Professional Documents

Culture Documents

ETP Time Limits

Uploaded by

Abu Mosarrof0 ratings0% found this document useful (0 votes)

19 views2 pagesGenerally, employers must pay an ETP within 12 months of the termination of employment to qualify for a reduced rate of tax withholding. However, slightly different rules apply until 30 June 2012 in relation to certain transitional ETPs. Employers should check with their tax advisers to determine whether these transitional arrangements apply to them.

http://www.perthemploymentlawyers.com.au/

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGenerally, employers must pay an ETP within 12 months of the termination of employment to qualify for a reduced rate of tax withholding. However, slightly different rules apply until 30 June 2012 in relation to certain transitional ETPs. Employers should check with their tax advisers to determine whether these transitional arrangements apply to them.

http://www.perthemploymentlawyers.com.au/

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesETP Time Limits

Uploaded by

Abu MosarrofGenerally, employers must pay an ETP within 12 months of the termination of employment to qualify for a reduced rate of tax withholding. However, slightly different rules apply until 30 June 2012 in relation to certain transitional ETPs. Employers should check with their tax advisers to determine whether these transitional arrangements apply to them.

http://www.perthemploymentlawyers.com.au/

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

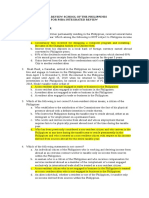

ETP time limits

Generally, employers must pay an ETP within 12 months of the termination of

employment to qualify for a reduced rate of tax withholding. However, slightly

different rules apply until 30 June 2012 in relation to certain transitional ETPs.

Employers should check with their tax advisers to determine whether these transitional

arrangements apply to them.

In cases where tax is required to he withheld from an ETP, employers must complete an

ATO PA YGPayment Summaty Employment Termination Payment form (NAT 70868).

They must also:

give a copy to the employee, or the trustee of the deceased estate, if applicable, within

14 days of payment

retain a copy for their records

Keyprinciples underpinning abest practice dismissal

the employee stopped working early (chat is, before their last retirement day), and

two legally qualified medical practitioners have certified that it is unlikely that

the employee can ever work again in a role that he or she is reasonably qualified

for because of his or her education, training or experience.

Paymentsondeathofemployee

When an employee dies, a death benefit payment may be made by his or her

employer to a dependant, a non-dependant (such as an adult child), or the trustee of

the employees estate. Such a payment is called a death benefit ETP.

The tax-free and taxable components are calculated the same for all ETPs, whether

paid in consequence of the death of the employee or not. However, different tax

rates apply. For example, where a death benefit ETP is paid to a dependent, the

tax-free component is not subject to any tax and the taxable component (up to the

ETP cap amount) is also tax-free.

Termination payments tosenior executives

In March 2009, the federal government announced reforms aimed at curbing

excessive termination benefits paid to company executives. As part of these

reforms, it introduced into parliament in June 2009 the Corporations Amendment

(Improving Accountability on Termination Payments) Bill 2009.

According to its Explanatory Memorandum, the Bill aims to address the

significant community concern about excessive pay practices, particularly at a

time when many Australian families are being hit by the global recession. It is

designed to strengthen the existing regulatory framework applying to termination

benefits by:

better empowering shareholders to disallow excessive termination benefits,

particularly where they are a reward for poor performance

improving the accountability of company management in setting remuneration,

and

promoting responsible remuneration practices.

The key features of the Bill include:

shareholder approval, which will be required for termination benefits for directors

and executives exceeding one years base salary (under current law termination

benefits can reach up to seven times a recipients total annual remuneration before

shareholder approval is required)

broadening of existing rules to cover, not only company directors, but also senior

executives and key management personnel, and

strengthened penalty provisions, with penalties of up to S99,000 for corporations

(instead of the S 16,500 maximum that applies under the current law).

The Bill wasthe subject of an inquiry by the Senate Economics Committee, which

handed downitsfinal report on 7 September 2009. On 9 September 2009, the Bill

was passed by the house of Representatives but, at the time of writing, it is still

awaiting passage through the Senate.

