Professional Documents

Culture Documents

Diamond Bank Half Year Results 2011 Summary

Uploaded by

Oladipupo Mayowa PaulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diamond Bank Half Year Results 2011 Summary

Uploaded by

Oladipupo Mayowa PaulCopyright:

Available Formats

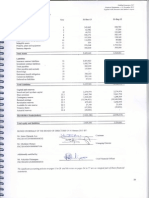

DIAMOND BANK PLC

UNAUDITED HALF YEAR RESULT AS AT JUNE 30, 2011

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE

PERIOD ENDED:

30th June 2011

Group

N'000

30th June 2010

Group

N'000

30th June 2011

Bank

N'000

30th June 2010

Bank

N'000

44,081,261

46,125,520

40,487,982

43,061,164

30,143,942

(4,847,345)

25,296,598

33,978,075

(11,233,706)

22,744,369

29,234,727

(4,265,173)

24,969,554

32,984,071

(10,985,015)

21,999,057

13,937,319

39,233,917

12,147,445

34,891,814

11,253,255

36,222,809

10,077,092

32,076,149

(26,255,879)

12,978,038

(23,157,840)

11,733,974

(23,466,847)

12,755,962

(20,558,201)

11,517,947

(10,992,461)

1,985,577

(5,529,282)

6,204,692

(10,930,745)

1,825,217

(5,426,021)

6,091,926

Taxation

Profit/(Loss) After Taxation

(781,690)

1,203,887

(1,619,510)

4,585,182

(638,826)

1,186,391

(1,522,982)

4,568,945

Non-controling Interest

Profit Attributable To The Group

(15,103)

1,188,784

(10,484)

4,574,698

1,186,391

4,568,945

40,594,389

10.8%

17

17

60,310,034

17.7%

63

63

37,667,729

10.5%

16

16

58,050,834

17.6%

63

63

Notes

Gross Earnings

Interest and Discount Income

Interest Expense

Net Interest And Discount Income

1

2

Other Income

Operating Income

Operating Expenses

Operating Profit before Tax

Provision For Losses

Profit/(Loss) Before Taxation

Key Financial Information

Total Non-Performing Loans

Total Non-Performing Loans To Total Loans

Basic Eps (Annualized, Kobo)

Diluted Eps (Annualized, Kobo)

DIAMOND BANK PLC

CONSOLIDATED BALANCE SHEET AS AT :

Notes

Assets

Cash And Balances With Central Banks

Due from Other Banks & Financial Institutions

Short Term Investment

Loans and Advances to Customers

Advances Under Finance Lease

Deferred Taxation

Other Assets

Investment Securites

Investment in subsidiaries

Investment Property

Property Plant & Equipment

Total Assets

31st Dec. 2010

Group

N'000

30th June 2011

Bank

N'000

31st Dec. 2010

Bank

N'000

31,856,806

98,769,676

27,901,959

348,679,118

5,361,930

4,824,529

19,630,360

80,196,067

4,028,241

36,176,394

657,425,079

27,606,200

66,815,068

51,302,987

307,135,161

5,071,279

4,757,142

18,109,748

73,491,632

3,755,064

36,750,856

594,795,137

23,941,774

90,922,068

14,727,754

335,759,417

5,345,339

3,426,533

15,504,260

56,225,684

14,173,582

3,650,010

33,799,676

597,476,097

17,764,318

61,609,150

43,063,637

307,828,170

5,071,279

3,265,430

8,386,866

49,528,513

17,442,980

34,442,217

548,402,560

464,806,545

3,759,526

1,454,052

580,464

51,706,198

27,126,992

549,433,777

412,031,918

15,347,216

1,995,250

580,464

29,474,415

28,281,011

487,710,274

425,712,990

3,759,526

1,271,195

580,464

24,313,559

27,126,992

482,764,725

378,733,006

4,104,098

1,649,557

580,464

18,173,265

28,281,011

431,521,401

7,237,622

100,364,609

107,602,230

7,237,622

99,391,580

106,629,202

7,237,622

107,473,750

114,711,371

7,237,622

109,643,537

116,881,159

389,072

455,661

Liabilities and Equity

657,425,079

594,795,137

597,476,097

548,402,560

Acceptances and guarantees

208,829,031

228,845,811

119,177,619

155,424,498

Liabilities

Deposits

Due to Other Banks & Financial Institutions

Current Taxation

Deferred Taxation

Other Liabilities

Borrowings

Total Liabilities

Equity

Share capital

Reserves

Non-controlling Interest

4

5

30th June 2011

Group

N'000

6

7

8

9

10

11

DIAMOND BANK PLC

CONSOLIDATED CASHFLOW STATEMENT FOR THE PERIOD ENDED:

