates' holding plus other locked-in portions.

Must have positive revenue reserve/ retained earnings.

Must be traded for at least 50% trading days of the six monthly review period.

Paid dividend in any of the last 2 years.

Company having negative Earning Per Share (EPS) for last two consecutive years will not be

considered.

Company falling under settlement category 'Z' will not be considered.

Financial Institution falling under the problem list of Bangladesh Bank will not be considered

provided such information is available from an acceptable source.

Company failing to pay the listing fees and/or penalty imposed under the Listing Regulations of CSE

for a period of 2 years will not be considered.

At least one company from each sector having minimum seven companies will be taken in the index

if the scrip satisfies the above criteria and achieves the minimum point (50 points) as evaluated on

the basis of the following Selection Criteria. The sector having less than seven companies will be

considered to be a part of Miscellaneous Sector.

On being qualified on the basis of the Basic Criteria, the companies are required to meet the

following further Selection Criteria to have the final berth in CSE-30 Index.

SELECTION CRITERIA

Higher Net Assets Value (NAV) per share

Higher rate of Earning Per Share (EPS)

Higher rate of Dividend

Lower Price Earning (PE) Ratio

Higher Dividend Yield (DY)

Higher rate of free floating in equity

Larger number of shareholders

Higher liquidity in terms of trading day

Higher liquidity in terms of number of contract

Longer duration of continuous remaining in the CSE-30 Index

Regular payment of listing fees

Conditions to be followed while forming the selective Index:

Only the active scrip will be considered for calculating the index.

Mutual Funds and Debt securities will not be considered in this index.

Only normal public market trades will be considered.

Selective Index will be refreshed after 3 minutes time interval during online trade.

At the time of update the Selective Index will consider the Weighted Average Price for each

constituent stock.

No changes in number of shares will be allowed during the business sessions.

Index committee will review the index - its criteria, performance, calculation method after every six

month.

Index Base Date is 30th December 1999 .

Base Day index is set to be 1000.

Free Float Free-float Methodology

Free-float Methodology refers to an index construction methodology that takes into consideration

only the free-float market capitalization of a company for the purpose of index calculation and

assigning weight to stocks in the Index. Free-float market capitalization takes into consideration only

those shares issued by the company that are readily available for trading at the Stock Exchange. It

generally excludes promoters' holding, government holding, strategic holding and other locked-in

shares that will not come to the market for trading in the normal course.

Free-Float Calculation Methodology:

Basic method of calculating Index in CSE

In countries where the stock price is strictly regulated and stock split is frequently happening, the

Price - weighted Index can be suitable whereas in countries like Bangladesh price is generally

unregulated and the event of stock splitting is also rare, therefore Price weighted Index is not

suitable for us. That is what the Chittagong Stock Exchange contends. Whereas Dhaka Stock

Exchange also uses Price weighted index as well along with Islamic Shariah based Index.

A general Example of Value weighted Index used in Chittagong Security Exchange is as follows:

Trading days Value of portfolio Index

DAY 1 (base day) Tk 20,000 1000

DAY 2 Tk 21,000 1050

We take Day 1 as the base day. The index on that day will be taken as a standard. The value assigned

to the base day index is 1000 in this example. On Day 2 the value of the portfolio has changed from

Tk 20,000 to Tk 21,000, a 5% increase. Therefore, the value of the index on Day 2 will change to

indicate a corresponding 5% increase in market value. The computation follows the procedure

below:

2nd day's portfolio value

2nd Day's index = ------------------------------------------------------ X Base Day's index (Say Day 1's)

Base Day's portfolio value (Say, Day 1)

=

X 1000

=

X 1000

=

X 1000

= 1050

Therefore the basic formula for Index calculation in CSE is =

X Base Index Value

The information about sampling is not available. In general, an index based on a larger percentage

of the total number of listed stocks will be more representative than that one based on a smaller

percentage. Although an index that consists of all listed stocks can be considered as more

representative, a number of stocks may have very few transactions, the quoted price of these

stocks may not reflect their true market value. An index may still be highly representative even if

it consists of only a relatively small percentage of the total number of stocks. Here, the sample

selection process plays an important role.