A further step taken by the government has been to refer the issue of excessive

executive remuneration to the Productivity Commission for inquiry. The

Commission is due to issue its final report findings on 19 December 2009. Further

information is available from the Commissions website.

Author is a employment law writer of Perth, Australia.

http://www.perthemploymentlawyers.com.au/

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Investment Slide 1Document17 pagesInvestment Slide 1ashoggg0% (1)

- Philippine Deposit Insurance CorporationDocument19 pagesPhilippine Deposit Insurance CorporationGuevarra AngeloNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- 100% Free - Forex MetaTrader IndicatorsDocument5 pages100% Free - Forex MetaTrader IndicatorsMuhammad Hannan100% (1)

- Weitzman Theorem ProofDocument3 pagesWeitzman Theorem ProofSaurav DuttNo ratings yet

- L6M5 Tutor Notes 1.0 AUG19Document22 pagesL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNo ratings yet

- Construction Contracts ProblemsDocument14 pagesConstruction Contracts ProblemsAngela A. MunsayacNo ratings yet

- BudgetDocument14 pagesBudgetPaul fernandezNo ratings yet

- ConsolidateDocument40 pagesConsolidatePopeye AlexNo ratings yet

- RY-Expected Optimal Exercise TimeDocument10 pagesRY-Expected Optimal Exercise TimeryaksickNo ratings yet

- A. Balance Sheet: Hytek Income Statement Year 2012Document3 pagesA. Balance Sheet: Hytek Income Statement Year 2012marc chucuenNo ratings yet

- (C501) (Team Nexus) Assignment 1Document14 pages(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNo ratings yet

- Updated VAT Rate 2018 PDFDocument6 pagesUpdated VAT Rate 2018 PDFAbdusSubhanNo ratings yet

- Chapter 05 Consolidation of Less Than WHDocument93 pagesChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhNo ratings yet

- Cpa Review School of The Philippines For Psba Integrated ReviewDocument13 pagesCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagNo ratings yet

- Institutional Support For SSIDocument11 pagesInstitutional Support For SSIRideRNo ratings yet

- Public Private Partnership Booklet - enDocument28 pagesPublic Private Partnership Booklet - enJoeNo ratings yet

- Week 4 Solutions To ExercisesDocument5 pagesWeek 4 Solutions To ExercisesBerend van RoozendaalNo ratings yet

- Everest Group Names HCL As A Leader For IT Outsourcing in Global Capital Markets (Company Update)Document3 pagesEverest Group Names HCL As A Leader For IT Outsourcing in Global Capital Markets (Company Update)Shyam SunderNo ratings yet

- Chapter 6 Power Point - ASSIGNDocument10 pagesChapter 6 Power Point - ASSIGNmuluNo ratings yet

- Afcqm QB 2013 PDFDocument99 pagesAfcqm QB 2013 PDFHaumzaNo ratings yet

- Hindustan Petroleum Corporation - FullDocument64 pagesHindustan Petroleum Corporation - FullSathyaPriya RamasamyNo ratings yet

- Laporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting DateDocument6 pagesLaporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting Datedok wahab siddikNo ratings yet

- Analysis of Pakistan Cement SectorDocument43 pagesAnalysis of Pakistan Cement SectorLeena SaleemNo ratings yet

- Why Oil and Gas Development Company Limited (OGDCL) Should Not Be PrivatizedDocument11 pagesWhy Oil and Gas Development Company Limited (OGDCL) Should Not Be PrivatizedZohaib GondalNo ratings yet

- CH 1 FAcc I @2015Document21 pagesCH 1 FAcc I @2015Gedion FeredeNo ratings yet

- Namkeen Farsan Manufacturing SchemeDocument2 pagesNamkeen Farsan Manufacturing SchemeYogesh ShivannaNo ratings yet

- IRS Publication Form Instructions 2106Document8 pagesIRS Publication Form Instructions 2106Francis Wolfgang UrbanNo ratings yet

- VAT Guidance For Retailers: 375,000 / 12 MonthsDocument1 pageVAT Guidance For Retailers: 375,000 / 12 MonthsMuhammad Suhaib FaryadNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet