Professional Documents

Culture Documents

Factor Pricing

Uploaded by

ashutosh_tyagiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factor Pricing

Uploaded by

ashutosh_tyagiCopyright:

Available Formats

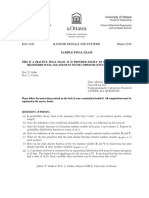

Advanced Asset Pricing

Factor Pricing and Beta Models

Dr. des. Matthias Huss

Wirtschaftswissenschaftliches Zentrum der Universitt Basel

Abteilung fr Finanzmarkttheorie

4 April 2013

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Table of Contents

1 Introduction

Linear Factor Models and Motivation

2 Factor Pricing Models and the APT

Factor Pricing Models

Exact Factor Pricing

Approximate Factor Pricing

3 Estimating Factor Models

Time-Series Regression

Cross-Sectional Regression

Fama MacBeth (1973)

Mimicking Portfolios

4 Empirical Application

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Linear Factor Models and Motivation

Motivation for Factor Models

Despite their beauty, the consumption based models do not work very

well in practice.

Consumption aggregates

are not immediately observable

may not be measurable with sucient precision, and

are available at a low frequency only.

Further, the consumption based models are stated in continuous time;

empirical applications, however, require a discrete time framework.

Thus, in empirical applications, we (often) need to replace the

consumption based expression for marginal utility by some other

factors...

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Linear Factor Models and Motivation

Motivation for Factor Models

Factor models exactly do this.

But they start from a very dierent approach.

Factor models simply build on the observation that asset returns have a

tendency to move together, i.e. asset returns are correlated.

These movements are associated with the movements of common risk

factors (whatever they may be) which inuence the returns of many or

even all assets likewise.

According to factor models, only a few economy-wide pervasive factors

are sucient to represent the systematic risk of assets.

In the spirit of ICAPM or C-CAPM, a factor should proxy for marginal

utility or consumption growth.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Linear Factor Models and Motivation

What is a Risk Factor?

Generally, a risk factor can be anything that commonly aects the

returns of many or even all assets in a systematic way.

There are three classes of risk factors:

Economic Factors are based on economic theory and/or intuition,

often macroeconomic factors. Among those that have proved to be

successful are: Industrial Production growth, (unanticipated) changes

in ination, the term premium and the default premium (e.g. Chen et

al (1986)). Advantage: they readily provide an economic

interpretation of sensitivities and risk premia.

Characteristics Based Factors are typically returns on portfolios of

traded assets that are formed on characteristics such as size of B/M.

Fama/French(1993,1996) etc. They often produce high R

2

, but it is

not clear what risks they represent.

Statistical Factors are derived by factor analysis or principal

components. This helps to determine the number of factors required

to represent systematic risk, but the factors are dicult to interpret.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Linear Factor Models and Motivation

Linear Factor Models

We will concentrate on the most popular class of factor models:

Linear factor models.

An assets sensitivity, or exposure, to (unexpected) changes in the

common factors can be estimated from a (multiple) time-series regression

of asset returns on either factors f or the factors unexpected changes

f

R

it

= a

i

+

K

j=1

ij

f

jt

+

it

, (1)

where r

it

denotes the return of asset i at time t and

ij

represents the

assets exposure to the systematic risk represented by factor j . The

variables a

i

and

it

are the intercept and the residuals of the regression

and are both specic for asset i .

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Factor Pricing Models

General Factor Pricing Models

Factor models are a statistical decomposition of asset returns into

systematic and idiosyncratic risk only.

But the central economic question in asset pricing is: Why do average

returns vary across assets?

Factor (or beta) pricing models use the statistical decomposition of asset

returns to derive a statement about the assets expected returns.

Idea: As idiosyncratic risk can be (completely) diversied away, only the

assets systematic risk is compensated with a risk premium.

In other words: The factor structure determines the price of an asset.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Factor Pricing Models

General Factor Pricing Models II

Linear factor pricing models state that the expected return on an asset is

a linear function of its factor betas.

E[R

e

i

] =

(2)

That is, if all assets are consistently priced, this imposes a restriction on

the intercept a

i

in the return representation given by equation (1) and

the return of an asset can be decomposed into (i) an expected return

component, which is linear in the betas, (ii) a systematic component that

links the assets return to unexpected changes of the risk factors, which is

also determined by the factor structure, and (iii) a residual idiosyncratic

component.

