Professional Documents

Culture Documents

TR Conversa P

Uploaded by

Mark Reinhardt0 ratings0% found this document useful (0 votes)

26 views5 pagessource: accesscorrections.com

Original Title

Tr Conversa p

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsource: accesscorrections.com

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views5 pagesTR Conversa P

Uploaded by

Mark Reinhardtsource: accesscorrections.com

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

451.699-2-01/1 [Rev.

9/07] Texas Department of Banking

TRUST COMPANY

CONVERSION APPLICATION

INFORMATION AND INSTRUCTIONS

1. The original and two copies of the application form and all attachments should be delivered to

the Texas Department of Banking, 2601 North Lamar Boulevard, Austin, Texas 78705-4294.

Both the original and duplicate copy of the Articles of Association must bear the original

signatures of the proposed Board of Directors. Inquiries concerning the preparation and filing of

this or any other application with the Department should be directed to the Corporate Activities

Division of the Texas Department of Banking, 2601 North Lamar Boulevard, Austin, Texas

78705-4294 (512/475-1300).

2. A check payable to the Banking Commissioner of Texas is required as an application filing fee.

It is not refundable. Additional costs associated with the application may include fees connected

with the examination of the applicant bank.

3. In lieu of stockholders affidavits, the president of the applicant trust company or trust bank

must execute the form certifying that each stockholder of the trust company or trust bank will

receive the same pro rata interest in the trust company. Any deviations or changes must be fully

described.

4. Provide a complete shareholders list.

5. Attach a certified copy of the resolution adopted by the Board of Directors approving the

conversion.

6. Provide evidence that public notice of the conversion has been published in a newspaper of

general circulation in the home office and any branch locations.

7. Attach a copy of the institution's most recent Statement of Condition and Income or equivalent

regulatory reports.

8. Authority to Release Information and Biographical Report and Financial Information forms must

be completed for all directors, executive officers and principal shareholders. The Department

will accept the completed Interagency Biographical and Financial Report in lieu of the State

forms provided that the forms are accompanied by the executed and notarized signature pages on

the State forms.

9. Confirmation Inquiry forms are only required if any directors, executive officers or principal

shareholders propose to purchase additional stock as part of the conversion or if any proposed

shareholders will become principal shareholders as a part of the transaction.

451.699-2-01/2 [Rev. 9/07] Texas Department of Banking

TRUST COMPANY

CONVERSION APPLICATION

All information submitted to the Texas Department of Banking is presumed to be public information, unless it is deemed

confidential under the Texas Open Records Act. Any document in the application for which you request confidential

treatment must be segregated and reference the Texas Open Records Act exception supporting the request. Final

determination as to the confidentiality of any information will rest with the Banking Commissioner.

State the name, address and phone number of the person who will represent the applicant.

1. State the name and location of the proposed trust company. Section 182.002(b) of the Texas Finance

Code provides that the Commissioner may determine that the proposed trust company name may be

misleading to the public and require the organizers to select a different name.

____________________________________________________

Name

____________________________________________________

Street Address

____________________________________________________

City County State Zip Code

2. Provide full details of the capital structure of the proposed trust company including number and types of

authorized shares, par value, total capital stock account, surplus, and any other components of capital.

Also, state the initial amount of any reserves to be established.

3. State the names and addresses of the Board of Directors and any principal shareholders of the proposed

trust company. (Use additional sheets if necessary.)

4. State the names and addresses of the Board of Directors and any principal shareholders of the proposed

trust company. (Use additional sheets if necessary.)

5. State the position and name of the officers of the proposed trust company, and the position they now hold

with the existing financial institution.

6. If approved for conversion, will this institution be a member of the Federal Reserve System? Will the

institution be FDIC insured? Have the appropriate notices/filings been made with the Federal agencies?

7. Complete and attach biographical report forms for individuals proposed as principal shareholders,

directors and executive officers.