We know that There are, in general, three different weighting methods, namely, value-weighted /

market value-weighted method such as Hong Kong Stock Index (HSI) , unweighted (or equally

weighted) such as Financial Times Ordinary Share Index , and price-weighted such as Dow Jones

Industrial Average (DJIA) . Value-weighted method may be considered as a most appropriate method

than others for both the bourses of the country (DSE & CSE) since the existing indices of the bourses

have been calculating under value-weighted method. For a value-weighted index, the weight of each

constituent stock is proportional to its market share in terms of capitalization. We can assume that

the amount of money invested in each of the constituent stocks is proportional to its percentage of

the total value of all constituent stocks. Examples include all major stock market indices of Hong

Kong, London and many others.

Computation of Value Weighted Indices and Adjustments for

Changes in Market Capitalization

The computation of a value-weighted index is useful to think in terms of evaluating the performance

of a portfolio of securities. Some adjustments need to be made due to changes in market

capitalization of the portfolio's constituent stocks. The adjustment procedures are discussed in detail

below.

To make our computation simple, we need to keep the number of constituent stocks small. Let us

assume that the index is composed of only three stocks: A, B and C.

Day 1 (base day)

Market Data of Constituent Stocks on Day 1

Stock Shares Outstanding Closing Price Market Value

A 20 10 200

B 5 8 40

C 10 5 50

Aggregate Market Value (AMV) = 290

The market value of each stock at closing is given by the product of the number of shares

outstanding and the closing price. For stock A, for instance, it is 20 shares times Tk.10 which yields

Tk.200. The aggregate market value (AMV) of all constituent stocks is the sum of the market value of

each stock. The AMV of day 1 is Tk.290. Day 1 will be taken as the base day on which the index is set

at 1000

Day 2

Market Data of Constituent Stocks on Day 2

Stock Shares Outstanding Closing Price Market Value

A 20 10 200

B 5 9 45

C 10 5.5 55

Aggregate Market Value (AMV) = 300

As there is no change in capitalization, no adjustment is needed on Day 2. The AMV is equal to

Tk.300. The computation of the index on Day 2 follows the procedure below:

Day 2's AMV

Day 2's index = -------------------- X Day 1's index

Day 1's AMV

300

= ------- X 1000

290

= 1034.4828

It should be clear that the change in the index value shows the relative change in the aggregate

market value of the constituent stocks. There is a 3.45% increase in AMV (also in index) on Day 2

relative to Day 1 (the base day).

Adjustment to Changes in Capitalization

Adjustments need to be made from time to time as a result of changes in capitalization of the

constituent stocks. They are discussed in detail below:

Day 3 (Ex-Bonus)

Company "A" issues 50% bonus shares. Its shares are to be traded ex-bonus at the ratio of "1 for 2",

i.e., one share will be given as bonus for every 2 shares held. This issue of shares is going to change

the total number of shares outstanding on Day 3. The adjustment is shown below:

20(1+2)

New Total No. of Shares Outstanding of Company A = ------------

2

= 30

Market Data of Constituent Stocks on Day 3

Stock Shares Outstanding Closing Price Market Value

A 30 7 210

B 5 8 40

C 10 6 60

Aggregate Market Value (AMV) = 310

Therefore,

Day 3's AMV

Day 3's index = ---------------------- X Day 2's index

Day 2's AMV

310

= ----------- X 1034.4828

300

= 1068.9656

Note that the closing price of Company A on day 3 is Tk. 7/- determined by demand and supply

factors in the market against the theoretically adjusted price (to the extent of disclosure) of Tk. 6.67

made on day 2 after closing market / on day 3 before starting market.

If the company issuing bonus share also recommends / declares cash dividend, then the cash

dividend (to the extent of disclosure) should also be adjusted in the aforesaid theoretical price.