R

e

it

=

K

j=1

ij

j

+

K

j=1

ij

f

jt

+

it

. (3)

We only require the Law Of One Price (LOOP) to conclude the

argument.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Factor Pricing Models

General Factor Pricing Models II

We start with the statistical characterization of an assets return:

R

i

= E[R

i

] +

K

j=1

ij

f

j

+

i

= E[R

i

] +

f +

i

(4)

Note, dierent to equation (1), the intercept is E[R

i

], not a

i

, as we want

to add some economic content to the equation.

However, equation 4 is still a purely statistical representation of returns.

If we choose

f = [1 (f E[f ])], E[R

i

] is simply the sample mean of R

i

.

E[R

i

] is NOT (yet) the prediction of a model!

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Factor Pricing Models

General Factor Pricing Models III

If betas are dened as regression coecients, the residuals are

uncorrelated with the factors by construction and have a zero mean.

E[

i

] = E[

i

f ] = 0

The basic economic content that keeps the equation from describing just

any arbitrary set of returns is the additional restriction that the residuals

are cross-sectionally uncorrelated.

E[

i

j

] = 0 The intuition is that the factor structure is complete.

The assumption implies a restriction on the covariance matrix of returns.

Assuming a single factor for simplicity

cov(R

i

, R

j

) = E[(i

f +

i

)(j

f +

j

)] =

i

2

(f ) +

_

2

1

0 0

0

2

2

0

0 0

.

.

.

_

_

(5)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Exact Factor Pricing

Exact Factor Pricing by LOOP

Exact factor pricing relates to the case when there is no error term in the

return decomposition, i.e.

i

= 0,

R

i

= E[R

i

] 1 +

f . (6)

Then, the Law of one price (LOOP) implies

p(R

i

) = E[R

i

] p(1) +

i

p(

f ), (7)

where p() denotes prices.

As p(R

i

) = 1 and p(1) = 1/R

f

, it follows that

E[R

i

] = R

f

+

i

[R

f

p(

f )]

. .

= R

f

+

i

. (8)

Expected returns are linear in their betas and s are related to the

prices of factors.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Exact Factor Pricing

Exact Factor Pricing by Arbitrage I

An arbitrage portfolio is one that

requires no investment:

w

p

= 0

carries no systematic risk:

w

p

= 0

To exclude arbitrage, the (net-zero investment) portfolio must have an

expected return of zero, that is

E[R

i

]

w

p

= 0 (9)

where E[R

i

] = R

f

+ E[R

e

i

].

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Exact Factor Pricing

Exact Factor Pricing by Arbitrage II

The system of equations can be compactly written as

_

E[R

i

]

_

w

p

= 0 (10)

Despite the trivial solution (w

p

= 0), the (homogeneous) system of

equations has a solution only, if the matrix is singular, i.e. does not have

full rows or column rank. That is the case if the rows or columns are

linearly dependent.

This is the case if we choose

E[R

i

] = 1

0

+ (11)

For a risk-free asset ( = 0) this implies that

E[R

0

] = R

f

=

0

(12)

which means in terms of excess returns

E[R

e

i

] =

(13)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Approximate Factor Pricing

Approximate Arbitrage Pricing

So far, we have assumed no idiosyncratic risk, i.e.

i

= 0.

But actual returns will typically not have an exact factor structure, but

rather exhibit some idiosyncratic risk.

Can the APT be saved if this assumption is relaxed?

The answer is yes, and the rst point is rather trivial. The APT will hold,

at least approximately, when the

i

are small.

A good indication is to look at the R

2

of the factor regression, since

var(

i

)

var(R

i

)

= 1 R

2

. (14)

Thus, a high R

2

implies that the (APT) model is an acceptable

approximation.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Approximate Factor Pricing

Approximate Arbitrage Pricing II

Consider an (equally weighted) portfolio. Then

R

p

=

1

N

N

i =0

R

i

=

1

N

N

i =0

(E[R

i

] +

f +

i

) = ( ) +

1

N

N

i =0

(

i

), (15)

and

var(

p

) = var

_

1

N

N

i =0

i

_

(16)

As long as the variance of

i

is bounded and the factor assumption

E[

i

j

] = 0 holds

lim

N

var(

p

) = 0 (17)

So, it is generally a good idea to test the APT on well-diversied

portfolios, rather than on individual assets!

