Professional Documents

Culture Documents

Kieso15e Testbank ch03

Uploaded by

softplay12100%(2)100% found this document useful (2 votes)

713 views47 pagesOriginal Title

kieso15e_testbank_ch03

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

713 views47 pagesKieso15e Testbank ch03

Uploaded by

softplay12Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 47

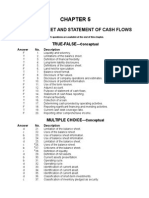

CHAPTER 3

THE ACCOUNTING INFORMATION SYSTEM

IFRS questions are available at te en! o" tis #a$ter%

TRUE&FA'SE

Ans(er No% )es#ri$tion

F 1. Recording transactions.

T 2. Nominal accounts.

F 3. Real (permanent) accounts.

F 4. Internal event example.

F 5. ia!ilit" and stoc#$olders% e&uit" accounts.

F '. (e!its and credits.

F ). *teps in accounting c"cle.

T +. ,urpose o- trial !alance.

T .. /eneral 0ournal.

F 11. ,osting and trial !alance.

T 11. 2d0usting entries -or prepa"ments.

T 12. 3xample o- accrued expense.

F 13. 4oo# value o- deprecia!le assets.

T 14. Reporting ending retained earnings.

F 15. ,ost5closing trial !alance.

F 1'. ,osting closing entries.

T 1). 6losing entries and Income *ummar".

F 71+. 2ccrual !asis accounting.

F 71.. ,urpose o- reversing entries.

F 721. 2d0usted trial !alance.

MU'TIP'E CHOICE*Con#e$tual

Ans(er No% )es#ri$tion

d 21. ,urpose o- an accounting s"stem.

d 22. (e-inition o- posting.

d 23. ,urpose o- an accounting s"stem.

d 24. 4oo# o- original entr".

d 25. ,urpose o- trial !alance.

d 2'. Identi-ication o- a real account.

! 2). Identi-ication o- a temporar" account.

a 2+. Temporar" accounts.

c 2.. (ou!le5entr" accounting s"stem.

c 31. (ou!le5entr" s"stem.

a 31. 3--ect on stoc#$olders% e&uit".

a 32. Transaction anal"sis.

a 33. 2ccounting e&uation.

! 34. 2ccounting process vs. accounting c"cle.

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

d 35. 2ccounting c"cle steps.

d 3'. 6riteria -or recording events.

d 3). Identi-ication o- a recorda!le event.

c 3+. Identi-ication o- internal events.

d 3.. 3xternal events.

d 41. imitations o- trial !alance.

a 41. /eneral 0ournal.

! 42. 8ournal entr".

c 43. 8ournal entr".

d 44. 8ournal entr".

d 45. Im!alance in a trial !alance.

d 4'. ,urpose o- unad0usted trial !alance.

! 4). Format o- ad0usting entr".

! 4+. 3xample o- accrued expense.

d 4.. 2ccrual5!asis o- accounting.

c 51. 2ccrued expense ad0usting entr".

a 51. 3--ect o- not recording accrued expense.

! 52. (escription o- a de-erral.

d 53. 3--ect o- not recording accrued revenue.

a 54. 3--ect o- not recording depreciation expense.

a 55. Timing o- ad0ustments.

a 5'. ,repaid expense.

a 5). 3xpiration o- prepaid expenses.

! 5+. 3--ect o- depreciation entr".

a 5.. 9nearned revenue relations$ips.

a '1. 6omputation o- interest expense -or ad0usting entr".

d '1. ,urpose o- ad0usting entries.

c '2. :atc$ing principle.

a '3. ,repaid items.

d '4. 2ccrued items.

c '5. (e-inition o- unearned revenue.

d ''. (e-inition o- accrued expense.

c '). 2d0usting entr" -or accrued expense.

d '+. Factors to consider in estimating depreciation.

d '.. 2d0usting entries.

d )1. 3--ect o- ad0usting entries.

! )1. ,repaid expense and t$e matc$ing principle.

c )2. 2ccrued revenue and t$e matc$ing principle.

! )3. 9nearned revenue and t$e matc$ing principle.

! )4. 2d0usted trial !alance.

c )5. 6losing process.

c )'. ,urpose o- closing entries.

d )). 6as$ collections vs. revenue recogni;ed.

d 7)+. 6as$5!asis revenue.

c 7).. 6onvert cas$ receipts to service revenue.

c 7+1. 6onvert cas$ paid -or operating expenses.

c 7+1. ,urpose o- reversing entries.

d 7+2. Identi-ication o- reversing entries.

d 7+3. Identi-ication o- reversing entries.

! 7+4. 2d0usting entries reversed.

d 7+5. Reporting inventor" on a <or#s$eet.

3 0 1

T$e 2ccounting In-ormation *"stem

MU'TIP'E CHOICE*Co-$utational

Ans(er No% )es#ri$tion

c +'. 3--ect o- transactions on o<ners% e&uit".

c +). 3--ect o- transactions on o<ners% e&uit".

c ++. 9nearned rent ad0ustment.

c +.. 9nearned rent ad0ustment.

d .1. (etermine ad0usting entr".

c .1. 2d0usting entr" -or !ad de!ts.

! .2. 2d0usting entr" -or !ad de!ts.

c .3. 2d0usting entr" -or interest receiva!le.

c .4. *u!se&uent period entr" -or interest.

d 7.5. 9se o- reversing entr".

d .'. 2d0usting entr" -or unearned rent.

! .). 2d0usting entr" -or supplies.

d .+. 3--ect o- closing entries.

! 7... 6alculate cas$ received -or interest.

! 7111. 6alculate cas$ paid -or salaries.

d 7111. 6alculate cas$ paid -or insurance.

c 7112. 6alculate insurance expense.

c 7113. 6alculate interest revenue.

c 7114. 6alculate salar" expense.

d 7115. 2d0usting entr" -or supplies.

c 711'. Reversing entries.

! 711). 9nearned rent ad0ustment.

a 711+. (etermine ad0usting entr".

d 711.. (etermine ad0usting entr".

MU'TIP'E CHOICE*CPA A!a$te!

Ans(er No% )es#ri$tion

c 111. (etermine accrued interest pa"a!le.

! 111. (etermine !alance o- unearned revenues.

a 112. 6alculate su!scriptions revenue.

c 113. (etermine interest receiva!le.

! 114. 6alculate !alance o- accrued pa"a!le.

! 115. 6alculate accrued salaries.

a 11'. 6alculate ro"alt" revenue.

d 11). 6alculate de-erred revenue.

! 711+. (i--erence !et<een cas$5!asis and accrual met$od.

c 711.. (etermine cas$5!asis revenue.

! 7121. (etermine accrual5!asis revenue.

a 7121. 6alculate cost o- goods sold.

7T$is topic is dealt <it$ in an 2ppendix to t$e c$apter.

3 0 3

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

+RIEF E2ERCISES

Ite- )es#ri$tion

4335122 (e-initions.

4335123 Terminolog".

4335124 2ccrued and de-erred items.

E2ERCISES

335125 2d0usting entries.

33512' 2d0usting entries.

33512) Financial statements.

733512+ 6as$5!asis vs. accrual5!asis accounting.

733512. 2ccrual !asis.

7335131 2ccrual !asis.

7335131 2ccrual !asis.

7335132 6as$ !asis.

PRO+'EMS

Ite- )es#ri$tion

,35133 2d0usting entries and account classi-ications.

,35134 2d0usting entries.

,35135 2d0usting and closing entries.

7,3513' 6as$ to accrual accounting.

7,3513) 2ccrual accounting.

7,3513+ 2ccrual accounting.

7,3513. 3ig$t5column <or# s$eet.

CHAPTER 'EARNING O+3ECTI4ES

1. 9nderstand !asic accounting terminolog".

2. 3xplain dou!le5entr" rules.

3. Identi-" steps in t$e accounting c"cle.

4. Record transactions in 0ournals= post to ledger accounts= and prepare a trial !alance.

5. 3xplain t$e reasons -or preparing ad0usting entries and identi-" ma0or t"pes o- ad0usting

entries.

'. ,repare -inancial statements -rom t$e ad0usted trial !alance.

). ,repare closing entries.

+. ,repare -inancial statements -or a merc$andising compan".

7.. (i--erentiate t$e cas$ !asis o- accounting -rom t$e accrual !asis o- accounting.

3 0 5

T$e 2ccounting In-ormation *"stem

711. Identi-" ad0usting entries t$at ma" !e reversed.

711. ,repare a 115column <or#s$eet.

