Professional Documents

Culture Documents

First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 Results

Uploaded by

Oladipupo Mayowa PaulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 Results

Uploaded by

Oladipupo Mayowa PaulCopyright:

Available Formats

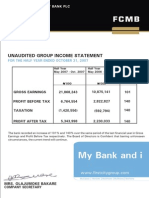

First City Monument Bank Plc.

Investor/Analyst Presentation

Review of H1 2008/9 results

Outline

PART A REVIEW OF THE OPERATING ENVIRONMENT

Global Scan and Implications for Nigeria

Nigeria Macro Report

o Scorecard, Risk Factors & Mitigants and Outlook

o Analysis of the Stock Market and outlook

o Review of the Banking Sector

PART B-FCMB

o Strategy & Strengths

o Highlights of Half year Results and Variance Analysis

o Outlook April 2009

2

Implications of

the global crisis for Nigeria

With increased financial globalization No one doubts that Africa will feel the effects of the crisis eventually. As world

trade contracts, so will the demand for Africas oil and minerals, the main commodity behind the recent boom Benedicte

Christen-Deputy Director of IMFs African Department

Impact of global recession (IMF-2009 global growth with slow to 3%, UBS-2.2%) on oil

prices and the likely downward pressure on revenue projections

Expected slowdown in exports stemming from the global recession

Heightened liquidity pressure on the stock market as foreign portfolio inflows reverse

Increased emphasis on the need to enhance supervision and regulatory oversight of

the financial system given the increased integration of markets

Global deleveraging (shift from debt to cash) reduces the amount of external financing

available for developing and emerging economies

Merrill Lynch ranks Nigeria among the 10 least vulnerable economies in the world out of a

universe of 60 countries and based on 62 indicators

(China, Egypt, Peru, Oman, Indonesia, Mexico, Philippines, Russia) 3

Outline

PART A REVIEW OF THE OPERATING ENVIRONMENT

Global Scan and Implications for Nigeria

Nigeria Macro Report

o Scorecard, Risk Factors & Mitigants and Outlook

o Analysis of the Stock Market and outlook

o Review of the Banking Sector

PART B-FCMB

o Strategy & Strengths

o Highlights of Half year Results and Variance Analysis

o Outlook April 2009

4

Macro Scorecard

o GDP growth remains fairly strong despite downward pressures on oil GDP

o Federally collected revenue, of which oil receipts is a key component has remained steady overtime

with a growing contribution from company income tax

o Inflationary pressures remain; Oct. YOY up to 14.7% from Sept. 13% but food inflation, month on

month, is down by 0.6%.

o The exchange rate remains stable and the CBN restates its commitment to defend the currency

Q1 2008 Q2 2008 Q3 2008

Real GDP growth rate 5.54% 6.65%

IMF & EIU

FY forecasts of

6.3%

Oil GDP growth rate -4.70% N/A N/A

non-oil GDP growth rate 9.67% 8.5% N/A

Federally Collected Revenue N1.89 trillion N1.88 trillion N/A

% Contribution of Oil Receipts 83% 82.6% N/A

Inflation rate (YOY) 7.8% 14% 12.40%

Average Exchange rates (N/USD) N118.04/$ N117.84/$ N117.77/$

Foreign Reserves (USD) 59.7 BILLION 59.2 BILLION 63 BILLION

Excess Crude Reserves (USD) as @ September 2008 US$17 billion

Current Account Surplus (Deficit) as at October 2008 US$21 billion

Crude Oil Prices (UDS/barrel)-Bonny Light US$98.9 US$138.74 US$121.07

Crude Oil Production (barrels per day) 2.02 million 1.82 million 2 million

5

Key Risk factor & Mitigants

Risk Factor -Impact of a global recession on oil revenues

Crude oil earnings account for over 80% of governments revenues

US accounts for over 50% of the nations crude oil exports and Europe 15%

Government revenue under pressure from falling oil prices and likely reduction in

government capital expenditure for 2009

Mitigant

Consensus projection for lower oil price of between $40-$50pb in Nov/Dec

o OPEC production cut of 1.5 m.b.d (2% of global consumption), with a further cut expected

on/before December 17

th

meeting

o China and India still growing albeit at a reduced rate, but China accounted for 27% of the

worlds growth in 2007, still growing at 9% and has implemented a US$586 billion stimulus

package

o Continued investment in marginal oil production ranges between $90 & $150 per barrel

