Professional Documents

Culture Documents

Two-Wheelers Update 27aug2014

Uploaded by

Chandreyee Manna0 ratings0% found this document useful (0 votes)

19 views12 pagesTwo wheeler Report

Original Title

Two-wheelers Update 27Aug2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTwo wheeler Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views12 pagesTwo-Wheelers Update 27aug2014

Uploaded by

Chandreyee MannaTwo wheeler Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

August 27, 2014

Automobiles Two-wheelers Segment Institutional Equities

India Research

2W SECTOR UPDATE

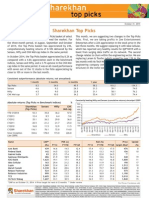

Hero MotoCorp BUY

CMP (Rs) 2,565

Target Price (Rs) 2,950

Upside (%) 15

52 Week High/Low (Rs)

2,788/1,786

3m Avg. Daily Volume (Rs mn)

1,232

TVS Motors SELL

CMP (Rs) 185

Target Price (Rs) 145

Downside (%) 22

52 Week High/Low (Rs) 188/29

3m Avg. Daily Volume (Rs mn)

487

Source; Bloomberg

Performance : Hero MotoCorp

1M 3M 12M YTD

Absolute 0.0 17.0 39.3 24.5

Rel. to Sensex 0.2 1.4 3.2 1.7

Source: Bloomberg

Performance : TVS Motors

1M 3M 12M YTD

Absolute 29.5 49.1 506.7 144.0

Rel. to Sensex 28.0 39.4 325.8 95.4

Source: Bloomberg

Analyst Contact

Mitul Shah

+91 22 6184 4312

mitul.shah@karvy.com

We Prefer Hero MotoCorp over TVS

MotorHMCL to Witness Margins Improvement

with Likely Reversal in Excise Duty in FY16

2W Industry to Record 13% CAGR over FY14-FY16E: Both the major two

wheeler companies Bajaj Auto and Hero MotoCorp have underperformed the

BSE Auto Index as well as BSE Sensex over last one year, primarily due to

volume performance and limited expansion in valuation multiple, as stocks

already traded at fair value. Within the segment, only TVS Motor delivered

strong volume performance, while its price run up is ahead of fundamentals.

We expect two wheeler industry to continue recording healthy volumes,

backed by demand from rural markets and improving sentiment in urban

markets, post formation of stable government at centre. We expect a growth of

13% CAGR for domestic two wheeler industry, 10% CAGR for motorcycle

industry and higher growth of 21.5% CAGR for scooter segment over FY14-

FY16E. We believe that competition will further intensify in the segment on

account of aggressive strategy of other global players like HMSI, Suzuki etc.

Therefore, we expect Hero MotoCorp to underperform the industry growth,

while healthy exports would help TVS Motor to outperform the industry.

TVS - stock price has moved 6x, as against earning soaring ~2x: For TVS

Motor, we expect volume growth of 16.5% CAGR, EBIDTA margin expansion

of 130 bps and EPS CAGR of 44% over FY14-FY16E. However, stock price has

moved 6x, as against earning soaring ~2x over last one year. In our blue sky

scenario, we arrive at its fair value of Rs 174, valuing TVSL at 14xFY16E EPS,

(our base case valuation stands at Rs 145, valuing at 13xFY16E EPS), leaving no

room for upside from current level. For TVS Motors, current valuation is ahead

of fundamentals and risk reward is highly unfavorable. Stock is trading at

higher end of valuation of two wheeler companies, despite single digit margin

profile and smaller size. We reiterate our SELL on TVS with TP of Rs 145.

Likely Reversal of Excise to Benefit Margins: We believe that Hero

MotoCorps various cost cutting initiative coupled with likely reversal of excise

duty by FY16E will help margin improvement for the company. On the other

hand competition, new product launch expenses and increasing advertising

expenses would eat into margins, therefore we expect improvement of only 50

bps in HMCLs EBIDTA margins over FY14-FY16E. Despite loss of some

market share by HMCL, we expect margin improvement on high base to

translate into EPS CAGR of 29% over FY14-FY16E. Strong product pipe-line

and higher volumes may lead to margin upgrade going forward. In view of

better traction for the company and valuation comfort, we reiterate our BUY on

Hero MotoCorp with TP of Rs 2,950, valuing the stock at 17xFY16E EPS.

Valuation Summary

Company Rating

CMP

(Rs)

TP

(Rs)

MCap

(Rs bn)

EPS (Rs) EV/EBIDTA (x) P/E (x)

FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E

Hero MotoCorp BUY 2,565 2,950 516 105.6 147.2 173.6 14.4 12.3 10.4 24.3 17.4 14.8

TVS Motor SELL 185 145 88 5.4 8.5 11.1 19.1 13.3 10.4 34.0 21.7 16.6

Source: Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

Automobiles August 27, 2014

Hero MotoCorp

Bloomberg: HMCL IN

Reuters: HROH.BO

BUY

Institutional Equities

India Research

UPDATE

Recommendation

CMP: Rs2,565

Target Price: Rs2,950

Previous Target Price Rs2,950

Upside (%) 15%

Stock Information

Market Cap. (Rs bn / US$ mn) 516/8,478

52-week High/Low (Rs) 2,788/1,786

3m ADV (Rs mn /US$ mn) 1,232/20.2

Beta 0.9

Sensex/ Nifty 25,908/7,747

Share outstanding (mn) 200

Stock Performance (%)