451.699-2-01/3 [Rev. 9/07] Texas Department of Banking

8. Complete and attach the financial information statements for individuals proposed as principal

shareholders, directors and executive officers.

9. List all existing facilities owned or leased by the trust company.

10. Has the institution been granted authority to operate a branch or other facility that is not yet opened? If

so, provide details.

11. Does the institution exercise any powers or engage in any activities or hold any investments that are not

currently authorized for a state trust company? If so, provide details.

12. If the institution is owned by a holding company provide detailed historical and financial information on

the holding company.

13. Is the institution operating under any commitments, agreements, formal or informal, or orders issued by a

regulatory agency? Are any such orders threatened? If so, provide full details.

14. Are there any assets or liabilities on the trust companys books that will be held in violation of state

statutes if the conversion is approved? If so, provide full details.

15. If there are any major changes anticipated in the trust companys current Strategic Plan, include a copy of

any proposed revisions.

16. The Commissioner is required, pursuant to Section 182.502 of The Texas Finance Code, to make certain

findings. Please address each of the required findings with respect to this application.

451.699-2-01/4 [Rev. 9/07] Texas Department of Banking

We, the Board of Directors of the proposed trust company, solemnly swear that the statements and representations

hereto made are true and correct to the best of our knowledge and belief, that the personal data and financial

statement submitted with this application is true and correct, and that this application is made in good faith, with

the purpose and intent that the affairs and business of the proposed corporation shall be honestly conducted upon

good and sound business principles.

THE STATE OF TEXAS

COUNTY OF _______________________

BEFORE ME, the undersigned authority, on this day personally appeared

known to me to be the persons described in and who executed the foregoing instrument and severally

acknowledged to me that they executed the same for the purposes and consideration therein expressed.

IN TESTIMONY, I have hereunto set my hand and affixed my seal of office, this __________ day of

_____________________________, __________.

_______________________________________________

(Notary Public)

________________________________________________

(Name Typed or Printed)

My commission expires: ___________________________

Date

451.699-2-01/5 [Rev. 9/07] Texas Department of Banking

Banking Commissioner of Texas

2601 North Lamar Boulevard

Austin, Texas 78705-4294

Dear Commissioner:

Please accept this letter as my certified statement that all stockholders at this time of conversion into a

trust company shall be issued one share of the common or preferred stock of (Trust Company) for each

share of the common or preferred stock of (Converting Entity) owned by them on the date the charter of

(Trust Company) is granted.

Sincerely,

President or Authorized Representative

Converting Entity

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Abramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFDocument424 pagesAbramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFptalus100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mathematics Into TypeDocument114 pagesMathematics Into TypeSimosBeikosNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- 20200206press Release IPC E 18 15Document1 page20200206press Release IPC E 18 15Mark ReinhardtNo ratings yet

- The First Rules of Los Angeles Police DepartmentDocument1 pageThe First Rules of Los Angeles Police DepartmentMark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- Transitioning Coal Plants To Nuclear PowerDocument43 pagesTransitioning Coal Plants To Nuclear PowerMark ReinhardtNo ratings yet

- Affidavit Writing Made EasyDocument6 pagesAffidavit Writing Made EasyMark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- NIYSTXDocument19 pagesNIYSTXMark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- HJR003Document1 pageHJR003Mark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- NIYSWADocument17 pagesNIYSWAMark ReinhardtNo ratings yet

- Idaho H0098 2021 SessionDocument4 pagesIdaho H0098 2021 SessionMark ReinhardtNo ratings yet