2009 Budget is built on a US$45/barrel benchmark

Increased emphasis on gas revenues at the Federal Level as well as Internally

generated revenue by the states

Key capital expenditure to be funded by increased deficit financing (4% of GDP)

6

Source: ENERGY INFORMATION ADMINISTRATION WEBSITE

0

20

40

60

80

100

120

140

160

J

a

n

0

4

,

2

0

0

8

F

e

b

0

4

,

2

0

0

8

M

a

r

0

4

,

2

0

0

8

A

p

r

0

4

,

2

0

0

8

M

a

y

0

4

,

2

0

0

8

J

u

n

0

4

,

2

0

0

8

J

u

l

0

4

,

2

0

0

8

A

u

g

0

4

,

2

0

0

8

S

e

p

0

4

,

2

0

0

8

O

c

t

0

4

,

2

0

0

8

N

o

v

0

4

,

2

0

0

8

Weekly Nigeria Bonny Light Spot Price FOB

(Dollars per Barrel)

Weekly Nigeria Bonny Light Spot Price FOB (Dollars per Barrel)

7

Nigerian Banking Sector

strongly capitalized

Globally banks are challenged in three ways; Huge losses from exposure to CDS & derivatives on the back of

subprime mortgages ; additional capital is required hence the bail out packages of govt , but Long term markets for

funds are closed and fear of further exposure is limiting the interaction in the short term markets , despite all the

palliatives The Economist

NOT the case for Nigerian Banks

o Having just raised significant capital with Capital Adequacy Ratios ranging between

25% and 42%

o Effective monetary policy is addressing liquidity constraints e.g. CBNs fresh liquidity

window,

o Limited product sophistication, foreign ownership and depth of shadow markets

cushioned exposure to the global crisis

Current Challenges

o Liquidity pressure; NIBOR rates up from 12.7% in January to 17.6% by early

November

o Exposure to the Capital markets, estimated between N600 billion to N900 billion

o Vulnerability to oil price fluctuations and earnings will come under pressure from

reliance on govt. deposits 8

Opportunities

o Trade Finance at a monthly import bill of US$1 billion

o Consumer Banking opportunities remain real, 42 million subscribers vs.1 million

loans

o Infrastructural gaps estimated at US$150 billion over the next 6 years

o Mergers and Acquisitions amongst the banks on the back of more reasonable

valuations; 2009 PE of 5.8x and in other economic sectors,

Nigerian Banking Sector

significant opportunities still exist

9

Nigerian Stock Market

recovery is in view

Opportunities and Key Drivers of a recovery

o Market is approaching bottom

o Estimates; 40,000 by Dec. 08 and 60,000 by Dec. 09

o November 24

th

ASI @33,836 and Market Cap @US$64 billion

o Strong Corporate Earnings plus more reasonable valuations

o Impending equilibrium in financial markets sure to make the stock market attractive

again

o Domestic Institutional investors are growing and returning to the market; 25%-29% of

N1 trillion of PFA Assets and only 3.4 million Nigerians out of 150 million participate in

the scheme

o Market still shallow at 57% of GDP vs. 206% for SA (2007) and a Nascent Bond

market amidst huge infrastructural gaps

10

Outline

PART A REVIEW OF THE OPERATING ENVIRONMENT

Global Scan and Implications for Nigeria

Nigeria Macro Report

o Scorecard, Risk Factors & Mitigants and Outlook

o Analysis of the Stock Market and outlook

o Review of the Banking Sector

PART B-FCMB

o Strategy & Strengths

o Highlights of Half year Results and Variance Analysis

o Outlook April 2009

11

Investment Case

Diversified Strategy with non-interest income accounting for 36% of earnings in H1 2008/9

Consumer Bank breaks even in Q4 of the 2008/9 FY

o Significant Upside from the Consumer Banking Business and the off payroll lending by

subsidiary-Credit Direct is reporting ROAs > 50%

Improving Competitive landscape

o Investment Banking shakeout

o Further banking industry consolidation likely

Exceptional Value for the discerning investor,

o P/NAV <1X

o Single digit PE Multiples vs. consistent EPS growth (avg. of 42% YOY from 2006/7 FY)

o Dividend yield >9% at current prices

12

Strategy & Strengths

diversified model is a fundamental strength

Value Proposition-Cash Mgt. and Trade Finance (Payments, Collections and liquidity Mgt. solutions)