1M 3M 12M YTD

Absolute 0.0 17.0 39.3 24.5

Rel. to Sensex 0.2 1.4 3.2 1.7

Performance

Source: Bloomberg

Analysts Contact

Mitul Shah

+91 22 6184 4312

mitul.shah@karvy.com

Maruti Kadam - Associate

022 - 6184 4322

maruti.kadam@karvy.com

1,300

1,800

2,300

2,800

15,500

17,500

19,500

21,500

23,500

25,500

27,500

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

F

e

b

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

n

-

1

4

A

u

g

-

1

4

Sensex (LHS) Hero MotoCorp (RHS)

Likely Excise Reversal to Expand Margins in

FY16E...New Launches to Boost Volumes

Hero MotoCorps recent performance was impacted by reduction in excise

duty post Budget in Q4FY14, lowering the excise benefit enjoyed by HMCL on

its production from Haridwar plant (40% of total production). Company is

exempted from excise duty on its production from Haridwar plant, while it

maintains its vehicle pricing across the products irrespective of its location of

production, which translated into direct benefit of 12% of net revenues from

Hridwar plant to companys financials till Q4FY14. However, lower excise

duty of 8% resulted in loss of benefit to the tune of 4% of net revenues from

this plant. Assuming constant average realization per vehicle across plants and

75% net impact on margins, our back of envelop calculation indicates direct

impact of 120 bps on companys EBIDTA margins. Our adjusted EBIDTA

margins stood at 14.7% as against reported margins of 13.5% in Q1FY15. Our

sensitivity analysis indicates net impact of 30 bps on EBIDTA margins for

every 1% cut in excise duty for HMCL. We believe that lower excise rate would

not continue for longer term and expect its reversal in FY16, benefitting

HMCLs operating margin going forward.

New Launches, Network Expansion and Additional Capacity to Pay off:

HMCLs strong product pipe line with expected launch of 8-10 new models

over next one year would help maintain market shares. Moreover, it expanded

annual production capacity by ~750,000 units at its Rajasthan plant. Companys

strong network of ~6000 touch points would be the key factor to grab the

opportunity arising out of expected economic recovery over next two years.

We expect companys R&D and promotional expenses to go up amid

intensifying competition, while operating leverage, value engineering and

likely excise reversal would compensate for higher expense. Therefore we

expect ~50 bps improvement in HMCLs EBIDTA margins to 14.5% in FY16E.

Outlook & Valuation

We maintain our estimates and we expect margins and return ratios to

improve for HMCL. In view of healthy return ratio and 29% EPS CAGR over

FY14-FY16E, we reiterate our BUY recommendation on HMCL and maintain

our target price of Rs 2,950, valuing the stock at 17x FY16E EPS.

Key Financials

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Net Sales 235,790 237,681 252,755 295,157 334,944

EBITDA 36,330 32,921 35,545 41,432 48,712

EBITDA margin (%) 15.4 13.9 14.1 14.0 14.5

Adj. Net Profit 23,781 21,182 21,090 29,397 34,659

EPS (Rs.) 119.1 106.1 105.6 147.2 173.6

YoY growth (%) 19.2 -10.9 -0.4 39.4 17.9

RoE (%) 57.4 39.6 34.8 41.6 40.1

RoCE (%) 54.7 38.5 34.5 41.7 40.2

PER (x) 21.5 24.2 24.3 17.4 14.8

EV/ EBITDA 14.1 15.5 14.4 12.3 10.4

Source: Company, Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

3

August 27, 2014

Hero MotoCorp

Exhibit 1: Hero MotoCorps Key Fundamental Parameters

Y/E March (Rs. mn) Q1 Q2 Q3 Q4 Q1

FY14 FY14 FY14 FY14 FY15

Net Revenue 61,595 57,262 68,768 65,130 70,368

Impact of 4% Excise Cut (at Haridwar plant) 0 0 0 320 940

Adj Revenue 61,595 57,262 68,768 65,450 71,308

Adj Revenue Per Vehicle 39,502 40,433 40,910 41,177 41,576

YoY Growth %

2.3% 5.2%

QoQ Growth %

0.7% 1.0%

Total Expenses 52,443 48,935 59,788 56,188 60,896

Reported EBIDTA 9,152 8,327 8,980 8,942 9,472

Adj EBIDTA 9,152 8,327 8,980 9,262 10,412

Reported EBIDTA Margin (%) 14.9 14.5 13.1 13.7 13.5

Adj EBIDTA Margin (%) 14.9 14.5 13.1 14.2 14.8

Impact Ananlysis of Excise Duty Cut

Production from Haridwar (40% of Total) Units 623,713 566,484 672,376 635,785 686,052

Revenues from Haridwar (Rs mn) 24,638 22,905 27,507 26,052 28,147

4% Excise Reduction with 75% Net Impact (Rs mn) - - - 333 946

Source: Company, Karvy Institutional Research, Note: Q4FY14 witnessed lower excise impact for 40 days only, hence lower impact as against full impact witnessed in

Q1FY15.