Day 4 (Ex-Rights)

Stock C has declared 40% rights share at the ratio of "2 for 5" at Tk.1.50 each including a premium of

Tk. 0.5 each. The offer expires on Day 4 (i.e. ex-rights). As mentioned earlier, it is useful to treat the

constituent stocks as a portfolio held by an investor. In the computation of the index on Day 4, the

investor is assumed to exercise the rights. Therefore, the new number of shares outstanding for

stock is given below:

10(2+5)

New Number of Shares Outstanding for Stock C = ----------

5

= 14

Market Data of Constituent Stocks on Day 4

Stock Shares Outstanding Closing Price Market Value

A 30 6.5 195

B 5 9.2 46

C 14 4.5 63

Aggregate Market Value (AMV) = 314

Since all rights are exercised, capitalization adjustment needs to be made on day 3 after closing

market / on day 4 before starting market. The number of shares outstanding increases by 4. This will

cause an increase in capitalization by Tk.6 (= 4 x 1.50). The adjusted AMV on Day 3 after closing

market / on day 4 before starting market in the index computation on Day 4 will be:

310 + 6 = 316

Therefore,

Day 4's AMV

Day 4's index = --------------------------------- X Day 3's index

Adjusted Day 3's AMV

304

= ---------- X 1068.9656

316

= 1028.3720

1028.3720 - 1068.9656

Percentage change = ------------------------------- X 100%

1068.9656

= -3.80%

The index dropped from 1068.9656 to 1028.3720. This can be interpreted as a 3.80% decrease in

AMV.

Day 5 (Replacement)

Stock B is replaced by stock D, which has a closing price at Tk.11.5 on Day 4 and its number of shares

outstanding is 20. Market Data of Constituent Stocks on Day 5

Stock Shares Outstanding Closing Price Market Value

A 30 7 210

D 20 11 220

C 14 5 70

Aggregate Market Value (AMV) = 500

The adjustment on Day 4's AMV in computing Day 5's Index follows a procedure as if the stock

replacement had taken place on Day 4. The adjusted AMV on Day 4 is given as:

Stock Shares Outstanding Closing Price Market Value

A 30 6.5 195

D 20 11.5 230

C 14 4.5 63

Aggregate Market Value (AMV) = 488

Therefore,

Day 5's AMV

Day 5's index = --------------------------------- X Day 4's index

Adjusted Day 4's AMV

500

= ------ X 1028.3720

488

= 1053.6598

Day 6 (Addition)

Stock E is added to the index as a constituent stock on Day 6. Stock E has a closing price of Tk.4 and

the number of shares outstanding is 40 on Day 5.

Market Data of Constituent Stocks on Day 6

Stock Shares Outstanding Closing Price Market Value

A 30 7.2 216

C 14 4.8 67.2

D 20 12 240

E 40 4.5 180

Aggregate Market Value (AMV) = 703.2

Since the number of stocks has changed, we need to compute the adjusted AMV for Day 5 in

computing Day 6's index. Day 5's adjusted AMV will be equal to the original AMV plus the market

value of stock E on Day 5. This is equal to Tk.500 + 160 (4 X 40) = 660.

Day 6's AMV

Day 6's index = ---------------------------------- X Day 5's index

Adjusted Day 5's AMV

703.2

= ------- X 1053.6598

660

= 1122.6266

Any new issue should not be considered in the computation of index for x days from the date of

first trade. x may be a single digit parameter e.g. x = 1, 2, 3...... days. Here, in DSE and CSE, x is

equal to 1.

Shares issued under Repeat Public Offer (RPO), conversion, amalgamation, acquisition etc. should

be treated as new issue (addition) and adjusted to give effect in the index on the following day of

crediting/ issuing of those shares as per the guideline of Day 6.

Day 7 (Deletion)

Stock C is deleted from the index's constituent stocks. The new total number of stocks is reduced to

3. Market Data of Constituent Stocks on Day 7

Stock Shares Outstanding Closing Price Market Value

A 30 7 210

D 20 12.3 246

E 40 5 200

Aggregate Market Value (AMV) = 656

The adjusted AMV on Day 6 will be a reduction by the amount of market value of stock C on Day 6.

Day 6's adjusted AMV will be equal to Tk 703.2 - 67.2 = 636.

