Professional Documents

Culture Documents

3a Bazzar

Uploaded by

Pradeep AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3a Bazzar

Uploaded by

Pradeep AgrawalCopyright:

Available Formats

An Analysis of Perception of Rural Consumers towards Organised Retail: A Case Study

of 3A Bazaar

Dr. S.K. Dubey*

Vivek Kumar Pathak**

Rajeev Kumar Malik***

Abstract: Retail is an emerging sector in India. Marketers are leaving no stone unturned to

influence the consumers by offering them products and services in various ways, at various

locations, in various forms, resulting in emergence of various retail formats throughout the

country. Paramount Trading Corp (Pvt.) Ltd has launched 3A Bazaar and taken the initiative

of uplifting and empowering rural India by enhancing reach of Information and quality

products. 3A Bazaar is a unique strategy to bring the first chain of rural retailing in India

through small stores and mobile vans. It is India's first shop on wheels to start in different

villages of JP Nagar, in Uttar Pradesh. It offers a wide range of products from Grocery to

FMCG, Cosmetics, Stationary and Women Accessories. The present study is an attempt to

analyse the perception of rural consumers towards organised retail with special reference to

3A Bazaar.

Key words: 3A Bazaar, Rural consumers, Organised retail, Perception

* Associate Professor, Faculty of Management Studies, Banaras Hindu University, Varanasi

** & *** Research Scholars, Faculty of Management Studies, Banaras Hindu University,

E-mail- dubey_sk@yahoo.com, vivekbizs@yahoo.co.in, rajeevcms@gmail.com

Mobile No.- 9415302077, 9450387713, 9795943341

Introduction: Are rural areas ill-suited for the organised retail business? This question has

assumed significant importance in the present time. At present, the penetration of organised

retail is very low in rural India. Approximately 10,000 out of 6, 00,000 villages in India have

access to organised retail services, but, the huge market potential is undisputable. India's rural

retail market is expected to go up to Rs. 2400 billion (US $ 58 billion, Approx.) by 2015

(Confederation of Indian Industries-YES Bank Study, 2007) helped by rising incomes and

changing consumption patterns. Current major players like ITC, Godrej and DSCL are

expanding their retail operations by setting up more stores, entering new states and offering

newer product categories. When organised retail first made its presence felt in rural India, it

wasnt a pure retailing operation targeting the rural masses. Initially it was more focussed on

the agri-inputs targeting farmers, but now, a shift has been seen towards non-farming

segments. Paramount Trading Corp (Pvt.) Ltd has launched 3A Bazaar and taken the

initiative of uplifting and empowering rural India by enhancing reach of Information and

quality products. 3A Bazaar is a unique strategy to bring the first chain of rural retailing in

India through small stores and mobile vans. It is India's first shop on wheels to start in

different villages of Moradabad & JP Nagar (Uttar Pradesh). Now 3A Bazaar has got three

stores at different locations in Moradabad and J.P. Nagar and 7 mobile vans are associated

with these stores and covers almost all the prominent villages of that area. It offers a wide

range of products from Grocery to FMCG, Cosmetics, Stationary and Women Accessories.

One practical problem that organised retail in rural areas faces is that of image. The products

are perceived as expensive and also the rural people find the ambience of the store

intimidating. The present study is an attempt to analyse the perception of rural consumers

towards organised retail with special reference to 3A Bazaar.

Review of Literature: Marketers are leaving no stone unturned to influence the consumers

by offering them products and services in various ways, at various locations, in various forms

resulting in emergence of various retail formats throughout the country.

According to Gupta & Mittal (2001), consumers are highly influenced by image of the retail

outlet, its attributes, product range, variety, services, employees behaviour, dcor, music and

marketing strategies.

According to Ghosh & Tripathi (2009), consumers choice of a particular store depends on

shopping orientation as well as satisfying experience. In addition, a customers attitude

towards the store may result from his / her evaluation of the perceived importance of store

attributes, moulded and remoulded by direct experiences with the stores overall offerings.

