Professional Documents

Culture Documents

Credit Lending Towrds Sme Sector

Uploaded by

Rahul VermanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Lending Towrds Sme Sector

Uploaded by

Rahul VermanCopyright:

Available Formats

Credit lending Towards SME sector

1

INSTITUTE FOR TECHNOLOGY AND MANAGEMENT

PGDM-FM

2013-2015

Summer project Report on

CREDIT LENDING TOWORDS SME SECTOR

A detailed study done in

Essel Finance

In the partial fulfilment of PGDM-FM 2013-2015 programme

By

Rahul

Roll No.201350092

Under the guidance of

Mr. Ramdas Acharya

Credit head

Essel Finance

And

Mrs. Latha Chari

Deputy director

ITM-Institute of Financial Markets

Credit lending Towards SME sector

2

CERTIFICATE

This is to certify that the project work entitled Credit Lending Towards SME

Sector has been carried out by the student Rahul of the Institute for Technology and

Management Financial Markets, Navi Mumbai doing the Post-Graduation Diploma

in Management Financial Markets 2013-2015, during his summer placement in

organisation between 21

st

June 2014 to 31

st

August 2014.

Submitted by: Rahul in partial fulfilment of the Post-Graduation Diploma in

Management Financial Markets 2013-2015 course.

Mr. Ramdas Acharya

Head Credit

Essel Finance.

Mrs. Latha Chari

Deputy Director

ITM-Institute of Financial Markets.

Credit lending Towards SME sector

3

Acknowledgement

It is my privilege to work on the project Credit Lending towards SME Sector . At the very

outset, I am obliged to Essel Finance for the permission to undertake training program and

provide me with the basic infrastructure and facilities.

I express my sincere sentiments of gratitude to Mr. Ramdas Acarya (Head Credit) who

guided me throughout this project

It is the spirit of being associated with the Credit department particular and Essel Finance in

general who inspired me to complete this project successfully.

I am indebted to my mentor Mrs Latha Chari for extending his untiring guidance to me, by

constantly discussing the project matter and helping me in clarifying my thinking in several

pertinent issues and providing a meaning full insight into the subject.

Last but not the least; I also thank Mr. Ruchir Kapoor (Business Head) who has been a

source of inspiration through his constant guidance, personal interest, encouragement and help

& has made my stay in the company such a pleasant memory. In spite of his busy schedule he

have always found time to guide me through the project. I am also grateful to all of them for

reposing confidence in my abilities and giving me the freedom to work on my project.

I owe my deep sense of gratitude and sincere thanks to all of them

Thank you.

Signature of the Student

Name: Rahul

Roll No.201350092

PGDM-FM(2013-15)

Institute of Financial Markets

Credit lending Towards SME sector

4

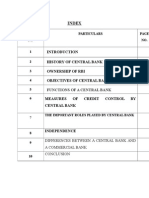

CONTENTS

SR.No Topic PAGE NO.

1. Tittle Page 1.

2. Certificate 2.

3. Acknowledgement 3.

4. Contents 4.

Project Report

1. Introduction .....05

2. MSME around the globe.....14

3. MSME in India....17

4. Company profile.24

5. Literature Review....34

6. How SME perceive financial Institution...36

7. Findings...45

8. Limitation ....46

9. Conclusion ...47

10. Recommendation ......48

11. Reference.....49

12. Annexures.....50

Credit lending Towards SME sector

5

INTRODUCTION

Small and Medium Enterprise (SMEs) have played a significant role world over in the

economic development of various countries. Over a period of time, it has been proved that

SMEs are dynamic, innovative and most importantly, the employer of first resort to millions

of people in the country. The sector is breeding ground for entrepreneurship.

The importance of SME sector is well-recognized world over owing to its significant

contribution in achieving various socio-economic objectives , such as employment generation

,contribution towards national GDP output and export , fostering new entrepreneurship and

to provide depth to the industrial base to the economy .Small and medium size enterprise

are the back bone of all economics and are a key source of economic growth , dynamism and

flexibility in advanced industrialized countries as well as in emerging and developing

economies

SMEs

[1]

constitute the dominant form of business organization, accounting for over 85% and

up to 90% of enterprise depending up on the country. They are responsible for between 50%-

60%

*

net job creation in developing countries. Small business is particularly important for

bringing innovative products or techniques to the market.

SMEs are vital for economic growth and development in both industrialized and developing

countries, by playing a key role in creating new jobs. Financing is necessary to help them to

set up and expand their operations, develop new products and invest in new staff or

production facilities .Many business starts as an idea from one or two people, who invest

their own money and probably turn to family and friends for financial help in return for a

share in the business. But if they are successful, there comes a time for all developing SMEs

when they need new investment to expand or innovate further. That is where they often run

into problems, because they find it much harder than larger businesses to obtain financing

from banks, capital markets or the other supplier of credit.

[1] World economic forum annual meeting 2014

Credit lending Towards SME sector

6

Overview

The Micro, Small and Medium Enterprise

sector is crucial to Indias economy. There are 36.17

million

[2]

enterprises in various industries, employing 80.52 million people. The sector

includes 2.61 million women-led

enterprises and 15.4 million rural enterprises. In all, the

MSME sector accounts for 45 percent of Indian industrial output and 40 percent of exports.

Although 94.5 percent of MSMEs are unregistered

[3]

, the contribution of the sector to Indias

GDP has been growing consistently at 11.5 percent a year, which is higher than the overall

GDP growth of 5.7 percent. Poor infrastructure and inadequate market linkages are key

factors that have constrained growth of the sector. The lack of adequate and timely access to

finance has been the biggest challenge. The financing needs of the sector depend on the size

of operation, industry, customer segment, and stage of development. Financial institutions

have limited their exposure to the sector due to a higher risk perception and limited access of

MSMEs to immovable collateral.

Figure 1: Broad Classification of the MSMEs in India

Source: MSME Census, NCEUS

[2]Ministry of Micro, Small and Medium Enterprise, Government of India estimates the population of Micro, Small and

Medium Enterprise in India to be 36.18 Million, the sector may also have a larger number of micro livelihood enterprises,

estimated to be 25-30 million.

[3]Registered Enterprise: MSMEs that file business information such as investment, nature of operations and manpower with

District Industry Centers (DICs) of the state/Union Territory are considered as registered enterprises.

Unregistered Enterprises: MSMEs that do not file business information with District Industry Centers (DICs) of the State/

Union Territory; the data on enterprise output performance is not adequately tracked by the government agencies.

There is a total finance requirement of INR 32.5 trillion ($650 billion) in the MSME sector,

which comprises of INR 26 trillion ($ 520 Billion) of debt demand and INR 6.5 trillion ($130

Billion) of equity demand. To estimate the debt demand that Financial Institutions would

consider financing in the near term, the study does not take into account the demand from

Total Number of

MSMEs 36.17

Million

Unorganized Sector

31 Million

Unregistered

MSMEs 34.17

Million

Registered Sector

2 Million

Credit lending Towards SME sector

7

the enterprises that are either not considered commercially viable by formal financial

institutions, or those enterprises that voluntarily exclude themselves from formal financial

services. Thus, after excluding (a) sick enterprises, (b) new enterprises (those with less than a

year in operation), (c) enterprises rejected by financial institutions (d) micro enterprises that

prefer finance from the informal sector, the viable and addressable debt demand is

estimated to be INR 9.9 trillion ($198 billion),which is 38 percent of the total debt demand.

