Professional Documents

Culture Documents

9M 2013 Unaudited Results

Uploaded by

Oladipupo Mayowa Paul0 ratings0% found this document useful (0 votes)

45 views2 pagesREPORT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentREPORT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pages9M 2013 Unaudited Results

Uploaded by

Oladipupo Mayowa PaulREPORT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

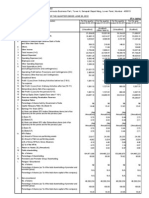

Group Group Company Company

30 Sept 13 30 Sept 12 30 Sept 13 30 Sept 12

Nmillion Nmillion Nmillion Nmillion

Profit for the period 16,057 6,997 8,268 -

Other comprehensive income

Items that will never be reclassified - - - -

to profit or loss

Items that are or may be reclassified

subsequently to profit or loss:

Net change in fair value of available-for-sale 1,016 3,062 - -

financial assets

Realised fair value adjustments on available-for-sale (79) 257 - -

financial assets reclassified to income statement

937 3,319 - -

Other comprehensive income for the period 937 3,319 - -

net of tax

Total comprehensive income for the period 16,994 10,316 8,268 -

Total comprehensive income attributable to:

Non-controlling interests 1,425 923 -

Equity holders of the parent 15,569 9,393 8,268 -

16,994 10,316 8,268 -

Group Group Company Company

30 Sept 13 30 Sept 12 30 Sept 13 30 Sept 12

Nmillion Nmillion Nmillion Nmillion

Gross earnings 82,921 64,030 8,898 -

Net interest income 27,094 26,601 - -

Interest income 46,190 42,535 - -

Interest expense (19,096) (15,934) - -

Non-interest revenue 36,446 21,318 8,898 -

Net fee and commission revenue 23,261 17,135 494 -

Fee and commission revenue 23,546 17,312 494 -

Fee and commission expense (285) (177) - -

Trading revenue 12,848 4,045 - -

Other revenue 337 138 8,404 -

Total income 63,540 47,919 8,898 -

Credit impairment charges (2,264) (3,075) - -

Income after credit impairment charges 61,276 44,844 8,898 -

Operating expenses (40,938) (35,827) (537) -

Staff costs (17,980) (15,177) (265) -

Other operating expenses (22,958) (20,650) (272) -

Net income before indirect taxation 20,338 9,017 8,361 -

Indirect taxation (106) (277) (11) -

Profit before direct taxation 20,232 8,740 8,350 -

Direct taxation (4,175) (1,743) (82) -

Profit for the period 16,057 6,997 8,268 -

Profit attributable to:

Non-controlling interests 1,459 971 - -

Equity holders of the parent 14,598 6,026 8,268 -

Profit for the period 16,057 6,997 8,268 -

Group Group Company Company

30 Sept 13 31 Dec 12 30 Sept 13 31 Dec 12

Nmillion Nmillion Nmillion Nmillion

Assets

Cash and balances with central bank 78,281 76,933 - -

Trading assets 134,694 114,877 - -

Pledged assets 23,239 24,440 - -

Derivative assets 2,040 1,709 - -

Financial investments 141,833 85,757 - -

Loans and advances 427,498 320,662 2,925 2,625

Loans and advances to banks 138,703 54,318 2,925 2,625

Loans and advances to customers 288,795 266,344 - -

Current tax assets 80 43 - -

Equity Investment in group companies - - 68,951 68,951

Other assets 38,915 22,771 1,341 916

Deferred tax assets 5,597 5,169 - -

Property and equipment 22,528 24,458 30 16

Total assets 874,705 676,819 73,247 72,508

Equity and liabilities

Equity 93,534 85,651 71,777 71,503

Equity attributable to ordinary shareholders 90,917 83,341 71,777 71,503

Ordinary share capital 5,000 5,000 5,000 5,000

Ordinary share premium 65,450 65,450 65,450 65,450

Reserves 20,467 12,891 1,327 1,053

Non-controlling interest 2,617 2,310 - -

Liabilities 781,171 591,168 1,470 1,005

Trading liabilities 92,137 88,371 - -

Derivative liabilities 627 772 - -

Deposit and current accounts 557,173 382,051 - -

Deposits from banks 65,314 26,632 - -

Deposits from customers 491,859 355,419 - -

Other borrowings 51,108 66,873 - -

Subordinated debt 6,517 - - -

Current tax liabilities 5,817 4,686 63 -

Deferred tax liabilities 242 158 19 -

Other liabilities 67,550 48,257 1,388 1,005

Total equity and liabilities 874,705 676,819 73,247 72,508

Board of directors

Atedo N.A. Peterside C O N (Chairman), Sola David-Borha (CEO), Dominic Bruynseels***, Moses Adedoyin, Sam Cookey,