Key Revenue Drivers- Trade Volumes ,Low cost deposits (largely non-govt. deposits), No of Customer

conversions as per value proposition

Competition- Citibank, Standard Chartered Bank, Stanbic/IBTC, Oceanic, UBA, Zenith and GTBank

Competitive Advantage -Robust product capability, 1st bank in Africa to provide liquidity management

on an internet banking platform , Consultative sales process & Experienced Mgt.

with low execution risk T

R

A

N

S

A

C

T

I

O

N

B

A

N

K

I

N

G

Value Proposition-Off Payroll deduction loans, Salary loans, Mortgages, Wealth Mgt, Unique liability

products

Key Revenue Drivers-Low cost deposits (Salary earners and HNIs) ,Customer Acquisition and

Activation

Competition-UBA, GTBank and BankPHB

Competitive Advantage -Robust Technology, Low Cost Distribution channels, Experienced Mgt. from r

relevant emerging markets, Experienced partnerships, Product Innovation (Wealth Mgt. Offering)

C

O

N

S

U

M

E

R

B

A

N

K

I

N

G

Value Proposition-Financial Advisory ,Capital Raising (Debt and Equity),Asset Management

Infrastructure and Project Financing

Key Revenue Drivers-Size of Capital Issues ,Size/No of infrastructural projects, Size/No. of Debt issues

Competition-FBN Capital ,Chapel Hill and Stanbic/IBTC

Competitive Advantage -Track Record and Strong Distribution through CSL

I

N

V

E

S

T

M

E

N

T

B

A

N

K

I

N

G

KEY CUSTOMER SEGMENTS-Corporates, SMEs, Individuals and Government

Financial Implications -40% Revenue CAGR by 2012, confer continuing cost

efficiency leadership and ensure diversified earnings

13

Strategy & Strengths

diversified model is a fundamental strength

Focused Strategy

(S & P-08) with minimal

execution risks

(Experienced Mgt. and global

partnerships)

Strong Corporate

Governance

(Pedigree of Board members

and 8 non executive to 4

executive directors)

One of a few banks in Nigeria

with an international rating

Top7 bank in terms of earnings

(PBT 2007)

&

Good asset quality NPLS<3% as at

HI 2008/9

Diversified Deposit base

(non-government deposits account

for 89% as @ HI 2008/9)

Tested Diversified Business Model;

traditional contribution from non

interest income >50%

Highly Capitalized Bank

36% as at HI 2008/9

(regulatory minimum of

10%)

Leading the industry in

cost efficiency

(CIR of 49% as at FYE

2008)

Exceptional Value to

shareholders dividend

yield ~10%

14

Outline

PART A REVIEW OF THE OPERATING ENVIRONMENT

Global Scan and Implications for Nigeria

Nigeria Macro Report

o Scorecard, Risk Factors & Mitigants and Outlook

o Analysis of the Stock Market and outlook

o Review of the Banking Sector

PART B-FCMB

o Strategy & Strengths

o Highlights of Half year Results and Variance Analysis

o Outlook April 2009

15

H1 2008/9-Highlights

growth over same period in FY 2007/8

HI 2008/9

(US$ million)

HI 2007/8

(US$ million) growth (%)

Deposits 2,484 950 161%

Risk Assets 2,429 838 190%

Shareholder Funds 1,066 285 274%

Gross Earnings 346 176 97%

Provision for losses 22 8 158%

Operating Expenses 107 67 58%

PBT 103 54 90%

Net Interest Income 150 66 127%

Corporate Finance Income 35 39 -12%

Foreign Exchange Earnings 8 4 90%

16

HI 2008/9 Variance analysis

for 90% acht. of PBT FORECAST

Operating Expenses recorded an additional 15% growth, reflected in the CIR

Corporate Finance Income was hampered by late take off of expected debt transactions

Trade related commissions were restricted by limited availability of offshore lines

Pressure of Trade and Corporate Finance explain the drop in the non funded income as a

% of net operating income to 36%

Healthier Net Interest Margins principally from;

o Repricing of risk assets to reflect money market realities with average lending rates at

18% per annum

o Less expensive mix of deposits with the impact on the cost of funds, non interest

bearing liabilities, mainly current accounts, contribute 59% of the deposit portfolio as

opposed to 45% as at FYE 2008 and up from 49% as at Q1 2008/9.