The viable and addressable equity demand is estimated to be INR 0.67 trillion ($13.4 billion),

after excluding: (a) entrepreneurs equity contribution to enterprises estimated at INR 4.6

trillion ($92 billion) and, (b) equity demand from micro and small enterprises that are

structured as proprietorship or partnership[4], and are unable to absorb equity from external

sources. The second is estimated to be worth INR 1.23 trillion ($24.6 billion),

Flow of Finance to the MSME Sector

This study shows that of the overall finance demand of INR 32.5 trillion[5] ($650 billion), 78

percent, or INR 25.5 trillion ($510 billion) is either self-financed or from informal sources.

Formal sources cater to only 22 percent or INR 7 trillion ($140 billion) of the total MSME debt

financing. Within the formal financial sector, banks account for nearly 85 percent of debt

supply to the MSME sector, with Scheduled Commercial Banks comprising INR 5.9 Trillion

(USD 118 Billion). Non-Banking Finance Companies and smaller banks such as Regional Rural

Banks (RRBs), Urban Cooperative Banks (UCBs) and government financial institutions

(including State Financial Corporation and State Industrial Development Corporations)

constitute the rest of the formal MSME debt flow. Within the informal financial sector non-

institutional sources include family, friends, and family business, while institutional sources

comprise moneylenders and chit funds

[4] Proprietorship and partnership structures are not amenable to external equity without change in legal

structure

[5] RBI, SIDBI, Annual Reports of NBFCs and government of India on MSME, SME Times-2010, Primary Research, IFC-

Intellecap Analysis

Credit lending Towards SME sector

8

Figure 2: MSME Finance Demand Flowchart

[6]

MSME Finance Gap in the Sector

Despite the increase in financing to MSMEs in recent years, there is still a considerable

institutional finance gap of INR 20.9

[7]

trillion ($418 billion). After exclusions in the debt

demand (62 percent of the overall demand) and the equity demand (from MSMEs that are

structured as proprietorship or partnership), there is still a demand-supply gap of INR 3.57

trillion ($ 71.4 billion), which formal financial institutions can viably finance in the near term.

This is the demand-supply gap for approximately 11.3 million enterprises. While a large

number of these already receive some form of formal finance, they are significantly

underserved with only 40-70

[8]

percent of their demand currently being met. With

appropriate policy interventions and support to the MSME sector, a considerable part of the

currently excluded demand can be made financially viable for the formal financial sector. Of

the viable and addressable demand-supply gap, the debt gap is INR 2.93 trillion ($58.6 billion)

and the equity gap is INR 0.64 trillion ($12.8 billion). The micro, small, and medium enterprise

segments respectively account for INR 2.25 trillion ($45 billion), INR 0.5 trillion ($10 billion)

and INR 0.18 trillion ($3.6 billion), of the debt gap that is viable and can be addressed by

financial institutions in the near term. Micro and small enterprises together account for 97

Percent of the viable debt gap and can be addressed by financial institutions in the near term.

Available data and primary interviews indicate that medium enterprises in India are relatively

Estimated population of unorganized enterprise 30 million

[6] International finance crop (World Bank, 2013)

[7]Excludes entrepreneurs finance contribution of INR 4.6 Trillion (USD 92 Billion) (IFC-Intellecap Analysis)

[8]Different across Enterprise Type, Geographies and sectors

Credit lending Towards SME sector

9

well financed. The equity gap in the sector is a combined result of demand-side challenges

such as the legal structures of enterprises, as well as supply-side gaps, such as a lack of

investment funds focused on MSMEs.

Figure 3: Overall Finance Gap in MSME Sector (in INR Trillion)*

Geography & Type of Enterprise

An overview of the MSMEs spread across the country indicates that although the Low-

Income States

[9]

(LIS) have 32.6 percent of Indias total MSMEs, the viable debt gap is

disproportionately high at INR 1.93 trillion ($38.6 billion) or ~66 percent of the countrys

total. On the other hand, only ~3 percent MSMEs are based in the North-Eastern States,

accounting for a viable debt gap of INR 0.09 trillion ($1.8 billion). The rest of India accounts

for the remaining ~65 percent of MSMEs, with a viable and addressable debt-supply gap of

INR 0.9 trillion ($18.2 billion) or ~31 percent. Across India, there are significantly more service

sector enterprises than manufacturing units (~ 71 percent versus a 29 percent split

respectively). However, manufacturing enterprises are more capital-intensive with longer

working capital cycles, and consequently have higher working capital requirements.

Therefore, nearly 60 percent of the demand for finance arises from the manufacturing sector.

The share of the debt gap in the manufacturing sector is also considerably higher at 73

percent of the total gap.

Figures in brackets is in USD (billion)

Sources: MSME Census, RBI, SIDBI, Annual Reports World Bank

[9]Bihar, Chattisgarh, Jharkhand, Madhya Pradesh, Odisha, Rajasthan, Uttar Pradesh,West Bengal, and the north-eastern

states including Sikkim as low-income states with a high-potential.

Credit lending Towards SME sector

10

Enabling Environment for Growth of Finance in the MSME Sector

The three main pillars of the enabling environment analyzed in the study are: (a) legal and

regulatory framework (b) government support (c) financial infrastructure support. MSMEs

function in a highly competitive environment and require an enabling environment to sustain

growth. Well-rounded fiscal support, a strong policy framework, and incentives promoting

innovation by financial institutions can significantly increase the penetration of formal

financial services to the MSME sector.

Figure 4: Schematic of Key Elements of the Enabling Environment*

Problems & Challenges of MSME Sector

Despite its commendable contribution to the Nations economy, SME sector does not get the

required support from the concerned government departments, banking sectors, Financial

Institutions and corporate body, which is handicapped in becoming more competitive in the

National and International Markets and which needs to be taken up for immediate and

*Source: IFC-Intellecap Analysis (World Bank)

Credit lending Towards SME sector

11

proper reversal. SME faces a number of problems absence of adequate and timely banking

finance, limited knowledge and non-availability of sustainable technology, low production

capacity, follow up with various agencies in solving regular activities and lack of interaction

with government agencies on various matters.

In terms of the finding of the 4

th

census of SMEs 2006

[10]

, some of the major problems and

challenges faced by the SMEs and the factors responsible for the sickness are:

Infrastructure constraints/ bottlenecks

Delayed realization of receivables

Delayed or inadequate credit

High cost of fund

Obsolete technology, low R&D and technology up-gradation efforts

Complicated procedures of banks/NBFC regarding credit.

What MSME sector wants?

Growth and better Return On Capital Employed (ROCE)

Not lose an opportunity/bag maximum order

Financial requirement

Timely credit

Adequate credit

Latest technology for competitive edge

Better infrastructure

Information symmetry

A healthy growth of SME sector will definitely ensure sustenance and acceleration of Indian

economy in general and industrial growth in particular. Potential Interventions to Increase

Access to MSME Finance Building on the efforts already underway, there are several

potential interventions that can be undertaken to expand the access to MSME finance in

India through enabling infrastructure, liquidity management and risk management. Some of

these potential interventions include:

Enabling infrastructure

Encourage securitization of trade-receivables in the sector through conducive legal

infrastructure.

Promote institutions to syndicate finance and provide advisory support to MSMEs in rural

and semi-urban areas.

Incentivize formation of new MSME-specific venture funds by allowing existing government

equity funds to make anchor investment in venture funds

[10] MSME Annual Report 2012-13(government of India)

Credit lending Towards SME sector

12

Liquidity management

Improve debt access to non-banking finance companies focused on these enterprises and

provide regulatory incentives for participation in the sector.

Develop an IT-enabled platform to track MSME receivables to facilitate securitization of

these trade receivables, or alternatively expand the scope of SIDBI and NSEs IT-platform

NTREES

*

to facilitate securitization.

Provide credit guarantee support for MSME finance to non-banking finance companies.

Risk management

Develop a better understanding of financing patterns of service enterprises in the sector.