Net cash generated from operating activities

30th June 2011

Group

N'000

31st Dec. 2010

Group

N'000

30th June 2011

Bank

N'000

31st Dec. 2010

Bank

N'000

28,948,212

(23,544,183)

23,766,104

(36,037,951)

Investing Activities

Purchase of Long Term Investment Securities - Bonds

Sale of Long Term Bonds

Additional Investment In Subsidiaries

Addition to Investment Property

Proceeds from Sale of Investment Property

Purchase of Property and Equipment

Proceeds from Sale of Property and Equipment

(11,669,695)

(273,177)

(3,385,494)

1,603,555

(9,851,099)

1,327,323

(427,452)

147,000

(4,385,205)

232,315

(7,837,246)

3,269,398

(3,650,010)

(3,385,494)

1,671,636

(9,688,084)

328,462

(1,000,000)

(4,166,145)

266,607

Net Cash From Investing Activities

(13,724,811)

(12,957,118)

(9,931,716)

(14,259,160)

Financing Activities

Repayment of Borrowings

Dividend Paid to Shareholders

Proceed of New Borrowings

(1,154,019)

(2,139,286)

-

(6,279,985)

(91,372)

15,510,000

(1,154,019)

(2,149,110)

-

(6,279,986)

(91,373)

15,510,000

Net Cash From Financing Activities

(3,293,306)

9,138,643

(3,303,130)

9,138,641

Effect of Exchange Rate Changes on Cash and Cash Equivalents

Increase In Cash and Cash Equivalents

Analysis of Changes In Cash and Cash Equivalents

Balance as st beginning of period

Balance as at end of period

Increase In Cash and Cash Equivalents

715,273

(305,883)

12,645,368

(27,668,541)

10,531,259

(41,158,470)

142,347,487

154,992,855

170,016,028

142,347,487

119,060,337

129,591,596

160,218,807

119,060,337

12,645,368

(27,668,541)

10,531,259

(41,158,470)

