Professional Documents

Culture Documents

Case A

Uploaded by

VijaySarafOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case A

Uploaded by

VijaySarafCopyright:

Available Formats

CASE STUDY A

N-Sight is a consulting firm based out of Bangalore with a headcount of over 30,000. The firm

reported revenues of about $2B for year ending 31

st

March, 2010. About 80% of the staff

operates out of the office in Bangalore, 5% of the professionals travel around to sell the

services and the remaining 15% work onsite at client locations. The firm is under severe

pressure to provide services at reduced rates. The firm has trimmed expenses in several ways

to reduce the cost of service and survive in the economic down turn.

The CFO of the firm has already curtailed the following business related expenses

Entertainment (official dinners, employee entertainment and other related team building

events), Travel (non-client travel, long term stay in expensive hotels), Talent related expenses

(recruitment and trainings), Capital Expenditure on Facility and Technology (fixed assets,

equipment, consolidating office locations, software purchase and upgrades), Eminence Building

(research, marketing and brand building), Supplies (re-negotiating with the vendors), Corporate

Social Responsibility (community involvement activities, donations and scholarship) and other

Admin expenses (transport, air conditioning, paper based products, beverages and snacks,

courier, and administrative staff). Also, support services were re-organized.

On second round, to achieve the desired cost of services, CFO of the firm focused on improving

the productivity and reducing the employee related cost by restructuring and re-organizing the

business model.

The number of headcount in the bench was reduced to improve the utilization of the firm. Also,

time spent on training was reduced to improve the billable hours per person. This enabled the

CFO to improve the utilization of the firm by 80% level to above 90% level. Also, headcount was

aligned to business need either by combining similar services or by providing the individual

additional responsibility. In April, the company reduced the workforce by 4000 and brought it

to the current level of 30000. Also, CFO advised the business leader to improve span control

and reduce the average salary cost per person. In this endeavor, the business leaders were

more focused on hiring from campus rather than lateral hires.

Most of these actions resulted in trimming the fat and have not significantly impacted the

overall operations or businesses so far. The reason quoted by the CFO in his last update to CEO

is that firms commitment to provide quality service to the clients, build the eminence in the

market place and continue with it to reward employees with salary hikes.

Balance Sheet analysis of FY10 statements revealed that about 60% of the revenue is spent on

salaries of the client service personnel. 5% of the revenue is spent on marketing and business

development expenses to improve the market share in new geographies.

General and admin expenses accounted for 7% of the revenue. Another 8% of the revenue was

incurred on depreciation and finance cost.

The New P&L of the firm put together by the CFO projected revenues of $2.2B. About 65% of

the revenue was spent on salaries after salary revisions. Marketing, admin and finance cost

accounted for 4%, 5% and 11% of the revenues.

Questions to be addressed

1. Summarize the issues, in the case described above.

2. Identify alternative solutions for the firms if the global economy (a) improves or (b)

continues to be stressful for next 3 years.

The solutions should describe what the firm should do to:

a. Continue operating with lean expenses

b. Provide quality services to the clients at the reduced prices

c. Build eminence and improve the market share in the new geographies

3. Define the assumptions if you have made any to analyze the data provided and develop

the alternatives

4. Evaluate alternatives and recommend preferred solutions. Define Criteria for

recommending the preferred solution to the firm for both the scenarios.

*********************************************************

You might also like

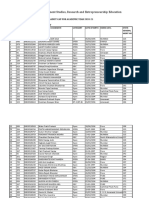

- Sydenham Institute of Management Studies, Research and Entrepreneurship EducationDocument28 pagesSydenham Institute of Management Studies, Research and Entrepreneurship EducationVijaySarafNo ratings yet

- Red SeaDocument15 pagesRed Seaamol maliNo ratings yet

- Sydenham Institute of Management Studies, Research and Entrepreneurship EducationDocument19 pagesSydenham Institute of Management Studies, Research and Entrepreneurship EducationVijaySarafNo ratings yet