Exhibit 2: HMCLs EBIDTA Margin Sensitivity to Excise Duty

Source: Company, Karvy Institutional Research

12.3

12.6

12.9

13.2

13.5

13.8

14.1

14.4

14.7

10

12

14

16

4 5 6 7 8 9 10 11 12

E

B

I

D

T

A

M

a

r

g

i

n

(

%

)

Excise Duty (%)

Current Rate &Margins

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

4

August 27, 2014

Hero MotoCorp

Financials

Exhibit 3: Profit & Loss Statement (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Net revenues 235,790 237,681 252,755 295,157 334,944

Operating expenses 199,460 204,760 217,210 253,726 286,233

EBIDTA 36,330 32,921 35,545 41,432 48,712

EBIDTA margin (%) 15.4 13.9 14.1 14.0 14.5

Other income 3,595 3,945 4,435 4,900 5,619

Interest 213 119 118 120 165

Depreciation 10,973 11,418 11,074 6,218 6,985

Profit Before Tax 28,738 25,330 28,788 39,994 47,181

Tax 4,866 4,110 7,582 10,597 12,522

Reported Net Profit 23,781 21,182 21,091 29,397 34,659

Net Margin (%) 10.1 8.9 8.3 10.0 10.3

Adjusted Net Profit 23,781 21,182 21,090 29,397 34,659

Source: Company, Karvy Institutional Research

Exhibit 4: Balance Sheet (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Equity capital 399 399 399 399 399

Reserves & surplus 42,499 49,663 55,599 68,809 87,281

Shareholders funds 42,898 50,062 55,999 69,209 87,681

Total Loans 0 0 0 0 0

Deferred tax liability 2,148 1,397 48 48 48

Total Liabilities and Equity 45,046 51,460 56,047 69,257 87,729

Gross block 63,083 66,851 69,089 89,331 94,481

Depreciation 25,228 36,141 46,657 52,875 59,860

Net block 37,855 30,710 22,433 36,455 34,621

Capital WIP 388 621 8,541 1,300 1,650

Investments 39,643 36,238 40,888 47,888 67,888

Inventory 6,756 6,368 6,696 7,647 8,626

Debtors 2,723 6,650 9,206 9,704 10,094

Cash & Bank Bal 768 1,810 1,175 2,284 3,426

Loans & Advances 10,821 14,093 12,083 12,768 13,507

Current Assets 21,068 28,921 29,160 32,402 35,654

Sundry Creditors 22,932 18,733 22,906 25,720 29,015

Other Current Liability 30,977 26,297 22,068 23,068 23,068

Current Liability& Provisions 53,908 45,030 44,974 48,788 52,083

Net current assets -32,840 -16,109 -15,815 -16,386 -16,429

Total Assets 45,046 51,460 56,047 69,257 87,729

Source: Company, Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

5

August 27, 2014

Hero MotoCorp

Exhibit 5: Cash Flow Statement (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

EBIT 25,357 21,504 24,471 35,213 41,727

Other Income 3,595 3,945 4,435 4,900 5,619

Depreciation & Amortisation 10,973 11,418 11,074 6,218 6,985

Interest paid(-) (213) (119) (118) (120) (165)

Tax paid(-) (4,866) (4,110) (7,582) (10,597) (12,522)

Extra Ord Income (91) (38) (116) 0 0

Operating Cash Flow 34,755 32,599 32,164 35,615 41,644

Change in Working Capital (27,609) (15,689) (930) 1,680 1,186

Cash flow from Operations 7,146 16,910 31,234 37,295 42,830

Capex (7,915) (4,505) (10,717) (13,000) (5,500)

Non Strategic Investment 11,645 3,404 (4,649) (7,000) (20,000)

Cash flow from Investing 3,730 (1,100) (15,366) (20,000) (25,500)

Change in borrowing 0 0 0 0 0

Others (380) (750) (1,316) 0 0

Dividends paid(-) (10,444) (14,018) (15,188) (16,187) (16,187)

Cashflow from Financial Activities (10,823) (14,768) (16,504) (16,187) (16,187)

Change in Cash 53 1,042 (635) 1,109 1,143

Opening cash 715 768 1,810 1,175 2,284

Closing cash 768 1,810 1,175 2,284 3,426

Source: Company, Karvy Institutional Research

Exhibit 6: Key Ratios

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Revenue Growth 21.5 0.8 6.3 16.8 13.5

EBITDA Margin 15.4 13.9 14.1 14.0 14.5

Net Profit Margin 10.1 8.9 8.3 10.0 10.3

ROCE (%) 54.7 38.5 34.5 41.7 40.2

ROE (%) 57.4 39.6 34.8 41.6 40.1

Source: Company, Karvy Institutional Research

Exhibit 7: Valuation Parameters

Y/E March (Rs. mn)

FY12 FY13 FY14 FY15E FY16E

EPS( Rs) 119.1 106.1 105.6 147.2 173.6

P/E (x) 21.5 24.2 24.3 17.4 14.8

P/ BV (x) 11.9 10.2 9.1 7.4 5.8

EV/ EBITDA (x) 14.1 15.5 14.4 12.3 10.4

Fixed Assets Turnover Ratio (x) 6.2 7.6 8.2 7.8 9.2

Debt / Equity (x) 0.0 0.0 0.0 0.0 0.0

EV/ Sales (x) 2.2 2.1 2.0 1.7 1.5

Source: Company, Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

Automobiles August 27, 2014

TVS Motor

Bloomberg: TVSL IN

Reuters: TVSM.BO

SELL

Institutional Equities

India Research

RESULT REVIEW

Recommendation

CMP: Rs185

Target Price: Rs145

Previous Target Price: Rs145

Downside (%) 22%

Stock Information

Market Cap. (Rs bn / US$ mn) 88/1,456

52-week High/Low (Rs) 188/29

3m ADV (Rs mn /US$ mn) 487/8.1

Beta 0.8

Sensex/ Nifty 26,443/7,905

Share outstanding (mn) 475

Stock Performance (%)

