Professional Documents

Culture Documents

Sbi Sbi Final

Uploaded by

omkarparshuramCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sbi Sbi Final

Uploaded by

omkarparshuramCopyright:

Available Formats

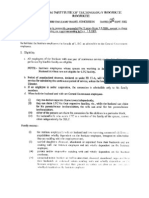

1 | P a g e

UNIVERSITY OF MUMBAI

PROJECT ON:-

STATE BANK OF INDIA

MASTER OF COMMERCE

(BANKING AND FINANCE)

SEMESTER I

2014-2015

In Partial Fulfillment of the Requirement under Semester Based Credit

And Grading System for Post Graduated (PG)

Programme under Faculty of Commerce

SUBMITTED BY:-

PARSHURAM.BABU.OMKAR

ROLL NO: 44

PROJECT GUIDE:-

PROF. SHRADDHA SHUKLE

2 | P a g e

ACKNOWLEDGEMENT

With great pleasure I thank Mrs. SHRADDHA SHUKLE Professor of

K.P.B.HINDUJA college of Commerce for being an inspiration in the

completion of this project. I thank for her invaluable help provided during

the completion of this project. I also thank her for providing me guidance

and numerous suggestions through out entire duration of the project. I am

thankful for invaluable help without which this project would not have

materialized.

I express my deep gratitude to my entire college friend and my family

members whose efforts and creativity helped us in giving the final structure

to the project work.

I am also thankful to all those seen and unseen hands and hands, which have

been of help in the completion of this project work.

3 | P a g e

CERTIFICATE

This is certify that Mr. Parshuram.Babu.Omkar of M.Com. Banking &

Finance 1st Semester (2014-2015) has successfully completed the Project on

"STATE BANK OF INDIA".

Under the guidance of Mrs. SHRADDHA SHUKLE

Project Guide ________________________

Course Coordinator ________________________

Internal Examiner ________________________

External Examiner ________________________

Principal ________________________

Date________________

Place: Mumbai

4 | P a g e

M.Com (Banking and Finance)

1st SEMESTER

"STATE BANK OF INDIA"

SUBMITTED BY

PARSHURAM.BABU.OMKAR

ROLL NO: 44

5

DECLARATION

I Mr. Parshuram.Babu.Omkar the student of M.com (Banking and Finance), 1st

Semester (2014-2015), hereby declares that I have completed the project on

"STATE BANK OF INDIA"

The information submitted is true and original to the best of my knowledge.

Parshuram.Babu.Omkar

(Signature)

6

TABLE OF CONTENTS

SR.NO PARTICULARS PAGE NO.

1 EXECUTIVE SUMMARY. 1

2

RESEARCH METHODOLOGY. 2

3 INTRODUCTION. 4

4 HISTORY OF STATE BANK OF

INDIA.

5

5

DEVELOPMENT OF SBI. 6

6 INTERNATIONAL PRESENCE OF

SBI.

9

7

CORPORATE STRUCTURE OF SBI. 10

8 SBIs TRANSITION FROM MANUAL

BANKING TO CORE BANKING.

11

9 FUNCTIONS OF COMMERCIAL

BANKS.

12

10

SERVICES OFFERED BY SBI. 16

11 SBI DEPOSIT PRODUCTS AND

MARKET SEGMENTATION OF

ADVANCES.

24

12 SBIs TECHNOLOGY BASED

PRODUCTS AND SERVICES.

36

7

13 BANKER CUSTOMER

RELATIONSHIP

44

14

FINANCIAL QUOTE OF SBI 45

15

FINANCIAL PERFORMANCE 46

16

CORE OPERATIONS 49

17

MARKETING MIX STRATEGIES 50

18

FINANCIAL INCLUSIONS OF SBI 54

19 PERSONAL INTERVIEW OF SBI

MANAGER

56

20

CONCLUSION AND SUGGESTIONS 58

21

ANNEXURE OF PUBLIC SURVEY 59

22

FIELD VISIT TO SBI BANK 61

23

BIBLIOGRAPHY 65

8

STATE BANK OF INDIA

Source: Google Images

9

INTRODUCTION:

State Bank of India (SBI) is a multinational banking and financial services company based

in India. It is a government-owned corporation with its headquarters in Mumbai,

Maharashtra. As of December 2014, it had assets of US$388 billion and 17,000 branches,

including 190 foreign offices, making it the largest banking and financial services company

in India by assets.

State Bank of India is one of the Big Four banks of India, along with ICICI Bank, Punjab

National Bank and HDFC Bank.

The bank traces its ancestry to British India, through the Imperial Bank of India, to the

founding, in 1806, of the Bank of Calcutta, making it the oldest commercial bank in

the Indian Subcontinent. Bank of Madras merged into the other two "presidency banks" in

British India, Bank of Calcutta and Bank of Bombay to form the Imperial Bank of India,

which in turn became the State Bank of India. Government of India owned the Imperial Bank

of India in 1955, with Reserve Bank of India (India's Central Bank) taking a 60% stake, and

renamed it the State Bank of India. In 2008, the government took over the stake held by the

Reserve Bank of India.

Source: Google Images

HISTORY:

The roots of the State Bank of India lie in the first decade of the 18

th

century, when the Bank

of Calcutta, later renamed the Bank of Bengal, was established on 2

nd

June 1806. The Bank

of Bengal was one of the Three Presidency banks, the other two being the Bank of Bombay

10

and the Bank of Madras. All the three Presidency banks were incorporated as joint stock

companies and were the result of royal charters. These three banks received the exclusive

right to issue paper currency till 1861 when, with the Paper Currency Act, the right was taken

over by the Government of India. The Presidency banks amalgamated on 27

th

January, 1921

and the re-organized banking entity took as its name Imperial Bank of India. The Imperial

Bank of India remained a joint stock company but without Government participation.

Pursuant to the provisions of State Bank of India Act of 1955, the Reserve Bank of India,

which is Indias Central Bank, acquired a controlling interest in the Imperial Bank of India.

On 1

st

July 1955, the Imperial Bank of India became the State Bank of India. In 2008, the

Government of India acquired the Reserve Bank of Indias Stake in SBI so as to remove any

conflict of interest because the RBI is the countrys banking regulatory authority. In 1959,

Government of India passed the State Bank of India (Subsidiary Banks) Act, which made

eight state banks associates of SBI. A process of consolidation began on 13 September 2008,

when the State Bank of Saurashtra merged with SBI.

SBI has acquired local banks in rescues. The first was the Bank of Bihar (est. 1911), which

SBI acquired in 1969, together with its 28 branches. The next year SBI acquired National

Bank of Lahore (est. 1942), which had 24 branches. SBI was the acquirer as its affiliate,

the State Bank of Travancore, already had an extensive network in Kerala.

The State Bank of India and all its associate banks are identified by the same blue

keyhole logo. The State Bank of India word mark usually has one standard typeface, but also

utilizes other typefaces.

DEVELOPMENTS:

1955:

On 1

st

July, State Bank of India was constituted under the State Bank of India Act 1955, for

the purpose of taking over the undertaking and business of Imperial Bank of India. The

Imperial Bank of India was founded in 1921 under the Imperial Bank of India Act 1920. The

bank transacts general banking business of every description including foreign exchange,

merchant banking and mutual funds.

1959:

In September, State Bank of India (Subsidiary Bank) Act was passed. In October , State Bank

of Hyderabad became the first subsidiary of SBI.

1960:

During this period, State Bank of Jaipur, State Bank of Bikaner, State Bank of Indore, State

Bank of Travancore, State Bank of Mysore, State Bank of Patiala and State Bank of

Saurashtra became subsidiaries of SBI.

1969:

11

On 8

th

November, the Bank of Behar was amalgamated.

1972:

A merchant banking division was set up in the central office to cater to promotional needs of

the corporate sector.

1977:

During the year, the bank introduced the Perennial Pension Plan Scheme.

1983:

SBI launched self-employment scheme for self-employment to educated unemployed youths.

1984:

The bank provided need-based rehabilitation assistance to large and medium sick industrial

units.

1986:

On 1

st

August, a new subsidiary named SBI Capital Market was functioning independently. It

took up leasing business and certain other new services.

1987:

Up to the end of the year, the bank had sponsored 30 Regional Rural banks covering 66

backward and under-banked districts in the country.