Expand the scope of the sectors credit information bureau to collate and process

important transaction data, including utility bill payment.

Strengthen the recently established collateral registry and create stronger linkages with

other financial infrastructure.

Methodology

In the process of completing this study several credible sources of data, including existing

research literature and industry publications annual reports has been referred. In addition, a

series of primary interviews and surveys were carried out to understand and evaluate the

size of the MSME finance market.

* NSE Trade Receivables Engine for E-discounting

Credit lending Towards SME sector

13

Conclusion

The common theme through this research and the interviews is the future potential of

MSME as sector, gap in credit , problems facing by MSME and to promote greater finance for

MSMEs in India and looking for innovative ways to overcome the current challenges to the

growth of this market, critical for national economic growth. Given the size and scope of this

market, the financial sector has a significant role to play in expanding their research to this

underserved and untapped segment in an enabling environment, facilitating sustainable

growth.

Credit lending Towards SME sector

14

MSME AROUND THE GLOBE

Introduction of MSME around the globe:

The financing of small and medium-size enterprises (SMEs) has been a subject of great

interest both to policy-makers and researchers because of the significance of SMEs in private

sectors around the world. Despite the non-prevalence of single universal definition, MSMEs

are clearly distinguishable in any country, be it a developed or a developing country. The

features that set them apart may broadly be classified into qualitative and comparative. On

the qualitative and comparative. On the qualitative side, the features may include decision-

making process, financial practices, internal management structure, trading styles, etc. Most

of the MSMEs are run by the single or few individuals or by their family or relatives. There is a

narrow line of discrimination between private and business assets, subjective and personal

factors play a larger role in decision-making. The comparative features have to do with the

way MSMEs are positioned vis-a-vis the large enterprises. They are small and medium sized in

comparison with the large corporate with which they share a given economic space. MSMEs,

therefore in varying sizes; MSMEs in one country may be larger than corporate defined in

another country. The interesting features is that, notwithstanding their absolute size, the

challenges confronting MSMEs appear to be similar n most countries whether developing or

developed country.

As the world economies are recovering from the financial crisis of 2008-09(popularly known

as Sub-Prime crisis), many economies need to create employment opportunities for their

growing citizen. So, in this respect, creation and the growth of SMEs is an important item on

the policy agenda of almost all the economies because of its significant contribution to the

economic growth of the nation. In addition, regulatory measures are necessary to ease

access to the formal financial services by SMEs. Historically, SMEs have been more likely

larger than firms to be denied new loans during a financial crisis.

Given the importance of SMEs in supporting sustainable, diversified, long-term economic

growth, they have indeed attracted renewed attention in the wake of 2008-09 financial

crises. In the year 2012 at Pittsburg G-20 summit, the G-20 members have committed to

identifying the lesson from the innovative approaches. Now in present scenario, SME

development is high on the reform agenda of many governments. Despite the importance of

SMEs for job creation and production, but the real fact is still that small and medium firm

face higher barriers to external financing compared with the large firms, which limits their

growth and development.

Credit lending Towards SME sector

15

World Banks MSME Programme:

Multilateral Investment Guarantee Agency (MIGA) of world Bank Group has developed a

guarantee programme called Small Investment Program (SIP) that is specially designed for

Small and Medium Enterprises(SMEs), MIGA helps the SME sector in emerging economies I

the following two ways:-

By providing political risk insurance to foreign investor directly who wish to invest

in SMEs

By providing political risk insurance to financial institution that in turn will lead to

small and medium sized business through local affiliates.

MIGAs SIP offers standard package of risk coverage including currency inconvertibility and

transfer restriction, expropriation, and war and civil disturbance. SIP guarantees have a term

of upto 10 years (3 year minimum), with the responsibility of an extension of upto 5 years at

the end of the original term, at MIGAs desecration. SIP covers upto 90% of the investment

for the equity and upto 95%for debt. For guarantee request programme .MIGA defines SMEs

that are eligible for coverage under this programme as units which fulfill the following

criteria:-

Not more than 300 employees.

Not more than $15 million of total assets.

Not more than $15 million of total annual sales.

Source: World Bank

Credit lending Towards SME sector

16

Definition of MSMEs in the emerging economies:

One of the major challenges for the MSMEs around the countries is the absence of universal

definition of what is MSME? Or what constitute of MSME? A number of efforts have been

aimed to streamline and harmonize SMEs definition, although the heterogeneity of SMEs

themselves and the nature of economy in which they operate-in might mean that

establishing a global definition is not feasible. The common definitions used by the regulators

for policy making decision are based on the number of employees, annual turnover and

investment in plant and machinery.

Table: 1 Definition of SMEs (figure shown are the maximum limit)

[11]

Country

Celling on o. of

Employees

Celling on Turnover

(US$ million )

Celling on Investment

(US$ million )

India 2.00*

Mexico 250 250 -

Brazil 250 - -

Jamaica 50 1.73 -

Laos PDR 99 0.25 0.15

South Africa 200 6.67 2.50

Kenya 100 9.65 -

China 2000 47.67 63.56

Taiwan 200 - 2.70

Japan 300 3.62

Indonesia 100 - -

Pakistan 250 2.75 0.30

South Korea 300 - 8.00

Malaysia 150 8.20 -

Philippines 150 - 2.30

Thailand 200 - 6.48

Singapore 200 - 12.00

Israel

100 - -

Bangladesh 99 - 1.22

UAE 250 68.00 -

EU 250 66.76 -

Srilanka 200 - 1.88

*For India Investment is calculated @1US$=Rs 50

[11] EXIM research & Policy Research Working Paper by World Bank

Credit lending Towards SME sector

17

MSMEs IN INDIA

As per the MSMED Act 2006 (Micro Small & Medium Enterprises Development Act); Micro Small and

Medium Enterprises were defined as an enterprise engaged in manufacturing/production or

preservation of goods subject to ceiling on investment in plant and machinery.

The same is now been modified vide RBI Master circular No.

RPCD.SME&NFS.BC.No.9/.06.02.31/2011-12 dated 1

st

July 2011.

An enterprise engaged in the manufacturing/production or preservation of goods or employing

plant and machinery in the process of value addition to the final product having a distinct name or

character to use.

In India the enterprises are classified broadly in two categories:

Manufacturing

Those engaged in providing/rendering of services

Both categories of enterprise have been further classified into micro, small and medium enterprises

based on their investment in plant and machinery (for manufacturing enterprises) or on equipments

(in case of enterprise providing or rendering services). The present celling on investment to be

classified as micro, small or medium enterprises is as under

Table: 2 Definition of MSME in India

Manufacturing Sector

Enterprises Investment in plant & machinery

Micro Enterprises Does not exceed twenty five lakh rupees

Small Enterprises More than twenty five lakh rupees but does not exceed five crore rupees

Medium

Enterprises

More than five crore rupees but does not exceed ten crore rupees

Service Sector

Enterprises Investment in equipment

Micro Enterprises Does not exceed ten lakh rupees:

Small Enterprises More than ten lakh rupees but does not exceed two crore rupees

Medium

Enterprises

More than two crore rupees but does not exceed five core rupees

Source: Ministry of MSME

Credit lending Towards SME sector

18

Table: 3 MSMED Act and its impact

Clause Salient Features Impact

Establishment of National and

Medium Enterprises Board with

maximum 47 members

Specific representation for

women.

Mandatory quarterly meetings

Statutory status, compact board

and quarterly meetings will

address problems of SMEs

immediately to take corrective

actions.

Concept of Enterprise Clear cut demarcation of

manufacturing/ production and

rendering services

Facilitate SMEs to enter into

service enterprise aggressively

Definition of Enterprise Specific celling limits of

manufacturing and service

enterprise.