1M 3M 12M YTD

Absolute 29.5 49.1 506.7 144.0

Rel. to Sensex 28.0 39.4 325.8 95.4

Performance

Source: Bloomberg

Analysts Contact

Mitul Shah

+91 22 6184 4312

mitul.shah@karvy.com

0

50

100

150

200

15,500

17,500

19,500

21,500

23,500

25,500

27,500

A

u

g

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

J

u

n

-

1

4

J

u

l

-

1

4

A

u

g

-

1

4

Sensex (LHS) TVS Motor (RHS)

Punchy Valuation Breaches Our Blue Sky

Scenario; Reiterate SELL

TVS Motor has outperformed BSE Auto Index and Sensex by 440% and 464%

respectively over last one year. Its price performance is way ahead of its

earnings performance. Its EPS growth was 30% in FY14, while we expect its

EPS to double over FY14-FY16E to Rs 11.1 However price has moved up by

over 5x in a years period. All the positives, even in our blue sky scenario, are

priced in. Current valuation of 16.6xFY16E EPS is expensive for a company

with single digit operating margin and RoE of 25%. We believe that stock

would remain under pressure until it delivers margin performance, despite

expectation of strong volume outperformance in coming quarters. Strong

margin performance is needed for re-rating, along with volumes.

Gaining Volumes and Shares at the Cost of Margins: TVSL outperformed

domestic as well as exports industry across the segments in Q1FY15 with

market shares gain in majority of the segments. However, its margins fell

sequentially and remained flat YoY despite favourable currency, which

indicates lack of competency to maintain profitability in a period of best of the

volume performance. Companys export contribution and three wheeler

contribution to total volume is highest ever at ~16.7% and 4.3% respectively

and exchange rate was favorable during Q1FY15, while its operating margins

remained under pressure indicating absence of product mix benefit. We

believe that companys operating expenses will increase with new launches in

the coming quarters. It may surprise on volumes front, but drastic

improvement operating margins would be a challenge for Company. This

would restrict re-rating of the company and may lead to de-rating in case of

subdued margins.

Expensive even in Blue Sky Scenario: In our blue sky scenario, we assumed

TVSLs EBIDTA margins to improve from current 5.7% to 8% in FY16E and

assigned P/E multiple of 14x (as against our base case assumption of 7.3% and

P/E of 13x) FY16E, we arrive at target price of Rs 174, implying 6% downside

from CMP. Risk reward is highly unfavorable at current valuation and way

ahead of fundamentals. We reiterate our SELL on TVS Motor with a target

price of Rs 145, valuing it at 13xFY16E EPS, potential downside of 22%.

Key Financials

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Net Sales 71,415 71,693 79,619 99,158 115,352

EBITDA 4,948 4,229 4,803 6,746 8,370

EBITDA margin (%) 6.9 5.9 6.0 6.8 7.3

Adj. Net Profit 2,491 1,982 2,583 4,043 5,293

EPS (Rs.) 5.2 4.2 5.4 8.5 11.1

YoY growth (%) 28.0 -20.4 30.3 56.5 30.9

ROE (%) 22.2 16.1 19.0 25.0 26.2

ROCE (%) 15.6 11.9 14.0 19.9 23.6

PER (x) 35.3 44.4 34.0 21.7 16.6

EV/ EBITDA 19.2 22.0 19.1 13.3 10.4

Source: Company, Karvy Institutional Research; We do not factor in any financial impact of BMW tie-up.

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

7

August 27, 2014

TVS Motor

Key Fundamental Parameters

Exhibit 1: TVS Key Financials

Y/E March (Rs. mn) Q1 Q2 Q3 Q4 Q1

FY14 FY14 FY14 FY14 FY15 FY15E FY16E

Sales Volume (units) 475,634 502,000 532,701 563,000 584,000 2,516,377 2,816,928

Growth YoY (%) (11.0) 4.4 3.1 10.0 22.8 21.0 11.9

Net Revenues 17,602 19,884 20,576 21,557 23,054 99,158 115,352

EBIDTA 989 1,171 1,234 1,387 1,312 6,746 8,370

Export Contribution (%) 14.1 15.9 14.5 15.1 16.7 15.7 16.5

Three Wheeler Contributions (%) 3.3 4.6 3.9 3.7 4.3 4.5 4.5

Exchange Rate (Rs/$) 56 60 62 61 61 61 61

Average Realisation per Vehicle (Rs) 36,587 39,084 38,196 37,669 38,754 38,880 40,435

YoY Growth (%) 7.4 11.7 9.5 10.1 5.9 2.9 4.0

EBIDTA Margins (%) 5.6 5.9 6.0 6.4 5.7 6.8 7.3

RM/Vehicle (Rs) 26,319 28,185 27,443 27,429 28,710 28,263 29,115

EBIDTA/Vehicle (Rs) 2,079 2,333 2,317 2,463 2,246 2,681 2,971

Source: Karvy Institutional Research

As evident in above table, TVS export contribution to total volume grew to 16.7%

and three wheeler contribution was high at 4.3% in Q1FY15. Company failed to

translate this benefit into financial performance, despite favourable exchange rate.

Increase in price per vehicle by Rs 1,085 QoQ is insufficient to compensate increase

of Rs 1,281 QoQ in raw material per vehicle, impacting margins.