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Traded vs. Non-traded Factors

The task is to estimate betas, the market price of risk (MPR, ) and

then to derive the pricing errors implied by the model and see whether

they are statistically dierent from zero.

For the empirical estimation of the MPR of a particular risk factor, there

is, however, another important distinction to be made that is not

necessarily related to the type of risk the factor represents:

A risk factor can be either traded or not.

Traded Factors are portfolios of traded assets, e.g., the market

portfolio, SMB or HML, etc.

Non-traded Factors typically include macroeconomic factors, e.g., GDP

growth, ination, or interest rates, etc.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Setup)

Estimating a beta pricing model from a time-series regression approach is

only valid when the risk factors of the model are traded, i.e. they are

themselves (excess) returns (e.g., CAPM).

An immediate implication when factors are traded is that the pricing

model also applies to the factors. Considering a single factor for

simplicity, that is:

E[R

e

i

] =

i

(18)

must hold for the factor.

By denition, a factor has a beta of one on itself and betas of zero with

respect to all other factors. This implies:

E[f ] =

f

= 1 (19)

It follows that

f

t

= E[f ] +

f

t

= +

f

t

(20)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Coecients)

The model can be estimated by running time-series regressions of asset

returns on full factor realizations.

R

e

i ,t

=

i

+

i

f

t

+

i ,t

(21)

which gives betas and alphas as the intercept of the regression.

Alphas immediately correspond to the pricing errors.

Note: Do not demean factors, as this takes away the risk premium!

The MPR is calculated as the sample mean (denoted by E

T

) of the factor

= E

T

[f ] (22)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Evaluation)

Theory predicts that the alphas (pricing errors), that is, the intercepts of

the regression should be zero.

On individual security level, this can be veried by simple t-tests.

However, the more interesting test is to verify that the pricing errors are

also jointly zero.

This requires a distribution theory for the joint distribution of alpha

estimates from separate regressions (run side-by-side).

These errors will likely be correlated (E[

i ,t

j,t

] = 0).

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Evaluation II)

Assuming

no autocorrelation in the residuals, and

homoscedasticity,

a classic

2

test applies

T

_

1 +

_

E

T

(f )

(f )

_

2

_

1

1

2

N

(23)

where, E

T

(f ) denotes the sample mean,

2

(f ) the sample variance of the

factor and = [

1

2

N

]

is the N 1 vector of regression intercepts.

is the covariance matrix of the residuals, i.e. the sample estimate of

E[

t

t

], i.e.,

=

1

T

T

t=1

t

t

.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Evaluation II)

The test is asymptotically valid (i.e. assumes that

2

(f ) and have

converged to their probability limits). It does not require normality of the

errors (only relies on the CLT), thus is normal.

However, it ignores sources of variation in a nite sample.

The Gibbons, Ross, and Shanken (1989) GRS test

T N 1

N

_

1 +

_

E

T

(f )

(f )

_

2

_

1

1

F

N,TN1

(24)

recognizes sampling variation in

, but requires normal errors.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Evaluation III)

Interpretation of the GRS Test:

By ecient set algebra:

_

q

_

2

=

_

E

T

(f )

(f )

_

2

+

1

(25)

where (

q

/

q

)

2

is the (squared) Sharpe Ratio of the ex post tangency

portfolio formed from the factor and the test assets, and

(E

T

(f )/ (f ))

2

is the Sharpe Ratio of the factor (i.e. that is formed ex

ante).

Using this notation, the GRS test statistic can be rewritten as

T N 1

N

(

q

/

q

)

2

(E

T

(f )/ (f ))

2

_

1 + (E

T

(f )/ (f ))

2

_

F

N,TN1

(26)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Time-Series Regression

Time-Series Regression (Evaluation III)

If the model contains more than one factor, we simply replace the Sharpe

Ratio of the single factor by its natural generalization.

With N test assets and K risk factors the GRS test becomes

T N K

N

_

1 + E

T

(f )

1

E

T

(f )

_

1

1

F

N,TNK

(27)

where

=

1

T

T

t=1

[f

t

E

T

(f )] [f

t

E

T

(f )]

=

1

T

T

t=1

t

t

.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Setup)

When factors are not traded (not returns), the expected value of the

factor is not equal to its risk premium.