Rajesh Rajaguru and Margaret J Matanda (2007), opined that Store attributes are measured

using variables such as store appearance, service quality, and store conveniences and these

variables are more relevant to Indian context.

For the first time, Martineau (1958), defined store image as a store defined in customers

mind partly based on functional attributes and partly based on psychological attributes. Store

image includes its characteristic attributes and it makes customers feel the store different

from others. Functional attributes are assortment of commodities, layout, location, price value

relation, and service that consumers can objectively compare with other stores. Psychological

attributes are attractiveness and luxuriousness that represent special attributes of that store.

Research Methodology: Consumer characteristics, store attributes, store image, store choice

and retailing strategies are some of the key concepts that play a role in successful retailing.

The marketing mix as well as store image attributes all contributes to the overall store image,

which consumers apply to evaluate the store on a multi-attribute utility function. This study

endeavours to gather information on customers perception of 3A Bazaar.

Objectives of the study: The study includes the following objectives,

To determine the consumers overall perception about 3A Bazaar with special reference

to the marketing mix and store image attributes.

To study the difference in the perception of different income-group consumers on the

basis of individual components of marketing mix and store image attributes.

To study the difference in the perception of different age-group consumers on the basis of

individual components of marketing mix and store image attributes.

Sampling & Questionnaire design: A non-probability, convenience sampling method is

used to select both the stores and the respondents from J P Nagar (Uttar Pradesh). The stores

were chosen arbitrarily in convenient locations across the area of study. A total of 100

respondents were approached, out of which 81 completed responses are used. For the final

study, a structured questionnaire consisting of different sections is compiled in accordance

with the conceptual framework and study objectives. The various sections dealt with

marketing mix & store attributes and demographic information. A Likert-type scale varying

from 1 to 5 was used to measure the degree to which the variables under study vary with 1 =

poor degree and 5 = excellent degree.

Data analysis: The data obtained was statistically analysed using various statistical tools

such as mean, standard deviation and t test using SPSS package. t test was used to find out

significance difference between the perception of different age and income groups.

8

2

4

20

20

2

49

0 10 20 30 40 50 60

REGULAR

AT NEW PRODUCT LAUNCH

SEASONAL SALES AND DISCOUNT

FAMILY OCCASIONS

FESTIVAL

SEASONAL

RARE

NO. OF RESPONDENTS

P

E

R

I

O

D

O

F

P

U

R

C

H

A

S

E

Results and discussion: The results obtained from the study are presented here. Profile of

the consumers is presented first and the latter part deals with descriptive statistics and

hypothesis testing.

Consumer profile: Table: 1 shows the profile of the consumers of 3A Bazaar. It is clear

from the table that most of the consumers (61%), who shop at 3A Bazaar, are in between the

age group of 20-34 years i.e. younger generation. Furthermore, the consumers having a

monthly income between Rs. 10,000-20,000 per month (58%) are the main shoppers at 3A

Bazaar. It is also clear that Home and personal care goods (65%) are more sought after goods

followed by food and beverages (50%).

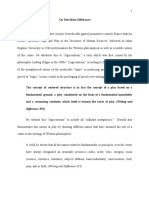

Further investigation of the data shows that consumers dont make a regular purchase at 3A

Bazaar (Figure: 1), only 10% of the respondents shop regularly at 3A Bazaar. The purchase is

mostly made at family occasions (25%) and in festival seasons (25%). More than half of the

respondents (60%) dont make a regular purchase at 3A bazaar.