12. 6ompare t$e accounting in-ormation s"stems under /22, and IFR*.

3 0 6

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

SUMMARY OF 'EARNING O+3ECTI4ES +Y 7UESTIONS

Item Type Item Type Item Type Item Type Item Type Item Type Item Type

'earnin. Ob8e#tive 9

1. TF 3. TF 21. :6 23. :6 25. :6 2). :6 123. 43

2. TF 4. TF 22. :6 24. :6 2'. :6 2+. :6

'earnin. Ob8e#tive 1

5. TF 2.. :6 31. :6 33. :6

'. TF 31. :6 32. :6 34. :6

'earnin. Ob8e#tive 3

). TF 35. :6 3'. :6 3). :6 3+. :6 3.. :6

'earnin. Ob8e#tive 5

+. TF 11. TF 41. :6 42. :6 44. :6 4'. :6 +). :6

.. TF 25. :6 41. :6 43. :6 45. :6 +'. :6

'earnin. Ob8e#tive 6

11. TF 54. :6 '4. :6 )4. :6 11). :6 11). :6

12. TF 55. :6 '5. :6 ++. :6 11+. :6 122. 43

13. TF 5'. :6 ''. :6 +.. :6 11.. :6 123. 43

4). :6 5). :6 '). :6 .1. :6 111. :6 124. 43

4+. :6 5+. :6 '+. :6 .1. :6 111. :6 125. 3

4.. :6 5.. :6 '.. :6 .2. :6 112. :6 12'. 3

51. :6 '1. :6 )1. :6 .3. :6 113. :6 133. ,

51. :6 '1. :6 )1. :6 .4. :6 114. :6 134. ,

52. :6 '2. :6 )2. :6 .'. :6 115. :6 135. ,

53. :6 '3. :6 )3. :6 .). :6 11'. :6

'earnin. Ob8e#tive :

14. TF )4. :6 12). 3

'earnin. Ob8e#tive ;

15. TF 1'. TF )5. :6 )'. :6 .+. :6 135. ,

'earnin. Ob8e#tive <

1). TF

'earnin. Ob8e#tive =>

1+. TF +1. :6 112. :6 11.. :6 12.. 3 13'. ,

)). :6 ... :6 113. :6 121. :6 131. 3 13). ,

)+. :6 111. :6 114. :6 121. :6 131. 3 13+. ,

).. :6 111. :6 11+. :6 12+. 3 132. 3

'earnin. Ob8e#tive =9?

1.. TF +2. :6 +4. :6 115. :6 11+. :6 12'. 3

+1. :6 +3. :6 .5. :6 11'. :6 11.. :c

'earnin. Ob8e#tive =99

21. TF +5. :6 13.. ,

'earnin. Ob8e#tive 91 @ IFRS 7uestions

1. TF 2. TF 3. :6 4. :6 5. :6 '. :6 ). :6

3 0 :

T$e 2ccounting In-ormation *"stem

+. *2 .. *2

Note> TF ? True@False 3 ? 3xercise 43? 4rie- 3xercise

:6 ? :ultiple 6$oice , ? ,ro!lem *2 ? *$ort 2ns<er

TRUE&FA'SE

1. 2 ledger is <$ere a compan" -irst records transactions and ot$er selected events.

2. Nominal (temporar") accounts are revenue= expense= and dividend accounts and are

periodicall" closed.

3. Real (permanent) accounts are revenue= expense= and dividend accounts and are

periodicall" closed.

4. 2n example o- an internal event <ould !e a -lood t$at destro"ed a portion o- a

compan"As inventor".

5. 2ll lia!ilit" accounts and stoc#$olders% e&uit" accounts are increased on t$e credit side

and decreased on t$e de!it side.

'. In general= de!its re-er to increases in account !alances= and credits re-er to decreases.

). T$e -irst step in t$e accounting c"cle is t$e 0ournali;ing o- transactions and selected

ot$er events.

+. Bne purpose o- a trial !alance is to prove t$at de!its and credits are e&ual in t$e

general ledger.

.. 2 general 0ournal c$ronologicall" lists transactions and ot$er events= expressed in terms

o- de!its and credits to accounts.

11. I- a compan" -ails to post one o- its 0ournal entries to its general ledger= t$e trial !alance

<ill not s$o< an e&ual amount o- de!it and credit !alance accounts.

11. 2d0usting entries -or prepa"ments record t$e portion o- t$e prepa"ment t$at represents

t$e expense incurred or t$e revenue recogni;ed in t$e current accounting period.

12. 2n ad0ustment -or <ages expense= earned !ut unpaid at "ear end= is an example o- an

accrued expense.

13. T$e !oo# value o- an" deprecia!le asset is t$e di--erence !et<een its cost and its

salvage value.

14. T$e ending retained earnings !alance is reported on !ot$ t$e retained earnings

statement and t$e !alance s$eet.

15. T$e post5closing trial !alance consists o- asset= lia!ilit"= o<nersA e&uit"= revenue and

expense accounts.

3 0 ;

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

1'. It is not necessar" to post t$e closing entries to t$e ledger accounts !ecause ne<

revenue and expense accounts <ill !e opened in t$e su!se&uent accounting period.

1). Total stoc#$olders% e&uit" consists o- common stoc# and t$e earnings retained in t$e

!usiness.

71+. T$e accrual5!asis o- accounting recogni;es revenue <$en t$e per-ormance o!ligation is

satis-ied and expenses <$en cas$ is paid.

71.. Reversing entries are made at t$e end o- t$e accounting c"cle to correct errors in t$e

original recording o- transactions.

721. 2n ad0usted trial !alance t$at s$o<s e&ual de!it and credit columnar totals proves t$e

accurac" o- t$e ad0usting entries.

True & False Ans(ers * Con#e$tual

Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans%

1. F 5. F .. T 13. F 1). T

2. T '. F 11. F 14. T 71+. F

3. F ). F 11. T 15. F 71.. F

4. F +. T 12. T 1'. F 721. F

MU'TIP'E CHOICE*Con#e$tual

21. Factors t$at s$ape an accounting in-ormation s"stem include t$e

a. nature o- t$e !usiness.

!. si;e o- t$e -irm.

c. volume o- data to !e $andled.

d. 2ll o- t$ese ans<er c$oices are correct.

22. T$e process o- trans-erring -igures -rom t$e !oo# o- original entr" to t$e ledger accounts is

called

a. ad0usting.

!. !alancing.

c. ledgering.

d. posting.

23. (e!it al(aAs means

a. t$e rig$t side o- an account.

!. an increase.

c. a decrease.

d. None o- t$ese ans<er c$oices are correct.

24. 2n accounting record into <$ic$ t$e essential -acts and -igures in connection <it$ all

transactions are -irst recorded is called t$e

a. ledger.

3 0 <

T$e 2ccounting In-ormation *"stem

!. account.

c. trial !alance.

d. None o- t$ese ans<er c$oices are correct.

3 0 >

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

25. 2 trial !alance

a. proves t$at de!its and credits are e&ual in t$e ledger.

!. supplies a listing o- open accounts and t$eir !alances t$at are used in preparing

-inancial statements.

c. is normall" prepared t$ree times in t$e accounting c"cle.

d. 2ll o- t$ese ans<er c$oices are correct.

2'. C$ic$ o- t$e -ollo<ing is a real (permanent) accountD

a. /ood<ill

!. *ervice Revenue

c. 2ccounts Receiva!le

d. 4ot$ /ood<ill and 2ccounts Receiva!le

2). C$ic$ o- t$e -ollo<ing is a nominal (temporar") accountD

a. 9nearned *ervice Revenue

!. *alaries and Cages 3xpense

c. Inventor"

d. Retained 3arnings

2+. Nominal accounts are also called

a. temporar" accounts.

!. permanent accounts.

c. real accounts.

d. None o- t$ese ans<er c$oices are correct.

2.. T$e dou!le5entr" accounting s"stem means

a. 3ac$ transaction is recorded <it$ t<o 0ournal entries.

!. 3ac$ item is recorded in a 0ournal entr"= t$en in a general ledger account.

c. T$e dual e--ect o- eac$ transaction is recorded <it$ a de!it and a credit.

d. None o- t$ese ans<er c$oices are correct.

31. C$en a corporation pa"s a note pa"a!le and interest=

a. t$e account notes pa"a!le <ill !e increased.

!. t$e account interest expense <ill !e decreased.

c. t$e" <ill de!it notes pa"a!le and interest expense.

d. t$e" <ill de!it cas$.