DIAMOND BANK PLC

NOTES TO THE ACCOUNT

1 Interest and discount income

Placements and short-term funds

Treasury bills and investment securities

Risk assets

2 Interest expense

Inter-bank takings

Current accounts

Time deposits

Savings accounts

Borrowed funds

3 Operating expenses

Staff costs

Depreciation

Other operating expenses

30th June 2011

Group

N'000

30th June 2010

Group

N'000

30th June 2011

Bank

N'000

30th June 2010

Bank

N'000

2,552,576

2,487,100

25,104,267

30,143,942

3,402,944

2,831,486

27,743,645

33,978,075

2,333,372

3,281,841

23,619,513

29,234,727

3,216,409

2,807,042

26,960,621

32,984,071

4,564

258,176

2,234,674

1,439,316

910,615

4,847,345

247

325,870

8,626,476

1,569,488

711,625

11,233,706

4,564

258,176

2,234,674

1,439,316

328,444

4,265,173

247

325,832

8,618,720

1,568,459

471,758

10,985,015

8,697,322

2,461,778

15,096,779

26,255,879

8,102,596

2,348,169

12,707,075

23,157,840

7,816,920

2,190,514

13,459,413

23,466,847

7,449,277

2,124,208

10,984,716

20,558,201

30th June 2011

Group

N'000

4 Cash and balances with central banks

Cash & Short Term Funds

Operating with central banks

Included in cash and cash equivalents

Mandatory reserve deposits with central banks

Escrow balances with central banks

5 Due from other banks

Banks within Nigeria

Banks Outside Nigeria

Placements with banks and discount houses

Provisioin for doubtful balances

6 Loans and advances to customers

Overdrafts

Term loans

Commercial papers

General Provision

Specific Provision

Interest in suspense

Analysis by performance

Performing

Non-performing

31st Dec. 2010

Group

N'000

30th June 2011

Bank

N'000

31st Dec. 2010

Bank

N'000

11,410,104

16,911,117

28,321,220

9,433,800

14,795,632

24,229,432

7,661,504

16,280,270

23,941,774

7,859,065

6,528,485

14,387,550

3,535,586

31,856,806

3,376,768

27,606,200

23,941,774

3,376,768

17,764,318

6,499,208

25,021,804

67,248,664

18,647

24,441,867

42,354,554

25,021,804

65,900,264

19,377,042

42,232,108

98,769,676

66,815,068

90,922,068

61,609,150

116,131,865

252,932,054

369,063,919

76,728,580

262,793,426

393,511

339,915,517

116,131,865

236,115,651

352,247,516

99,870,391

235,988,074

335,858,465

(1,541,502)

(12,543,185)

(6,300,115)

348,679,118

(23,708,591)

(9,071,765)

307,135,161

(1,541,502)

(9,109,451)

(5,837,146)

335,759,417

(19,749,088)

(8,281,207)

307,828,170

328,469,530

40,594,389

369,063,919

288,793,843

51,121,674

339,915,517

314,579,788

37,667,729

352,247,516

289,252,958

46,605,507

335,858,465

DIAMOND BANK PLC

NOTES TO THE ACCOUNT (contd.)

30th June 2011

Group

N'000

7 Advances under finance lease

Investment

Less: Unearned Income

Net Investment

General Provision

Analysis by performance

Performing

Non-performing

8 Investment securities

Debt securities- at cost

listed

Unlisted

Equity securities- at cost

Listed

Unlisted

Provision for diminution in value

9 Investment in subsidiaries

Diamond Bank du Benin S.A

Diamond Pension Fund Custodian Limited

Diamond Mortgages Limited

ADIC Insurance Limited

Diamond Capital & Financial Mkts Ltd

31st Dec. 2010

Group

N'000

11 Borrowings

BOI Intervention Funds

Multilateral Finance Institutions

31st Dec. 2010

Bank

N'000

5,420,120

5,420,120

5,737,504

(666,225)

5,071,279

5,403,530

5,403,530

5,737,504

(666,225)

5,071,279

(58,191)

5,361,930

5,071,279

(58,191)

5,345,339

5,071,279

5,420,120

5,071,279

5,403,530

5,071,279

5,420,120

5,071,279

5,403,530

5,071,279

57,138,696

6,069,168

45,270,953

7,552,309

46,743,711

5,054,768

40,511,663

4,424,283

4,431,678

16,443,423

11,269,381

14,583,279

80,094

4,417,280

1,280,073

4,480,432

(3,886,898)

80,196,067

(5,184,290)

73,491,632

(70,169)

56,225,684

(1,167,938)

49,528,513

5,865,622

2,000,000

6,307,959

5,000,000

3,135,020

2,000,000

1,000,000

6,307,960

5,000,000

(5,000,000)

14,173,582

17,442,980

Provision For Subsidiary Investment

10 Customer deposits

Demand

Time

Savings

30th June 2011

Bank

N'000

245,103,155

106,858,425

112,844,964

464,806,545

203,871,527

110,468,884

97,691,507

412,031,918

227,459,982

93,501,333

104,751,675

425,712,990

189,025,468

98,270,906

91,436,632

378,733,006

16,124,858

11,002,134

27,126,992

15,373,750

12,907,261

28,281,011

16,124,858

11,002,134

27,126,992

15,373,750

12,907,261

28,281,011

You might also like

- Quarterly Acc 3rd 2011 12Document10 pagesQuarterly Acc 3rd 2011 12Asif Al AminNo ratings yet

- Financial Report Financial ReportDocument14 pagesFinancial Report Financial Report8001800No ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- Common Size Analysis 2009-2011: Balance Sheet Indexed (%)Document1 pageCommon Size Analysis 2009-2011: Balance Sheet Indexed (%)Ahsan ShahidNo ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- AB Bank Limited Consolidated FinancialsDocument26 pagesAB Bank Limited Consolidated FinancialsSourav KarmakarNo ratings yet

- Financial Report Financial ReportDocument16 pagesFinancial Report Financial Report8001800No ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Ific Bank LimitedDocument12 pagesIfic Bank LimitedDeedar OntuNo ratings yet

- BASIC Bank Limited: Analytical ReviewDocument6 pagesBASIC Bank Limited: Analytical ReviewGazi Ahsan RubbyNo ratings yet