17

H1 2008/9

Deposit Mix; current accounts

growing in contribution across periods

0% 10% 20% 30% 40% 50% 60% 70%

Current Accounts

Savings Accounts

Term Deposits

FCY Deposits

Deposit Mix

H1 2007/8

FYE 2008

Q1 2008/9

H1 2008/9

18

H1 2008/9

Deposit Mix diversified across

business segments

11%

35%

27%

27%

Deposit Mix by Sector as @ Oct 31

ST

, 2008

Government deposits

Retail

Corporate Banking

Financial Institutions

19

H1 2008/9-Asset & Risk Asset mix

Limited Margin exposure

Risk Asset Composition H1 2008/9 H1 2007/8 Q1 2008/9 FYE 2008

Overdrafts 27% 35% 25% 21%

Term Loans 30% 27% 21% 18%

Commercial Papers 37% 28% 46% 48%

Others 4% 2% 3% 7%

Margin Finance 3% 8% 4% 4%

33%

47%

7%

8%

5%

Asset Mix as @ H1 2007/8

Liquid Assets Risk Assets Fixed Assets

Other Assets Investment Securities

27%

59%

4%

6%

4%

Asset Mix as @ H1 2008/9

Liquid Assets Risk Assets

Fixed Assets Other Assets

Investment Securities

The Banks Margin Lending is N7.9 billion but the bank is reviewing its borrower base to ascertain borrowers with capital

market exposure, as this might have adverse effects on their cash flows and consequently their ability to service loan

obligations

20

H1 2008/9 vs. FYE 2007/8

Key Ratios remain healthy

APRIL '08 OCT'08

Net Interest Margin 7.4% 9.1%

CIR 49.2% 50.8%

ROA 4.1% 4%

ROE 11.3% 15.32%

Loan to Deposit Ratio 75.2% 97.8%

Liquidity Ratio 81.3% 42.31%

NPLs 2.74% 2.85%

Coverage Ratios 127.8% 130.7%

Capital Adequacy Ratio 55.0% 36.00%

Non-Interest Income /Net Operating Income 51.9% 35.44%

21

Outline

PART A REVIEW OF THE OPERATING ENVIRONMENT

Global Scan and Implications for Nigeria

Nigeria Macro Report

o Scorecard, Risk Factors & Mitigants and Outlook

o Analysis of the Stock Market and outlook

o Review of the Banking Sector

PART B-FCMB

o Strategy & Strengths

o Highlights of Half year Results and Variance Analysis

o Outlook April 2009

22

H2 2008/9 Estimates

Expectations

Anticipate some FX volatility as the currency comes under pressure from traders and

manufacturers stocking up for year end

Continued pressure on available trade lines and the impact transferring the increased

pricing to customers (at least 200 basis points more)-boost commissions

Minimal Loan growth, in reaction to money market conditions and factoring transactions

already in the pipeline

Repricing of Naira Assets and maintaining the current deposit mix, where non interest

bearing liabilities account for 59% of the portfolio will assist the Net Interest Margin

Investment Bank will close on at least 3 transactions, boosting corporate finance income

23

H2 2008/9 Estimates

Low and Mid Case assumptions

Net interest margin will in either case come under pressure if money market conditions

persist

Loan growth will be negative in the low case and in the mid case, will stay at half year

levels and Risk Assets are assumed to account 65% of average earning assets

Deposits will grow at an average of 12% (mid case) and 10% (low case), to close the year

at 60% growth on FYE 2008

Non-interest income will account for at least 50% of net operating income in either case,

flowing from the diversified business model

A 3% loss norm is assumed for performing loans, NPLs in either case will be impacted by

a prudent provision for margin loans; 20% of exposure is assumed

CIR will at best improve to 47% as a result of a number of cost management initiatives;

fleet management and other outsourcing initiatives plus the implementation of a few

tactical measures and Exchange rate is assumed at NGN120/$

24

H2 2008/9- revenue and cost drivers & assumptions

H2 2008/9 Estimates

-Assumptions

Low Case Mid Case

Net Interest Margin 7.6% 8.2%

Average Risk Assets (US$'000)