Then, the risk premium (MPR, ) of the risk factors has to be

estimated from the cross-section of asset returns.

The beta pricing equation () implies that (i) s are the same for all

assets and (ii) expected returns are linear in their betas.

E[R

e

i

] =

i

(28)

A natural idea is therefore to employ cross-sectional regressions of

average returns on betas to estimate the risk premia of factors.

However, to do this, we rst need the betas of the test assets.

The procedure therefore is two-step.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Setup)

The rst step is to estimate the betas of the test assets by running

time-series regressions of asset returns on factors.

R

e

i ,t

= a

i

+

f

t

+

i ,t

(29)

Note: Dierent to equation (21), the intercept is a

i

, not

i

!

The second step is then to cross-sectionally regress average returns on

betas to estimate the risk premia () and the pricing errors ().

E

T

[R

e

i

] =

i

+

i

(30)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Setup II)

The cross-sectional regression can be run with, or without a constant.

That is, adding a vector of ones to the beta matrix.

As theory predicts the zero-beta excess return should be zero, a constant

is not necessarily required.

However, including a constant, allows for a test whether the constant

turns out to be empirically small.

Clearly: There is also a trade-o between eciency (in the sense of

being close to the null) and robustness of the regression.

Empirically this really makes a dierence!

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Coecients by OLS)

For simplicity, we will consider the case of no intercept.

Then, from standard OLS notation the estimates for the risk premia are

= (

)

1

E

T

(R

e

) (31)

and for pricing errors

= E

T

(R

e

)

(32)

respectively.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Evaluation, OLS)

Next, we want to evaluate the model. Again, we need to derive a

distribution that accounts for correlated errors.

These are given by

2

(

) =

1

T

_

(

)

1

)

1

+

f

(33)

and

cov( ) =

1

T

_

I (

)

1

_

I (

)

1

(34)

Test whether all pricing errors are jointly zero:

cov( )

1

2

NK

(35)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Cross-Sectional Regression

Cross-Sectional Regression (Shanken Correction)

However, betas are estimates, not the true parameters, which gives rise

to the so-called errors-in-variables (EIV) problem.

Hence, we need to account for sampling error in (rst-pass) betas, when

computing standard errors of the (second-pass) coecients ( and ).

Shanken (1992) derives the following correction for risk premia estimates

2

(

OLS

) =

1

T

_

(

)

1

)

1

(1 +

1

f

) +

f

(36)

and pricing errors

cov(

OLS

) =

1

T

_

I (

)

1

_

I (

)

1

(1 +

1

f

)

(37)

Importance of this correction?

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Fama MacBeth (1973)

Fama MacBeth (Intuition)

Fama and MacBeth suggest an alternative procedure to the

cross-sectional approach discussed so far.

The basic idea is to replace the single cross-sectional regression by T

individual regressions, one regression for each period.

The procedure is historically important and still widely used.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Fama MacBeth (1973)

Fama/MacBeth (Estimation)

First, run a time-series regression to nd the assets betas.

In their original paper, Fama and MacBeth use rolling regressions over a

5 year interval. Todays practice that is followed by most authors,

however, is to estimate a single beta over the entire sample period.

Second, run a cross-sectional regression at each time period t

R

e

i ,t

=

t

+

i ,t

(38)

Then, estimate the MPR and the pricing error as the average of the T

cross-sectional regression coecients.

=

1

T

T

t=1

t

and

i

=

1

T

T

t=1

i ,t

(39)

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Fama MacBeth (1973)

Fama/MacBeth (Evaluation)

Fama and McBeth suggest to derive the sampling errors for the estimates

from the (empirical) distribution of the estimates. That is to use the

standard deviation of the cross-sectional regression estimates.

Then, estimate the MPR and the pricing error as the average of the T

cross-sectional regression coecients.

2

(

) =

1

T

2

T

t=1

(

)

2

(40)

and

2

(

i

) =

1

T

2

T

t=1

(

i ,t

)

2

(41)

Intuition: Use the variation in the statistic

t

over time to derive the

variation across samples.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Fama MacBeth (1973)

Fama/MacBeth (Evaluation II)

Joint test of alphas:

cov =

1

T

2

T

t=1

(

t

)(

t

)

(42)

using

cov( )

2

NK

(43)

One of the major advantages of the Fama/MacBeth approach is that it

allows for time-varying betas.