- Sydenham Institute of Management Studies, Research and Entrepreneurship Education, (Simsree) B-Road, Churchgate, Mumbai - 400 020Document1 pageSydenham Institute of Management Studies, Research and Entrepreneurship Education, (Simsree) B-Road, Churchgate, Mumbai - 400 020VijaySarafNo ratings yet

- Seat Type For Admission Provisionally Admitted Till Cap Round 2, 31/01/2021Document1 pageSeat Type For Admission Provisionally Admitted Till Cap Round 2, 31/01/2021VijaySarafNo ratings yet

- Mms Admission Notification Against Vacant Seats FOR AY2020-21 Additional Round Against Vacant SeatsDocument1 pageMms Admission Notification Against Vacant Seats FOR AY2020-21 Additional Round Against Vacant SeatsVijaySarafNo ratings yet

- Government of Maharashtra'sDocument19 pagesGovernment of Maharashtra'sVijaySarafNo ratings yet

- 5 6183832297179972034Document50 pages5 6183832297179972034pratikNo ratings yet

- Himalayan and Peninsular Drainage: River GangaDocument8 pagesHimalayan and Peninsular Drainage: River GangapratikNo ratings yet

- SimsreeNotice 41Document1 pageSimsreeNotice 41VijaySarafNo ratings yet

- StraitsDocument2 pagesStraitsWaseem KhanNo ratings yet

- Assignment No 3Document1 pageAssignment No 3VijaySarafNo ratings yet

- SoilsDocument2 pagesSoilsWaseem KhanNo ratings yet

- Shareholders Capital and Liabilities AmountDocument2 pagesShareholders Capital and Liabilities AmountVijaySarafNo ratings yet

- VOCDocument10 pagesVOCVijaySarafNo ratings yet

- Metamorphosed Oldest Metamorphic RocksDocument4 pagesMetamorphosed Oldest Metamorphic RocksWaseem KhanNo ratings yet

- 5 6183832297179972036 PDFDocument4 pages5 6183832297179972036 PDFGaurav SinghNo ratings yet

- Group No. 6Document23 pagesGroup No. 6VijaySarafNo ratings yet

- Corp LawDocument11 pagesCorp LawVijaySarafNo ratings yet

- Q.2 ESPIRIT DE CORPS' Here Means Team Spirit and Team Work. This PrincipleDocument5 pagesQ.2 ESPIRIT DE CORPS' Here Means Team Spirit and Team Work. This PrincipleVijaySarafNo ratings yet

- 51 MMS Operations 2-1Document11 pages51 MMS Operations 2-1VijaySarafNo ratings yet

- Answer: See, India Wants To Be A Major Player in The Global Economy and OurDocument1 pageAnswer: See, India Wants To Be A Major Player in The Global Economy and OurVijaySarafNo ratings yet

- 51 MMS Operations 2-1Document11 pages51 MMS Operations 2-1VijaySarafNo ratings yet

- CFA Study PlanDocument1 pageCFA Study PlanVijaySarafNo ratings yet

- FMCG SectorDocument2 pagesFMCG SectorVijaySarafNo ratings yet

- FMCG SectorDocument2 pagesFMCG SectorVijaySarafNo ratings yet

- Filters Active Passive N Switched CapacitorDocument24 pagesFilters Active Passive N Switched Capacitorgotti45No ratings yet

- Op2 AssDocument4 pagesOp2 AssVijaySarafNo ratings yet

- Automatic Room Light Controller With - pdf20130912 6006 f5vrsv Libre LibreDocument36 pagesAutomatic Room Light Controller With - pdf20130912 6006 f5vrsv Libre LibreSrinivasMunubarthiNo ratings yet

- Innovative Ideas To Avoid Water Logging Problem in MumbaiDocument5 pagesInnovative Ideas To Avoid Water Logging Problem in MumbaiVijaySarafNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Tuition Training Re FormDocument4 pagesTuition Training Re FormLee CogburnNo ratings yet