Margin and Valuation Scenario Analysis

Exhibit 2: Margin Scenario

Y/E March (Rs. mn) Bear Case Base Case Bull Case

FY15E FY16E FY15E FY16E FY15E FY16E

Revenue 99,158 115,352 99,158 115,352 99,158 115,352

EBIDTA 5,949 8,075 6,746 8,370 6,941 9,228

EBIDTA Margins (%) 6.0 7.0 6.8 7.3 7.0 8.0

EPS (Rs) 7.26 10.6 8.5 11.1 8.8 12.4

Source: Karvy Institutional Research

Exhibit 3: Valuation Doesnt Justify Even in Blue Sky Scenario

Target Price (Rs)

1 Year Forward P/E 10x 11x 12x 13x 14x

FY16E EPS (Rs)

Bear Case 10.6 106 117 127 138 148

Base Case 11.1 111 123 134 145 156

Bull Case 12.4 124 136 149 161 174

Source: Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

8

August 27, 2014

TVS Motor

In a blue sky scenario of EBIDTA margin improvement of 230 bps from current

level to 8% in FY16E and P/E multiple of 14x (as compared to TVS historical up-

cycle average multiple of 12.5x 1 year forward P/E), we arrive at target price of Rs

174 per share. This implies 6% downside from CMP, resulting in highly

unfavourable risk reward at current valuation. There is no room for upside...even

in our blue sky scenario.

Exhibit 4: P/E Price band

Source: Bloomberg, Company, Karvy Institutional Research

Exhibit 5: Volumes and EBIDTA Margin Trend

Source: SIAM, Company, Karvy Institutional Research

Valuation Surpasses Previous Peak

As evident in above P/E chart for TVSL, the stock has traded at 12.5x during FY11-

FY12, when its volumes surpassed 2 mn mark and sales volume grew by 20%

CAGR over FY10-FY12. Its EBIDTA margins were in the range of 6.5 - 6.9% during

the same period. Historically, its high multiple was backed by strong volumes and

operating margins of ~7%. Current situation resembles the past scenario of volume

and margin performance, however at present stock is trading at 16.6xFY16E EPS as

compared to historical valuation of 12.5x, which is very expensive, we reiterate our

SELL on TVS Motor.

0

20

40

60

80

100

120

140

160

180

200

A

p

r

-

0

5

N

o

v

-

0

5

J

u

n

-

0

6

J

a

n

-

0

7

A

u

g

-

0

7

M

a

r

-

0

8

O

c

t

-

0

8

M

a

y

-

0

9

D

e

c

-

0

9

J

u

l

-

1

0

F

e

b

-

1

1

S

e

p

-

1

1

A

p

r

-

1

2

N

o

v

-

1

2

J

u

n

-

1

3

J

a

n

-

1

4

A

u

g

-

1

4

(Rs)

3.5x

7.5x

12.5x

15.5x

Mean

-

2.0

4.0

6.0

8.0

10.0

12.0

-

500

1,000

1,500

2,000

2,500

3,000

F

Y

0

5

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Y

1

3

F

Y

1

4

F

Y

1

5

E

F

Y

1

6

E

Total Volume EBIDTA margin (RHS)

('000 Units) (%) High Volumes and Margins

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

9

August 27, 2014

TVS Motor

Financials

Exhibit 6: Profit & Loss Statement (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Net revenues 71,415 71,693 79,619 99,158 115,352

Operating expenses 66,467 67,464 74,816 92,412 106,982

EBIDTA 4,948 4,229 4,803 6,746 8,370

EBIDTA margin (%) 6.9 5.9 6.0 6.8 7.3

Other income 200 237 279 365 414

Interest 574 483 254 229 151

Depreciation 1,175 1,304 1,317 1,421 1,529

Profit Before Tax 3,165 1,636 3,525 5,461 7,104

Tax 674 476 909 1,418 1,812

Reported Net Profit 2,491 1,160 2,616 4,043 5,293

Net Margin (%) 3.5 1.6 3.3 4.1 4.6

Adjusted Net Profit 2,491 1,982 2,583 4,043 5,293

Adj. Net Margin (%) 3.5 2.8 3.2 4.1 4.6

Source: Company, Karvy Institutional Research

Exhibit 7: Balance Sheet (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Equity capital 475 475 475 475 475

Reserves & surplus 11,221 11,772 13,678 17,056 21,684

Shareholders' funds 11,696 12,247 14,153 17,531 22,159

Total Loans 7,155 5,459 4,759 2,759 259

Deferred tax liability 976 931 1,247 1,247 1,247

Total Liabilities and Equity 19,826 18,637 20,158 21,536 23,665

Gross block 21,545 22,479 24,723 26,959 29,659

Depreciation 11,289 12,365 13,466 14,887 16,416

Net block 10,256 10,115 11,257 12,072 13,243

Capital WIP 525 361 481 945 945

Investments 9,309 8,688 8,959 10,459 10,959

Inventory 5,846 5,097 5,482 6,836 7,914

Debtors 2,080 3,169 3,341 4,075 4,740

Cash & Bank Bal 130 175 826 1,192 1,132

Loans & Advances 2,998 3,752 5,302 4,116 4,886

Current Assets 11,055 12,192 14,950 16,219 18,672

Sundry Creditors 7,117 8,086 9,989 12,659 14,655

Other Current Liability 1,063 1,066 1,211 1,211 1,211

Current Liability& Provisions 11,319 12,720 15,489 18,159 20,155

Net current assets -264 -528 -539 -1,940 -1,483

Total Assets 19,826 18,637 20,158 21,536 23,665

Source: Company, Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

10

August 27, 2014

TVS Motor

Exhibit 8: Cash Flow Statement (Standalone)

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

EBIT 3,773 2,925 3,486 5,325 6,841

Other Income 200 237 279 365 414

Depreciation & Amortisation 1,175 1,304 1,317 1,421 1,529

Interest paid(-) (574) (483) (254) (229) (151)