Definition of medium enterprise

Existing small units can

graduate into medium and

facilities under the act

Source: Ministry of MSME&www.scribd.com

Performance:

The MSME sector in India contributes 45% of the manufacturing output and 49% of the total export

of our country. The country estimated to employ about 80.52 million in over 36.17 million uits

throughout the country. According to the Fourth All India Census of MSME sector, the size of

registered MSME was about 2 million units. This comprises 0f 67% of manufacturing enterprises and

33% of service enterprise. About 45% units were located in rural areas. Of the total working

enterprises, the proportion of micro, small and medium enterprises were 94.94%, 4.89% and 0.17%

respectively. Total export for the year from MSME sector stood at Rs.128,162* a lttele less than

previous year

[12]

.

* In US$ Million

[12] Press information bureau, Government of India, MSME

MSMEs performance over the years are showed separately at Annexure:A

Credit lending Towards SME sector

19

Figure.5. Distribution of MSME Enterprise across INDIA

SOURCE:IFC Intellecap Analysis (World Bank)

Credit lending Towards SME sector

20

Contribution in GDP of India

Table: 4 contribution of MSMEs in GDP

Contribution of MSEs(%)at an 1999-2000 pricces

Year

Total industrial production Gross Domestic Production(GDP)

2004-2005* 38.63 5.84

2005-2006* 38.56 5.83

2006-2007 45.62 7.20

2007-2008 45.24 8.00

2008-2009 44.86 8.72

The data upto 2005-2006 is for the SSI .

Source:MSME Annual Report 2012-2013, Ministry of MSME

Credit lending Towards SME sector

21

Classification of MSME Sector:

There are over 6000 products ranging from traditional to high-tech items, which are beig

manufactured by the MSMEs in India

Figure: 6 Leading Industries: MSMEs Sector

Source:MSME Annual reports 2012-13, Ministry of MSME.

PRODUCTS of MSMEs

More than 6000 products

Food products & Beverages

Retail Trade, Except of Motor Vehicles

And Motorcycles; Repair of Personal

and househol Goods

Manufacturing of Wearing

Apparel;Dressing And Dyeing

Other Sevices

Other Service Activities

Other Business Activity

Hotel and Restaurants

Sales, Maintenance And Repair of

Motor Vehicles And

Motorcycles;retail sales of

Automotive Fuel

Manufacture of

Furniture;Manufacturing N.E.C

Manufacturing of Fabricated Meta

Products, Except Machinery and

Equipement

Manufacturing of textiles

Credit lending Towards SME sector

22

Sickness of SMEs in India:

Growing incidence of sickness is yet another area of concern. When the sickness prolongs it

leads to the closure of units and unemployment. The mortality of the SSI units is high. This

has wider implications including locking of funds of the leading institutions, loss of scarce

material resources and loss of employment.

Table: 5 Data showing number of sick units

Source: Inter Ministerial Committee for MSME, September 2013

Credit lending Towards SME sector

23

Figure: 6 Reason for sickness of SMEs

Source: Smechamberofindia.com

0

10

20

30

40

50

60

70

80

Credit lending Towards SME sector

24

Company Overview

Introduction

Essel Group is an Indian conglomerate company headed by Subhash Chandra based in

Mumbai, Maharashtra .Essel Group has been a leading business conglomerate having diverse

business presence across finance, media, entertainment, packaging, infrastructure,

education, precious metals and technology sectors. It is headed by Mr. Subhash Chandra. It

has created an impressive track record of value creation in all around businesses that

compares well with their respective industry peers. Essel group strive to bring the latest

innovations and the best value offerings to all their consumers in the quest to deliver the

best in class. "Faith in innovative and organized growth" works as the guiding principle

behind every business at Essel and keeps committed to enhancing operational excellence

through greater focus on innovation and efficient resource utilization. With worldwide

operations and a workforce of over 8000 employees, Essel Group is growing in strength day

by day.

Founded in 1976 with a commodity trading and export firm. With its ardent passion and a

clear and focused vision, Essel has not only built and expanded new businesses but has built a

formidable and exemplary position in all these businesses in a short span of time. Essel has

grown to become a strong integrated media network in India with presence across the entire

value chain, developing and adopting new technologies to remain ahead of the growth curve.

Essel offers a strong portfolio of numerous entertainment and news channels, reaching

millions of viewers in India and internationally. "ZEE" is considered as one of the strongest

Indian Media brands across the world. Essels print venture "DNA" an English daily, provides

responsible journalism to its readers.

Essel's distribution arms 'Dish TV' and 'WWIL' with their vast reach across the country

provides quality viewership experience to millions of subscribers and is well poised to take

advantage of the mandatory digitization of the distribution platforms in the country.

Essel has made a successful foray into socially relevant business ventures such as

infrastructure and education. Essel Infrastructure is engaged into construction of roads,

power plants and urban infrastructure development and has built an impressive order book.

Essel has established a vast network of preschools across the country shaping young minds to

drive Indias future. Essel is currently building its network of K-12 schools and vocational

training centres expanding its reach to millions of students in the country.

Another Group venture - "Essel Propack", a laminated tube manufacturer, is considered to be

one of the largest in the world. Essel has also undertaken new ventures such as precious

metals which has a promising outlook.

Our companies are at an exciting juncture of their business journey, as they continue to

expand their product offerings and explore new markets. Having attained respectable scales

in most of its businesses, Essel is now pursuing the next level of growth. We are committed

Credit lending Towards SME sector

25

to adopt and develop new technologies to provide a wider range of offerings and a better

experience to our consumers. Given Essels growth potential and increasing international

outlook, the promoters as well as the entities in the Group continue to pursue fund-raising

opportunities both domestically and in the international markets. Essel with its experience

and resources will keep tapping new growth opportunities.

GROUP PROFILE

MEDIA

Zee Entertainment Enterprises Ltd - Zee Entertainment Enterprises Limited is one of India's

leading television media and entertainment companies. It is amongst the largest producers

and aggregators of Hindi programming in the world, with an extensive library housing over

120,000 hours of television content.

Zee Media Corporation Ltd - Zee Media Corporation Limited is India's largest News Network,

with 10 channels, reaching out to over 130 million viewers through its national and regional

channels across India as well as those of its digital properties like zeenews.com and

dnaindia.com.

dna

dna is a daily, English-language broadsheet owned by Diligent Media Corporation Limited, an

Essel Group company. In a short span of 9 years, dna has entrenched itself into the lives of

the young and dynamic readers through its news, views, analyses and interactivity with a

composite unbiased picture of the city, the country and the world around them.

TECHNOLOGY

Dish TV - Asia's largest Direct to Home Entertainment Company, DishTV is the pioneer when

it comes to digital entertainment.

SITI Cable Network Ltd - SITI Cable Network Limited is one of India's leading Multi System

Operators (MSO)

Cyquator Technologies Limited - an IT infrastructure outsourcing company that provides end-

to-end Internet Data center and high-end managed hosting services.

PACKAGING

Essel Propack - It is the largest specialty packaging company manufacturing laminated

and seamless or extruded plastic tubes. With over 2500 people representing 25 different

nationalities, Essel Propack functions through 24 state of the art facilities in twelve countries,

selling more than 5 billion tubes and continuing to grow every year.

Credit lending Towards SME sector

26

ENTERTAINMENT

Pan India Network Pvt Ltd - Playwin, India's first and largest online gaming company, provides

infrastructure, data communication, marketing support and service to facilitate a secure

online lottery network.

Pan India Paryatan Private Limited - PIPPL owns and operates India's most favourite

entertainment parks, 'EsselWorld' and 'Water Kingdom' located at Gorai, Mumbai.