However, the methodology does also not circumvent the EIV problem of

the classical cross-sectional approach.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Mimicking Portfolios

One way to deal with some of the diculties tied to the two-pass

methodology is to construct a portfolio of traded assets that mimics the

realizations of a non-traded factor.

Such mimicking factor portfolios are linear combinations of traded

assets the replicate the time series of a (non-traded) factor.

They can serve as an articial traded factor, which allows to test asset

pricing models from the time-series approach.

Many authors advocate such a design over the direct application of a

non-traded factor.

Conceptually, mimicking portfolios have close ties to the hedge

portfolio in the ICAPM.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Mimicking Portfolios II

There are two forms of such mimicking portfolios that should be

distinguished from one another:

Maximum Correlation Portfolios maximize the (squared) correlation

with a particular factor.

Unit-Beta Portfolios impose the additional restriction the the

portfolio has a beta of one with respect to the particular factor and

betas of zero with respect to all other factors implied in the model.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Maximum Correlation Portfolios

The idea of a maximum correlation portfolio goes back to Huberman,

Kandel and Stambaugh (1987).

The portfolio weights can be obtained from a linear regression of a

non-traded factor on the space of N excess returns of the chosen base or

test assets.

The regression is of the form

f

t

= c +

R

e

t

+

t

, (44)

where f

t

denotes the vector of (K 1) non-traded factors and r

t

represents the vector of (N 1) excess returns of the base assets.

The matrix of (N K) regression coecients can be interpreted as

the mimicking portfolio weights.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Maximum Correlation Portfolios II

The risk premium of factor mimicking portfolio (f

) is given by

= E [f

] =

E [R

e

] , (45)

where the estimated weights are typically normalized to sum up to one.

If the assets returns, and thus the residuals of the regression are assumed

to be i.i.d., an OLS estimation fullls the requirements of minimizing the

(unweighted) sum of the squared residuals.

It can be shown that the procedure is equivalent to the solution of

maximizing the correlation between the returns of the base assets and the

factor(s).

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Maximum Correlation Portfolios III

Maximum correlation portfolios are subject to mainly two diculties.

First, the estimation of the risk premium of a factor mimicking portfolio

is particularly sensitive to the choice of the base assets. Low correlation

between the mimicking portfolio and the original factor often leads to

misrepresentative factor risk premiums (indicated by a low R-squared

of the regression).

Second, a maximum correlation portfolio only implies the constraint of

being maximum correlated to the factor of interest. It does not imply a

restriction on the correlation to other factors. Therefore, the inherent risk

premium of a maximum correlation portfolio may substantially dier from

the market price of risk of the true factor of interest, due to potential

correlation to other economic factors.

However, the product of the factor risk premium (

) and the estimated

beta (

f

) with respect to the factor mimicking portfolio are proportional

to the true factor (

f

) and the respective MPR (), i.e.

f

=

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Unit-Beta Portfolios

The issue is somehow resolved by the construction of a unit beta

portfolio, which are formed on the additional constraint to have a beta of

one with respect to the factor of interest and zero to all other factors.

Conceptually, the (true) market price of risk is the expected value of

the excess return on a unit-beta portfolio.

However, the additional restrictions require full knowledge of all

pricing-relevant factors, which is empirically questionable.

Further, an important property of the weights of a unit beta portfolio is

demonstrated by Balduzzi and Robboti (2008), who show that the so

constructed weights are equal to the weights obtained from the

cross-sectional approach.

Thus, unit-beta portfolios do not provide any empirical advantages.

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Mimicking Portfolios

Unit-Beta Portfolios

We will look at the concept of mimicking portfolios in much more detail

in one of the upcoming lectures...