Tax paid(-) (674) (476) (909) (1,418) (1,812)

Extra Ord Income (235) (1,043) 14 0 0

Operating Cash Flow 3,666 2,464 3,933 5,464 6,821

Change in Working Capital 1,058 308 662 1,767 (517)

Cash flow from Operations 4,724 2,772 4,595 7,231 6,304

Capex (2,006) (999) (2,579) (2,700) (2,700)

Strategic Investment (2,815) 660 (304) (1,500) (500)

Non Strategic Investment 118 (39) 33 0 0

Cash flow from Investing (4,704) (378) (2,850) (4,200) (3,200)

Change in borrowing 820 (1,696) (700) (2,000) (2,500)

Others (52) 2 381 0 0

Dividends paid(-) (718) (655) (775) (664) (664)

Cashflow from Financial Activities 50 (2,350) (1,094) (2,664) (3,164)

Change in Cash 70 44 651 366 (60)

Opening cash 60 130 175 826 1,192

Closing cash 130 175 826 1,192 1,132

Source: Company, Karvy Institutional Research

Exhibit 9: Key Ratios

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

Revenue Growth 13.6 0.4 11.1 24.5 16.3

EBITDA Margin 6.9 5.9 6.0 6.8 7.3

Net Profit Margin 3.5 2.8 3.2 4.1 4.6

ROCE (%) 15.6 11.9 14.0 19.9 23.6

ROE (%) 22.2 16.1 19.0 25.0 26.2

Source: Company, Karvy Institutional Research

Exhibit 10: Valuation Parameters

Y/E March (Rs. mn) FY12 FY13 FY14 FY15E FY16E

EPS( Rs) 5.2 4.2 5.4 8.5 11.1

P/E (x) 35.3 44.4 34.0 21.7 16.6

P/ BV (x) 7.5 7.2 6.2 5.0 4.0

EV/ EBITDA (x) 19.2 22.0 19.1 13.3 10.4

Fixed Assets Turnover Ratio (x) 6.7 6.8 6.5 8.2 8.7

Debt / Equity (x) 0.6 0.4 0.3 0.2 0.0

EV/ Sales (x) 1.3 1.3 1.2 0.9 0.8

Source: Company, Karvy Institutional Research

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

Institutional Equities Team

Rahul Sharma

Head Institutional Equities /

Research / Pharma

+91-22 61844310/01 rahul.sharma@karvy.com

Gurdarshan Singh Kharbanda Head - Sales-Trading +91-22 61844368/69 gurdarshansingh.k@karvy.com

INSTITUTIONAL RESEARCH

Analysts Industry / Sector Desk Phone Email ID

Mitul Shah Automobiles/Auto Ancillary +91-22 61844312 mitul.shah@karvy.com

Parikshit Kandpal Infra / Real Estate / Strategy/Consumer +91-22 61844311 parikshit.kandpal@karvy.com

Rajesh Kumar Ravi Cement/ Logistics/ Paints +91-22 61844313 rajesh.ravi@karvy.com

Rupesh Sankhe Power/Capital Goods +91-22 61844315 rupesh.sankhe@karvy.com

Asutosh Mishra Banking & Finance +91-22-61844329 asutosh.mishra@karvy.com

Vinesh Vala Research Associate +91 22 61844325 vinesh.vala@karvy.com

Rajesh Mudaliar Research Associate +91 22 61844322 rajesh.mudaliar@karvy.com

INSTITUTIONAL SALES

Celine Dsouza

Sales

+91 22 61844341 celine.dsouza@karvy.com

Edelbert Dcosta

Sales

+91 22 61844344 edelbert.dcosta@karvy.com

INSTITUTIONAL SALES TRADING & DEALING

Aashish Parekh Institutional Sales/Trading/ Dealing +91-22 61844361 aashish.parekh@karvy.com

Prashant Oza Institutional Sales/Trading/ Dealing +91-22 61844370 /71 prashant.oza@karvy.com

Pratik Sanghvi Institutional Sales/Trading/ Dealing +91-22 61844366 /67 pratik.sanghvi@karvy.com

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

For further enquiries please contact:

research@karvy.com

Tel: +91-22-6184 4300

Disclosures Appendix

Analyst certification

The following analyst(s), who is (are) primarily responsible for this report, certify (ies) that the views expressed

herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of

his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views

contained in this research report.

Disclaimer

The information and views presented in this report are prepared by Karvy Stock Broking Limited. The information

contained herein is based on our analysis and upon sources that we consider reliable. We, however, do not vouch for

the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any

loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all

investors. Investors must make their own investment decisions based on their specific investment objectives and

financial position and using such independent advice, as they believe necessary. While acting upon any information

or analysis mentioned in this report, investors may please note that neither Karvy nor Karvy Stock Broking nor any

person connected with any associate companies of Karvy accepts any liability arising from the use of this information

and views mentioned in this document.

The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the above

mentioned companies from time to time. Every employee of Karvy and its associate companies are required to

disclose their individual stock holdings and details of trades, if any, that they undertake. The team rendering

corporate analysis and investment recommendations are restricted in purchasing/selling of shares or other securities

till such a time this recommendation has either been displayed or has been forwarded to clients of Karvy. All

employees are further restricted to place orders only through Karvy Stock Broking Ltd. This report is intended for a

restricted audience and we are not soliciting any action based on it. Neither the information nor any opinion

expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities, or any options,

futures nor other derivatives related to such securities.