'EsselWorld' - launched in 1989 is the largest amusement park in the country & 'Water

Kingdom' - commissioned in 1998 adjacent to the EsselWorld, are the largest Theme Water

Parks in Asia.

E-City Bioscope Entertainment Pvt Ltd - A chain of multiplex cinema cum- family activity

centers across non-metro towns in India.

Fun Multiplex Pvt Ltd - One of the premier cinema chains in India, Fun Cinemas has a Pan-

India footprint covering 82 screens across 20 cities. FMPL garners about 10% of market share

among top national chains despite the huge growth in the category with numerous new

players.

E-City Digital Cinemas - E-City Digital Cinemas is committed to revolutionising the

Indian movie business by implementing state-of-the-art digital technology at the various

independent cinema houses in this fragmented industry.

INFRASTRUCTURE

Essel Infraprojects Limited - One of the fastest growing companies having diversified interests

in infrastructure projects, Essel Infraprojects Ltd. is a successful venture with three key

Strategic Business Units in areas of Core Infrastructure, Green Solutions & Integrated Utilities

Services.

Smart Utilities - Smart Utilities is India's first integrated utilities brand- a consumer-centric

integrated utility services brand delivering smart value and efficiency.

E-City Real Estate Pvt. Ltd - The Company behind the successful lifestyle brand Fun Republic -

currently operates 4 lifestyle malls in Mumbai, Chandigarh, Lucknow and Coimbatore. The

Company aims to operate successful retail formats that align the interests of operators,

retailers and consumers providing an ideal size and brand mix.

Siti Energy Limited (SEL) - It is incorporated under Companies Act 1956 to inter-alia,

implement the Piped Natural Gas (PNG) and Compressed Natural Gas (CNG) project for

Credit lending Towards SME sector

27

various application in the Domestic, Commercial, Industrial & Automotive sectors in Indian

cities.

E-City Property Management Systems - EPMS is an E-City Venture that provides the most

comprehensive and reliable property management services in India, including overall

operations, marketing, consultancy, occupant management, retail leasing services and

advisory services.

EDUCATION

Zee Learn - The education arm, through its chain of pre-schools (Kidzee), K-12 schools (Mount

Litera) and youth institutes (ZICA and ZIMA) promises to give light to the paths of children

and youngsters who wish to realise their potential in order to set foot on the path of

development. Zee Learn's purpose is to improve human capital via quality education.

HEALTHY LIFESTYLE & WELLNESS

Veria Living - Veria Living is a leading media brand devoted to showcasing healthy lifestyle

and wellness programming and related content across multiple media platforms in the

United States and beyond.

PRECIOUS METALS

Shirpur Gold Refinery Ltd - It is one of the leading players in the precious metals market in

India. With state-of-the-art refining & minting processes and professionally driven

management coupled with experienced manpower, SGRL takes pride in producing gold &

silver bars and coins which meet the strictest international standards in quality.

FINANCIAL SERVICES

Essel Finance - Essel Finance is a customer-centric, pioneer financial services firm arranged

into three business groups - commercial finance, investment banking and private equity.

Credit lending Towards SME sector

28

EESEL FINANCE BUSSINESS LOAN LTD.

Essel Finance Business Loans Limited, a registered Non Banking Finance Company (NBFC)

with Reserve Bank of India (RBI) is the lending arm of Essel Finance, providing innovative

financial services to micro, small, and medium enterprises.

The micro, small and medium enterprise (MSME) sector has often been termed the engine of

growth for developing economies.

Even though the success of small and medium enterprises in India constitutes one of the key

drivers of GDP growth and employment, the access to finance in this segment has often been

limited.

Essel Finance Business Loans is founded to cater to this underserved segment. With its highly

specialized financial solutions that focus on green field micro entrepreneurs and small and mid

segment growth oriented enterprises, Essel Finance inspires SMEs to dream big and grow.

Whether you need to fund a commercial property purchase or invest in plant and machinery,

avail working capital facilities or corporate backed supply chain solutions, or are looking to

discount receivables or lease rentals, Essel Finance will help you catalyze each one of your

business aspirations aligned to your particular needs.

Understanding credentials that extend beyond financial statements and taking a comprehensive

approach to evaluating business, we at Essel Finance help enterprises reach their true potential.

Credit lending Towards SME sector

29

EFBLL offers two Products. Mortgage Finance and Equipment Finance.

Mortgage Finance.

SME Mortgage Finance Product focuses on providing long term finance to entities for the

purpose of business expansion and to create self-owned infrastructure. Financing is offered

for Purchasing of Commercial or Industrial Premises, Construction of Commercial/Industrial

Premises and Loan against Residential Premises. The guidelines for this product will be

approved by the Risk Management Committee as per the Risk Management Committee

charter and subsequently ratified by the Board of Directors.

Equipment Finance.

SME Equipment Finance Product extends the financing for the purpose of acquiring new or

refurbished machines/equipment from the manufacturer or the dealer. Financing is offered

for Purchase of New Machinery/Equipment(Domestic & Imported), Purchase of Refurbished

Machinery/Equipment(Domestic & Imported) and Refinance Loan-Financing of Existing Free

asset in form of Machinery/Equipment. The guidelines for this product will be approved by

the Risk Management Committee as per the Risk Management Committee charter and

subsequently ratified by the Board of Directors.

UNDERWRITING APPROACHES

EFBLL adopts a holistic approach to the credit assessment of the customer. One of the key

ratios in its assessment methodology pertains to Fixed Obligation to Income Ratio(FOIR).

Fixed obligations refer to all the loan obligations in the form of EMI including the obligation

being created out of the proposed loan. Income is the amount derived from various

approaches of income estimation given in the policy. The obligations are only loan obligations

and do not include PF, Professional Tax, LIC premium, Recurring Deposit scheme charity to

trust etc.

Credit lending Towards SME sector

30

Key Credit Appraisal Methodologies.

1) Past Financial Assessment.

This method establishes the customers eligibility on the basis of his past financial

documents like Salary Slip, Balance Sheet, P&L Statements, Income Tax Returns (ITR),

Audit Reports etc. This is the most common method and the loans advanced under

this method have a lower margin on the asset vis--vis any other method. External

Credit Ratings also tend to use traditional analysis as basis for arriving at their Credit

Rating.

There are two methods to calculate eligible income under Past Financial Assessment.

Cash Profit Method and Top Line Assessment

2) Projections Based Approach

The method uses only future projections generated by the customer. Techno

economic feasibility is carried out to validate the projections. Once validated DSCR

concept is used to establish loan repayment capability of the borrower especially in

Project Funding

3) Hybrid Approach

This method is applicable to existing SMEs going for expansion or purchase of value

generating equipments which adds to the Balance Sheet and P & L directly after

utilization of such funds. In this approach a reference to past financials is taken, CAGR

concept is applied for projection and repayment capability is calculated based on the

average DSCR.

4) Revenue Generating Approach

Under this approach appraisal is done on the revenue generating ability of the

collateral. The charge may or may not be created on the rentals from the asset

depending on the contractual nature of the revenue and asset being financed. In such

methods financial assessment of the entity assumes negligible importance.

Lease Rental Discounting, where the collateral which is coming for the funding is

generating revenue in terms of rentals and the rents received from this property are

considered as the base for income assessment of the customer. The charge is created

on the rentals from the property and the same is escrowed into an account on which

the lender has a first charge.