Ifeoma Esiri, Arnold Gain**, Ben Kruger*, Ratan Mahtani, Chris Newson**, Maryam Uwais MFR

Unaudited results for the period ended 30 September 2013

*South African ** South African/British ***British

Statement of financial position Statement of profit or loss

Stanbic IBTC Holdings PLC RC1018051

Sola David-Borha

Chief Executive Officer

FRC/2013/CIBN/00000001070

25 October 2013

Arthur Oginga

Chief Financial Officer

FRC/2013/IODN/00000003181

25 October 2013

Atedo N.A. Peterside C O N

Chairman

FRC/2013/CIBN/00000001069

25 October 2013

Statement of other comprehensive income

Gross income growth 29.5%

Total income growth 32.6%

Profit before tax growth 125.6%

Profit after tax growth 129.5%

Gross loans and advances growth (9 months) 8.0%

Deposit growth (9 months) 38.4%

Net interest margin (annualised) 4.9%

Non-performing loan to total loan 4.5%

After-tax return on average equity (annualised) 22.3%

After-tax return on average assets (annualised) 2.5%

Cost-to-income ratio 64.4%

Credit loss ratio 0.8%

Capital adequacy: Group: 19.6%

Bank: 16.0%

Earnings per share (kobo) 146

Price to book (times) 2.1

Fitch ratings AAA(nga)

Overview of financial results

The operating environment in the first nine months of 2013 has been

characterised by increased changes to regulations, sustained high

interest rates, continuous improvement in the capital market though a

slowdown was witnessed in 3Q 2013.

The operating environment also experienced sustained single digit

inflation as a result of tight monetary policy and other monetary policy

measures by the central bank, favourable yields in money market

instruments and strong competition for good quality corporate credits.

Income statement analysis

Our results in the first nine months of 2013 showed an increase of

33% in total income to N63.5 billion despite the challenging operating

environment. This improved performance was majorly driven by a 71%

growth in non-interest revenue and a more modest 2% growth in net

interest income.

Interest income was up 9% to N46.2 billion as a result of sustained

growth in lending activities and positive yields in investment securities.

Income from loans and advances represented 67% of interest income,

while income from investment securities contributed 28% and revenue

from interbank activities accounted for the remaining 5%. On a quarter-

on-quarter basis, interest income was up marginally by 1% to N15.8

billion in 3Q 2013 from N15.7 billion in 2Q 2013, and up 8% from N14.7

billion recorded in 1Q 2013.

Interest expense increased by 20% to N19.1 billion due to a 38%

growth in deposits, a portion of which comprises term deposits. Interest

expense on a quarter-on-quarter basis, was up 10% to N6.7 billion in 3Q

2012 from N6.0 billion in 2Q 2013 and up 4% from N6.4 billion in 1Q

2013 as a result of the effect of the tier 2 capital raised towards the end

of Q2 2013. Overall, net interest margin declined to 4.9% from 5.6%

recorded in nine months of 2012.

Non-interest revenue, made up of revenue from commissions, fees,

trading and other non-interest bearing revenue, increased by 71% to

N36.4 billion. The increase is as a result of a 36% growth in net fee

and commission revenue and over a 100% growth in trading revenue.

to The growth in net fee and commission revenue is due to the increase

in transactional volumes and activities, a function of our enlarged

delivery channels, excellent customer services, steady growth within

our wealth business and good advisory mandates in investment banking.

The continued good performance of the capital market also impacted

positively on the revenues of our stockbroking, asset management

and custody businesses. The growth in trading revenue is as a result

of increased transaction volumes from customers as well as a well

positioned trading book taking advantage of volatility in the fixed

income and foreign exchange trading.