Karvy Stock Broking Limited

Institutional Equities

Office No. 701, 7

th

Floor, Hallmark Business Plaza, Opp.-Gurunanak Hospital, Mumbai 400 051

Regd Off : 46, Road No 4, Street No 1, Banjara Hills, Hyderabad 500 034.

Karvy Stock Broking Research is also available on: Bloomberg - KRVY <GO>, Thomson Publisher & Reuters.

Stock Ratings Absolute Returns

Buy : > 15%

Hold : 5 - 15%

Sell : < 5%

EMISPDF in-iiftemis from 203.190.248.30 on 2014-09-16 11:18:35 BST. DownloadPDF.

Downloaded by in-iiftemis from 203.190.248.30 at 2014-09-16 11:18:35 BST. EMIS. Unauthorized Distribution Prohibited.

You might also like

- Apola Ose-Otura (Popoola PDFDocument2 pagesApola Ose-Otura (Popoola PDFHowe JosephNo ratings yet

- Music Literature (Western Music)Document80 pagesMusic Literature (Western Music)argus-eyed100% (6)

- Madras Cement: Ready To BuildDocument38 pagesMadras Cement: Ready To BuildAnant JainNo ratings yet

- 2015 Masonry Codes and Specifications Compilation, MCAA StoreDocument1 page2015 Masonry Codes and Specifications Compilation, MCAA StoreMuhammad MurtazaNo ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- Otis, Elisha Graves REPORTDocument7 pagesOtis, Elisha Graves REPORTrmcclary76No ratings yet

- Wave of WisdomDocument104 pagesWave of WisdomRasika Kesava100% (1)

- Gabriel India LTD: Multiple Levers For GrowthDocument18 pagesGabriel India LTD: Multiple Levers For GrowthpriyaranjanNo ratings yet

- PersonalDevelopment Q1 Module 2Document7 pagesPersonalDevelopment Q1 Module 2Stephanie DilloNo ratings yet

- IndiNivesh Best Sectors Stocks Post 2014Document49 pagesIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- AngelBrokingResearch SetcoAutomotive 4QFY2015RUDocument10 pagesAngelBrokingResearch SetcoAutomotive 4QFY2015RUvijay4victorNo ratings yet

- Hero Motocorp: CMP: Inr2,792 TP: Inr2,969 BuyDocument8 pagesHero Motocorp: CMP: Inr2,792 TP: Inr2,969 BuyDenisJose2014No ratings yet

- Auto Two Wheelers-Shifting Into Top Gear!!Document91 pagesAuto Two Wheelers-Shifting Into Top Gear!!ronaksarda123No ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- 1 - 0 - 08072011fullerton Escorts 7th July 2011Document5 pages1 - 0 - 08072011fullerton Escorts 7th July 2011nit111No ratings yet

- Setco Automotive LTD: Opportunity Boost CMP: 198Document9 pagesSetco Automotive LTD: Opportunity Boost CMP: 198priyaranjanNo ratings yet

- Research Report On Mahindra...Document8 pagesResearch Report On Mahindra...Sahil ChhibberNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Mahindra and Mahindra Q1FY13Document4 pagesMahindra and Mahindra Q1FY13Kiran Maruti ShindeNo ratings yet

- TVS Motors: ' 96 ' 69 Fy13 Pe 8.8XDocument14 pagesTVS Motors: ' 96 ' 69 Fy13 Pe 8.8XVinit BolinjkarNo ratings yet

- Hero Honda Motors LTD.: Key HighlightsDocument9 pagesHero Honda Motors LTD.: Key HighlightsSachinNo ratings yet

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Document12 pagesTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289No ratings yet

- Sharekhan Top Picks Analysis and Stock RecommendationsDocument7 pagesSharekhan Top Picks Analysis and Stock RecommendationsAnonymous W7lVR9qs25No ratings yet

- Edelweiss 5 Stocks 2016Document14 pagesEdelweiss 5 Stocks 2016Anonymous W7lVR9qs25No ratings yet

- Exide Industries: Running On Low ChargeDocument9 pagesExide Industries: Running On Low ChargeAnonymous y3hYf50mTNo ratings yet

- Jamna AutoDocument5 pagesJamna AutoSumit SinghNo ratings yet

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesDocument20 pagesIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedNo ratings yet

- Sharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksDocument7 pagesSharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksSoumik DasNo ratings yet

- TVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellDocument5 pagesTVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellSwastik PradhanNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- IEA Report 13th DecemberDocument23 pagesIEA Report 13th DecembernarnoliaNo ratings yet

- Exide Industries, 1Q FY 2014Document12 pagesExide Industries, 1Q FY 2014Angel BrokingNo ratings yet

- Zee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Document3 pagesZee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Marutisinh RajNo ratings yet

- Bajaj Auto: Uncertainty Priced In, Upgrade To BUYDocument8 pagesBajaj Auto: Uncertainty Priced In, Upgrade To BUYvipin51No ratings yet

- Hero Motocorp Limited: Icra Equity Research ServiceDocument7 pagesHero Motocorp Limited: Icra Equity Research ServiceArunkumar PalanisamyNo ratings yet

- Kamat Hotels (KAMHOT) : Results InlineDocument4 pagesKamat Hotels (KAMHOT) : Results InlinedidwaniasNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- RKFL ReportDocument19 pagesRKFL ReportpriyaranjanNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- BEML - Visit Update - Oct 14Document5 pagesBEML - Visit Update - Oct 14Pradeep RaghunathanNo ratings yet