Credit lending Towards SME sector

31

5) Cash Flow/ Receivable/ Bill Discounting Approach

The approach is used to fund invoices raised by the customer (producer of goods or

services) or on the customer with or without recourse. Assessment of credit

worthiness of the payee depends on the rating of such institution. This may be applied

on sales side or purchase side under different variants of the product. In this method

the asset ceases to be in existence with the revenue / cash receipt. Financial appraisal

of the entity depends on the Payees strength and whether a transaction is with or

without recourse. Products under this method: Factoring, Supply Chain Solutions,

Forfaiting. Fee Receivables Discounting, where the collateral is in the form of an

escrow on the fees receivable from students of the Educational Institution which has

availed of the funding for any expansion purposes. The fees receivable are considered

as base for income assessment whiles the property is taken as additional collateral.

6) Surrogate Income Approach

In SME cases, the documentation available such as IT returns, profit and loss accounts

may not be reflective of the actual income of the borrower. Accordingly, the loan

eligibility of the borrower is determined based on evaluation of alternate criteria to

determine the his repayment capacity & corresponding loan eligibility. Products under

this method: Retail Consumer Loans under Repayment track, banking surrogate,

subjective assessment of income by in-house or outsourced credit.

Banking Surrogate (BS)/Banking Turnover Surrogate (BTS) Under this method, the

customers bank records for the past 12 months are taken. The bank statement of the

customer is an indicator of his ability and intention to pay (bounces), inflows,

outflows, average bank balance which is a reflection of the customers turnover, cash

flows which may not necessarily be documented in the reported financials of the

customer. This product has worked well with players who have launched this scheme

and delinquencies are very low in this scheme. Besides, the pricing on these loans is

much better that the Cash flow /income based method and also margins are higher

that the cash flow/ income based method.

Repayment Track Record (RTR) Under this method, the customers ability and

intention to pay is derived from loans that he has been paying over a reasonable

period of time. The customers eligibility is derived by giving him a multiplier on the

loans that he has been servicing for a reasonable period of time. The rationale is that

since the customer has been paying a certain amount of repayment every month for a

Credit lending Towards SME sector

32

reasonably long period, he will continue to do so we grant him a loan such that his

obligations increase by a maximum of 15-25% over his existing loans. The margin on

the asset is much higher than the banking surrogate scheme and the pricing as well.

Debt Consolidation (DC) This scheme is used under SME Mortgage Loans wherein

the customer has various loans running and at higher rates of interest. The customer

with the intention of consolidating these multiple loans into a single loan and to

leverage on the property value avails of this facility. This enables the customer to get a

better rate than the previous loan and also for a longer tenor and all the existing loans

as directly closed by the financier against the loan sanctioned to the customer. The

pricing is higher than the regular Loan against Property (LAP) loans based on Cash

profit/income based method.

EMI Consolidation (EC) This scheme is used under for LAP wherein the customer has

various loans running and at higher rates of interest. The customer with the intention

of consolidating these multiple loans into a single loan and to leverage on the property

value avails of this facility. This enables in ease of debt management and also

decreases his financial burden. EMI which are being considered are closed by the

financier against the loan sanctioned to the customer. The pricing is higher than the

regular LAP loans based on Cash profit/income based method.

7) Collateral Based Funding Approach

EMI Consolidation (EC) This scheme is used under for LAP wherein the customer has

various loans running and at higher rates of interest. The customer with the intention

of consolidating these multiple loans into a single loan and to leverage on the property

value avails of this facility. This enables in ease of debt management and also

decreases his financial burden. EMI which are being considered are closed by the

financier against the loan sanctioned to the customer. The pricing is higher than the

regular LAP loans based on Cash profit/income based method.

Credit lending Towards SME sector

33

Literature review

For the report on Credit lending Towards SME Sector, I have referred to different papers

published by the government as well as individual authors from time-to-time and drawn

inference from them-

1. Financing SMEs- An Industry Perspective by R. Seshasayee, July-Sept 2008

This paper emphasizes on the role played by the confederation of Indian Industry (CII).

Confederation of Indian Industry (CII) has been involved inn the promotion of SMEs sector

since inception. CII strongly believes that employment will be best served by promotion of

the small sector. Promotion of SME sector addresses other larger problems of regional

equity, income distribution and strain on urban infrastructure. Thus, approximately 80% of

CIIs members are from the SME sector. CII has been deeply involved in their development

and modernization including concept of quality management, energy conservation,

globalization and technology upgraditation to its members-companies. It also undertakes

dedicated measures for marketing linkages and access to export marketing for SME units.

1. Report of the Working Group for MSMEs growth for 12

th

five year plan(2012-

2017)

The National manufacturing Policy envisages increasing the sectorial share of Manufacturing

in GDP to 25% over next decade and generating additional 100 million jobs in manufacturing

sector through an annual average growth rate of 12-14% in manufacturing sector. MSME

sector is the major base of manufacturing sector in India with its contribution over 45% in

overall industrial output. To achieve these ambitious targets of National Manufacturing

Policy, the working group on MSME Growth looks forward to enhance the growth rate of

MSME sector substantially from the existing level 12-14% growth rate.

3. Bank financing for SMEs around the world by World Banks Development Research

Group.

This paper is based on the survey conducted by the Development Research Group of World

Bank. This survey is done by collecting the data from 91 banks around 41 countries in the

world. This survey is sub-divided in to three segments- First, how bank perceive SME

segment, discussing the factors driving and implementing SME finance. Second- the business

models banks have adopted to serve SMEs and finally- the extent and type of bank lending to

SMEs

Credit lending Towards SME sector

34

4. Micro, Small and Medium Enterprise finance in India by International Finance

Corporation, World Bank.

This paper aims to provide an assessment of the Micro, Small and Medium Enterprise sector

(MSME) finance in India. It highlights the key characteristics of the MSME sector, and assess

the demand for, and the flow of finance into the sector. The study also evaluates the

consequent gap in the financing needs of MSMEs. Finally, it explores potential interventions

to address the lack of access to formal finance for MSMEs.

5. Empowering MSMEs for financial Inclusion and Growth-role of Banks & Industry

Association by K.C. Chakraborty

This paper by Dr. K.C. Chakraborty explains the role of MSMEs toward the growth of financial

development of the country. This also deals with the roles of banks and other financial

Institutions for financing the need of the MSMEs.

Credit lending Towards SME sector

35

HOW SMEs PERCEIVE BANK/NBFC FINACE

About the survey and its objectives:

To gather information on bank finance to SMEs and the major issues faced by the SMEs in

raising money from financial institution. I have designed a survey questioner 13 different

questions focusing how the SMEs get funds to run their business, what are the major

obstacles they face in raising funds from financial institution and if they gets loan from the

bank/NBFC than for what purpose they use those funds. The survey was mainly focused on

the SMEs situated at MIDC Mahape, MIDC Taloja and several Industrial Associations in

Mumbai district. These areas was selected, because of its immense gathering of SMEs and

multiple industry operates in that area, so it has helped me to gather information from

different types of industries which becomes helpful in cross-industry analysis.

Result of Survey

In lieu of the above survey, I have visited more than 75 SME units but out of which 54 shared

the information and solved the questioner and 21 denied to share any data, so in percentage

terms I was able to collect data from 72% of the units I visited. The industry visited from

different sectors across the spectrum viz Heavy Metals, Rubber, Chemicals, Steels, Textile

prints, Paper, plastics and service industry etc. Sample survey conducted by me also proves

that there is a wide gap of fund flow between SME sector and financial Institution. The units

visited are basically Micro & Small enterprises. Survey also shown that MSMEs are unaware

of various schemes sponsored by the Government and other government agencies for the

betterment of SMEs. While talking to various Associations it was noted that every year there

are lots of cases relating to sickness of enterprises in that area. According to the CII in

Mumbai alone on an average 4 SME units are shut down alone in Mumbai area per week .

The main reason sighted by them is lack in technology innovation, old traditional followed to

run business or credit crunch.