31. *toc#$olders% e&uit" is not a--ected !" all

a. cas$ receipts.

!. dividends.

c. revenues.

d. expenses.

32. T$e de!it and credit anal"sis o- a transaction normall" ta#es place

a. !e-ore an entr" is recorded in a 0ournal.

!. <$en t$e entr" is posted to t$e ledger.

c. <$en t$e trial !alance is prepared.

d. at t$e end o- t$e accounting c"cle.

3 0 9?

T$e 2ccounting In-ormation *"stem

33. T$e accounting e&uation must remain in !alance

a. t$roug$out eac$ step in t$e accounting c"cle.

!. onl" <$en 0ournal entries are recorded.

c. onl" at t$e time t$e trial !alance is prepared.

d. onl" <$en -ormal -inancial statements are prepared.

34. T$e di--erence !et<een t$e accounting process and t$e accounting c"cle is

a. t$e accounting process results in t$e preparation o- -inancial statements= <$ereas t$e

accounting c"cle is concerned <it$ recording !usiness transactions.

!. t$e accounting c"cle represents t$e steps ta#en to accomplis$ t$e accounting

process.

c. t$e accounting process represents t$e steps ta#en to accomplis$ t$e accounting

c"cle.

d. merel" semantic= !ecause !ot$ concepts re-er to t$e same t$ing.

35. 2n optional step in t$e accounting c"cle is t$e preparation o-

a. ad0usting entries.

!. closing entries.

c. a statement o- cas$ -lo<s.

d. a post5closing trial !alance.

3'. C$ic$ o- t$e -ollo<ing criteria must !e met !e-ore an event or item s$ould !e recorded -or

accounting purposesD

a. T$e event or item can !e measured o!0ectivel" in -inancial terms.

!. T$e event or item is relevant and relia!le.

c. T$e event or item is an element.

d. 2ll o- t$ese must !e met.

3). C$ic$ o- t$e -ollo<ing is a recorda!le event or itemD

a. 6$anges in managerial polic"

!. T$e value o- $uman resources

c. 6$anges in personnel

d. None o- t$ese ans<er c$oices are correct.

3+. C$ic$ o- t$e -ollo<ing is not an internal eventD

a. (epreciation

!. 9sing ra< materials in t$e production process

c. (ividend declaration and su!se&uent pa"ment

d. 2ll o- t$ese are internal transactions.

3.. 3xternal events do not include

a. interaction !et<een an entit" and its environment.

!. a c$ange in t$e price o- a good or service t$at an entit" !u"s or sells.

c. improvement in tec$nolog" !" a competitor.

d. using !uildings and mac$iner" in operations.

41. 2 trial !alance ma" prove t$at de!its and credits are e&ual= !ut

a. an amount could !e entered in t$e <rong account.

!. a transaction could $ave !een entered t<ice.

c. a transaction could $ave !een omitted.

d. 2ll o- t$ese ans<er c$oices are correct.

3 0 99

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

41. 2 general 0ournal

a. c$ronologicall" lists transactions and ot$er events= expressed in terms o- de!its and

credits.

!. contains one record -or eac$ o- t$e asset= lia!ilit"= stoc#$olders% e&uit"= revenue= and

expense accounts.

c. lists all t$e increases and decreases in eac$ account in one place.

d. contains onl" ad0usting entries.

42. 2 0ournal entr" to record t$e sale o- inventor" on account <ill include a

a. de!it to Inventor".

!. de!it to 2ccounts Receiva!le.

c. de!it to *ales Revenue.

d. credit to 6ost o- /oods *old.

43. 2 0ournal entr" to record a pa"ment on account <ill include a

a. de!it to 2ccounts Receiva!le.

!. credit to 2ccounts Receiva!le.

c. de!it to 2ccounts ,a"a!le.

d. credit to 2ccounts ,a"a!le.

44. 2 0ournal entr" to record a receipt o- rent in advance <ill include a

a. de!it to Rent Revenue.

!. credit to Rent Revenue.

c. credit to 6as$.

d. credit to 9nearned Revenue.

45. C$ic$ o- t$e -ollo<ing errors <ill cause an im!alance in t$e trial !alanceD

a. Bmission o- a transaction in t$e 0ournal.

!. ,osting an entire 0ournal entr" t<ice to t$e ledger.

c. ,osting a credit o- E)21 to 2ccounts ,a"a!le as a credit o- E)21 to 2ccounts

Receiva!le.

d. isting t$e !alance o- an account <it$ a de!it !alance in t$e credit column o- t$e trial

!alance.

*

4'. C$ic$ o- t$e -ollo<ing is not a principal purpose o- an unad0usted trial !alanceD

a. It proves t$at de!its and credits o- e&ual amounts are in t$e ledger.

!. It is t$e !asis -or an" ad0ustments to t$e account !alances.

c. It supplies a listing o- open accounts and t$eir !alances.

d. It proves t$at de!its and credits <ere properl" entered in t$e ledger accounts.

*

4). 2n ad0usting entr" s$ould never include

a. a de!it to an expense account and a credit to a lia!ilit" account.

!. a de!it to an expense account and a credit to a revenue account.

c. a de!it to a lia!ilit" account and a credit to revenue account.

d. a de!it to a revenue account and a credit to a lia!ilit" account.

4+. C$ic$ o- t$e -ollo<ing is an example o- an accrued expenseD

a. B--ice supplies purc$ased at t$e !eginning o- t$e "ear and de!ited to an expense

account.

!. ,ropert" taxes incurred during t$e "ear= to !e paid in t$e -irst &uarter o- t$e

su!se&uent "ear.

c. (epreciation expense

d. Rent recogni;ed during t$e period= to !e received at t$e end o- t$e "ear

3 0 91

T$e 2ccounting In-ormation *"stem

,

4.. C$ic$ o- t$e -ollo<ing statements is true a!out t$e accrual !asis o- accountingD

a. T$e timing o- cas$ receipts and dis!ursements is emp$asi;ed.

!. 2 minimal amount o- record #eeping is re&uired in accrual !asis accounting compared

to cas$ !asis.

c. T$is met$od is used less -re&uentl" !" !usinesses t$an t$e cas$ met$od o-

accounting.

d. Revenues are recogni;ed in t$e period t$e per-ormance o!ligation is satis-ied=

regardless o- t$e time period t$e cas$ is received.

,

51. 2n ad0usting entr" to record an accrued expense involves a de!it to a(an)

a. expense account and a credit to a prepaid account.

!. expense account and a credit to 6as$.

c. expense account and a credit to a lia!ilit" account.

d. lia!ilit" account and a credit to an expense account.

,

51. T$e -ailure to properl" record an ad0usting entr" to accrue an expense <ill result in an

a. understatement o- expenses and an understatement o- lia!ilities.

!. understatement o- expenses and an overstatement o- lia!ilities.

c. understatement o- expenses and an overstatement o- assets.

d. overstatement o- expenses and an understatement o- assets.

,

52. C$ic$ o- t$e -ollo<ing properl" descri!es a de-erralD

a. 6as$ is received a-ter revenue is recogni;ed.

!. 6as$ is received !e-ore revenue is recogni;ed.

c. 6as$ is paid a-ter expense is incurred.

d. 6as$ is paid in t$e same time period t$at an expense is incurred.

,

53. T$e -ailure to properl" record an ad0usting entr" to accrue a revenue item <ill result in an

a. understatement o- revenues and an understatement o- lia!ilities.

!. overstatement o- revenues and an overstatement o- lia!ilities.

c. overstatement o- revenues and an overstatement o- assets.

d. understatement o- revenues and an understatement o- assets.

,

54. T$e omission o- t$e ad0usting entr" to record depreciation expense <ill result in an

a. overstatement o- assets and an overstatement o- o<nersA e&uit".

!. understatement o- assets and an understatement o- o<nerAs e&uit".

c. overstatement o- assets and an overstatement o- lia!ilities.

d. overstatement o- lia!ilities and an understatement o- o<nersA e&uit".

55. 2d0ustments are o-ten prepared

a. a-ter t$e !alance s$eet date= !ut dated as o- t$e !alance s$eet date.

!. a-ter t$e !alance s$eet date= and dated a-ter t$e !alance s$eet date.

c. !e-ore t$e !alance s$eet date= and dated !e-ore t$e !alance s$eet date.

d. !e-ore t$e !alance s$eet date= and dated a-ter t$e !alance s$eet date.