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

Introduction Factor Pricing Models and the APT Estimating Factor Models Empirical Application

Application

Dr. des. Matthias Huss Universitt Basel - WWZ - Abteilung fr Finanzmarkttheorie

AAP Factor Pricing and Beta Models

You might also like

- Arbitrage Pricing Theory ExplainedDocument8 pagesArbitrage Pricing Theory Explainedsush_bhatNo ratings yet

- AptDocument21 pagesAptBushra HaroonNo ratings yet

- 6 APT Slides ch10Document53 pages6 APT Slides ch10Zoe RossiNo ratings yet

- Ec371 Topic 3Document13 pagesEc371 Topic 3Mohamed HussienNo ratings yet

- Literature On CapmDocument14 pagesLiterature On CapmHitesh ParmarNo ratings yet

- Portfolio Choice: Factor Models and Arbitrage Pricing TheoryDocument23 pagesPortfolio Choice: Factor Models and Arbitrage Pricing TheoryDarrell PassigueNo ratings yet

- The APT Formula: Expected Return RF + b1 X (Factor 1) + b2 X (Factor 2) ... + BN X (Factor N)Document5 pagesThe APT Formula: Expected Return RF + b1 X (Factor 1) + b2 X (Factor 2) ... + BN X (Factor N)Nisanth PramodNo ratings yet

- Jau-Lian Jeng - Empirical Asset Pricing Models-Chap 1Document41 pagesJau-Lian Jeng - Empirical Asset Pricing Models-Chap 120203111No ratings yet

- Hilpisch 2020 Artificial Intelligence in Finance 1 477 PagesDocument7 pagesHilpisch 2020 Artificial Intelligence in Finance 1 477 Pagesthuyph671No ratings yet

- Summary Chap 12, MKL, Findi Kumala DewiDocument5 pagesSummary Chap 12, MKL, Findi Kumala Dewiresty auliaNo ratings yet

- Capital Asset Pricing Model ExplainedDocument4 pagesCapital Asset Pricing Model ExplainedR Shyaam KumarNo ratings yet

- Stochastic Excess of Loss Pricing - Extreme ValuesDocument56 pagesStochastic Excess of Loss Pricing - Extreme Valuesgonzalo diazNo ratings yet

- Arbitrage Pricing TheoryDocument5 pagesArbitrage Pricing TheoryFahd Rizwan100% (1)

- Quantitative Portfolio Management: with Applications in PythonFrom EverandQuantitative Portfolio Management: with Applications in PythonNo ratings yet

- 3.Self-Consistent Asset Pricing ModelsDocument23 pages3.Self-Consistent Asset Pricing ModelsPeerapong NitikhetprechaNo ratings yet

- M430 Unit-01 SampleDocument37 pagesM430 Unit-01 SamplepedroNo ratings yet

- Stress Testing Correlation Matrix A Maximum Empirical Likelihood ApproachDocument8 pagesStress Testing Correlation Matrix A Maximum Empirical Likelihood ApproachGiuliano de Queiroz FerreiraNo ratings yet

- Carassus Rásonyi2020 Article Risk NeutralPricingForArbitragDocument16 pagesCarassus Rásonyi2020 Article Risk NeutralPricingForArbitragAnshul GoelNo ratings yet

- Chapter 3: The Arbitrage Pricing TheoryDocument8 pagesChapter 3: The Arbitrage Pricing TheoryAshikNo ratings yet

- Allen Et Al 09 Asset Pricing The Fama French Factor Model and The Implications of Quantile Regression AnalysisDocument24 pagesAllen Et Al 09 Asset Pricing The Fama French Factor Model and The Implications of Quantile Regression AnalysisPeterParker1983No ratings yet

- Analysis and Comparison of Capital Asset Pricing Model and Arbitrage Pricing Theory ModelDocument8 pagesAnalysis and Comparison of Capital Asset Pricing Model and Arbitrage Pricing Theory ModelAmal AsseyrNo ratings yet

- Enhanced Portfolio Optimization: Lasse Heje Pedersen, Abhilash Babu, and Ari LevineDocument49 pagesEnhanced Portfolio Optimization: Lasse Heje Pedersen, Abhilash Babu, and Ari LevineLoulou DePanamNo ratings yet

- Arbitrage Pricing Theory (APT) IntroductionDocument5 pagesArbitrage Pricing Theory (APT) IntroductionromanaNo ratings yet

- Index Models: Juan Sotes-Paladino FNCE30001 InvestmentsDocument57 pagesIndex Models: Juan Sotes-Paladino FNCE30001 Investments080395No ratings yet

- Nature of Mathematical Economics: Contact Information: Kadjei-Mantey@ug - Edu.ghDocument19 pagesNature of Mathematical Economics: Contact Information: Kadjei-Mantey@ug - Edu.ghDarling Jonathan WallaceNo ratings yet