Day 7's AMV

Day 7's index = --------------------------------- X Day 6's index

Adjusted Day 6's AMV

656

= ----- X 1122.6266

636

= 1157.9293

Day 8 (Ex-Dividend)

Cash dividends of Tk .50 per share are declared for stock E and Day 8 is to be ex-dividend. Market

Data of Constituent Stocks on Day 7

Stock Shares Outstanding Closing Price Market Value

A 30 7.2 216

D 20 12.3 246

E 40 4.6 184

Aggregate Market Value (AMV) = 646

No adjustment is needed, as there is no change in capitalization.

646

Day 8's index = ------- X 1157.9293

656

= 1140.2779

Note that the price of stock E drops. This is a normal phenomenon as a stock goes ex-dividend. Day

8s index records a decrease as well.

Note that the closing price of Company E on day 8 is Tk. 4.6 determined by demand and supply

factors in the market against the theoretically adjusted price (to the extent of corporate disclosure)

of Tk. 4.50 made on day 7 after closing market / on day 8 before starting market.

You might also like

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- The Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsFrom EverandThe Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsNo ratings yet

- Stock Index of Stock Market in Bangladesh PDFDocument11 pagesStock Index of Stock Market in Bangladesh PDFSajeed Mahmud MaheeNo ratings yet

- PSX Indices AssDocument7 pagesPSX Indices AssFlourish edible CrockeryNo ratings yet

- Stock MarketDocument12 pagesStock MarketMuhammad Saleem SattarNo ratings yet

- Chapter 6Document5 pagesChapter 6kamma1No ratings yet

- SENSEX - The Barometer of Indian Capital Markets: Index SpecificationDocument25 pagesSENSEX - The Barometer of Indian Capital Markets: Index SpecificationsathwickbNo ratings yet

- IntroductionDocument6 pagesIntroductionCarol SilveiraNo ratings yet

- Stock Index of Bangladesh Stock MarketDocument9 pagesStock Index of Bangladesh Stock MarketFuhad AhmedNo ratings yet

- SENSEX - The Barometer of Indian Capital MarketsDocument7 pagesSENSEX - The Barometer of Indian Capital MarketsSachin KingNo ratings yet

- SENSEX - The Barometer of Indian Capital MarketsDocument7 pagesSENSEX - The Barometer of Indian Capital MarketsSandeep S SalviNo ratings yet

- Submitted by V.Uthra 1091057: What Are The Criteria Applied To Include Stocks in BseDocument12 pagesSubmitted by V.Uthra 1091057: What Are The Criteria Applied To Include Stocks in BseUthra VijayNo ratings yet

- KSE - 30 IndexDocument21 pagesKSE - 30 IndexNadeem uz Zaman100% (1)

- Kse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedDocument21 pagesKse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedJan Muhammad MemonNo ratings yet

- Financial Market CH - 2Document53 pagesFinancial Market CH - 2amita_singhNo ratings yet

- SENSEX - The Barometer of Indian Capital MarketsDocument6 pagesSENSEX - The Barometer of Indian Capital MarketsmondalsunilNo ratings yet

- ProjectDocument80 pagesProjectShameem AnwarNo ratings yet

- Calculation of KSE 100 IndexDocument10 pagesCalculation of KSE 100 IndexAdnan SethiNo ratings yet

- Sen SexDocument4 pagesSen Sexvaibs14No ratings yet

- 1.1 General Introduction: Security AssetsDocument20 pages1.1 General Introduction: Security AssetschenchukalNo ratings yet

- SENSEX - The Barometer of Indian Capital Markets: Dollex Series of BSE Indices'Document6 pagesSENSEX - The Barometer of Indian Capital Markets: Dollex Series of BSE Indices'yraghav_1No ratings yet

- Correlation Between NSE and BSE Indices: Project Work OnDocument27 pagesCorrelation Between NSE and BSE Indices: Project Work OnKishan SekhadaNo ratings yet

- Assignment On PSXDocument6 pagesAssignment On PSXHaris Munir100% (1)

- CH 2 1SecondaryMarketDocument47 pagesCH 2 1SecondaryMarketHarsh SenNo ratings yet

- CH 2 1SecondaryMarketDocument47 pagesCH 2 1SecondaryMarketAnshulNo ratings yet

- Indian Stock Exchanges and How Their Indices Are CalculatedDocument30 pagesIndian Stock Exchanges and How Their Indices Are CalculatedAapnijche FakeidNo ratings yet