1988:

On 20

th

September, the bank inaugurated SBINET, an integrated communication project

aimed at improving customer service, operational efficiency and administrative convenience.

1990:

During Kharif 1990, the bank introduced an agricultural credit card, known as SBI Green

Card to give greater liquidity and flexibility to farmers in procuring agricultural inputs. As on

31

st

March, SBIMF had over 3,40,000 Indian investors and about 475 crores by way of

investible domestic funds.

1991:

During February, the bank set up a new subsidiary called the SBI Factors and Commercial

Services Pvt. Ltd. for rendering factoring services to the industrial and commercial units in

the Western India.

12

1999:

The State Bank of India (SBI) proposed to take up the life insurance and general insurance

business. SBI proposed to introduce a value added service to the cardholders whereby the

credit card could also be used as an ATM card.

2000:

The bank was embarked upon the expansion of its ATM Network in the twin cities of

Hyderabad and Secunderabad. The bank had become the First Government Owned Financial

Institution.

SBI had become the first public sector bank to offer fixed rate home loans. It had also

incorporated a subsidiary called SBI Life Insurance Company Ltd. for doing life insurance

business. SBI installed 10 more ATMs in the north-eastern region in addition to the one

already commissioned at Guwahati. It also launched 3 more ATMs in Bangalore.

2002:

SBI and ICICI were among the Top 100 banks in Asia as per the study by Asian Banker

Journal.

2003:

SBI join hands with LIC to identify log term investment proposals for LIC. It launched its

First Mobile ATM for increasing the banking convenience of its customers.

2005:

SBI opened branch at Vadakara. It also opened its First branch at Lakshadweep Island at

Kavaratti.

2007:

The State Bank of India became the First Foreign Bank to set up a branch in the Israels

Diamond Exchange.

2010:

The State Bank of India acquired State Bank of Indore.

2012:

SBI planned to cut the processing and conversion fee for home loans.

13

2013:

Indias Leading Public Sector lender the State Bank of India was stepping up efforts to

expand its presence in the worlds second biggest economy with the lender set to launch its

second branch in China.

2014:

SBI Youth for India is a fellowship programme initiated, funded and managed by the State

Bank of India in partnership with reputed NGOs. It provides a framework for Indias best

young minds to join hands with rural communities, empathise with their struggles and

connect with their aspirations.

INTERNATIONAL PRESENCE:

As of 28 June 2014, the bank had 180 overseas offices spread over 34 countries. It has

branches of the parent in Moscow, Colombo, Dhaka, Frankfurt, Hong Kong, Tehran,

Johannesburg, London, Los Angeles, Male in the Maldives, Muscat, Dubai, New

York, Osaka, Sydney, and Tokyo. It has offshore banking units in the Bahamas, Bahrain, and

Singapore, and representative offices in Bhutan and Cape Town. It also has an ADB in

Boston, USA.

The Canadian subsidiary, State Bank of India (Canada) also dates to 1982. It has seven

branches, four in the Toronto area and three in the Vancouver area.

SBI operates several foreign subsidiaries or affiliates. In 1990, it established an offshore

bank: State Bank of India (Mauritius). SBI (Mauritius) has 15 branches in major cities/towns

of the country including Rodrigues.

SBI Sri Lanka, Oldest Bank in Sri Lanka now has three branches located

in Colombo, Kandy and Jaffna. The 3rd branch was opened in Jaffna, Northern Province on

09th September 2013. On 1st July 2014 SBI Sri Lanka celebrated their 150th year presence in

Sri Lanka.

14

In 1982, the bank established a subsidiary, State Bank of India (California), which now has

ten branches nine branches in the state of California and one in Washington, D.C. The 10th

branch was opened in Fremont, California on 28 March 2011. The other eight branches in

California are located in Los Angeles, Artesia, San Jose, Canoga Park, Fresno, San Diego,

Tustin and Bakersfield.

In Nigeria, SBI operates as INMB Bank. This bank began in 1981 as the Indo-Nigerian

Merchant Bank and received permission in 2002 to commence retail banking. It now has five

branches in Nigeria.

In Nepal, SBI owns 55% of Nepal SBI Bank, which has branches throughout the country. In

Moscow, SBI owns 60% of Commercial Bank of India, with Canara Bank owning the rest.

In Indonesia, it owns 76% of PT Bank Indo Monex.

The State Bank of India already has a branch in Shanghai and plans to open one in Tianjin.

In Kenya, State Bank of India owns 76% of Giro Commercial Bank, which it acquire

for US$8 million in October 2005.

CORPORATE STRUCTURE:

State Bank of India with more than 14,097 offices and branches in India has a well defined

and decentralized organizational structure. The State Bank of India is headed by a Chairman

and four Managing Directors. While the Chairman is the Executive Head and each Managing

Director heads a Banking Group/ Entity within the Bank. The organizational structure can be

understood by the help of a chart which is as follows:

15

Source: Google Images

MD: Managing Director

DMD: Deputy Managing Director

GE: General Executive

CGM: Chief General Manager

CVO: Chief Vigilance Officer

CFO: Chief Financial Officer

CAG: Comptroller Accountant General

16

Source: Google Images

SBIs TRANSITION FROM MANUAL BANKING TO CORE BANKING:

SBI was one of the first banks globally to use the IBM 1401 mainframe for interoffice

transactions and reconciliation, back in the early 1960s. In 1970s, Data Processing Centers

were set up by the SBI in the Local head offices.

With the introduction of Desktop Computers in 1982, SBI upgraded the Data Processing

Centers at Local Head Offices to mini computers and introduced ALPMs in branches.

Branch computerization started in the 80s and 90s, and a clear cut IT strategy was put in

place in the late 90s. It started with local area network and branch automation, along with a

massive inter branch networking project to connect all the branches.

The Bank acquired Bankmaster software in February 1992 and Backbay Reclamation

branch at Mumbai was the first branch to be fully computerized with Bankmaster Software

Application.

Between 1992 and 31

st

March 2003, 3701 branches were computerized. The drive was taken

to fully computerize all the branches.

Meanwhile, SBI rolled out Core Banking Solution and implemented CBS at the first Pilot

Branch (PBB, Hiranandhani) in August 2003. SBI along with associate banks completely

migrated to CBS platform in 2008.

With the roll out of Networking of branches, named as SBI connect, many more IT projects

were also put right or rolled out. ATM, Internet Banking, Mobile Banking and Payment

solutions transformed SBI into a tech savvy bank.

FUNCTIONS OF COMMERCIAL BANKS:

17

The functions of commercial banks are divided into two categories:

Primary functions

Secondary functions including agency functions.

Primary Functions:

The primary functions of the commercial banks include the following:

A. Acceptance of Deposits

Source: Google Images

(a) Fixed Deposits:

The deposits can be withdrawn only after expiry of certain period say 3 years, 5 years or 10

years. The banker allows a higher rate of interest depending upon the amount and period of

time. Previously the rates of interest payable on fixed deposits were determined by Reserve

Bank.

(b) Recurring Deposits:

In recurring deposit, the customer opens an account and deposit a certain sum of money every

month. After a certain period, say 1 year or 3 years or 5 years, the accumulated amount along

with interest is paid to the customer. It is very helpful to the middle and poor sections of the

people. The interest paid on such deposits is generally on cumulative basis. This deposit

system is a useful mechanism for regular savers of money.

(c) Savings Deposits:

The savings deposit promotes thrift among people. The savings deposits can only be held by

individuals and non-profit institutions. The rate of interest paid on savings deposits is lower

than that of time deposits. The savings account holder gets the advantage of liquidity (as in

current a/c) and small income in the form of interests.

(d) Current Account Deposits:

These accounts are maintained by the people who need to have a liquid balance. Current

account offers high liquidity. No interest is paid on current deposits and there are no

18

restrictions on withdrawals from the current account. These accounts are generally in the case

of business firms, institutions and co-operative bodies.

B. Advancing of Loans:

Source: Google Images

The commercial banks provide loans and advances in various forms. They are given below:

1. Overdraft:

This facility is given to holders of current accounts only. This is an arrangement with the

bankers thereby the customer is allowed to draw money over and above the balance in his/her

account. It is a short-term temporary fund facility from bank and the bank will charge interest

over the amount overdrawn. This facility is generally available to business firms and

companies.