- Forecasting DPDocument6 pagesForecasting DPmeagon_cjNo ratings yet

- Arbitrage Pricing Theory: Gur Huberman Zhenyu Wang August 15, 2005Document19 pagesArbitrage Pricing Theory: Gur Huberman Zhenyu Wang August 15, 2005Pranav ModakNo ratings yet

- Portfolio Performance Attributions FinalDocument27 pagesPortfolio Performance Attributions FinalOussama BOUDCHICHINo ratings yet

- Nejat EconometricsDocument6 pagesNejat EconometricsAbnet BeleteNo ratings yet

- Econometrics Chapter 1& 2Document35 pagesEconometrics Chapter 1& 2Dagi AdanewNo ratings yet

- The Capital Asset Pricing Model - : The Cost of EquityDocument8 pagesThe Capital Asset Pricing Model - : The Cost of EquityMuhammad YahyaNo ratings yet

- Logically Consistent Market Share Models: Philippe A. Naert and Alain BultezDocument8 pagesLogically Consistent Market Share Models: Philippe A. Naert and Alain Bultezk_ij9658No ratings yet

- Multifactor Models and The CapmDocument6 pagesMultifactor Models and The CapmNguyễn Dương Trọng KhôiNo ratings yet

- HP (2013) - Paper TemplateDocument9 pagesHP (2013) - Paper TemplateLoik-mael NysNo ratings yet

- Answers Review Questions EconometricsDocument59 pagesAnswers Review Questions EconometricsZX Lee84% (25)

- Resume CH 7 - 0098 - 0326Document5 pagesResume CH 7 - 0098 - 0326nur eka ayu danaNo ratings yet

- Arbitrage Pricing Theory or APTDocument3 pagesArbitrage Pricing Theory or APTSnehaguddu SnehadeepNo ratings yet

- Measuring Model Risk: Philipp SibbertsenDocument17 pagesMeasuring Model Risk: Philipp SibbertsenvickyNo ratings yet

- Economic ModelsDocument6 pagesEconomic ModelsBellindah GNo ratings yet

- Portfolio Theories1Document17 pagesPortfolio Theories1ayazNo ratings yet

- Solution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiDocument10 pagesSolution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiJonathanBradshawsmkc100% (42)

- Principal Portfolios: Bryan Kelly, Semyon Malamud, and Lasse Heje PedersenDocument71 pagesPrincipal Portfolios: Bryan Kelly, Semyon Malamud, and Lasse Heje PedersenPedro PortellaNo ratings yet

- Hamada 1972Document18 pagesHamada 1972Ivon SilvianaNo ratings yet

- PLMDocument51 pagesPLMBruno André NunesNo ratings yet

- Econometrics Notes PDFDocument8 pagesEconometrics Notes PDFumamaheswariNo ratings yet

- AdsdadDocument9 pagesAdsdadAlfieNo ratings yet

- The Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Document12 pagesThe Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Gu GraceNo ratings yet

- Asymmetric Preferences in Investment Decisions in The Brazilian Financial Market Luiz Augusto Martits William Eid Junior (FGV/EAESP)Document17 pagesAsymmetric Preferences in Investment Decisions in The Brazilian Financial Market Luiz Augusto Martits William Eid Junior (FGV/EAESP)Neto AlcidesNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- GREBENKOV-Optimal Allocation of Trend Following StrategiesDocument35 pagesGREBENKOV-Optimal Allocation of Trend Following StrategieschemoulpraviNo ratings yet

- Empirical Cross-Sectional Asset PricingDocument60 pagesEmpirical Cross-Sectional Asset PricingThomas FlanaganNo ratings yet

- Day 2 Introduction To EconometricsDocument11 pagesDay 2 Introduction To EconometricsSegoata EvandaNo ratings yet

- Dan Gode-Affect CocDocument32 pagesDan Gode-Affect CocShanti PertiwiNo ratings yet

- Perf Assignment 1Document7 pagesPerf Assignment 1Blessed NyamaNo ratings yet

- CVPDocument20 pagesCVPThomas K. AddaiNo ratings yet

- 221 ChowDocument6 pages221 Chowaaditya_prakashNo ratings yet

- The Black-Litterman Model ExplainedDocument19 pagesThe Black-Litterman Model ExplainedbboyvnNo ratings yet