2,010,685 2,456,691

Average Earning Assets (US$'000)

3,093,361 3,779,525

Other Earning Assets (US$000)

1,082,676 1,322,834

Average Deposits (US$'000)

2,680,913 2,729,657

Average Loan to Deposit Ratio 75% 90%

Non Interest Income/Net Operating Income 50% 50%

Provision for losses (US$'000)

13,318 (62)

NPLs 4.0% 3.3%

Provision for NPLs (US$'000)

(22,854) (22,854)

Cost to Income Ratio 49% 47%

25

H2 2008/9 FORECASTS

H2 2008/9 Estimates

Low Case Mid Case

Net Interest Income (US$'000) 116,774 154,961

Other Operating Income

(Corporate Finance, Commissions and FX income)-US$'000 116,774 154,961

Net Operating Income (US$'000) 233,549 309,921

Provision for losses (US$'000) (9,536) (22,916)

Operating Expenses (US$'000) (109,766) (134,892)

Profit Before Tax H2 2008/9 (US$'000) 114,246 152,112

Profit Before Tax H1 2008/9 (US'000) 103,301 103,301

PBT FY 2008/9 (US'000) 217,548 255,414

26

H1 2008/9 vs. H2 2008/9

Segment Review and Estimates

Investment banking Income will grow in H2 2008/9 due to debt and M & A deals in the

pipeline

Consumer Bank is on track to break even in the last quarter of FY 2008/9, note that the

losses are halved in H2 2008/9

HI 08/9

(Forecast)

H1 08/9

(Actual)

H2 08/9

(Low Case)

H2 08/9

(Mid Case)

Corporate/Investment Banking(US$ million) 60 54 61 81

Commercial Banking (US$ million) 41 37 38 50

Consumer Banking (US$ million) (0.73) (0.66) (0.31) (0.41)

Treasury & Financial Markets (US$ million) 14 13 16 21

PROFIT BEFORE TAX (US$ million) 115 103 114 152

27

CONSENSUS ESTIMATES

Source

Date of

Report

Dividend Yield

(%)

EPS

(NGN)

P/E

(X)

P/NAV

(X)

RoE

(%)

Afrinvest 17-Nov-08 11.5 1.41 4.86 0.7 13.7

RENCAP 14-Nov-08 11.8 1.34 5.1 0.79 15.8

African Alliance 14-Nov-08 8.3 1.43 4.83 0.76 15.7

CSL Research 11-Nov-08 11.2 1.38 4.5 0.68 15.9

Mean 10 1.43 4.72 0.73 15.28

H2 2008/9 Valuations

Low Case Mid Case

No of shares outstanding 16,271,192

Estimated EPS (kobo)

126 148

Dividend Per share (Pay out Ratio of 45%)-kobo 57 66

PE Multiple at November 21st prices of N5.93 4.72 4.01

P/NAV at November 21st prices of N5.93 0.66 0.65

Dividend Yield at November 21st Prices 9.5% 11.2%

ROE 14.0% 16.1%

28

Conclusion

Despite external shocks, the Nigerian economy remains resilient, ranked least vulnerable

by Merrill Lynch, November 2008

Downside risks particularly from oil shocks, have been adequately mitigated at least in the

short term -6 months period

The banks diversified Business Model and focused strategy significantly reduces the risk

to earnings within the short and long term time frame

Strong Financial Performance given market realities

The bank remains adequately capitalized and liquidity ratios are well above the regulatory

requirements (RR); CAR @36% vs. 10% (RR) & Liquidity Ratio @42% vs. 30% (RR)

Current price offers unprecedented bargain

o P/NAV >1 times and single digit PE Multiples vs. consistent EPS growth (average of 42% growth

from 2006/7 FY); fair valued and often undervalued stock by consensus estimates

29

Sources

This Day Newspapers, various issues; citing Federal Government of Nigeria 2009 Budget

Preparation and Submission Call Circular

Transcript from Town Hall Meeting discussing the Global Crisis-organized by This Day