- ICI Pakistan Balance Sheet TitleDocument9 pagesICI Pakistan Balance Sheet TitleSehrish HumayunNo ratings yet

- July 2011 Financial Report for St. Vincent Building and Loan AssociationDocument17 pagesJuly 2011 Financial Report for St. Vincent Building and Loan Associationmarlynrich3652No ratings yet

- PT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atDocument2 pagesPT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atIsni AmeliaNo ratings yet

- Axis Bank reports net profit of Rs. 3,165 crore for FY11Document3 pagesAxis Bank reports net profit of Rs. 3,165 crore for FY11Mahesh PoojaryNo ratings yet

- MDRX10 Q 2Document63 pagesMDRX10 Q 2mrjohnseNo ratings yet

- Votorantim Financial ReportDocument0 pagesVotorantim Financial ReporthyjulioNo ratings yet

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Balance SheetDocument1 pageBalance SheetAshutosh KumarNo ratings yet

- OCH FoundationDocument4 pagesOCH FoundationDCHS FriendsNo ratings yet

- 2011 Bis PDFDocument575 pages2011 Bis PDFMohamed ZayedNo ratings yet

- Square Textiles Limited Balance Sheet 2009Document5 pagesSquare Textiles Limited Balance Sheet 2009jeeji126No ratings yet

- 18 Horizontal & Vertical AnalysisDocument2 pages18 Horizontal & Vertical AnalysisChaudhry EzHarNo ratings yet

- Fianancial StatementsDocument84 pagesFianancial StatementsMuhammad SaeedNo ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- EIH DataSheetDocument13 pagesEIH DataSheetTanmay AbhijeetNo ratings yet

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- Ticker Data Period: Cash S/T Investments Accts Rec InventoryDocument4 pagesTicker Data Period: Cash S/T Investments Accts Rec InventoryDennis LiverettNo ratings yet

- Webster University 2011-2012 Audited Financial StatementsDocument36 pagesWebster University 2011-2012 Audited Financial StatementsWebsterJournalNo ratings yet

- Ambuja Cements LTD.: Shareholder's FundsDocument4 pagesAmbuja Cements LTD.: Shareholder's Fundscutie_pixieNo ratings yet

- Financial Statement SolutionDocument21 pagesFinancial Statement SolutionYousaf BhuttaNo ratings yet

- Financial Position of The Engro FoodsDocument2 pagesFinancial Position of The Engro FoodsJaveriarehanNo ratings yet

- Daily Trade Journal - 01.07.2013Document6 pagesDaily Trade Journal - 01.07.2013Randora LkNo ratings yet

- Finan StatDocument11 pagesFinan StatMd. Abu Yousuf NoshedNo ratings yet

- Square Textiles Limited: Balance Sheet As of 31st March, 2010Document4 pagesSquare Textiles Limited: Balance Sheet As of 31st March, 2010SUBMERINNo ratings yet

- Fund Memo 1 ST QRTDocument15 pagesFund Memo 1 ST QRTIsaac BundiNo ratings yet

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013No ratings yet

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNo ratings yet

- MCB Bank Limited 2007 Financial Statements ReviewDocument83 pagesMCB Bank Limited 2007 Financial Statements Reviewusmankhan9No ratings yet

- Consolidated Balance Sheet Consolidated Balance SheetDocument12 pagesConsolidated Balance Sheet Consolidated Balance SheetAbu Ammar AsrafNo ratings yet

- Financial Statements Year Ended Dec 2010Document24 pagesFinancial Statements Year Ended Dec 2010Eric FongNo ratings yet

- Ashok LeylandDocument124 pagesAshok LeylandananndNo ratings yet

- Uttara Bank LimitedDocument1 pageUttara Bank LimitedHasan Imam FaisalNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- BIBLIOGRAPHY1Document11 pagesBIBLIOGRAPHY1MOHAIDEEN THARIQ MNo ratings yet

- 2015 TOTO TOTO Annual Report 2015Document242 pages2015 TOTO TOTO Annual Report 2015moriaNo ratings yet

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tNo ratings yet

- 3rd Quarter Financial Statement 2015 PDFDocument1 page3rd Quarter Financial Statement 2015 PDFsakibNo ratings yet