2. Cash Credit:

Cash credit is a form of working capital credit given to the business firms. The customer can

operate that account within the sanctioned limit as and when required. It is made against

security of goods, personal security etc. On the basis of operation, the period of credit facility

may be extended further. Bank charges interest only on the amount utilized and not on total

amount sanctioned or credited to the account.

3. Discounting of Bills:

Discounting of Bills may be another form of bank credit. The bank may purchase inland and

foreign bills before these are due for payment by the drawer debtors, at discounted values,

i.e., values a little lower than the face values. The Banker's discount is generally the interest

on the full amount for the unexpired period of the bill.

4. Loans and Advances:

It includes both demand and term loans, direct loans and advances given to all type of

customers mainly to businessmen and investors against personal security or goods of

movable or immovable in nature. The loan amount is paid in cash or by credit to customer

19

account which the customer can draw at any time. The interest is charged for the full amount

whether he withdraws the money from his account or not.

Secondary Functions:

The secondary functions of the banks consist of agency functions and general utility

functions.

A. Agency Functions:

Agency functions include the following:

(1) Collection of cheques, dividends, and interests:

As an agent the bank collects cheques, drafts, promissory notes, interest, dividends etc., on

behalf of its customers and credit the amounts to their accounts.

(2) Payment of rent, insurance premiums:

The bank makes the payments such as rent, insurance premiums, subscriptions, on standing

instructions until further notice. Till the order is revoked, the bank will continue to make such

payments regularly by debiting the customer's account.

(3) Dealing in foreign exchange:

As an agent the commercial banks purchase and sell foreign exchange as well for customers

as per RBI Exchange Control Regulations.

(4) Purchase and sale of securities:

Commercial banks undertake the purchase and sale of different securities such as shares,

debentures, bonds etc., on behalf of their customers. They run a separate 'Portfolio

Management Scheme' for their big customers.

(5) Act as trustee, executor, attorney, etc:

The banks act as executors of Will, trustees and attorneys. It is safe to appoint a bank as a

trustee than to appoint an individual. Acting as attorneys of their customers, they receive

payments and sign transfer deeds of the properties of their customers.

B. General Utility Services:

The General utility services include the following:

(1) Safety Locker facility:

20

Safe keeping of important documents, valuables like jewels are one of the oldest services

provided by commercial banks. 'Lockers' are small receptacles which are fitted in steel racks

and kept inside strong rooms known as vaults. These lockers are available on half-yearly or

annual rental basis. The bank merely provides lockers and the key but the valuables are

always under the control of its users.

(3) Issue "Travellers Cheques":

Banks issue travellers cheques to help carry money safely while travelling within India or

abroad. Thus, the customers can travel without fear, theft or loss of money.

(4) Letters of Credit:

Letter of Credit is a payment document provided by the buyer's banker in favour of seller.

This document guarantees payment to the seller upon production of document mentioned in

the Letter of Credit evidencing dispatch of goods to the buyer.

(5) ATM facilities:

The banks today have ATM facilities. Under this system the customers can withdraw their

money easily and quickly and 24 hours a day. This is also known as 'Any Time Money'.

Customers under this system can withdraw funds i.e., currency notes with a help of certain

magnetic card issued by the bank and similarly deposit cash/cheque for credit to account.

SERVICES OFFERED BY SBI:

1. E-TICKETING:

21

Source: Google Images

You can book your railway, air and bus tickets online through OnlineSBI.

Service charges @ Rs.10/- per transaction shall be levied in addition to the cost of the ticket.

Cancellation of E-ticket can be done by logging on to IRCTC's site; refund amount will be

credited to your account directly within 2-3 days. For cancellation of i-ticket, you shall be

required to submit your ticket at a computerized counter of Railways and on cancellation, the

amount shall be credited back to your account.

2. SBI E-TAX:

Source: Google Images

You can pay your taxes online through SBI E-Tax. This facility enables you to pay TDS,

Income tax, Indirect tax, Corporation tax, Wealth tax, Estate Duty and Fringe Benefits tax.

Click the e-Tax link in the home page. You are displayed a page with two links Direct Tax

and Indirect Tax.

The Indirect Tax link is used to make Central Excise and Service Tax payments to Central

Board of Excise and Customs. The online payment feature facilitates anytime, anywhere

payment and an instant E-Receipt is generated once the transaction is complete. The Indirect

Tax payment facility is available to Registered Central Excise/Service Tax Assessee who

possesses the 15 digit PAN based Assessee Code. You can make CBEC payments using the

Indirect Taxes link available in the Payments/Transfers tab.

3. BILL PAYMENT:

22

Source: Google Images

A simple and convenient service for viewing and paying your bills online.

a) No more late payments

b) No more queues

c) No more hassles of depositing cheques

Using the bill payment you can view and Pay various bills online, directly from your SBI

account. You can pay telephone, electricity, insurance, credit cards and other bills from the

comfort of your house or office, 24 hours a day, 365 days a year.

The e-PAY service is available in various cities across the country and you can now make

payments to several billers in your region.

4. DEMAND DRAFT:

Source: Google Images

The Internet Banking application enables you to register demand drafts requests online. You

can get a demand draft from any of your Accounts. You can set limits for demand drafts

issued from your accounts or use the bank specified limit for demand drafts. You can opt to

collect the draft in person at your branch, quoting a reference to the transaction. A printed

advice can also be obtained from the site for your record.

5. CHEQUE BOOK REQUEST:

23

Source: Google Images

You can request for a cheque book online. Cheque book can be requested for any of your

Savings, Current, Cash Credit, and Over Draft accounts. You can opt for cheque books with

25, 50 or 100 cheque leaves. You can either collect it from branch or request your branch to

send it by post or courier. You can opt to get the cheque book delivered at your registered

address or you can provide an alternate address. Cheque books will be dispatched within 3

working days from the date of request.

6. ACCOUNT OPENING REQUEST:

OnlineSBI enables you to open a new account online. You can apply for a new account only

in branches where you already have accounts. You should have an INB-enabled account with

transaction right in the branch. Funds in an existing account are used to open the new

account. You can open Savings, Current, Term Deposit and Recurring Deposit accounts of

Residents, NRO and NRE types.

7. THIRD PARTY TRANSFER:

You can transfer funds to your trusted third parties by adding them as third party accounts.

The beneficiary account should be any branch SBI.Transfer is instant.You can do any number

of Transactions in a day for amount aggregating Rs.5 lakhs.

To transfer funds to third party having account in SBI,you need to add and approve a third

party, you need to register your mobile number in personel details link under profile section.

You will receive a One Time SMS password on your mobile phone to approve a third party.

If you do not have a mobile number, third party approval will be handled by your branch.

Only after approval of third party, you will be able to transfer funds to the third party. You

can set limits for third party transactions made from your accounts or even set limits for

individual third parties.

8. FUNDS TRANSFER:

24

The Funds Transfer facility enables you to transfer funds within your accounts in the same

branch or other branches. To make a funds transfer, you should be an active Internet Banking

user with transaction rights.

Daily limit for Funds Transfer to own Accounts:

Between Accounts in the same branch: Rs.10 Lacs.

Between Accounts across branches: Rs.5 Lacs.

Daily limit for Funds Transfer to PPF Accounts in the same branch or across

branches: Rs.1,00,000. This is subject to a ceiling of Rs.1,00,000, by a maximum 12 deposits,

during the Financial Year, for the Principal Amount.

9. NOMINATION FACILITIES:

1. Nomination facility is governed by provisions of Banking Regulation Act, 1949- Section

45ZA for deposit accounts, 45ZC for Safe Custody Accounts and 45ZE for Safe Deposit

Lockers.

2. Nomination facility is available for all deposit accounts, articles in safe custody and safe

deposit vaults.

3. Nomination is available for accounts opened in individual capacity only, i.e. not for

accounts opened in representative capacity.

4. Nomination can be done in favour of one person only. However, nomination in favour of

more than one person is permissible in jointly operated locker accounts with common

consent.

5. Nomination can be made, cancelled or varied by the account holder anytime during the life

time.

6. Nomination can be made in favour of a minor also. During the period the minor does not

attain majority, the natural person appointed by the account holder will receive the amount on

the minors behalf.

7. For the existing accounts where nomination is not made, the account holder/s can do so by

filling up form available with the branches.

8. The right of nominee to receive payment from the Bank arises only after the death of the

depositor in single account and death of all depositors in case of joint accounts.