5'. 2t t$e time a compan" prepa"s a cost

a. it de!its an asset account to s$o< t$e service or !ene-it it <ill receive in t$e -uture.

!. it de!its an expense account to matc$ t$e expense against revenues recogni;ed.

c. its credits a lia!ilit" account to s$o< t$e o!ligation to pa" -or t$e service in t$e -uture.

d. it credits an asset account and de!its an expense account.

3 0 93

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

5). Fo< do t$ese prepaid expenses expireD

Rent Supplies

a. Cit$ t$e passage o- time T$roug$ use and consumption

!. Cit$ t$e passage o- time Cit$ t$e passage o- time

c. T$roug$ use and consumption T$roug$ use and consumption

d. T$roug$ use and consumption Cit$ t$e passage o- time

5+. Recording t$e ad0usting entr" -or depreciation $as t$e same e--ect as recording t$e

ad0usting entr" -or

a. an unearned revenue.

!. a prepaid expense.

c. an accrued revenue.

d. an accrued expense.

5.. 9nearned revenue on t$e !oo#s o- one compan" is li#el" to !e

a. a prepaid expense on t$e !oo#s o- t$e compan" t$at made t$e advance pa"ment.

!. an unearned revenue on t$e !oo#s o- t$e compan" t$at made t$e advance pa"ment.

c. an accrued expense on t$e !oo#s o- t$e compan" t$at made t$e advance pa"ment.

d. an accrued revenue on t$e !oo#s o- t$e compan" t$at made t$e advance pa"ment.

'1. To compute interest expense on a note -or an ad0usting entr"= t$e -ormula is (principal G

annual rate G a -raction). T$e numerator and denominator o- t$e -raction are>

Numerator Denominator

a. engt$ o- time note $as !een outstanding 12 mont$s

!. Total lengt$ o- note 12 mont$s

c. engt$ o- time until note matures Total lengt$ o- note

d. engt$ o- time note $as !een outstanding Total lengt$ o- note

'1. 2d0usting entries are necessar" to

1. o!tain a proper matc$ing o- revenue and expense.

2. ac$ieve an accurate statement o- assets and e&uities.

3. ad0ust assets and lia!ilities to t$eir -air mar#et value.

a. 1

!. 2

c. 3

d. 1 and 2

'2. C$" are certain costs o- doing !usiness capitali;ed <$en incurred and t$en depreciated

or amorti;ed over su!se&uent accounting c"clesD

a. To reduce t$e -ederal income tax lia!ilit"

!. To aid management in cas$5-lo< anal"sis

c. To matc$ t$e costs o- production <it$ revenues as recogni;ed

d. To ad$ere to t$e accounting constraint o- conservatism

'3. C$en an expense is paid in cas$ !e-ore it is used= it is called a(n)

a. prepaid expense.

!. accrued expense.

c. estimated expense.

d. cas$ expense.

3 0 95

T$e 2ccounting In-ormation *"stem

'4. C$en revenue or expense $as !een recogni;ed or incurred !ut not "et collected or paid= it

is normall" called a(n) HHHHHHHHHHHH revenue or expense.

a. de-erred

!. ad0usted

c. estimated

d. None o- t$ese ans<er c$oices are correct.

'5. C$en a revenue is collected and recorded in advance= it is normall" accounted -or as a(n)

HHHHHHHHHHH revenue.

a. accrued

!. prepaid

c. unearned

d. cas$

''. 2n accrued expense can !est !e descri!ed as an amount

a. paid and currentl" matc$ed <it$ earnings.

!. paid and not currentl" matc$ed <it$ earnings.

c. not paid and not currentl" matc$ed <it$ earnings.

d. not paid and currentl" matc$ed <it$ earnings.

'). (uring an accounting period= i- an expense $as !een incurred and consumed !ut not "et

paid -or or recorded= t$en t$e end5o-5period ad0usting entr" <ould involve

a. a lia!ilit" account and an asset account.

!. an asset or contra asset account and an expense account.

c. a lia!ilit" account and an expense account.

d. a receiva!le account and a revenue account.

'+. C$ic$ o- t$e -ollo<ing must !e considered in estimating depreciation on an asset -or an

accounting periodD

a. T$e original cost o- t$e asset

!. Its use-ul li-e

c. T$e decline o- its -air value

d. 4ot$ t$e original cost o- t$e asset and its use-ul li-e.

'.. C$ic$ o- t$e -ollo<ing <ould not !e a correct -orm -or an ad0usting entr"D

a. 2 de!it to a revenue and a credit to a lia!ilit"

!. 2 de!it to an expense and a credit to a lia!ilit"

c. 2 de!it to a lia!ilit" and a credit to a revenue

d. 2 de!it to an asset and a credit to a lia!ilit"

)1. Iear5end net assets <ould !e overstated and current expenses <ould !e understated as

a result o- -ailure to record <$ic$ o- t$e -ollo<ing ad0usting entriesD

a. 3xpiration o- prepaid insurance

!. (epreciation o- -ixed assets

c. 9se o- supplies

d. 2ll o- t$ese ans<er c$oices are correct.

)1. 2 prepaid expense can !est !e descri!ed as an amount

a. paid and currentl" matc$ed <it$ revenues.

!. paid and not currentl" matc$ed <it$ revenues.

c. not paid and currentl" matc$ed <it$ revenues.

d. not paid and not currentl" matc$ed <it$ revenues.

3 0 96

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

)2. 2n accrued revenue can !est !e descri!ed as an amount

a. collected and currentl" matc$ed <it$ expenses.

!. collected and not currentl" matc$ed <it$ expenses.

c. not collected and currentl" matc$ed <it$ expenses.

d. not collected and not currentl" matc$ed <it$ expenses.

)3. 2n unearned revenue can !est !e descri!ed as an amount

a. collected and currentl" matc$ed <it$ expenses.

!. collected and not currentl" matc$ed <it$ expenses.

c. not collected and currentl" matc$ed <it$ expenses.

d. not collected and not currentl" matc$ed <it$ expenses.

)4. 2n ad0usted trial !alance

a. is prepared a-ter t$e -inancial statements are completed.

!. proves t$e e&ualit" o- t$e de!it !alances and credit !alances o- ledger accounts a-ter

all ad0ustments $ave !een made.

c. is a re&uired -inancial statement under generall" accepted accounting principles.

d. cannot !e used to prepare -inancial statements.

)5. C$ic$ t"pe o- account is al<a"s de!ited during t$e closing processD

a. (ividends

!. 3xpense

c. Revenue

d. Retained earnings

*

)'. C$ic$ o- t$e -ollo<ing statements !est descri!es t$e purpose o- closing entriesD

a. To -aciliate posting and ta#ing a trial !alance.

!. To determine t$e amount o- net income or net loss -or t$e -ollo<ing period.

c. To reduce t$e !alances o- revenue and expense accounts to ;ero so t$at t$e" ma" !e

used to accumulate t$e revenues and expenses o- t$e next period.

d. To complete t$e record o- various transactions t$at <ere started in a prior period.

,

)). I- ending accounts receiva!le exceeds t$e !eginning accounts receiva!le

a. cas$ collections during t$e period exceed t$e amount o- revenue recogni;ed.

!. net income -or t$e period is less t$an t$e amount o- cas$5!asis income.

c. no cas$ <as collected during t$e period.

d. cas$ collections during t$e "ear are less t$an t$e amount o- revenue recogni;ed.

7)+. 9nder t$e cas$5!asis o- accounting= revenues are recorded

a. <$en t$e" are recogni;ed and reali;ed.

!. <$en t$e" are recogni;ed and reali;a!le.

c. <$en t$e" are recogni;ed.

d. <$en t$e" are reali;ed.

7).. C$en converting -rom cas$5!asis to accrual5!asis accounting= <$ic$ o- t$e -ollo<ing

ad0ustments s$ould !e made to cas$ receipts -rom customers to determine accrual5!asis

service revenueD

a. *u!tract ending accounts receiva!le.

!. *u!tract !eginning unearned service revenue.

c. 2dd ending accounts receiva!le.

d. 2dd cas$ sales.

3 0 9:

T$e 2ccounting In-ormation *"stem

7+1. C$en converting -rom cas$5!asis to accrual5!asis accounting= <$ic$ o- t$e -ollo<ing

ad0ustments s$ould !e made to cas$ paid -or operating expenses to determine accrual5

!asis operating expensesD

a. 2dd !eginning accrued lia!ilities.