- Financials at A GlanceDocument2 pagesFinancials at A GlanceAmol MahajanNo ratings yet

- 2015 3rd Quarter Financial ReportDocument5 pages2015 3rd Quarter Financial ReportNur Md Al HossainNo ratings yet

- Banking Survey 2010Document60 pagesBanking Survey 2010Fahad Paracha100% (1)

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- PETRONAS Q3 2011 financial report highlights revenue growthDocument19 pagesPETRONAS Q3 2011 financial report highlights revenue growthNorliza YusofNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Data Presentation (Horizontal & Vertical)Document3 pagesData Presentation (Horizontal & Vertical)Rap PhaelNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Creating a Balanced Scorecard for a Financial Services OrganizationFrom EverandCreating a Balanced Scorecard for a Financial Services OrganizationNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- EH101 Course InformationDocument1 pageEH101 Course InformationCharles Bromley-DavenportNo ratings yet

- Woodside in LibyaDocument5 pagesWoodside in LibyaabhishekatupesNo ratings yet

- CH 31 Open-Economy Macroeconomics Basic ConceptsDocument52 pagesCH 31 Open-Economy Macroeconomics Basic ConceptsveroirenNo ratings yet

- Lesson 6 Global DividesDocument5 pagesLesson 6 Global DividesRachel VillasisNo ratings yet

- Selected Bibliography On The Right To Development PDFDocument32 pagesSelected Bibliography On The Right To Development PDFMatheus GobbatoNo ratings yet

- 25-07-2023 DSRDocument4 pages25-07-2023 DSRRishavNo ratings yet

- DDMP - DRT CaseDocument29 pagesDDMP - DRT CaseankitgrewalNo ratings yet

- BlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressDocument2 pagesBlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressPrashant100% (1)

- Chapt 12Document50 pagesChapt 12KamauWafulaWanyamaNo ratings yet

- Capital Market InstrumentsDocument6 pagesCapital Market Instrumentsgeet_rawat36No ratings yet

- Sample Chapter PDFDocument36 pagesSample Chapter PDFDinesh KumarNo ratings yet

- Stock Table WorksheetsDocument3 pagesStock Table WorksheetsKaren MartinezNo ratings yet

- Construction EngineeringDocument45 pagesConstruction EngineeringDr Olayinka Okeola100% (4)

- CRM ProcessDocument9 pagesCRM ProcesssamridhdhawanNo ratings yet

- EdpDocument163 pagesEdpCelina SomaNo ratings yet

- StopfordDocument41 pagesStopfordFarid OmariNo ratings yet

- Distress For Rent ActDocument20 pagesDistress For Rent Actjaffar s mNo ratings yet

- Case Digest FinalDocument13 pagesCase Digest FinalAngelo Igharas Infante60% (5)

- 4 AE AutomotionDocument1 page4 AE AutomotionKarthikeyan MallikaNo ratings yet

- Activity 2 Applied Economics March 12 2024Document1 pageActivity 2 Applied Economics March 12 2024nadinebayransamonte02No ratings yet

- Compressors system and residue box drawingDocument1 pageCompressors system and residue box drawingjerson flores rosalesNo ratings yet

- Risk Assessment For Grinding Work: Classic Builders and DevelopersDocument3 pagesRisk Assessment For Grinding Work: Classic Builders and DevelopersradeepNo ratings yet

- Pre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectDocument59 pagesPre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectCarl50% (4)

- 6021-P3-Lembar KerjaDocument48 pages6021-P3-Lembar KerjaikhwanNo ratings yet

- Unit II Competitve AdvantageDocument147 pagesUnit II Competitve Advantagejul123456No ratings yet

- BOOKING INVOICE M06AI22I08332696 To Edit 1Document2 pagesBOOKING INVOICE M06AI22I08332696 To Edit 1AkshayMilmileNo ratings yet

- Sipcot 1Document1 pageSipcot 1sfdsddsNo ratings yet

- Eric Stevanus - LA28 - Cost AnalysisDocument8 pagesEric Stevanus - LA28 - Cost Analysiseric stevanusNo ratings yet

- Green HolidaysDocument5 pagesGreen HolidaysLenapsNo ratings yet

- S Poddar and Co ProfileDocument35 pagesS Poddar and Co ProfileasassasaaNo ratings yet