Newspapers

2008 Budget Speech by the President of Nigeria to the Joint session of the National

Assembly, November 2007

World Economic Outlook (IMF) October 2008

CBN 2

nd

Quarter Economic Report 2008 and monthly reports

Global Financial Meltdown: Impact on Nigeria's Capital Market and Foreign Reserves

Mobolaji Aluko, PHD, October 2008

Sources

30

Sources

National Bureau of Statistics Trade Report (2006)

Nigerian National Petroleum Corporation (NNPC) Statistical Bulletin 2007

RENCAP Equity Research , November 2008

The Economists; several issues

Presentation by Bismarck Rewane, MD-Financial Derivatives at the Lagos Business

School, 02 November, 2008

Global Economics Review by Merrill Lynch 04 November 2008

Energy Information Administration websites

Reports by various Research Houses- as detailed in the Consensus estimates

31

You might also like

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Sumitomo Copper Derivatives DisasterDocument11 pagesSumitomo Copper Derivatives DisasterRupal100% (1)

- COMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakDocument73 pagesCOMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakRajendra Babu DaraNo ratings yet

- Var, CaR, CAR, Basel 1 and 2Document7 pagesVar, CaR, CAR, Basel 1 and 2ChartSniperNo ratings yet

- Macroeconomic Factors affecting USDINR: An AnalysisDocument16 pagesMacroeconomic Factors affecting USDINR: An Analysistamanna210% (1)

- Banking in Africa: financing transformation amid uncertaintyFrom EverandBanking in Africa: financing transformation amid uncertaintyNo ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- Options Futures and Other DerivativesDocument28 pagesOptions Futures and Other DerivativesAmir AuditorNo ratings yet

- W.D. Gann - Masterforex-VDocument2 pagesW.D. Gann - Masterforex-Vanthonycacciola100% (1)

- CH 9-The Cost of Capital by IM PandeyDocument36 pagesCH 9-The Cost of Capital by IM PandeyJyoti Bansal89% (9)

- Team PRTC Afar-Finpb - 5.21Document16 pagesTeam PRTC Afar-Finpb - 5.21Nanananana100% (2)

- Monetary Policy 2016Document2 pagesMonetary Policy 2016Mukunda WagleNo ratings yet

- President's Visit To Nigeria - Current General Information On Nigeria Draft3 - 3 - XDocument3 pagesPresident's Visit To Nigeria - Current General Information On Nigeria Draft3 - 3 - XStevenNo ratings yet

- 2009 Budget FinalspeachDocument18 pages2009 Budget FinalspeachAnabellNo ratings yet

- Abraaj Emerging With Confidencev2Document34 pagesAbraaj Emerging With Confidencev2ajudehNo ratings yet

- 2007-8 Financial CrisesDocument4 pages2007-8 Financial CrisesHajira alamNo ratings yet

- The Indian Economy: July 25, 2000Document25 pagesThe Indian Economy: July 25, 2000abhi.sabaNo ratings yet

- Research Task To Complete - 2080-81Document8 pagesResearch Task To Complete - 2080-81Nishant DhakalNo ratings yet

- Rs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundDocument23 pagesRs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundSohail HanifNo ratings yet

- Banking Law Monetary Policy 1231598267812073 1Document49 pagesBanking Law Monetary Policy 1231598267812073 1Yasir KhanNo ratings yet

- Monetary Policy 2016Document2 pagesMonetary Policy 2016immukundaNo ratings yet

- Chart BookDocument74 pagesChart BookMuthirevula SiddarthaNo ratings yet

- Financial Aspects of Economic ReformsDocument14 pagesFinancial Aspects of Economic ReformsKhushi KanswaNo ratings yet

- The Global Economic Crisis and The Nigerian Financial SystemDocument35 pagesThe Global Economic Crisis and The Nigerian Financial SystemKing JoeNo ratings yet

- Benchmarking: Practices and Tools For Achieving International Standards in Banking Sector To Overcome The Economic CrisisDocument29 pagesBenchmarking: Practices and Tools For Achieving International Standards in Banking Sector To Overcome The Economic Crisissadik953No ratings yet

- Unit 4 Economic EnvironmentDocument10 pagesUnit 4 Economic EnvironmentlaxmisunitaNo ratings yet