Credit lending Towards SME sector

36

Table: 01.Demographic profile of sample

Demographic Number of Respondent Percentage of Respondent

Organizational Stricture

i. Proprietorship 32 60.00

ii. Partnership 19 35.50

iii. company 03 6.50

Total respondents 54

Industry Covered

i. Heavy metal 10 13.00

ii.Chemical 12 16.00

iii.Rubber 05 7.00

iv.Steel utensils 09 12.00

v.Textile Prints 06 8.00

vi. Paper 08 11.00

vii. Auto Accessories 02 3.00

viii. Electrical 06 8.00

ix. Service Industry 09 12.00

x. Plastic 01 1.00

xi. Food processing 01 1.00

xii. Printing 06 8.00

Total No. of Co. visited 75 100.00

Credit lending Towards SME sector

37

Data Analysis and Interpretation

1. Sources of finance

Table: 02. To know about the source of finance for SMEs

Sources of Fund Number of Respondent

Owners own fund 17

Bank Finance 10

Owners plus Bank Finance 14

Owners Fund plus Finance from other

sources

05

Finance from other sources 06

Total no. of respondent 52

Two of the respondent did not answer this question even asking few times to fill.

Interpretation: Form the survey; it is found that only 29% of SME situated in the above

mentioned area avail NBFC loan facilities. Whereas private banks have a good penetration

and channel through which they reaches to SMEs. It was also found that some of the banks

uses its NBFC sources to channelize the fund. The report also clarifies that though the area is

located in tier 1 city and too in an industrial zone still the people are not aware fo different

schemes sponsored by the Government and it bodies, thus therefore from this fact any one

can gauge what might be the condition of the SMEs across the country

Sources of finance

Owners own fund

Bank Finance

Owners plus Bank Finance

Owners Fund plus Finance

from other sources

Finance from other sources

Credit lending Towards SME sector

38

Comment: with the economy is reviving NBFC should try to cover the above un-tap market

and increase its credit portfolio with better dudeligence.

2. Obstacles faced in growth of the enterprises:

Table: 03. To know about the Obstacles faced in growth

Major Obstacles No. of Respondent

Frequent need to renew the equipment 09

Instability of demand of products & supply 08

Obtaining adequate fianc 18

Low profitability of the sector 10

Taxation level 9

Total No. of Respondent 54

Interpretation: The survey shows that one of the major problem SMEs faces in the growth of

its firm is adequate finance to 18 out of 52 units. Many MSME industry people doesnt know

the various schemes run by the government and its agencies.

Comment: One of the biggest issues in the growth is related to finance, moreover SIDBI and

various Regional Rural Banks who are instructed to finance by the government are outsource

Major problem faced by the MSME

Frequent need to renew the

equipment

Instability of demand of

products & supply

Obtaining adequate fianc

Low profitability of the sector

Taxation level

Credit lending Towards SME sector

39

their funding to private NBFCs, who funds them at higher rate of interest and takes long time

to disperse the loan

3. Ever raised funds from Banks & other Financial Institution

Table: 04. To know whether SME raised funds

Raised Funds No. of Respondent

Yes 25

No 29

Total number 54

Interpretation: From the 54 respondents, only 25 had raised funds from the organized

sectors i.e; banks and other financial institution while 28 said either they have raised from

their friends or relative or invested their own savings.

Comment: Financial should provide attractive financing schemes with lower rate of interest

and timely credit to the SME borrowers. The loan procedure should be hassle free and should

take least time to disperse the fund.

23

24

25

26

27

28

29

30

Yes No

Ever raised funds

Ever raised funds

Credit lending Towards SME sector

40

4. Type of loan taken

Table: 05.Type of loan taken

Type of loan Number of respondent

Term loan 05

Working Capital/CC 14

Letter of credit 0

Others 06

Interpretation: From the above data, it can be noted that cc is the most common form f loan

taken by the SMEs instead of instead of higher rate of interest rate resulting 14 SMEs

choosing out of 29. It can also be noted down that the government through in its budget

keep a huge amount of corpus fund with SIDBI for financing SMEs under its sponsored

schemes of CGTMSE; it is less popular among SMEs. Only one respondent was aware about

the schemes as he has tale loan from SIDBI at lower rate of interest.

Comment: Financial Institution should promote its different schemes with a lower rate of

interest.

Type of laon taken

Term loan

Working Capital/CC

Letter of credit

Others

Credit lending Towards SME sector

41

5. Purpose of the loan

Table: 06.To know the purpose of the loan

Purpose Number of Respondent

Increase in production 07

Modernization & upgraditation of Technology 10

Storing of raw materials 08

Real Estate acquisition 0

Total 25

Interpretation: Modernization & upgraditation of technology need more funds for the SMEs

and hence the loan taken from the banks is used basically for this purpose, since most firms

become sick due to lack of improvisation in technology. Warehousing of raw materials to

carry out the production also need huge funds for the firm because of volatile market

condition and fare raising input cost.

Comment: Financial institution should give loan to SMEs for technology upgraditation at a

lower rate based on the life of the machinery and also promote the various technology

upgraditation loans present in their lending portfolio.

Purpose of loan

Increase in production

Modernization & upgraditation

of Technology

Storing of raw materials

Credit lending Towards SME sector

42

6. Satisfaction level after obtaining loan

Table: 07. to know the satisfaction level after various aspects of obtaining loan

Various Aspects PSBs Private Banks NBFC

The amount granted

by the bank relative

to the amount

requested

04 04 05

The simplicity of the

application form

04 03 05

Interest rate 04 04 05

Service or processing

fees

04 03 05

Time to obtain

approval

05 03 03

Documentation 05 04 04

Guarantees required

by the institution

05 05 05

This question was asked mainly because to know about the satisfaction level of the customer

after they avail the loan since they would be better to tell about the services of the bank

regarding various aspects of loan. The question was a ranking based and the borrower has to

rank 1 if he/she are strongly satisfied as 5 if he strongly dissatisfied.

Interpretation: from the above table it can be inferred that private banks emerges as the

favorable choice for the most of the borrowers because of their attractive financial schemes

and different other services. SMEs said that some co-operative banks negotiate with the

interest rates and even there is less documentation process which is also much higher in case

of PSBs and NBFCs as compared with private as well as co-operatives.

Comment: Here I have taken the majority in each category. From above we can see that

SMEs are not very happy with the financial institutions when it comes to funding. NBFCs

should look into early disbursement of loan. This can be done with proper coordination of

credit department with other departments and proper work flow of an application.

Credit lending Towards SME sector

43

7. Initiative government should take to improve SMEs

Table: 08.to know about what initiative GOI should take

Initiatives Number of Respondent

Decrease in the amount of tax 17

Support innovative technological companies 03

Guidance for upgrading skills and knowledge

of entrepreneurs

11

Assistance and support for revival sickness 05

Introduce a single window concept for

helping SMEs

18

Interpretation: the results clearly shows that the fact that SMEs are really frustrated with the

different department involved in the running of the SMEs, instead of concentrating

themselves in their work they have to run from office to office to get various approval. The

second point which need to highlights is to have different tax slab and not be treated as big

corporate.

Comments: The government should come up with single window help desk for the SMEs

where they can clear all their paper works, approval, registration etc. under one roof. To

provide awareness about the different skill development programme, government should do

Initiative should be taken by the government

Decrease in the amount of tax

Support innovative

technological companies

Guidance for upgrading skills

and knowledge of

entrepreneurs

Assistance and support for

revival sickness

Credit lending Towards SME sector

44

proper marketing of those programme, these can be done by the various chambers,

association etc.