Table: 1- Profile of the consumers of 3A Bazaar (N=81)

Age of Respondents

< 20 Years 20-34 Years 35-50 Years >50 Years

Number 4 50 19 8

Percentage 5 61 23 11

Income of Respondents (Rs./Month)

< Rs.10,000 Rs.10,000-Rs.20,000 >Rs.20,000

Number 30 47 4

Percentage 37 58 5

Types of Product Purchased

Food and Beverages Apparel Home and Personal care

Number 41 24 53

Percentage 50 30 65

Figure: 1-Period of purchase at 3A Bazaar

Descriptive statistics: A list of 19 individual components of marketing mix and store image

attributes were selected. Table:2 shows the mean values of responses received for different

individual components of marketing mix and store image attributes. Quality, availability,

range of products, & store ambience received the higher mean values (>4). Credit facility

received the lowest mean score (1.9933).

Hypothesis Testing: The following hypotheses were designed to be tested in order to attain

the objectives.

Ho1: Consumers overall perception of 3A Bazaar stores marketing mix and store image

attributes is not positive.

Ha1: Consumers overall perception of 3A Bazaar stores marketing mix and store image

attributes is positive.

The descriptive statistics shows that the sample mean of the consumers perception scores is

3.2250, with a standard deviation of .30977. It gives an indication that the Consumers

overall perception of 3A Bazaar stores marketing mix and store image attributes is positive.

Table: 2- Descriptive statistics showing the mean values of responses (Higher is better)

Attributes Mean

Statistic*

Attributes Mean

Statistic

Quality of products 4.2500 Fixed rate 3.3333

Availability of products 4.1800 Range of fresh stock 3.0833

Range of products 4.1667 Range of local items 2.8333

Store ambience 4.0833 Price of products 2.7500

Parking facility 4.0000 Convenient location 2.5000

Staff attitude 3.9167 Scheme and offers 2.4167

Ease of locating things 3.7500 Return/Exchange 2.3333

Time taken in billing 3.7500 Ability to bargain 2.2500

Operating time 3.5833 Credit facility 1.9933

Range of branded items 3.5833

Note: *Mean value of responses (in descending order) on a Likert-type scale varying from 1

to 5 (1 = poor degree and 5 = excellent degree).

One samplet test was conducted and the hypothesis that consumers overall perception of

3A Bazaar is positive (with test value=3, the midpoint of the scale) for selected stores

marketing mix and store image attributes was found to be statistically significant (p<.05).

Table:3 One Sample t test

Test Value = 3 *

95% Confidence Interval of

the Difference

t Df Sig. (1-tailed) Mean Difference Lower Upper

5.032 80 .000 .22500 .1351 .3149

Note: *Statistically significant at p<0.05, mean value compared with the midpoint of the

scale, ie., 3

In the One-Sample Test output, we see that t = 5.032 with a p-value of 0.00. Thus, at the

= .05 level of significance, null hypothesis is rejected in favour of the positive perception of

Consumers towards 3A Bazaars selected stores marketing mix and store image attributes.

For the individual components, only in the case of range of local items (p=.209>0.05), range

of fresh stocks (p=.455>0.05) & price of the products (p=.070>0.05), the perception was not

found to be positive.

H02: There is no significant difference in the perception of different income-group

consumers in terms of individual components of marketing mix and store image attributes.

Ha2: There is significant difference in the perception of different income-group consumers in

terms of individual components of marketing mix and store image attributes.

The significance value of t test in independent samples t test is 0.05. When the value of

the statistic is greater than 0.05, the groups have equal variance. An independent-samples t-

test was conducted to compare the perception scores for the two income groups (low income

group-up to Rs. 10,000 per month and high income Group- above Rs 10,000 per month).

There was no significant difference in scores for low income group (M = 3.23, SD =.327) and

high income group (M = 3.20, SD = .280); t (79) = -.392, p = .697 (two-tailed).