!. *u!tract !eginning prepaid expense.

c. *u!tract ending prepaid expense.

d. *u!tract interest expense.

7+1. Reversing entries are

1. normall" prepared -or prepaid= accrued= and estimated items.

2. necessar" to ac$ieve a proper matc$ing o- revenue and expense.

3. use-ul in simpli-"ing t$e recording o- transactions in t$e next accounting

period.

a. 1

!. 2

c. 3

d. 1 and 2

7+2. 2d0usting entries t$at s$ould !e reversed include t$ose -or prepaid or unearned items t$at

a. create an asset or a lia!ilit" account.

!. <ere originall" entered in a revenue or expense account.

c. <ere originall" entered in an asset or lia!ilit" account.

d. create an asset or a lia!ilit" account and <ere originall" entered in a revenue or

expense account.

7+3. 2d0usting entries t$at s$ould !e reversed include

a. all accrued revenues.

!. all accrued expenses.

c. t$ose t$at de!it an asset or credit a lia!ilit".

d. 2ll o- t$ese ans<er c$oices are correct.

*

7+4. 2 reversing entr" s$ould never !e made -or an ad0usting entr" t$at

a. accrues unrecorded revenue.

!. ad0usts expired costs -rom an asset account to an expense account.

c. accrues unrecorded expenses.

d. ad0usts unexpired costs -rom an expense account to an asset account.

*

7+5. T$e <or#s$eet -or *$ar#o 6o. consisted o- -ive pairs o- de!it and credit columns. T$e

dollar amount o- one item appeared in !ot$ t$e credit column o- t$e income statement

section and t$e de!it column o- t$e !alance s$eet section. T$at item is

a. net income -or t$e period.

!. !eginning inventor".

c. cost o- goods sold.

d. net loss -or t$e period.

3 0 9;

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

Multi$le Coi#e Ans(ers*Con#e$tual

Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans%

21. d 32. a 43. c 54. a '5. c )'. c

22. d 33. a 44. d 55. a ''. d )). d

23. d 34. ! 45. d 5'. a '). c 7)+. d

24. d 35. d 4'. d 5). a '+. d 7).. c

25. d 3'. d 4). ! 5+. ! '.. d 7+1. c

2'. d 3). d 4+. ! 5.. a )1. d 7+1. c

2). ! 3+. c 4.. d '1. a )1. ! 7+2. d

2+. a 3.. d 51. c '1. d )2. c 7+3. d

2.. c 41. d 51. a '2. c )3. ! 7+4. !

31. c 41. a 52. ! '3. a )4. ! 7+5. d

31. a 42. ! 53. d '4. d )5. c

*olutions to t$ose :ultiple 6$oice &uestions -or <$ic$ t$e ans<er is Jnone o- t$ese.K

23. le-t or le-t5side.

24. 0ournal.

3). :an" ans<ers are possi!le.

'4. accrued.

MU'TIP'E CHOICE*Co-$utational

+'. :aso 6ompan" recorded 0ournal entries -or t$e issuance o- common stoc# -or E1'1=111=

t$e pa"ment o- E52=111 on accounts pa"a!le= and t$e pa"ment o- salaries expense o-

E+4=111. C$at net e--ect do t$ese entries $ave on o<ners% e&uit"D

a. Increase o- E1'1=111.

!. Increase o- E11+=111.

c. Increase o- E)'=111.

d. Increase o- E24=111.

+). :une 6ompan" recorded 0ournal entries -or t$e declaration o- E151=111 o- dividends= t$e

E.'=111 increase in accounts receiva!le -or services rendered= and t$e purc$ase o-

e&uipment -or E'3=111. C$at net e--ect do t$ese entries $ave on o<ners% e&uit"D

a. (ecrease o- E213=111.

!. (ecrease o- E11)=111.

c. (ecrease o- E54=111.

d. Increase o- E33=111.

++. ,app" 6orporation received cas$ o- E24=111 on *eptem!er 1= 2114 -or one "ear%s rent in

advance and recorded t$e transaction <it$ a credit to 9nearned Rent Revenue. T$e

(ecem!er 31= 2114 ad0usting entr" is

a. de!it Rent Revenue and credit 9nearned Rent Revenue= E+=111.

!. de!it Rent Revenue and credit 9nearned Rent Revenue= E1'=111.

c. de!it 9nearned Rent Revenue and credit Rent Revenue= E+=111.

d. de!it 6as$ and credit 9nearned Rent Revenue= E1'=111.

3 0 9<

T$e 2ccounting In-ormation *"stem

+.. ,anda 6orporation paid cas$ o- E'1=111 on 8une 1= 2114 -or one "ear%s rent in advance

and recorded t$e transaction <it$ a de!it to ,repaid Rent. T$e (ecem!er 31= 2114

ad0usting entr" is

a. de!it ,repaid Rent and credit Rent 3xpense= E25=111.

!. de!it ,repaid Rent and credit Rent 3xpense= E35=111.

c. de!it Rent 3xpense and credit ,repaid Rent= E35=111.

d. de!it ,repaid Rent and credit 6as$= E25=111.

.1. Tate 6ompan" purc$ased e&uipment on Novem!er 1= 2114 and gave a 35mont$= .L note

<it$ a -ace value o- E'1=111. T$e (ecem!er 31= 2114 ad0usting entr" is

a. de!it Interest 3xpense and credit Interest ,a"a!le= E5=411.

!. de!it Interest 3xpense and credit Interest ,a"a!le= E1=351.

c. de!it Interest 3xpense and credit 6as$= E.11.

d. de!it Interest 3xpense and credit Interest ,a"a!le= E.11.

.1. 4ro<n 6ompan"As account !alances at (ecem!er 31= 2114 -or 2ccounts Receiva!le and

t$e related 2llo<ance -or (ou!t-ul 2ccounts are E.21=111 de!it and E1=411 credit=

respectivel". From an aging o- accounts receiva!le= it is estimated t$at E23=111 o- t$e

(ecem!er 31 receiva!les <ill !e uncollecti!le. T$e necessar" ad0usting entr" <ould

include a credit to t$e allo<ance account -or

a. E23=111.

!. E24=411.

c. E21='11.

d. E1=411.

.2. 6$en 6ompan"As account !alances at (ecem!er 31= 2114 -or 2ccounts Receiva!le and

t$e 2llo<ance -or (ou!t-ul 2ccounts are E4+1=111 de!it and E.11 credit. *ales during

2114 <ere E1='51=111. It is estimated t$at 1L o- sales <ill !e uncollecti!le. T$e ad0usting

entr" <ould include a credit to t$e allo<ance account -or

a. E1)=411.

!. E1'=511.

c. E15='11.

d. E4=+11.

.3. *tarr 6orporation loaned E451=111 to anot$er corporation on (ecem!er 1= 2114 and

received a 35mont$= +L interest5!earing note <it$ a -ace value o- E451=111. C$at

ad0usting entr" s$ould *tarr ma#e on (ecem!er 31= 2114D

a. (e!it Interest Receiva!le and credit Interest Revenue= E.=111.

!. (e!it 6as$ and credit Interest Revenue= E3=111.

c. (e!it Interest Receiva!le and credit Interest Revenue= E3=111.

d. (e!it 6as$ and credit Interest Receiva!le= E.=111.

.4. 2 compan" receives interest on a E)1=111= +L= 55"ear note receiva!le eac$ 2pril 1. 2t

(ecem!er 31= 2114= t$e -ollo<ing ad0usting entr" <as made to accrue interest receiva!le>

Interest Receiva!le ............................................................. 4=211

Interest Revenue ..................................................... 4=211

3 0 9>

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

2ssuming t$at t$e compan" does not use reversing entries= <$at entr" s$ould !e made

on 2pril 1= 2115 <$en t$e annual interest pa"ment is receivedD

a. 6as$ ................................................................................... 1=411

Interest Revenue ..................................................... 1=411

!. 6as$ ................................................................................... 4=211

Interest Receiva!le ................................................. 4=211

c. 6as$ ................................................................................... 5='11

Interest Receiva!le ................................................. 4=211

Interest Revenue ..................................................... 1=411

d. 6as$ ................................................................................... 5='11

Interest Revenue ..................................................... 5='11

7.5. 2 compan" receives interest on a E)1=111= +L= 55"ear note receiva!le eac$ 2pril 1. 2t

(ecem!er 31= 2114= t$e -ollo<ing ad0usting entr" <as made to accrue interest receiva!le>

Interest Receiva!le ............................................................. 4=211