- NIYSVADocument15 pagesNIYSVAMark ReinhardtNo ratings yet

- NIYSTNDocument5 pagesNIYSTNMark ReinhardtNo ratings yet

- NIYSUTDocument4 pagesNIYSUTMark ReinhardtNo ratings yet

- NIYSVTDocument4 pagesNIYSVTMark ReinhardtNo ratings yet

- NIYSSCDocument11 pagesNIYSSCMark ReinhardtNo ratings yet

- NIYSPRDocument7 pagesNIYSPRMark ReinhardtNo ratings yet

- NIYSSDDocument4 pagesNIYSSDMark ReinhardtNo ratings yet

- NIYSWIDocument8 pagesNIYSWIMark ReinhardtNo ratings yet

- NIYSRIDocument9 pagesNIYSRIMark ReinhardtNo ratings yet

- NIYSPADocument8 pagesNIYSPAMark ReinhardtNo ratings yet

- Caregiving Learning Activity Sheet 3Document6 pagesCaregiving Learning Activity Sheet 3Juvy Lyn CondaNo ratings yet

- Entrenamiento 3412HTDocument1,092 pagesEntrenamiento 3412HTWuagner Montoya100% (5)

- Diane Mediano CareerinfographicDocument1 pageDiane Mediano Careerinfographicapi-344393975No ratings yet

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Document5 pagesInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroNo ratings yet

- IBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Document4 pagesIBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Sunny VarshneyNo ratings yet

- Maule M7 ChecklistDocument2 pagesMaule M7 ChecklistRameez33No ratings yet

- TEsis Doctoral en SuecoDocument312 pagesTEsis Doctoral en SuecoPruebaNo ratings yet

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDocument2 pagesTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiNo ratings yet

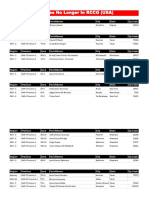

- Churches That Have Left RCCG 0722 PDFDocument2 pagesChurches That Have Left RCCG 0722 PDFKadiri JohnNo ratings yet

- InnovationDocument19 pagesInnovationPamela PlamenovaNo ratings yet

- Conrad John's ResumeDocument1 pageConrad John's ResumeTraining & OD HRODNo ratings yet

- GE 110HP DC Trolley MotorDocument10 pagesGE 110HP DC Trolley MotorAnthony PetersNo ratings yet

- SULTANS OF SWING - Dire Straits (Impresión)Document1 pageSULTANS OF SWING - Dire Straits (Impresión)fabio.mattos.tkd100% (1)

- Research Report On Energy Sector in GujaratDocument48 pagesResearch Report On Energy Sector in Gujaratratilal12No ratings yet

- PEG Catalog Siemens PDFDocument419 pagesPEG Catalog Siemens PDFrukmagoudNo ratings yet

- DMSCO Log Book Vol.25 1947Document49 pagesDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomNo ratings yet

- Personal Training Program Design Using FITT PrincipleDocument1 pagePersonal Training Program Design Using FITT PrincipleDan DanNo ratings yet

- Aero - 2013q2 Apu On DemandDocument32 pagesAero - 2013q2 Apu On DemandIvan MilosevicNo ratings yet

- MPU Self Reflection Peer ReviewDocument3 pagesMPU Self Reflection Peer ReviewysaNo ratings yet

- Weill Cornell Medicine International Tax QuestionaireDocument2 pagesWeill Cornell Medicine International Tax QuestionaireboxeritoNo ratings yet

- Student Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDocument2 pagesStudent Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDANIELA SIMONELLINo ratings yet

- Vce Smart Task 1 (Project Finance)Document7 pagesVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Intro To EthicsDocument4 pagesIntro To EthicsChris Jay RamosNo ratings yet

- FPSCDocument15 pagesFPSCBABER SULTANNo ratings yet

- Steven SheaDocument1 pageSteven Sheaapi-345674935No ratings yet

- EDCA PresentationDocument31 pagesEDCA PresentationToche DoceNo ratings yet

- A Professional Ethical Analysis - Mumleyr 022817 0344cst 1Document40 pagesA Professional Ethical Analysis - Mumleyr 022817 0344cst 1Syed Aquib AbbasNo ratings yet

- Sample Financial PlanDocument38 pagesSample Financial PlanPatrick IlaoNo ratings yet