- Hero MotocorpDocument11 pagesHero MotocorpAngel BrokingNo ratings yet

- JMV PreferredDocument25 pagesJMV PreferredAnonymous W7lVR9qs25No ratings yet

- Autos: 2QFY17E Results PreviewDocument11 pagesAutos: 2QFY17E Results Previewarun_algoNo ratings yet

- Mahindra N Mahindra, 1Q FY 2014Document14 pagesMahindra N Mahindra, 1Q FY 2014Angel BrokingNo ratings yet

- Force Motors Result UpdatedDocument11 pagesForce Motors Result UpdatedAngel BrokingNo ratings yet

- Amara Raja Batteries: CMP: INR851 TP: INR975 (+15%)Document10 pagesAmara Raja Batteries: CMP: INR851 TP: INR975 (+15%)Harshal ShahNo ratings yet

- Ramkrishna Forgings: Ready For The Big LeapDocument10 pagesRamkrishna Forgings: Ready For The Big LeappriyaranjanNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- Sharekhan top picks outperform in FY2010Document6 pagesSharekhan top picks outperform in FY2010Kripansh GroverNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Eicher MotorsDocument12 pagesEicher MotorsPreet Jain100% (1)

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Eicher Motors: Gearing Up For The Next LevelDocument11 pagesEicher Motors: Gearing Up For The Next LevelumaganNo ratings yet

- FAG Bearings Result UpdatedDocument10 pagesFAG Bearings Result UpdatedAngel BrokingNo ratings yet

- Auto NBFCS: 4qfy21 Results Review - Growth Decelerates, Stress Pool Remains ElevatedDocument22 pagesAuto NBFCS: 4qfy21 Results Review - Growth Decelerates, Stress Pool Remains Elevatedanil1820No ratings yet

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocument25 pagesInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNo ratings yet

- Automobile Club Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomobile Club Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Classical and Neoclassical Economics in IndiaDocument1 pageClassical and Neoclassical Economics in IndiaChandreyee MannaNo ratings yet

- Accel India Ecommerce Mar14Document33 pagesAccel India Ecommerce Mar14torsionNo ratings yet

- Glen CoreDocument2 pagesGlen CoreChandreyee MannaNo ratings yet

- Brand Extension or Brand PretensionDocument24 pagesBrand Extension or Brand PretensionChandreyee MannaNo ratings yet

- 150 Most Common Regular VerbsDocument4 pages150 Most Common Regular VerbsyairherreraNo ratings yet

- MASM Tutorial PDFDocument10 pagesMASM Tutorial PDFShashankDwivediNo ratings yet

- Ra 1425 Rizal LawDocument7 pagesRa 1425 Rizal LawJulie-Mar Valleramos LabacladoNo ratings yet

- Bhagavad Gita: Chapter 18, Verse 47Document3 pagesBhagavad Gita: Chapter 18, Verse 47pankaj kararNo ratings yet

- Journal Entry DiscussionDocument8 pagesJournal Entry DiscussionAyesha Eunice SalvaleonNo ratings yet

- Reviewer in Intermediate Accounting IDocument9 pagesReviewer in Intermediate Accounting ICzarhiena SantiagoNo ratings yet

- Final Exam, Business EnglishDocument5 pagesFinal Exam, Business EnglishsubtleserpentNo ratings yet

- Notation For Chess PrimerDocument2 pagesNotation For Chess PrimerLuigi Battistini R.No ratings yet

- Life Stories and Travel UnitDocument3 pagesLife Stories and Travel UnitSamuel MatsinheNo ratings yet

- Self Respect MovementDocument2 pagesSelf Respect MovementJananee RajagopalanNo ratings yet

- Chrome Settings For CameraDocument6 pagesChrome Settings For CameraDeep BhanushaliNo ratings yet

- History of Filipino Mural (Filipino Americans: A Glorious History, A Golden Legacy)Document9 pagesHistory of Filipino Mural (Filipino Americans: A Glorious History, A Golden Legacy)Eliseo Art Arambulo SilvaNo ratings yet

- Research Paper 1 Eng Lang StudiesDocument4 pagesResearch Paper 1 Eng Lang Studiessastra damarNo ratings yet

- Cultural Briefing: Doing Business in Oman and the UAEDocument2 pagesCultural Briefing: Doing Business in Oman and the UAEAYA707No ratings yet

- The Beatles - Allan Kozinn Cap 8Document24 pagesThe Beatles - Allan Kozinn Cap 8Keka LopesNo ratings yet

- Development Proposal ReportDocument37 pagesDevelopment Proposal ReportJean-Pierre RouxNo ratings yet

- Toe Movement - v22 Print FormatDocument10 pagesToe Movement - v22 Print FormatbensonNo ratings yet

- MMS-TRG-OP-02F3 Narrative ReportDocument14 pagesMMS-TRG-OP-02F3 Narrative ReportCh Ma100% (1)

- Aaps Pronouns-ExplainedDocument2 pagesAaps Pronouns-Explainedapi-277377140No ratings yet

- OutletsDocument226 pagesOutletsPraveen Kumar Saini100% (1)

- 13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsDocument14 pages13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsWillSmathNo ratings yet

- Full Download Test Bank For Macroeconomics 11th Edition Arnold PDF Full ChapterDocument36 pagesFull Download Test Bank For Macroeconomics 11th Edition Arnold PDF Full Chaptervitalizefoothook.x05r100% (17)

- Write The Missing Words of The Verb To Be (Affirmative Form)Document1 pageWrite The Missing Words of The Verb To Be (Affirmative Form)Daa NnaNo ratings yet

- Vol 98364Document397 pagesVol 98364spiveynolaNo ratings yet