Interest Revenue ..................................................... 4=211

2ssuming t$at t$e compan" !oes use reversing entries= <$at entr" s$ould !e made on

2pril 1= 2115 <$en t$e annual interest pa"ment is receivedD

a. 6as$ ................................................................................... 1=411

Interest Revenue ..................................................... 1=411

!. 6as$ ................................................................................... 4=211

Interest Receiva!le ................................................. 4=211

c. 6as$ .................................................................................. 5='11

Interest Receiva!le ................................................. 4=211

Interest Revenue ..................................................... 1=411

d. 6as$ ................................................................................... 5='11

Interest Revenue...................................................... 5='11

.'. :urp$" 6ompan" su!let a portion o- its <are$ouse -or -ive "ears at an annual rental o-

E'1=111= !eginning on :a" 1= 2114. T$e tenant= *$eri 6$arter= paid one "earAs rent in

advance= <$ic$ :urp$" recorded as a credit to 9nearned Rent Revenue. :urp$" reports

on a calendar5"ear !asis. T$e ad0ustment on (ecem!er 31= 2114 -or :urp$" s$ould !e

a. No entr"

!. 9nearned Rent Revenue .................................................... 21=111

Rent Revenue ......................................................... 21=111

c. Rent Revenue ..................................................................... 21=111

9nearned Rent Revenue ......................................... 21=111

d. 9nearned Rent Revenue .................................................... 41=111

Revenue Revenue................................................... 41=111

.). (uring t$e -irst "ear o- Cil#inson 6o.As operations= all purc$ases <ere recorded as assets.

*upplies in t$e amount o- E25=+11 <ere purc$ased. 2ctual "ear5end supplies amounted to

E5='11. T$e ad0usting entr" -or store supplies <ill

a. increase net income !" E21=211.

!. increase expenses !" E21=211.

c. decrease supplies !" E5='11.

d. de!it 2ccounts ,a"a!le -or E5='11.

3 0 1?

T$e 2ccounting In-ormation *"stem

.+. 4ig5:out$ Frog 6orporation $ad revenues o- E311=111= expenses o- E211=111= and

dividends o- E45=111. C$en Income *ummar" is closed to Retained 3arnings= t$e amount

o- t$e de!it or credit to Retained 3arnings is a

a. de!it o- E55=111.

!. de!it o- E111=111.

c. credit o- E55=111.

d. credit o- E111=111.

7... T$e income statement o- (olan 6orporation -or 2114 included t$e -ollo<ing items>

Interest revenue E121=111

*alaries and <ages expense 1+1=111

Insurance expense 1+=211

T$e -ollo<ing !alances $ave !een excerpted -rom (olan 6orporationAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

Interest receiva!le E1+=211 E15=111

*alaries and <ages pa"a!le 1)=+11 +=411

,repaid insurance 2=211 3=111

T$e cas$ received -or interest during 2114 <as

a. E112=+11.

!. E11)=+11.

c. E121=111.

d. E124=211.

7111. T$e income statement o- (olan 6orporation -or 2114 included t$e -ollo<ing items>

Interest revenue E121=111

*alaries and <ages expense 1+1=111

Insurance expense 1+=211

T$e -ollo<ing !alances $ave !een excerpted -rom (olan 6orporationAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

Interest receiva!le E1+=211 E15=111

*alaries and <ages pa"a!le 1)=+11 +=411

,repaid insurance 2=211 3=111

T$e cas$ paid -or salaries and <ages during 2114 <as

a. E1+.=411.

!. E1)1='11.

c. E1)1='11.

d. E1.)=+11.

7111. T$e income statement o- (olan 6orporation -or 2114 included t$e -ollo<ing items>

Interest revenue E121=111

*alaries and <ages expense 1+1=111

Insurance expense 1+=211

3 0 19

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

T$e -ollo<ing !alances $ave !een excerpted -rom (olan 6orporationAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

Interest receiva!le E1+=211 E15=111

*alaries and <ages pa"a!le 1)=+11 +=411

,repaid insurance 2=211 3=111

T$e cas$ paid -or insurance premiums during 2114 <as

a. E1'=111.

!. E15=211.

c. E1.=111.

d. E1)=411.

7112. Blsen 6ompan" paid or collected during 2114 t$e -ollo<ing items>

Insurance premiums paid E 25=+11

Interest collected '2=+11

*alaries paid 2'1=411

T$e -ollo<ing !alances $ave !een excerpted -rom BlsenAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

,repaid insurance E 2=411 E 3=111

Interest receiva!le )=411 5=+11

*alaries and <ages pa"a!le 24='11 21=211

T$e insurance expense on t$e income statement -or 2114 <as

a. E21=411.

!. E25=211.

c. E2'=411.

d. E31=211.

7113. Blsen 6ompan" paid or collected during 2114 t$e -ollo<ing items>

Insurance premiums paid E 25=+11

Interest collected '2=+11

*alaries paid 2'1=411

T$e -ollo<ing !alances $ave !een excerpted -rom BlsenAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

,repaid insurance E 2=411 E 3=111

Interest receiva!le )=411 5=+11

*alaries and <ages pa"a!le 24='11 21=211

T$e interest revenue on t$e income statement -or 2114 <as

a. E4.='11.

!. E'1=211.

c. E'4=411.

d. E)'=111.

3 0 11

T$e 2ccounting In-ormation *"stem

7114. Blsen 6ompan" paid or collected during 2114 t$e -ollo<ing items>

Insurance premiums paid E 25=+11

Interest collected '2=+11

*alaries and <ages paid 2'1=411

T$e -ollo<ing !alances $ave !een excerpted -rom BlsenAs !alance s$eets>

(ecem!er 31= 2114 (ecem!er 31= 2113

,repaid insurance E 2=411 E 3=111

Interest receiva!le )=411 5=+11

*alaries and <ages pa"a!le 24='11 21=211

*alaries and <ages expense on t$e income statement -or 2114 <as

a. E214='11.

!. E25)=111.

c. E2'3=+11.

d. E31'=211.

7115. T$e *upplies account $ad a !alance at t$e !eginning o- "ear 3 o- E+=111 (!e-ore t$e

reversing entr"). ,a"ments -or purc$ases o- supplies during "ear 3 amounted to E51=111

and <ere recorded as expense. 2 p$"sical count at t$e end o- "ear 3 revealed supplies

costing E11=511 <ere on $and. Reversing entries are used !" t$is compan". T$e re&uired

ad0usting entr" at t$e end o- "ear 3 <ill include a de!it to>

a. *upplies 3xpense -or E3=511.

!. *upplies -or E3=511.

c. *upplies 3xpense -or E4'=511.

d. *upplies -or E11=511.

711'. 2t t$e end o- 2114= (re< 6ompan" made -our ad0usting entries -or t$e -ollo<ing items>

1. (epreciation expense= E25=111.

2. 3xpired insurance= E2=211 (originall" recorded as prepaid insurance.)

3. Interest pa"a!le= E'=111.

4. Rent receiva!le= E11=111.

In t$e normal situation= to -acilitate su!se&uent entries= t$e ad0usting entr" or entries t$at

ma" !e reversed is (are)

a. 3ntr" No. 3 onl".

!. 3ntr" No. 4 onl".

c. 3ntr" No. 3 and No. 4.

d. 3ntr" No. 2= No. 3 and No. 4.

711). /arcia 6orporation received cas$ o- E3'=111 on 2ugust 1= 2114 -or one "earAs rent in

advance and recorded t$e transaction <it$ a credit to Rent Revenue. T$e (ecem!er 31=

2114 ad0usting entr" is

a. de!it Rent Revenue and credit 9nearned Rent Revenue= E15=111.

!. de!it Rent Revenue and credit 9nearned Rent Revenue= E21=111.

c. de!it 9nearned Rent Revenue and credit Rent Revenue= E15=111.

d. de!it 6as$ and credit 9nearned Rent Revenue= E21=111.

3 0 13

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

711+. ope; 6ompan" received E14=411 on 2pril 1= 2114 -or one "earAs rent in advance and

recorded t$e transaction <it$ a credit to a nominal account. T$e (ecem!er 31= 2114

ad0usting entr" is

a. de!it Rent Revenue and credit 9nearned Rent Revenue= E3='11.

!. de!it Rent Revenue and credit 9nearned Rent Revenue= E11=+11.

c. de!it 9nearned Rent Revenue and credit Rent Revenue= E3='11.

d. de!it 9nearned Rent Revenue and credit Rent Revenue= E11=+11.