- Lbs August 213Document123 pagesLbs August 213adoekitiNo ratings yet

- The Global Banking Crisis: An African Banker's Response: Sir Patrick Gillam LectureDocument21 pagesThe Global Banking Crisis: An African Banker's Response: Sir Patrick Gillam LectureMuhammad ZahoorNo ratings yet

- State of The Economy 2011Document8 pagesState of The Economy 2011agarwaldipeshNo ratings yet

- Economy FY22Document2 pagesEconomy FY22sumeraNo ratings yet

- Industry Insights-Issue 03Document12 pagesIndustry Insights-Issue 03nmijindadiNo ratings yet

- UPSC PYQs AnalysisDocument18 pagesUPSC PYQs AnalysisRaja AnsNo ratings yet

- Impact of The Financial and Economic Crisis On Debt Vulnerability: Nigeria's CaseDocument12 pagesImpact of The Financial and Economic Crisis On Debt Vulnerability: Nigeria's CaseThomas GarrettNo ratings yet

- State of The Economy and SarathDocument2 pagesState of The Economy and SarathRenjith Govt Clg NddNo ratings yet

- Global Financial CrisisDocument31 pagesGlobal Financial CrisisF-10No ratings yet

- Usim Webcast 3q06 VersDocument18 pagesUsim Webcast 3q06 VersUsiminas_RINo ratings yet

- Industry Insights - Issue 04Document12 pagesIndustry Insights - Issue 04nmijindadiNo ratings yet

- Monetary Policy Highlights 2018-19 - 20180801024342 - 20181126031302 PDFDocument10 pagesMonetary Policy Highlights 2018-19 - 20180801024342 - 20181126031302 PDFMadhav SilwalNo ratings yet

- Turmoil in Global Economy: The Indian PerspectiveDocument35 pagesTurmoil in Global Economy: The Indian PerspectiveShivam AgrawalNo ratings yet

- August 20, 2009 Central Bank of Argentina Conference August 31 - September 1, 2009Document20 pagesAugust 20, 2009 Central Bank of Argentina Conference August 31 - September 1, 2009api-26091012No ratings yet

- Asia Economic Monitor - July 2008Document67 pagesAsia Economic Monitor - July 2008Asian Development BankNo ratings yet

- Security PresentationDocument33 pagesSecurity PresentationmpictalhaNo ratings yet

- Impact of Financial Crisis on Global FDI FlowsDocument15 pagesImpact of Financial Crisis on Global FDI FlowsrogerwaterNo ratings yet

- Bank of Thailand Inflation Report October 2008Document76 pagesBank of Thailand Inflation Report October 2008Tien DangNo ratings yet

- Capital formation in the Middle East Energy SectorDocument28 pagesCapital formation in the Middle East Energy SectorJamalNo ratings yet

- Highlights of Monetary Policy Committee Meeting: External Demand Is Still AnaemicDocument2 pagesHighlights of Monetary Policy Committee Meeting: External Demand Is Still AnaemicNeeraj GargNo ratings yet

- Axis Bank's Balanced Growth Strategy Focusing on Domestic OpportunitiesDocument13 pagesAxis Bank's Balanced Growth Strategy Focusing on Domestic OpportunitiesRahul SaikiaNo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- The Banking Industry in The UAEDocument4 pagesThe Banking Industry in The UAEMuhammad Ahsan AkramNo ratings yet

- Miracle On The Han RiverDocument62 pagesMiracle On The Han RiverSiddharth ChaudharyNo ratings yet

- NBP Bank InternshipreportDocument6 pagesNBP Bank Internshipreportwaqas609No ratings yet

- The Nigerian Financial SystemDocument18 pagesThe Nigerian Financial SystemSonye ConsimaNo ratings yet

- GTBank EconomicOutlook2017Document10 pagesGTBank EconomicOutlook2017ustino imoNo ratings yet

- Libya's monetary and fiscal responses to 2008 crisisDocument4 pagesLibya's monetary and fiscal responses to 2008 crisisOmar HussinNo ratings yet

- EconomyDocument5 pagesEconomyShan Ali ShahNo ratings yet

- NBP Funds: Capital Market ReviewDocument1 pageNBP Funds: Capital Market ReviewSufyan SafiNo ratings yet