- Security Analysis and Portfolio Management: Presented By: OmkarDocument25 pagesSecurity Analysis and Portfolio Management: Presented By: Omkarpatil0055No ratings yet

- Indian Stock Exchanges and How Their Indices Are CalculatedDocument30 pagesIndian Stock Exchanges and How Their Indices Are CalculatedKirron ThakurNo ratings yet

- Method Nifty 50Document16 pagesMethod Nifty 50Richard JonesNo ratings yet

- Nifty 50: Index MethodologyDocument14 pagesNifty 50: Index MethodologyAkshay AgarwalNo ratings yet

- Methodology Document of NIFTY Sectoral Index Series: January 2020Document16 pagesMethodology Document of NIFTY Sectoral Index Series: January 2020Sumit KhatanaNo ratings yet

- Nifty, Sensex A Long Way From Truly Representing The EconomyDocument22 pagesNifty, Sensex A Long Way From Truly Representing The Economyharsh_monsNo ratings yet

- Assignment INVESTMENTDocument3 pagesAssignment INVESTMENTfariaNo ratings yet

- Stock Price IndexDocument12 pagesStock Price IndexMadhurGuptaNo ratings yet

- CNX Bank IndexDocument3 pagesCNX Bank IndexNidhi AgarwalNo ratings yet

- Review About Karachi and Lahore Stock ExchangeDocument4 pagesReview About Karachi and Lahore Stock ExchangeReaderNo ratings yet

- Stock Market IndicesDocument2 pagesStock Market IndicesbijubodheswarNo ratings yet

- Method Nifty 50Document16 pagesMethod Nifty 50divyajeetNo ratings yet

- Indices Calculation Methodology of DSE & CSEDocument5 pagesIndices Calculation Methodology of DSE & CSESakhawat Hossain100% (1)

- Introduction To MFDocument52 pagesIntroduction To MFAnupam MardhekarNo ratings yet

- EQUITY ANALYSIS WITH REPECT TO Automobile SectorDocument83 pagesEQUITY ANALYSIS WITH REPECT TO Automobile SectorSuraj DubeyNo ratings yet

- A Study On Mutual Funds in IndiaDocument32 pagesA Study On Mutual Funds in IndiaAbhranil DasNo ratings yet

- LQ45 Index Methodology by IDX PDFDocument2 pagesLQ45 Index Methodology by IDX PDFgalingpriyatnaNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- Modifed SaDocument34 pagesModifed SaPooja LilaniNo ratings yet

- Studt of Mutual Fund in India Final ProjectDocument38 pagesStudt of Mutual Fund in India Final ProjectjitendraouatNo ratings yet

- Online Trading On Bse and NseDocument58 pagesOnline Trading On Bse and NseShaikh JahirNo ratings yet

- How Sensex WorksDocument3 pagesHow Sensex WorksChandan ArunNo ratings yet

- Stock Market Indices (BBA)Document5 pagesStock Market Indices (BBA)Akshita DhyaniNo ratings yet

- Bse FunctionsDocument41 pagesBse FunctionsSree LakshmiNo ratings yet

- A Study On Mutual Funds in IndiaDocument17 pagesA Study On Mutual Funds in IndiaAlok ShahNo ratings yet

- Free Float IndexDocument8 pagesFree Float IndexJaishalNo ratings yet

- A Study On Mutual Funds in IndiaDocument31 pagesA Study On Mutual Funds in Indianikhil5822No ratings yet

- The Dhaka Stock ExchangeDocument13 pagesThe Dhaka Stock ExchangeFarjana MouNo ratings yet

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahNo ratings yet

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahNo ratings yet

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathNo ratings yet

- Lecture 1 - Introduction of Investment in Stock ExchangeDocument15 pagesLecture 1 - Introduction of Investment in Stock Exchangechemeleo zapsNo ratings yet

- Executive SummaryDocument43 pagesExecutive SummaryarpitNo ratings yet

- National Stock ExchangeDocument11 pagesNational Stock ExchangeHanuman MbaliveprojectsNo ratings yet

