Professional Documents

Culture Documents

DHS Efforts Save MI Taxpayers $127 Million

Uploaded by

Michigan News0 ratings0% found this document useful (0 votes)

12 views2 pagesLast year alone the unit determined $116 million of fraud, cost savings and established program disqualifications. The OIG saved $9 million by finding assistance recipients who were incarcerated. For every hour spent on an investigation, $286 of fraud was identified.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLast year alone the unit determined $116 million of fraud, cost savings and established program disqualifications. The OIG saved $9 million by finding assistance recipients who were incarcerated. For every hour spent on an investigation, $286 of fraud was identified.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesDHS Efforts Save MI Taxpayers $127 Million

Uploaded by

Michigan NewsLast year alone the unit determined $116 million of fraud, cost savings and established program disqualifications. The OIG saved $9 million by finding assistance recipients who were incarcerated. For every hour spent on an investigation, $286 of fraud was identified.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

DHS Efforts Save MI Taxpayers $127 Million

Contact: Maura Campbell 517-243-7437

Detroit, Mich. Oct. 23, 2014 Effective stewardship of taxpayer dollars is a key goal of the Michigan

Department of Human Services (DHS). Recent initiatives have saved taxpayers $127 million and

underscore the success of DHS efforts to tackle fraud and to ensure that public assistance goes to

Michigan families, children and individuals with the greatest need, DHS announced today.

The DHS Office of Inspector Generals (OIG) fiscal year 2013 Annual Report shows that last year

alone the unit determined $116 million of fraud, cost savings and established program

disqualifications. The OIG saved $9 million by finding assistance recipients who were incarcerated

and $2 million by matching big lottery winners with recipients.

The OIG has done an outstanding job protecting taxpayer interests and helping to us to make sure

dollars intended to go to those truly in need are secured for them, said DHS Director Maura

Corrigan. The OIGs investigations over the last three years have saved taxpayers $282.6 million.

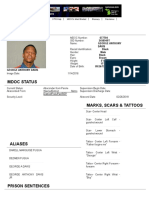

Through the Jail Match program, OIG investigations determine whether someone is incarcerated.

Anyone who is imprisoned is removed from the household and benefits are discontinued.

The OIG is extremely effective and efficient. For every hour spent on an investigation, $286 of fraud

was identified and, for every dollar spent on fraud prevention, $22 were saved due to cost

avoidance.

Specific successes highlighted in the OIG annual report include:

9,063 recipient fraud investigative dispositions completed.

24,965 fraud prevention investigations completed to make sure taxpayer dollars arent paid

to people who arent eligible for assistance, a 32-percent increase over fiscal year 2012.

$76.6 million in cost avoidance in fraud prevention investigations completed, a 10 percent

increase over FY2012.

$14.7 million in cost savings from intentional program violations.

$20.3 million of recipient fraud identified.

337 investigations completed by the special investigations agents unit, a 50-percent increase

over fiscal year 2012.

$3.9 million of provider, contractor and employee fraud identified.

1,820 benefit trafficking investigations resulting in $2.4 million receivables, a 71-percent

increase from fiscal year 2012.

The second report shows the ongoing success of the Lottery Match program. This is the second

report to be released on this program since the Legislature mandated that all lottery winners must be

matched against those receiving various types of public assistance in Michigan.

In 2013, 7,216 Michigan Lottery winners of $1,000 or more were matched and identified as living in

households that were receiving some sort of assistance. These 7,216 lottery winners accounted for

nearly $44 million in lottery proceeds and averaged $6,056 per case.

These winnings add up, said Corrigan. While federal regulations prevent us from being able to

discontinue certain types of benefits, we were able to close food assistance and Medicaid benefits

for 810 recipients, saving taxpayers nearly $2 million.

Corrigan said DHS is working closely with the Legislature and the federal government to seek

changes to policy and law that would allow for DHS to cease paying benefits to lottery winners

collecting other types of public assistance.

It does not sit well with taxpayers when someone who has won millions of dollars continues to

collect assistance because of federal loopholes that do not count these winnings as assets,

Corrigan said.

She added that one of the biggest benefits of the Lottery Match program is that DHS now has the

ability to systematically track these winnings and can document the scope of the problem and the

potential payoff from federal reforms.