- Executive Summary of Bangladesh's Macro Financial Environment and Banking Sector DevelopmentsDocument5 pagesExecutive Summary of Bangladesh's Macro Financial Environment and Banking Sector DevelopmentsSajib DasNo ratings yet

- Rbi Bulletin August 2015Document74 pagesRbi Bulletin August 2015Accounting & Taxation100% (1)

- Reserve Bank of India Second Quarter Review of Monetary Policy 2013-14 by Dr. Raghuram G. Rajan Governor Monetary PolicyDocument11 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2013-14 by Dr. Raghuram G. Rajan Governor Monetary Policyjohann_747No ratings yet

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- Macroeconomic Developments in Serbia: September 2014Document20 pagesMacroeconomic Developments in Serbia: September 2014faca_zakonNo ratings yet

- Imf Ninth Review DR Hafiz PashaDocument2 pagesImf Ninth Review DR Hafiz PashaKamran AliNo ratings yet

- Breaking of Dawn - Reflection On 5 Years of The NCM 011211Document47 pagesBreaking of Dawn - Reflection On 5 Years of The NCM 011211ProshareNo ratings yet

- SWOT Analysis of Bank Alfalah: StrengthsDocument14 pagesSWOT Analysis of Bank Alfalah: Strengthsusman_3No ratings yet

- SWOT Analysis of Bank AlfalahDocument14 pagesSWOT Analysis of Bank Alfalahamina8720% (1)

- Factors Affecting Investments in Pakistan's EconomyDocument7 pagesFactors Affecting Investments in Pakistan's EconomyHome PhoneNo ratings yet

- Asia Economic Monitor - August 2005Document36 pagesAsia Economic Monitor - August 2005Asian Development BankNo ratings yet

- Asia Economic Monitor - December 2008Document79 pagesAsia Economic Monitor - December 2008Asian Development BankNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- Prob1 Afar QuizDocument7 pagesProb1 Afar Quizryan rosalesNo ratings yet

- Entrepreneurial Finance Leach & Melicher: Venture Capital Valuation MethodsDocument29 pagesEntrepreneurial Finance Leach & Melicher: Venture Capital Valuation MethodsIT manNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- Google Earnings ReportDocument8 pagesGoogle Earnings ReportNotice AlertNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Unit Test 11: Name - ClassDocument3 pagesUnit Test 11: Name - ClassAkaki saneblidzeNo ratings yet

- Class Exercises 3 - 4Document2 pagesClass Exercises 3 - 4shettysagar30No ratings yet

- ValuationDocument17 pagesValuationNimisha PalawatNo ratings yet

- ICS ProjectDocument22 pagesICS Projectauf haziqNo ratings yet

- Topic03 - Capital AllocationDocument49 pagesTopic03 - Capital Allocationmatthiaskoerner19No ratings yet

- Capital StructureDocument44 pagesCapital StructureHardeep KaurNo ratings yet

- Security AnalysisDocument305 pagesSecurity AnalysisAoc HyderporaNo ratings yet

- VINAMILK VALUATION REPORTDocument24 pagesVINAMILK VALUATION REPORTThúy HằngNo ratings yet

- Sarana Meditama Metropolitan (Q4 - 2017)Document93 pagesSarana Meditama Metropolitan (Q4 - 2017)Wihelmina DeaNo ratings yet

- 23 Debtor's ManagementDocument6 pages23 Debtor's ManagementSakshi Baiwal100% (1)

- Unit - 01 (Lecture PPT) - 1Document12 pagesUnit - 01 (Lecture PPT) - 1Vaibhav ChauhanNo ratings yet

- Intraday IndicatorDocument7 pagesIntraday IndicatoremailtodeepNo ratings yet

- Corporate Finance Tutorial - Raising Capital GuideDocument2 pagesCorporate Finance Tutorial - Raising Capital GuideAmy LimnaNo ratings yet

- Cochan Singapore Pte. Ltd. - Annual Report 2011Document30 pagesCochan Singapore Pte. Ltd. - Annual Report 2011aliciawittmeyerNo ratings yet

- Company AnalysisDocument11 pagesCompany AnalysisSumi DharmarajNo ratings yet

- ch5 Test BankDocument41 pagesch5 Test BankTôn Nữ Hương GiangNo ratings yet

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsDocument18 pagesFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaNo ratings yet