Operating expenses grew by 14% on the back of 18% and 11% growth in

staff costs and other operating expenses respectively. Staff cost growth

was due to inflation related salary increases and increase in headcount of

non-full time staff and sales agents to drive customer acquisition, while

growth in other operating expenses was occasioned by the increase

in AMCON sinking fund contribution, deposit insurance and premises

related expenses. On a quarter-on-quarter basis, staff costs increased

by 5% to N6.2 billion to in 3Q 2013 over N5.9 billion recorded in 2Q

2013, and 1Q 2013, while other operating expenses increased by 16%

to N8.2 billion from N7.1 billion recorded in 2Q 2013.

Credit impairments declined 26% to N2.3 billion at the end of 3Q 2013.

The decline in credit impairment is on the back of resolution of some

delinquent loans and write back of provisions no longer required.

Profit before tax consequently was up 126% to N20.3 billion, while

profit after tax increased by 129% to N16.1 billion. The cost-to-income

ratio improved to 64.4% (9M 2012: 74.8%), as revenue continued to

rise faster than cost.

Statement of financial position analysis

The groups total assets stood at N874.7 billion at the end of nine months

in 2013, representing a 29% growth over N676.8 billion recorded at the

end of December 2012. Total assets growth was mainly driven by the

growth in deposit liabilities which enhanced the opportunities to create

more assets.

Gross loans and advances increased by 8% in the first nine months of

the year to N301.8 billion. The loan book growth has been negatively

impacted by the high interest rate environment and sustained

competition for good quality corporate credits. We are committed to

taking advantage of opportunities to grow our loan book responsibly.

The quality of risk assets continues to improve as the groups non-

performing loan book declined by 6% to close at N13.5 billion at the

end of 3Q 2013 from N14.3 billion in FY 2012. The decrease is as a

result of resolution of some loans in the Personal and Business Banking

segment. Consequently, this reduction positively impacted the ratio of

non-performing loans to total loans which improved from 5.1% in FY

2012 to 4.5% at the end of September 2013. The credit loss ratio also

declined from 2.5% in FY 2012 to 0.8% at the end of 3Q 2013. The

coverage ratio for non-performing loans improved to 96% from 92%

in FY 2012.

The groups deposit liability from customers was up 38% to close at

N491.9 billion at the end of September 2013. The deposit book grew

on the back of our enlarged points of representation, growing customer

base and excellent service delivery. We continued to consciously exit

matured expensive funding and replace them with cheaper deposits.

Consequently, the deposit mix improved as the ratio of low cost and

stable deposits increased to 59% from 49% at the end of 4Q 2012. We

are committed to leveraging our expanded delivery channels, our brand

and service excellence to increase our share of low cost deposits.

The balance sheet was funded mainly by deposits from customers as

it accounted for 56% of total assets and 63% of total liabilities at the

end of 3Q 2013. The liquidity ratio at the end of the period stood at

72.7% (4Q 2012: 45.5%). This is significantly higher than the regulatory

minimum of 30%.

Capital adequacy

The group continued to maintain a healthy capital base as capitalisation

ratios remain at strong levels and are well above the regulatory

requirement. The groups current capital level is considered adequate to

support business growth, risks and contingencies.

Key financial highlights

9M 2013 results review

Total operating income

Sept 2012 Dec 2012 Dec 2011 Sept 2013

0

100.0

200.0

300.0

600.0

500.0

400.0

Nbillion

287.2

315.8

355.4

491.9

Total operating income

Sept 2011 Sept 2012 Sept 2013

0

2,000

4,000

6,000

10,000

18,000

16,000

14,000

12,000

8,000

Nmillion

5,703

6,997

16,057

Total operating income

Sept 2011 Sept 2012 Sept 2013

0

10,000

20,000

30,000

40,000

50,000

70,000

60,000

Nmillion

42,508

47,919

63,540

Total income

CAGR (Sept 2011-Sept 2013): 22%

Profit after tax

CAGR (Sept 2011-Sept 2013): 68%

Deposits from customers

CAGR (Sept 2012-Sept 2013): 25%

Group Group Bank Bank

9M 2013 FY 2012 9M 2013 FY 2012

Nmillion Nmillion Nmillion Nmillion

Tier I capital 69,840 78,172 54,817 59,019

Tier II capital 13,800 6,152 11,471 3,842

Total qualifying capital 83,640 84,324 66,288 62,861

Risk weighted assets 427,054 377,993 414,334 362,856

Capital adequacy

Tier I 16.4% 20.7% 13.2% 16.3%

Tier II 3.2% 1.6% 2.8% 1.1%

Total 19.6% 22.3% 16.0% 17.3%

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- Assignment: Topic: Financial Statement Analysis of National Bank of PakistanDocument28 pagesAssignment: Topic: Financial Statement Analysis of National Bank of PakistanSadaf AliNo ratings yet