9. Customers (new as well as existing) are advised to avail nomination facility, if they have

not availed so far. In case the depositor(s) do(es) not wish to make nomination, the same

should be recorded on the account opening form by the depositor(s) with their full signature.

10. CHEQUE COLLECTIONS:

25

(A) Immediate Credit of Outstation/local cheques:

Outstation Cheques:

Branches will, on their own accord, afford immediate credit of outstation cheques of other

banks up to and inclusive of Rs.20, 000/- (Rupees twenty thousand only) tendered for

collection by their customers. For the purpose of this Policy, a satisfactorily conducted

account shall be one which has been:-

i) Opened at least six months earlier and is fully complying with the KYC documentation

requirements.

ii) Is neither dormant nor inoperative.

iii) Where branch has not noticed any irregular dealings/ suspicious transactions in the last 6

months.

v) Where no adverse features attached to the account/account holders has been brought to the

notice of the Bank.

vi) Where no cheques/ instruments for which immediate credit was afforded returned unpaid

for financial reason.

The facility will be available to all individual deposit account holders, without making a

distinction about the type of their accounts i.e. Savings Bank/Current Account etc. It will also

be available at all branches/extension counters of the Bank.

Local Cheques:

Negotiation of local cheques/instruments will not be encouraged. However, Branch Managers

may use their discretion in exceptional circumstances (business exigencies) to permit drawls

against uncleared effects up to Rs. 20,000/- (Rupees twenty thousand only), for deposit

accounts on recovery of collection charges of Rs. 100/- per instrument.

Cheques returned unpaid:

If a cheque/instrument for which immediate credit has been afforded is returned unpaid, Bank

shall recover interest at clean overdraft rate for the period Bank remained out of funds and

also cheque return charges subject to the following :-

a) Bank will charge interest from the date of credit of proceeds of the cheque in the account

till reimbursement/realisation of the amount to/by the Bank.

b) Where the cheque is credited to a Savings Bank account, such credits will not be reckoned

for interest purposes, if the cheque is 13 returned unpaid.

c) If proceeds are credited in an overdraft/loan account, interest would be recovered at

applicable rate/clean overdraft rate, whichever is higher, on the amount of returned

cheque/instrument.

26

11. REMITTANCE FACILITIES:

i. Customers can make local payment through Bankers Cheques and remit funds from one

centre to another through drafts, telegraphic transfers, electronic funds transfer

(RTGS,EFT,ECS etc) at specified service charges (exchange).

ii. Drafts are issued on our branches. They are issued on the branches of Associate Banks at

centres where we do not have any branch.

iii. The issue and payment of Bankers cheques and drafts in cash across the counter is subject

to Income Tax provisions and RBI guidelines against money laundering activities. Issue of

these instruments of Rs. 50,000/- and above is not permitted against cash but only through

debit to customers account or against cheques/other instruments tendered by the purchaser.

iv. Bankers cheques / drafts for an amount of Rs.50,000/- and over will not be paid in cash,

but only for credit of the payees account or to his banker.

v. Drafts of Rs.50,000/- and above are required to have signatures of two authorised officials.

Before taking delivery of the drafts, please verify that the draft is complete in all respects

including signature of the official(s) along with their specimen signature numbers at the place

provided for.

vi. Bankers cheques and drafts are valid for 3 and 6 months respectively and can be

revalidated by issuing branches on written request of the purchasers. The drafts can be

revalidated by the payee(s) if they are identified as the holder in due course. The drafts can be

revalidated only once within one year from the date of issue. After one year of the draft, they

are to be cancelled at the issuing branch, and a fresh draft obtained after paying the requisite

service charges.

vii. In respect of lost drafts, duplicate drafts for amounts above Rs 10000/-(in cases where

there is no reason to doubt the bonafides of the applicant) shall be issued by the issuing

branches on receipt of confirmation of non payment from the drawee branch and on

execution of stamped letter of indemnity with two sureties good for the amount involved.

viii. For issue of duplicate drafts up to Rs.10, 000/- requirement of the relative non-payment

certificate from the other branch is waived. For issue of duplicate drafts below Rs.1,000/-,

only indemnity letter will be necessary. The customer should inform the issuing branch

promptly of loss of demand draft giving full particulars thereof in order to prevent misuse

thereof.

ix. The Bank may not insist on production of sureties for issue of duplicate demand drafts for

amounts up to Rs 50, 000/- if the applicant/purchaser after complying KYC norms is

maintaining a satisfactorily conducted account with the issuing branch for a minimum period

of six months as on the date of issue of original draft and he/she is considered good for the

amount involved.

27

x. The bank will issue duplicate demand draft to the customer within 14 days from the date of

receipt of request. For delay in issuing duplicate draft beyond the above stipulated period, the

banks will pay interest at the rate applicable for fixed deposit of corresponding maturity in

order to compensate the customer for such delay.

xi. Where the bank is found to have committed an error in non payment of a draft/remittance

issued by it to a holder in due course, the customer will be compensated with interest at

SBAR for the number of days the instrument remains unpaid from the date of its first

presentment.

12. SAFE DEPOSIT LOCKER:

For the safety of your valuables we offer our customers safe deposit vault or locker facilities

at a large number of our branches. There is a nominal annual charge, which depends on the

size of the locker and the centre in which the branch is located.

13. E-RAIL:

Book your Railways Ticket Online.

The facility has been launched with effect from 1

st

September 2003 in association with

IRCTC. The scheme facilitates Booking of Railways Ticket Online. All Internet banking

customers can use the facility.

14. OTHER SCHEMES AND FACILITIES:

i. Various other deposit schemes to meet the requirements of individual depositors, like Multi

Option Deposit Scheme etc. are also available with the branches of the Bank. Detailed

information on these schemes is available from our branches.

ii. Deposit Schemes for Senior Citizens: The fixed deposits of senior citizens (60 years and

over)attract additional interest of 0.50% for maturity period of one year and above up to 5

years and 0.25% for maturity period of 5 years. These are subject to change.

iii. Articles in safe custody: Articles such as shares, securities etc. can be kept in safe custody

of the Bank. The terms and conditions and charges for safe custody are available on request

at branches and our helplines.

iv. Exchange of soiled/mutilated currency notes: All the branches of the Bank will exchange

freely soiled/slightly mutilated currency notes and certain other types of mutilated currency

notes of all denominations. The Bank's currency chest branches will exchange all categories

of mutilated currency notes. Currency exchange facility is offered to the Bank's customers

and others. The Bank follows RBI guidelines in this respect. RBI has permitted the banks to

exchange mutilated currency notes which are genuine and where mutilations are such as not

to cause suspicion or fraud.

v. Safe Deposit Lockers: This ancillary service available at select branches is by hiring a

locker of various sizes by an individual, firms, limited companies etc. for a minimum period

28

of one year for which rent is payable in advance. Nomination facility is available to the hirer.

Terms and conditions and annual hire charges can be obtained from the branches. The hire

charges are also available on clicking the link Service Charges and fees on the home page of

the Banks website.

vi. Foreign Exchange Services and Cross-Border Payments: Details of the exchange rate and

charges which will apply to foreign exchange transactions are provided at select branches.

Cross border payments will be made subject to the provisions of the applicable Regulations

about foreign exchange.

15. MULTI CITY CHEQUES:

A Multi-City Cheque (MCC) is one that can be written by the customer in favour of his client

and is payable at par at all branches of the Bank. These are issued as Order Cheque . MCC

can be issued in cheque operated accounts (SB and Current. The MCC facility is to be used

only for genuine transactions / bonafide remittances. No cash payments will be made to third

parties at other branches.

The upper limit for issue of MCCs is Rs.5 lacs. The issue charges for MCC are Rs. 2 per

cheque leaf and will be debited from the account at the time of issue of the cheque book. 50

Cheque leaves are provided without any charge to each account. There are no transaction

charges.

SBIs PRODUCTS:

DEPOSIT PRODUCTS (DOMESTIC):

1. SAVINGS BANK ACCOUNT:

29

1. No Minimum Balance requirement.

2. Personal Accident Insurance of Rs. 2 lacs (w.e.f. 01/08/2013) available at an annual

Premium of Rs. 100/-.