Find the full OIG Annual Report here.

Find the Fiscal Year 2013 Lottery Match Report here.

You might also like

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 6 - The New Classical and RBC ModelsDocument28 pages6 - The New Classical and RBC ModelsZenyuiNo ratings yet

- Case StudyDocument1 pageCase StudyJaya MishraNo ratings yet

- Theory of Cost and ProfitDocument11 pagesTheory of Cost and ProfitCenniel Bautista100% (4)

- Top Tips On ExportingDocument2 pagesTop Tips On ExportingUKTI South EastNo ratings yet

- Tourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanDocument8 pagesTourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanRAJAT SINGH MBA-2017No ratings yet

- FOE: Session 5: Economic Systems Capitalism Socialism Communism Mixed EconomyDocument4 pagesFOE: Session 5: Economic Systems Capitalism Socialism Communism Mixed EconomylulughoshNo ratings yet

- TapaswiniDocument87 pagesTapaswinirinkuchoudhuryNo ratings yet

- Project DetailsDocument4 pagesProject DetailsSKSAIDINESHNo ratings yet

- Decision Analysis: September 29, 2015Document35 pagesDecision Analysis: September 29, 2015Jazell Jose100% (1)

- Iocl Trichy 1st Po-27076875Document14 pagesIocl Trichy 1st Po-27076875SachinNo ratings yet

- A Report On Internship Project AT Reliance Jio, Bangalore: Master of Business AdministrationDocument51 pagesA Report On Internship Project AT Reliance Jio, Bangalore: Master of Business AdministrationSahas ShettyNo ratings yet

- 1.1 Introduction To Financial CrisisDocument13 pages1.1 Introduction To Financial CrisisvarshikaNo ratings yet

- Chapter 20 - Non-Current Assets Held For Sale and Discontinued OperationsDocument35 pagesChapter 20 - Non-Current Assets Held For Sale and Discontinued OperationsVera Angraini50% (2)

- Eia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshDocument3 pagesEia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshropovevNo ratings yet

- Renewal Premium Receipt: Zindagi Ke Saath Bhi, Zindagi Ke Baad BhiDocument1 pageRenewal Premium Receipt: Zindagi Ke Saath Bhi, Zindagi Ke Baad BhiHariom TomarNo ratings yet

- Candidate Statement - ChicagoDocument2 pagesCandidate Statement - ChicagoAlan GordilloNo ratings yet

- Product Release Oracle Banking Treasury Management Release 14.6.0.0.0 File NameDocument64 pagesProduct Release Oracle Banking Treasury Management Release 14.6.0.0.0 File NamenajusmaniNo ratings yet

- Conceptual Analysis Challenge of Marketing For Small Enterprise in BangladeshDocument4 pagesConceptual Analysis Challenge of Marketing For Small Enterprise in BangladeshInternational Journal of Business Marketing and ManagementNo ratings yet

- Quotation2024021303 Kitchen Renovation UpdatedDocument2 pagesQuotation2024021303 Kitchen Renovation UpdatedPearl FernandesNo ratings yet

- Designing Grease Distribution Systems: Is Bigger Always Better?Document2 pagesDesigning Grease Distribution Systems: Is Bigger Always Better?José Cesário NetoNo ratings yet

- Limited: Prime BankDocument1 pageLimited: Prime BankHabib MiaNo ratings yet

- Urban Renewal DelhiDocument18 pagesUrban Renewal DelhiaanchalNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentAnonymous e9EIwbUY9No ratings yet

- EmamiDocument13 pagesEmamiManish JhaNo ratings yet

- Gann CyclesDocument16 pagesGann CyclesChandraKant Sharma33% (3)

- Taipei Artist VillageDocument3 pagesTaipei Artist VillageErianne DecenaNo ratings yet

- BQSPS0080B 2019 PDFDocument4 pagesBQSPS0080B 2019 PDFsaiNo ratings yet

- Horasis Global India Business Meeting 2010 - Programme BrochureDocument32 pagesHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNo ratings yet

- Taxation Quiz - ADocument2 pagesTaxation Quiz - AKenneth Bryan Tegerero TegioNo ratings yet

- Theories of Demand For MoneyDocument15 pagesTheories of Demand For MoneykamilbismaNo ratings yet