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- IFRS Financial Statements for Standard AccountsDocument25 pagesIFRS Financial Statements for Standard AccountsanisaNo ratings yet

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsNo ratings yet

- Topic 3.5 Ratio AnalysisDocument22 pagesTopic 3.5 Ratio AnalysisSevarakhon UmarovaNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- UBL Analysis 2018Document4 pagesUBL Analysis 2018Zara ImranNo ratings yet

- Annual Report Meezan Bank (The Premier Islamic Bank) : Ratio Analysis Introduction of The CompanyDocument8 pagesAnnual Report Meezan Bank (The Premier Islamic Bank) : Ratio Analysis Introduction of The CompanyMaida KhanNo ratings yet

- Course Code: Fn-550Document25 pagesCourse Code: Fn-550shoaibraza110No ratings yet

- Topic 3 5 Ratio AnalysisDocument16 pagesTopic 3 5 Ratio AnalysisEren BarlasNo ratings yet

- Acc Projects by Adnan SHKDocument23 pagesAcc Projects by Adnan SHKADNAN SHEIKHNo ratings yet

- Annual Report Project ExplanationDocument8 pagesAnnual Report Project Explanationmax mostNo ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- BMW Group reports net profit of €5.3 billionDocument8 pagesBMW Group reports net profit of €5.3 billionaudit202No ratings yet

- Oman Oil Balance SheetDocument27 pagesOman Oil Balance Sheeta.hasan670100% (1)

- COMPARATIVE FINANCIAL POSITIONDocument4 pagesCOMPARATIVE FINANCIAL POSITIONशिशिर ढकालNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Financial Analysis of Lucky Cement LTD For The Year 2013Document11 pagesFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErNo ratings yet

- MCB Bank Limited Consolidated Financial Statements SummaryDocument93 pagesMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNo ratings yet

- MMDZ Audited Results For FY Ended 31 Dec 13Document1 pageMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- SAMP - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesSAMP - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Annual Report 2014 RevisedDocument224 pagesAnnual Report 2014 RevisedDivya AhujaNo ratings yet

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRINo ratings yet

- Kaspi Bank 21Document4 pagesKaspi Bank 21Serikkizi FatimaNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Lucky Cement Final Project Report On: Financial Statement AnalysisDocument25 pagesLucky Cement Final Project Report On: Financial Statement AnalysisPrecious BarbieNo ratings yet

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaNo ratings yet

- JansevaDocument21 pagesJansevaHarshil KoushikNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Attachments To: Mid-Term ExamDocument7 pagesAttachments To: Mid-Term Examveda20No ratings yet

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroNo ratings yet

- Financial Analysis 2019Document27 pagesFinancial Analysis 2019Umer MalikNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument81 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- W. R. Berkley Corporation Reports Third Quarter Results: Net Income of $94 Million, Book Value Per Share Up 6%Document6 pagesW. R. Berkley Corporation Reports Third Quarter Results: Net Income of $94 Million, Book Value Per Share Up 6%Tariq AliNo ratings yet

- Nestlé Company Financial AnalysisDocument23 pagesNestlé Company Financial Analysisshahtaj khanNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- NBK Annual Report 2011Document43 pagesNBK Annual Report 2011Mohamad RizwanNo ratings yet

- Wipro Annual Report SummaryDocument17 pagesWipro Annual Report SummaryApoorv SrivastavaNo ratings yet

- ConsolidatedReport08 (BAHL)Document87 pagesConsolidatedReport08 (BAHL)Muhammad UsmanNo ratings yet

- DemonstraDocument75 pagesDemonstraFibriaRINo ratings yet

- SSS 2017 Financial Report: Members' Contributions Hit P158 Billion, Benefit Payments Up 28Document16 pagesSSS 2017 Financial Report: Members' Contributions Hit P158 Billion, Benefit Payments Up 28Ariel DimalantaNo ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Companies Act - SI 62 - 1996Document35 pagesCompanies Act - SI 62 - 1996CourageNo ratings yet