- Apple LBO ModelDocument34 pagesApple LBO ModelShawn PantophletNo ratings yet

- Demand Letter Ep5Document2 pagesDemand Letter Ep5api-371210650No ratings yet

- REVENUE MEMORANDUM ORDER NO. 3-2009 Issued On January 23, 2009 Amends andDocument7 pagesREVENUE MEMORANDUM ORDER NO. 3-2009 Issued On January 23, 2009 Amends andGedan TanNo ratings yet

- Guide Notes On RemediesDocument38 pagesGuide Notes On RemediesGyLyoung Sandz-GoldNo ratings yet

- Bukit Asam (Persero) TBK Bilingual 31 Des 2016 Released PDFDocument202 pagesBukit Asam (Persero) TBK Bilingual 31 Des 2016 Released PDFchris yeremiaNo ratings yet

- Business Name RegistrationDocument14 pagesBusiness Name RegistrationEdrey QuerimitNo ratings yet

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocument80 pagesGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNo ratings yet

- Bridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessDocument0 pagesBridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessChad Thayer V100% (2)

- Check Reprint Fch8 IN SAPDocument16 pagesCheck Reprint Fch8 IN SAPPromoth JaidevNo ratings yet

- Lifting The Corporate VeilDocument21 pagesLifting The Corporate VeilPrakhar BhandariNo ratings yet

- PhiladelphiaBusinessJournal Feb. 16, 2018Document28 pagesPhiladelphiaBusinessJournal Feb. 16, 2018Craig EyNo ratings yet

- Shipping InsightsDocument7 pagesShipping InsightsRajendraBnNo ratings yet

- Nse MemberDocument55 pagesNse MembernarendraonnetNo ratings yet

- Daffodil Computers Limited Balance Sheet As at 30 June 2007: Aziz Halim Khair ChoudhuryDocument20 pagesDaffodil Computers Limited Balance Sheet As at 30 June 2007: Aziz Halim Khair ChoudhuryShafayet JamilNo ratings yet

- Asia's Governance Challenge - Dominic BartonDocument8 pagesAsia's Governance Challenge - Dominic BartonDevyana Indah FajrianiNo ratings yet

- AR 2021 PT Alkindo Naratama TBKDocument266 pagesAR 2021 PT Alkindo Naratama TBKSella YunitaNo ratings yet

- DuPont AnalysisDocument4 pagesDuPont AnalysisRaman SutharNo ratings yet

- Investment and Security Analysis by Charles P Jones 12th Ed Chapter 1 - Tabish Khan From KohatDocument25 pagesInvestment and Security Analysis by Charles P Jones 12th Ed Chapter 1 - Tabish Khan From KohatTabish KhanNo ratings yet

- Hansson Private LabelDocument4 pagesHansson Private Labelsd717No ratings yet

- Working Capital ManagementDocument11 pagesWorking Capital ManagementWonde BiruNo ratings yet

- And Corporatisation of Stock Exchanges in IndiaDocument8 pagesAnd Corporatisation of Stock Exchanges in IndiaShashank JoganiNo ratings yet

- 2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Document69 pages2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Roze JustinNo ratings yet

- RSM 332 Lec1Document16 pagesRSM 332 Lec1Bella ChungNo ratings yet

- Pertemuan 9BDocument36 pagesPertemuan 9Bleny aisyahNo ratings yet

- Pooling & Servicing Agreement JPMAC2006-NC1 PSADocument147 pagesPooling & Servicing Agreement JPMAC2006-NC1 PSA83jjmack100% (1)

- Unit 1Document16 pagesUnit 1Rahul kumar100% (1)

- To Buy or Not To Buy?: Divyesh ShahDocument30 pagesTo Buy or Not To Buy?: Divyesh ShahAbhay DoshiNo ratings yet

- Halley vs. PrintwellDocument3 pagesHalley vs. PrintwellGRNo ratings yet

- This Activity Contains 30 QuestionsDocument19 pagesThis Activity Contains 30 QuestionsSylvan Muzumbwe MakondoNo ratings yet

- Tabreed06 ProspectusDocument142 pagesTabreed06 ProspectusbontyonlineNo ratings yet