711.. /i!son 6ompan" paid E12=111 on 8une 1= 2114 -or a t<o5"ear insurance polic" and

recorded t$e entire amount as Insurance 3xpense. T$e (ecem!er 31= 2114 ad0usting

entr" is

a. de!it Insurance 3xpense and credit ,repaid Insurance= E3=511.

!. de!it Insurance 3xpense and credit ,repaid Insurance= E+=511.

c. de!it ,repaid Insurance and credit Insurance 3xpense= E3=511

d. de!it ,repaid Insurance and credit Insurance 3xpense= E+=511.

Multi$le Coi#e Ans(ers*Co-$utational

Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans

%

Ite- Ans

%

Ite- Ans%

+'. c .1. d .4. c .+. d 7112. c 711'. c

+). c .1. c .5. d 7... ! 7113. c 711). !

++. c .2. ! .'. d 7111. ! 7114. c 711+. a

+.. c .3. c .). ! 7111. d 7115. d 711.. d

MU'TIP'E CHOICE*CPA A!a$te!

111. Bn *eptem!er 1= 2114= o<e 6o. issued a note pa"a!le to National 4an# in t$e amount

o- E.11=111= !earing interest at .L= and pa"a!le in t$ree e&ual annual principal pa"ments

o- E311=111. Bn t$is date= t$e !an#As prime rate <as +L. T$e -irst pa"ment -or interest

and principal <as made on *eptem!er 1= 2115. 2t (ecem!er 31= 2115= o<e s$ould

record accrued interest pa"a!le o-

a. E2)=111.

!. E24=111.

c. E1+=111.

d. E1'=111.

111. 3aton 6o. sells ma0or $ouse$old appliance service contracts -or cas$. T$e service

contracts are -or a one5"ear= t<o5"ear= or t$ree5"ear period. 6as$ receipts -rom contracts

are credited to 9nearned *ervice Revenue. T$is account $ad a !alance o- E3=+11=111 at

(ecem!er 31= 2114 !e-ore "ear5end ad0ustment. *ervice contract costs are c$arged as

incurred to t$e *ervice 6ontract 3xpense account= <$ic$ $ad a !alance o- E.11=111 at

(ecem!er 31= 2114.

*ervice contracts still outstanding at (ecem!er 31= 2114 expire as -ollo<s>

(uring 2115 E.'1=111

(uring 211' 1=141=111

(uring 211) )11=111

3 0 15

T$e 2ccounting In-ormation *"stem

C$at amount s$ould !e reported as 9nearned *ervice Revenue in 3atonAs (ecem!er 31=

2114 !alance s$eetD

a. E2=.11=111.

!. E2=+11=111.

c. E1=.11=111.

d. E1=111=111.

112. In Novem!er and (ecem!er 2114= ane 6o.= a ne<l" organi;ed maga;ine pu!lis$er=

received E'1=111 -or 1=111 t$ree5"ear su!scriptions at E21 per "ear= starting <it$ t$e

8anuar" 2115 issue. ane included t$e entire E'1=111 in its 2114 income tax return. C$at

amount s$ould ane report in its 2114 income statement -or su!scriptions revenueD

a. E1.

!. E3=333.

c. E21=111.

d. E'1=111.

113. Bn 8une 1= 2114= Nott 6orp. loaned Forn E+11=111 on a 12L note= pa"a!le in -ive annual

installments o- E1'1=111 !eginning 8anuar" 2= 2115. In connection <it$ t$is loan= Forn

<as re&uired to deposit E5=111 in a noninterest5!earing escro< account. T$e amount $eld

in escro< is to !e returned to Forn a-ter all principal and interest pa"ments $ave !een

made. Interest on t$e note is pa"a!le on t$e -irst da" o- eac$ mont$ !eginning 8ul" 1=

2114. Forn made timel" pa"ments t$roug$ Novem!er 1= 2114. Bn 8anuar" 2= 2115= Nott

received pa"ment o- t$e -irst principal installment plus all interest due. 2t (ecem!er 31=

2114= NottAs interest receiva!le on t$e loan to Forn s$ould !e

a. E1.

!. E+=111.

c. E1'=111.

d. E24=111.

114. Included in 2llen 6orp.As !alance s$eet at 8une 31= 2113 is a 11L= E3=111=111 note

pa"a!le. T$e note is dated Bcto!er 1= 2113 and is pa"a!le in t$ree e&ual annual

pa"ments o- E1=511=111 plus interest. T$e -irst interest and principal pa"ment <as made

on Bcto!er 1= 2114. In 2llenAs 8une 31= 2115 !alance s$eet= <$at amount s$ould !e

reported as accrued interest pa"a!le -or t$is noteD

a. E33)=511.

!. E225=111.

c. E112=511.

d. E)5=111.

115. 6ola< 6o. pa"s all salaried emplo"ees on a !i<ee#l" !asis. Bvertime pa"= $o<ever= is

paid in t$e next !i<ee#l" period. 6ola< accrues salaries expense onl" at its (ecem!er 31

"ear end. (ata relating to salaries earned in (ecem!er 2114 are as -ollo<s>

ast pa"roll <as paid on 12@2'@14= -or t$e 25<ee# period ended 12@2'@14.

Bvertime pa" earned in t$e 25<ee# period ended 12@2'@14 <as E21=111.

Remaining <or# da"s in 2114 <ere (ecem!er 2.= 31= 31= on <$ic$ da"s t$ere <as no

overtime.

T$e recurring !i<ee#l" salaries total E3'1=111.

3 0 16

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

2ssuming a -ive5da" <or#<ee#= 6ola< s$ould record a lia!ilit" at (ecem!er 31= 2114 -or

accrued salaries o-

a. E11+=111.

!. E12+=111.

c. E21'=111.

d. E23'=111.

11'. Tolan 6orp.As trademar# <as licensed to 3dd" 6o. -or ro"alties o- 15L o- sales o- t$e

trademar#ed items. Ro"alties are pa"a!le semiannuall" on :arc$ 15 -or sales in 8ul"

t$roug$ (ecem!er o- t$e prior "ear= and on *eptem!er 15 -or sales in 8anuar" t$roug$

8une o- t$e same "ear. Tolan received t$e -ollo<ing ro"alties -rom 3dd">

:arc$ 15 *eptem!er 15

2113 E5=111 E)=511

2114 '=111 .=511

3dd" estimated t$at sales o- t$e trademar#ed items <ould total E31=111 -or 8ul" t$roug$

(ecem!er 2114. In TolanAs 2114 income statement= t$e ro"alt" revenue s$ould !e

a. E14=111.

!. E15=511.

c. E21=111.

d. E21=511.

11). 2t (ecem!er 31= 2114= *ue%s 4outi&ue $ad 1=111 gi-t certi-icates outstanding= <$ic$ $ad

!een sold to customers during 2114 -or E'1 eac$. *ue%s operates on a gross pro-it o- '1L

o- its sales. C$at amount o- revenue pertaining to t$e 1=111 outstanding gi-t certi-icates

s$ould !e de-erred at (ecem!er 31= 2114D

a. E1.

!. E24=111.

c. E3'=111.

d. E'1=111.

711+. 6ompared to t$e accrual !asis o- accounting= t$e cas$ !asis o- accounting overstates

income !" t$e net increase during t$e accounting period o- t$e

2ccounts Receiva!le 2ccrued 3xpenses ,a"a!le

a. No No

!. No Ies

c. Ies No

d. Ies Ies

711.. /regg 6orp. reported revenue o- E1=451=111 in its accrual !asis income statement -or t$e

"ear ended 8une 31= 2115. 2dditional in-ormation <as as -ollo<s>

2ccounts receiva!le 8une 31= 2114 E411=111

2ccounts receiva!le 8une 31= 2115 531=111

9ncollecti!le accounts <ritten o-- during t$e -iscal "ear 15=111

9nder t$e cas$ !asis= /regg s$ould report revenue o-

a. E1=135=111.

!. E1=151=111.

c. E1=315=111.

d. E1=335=111.

3 0 1:

T$e 2ccounting In-ormation *"stem

7121. 8im Iount= :.(.= #eeps $is accounting records on t$e cas$ !asis. (uring 2115= (r. Iount

collected E351=111 -rom $is patients. 2t (ecem!er 31= 2114= (r. Iount $ad accounts

receiva!le o- E41=111. 2t (ecem!er 31= 2115= (r. Iount $ad accounts receiva!le o-

E)1=111 and unearned revenue o- E11=111. Bn t$e accrual !asis= $o< muc$ <as (r.