- Theories of Venture Capital and Capital Market ImperfectionDocument32 pagesTheories of Venture Capital and Capital Market ImperfectionДр. ЦчатерйееNo ratings yet

- Individual Assignment - EffaDocument16 pagesIndividual Assignment - EffayuhanaNo ratings yet

- 9101 - Partnership FormationDocument2 pages9101 - Partnership FormationGo FarNo ratings yet

- Certified Tax Adviser (CTA) Qualifying Examination: Paper 1 - Accounting and FinanceDocument4 pagesCertified Tax Adviser (CTA) Qualifying Examination: Paper 1 - Accounting and FinancesamNo ratings yet

- Afs - Final Project - Bajaj Auto PDFDocument19 pagesAfs - Final Project - Bajaj Auto PDFKaushik GowdaNo ratings yet

- Jain BBA Financial Management Practice PaperDocument2 pagesJain BBA Financial Management Practice PaperRavichandraNo ratings yet

- JPE Fall 2013 Fordham PDFDocument12 pagesJPE Fall 2013 Fordham PDFVijendranArumugamNo ratings yet

- Jazeera AirwaysDocument17 pagesJazeera AirwaysMadhusudan PartaniNo ratings yet

- Share ValuationDocument7 pagesShare ValuationroseNo ratings yet

- Sadernia Investments LTD - 2021 - Draft FSDocument23 pagesSadernia Investments LTD - 2021 - Draft FSzubairNo ratings yet

- Managerial Accounting Insights for Legend GuitarsDocument33 pagesManagerial Accounting Insights for Legend GuitarsMah ElNo ratings yet

- IasDocument229 pagesIasPeter Apollo Latosa100% (1)

- Arbitrage Pricing TheoryDocument20 pagesArbitrage Pricing TheoryDeepti PantulaNo ratings yet

- ASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFDocument589 pagesASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFLea Ann Cruz100% (1)

- Hotel Ms DiantiDocument2 pagesHotel Ms DiantiUsman BisnisNo ratings yet

- Auditor's Report - FORMAT 2022 WITHOUT CARODocument5 pagesAuditor's Report - FORMAT 2022 WITHOUT CAROkannan associatesNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource Wasdebate ddNo ratings yet

- 0 - Co-Investment Diligence Assessing The Operating Plan - RCP AdvisorsDocument24 pages0 - Co-Investment Diligence Assessing The Operating Plan - RCP Advisorsdajeca7No ratings yet

- Traders in FuturesDocument10 pagesTraders in FuturesmymadhavaNo ratings yet

- Auditing Theory and Problems (Qualifying Round) : Answer: DDocument15 pagesAuditing Theory and Problems (Qualifying Round) : Answer: DJohn Paulo SamonteNo ratings yet

- Does Portfolio Concentration Affect Corporate Bond Fund PerformanceDocument19 pagesDoes Portfolio Concentration Affect Corporate Bond Fund PerformanceLauraNo ratings yet

- Tugas Manajemen KeuanganDocument3 pagesTugas Manajemen KeuanganmunawarchalilNo ratings yet

- Chap001 Test Bank For Managerial Accounting, 12th EditionDocument18 pagesChap001 Test Bank For Managerial Accounting, 12th EditionlunaNo ratings yet

- Capitallization Table Template: Strictly ConfidentialDocument3 pagesCapitallization Table Template: Strictly Confidentialsh munnaNo ratings yet

- Inventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inDocument6 pagesInventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inleare ruazaNo ratings yet

- ICRA Securitisation Rating Methodology PDFDocument32 pagesICRA Securitisation Rating Methodology PDFShivani AgarwalNo ratings yet

- Financial Closing Process Checklist by Said IslamDocument8 pagesFinancial Closing Process Checklist by Said IslamAndi Tri JatiNo ratings yet

- FinancialPlan - 2013 Version - Prof DR IsmailDocument129 pagesFinancialPlan - 2013 Version - Prof DR IsmailSyukur Byte0% (1)

- IBS Hyderabad MBA Financial Management Course HandoutDocument4 pagesIBS Hyderabad MBA Financial Management Course HandoutApoorva PattnaikNo ratings yet