- Sem-V Principle of Taxation LawDocument3 pagesSem-V Principle of Taxation LawAnantHimanshuEkkaNo ratings yet

- Final Soutnwest Airline PresentationDocument26 pagesFinal Soutnwest Airline PresentationGOUTAM DASH100% (1)

- Florida Declaration of Residency FormDocument1 pageFlorida Declaration of Residency Formfilmnorthflorida100% (1)

- "A Study On Effectiveness of Grievance Redressal System in Reliance Infocomm (Samastipur)Document26 pages"A Study On Effectiveness of Grievance Redressal System in Reliance Infocomm (Samastipur)Nirnaya AgarwalNo ratings yet

- Character Formation With Leadership - Module 1Document16 pagesCharacter Formation With Leadership - Module 1cyraviveroNo ratings yet

- Indian Ethos and Values: by DR Kishor BaradDocument26 pagesIndian Ethos and Values: by DR Kishor BaradAalap N PrajapatiNo ratings yet

- HR GDDocument8 pagesHR GDNisheeth BeheraNo ratings yet

- Eta HR FinalDocument55 pagesEta HR FinalvipinrajNo ratings yet

- Seniority Roster Department of HealthDocument519 pagesSeniority Roster Department of HealthoptivityNo ratings yet

- PWC Driving High Performing Shared Services OutsourcingDocument0 pagesPWC Driving High Performing Shared Services OutsourcingRamona PaulaNo ratings yet

- Lockes Goal Setting TheoryDocument3 pagesLockes Goal Setting Theoryca marquezNo ratings yet

- A. Incident Reporting ProcedureDocument2 pagesA. Incident Reporting Proceduresiva kNo ratings yet

- User Manual On Mediassist His Portal (Web Based Module) : Tcs ConfidentialDocument18 pagesUser Manual On Mediassist His Portal (Web Based Module) : Tcs ConfidentialNaina GargNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysisFoufina2012elkhatmxNo ratings yet

- EXD - Form A6 - 05MAY2022-Grayscale PDFDocument1 pageEXD - Form A6 - 05MAY2022-Grayscale PDFdindi genilNo ratings yet

- Income From SalariesDocument30 pagesIncome From SalariesDeepak Gupta50% (2)

- IMS Policy Statement:: Quality, Environment, Occupational Health and Safety PolicyDocument1 pageIMS Policy Statement:: Quality, Environment, Occupational Health and Safety PolicyAbhishekNo ratings yet

- Project FinalDocument75 pagesProject Finalpraveenpv7No ratings yet

- Extended Hours Claim Form 012022Document1 pageExtended Hours Claim Form 012022Shamsul RidzuanNo ratings yet

- Trouble at Tessei: Case SummaryDocument1 pageTrouble at Tessei: Case Summaryu bridgeNo ratings yet

- Learning & GrowthDocument40 pagesLearning & GrowthAlamin SheikhNo ratings yet

- Earl R. Foster v. Dravo Corporation, 490 F.2d 55, 3rd Cir. (1973)Document14 pagesEarl R. Foster v. Dravo Corporation, 490 F.2d 55, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- 1 The Case of The Missing Mona Lisa For Weebly ExampleDocument12 pages1 The Case of The Missing Mona Lisa For Weebly Exampleapi-298278157No ratings yet

- Environmental Awareness Pays Off at Farmers InsuranceDocument2 pagesEnvironmental Awareness Pays Off at Farmers InsuranceSanto AntonyNo ratings yet

- Offer Letter Template Promotion Transfer AppointmentsDocument2 pagesOffer Letter Template Promotion Transfer AppointmentsisabelaNo ratings yet

- IRS Decoding Manual 6209-2003Document674 pagesIRS Decoding Manual 6209-2003Julie Hatcher-Julie Munoz Jackson100% (5)

- Iklan 3Document3 pagesIklan 3Akhma Norasikin AhmadNo ratings yet

- November 1, 2013 Strathmore Times PDFDocument28 pagesNovember 1, 2013 Strathmore Times PDFStrathmore TimesNo ratings yet