Table:4 Independent Samples- t Test for Income groups

Levene's Test for

Equality of Variances

t-test for Equality of Means*

F Sig. t df Sig. (2tailed)

Equal variances

assumed

.097 .757 .392 79 .697

Equal variances not

assumed

.413 34.588 .682

Note: *Statistically significant at p<0.05

The second hypothesis that there is significant difference in the perception of different

income-group consumers in terms of individual components of marketing mix and store

image attributes was not found to be statistically significant. The null hypothesis thus is not

rejected against the alternative hypothesis. The study found no significant difference in the

perception of different income groups (p>.05) except for the following attributes,

Table:5 Independent Samples- t Test for Income groups, significant*

Attributes F Sig.(2-

tailed)

Low income group High income group

Range of branded items 1.053 .002 3.87 3.00

Range of Local items 1.179 .000 2.50 3.50

Ability to bargain .357 .040 2.12 2.50

Return/Exchange 1.022 .029 2.50 2.00

Note: *Statistically significant at p<0.05

H03: There is no significant difference in the perception of different age-group consumers in

terms of individual components of marketing mix and store image attributes.

Ha3: There is significant difference in the perception of different age-group consumers in

terms of individual components of marketing mix and store image attributes.

An independent-samples t-test was conducted to compare the perception scores for the two

age groups (Gr-1-up to 35 years ie. younger generation & Gr-2 above 35 years of age). There

was no significant difference in scores for Gr-1 (M = 3.22, SD =.310) and Gr-2 age groups

(M = 3.12, SD = .320); t (79) = -.106, p = .916 (two-tailed). The third hypothesis that there is

significant difference in the perception of different age-group consumers in terms of

individual components of marketing mix and store image attributes was also not found to be

statistically significant. The null hypothesis thus is not rejected against the alternative

hypothesis.

Table:6 Independent Samples- t Test for Age groups

Levene's Test for

Equality of Variances

t-test for Equality of Means*

F Sig. t df Sig. (2tailed)

Equal variances

assumed

.083 .774 -.106 79 .916

Equal variances not

assumed

-.105 18.434 .918

Note: *Statistically significant at p<0.05

The study found no significant difference in the perception of different age groups (p>.05)

except for the following attributes,

Table:7 Independent Samples- t Test for Age groups, significant

Attributes F Sig.(2-tailed) Mean (Gr-1)* Mean (Gr-2)*

Range of fresh stocks .578 .028 3.22 2.66

Ability to bargain .162 .004 2.11 2.76

Fixed rate 1.822 .004 3.12 3.76

Note: * Gr-1= up to 35 years of age group, Gr-2= above 35 years of age group

Conclusion: As per the results of the study, the overall perception of rural consumers

regarding the selected stores marketing mix and store image attributes of 3A bazaar is

positive. However, even then the rural consumers dont make a regular purchase at such

stores. As the rural consumers have limited ability to pay, it is quite obvious from the analysis

that their perception regarding the price of the goods of 3A bazaar is not positive. Apart from

this the rural consumers search for local goods which are quit cheaper as compared to

branded items. The study also indicates that the perception of rural consumers towards the

product component of marketing mix is highly positive, with most of the product variables

receiving a mean response of more than four. The study also found that there is no significant

difference in the perception of different income-group/age-group consumers in terms of

individual components of marketing mix and store image attributes except for certain

variables. Range of branded items received low mean scores by high income group while

range of local items received low mean scores by low income group. For these two variables

there was a significant difference in the perception. To improve the flow of consumers to the

store the range of local items needs to be increased without compromising with the range of

branded items. The reason for not making a regular purchase at 3A bazaar can be attributed to

these factors. A detailed investigation in this area is needed.

Bibliography:

1. Gupta M and Mittal A, Consumer Perceptions towards Different Retail Formats in

India (October 24, 2011). Available at SSRN: http://ssrn.com/abstract=1948865

2. Ghosh P et. al (2010), Customer expectations of store attributes: A study of organized

retail outlets in India, Journal of retail and leisure property, vol-9,pp.-7587

3. Goswami, P and Mishra M (2009), Would Indian consumers move from kirana stores to

organized retailers when shoppingfor groceries?, Asia Pacific Journal of Marketing and

Logistics, Vol. 21, no. 1, pp. 127-143

4. Kotler P, Keller K, Koshy A, Zha M, (2008), Marketing Management: A South Asian

Perspective, 13/e, Pearson Education Ltd., New Delhi.