- Constrained Mean-Variance Portfolio Optimization With Alternative Return EstimationDocument18 pagesConstrained Mean-Variance Portfolio Optimization With Alternative Return EstimationMommiza MommizaNo ratings yet

- Financial Econometrics: Problems, Models, and MethodsFrom EverandFinancial Econometrics: Problems, Models, and MethodsRating: 4 out of 5 stars4/5 (1)

- Set 3Document4 pagesSet 3Sharan SNo ratings yet

- Tutorial Week 10 Statistics AnswersDocument10 pagesTutorial Week 10 Statistics AnswersChristie BudiatmantoNo ratings yet

- S1 Regression Past Paper QuestionsDocument9 pagesS1 Regression Past Paper QuestionsDEVAK ANAND YAGNIK-02306No ratings yet

- 4th Test QuestionsDocument7 pages4th Test QuestionsJayphoy Caspíz BacusNo ratings yet

- The Use of Control ChartsDocument16 pagesThe Use of Control ChartsAmeer MuhammadNo ratings yet

- Assignment2 Numerical AnylsisDocument3 pagesAssignment2 Numerical AnylsisZiad Mohmed FawzyNo ratings yet

- Stats Chapter 17 Chi SquaredDocument21 pagesStats Chapter 17 Chi SquaredMadison HartfieldNo ratings yet

- Bias Testing of Cross-Belt SamplersDocument10 pagesBias Testing of Cross-Belt SamplersSamantha PowellNo ratings yet

- Sinharay S. Definition of Statistical InferenceDocument11 pagesSinharay S. Definition of Statistical InferenceSara ZeynalzadeNo ratings yet

- Comparing Groups using Box-plotsDocument3 pagesComparing Groups using Box-plotsDayini KamarulNo ratings yet

- Correlation and Regression Activity - Answer KeyDocument22 pagesCorrelation and Regression Activity - Answer KeyLalaine Bautista LlabanNo ratings yet

- Seznam Literatury o StatisticeDocument151 pagesSeznam Literatury o StatisticecherokezNo ratings yet

- Chap 9Document64 pagesChap 9joNo ratings yet

- Linear RegressionDocument499 pagesLinear Regressionope ojo83% (6)

- Logit and SpssDocument37 pagesLogit and SpssSagn MachaNo ratings yet

- PjBL MotivationDocument5 pagesPjBL MotivationSatria hattaNo ratings yet

- Latihan Soal Utk UASDocument5 pagesLatihan Soal Utk UASReviandi RamadhanNo ratings yet

- Dataset - Airport PassengersDocument10 pagesDataset - Airport PassengersRiddhi Madani100% (1)

- 5 - RegressionDocument63 pages5 - RegressionMarcello RossiNo ratings yet

- A Probability and Statistics CheatsheetDocument28 pagesA Probability and Statistics CheatsheetfarahNo ratings yet

- Elg 3126Document6 pagesElg 3126Serigne Saliou Mbacke SourangNo ratings yet

- Hypothesis TestsDocument7 pagesHypothesis TestsArif NugrohoNo ratings yet

- Assignment of SPSS Data AnalysisDocument6 pagesAssignment of SPSS Data AnalysisangelNo ratings yet

- Lecture 5: Hypothesis Testing About Population Mean: S. Nakale University of NamibiaDocument21 pagesLecture 5: Hypothesis Testing About Population Mean: S. Nakale University of NamibiaPanduh Shvely AmukamboNo ratings yet

- 3 SlsDocument31 pages3 Sls.cadeau01No ratings yet

- Applied Econometrics With RDocument5 pagesApplied Econometrics With RSebastian GuatameNo ratings yet

- Probability and Statistics Quiz: Key ConceptsDocument27 pagesProbability and Statistics Quiz: Key ConceptsBruce MendezNo ratings yet

- Advanced Statistics ReviewDocument21 pagesAdvanced Statistics ReviewJorie RocoNo ratings yet

- 19 Measure Systems GageRRDocument18 pages19 Measure Systems GageRRtkhurshid3997No ratings yet

- RCA Plant IssuesDocument12 pagesRCA Plant IssuesMatthew AdeyinkaNo ratings yet