3. Earn Interest at 4.00% p.a.

4. Transferability of accounts to any SBI Branch without changing the account number.

5. Multicity cheques available.

6. Internet Banking, Mobile Banking, Kiosk Banking available.

7. Safe Deposit lockers available.

8. Interest is calculated on a daily balance.

9. Nomination facility is available and recommended.

10. Passbook issued free of charge.

11. 50 Multicity cheque leaves free in the first instance thereafter Rs. 2/- is charged for each

subsequent leaf for Savings Bank account having QAB as on previous quarter end Rs.

25000/- and above. 20 Multicity cheque leaves free in the first instance thereafter Rs. 3/- is

charged for each subsequent leaf for Savings Bank account having QAB as on previous

quarter end below Rs. 25000/-. Emergency Cheque request (10 leaves set): Rs 3/- per leaf.

12. Multiple variants of ATM-cum-Debit Cards available.

13. Inter Core charges NIL for transfer transactions.

2. CURRENT ACCOUNT:

1. Personal Accident Insurance of Rs. 2 lacs (w.e.f. 01/08/2013) available at an annual

Premium of Rs. 100/-.

2. Internet Banking.

3. Standing instructions.

4. Low minimum balance requirement.

5. Overdraft facility available based on credit history.

6. Free ATM / Debit Card in the 1st year; charge from 2nd year onwards.

7. No restrictions on number of Payments / Withdrawals.

8. No interest paid on Deposits.

9. Transfer of account to any branch possible.

30

10. Account maintenance charge applicable.

11. No Passbook is issued but monthly Statement of account is issued.

12. Nomination facility available.

13. KYC Norms as applicable to be followed for opening of Account.

14. Multicity cheque facility available.

3. SAVINGS PLUS ACCOUNT:

Savings Plus Account is a Savings Bank Account linked to MODS, wherein surplus fund

above a threshold limit from the Savings Bank Account is transferred automatically to Term

Deposits opened in multiples of Rs. 1000.

Any surplus funds in the account exceeding the threshold limit (to be set by the customer),

for a minimum amount of Rs.10,000/- and in multiple of Rs.1000/- in any one instance, are

transferred as Term Deposit and earns interest as applicable to Term Deposits.

Account holder has the flexibility to choose the period of deposit from 1 year to 5 years and

to set any threshold limit of Rs.5,000/- or above.

Payments in excess of available balance in the Savings bank Account can be made by

breaking MODs Last in First Out.

4. YUVA SB ACCOUNT:

It is a special Savings Bank product for the youths.

Eligibility:

Residents, above 18 years of age and upto 30 years of age, at the time of entry. Account to

continue as it is, even if the account holder attains the age of 30 years.

ATM- cum-Debit card facility:

Yuva Card (Visa), which have many concessionary/ complementary facilities, will be issued

free of cost.

Remittance/ collection:

One draft / Bankers Cheque will be issued free, per calendar month, favouring Educational

Institutions or for applying jobs.

Free collection of one cheque, with a ceiling of Rs. 20,000/- per month.

Other Facilities:

As applicable to Normal Savings Bank Account.

5. PREMIUM SAVINGS ACCOUNT:

Premium Savings Account provides an enriched version of Savings Bank account consisting

of various concessions and add-ons.

Auto-sweep facility

31

Auto-sweep facility will be operative at monthly intervals.

Term Deposits (TD)/ Special Term Deposits (STD) would be created under the MOD

scheme, in units of Rs.1,000/-, subject to a minimum amount of Rs. 10,000/-.

Unitised break-up available for withdrawing the deposits conveniently.

TD/STD shall be opened for a period of 1 year to 5 years.

Other Facilities available

i. 50 Multicity cheque leaves free in the first instance thereafter Rs. 2/- is charged for each

subsequent leaf for Savings Bank account having QAB as on previous quarter end Rs.

25000/- and above. 20 Multicity cheque leaves free in the first instance thereafter Rs. 3/- is

charged for each subsequent leaf for Savings Bank account having QAB as on previous

quarter end below Rs. 25000/-. Emergency Cheque request (10 leaves set): Rs 3/- per leaf.

ii. Unlimited number of debits.

iii. ATM-cum-Debit Gold cards (Master/ Visa) will be issued, free of cost.

iv. Internet Banking facility.

v. 50% concession in draft issue charges and cheque collection charges.

vi. Bankers Cheques will be issued free.

vii. No service charges in respect of outward RTGS/ NEFT transactions.

6. TERM DEPOSITS:

Period of deposit from 7 days to 10 years.

Deposit Amount: Minimum: Rs.1000/-, maximum: No limit.

Payment of interest at Monthly/Quarterly/Calendar quarter basis as per your requirement.

Payment of interest on monthly interval will be at discounted rate.

Interest will be paid at the contracted rate irrespective of change in the rate thereafter.

Senior Citizens get 0.25% extra interest rate.

Loans / OD upto 90% of the Principal deposit.

Premature payment:

The penalty for premature withdrawal of deposits below Rs 15 lacs for all tenors will be

0.50% p.a. provided these have remained with the Bank for at least 7 days.

32

Auto renewal is exercised if maturity instructions are not given

Flexibility to convert TDR to STDR and vice versa

Nomination facility available and recommended

TDS at prevalent rate is deducted at source if Form 15G/15H not submitted.

TDS will be deducted when interest paid or

accrued or reinvested per customer, per branch, exceeds Rs. 10,000 in a financial year.

The TDR can be linked to any Savings Bank or Current Account from where you can

withdraw periodical interest. TDS payments, if any, can be made to the Government as and

when it is due from linked account.

7. MULTI OPTION DEPOSIT SCHEME:

These are the Term Deposits but at the time of need for funds, withdrawals can be made in

units of Rs.1,000/- from the Deposits by issuing a cheque from Savings Bank Account or

through overdraft facility from Current account.

Flexibility in period of Term Deposit from 1 year to 5 years.

Minimum amount of Rs. 10,000/- only.

8. RECURRING DEPOSITS:

1. Monthly deposits of Minimum Rs.100/- no maximum.

2. Minimum period 12 months maximum 120 months.

3. Rate of interest as applicable to Banks TDR / STDR for the period of the RD.

4. Loan / Overdraft up to 90% available against the balance in RD account.

5. TDS is not applicable.

9. SBI FLEXI DEPOSIT SCHEME:

A variant of Recurring Deposit with the facility of depositing variable deposit instead of a

fixed instalment.

33

Period of deposit: Minimum - 5 years and Maximum - 7 years

Minimum deposit amount:

Rs. 5,000/- per Financial Year.

Minimum of Rs. 500/- at any one instance.

Deposits can be made anytime during a month and any number of times.

Penalty for default in payment of minimum deposit will be Rs.50/- per Financial Year.

Maximum deposit amount: Rs.50,000/- in a Financial Year.

Rate of interest: As applicable to Term deposits. Interest will be compounded at quarterly

intervals, based on the balance outstanding on the last date of each month.

Tax deduction at source: Interest payable will be subject to TDS.

Premature closure: Allowed.

MARKET SEGMENTATION OF ADVANCES:

The following is the broad classification of advances according to market segments:

34

1. Personal Banking

2. S.M.E(Small and Medium Entrepreneurs)

3. C & I( Commercial And Institutional)

4. Agriculture.

1. PERSONAL BANKING:

(1) HOUSING LOANS:

Source: Google Images

1. Package of exclusive benefits.

2. Low interest rates. Further, we charge interest on a daily reducing balance!!

3. Low processing charges.

4. No hidden costs or administrative charges.

5. No prepayment penalties. Reduce your interest burden and optimally utilize your surplus

funds by prepaying the loan.

6. Over 15,969 branches nationwide, you can get your Home Loan account parked at a

branch nearest to your present or proposed residence.

SBI Realty:

SBI Realty provides an opportunity to the customer to purchase a plot for construction of

house. The construction of house should commence within 2 years from the date of availment

of SBI Realty Loan.

Customers are also eligible to avail another Home Loan for construction of house on the plot

financed under the SBI Realty with the benefit of running both the loans concurrently.

Loan Amount : Maximum Loan Amount: Rs.10 crores

Repayment Period : Upto 15 years.

SBI Maxgain:

35

An innovative and customer-friendly product enabling the customers to earn optimal yield on

their savings by reducing interest burden on Home Loans, with no extra cost.

The loan is sanctioned as an Overdraft with added flexibility to operate the Home Loan

Account like SB or Current Account. Bank also provides Cheque Book/Net Banking facility

for the purpose.