5. Martineau, Pierre (1958), The Personality of the Retail Store, Harvard Business

Review, vol.36, pp.47-55.

6. Mokhlis S (2008), Consumer Religiosity and the Importance of Store Attributes, The

Journal of Human Resource and Adult Learning, Vol. 4, no. 2, pp.122-134

7. Patel S et al.(2010), Study on Customer Perception of Planet Health Retail Pharmacy

Chain Store at Ahmedabad City, Asian journal of management research, pp337-347

8. Rajaguru R and Matanda M J (2007), Consumer Perception of Store and Product

Attributes and its Effect on Customer Loyalty within the Indian Retail Sector, Monash

university

9. Yoo S J and Chang Y J (2005), An Exploratory Research on the Store Image Attributes

Affecting its Store Loyalty, Seoul Journal of Business, Volume 11, no. 1, pp.19-40

10. http://business-standard.net.in/india/news/surinder-sud-foreign-retail-needs-rural-

roots/408649/ (Accessed on 30 Dec,2011)

11. http://www.moneycontrol.com/news/business/rural-retail-opportunity-expected-to-grow-

to-rs-2400bn_305251.html (Accessed on 30 Dec, 2011)

12. http://retailipedia.wordpress.com/2008/09/26/3a-bazar-anyone/ (Accessed on 18

th

Jan,

2012)

13. http://www.3abazaar.com/aboutus.html (Accessed on 28

th

Feb, 2012)

14. http://www.ibef.org/industry/retail.aspx (Accessed on 29

th

March, 2012)

15. http://www.drishtikona.com/archives/government_policyadministration/001508.php

(Accessed on 10th Nov,2011)

------------------------------------------------------------------------------------------------------------

DECLARATION

This is to declare that the paper entitled- An Analysis of Perception of Rural Consumers

towards Organised Retail: A Case Study of 3A Bazaar is the original work of the

author(s)- Dr. S.K.Dubey, Vivek Kumar Pathak & Rajeev Kumar Malik and that

the paper has not been submitted for publication anywhere else.

Dr. S.K. Dubey

Associate Professor

Faculty of Management Studies

Banaras Hindu University

Varanasi

Vivek Kumar Pathak Rajeev Kumar Malik

Research Scholar Research Scholar

Faculty of Management Studies Faculty of Management Studies

Banaras Hindu University Banaras Hindu University

Varanasi Varanasi

You might also like

- Western Railway CateringDocument18 pagesWestern Railway CateringPradeep AgrawalNo ratings yet

- Different Types of Advertising AppealsDocument5 pagesDifferent Types of Advertising AppealsPradeep AgrawalNo ratings yet

- Comm SkillsDocument34 pagesComm SkillsPradeep AgrawalNo ratings yet

- The Anatomy of Financial CrisisDocument16 pagesThe Anatomy of Financial CrisisPradeep AgrawalNo ratings yet

- Ambush MarketingDocument23 pagesAmbush MarketingPradeep AgrawalNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lesson PlanDocument2 pagesLesson Plannicole rigonNo ratings yet

- 2SB817 - 2SD1047 PDFDocument4 pages2SB817 - 2SD1047 PDFisaiasvaNo ratings yet

- Hima OPC Server ManualDocument36 pagesHima OPC Server ManualAshkan Khajouie100% (3)

- On Derridean Différance - UsiefDocument16 pagesOn Derridean Différance - UsiefS JEROME 2070505No ratings yet

- Soosan Crane Training: (Principles)Document119 pagesSoosan Crane Training: (Principles)Boumediene CHIKHAOUINo ratings yet