8. Apart from financing other problems faced by the MSMEs

Table: 09.to know about other problem faced by the SMEs apart from finance

Issues Number of Respondent

Marketing/Publicity 18

Sales 06

Lack of skilled laborers 15

Procurement of raw materials 04

Government/level intervention 12

Interpretation: Marketing seems to be a major problem for survival, there is a huge cost

required to market a product which in turn put pressure on the balance sheet of the

company. Lack of skilled laborers is also a major problem faced by the small industries today.

Comments: government should provide marketing platform to the SMEs at a lower cost.

Though there are various schemes as related to marketing of a product but they needs to be

Problems other than finance faced by the

MSMEs

Marketing/Publicity

Sales

Lack of skilled laborers

Procurement of raw materials

Government/level intervention

Credit lending Towards SME sector

45

implemented properly. Government should arrange MSMEs expo in different part of the

countries.

9.Which financial institutions provide better services?

Table: 10.to know who provide better services?

Government banks 19

Private banks 21

NBFC 9

Others 5

Interpretation: Private Banks are preferred by the SMEs over government banks and NBFCs

as they aggressively target SMEs as important sector. Moreover they have specialized

branches and counters to solve their problems related to funding.

Comment: NBFCs should try to convince the confidence of SMEs that they are well enough

equipped to solve the problems with related to finance. NBFCs need to come up with new

schemes which attract the SMEs.

0

5

10

15

20

25

Government banks

Private banks

NBFC

Others

Better service provider

Credit lending Towards SME sector

46

10. Do you think change in government at center will bring favorable environment to run

business?

Yes 39

No 15

Interpretation: Majority of the respondent feel that a change in the government will bring

favorable condition to run business by change in the policies and attitude of government

towards SMEs.

Comment: With the change in government at center have given confidence to SME sector

that this government make some changes in policies and taxations which will make positive

environment to run their business.

0

5

10

15

20

25

30

35

40

45

Yes No

Change in government will brig favorble

enviornment to run business

Credit lending Towards SME sector

47

FINDINGS

After undertaking the study, the following findings were made about the SMEs in Navi-

Mumbai area.

Most of the SMEs rely on their on funds or on their friend or relatives for the business.

Since obtaining finance is one of the biggest nightmares for them.

Many a times when SMEs apply for loan, payment get delayed.

The most common reasons cited by financial institution of rejection of application by

them are

Balance sheet is not so attractive.

Not enough guarantee.

Document is not correct.

Poor credit rating.

Little income.

Co-applicant has a poor CIBIL record

People get de-motivated to apply for loan because of their lengthy process. Some

people also did not apply because of too much documentation and complicated

procedures applying for loan.

There is Lack of awareness among people running the SMEs.

Besides financial issues SMEs are also having problems like infrastructure and skill

development.

Credit lending Towards SME sector

48

Limitations

Due to constraints of time and resources, the study is likely to suffer from certain limitations.

The limitations are given below.

Data mining was a time consuming task. Useful data had to be extracted after careful

scrutinizing from the huge data gathered.

The research was carried out in a short period of time i.e; 20 days . therefore the

sample size and parameters were restricted and selected accordingly so as to finish

the work within the time given.

The information given by the respondent may be biased as some of them were not

interested in giving correct information.

Some of the respondents could not answer the question due to lack of proper

knowledge.

There were a few problems with the respondents as I was speaking Hindi and he was

speaking Marathi.

Many of the respondents did not shared information.

Some association did not entertained.

SME is a very vast topic to study and understood so all the aspects are difficult to

cover within the given time period.

There exits many more scope for further studies in this subject. Further study can be

done in cross-country analysis of SMEs or comparison of Indian SMEs with that of the

developed countries SMEs, their capital structure and banking model.

Credit lending Towards SME sector

49

Conclusion

The growing importance of SMEs, which account for about one-sixth of Indias total GDP, is

manifesting itself in various quarters of the economy. Government is trying to push it forward

with a number of plans to foster technology, innovation and quality in SMEs. Banks have

joined hands with private players to create a rating agency focused on SMEs in order to

improve the credit disbursal to them. Indian SMEs are increasingly organizing themselves in

clusters, which improve their access to business associations are technical assistance

providers. It also helps in building inter-firm cooperation that adds to productivity and

innovation. The MSMEs already account for 40 per cent of the nations industrial output and

35 per-cent of direct exports.

Indias manufacturing SME sector is well equipped to grow, and the fundamental drivers are

in the right place. The next level of growth in Indian economy will have to necessary come

from the MSME sector, which can propel Indias growth rate from 5 per-cent to 8-9 per-cent

and beyond in the medium and long-term. Therefore, all stakeholders in the development of

SMEs, viz., the government, banks and other agencies like MSME association/chambers and

large industry associations should gear up to provide an enabling environment to the SMEs

for taking them to a higher and sustained growth trajectory. SMEs, on their part, should

strive hard to take advantage of the available opportunities. In dealing with the needs of

small and medium enterprise, financial institution have to look for new delivery mechanisms,

they need to equip itself with the emerging challenges and are needed to be prepared to

cash in on the opportunities unleashed by higher growth.

Continued empowerment of SMEs will enable them to attain high and sustainable growth in

the long-run.

Credit lending Towards SME sector

50

Recommendation

With the focus in entertainment and packaging as a main source of business, Essel

Group has entered in the field of finance to cater the demand of finance. So for that

company should engage in some branding activity such as advertisement in print as

well as electronic media, one pager pamphlet, outdoor display, adds on websites of

various Associations

So

1. Company should open specialized SME/SSI branches near industrial areas.

2. Company should start In-house Credit Rating for SMEs as it will help SMEs to

know where they stands and how much amount loan they can expect from

Banks/NBFCs. Validation of rating can be done as per the guidelines of the

Credit Risk Management.

3. Many SSI/SMEs are directly linked to the large corporate as a suppliers, service

providers, etc. are usually successful. It is relatively easier for the Essel Finance

to finance various requirements including working capital, technology

upgraditation, etc. of these units. Promotions of clusters linked to large units,

thus, could help expansion of credits to small units.

4. Participation with Trade promotion organization and various Associations.

Credit lending Towards SME sector

51

REFERENCE

1. Bank Finance for SMEs around the world; a project by the World Bank Development

Research Group Finance and Private Sector.

2. Micro, Small and Medium Enterprise finance in India by International Finance

Corporation, World Bank.

3. Bank involvement with SMEs: Beyond Relationship by Augusto de la Torre, Maria

Scoledad Martinez peria& Sergio L. Schmukler.

4. Financing SMEs- An Industrial Prospective.

5. Empowering the Growth of Emerging Enterprises by Dr. K.C.Chakrabarty.

6. Empowering MSMEs for the Financial Inclusion and Growth Role of Banks and Industry

Associations by Dr. K.C.Chakrabarty.

7. Report on The Working Group on MSMEs Growth for 12

th

Five Year Plan (2012-2017)by

ministry of MSMEs, Government of India.

8. Small and Medium Enterprises (SMEs): Past, Present and Future in India by KD Raju.

9. Report of The Internal Group to Review Guidelines on Credit Flow to SME Sector by RBI.

10. Annual Report of MSME 2010-11,2011-12,2012-13, Ministry of MSME,GOI.

11. MSME in India: AN overview by Ministry of MSME, GOI.

12. Lending Policy to SMEs by Reserve Bank of India.

Credit lending Towards SME sector

52

Annexure :A

Questioner

I Rahul student of ITM-Institute of financial Market pursing PGDM, is conducting a

research on CREDIT LENDING TOWARDS SME SECTOR as a part of my summer

internship program. So I request you to spare few minutes from your busy schedule and fill

this form. I assure you that the information will be kept confidential.