Minimum Loan Amount: Rs.5 lacs

Maximum Loan Amount: No Cap

Interest Rate: A premium of 0.25% over and above the applicable Home Loan interest rate

for Home Loan > Rs.1 crore is payable.

Home Equity:

Loan for any purpose other than speculative.

Repayment period co-terminus with the underlying Home Loan account.

Upto two Home Equity Loans allowed to exist together.

No prepayment/preclosure penalty.

Eligibility:

All Home Loans with a satisfactory repayment track of at least one year.

Valid mortgage should have been created in favour of the Bank.

Minimum Loan Amount: Rs. 0.50 lacs

Maximum Loan Amount: Rs. 2 crores.

Gram Nivas:

Scheme covers all Rural and Semi-urban centres having population upto 50,000 as per 2001

census.

Maximum Loan Amount: Rs. 5 lacs

Maximum repayment period: 15 years.

Sahayog Niwas:

Under this Self Help Groups with existence of 2 years or more are financed for on lending

housing loans to their members not exceeding Rs 50000 for construction and Rs 25000 for

repairs.

36

(2) EDUCATION LOANS:

Source: Google Images

SBI Student Loan:

Under this scheme financial assistance is provided to deserving/ meritorious students for

pursuing higher education in India and abroad to an extent of Rs 10 lakhs and Rs 30 lakhs

respectively. The students should undergo the studies in recognized colleges/ universities

only. Margin and collateral security is waived up to Rs 4 lakhs. Loan can be repaid in 5 to 7

years after completion of the course. There is interest concession of 0.50% to girl students.

SBI Scholar:

Under the scheme loans to deserving/ meritorious students for pursuing full time courses in

India in premier and 112 reputed institutes identified by the bank. Under this scheme a

maximum amount of Rs 20 locs without security and Rs 30 lacs with security can be

financed.

SBI Education Plus:

Under this scheme loans are sanctioned to permanent employees having minimum service of

2 years, with age below 45 years, for pursuing courses in distance education mode up to

maximum amount of Rs 1 lac.

(3) CAR LOANS:

37

Source: Google Images

This scheme is meant for sanction of loans for purchase of loans for purchase of cars either

new or old for those who have independent and permanent source of income and between 21

to 65 years of age. Loan has to be closed before borrower attains 70 years of age. There is no

upper limit of loan for new cars and for used cars the maximum is Rs. 15 lakhs. Loan is

sanctioned on the basis of EMI Ratio and on road cost of the car. Loan is repayable in 7

years.

(4) OTHER LOANS:

Loans against Banks TDR/STDR: Demand Loan or overdraft can be sanctioned

to the customer upto 90% of the value of the TDR/STDR (Principal plus accrued

interest) @ 0.50% above the interest rate paid on the deposit by the bank.

Loans against Shares/Debentures: Loans are sanctioned by selected branches

against shares that are fully paid and listed in BSE 100 index up to a maximum limit

of Rs 20 Lakhs on minimum AA+ by CRISIL or equally by ICRA.

Loans against Life Insurance policies: Loans are sanctioned against surrender

value of Life Insurance policies (LIC or SBI Life Policies). 95% of surrender value of

the policy can be sanctioned after obtaining surrender value of the Life Insurance

policies. Maximum repayment period is 36 months.

Loans against NSCs/KVP/IVP: Loans are sanctioned against NSCs/KVP/IVP to

the extent of 60% of the face value and accrued interest for public and 85% for staff.

Gold Loans: Under the scheme loans are sanctioned against pledge of gold

ornaments to a maximum extent of Rs 10 lakhs. Gold prices are circulated by LHO

every month.

38

Bhyagyarekha loan for women depositors: Bank introduced this scheme garner

regular savings through Recurring Deposit Scheme and grant Demand Loans to

women for general purposes needs. RD a/c holder is eligible to avail this loan after the

RD has run for atleast 12 months. The RD installments should have been paid

regularly. Minimum installment in RD is Rs. 400/- p.m. for 36 months maturity (to

arrive at minimum loan amount of Rs. 10,000/-) and Rs. 200/- p.m. for 60 months

maturity (To arrive at minimum loan amount of Rs. 5,000/-). Loan amount will be

twice the balance outstanding in the RD account, with a minimum of Rs. 5,000/- &

maximum of Rs. 50,000/-. The Loan would be repaid in 24/48 monthly installments.

Pension Loans: Under the scheme loans against pensions can be sanctioned to all

Government/SBI pensioners where accounts are maintained with us and whose age is

not above 72 years for self and 65 years for family pensioners. Under the scheme the

amount of loan that can be sanctioned to self is 12 months net pension subject to a

maximum of Rs 1 lakh and for family pensioner 9 months pension subject to a

maximum of Rs 50,000/-. Under loan to affluent pensioners scheme loan can be

sanctioned up to Rs 3 lakhs for pensioner &Rs 1.50 lakh for family pensioner subject

to the condition that the EMI of the pension loan should not exceed 25% of the

pension drawn by the family pensioners. Under the Jai Jawan Pension loan scheme

loan can be sanctioned upto Rs 2 lakhsn for pensions of armed forces yp to the age of

50.

Xpress Credit: This is a personal loan sanctioned to a maximum extent of Rs 15 lacs

to employees of PSUs, Government organizations, Quasi companies with SB1 and

SB2 ratings etc whose salary accounts are maintained with us. Repayment should be

effected through check off system.

2. S.M.E (Small and Medium Entrepreneurs)

1) Traders Easy Loan: Under the scheme Bank extends hassle free finance to the

borrowers who are engaged in trade and services sector for acquiring fixed assets and

working capital needs. The amount that can be sanctioned under the scheme is

minimum Rs 25,000/- & maximum Rs 5 Crores.

2) Rent Plus: Under this scheme Bank extends finance to owners of

residential/commercial buildings which are rented/to be rented to MNCs/Banks/Large

and Medium size corporates. Against assignment of future rentals to meet borrowers

liquidity mismatch. The amount that can be sanctioned under the scheme is minimum

Rs 50,000/- & maximum Rs 10 Crore.

3) SME Credit Card: Borrowers of Small Scale Industrial Units, Small Retail Traders,

with 2 years satisfactory track record are eligible under the scheme. Can be financed

by means of either Term loan or Cash credit up to a maximum of Rs 10 lakhs.

Eligibility is on the basis of scoring model. The Cash credit is valid for 3 years subject

annual review.

39

4) SME Smart Score: SME units whose credit requirements are between Rs 5 lakhs

and 50 lakhs can be sanctioned under the scheme in the form of either Term Loan or

Cash Credit. While the maximum limit for manufacturing units is Rs 50 lakhs, the

Trade and services sector units can be sanctioned up to an amount of Rs 25 lakhs. The

applicant must obtain a minimum overall score of 60% with a minimum of 50% under

each sub-head like Personal details, Business details and collateral details.

5) SBI Shoppe: Under the scheme individuals, Firms, Partnership firms, etc can be

sanctioned up to Rs 20 lakhs for the purpose of purchasing/repairing/modernization of

shops/show rooms etc and purchases of furniture/fixtures/electrical fittings etc for the

shops.

3. COMMERCIAL & INSTITUTIONAL (C & I) SEGMENT

All loans and advances given to business (business include the activities of

manufacturing, services and trading), other than those classified under SME are classified as

C & I advances. These advances are sanctioned after assessment of the need and the level of

risk involved. These advances are governed by guidelines issued by Credit Policy & Planning

Department of the Bank from time to time.

4. AGRICULTURAL SEGMENT:

Source: Google Images

1) Kisan Credit Card: This product is meant for farmers to meet short term loan

requirements and Investment credit needs of small value in the nature of farm implements/

equipments etc. and consumption requirements. KCC limits are valid for 5 years. For every

successive years (2

nd

, 3

rd

, 4

th

and 5

th

year), the limit will be stepped up @ 10%. (Short term

40

credit limit sanctioned for 5

th

year will be about 150% of the first year limit allowed to

farmers). Finance is made on the basis of scale of finance fixed by District consultative

committee. All farmers are covered by Personal Accident Insurance scheme up to the age of

70 years. The coverage is Rs 50,000/- per farmer with a premium of Rs 15/- per annum. The

premium is paid in the ratio of 2:1 by the bank and the borrower.