- TCL LD24D50 - Chassis MS09A-LA - (TKLE2413D) - Manual de Servicio PDFDocument41 pagesTCL LD24D50 - Chassis MS09A-LA - (TKLE2413D) - Manual de Servicio PDFFabian OrtuzarNo ratings yet

- FM 2030Document18 pagesFM 2030renaissancesamNo ratings yet

- Linguistics Is Descriptive, Not Prescriptive.: Prescriptive Grammar. Prescriptive Rules Tell You HowDocument2 pagesLinguistics Is Descriptive, Not Prescriptive.: Prescriptive Grammar. Prescriptive Rules Tell You HowMonette Rivera Villanueva100% (1)

- Crown WF-3000 1.2Document5 pagesCrown WF-3000 1.2Qirat KhanNo ratings yet

- SSGC-RSGLEG Draft Study On The Applicability of IAL To Cyber Threats Against Civil AviationDocument41 pagesSSGC-RSGLEG Draft Study On The Applicability of IAL To Cyber Threats Against Civil AviationPrachita AgrawalNo ratings yet

- Wilcoxon Matched Pairs Signed Rank TestDocument3 pagesWilcoxon Matched Pairs Signed Rank TestDawn Ilish Nicole DiezNo ratings yet

- MASONRYDocument8 pagesMASONRYJowelyn MaderalNo ratings yet

- PhraseologyDocument14 pagesPhraseologyiasminakhtar100% (1)

- UTP Student Industrial ReportDocument50 pagesUTP Student Industrial ReportAnwar HalimNo ratings yet

- Regions of Alaska PresentationDocument15 pagesRegions of Alaska Presentationapi-260890532No ratings yet

- Pe 03 - Course ModuleDocument42 pagesPe 03 - Course ModuleMARIEL ASINo ratings yet

- Dialogue Au Restaurant, Clients Et ServeurDocument9 pagesDialogue Au Restaurant, Clients Et ServeurbanuNo ratings yet

- DC 7 BrochureDocument4 pagesDC 7 Brochures_a_r_r_yNo ratings yet

- Technical Specification For 33KV VCB BoardDocument7 pagesTechnical Specification For 33KV VCB BoardDipankar ChatterjeeNo ratings yet

- Quantitative Methods For Economics and Business Lecture N. 5Document20 pagesQuantitative Methods For Economics and Business Lecture N. 5ghassen msakenNo ratings yet

- Introduction-: Microprocessor 68000Document13 pagesIntroduction-: Microprocessor 68000margyaNo ratings yet

- Online Extra: "Economists Suffer From Physics Envy"Document2 pagesOnline Extra: "Economists Suffer From Physics Envy"Bisto MasiloNo ratings yet

- Read While Being Blind.. Braille's Alphabet: Be Aware and Active !Document3 pagesRead While Being Blind.. Braille's Alphabet: Be Aware and Active !bitermanNo ratings yet

- 2021-03 Trophy LagerDocument11 pages2021-03 Trophy LagerAderayo OnipedeNo ratings yet

- 8.ZXSDR B8200 (L200) Principle and Hardware Structure Training Manual-45Document45 pages8.ZXSDR B8200 (L200) Principle and Hardware Structure Training Manual-45mehdi_mehdiNo ratings yet

- Heterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Document5 pagesHeterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Gabriel RoblesNo ratings yet

- Global Geo Reviewer MidtermDocument29 pagesGlobal Geo Reviewer Midtermbusinesslangto5No ratings yet

- The Mantel Colonized Nation Somalia 10 PDFDocument5 pagesThe Mantel Colonized Nation Somalia 10 PDFAhmad AbrahamNo ratings yet

- Fusion Implementing Offerings Using Functional Setup Manager PDFDocument51 pagesFusion Implementing Offerings Using Functional Setup Manager PDFSrinivasa Rao Asuru0% (1)

- Snapdragon 435 Processor Product Brief PDFDocument2 pagesSnapdragon 435 Processor Product Brief PDFrichardtao89No ratings yet