2) Kisan Gold Card: This is General purpose loan for farmers for productive and

consumption purposes. This product cant be used for purchase purposes of tractors &

accessories and for purchase of land and construction of farm shed. Farmers with 2 years

excellent repayment record or farmers who maintained sizeable deposits with our Branches

for last 2 years are eligible under the scheme. Maximum amount that can be sanctioned under

the scheme is Rs 10 lakhs. 20% of the sanctioned amount can be allowed towards

consumption needs.

3) Produce Marketing Loan: This is a short term loan sanctioned to farmers to help them,

avoid distress sale of their farm produce at the time of harvest and to provide them liquidity

to meet immediate needs. Maximum amount that can be sanctioned under this scheme is Rs

10 lakhs. Loan to be repaid within a maximum period of 12 months. The advance is

sanctioned against warehouse receipts issued by Central warehousing corporation, State

Warehousing Corporation, and other private houses.

4) Tractor Finance under Scoring Model: The scheme provides finance for purchase of

new tractors, accessories and implements so as to enable the farmers to improve crop

productivity and to use it for custom hiring. The loan is to be repaid within a maximum

period of 9 years. The assessment process is done through scoring model. SBI TAFE

Nayaroop and SBI Mahindra Vishwas are the schemes meant for financing of second hand/

used tractors, with a maximum limit of Rs 2.50 lakhs. Sanjeevani is the loan for repairs of a

tractor financed by us and the loan is regular. We also finance Power Tillers for farmers or

group of farmers having a minimum of 2 acres of perennially irrigated land.

5) New Tractor Loan Scheme (NTLS): Borrowers with a minimum land holding of 2 acres

can be financed with a maximum repayment period of 5 years with one month moratorium.

Mortgage of land is required to cover 100% of the loan sanctioned. Scheme is available in

selected Branches only.

6) SBI Krishak Utthan Yojna: This scheme provides easy access to short term production

and consumption credit to meet genuine requirements of tenant farmers, share croppers and

oral lessees who do not have recorded land records and where there is no written undertaking/

document available to substantiate raising of crops by the tenant farmer/ share cropper/ oral

lessee. It will help increase their income from agriculture production activities.

41

SBIs TECHNOLOGY BASED PRODUCTS AND SERVICES

1. ATM SERVICES:

Source: Google Images

State Bank offers you the convenience of over 43,000+ ATMs in India, the largest network in

the country and continuing to expand fast! This means that you can transact free of cost at the

ATMs of State Bank Group (This includes the ATMs of State Bank of India as well as the

Associate Banks - namely, State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State

Bank of Mysore, State Bank of Patiala, and State Bank of Travancore) and wholly owned

subsidiary viz. SBI Commercial and International Bank Ltd., using the State Bank ATM-

cum-Debit (Cash Plus) card.

Plastic Money may be distinguished into three different cards:

1. Debit Card : PAY NOW, BUY NOW.

2. Credit Card : BUY NOW, PAY LATER.

3. SMART CARD : PAY NOW, BUY LATER.

Smart Card is an electronic purse, an e-cash card, a standard card with an integrated micro-

processor chip and inboard CPU to store information, examples- Pay Roll card, Gift Card all

of SBI. Developed with latest silicon technology, with pre- programmed memory and

security codes, Credit Cards are other examples of convenient banking. Debit cards are

similar to ATM Card with an additional facility of using them in merchant establishments.

KINDS OF CARDS ACCEPTED AT STATE BANK ATMs

Besides all cards of State Bank of India, State Bank ATM-Cum-Debit Card and State Bank

International ATM-Cum-Debit Cards following cards are also accepted at State Bank ATMs:

1. State Bank Credit Card

2. Cards issued by other banks displaying Maestro, Master Card, Cirrus, VISA and

VISA Electron logos

3. All Debit/ Credit Cards issued by any bank outside India displaying Maestro, Master

Card, Cirrus, VISA and VISA Electron logos.

42

Other Features: ATM cards among other things, facilitate the customer for conducting the

following types of transactions:

Recharge pre-paid mobile phones of almost all companies

Pay MTNL, Mumbai bills through State Bank ATMs

Payment of SBI Credit Card bills

Payment of SBI Life Insurance premium

Pay fees of select colleges

Donate to select Temple Trusts

Registration for Mobile Banking services

Register for SMS alerts

Funds Transfer through ATMs( Card to Card Transfer):

This is a new product available on ATMs of State Bank Group. Card holders can transfer

funds to any cardholder within the State Bank Group through State Bank ATM, subject to a

maximum of Rs 50,000 per transaction. The recipients account will be credited on the next

working day. All Card holders of all branches of State Bank Group can avail the facility.

Transaction Costs/ Customer Charges:

As per RBI guidelines, the following service charges are applicable for using ATMs other

than that of the Card issuer:

Type of Account Service Availed Charge Applicable

Savings Bank A/c Both Financial and Non-

financial transactions per

calendar month:

a) Upto 5 transactions at

other Bank ATMs

b) Above 5 transactions

Financial

Non- financial

Free

Rs 17 per transaction

Rs 6 per transaction

Current A/c and KCC Cash Withdrawal transaction Rs 17 per transaction

Maximum amount of withdrawal at other bank ATMs is Rs10,00 per transaction. Similarly

our group ATMs will also disburse maximum Rs10,00 per withdrawal to other bank

customers.

2. INTERNET BANKING:

43

Source: Google Images

The Internet banking portal of SBI, enables its retail banking customers to operate their

accounts from anywhere anytime, removing the restrictions imposed by geography and time.

It's a platform that enables the customers to carry out their banking activities from their

desktop, aided by the power and convenience of the Internet. Using Internet banking services,

you can do the following normal banking transactions online:

Funds transfer between own accounts.

Third party transfers to accounts maintained at any branch of SBI

Group Transfers to accounts in State Bank Group

Inter Bank Transfers to accounts with other Banks

Online standing instructions for periodical transfer for the above

Credit PPF accounts across branches

Request for Issue of Demand Draft

Request for opening of new accounts

Request for closure of Loan Accounts

Request for Issue of Cheque Book.

Apart from these, the other salient value-added features available are:

Utility bill payments

Online Ticket Booking for travel by Road, Rail and Air

SBILIFE, LIC and other insurance premium payments

SBI and other Mutual funds Investments

SBI and other Credit Card dues payments

Tax Payment Income, Service, State Government

Customs Duty Payment

Online Share Trading (eZ-trade@SBI)

Online Application for IPO

44

3. MOBILE BANKING:

Source: Google Images

Apart from generating access to new business opportunities and new alliances, cost conscious

banks see the launch of this new channel, mobile banking services, as an opportunity to

reduce the operational costs while offering the customers convenience of facilitating 24X7

banking service. This will also result in increased customer satisfaction.

The mobile banking services can be offered over different modes, catering to both high end

and low end mobile phones. For customers with java enabled mobile phone, application

based service would be the best choice. The mobile banking application will reside in the

handset of the customer and is menu driven. This is a very secure mode since the messages

from the handset is encrypted end to end and cannot be tampered with during the

transmission to the banks server. Where the customer does not have GPRS facility, which is

chargeable service provided by the mobile operators, the messages are sent as encrypted

SMS. Mobile banking services over WAP is available for customers having mobiles with

GPRS facility. RBI has come out with guidelines for mobile banking services.

SBI has already put in place suitable infrastructure for offering this facility to its customers.

The product is named as STATE BANK FREEDOM. The ceilings for transactions under

Mobile Banking are as under:

45

Transactions Under Regular State

Bank Freedom

Under USSD/ SMS

Banking facility*

Maximum amount of

transactions for a day

Rs 50,000/- Rs 1,000/-

Maximum amount of

transactions per Calendar

month

Rs 2,50,000/- Rs 5,000/-

*It has been decided to increase the daily limits for transactions using plain SMS text, to

Rs.5000 subject to calendar month limit of Rs.25, 000 with the use of one time password.

3. REAL TIME GROSS SETTLEMENT (RTGS):

Source: Google Images

RTGS is an electronic payment system like wire transfer, Structural Financial Messaging

System (SFMS). Real time means payment transaction is not subjected to any waiting

period. Gross settlement means the transaction is settled on one to one basis without

bunching with any other transaction.

It saves time and cost of remittance and dispatch by the usual modes of remittance like draft,

cheque, etc. It is cost effective, saves money on reconciliation, follow-up, postage, etc. In SBI

all the information is routed through a dedicated accounting unit (DAU) setup under

Payments System Group at Global IT Centre, Navi Mumbai. Transaction amount under

RTGS should be more than Rs.2 lakhs.

RTGS transactions:

Day Start time End time

Monday to Friday 9.00 hrs 16.00 hrs

Saturday 9.00 hrs 13.00 hrs

Under normal circumstances the Beneficiary branches are expected to receive the funds in

real time as soon as funds are transferred by the remitting bank. If the money cannot be

credited for any reason, the receiving bank would have to return the money to the remitting

bank within 2 hours. Once the money is received back by the remitting bank, the original

46

debit entry in the customers account is reversed. The remitting customer has to furnish the

following information to a bank for effecting a RTGS remittance:

Amount to be remitted

His account number which is to be debited

Name of the beneficiary bank

Name of the beneficiary customer

Account number of the beneficiary customer

Sender to receiver information, if any

The IFSC number of the receiving branch

Remitters Mobile Number.

4. NATIONAL ELECTRONIC FUNDS TRANSFER (NEFT):

Source: Google Images

Inter Bank Transfer enables electronic transfer of funds from the account of the remitter in

one Bank to the account of the beneficiary maintained with any other Bank branch. NEFT is

maintained by Reserve Bank of India.

This system of fund transfer operates on a Deferred Net Settlement basis. Fund transfer

transactions are settled in batches as opposed to the continuous, individual settlement in

RTGS. Presently, NEFT operates in hourly batches from 9 am to 7 pm on week days and 9

am to 1 pm on Saturdays.

Day Start time End time

Monday to Friday 8.00 hrs 18.30 hrs

Saturday 8.00 hrs 12.30 hrs

If the beneficiary's bank is unable to credit the beneficiary's account for any reason, the

former will return the money to the remitting bank within 2 hours of completion of the batch

in which the transaction was processed. Once the amount is received by the remitting bank, it

is credited to the remitter's account by the branch concerned.

47

For affecting an NEFT remittance the remitter has to furnish the following information:

Amount to be remitted.

Remitting customer's account number which is to be debited

Name of the beneficiary bank.

Name of the beneficiary.

Account number of the beneficiary.

Sender to receiver information, if any

IFSC code of the destination bank branch.

5. DEMAT SERVICES:

Source: Google Images

Overview:

(i) All the new demat accounts and Online Trading accounts can be opened in the books of

SBI Cap Securities Ltd.

(ii) The existing demat accounts in the books of the Bank will continue to be maintained by

the Bank.

Existing demat customers of SBI will continue to get the services from SBI as before. SBI is

a Depository Participant registered with both National Securities Depositories Limited

(NSDL) and Central Depository Services Limited (CDSL) and is operating its DP activity

through more than 1000 branches. Our Power Demat Account offers you the following

features:

As opposed to the earlier form of dealing in physical certificates with delays in transaction,

holding and trading in Demat form has the following benefits:

48

Account Maintenance & Safe custody: Facilitates Maintaining Security Balance in

electronic form.

Dematerialization: Facilitates converting physical share certificate into electronic balances.

Rematerialization: Facilitates converting the electronic balances to physical (share

certificate) form.

Account Transfers: Facilitates delivery/receipt of electronic balances consequent to market /

off-market trades.

Pledge/Hypothecation: Facilitates blocking securities balance of borrowers in favour of

lenders for obtaining Loans / advances against shares.

Initial Public offer: Facilitates faster and direct credit of security balances into DP account

on allotment through public issue of companies.

Disbursement of corporate benefits: Facilitates faster and direct credit of security balance

into DP account on account of non-monetary corporate benefits as bonus and rights issues.

Security Lending: Facilitates earning extra income on your dematerialized holdings by the

way of securities lending.

A Demat account with SBI provides you the following benefits:

Customer Care: You can now call our dedicated Customer Care 24X7 and rest assured that

all your queries are taken care of.

Transact Anywhere: Now operate your Demat account from any of the 1000 plus Demat

enabled branches of SBI.

Statements by e-mail: Receive your account statement and bill by email.

Demat Services Online Facility: This convenient and paper free facility lets you operate

from the comfort of your home or office through SBI s Internet Banking Facility.

Online Demat Statements: You can now view your Demat account details, statement of

holdings, statement of transactions and statement of billing online.

BANKER CUSTOMER RELATIONSHIP:

Sr. No TYPE OF TRANSACTIONS POSITION OF

BANK

POSITION OF

CUSTOMER

1 Deposit Accounts, CC (with Credit

Balance)

Debtor Creditor

49

2 O.D, CC, Loan Accounts (with

Debit Balance)

Creditor Debtor

3 Collection of Cheques Agent Principal

4 Sale or Purchase of Securities Agent Principal

5 Issuing/ Purchase of Draft by

purchaser

Debtor Creditor

6 Payee of Drafts at Paying Branch Trustee Beneficiary

7 Mail Transfers, Telegraphic

Transfers

Agent Principal

8 Complying with Standing

Instructions

Agent Principal

9 Providing Various Services to non

account holders

Agent Principal

10 Cheques deposited pending

instructions for disposal thereof

Trustee Beneficiary

11 Safe Custody of Articles Bailee Bailor

12 Leasing of Locker Lessor

Licensor

Lessee

Licensee

13 Mortgage of Immovable Property Mortgagee Mortgagor

14 Pledge of Securities/ Shares Pledgee Pledgor

15 Hypothecation of Securities Hypothecatee Hypothecator

16 Sale/ Purchase of Shares etc Agent Principal

17 Maintaining Currency Chest

(RBIs property)

Agent Principal

18 FDR with Bank after maturity Debtor Creditor

19 Wrong credit given by the bank

where the amount has not yet been

recovered.

Beneficiary Trustee

FINANCIAL QUOTE OF STATE BANK OF INDIA:

MARKET CAP (RS CR): 182,148.90

50

P/E: 16.56

BOOK VALUE: (RS) 1584.34

DIV (%): 300.00%

MARKET LOT: 1

INDUSTRY P/E: 10.10

EPS (TTM): 147.33

P/C: 14.77

PRICE/BOOK: 1.54

DIV YIELD (%): 1.23%

FACE VALUE: (RS) 10.00

FINANCIAL PERFORMANCE:

Profit:

51

Given the system wide economic slowdown, the financial performance of the Bank during

the financial year ended 31st March, 2014, remained satisfactory. The Bank registered a good

growth in Operating Profit during the fourth quarter of the year as compared to previous

quarters. The Operating Profit of the Bank for 2013-14 was higher at Rs.32,109.24 crores, as

compared to Rs.31,081.72 crores in 2012-13, an increase of 3.31%.

The Bank posted a Net Profit of Rs.10,891.17 crores for 2013-14, as compared to

Rs.14,104.98 crores in 2012-13, i.e. a decline of 22.78% on the back of higher provisioning

requirement.

Net interest income:

Due to higher growth in the advances and investment portfolios, the gross interest income

from global operations rose from Rs.1,19,655.10 crores to Rs.1,36,350.80 crores during the

year registering a growth of 13.95%.

The Net Interest Income of the Bank correspondingly registered a growth of 11.17% from

Rs.44,329.30 crores in 2012-13 to Rs.49,282.17 crores in 2013-14.

Interest income on advances in India increased from Rs.85,782.26 crores in 2012-13 to

Rs.97,674.91 crores in 2013- 14 registering a growth of 13.86%, due to higher volumes.

However, the average yield on advances in India has declined from 10.54% in 2012-13 to

10.30% in 2013-14.

Income from resources deployed in treasury operations in India increased by 15.24% mainly

due to higher average resources deployed. The average yield has also increased to 7.65% in

2013-14 from 7.54% in 2012-13.

Total interest expenses of global operations increased from Rs.75,325.80 crores in 2012-13 to

Rs.87,068.63 crores in 2013- 14. Interest expenses on deposits in India during 2013-14

recorded an increase of 15.65% compared to the previous year. The average cost of deposits

has increased by 6 basis points from 6.29% in 2012-13 to 6.35% in 2013-14, whereas the

average level of deposits in India grew by 14.55%.

Non-interest income:

52

Non-interest income increased by 15.69% to Rs.18,552.92 crores in 2013-14 as against

Rs.16,036.84 crores in 2012- 13. During the year, the Bank received an income of Rs.496.86