IountAs patient service revenue -or 2115D

a. E311=111.

!. E3)1=111.

c. E3+1=111.

d. E3.1=111.

7121. T$e -ollo<ing in-ormation is availa!le -or 2ce 6ompan" -or 2114>

(is!ursements -or purc$ases E1=3'1=111

Increase in trade accounts pa"a!le 111=111

(ecrease in merc$andise inventor" 41=111

6ost o- goods sold -or 2114 <as

a. E1=511=111.

!. E1=421=111.

c. E1=311=111.

d. E1=221=111.

Multi$le Coi#e Ans(ers*CPA A!a$te!

Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans% Ite- Ans

%

Ite- Ans%

111. c 112. a 114. ! 11'. a 711+. ! 7121. !

111. ! 113. c 115. ! 11). d 711.. c 7121. a

3 0 1;

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

)ERI4ATIONS * Co-$utational

No% Ans(er )erivation

+'. c E1'1=111 5 E+4=111 ? E)'=111.

+). c E151=111 5 E.'=111 ? E54=111.

++. c E24=111 x 4@12 ? E+=111.

+.. c E'1=111 x )@12 ? E35=111.

.1. d 2@12 x .L x E'1=111 ? E.11.

.1. c E23=111 M E1=411 ? E21='11.

.2. ! E1='51=111 x 1L ? E1'=511.

.3. c 1@12 x +L x E451=111 ? E3=111.

.4. c E)1=111 x +L ? E5='11N E5='11 5 E4=211 ? E1=411 int. rev.

7.5. d E)1=111 x +L ? E5='11

.'. d E'1=111 x +@12 ? E41=111.

.). ! E25=+11 M E5='11 ? E21=211.

.+. d E311=111 5 E211=111 ? E111=111.

7... ! E15=111 O E121=111 5 E1+=211 ? E11)=+11.

7111. ! E+=411 O E1+1=111 5 E1)=+11 ? E1)1='11.

7111. d E1+=211 M E3=111 O E2=211 ? E1)=411.

7112. c E25=+11 O E'11 ? E2'=411.

7113. c E'2=+11 M E5=+11 O E)=411 ? E'4=411.

7114. c E2'1=411 M E21=211 O E24='11 ? E2'3=+11.

7115. d E11=511 O E+=111 M E+=111 ? E11=511.

711'. c

711). ! )@12 x E3'=111 ? E21=111.

711+. a 3@12 x E14=411 ? E3='11.

711.. d 1)@24 x E12=111 ? E+=511.

3 0 1<

T$e 2ccounting In-ormation *"stem

)ERI4ATIONS * CPA A!a$te!

No% Ans(er )erivation

111. c (E.11=111 M E311=111) G .L G 4@12 ? E1+=111.

111. ! E.'1=111 O E1=141=111 O E)11=111 ? E2=+11=111.

112. a E1= none o- t$e E'1=111 is recogni;ed.

113. c E+11=111 G 12L G 2@12 ? E1'=111.

114. ! E3=111=111 G .@12 G 11L ? E225=111.

115. ! E21=111 O (E3'1=111 P 11 G 3) ? E12+=111.

11'. a E.=511 O (E31=111 G 15L) ? E14=111.

11). d 1=111 G E'1 ? E'1=111.

711+. ! 6onceptual.

711.. c E1=451=111 O E411=111 M E531=111 M E15=111 ? E1=315=111.

7121. ! E351=111 M E41=111 O E)1=111 M E11=111 ? E3)1=111.

7121. a E1=3'1=111 O E111=111 O E41=111 ? E1=511=111.

+RIEF E2ERCISES

+E% 30911Q(e-initions.

,rovide clear= concise ans<ers -or t$e -ollo<ing.

1. C$at is t$e accrual5!asis o- accountingD

2. C$at is an accrued expenseD

3. C$at is accrued revenueD

4. C$at is a prepaid expenseD

5. C$at is unearned revenueD

7'. *tate t$e rule t$at indicates <$ic$ ad0usting entries -or prepaid and unearned items s$ould !e

reversed.

3 0 1>

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

Solution 30911

1. T$e accrual !asis o- accounting recogni;es revenue <$en t$e per-ormance o!ligation is

satis-ied and recogni;es expenses in t$e period incurred.

2. 2n accrued expense is an expense <$ic$ is incurred !ut not paid in cas$ or recorded.

3. 2n accrued revenue is a revenue <$ic$ is recogni;ed !ut not "et received in cas$ or

recorded.

4. 2 prepaid expense is an expense paid in cas$ and recorded as an asset !e-ore it is used.

5. 9nearned revenues are t$e revenues received in cas$ and recorded as lia!ilities !e-ore t$e"

are recogni;ed.

7'. 2d0usting entries t$at create an asset or a lia!ilit" account s$ould !e reversed. T$is <ould

include prepaid and unearned items originall" recorded in a revenue or expense account.

+E% 30913QTerminolog".

In t$e space provided at t$e rig$t= <rite t$e <ord or p$rase t$at is de-ined or indicated.

1. Revenue and expense accounts. 1. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

2. 2n optional step in t$e accounting 2. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

c"cle.

3. 2 revenue collected= !ut not recogni;ed.3. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

4. 2 revenue recogni;ed= !ut not collected.4. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

5. 2sset= lia!ilit"= and e&uit" accounts. 5. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

'. 2n expense paid= !ut not incurred. '. HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

). 2n expense incurred= !ut not paid. ). HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

Solution 30913

1. Nominal (temporar") accounts. 5. Real (permanent) accounts.

2. Reversing entries. '. ,repaid expense.

3. 9nearned revenue. ). 2ccrued expense.

4. 2ccrued revenue.

+E% 30915Q2ccrued items and de-erred (unearned or prepaid) items.

/enerall" accepted accounting principles re&uire t$e use o- accruals and de-errals in t$e

determination o- income. Fo< is income determined under t$e accrual5!asis o- accountingD

Include in "our ans<er <$at constitutes an accrued item and a de-erred (prepaid) item= and give

appropriate examples o- eac$.

3 0 3?

T$e 2ccounting In-ormation *"stem

Solution 30915

2ccrual accounting recogni;es and reports t$e e--ects o- transactions and ot$er events in t$e time

periods to <$ic$ t$e" relate rat$er t$an onl" <$en cas$ is received or paid. 2ccrual accounting

attempts to matc$ revenues and t$e expenses associated <it$ t$ose revenues in order to

determine net income -or an accounting period.

2n accrued item is an item o- revenue or expense t$at $as !een recogni;ed or incurred during

t$e period= !ut $as not "et !een collected or paid in cas$. 2n example o- an accrued revenue is

rent -or t$e last mont$ o- an accounting period t$at $as !een recogni;ed !" a landlord !ut not "et

paid !" t$e tenant. 2n example o- an accrued expense is salaries incurred -or t$e last <ee# o- an

accounting period t$at are not pa"a!le until t$e su!se&uent accounting period.

2 de-erred (unearned or prepaid) item is an item o- revenue or expense t$at $as !een received or

paid in cas$= !ut $as not "et !een recogni;ed or consumed. 2n example o- a de-erred revenue is

unearned su!scription revenue collected in advance o- !eing recogni;ed. 2n example o- a

de-erred expense is an insurance premium paid at t$e end o- an accounting period <$ic$ <ill

provide insurance coverage -or t$e -irst six mont$s o- t$e su!se&uent period.

E2ERCISES

EB% 30916Q2d0usting entries.

,resent= in 0ournal -orm= t$e ad0ustments t$at <ould !e made on 8ul" 31= 2115= t$e end o- t$e

-iscal "ear= -or eac$ o- t$e -ollo<ing.

1. T$e supplies inventor" on 2ugust 1= 2114 <as E.=351. *upplies costing E22=151 <ere

ac&uired during t$e "ear and c$arged to t$e supplies inventor". 2 count on 8ul" 31= 2115

indicated supplies on $and o- E+=+11.

2. Bn 2pril 31= a ten5mont$= 'L note -or E31=111 <as received -rom a customer.

73. Bn :a" 1= E12=111 <as collected as rent -or one "ear and a nominal account <as credited.

Solution 30916

1. *upplies 3xpense .................................................................... 22='.1

*upplies ........................................................................ 22='.1

2. Interest Receiva!le .................................................................. 451

Interest Revenue ........................................................... 451

73. Rent Revenue .......................................................................... .=111

9nearned Rent Revenue .............................................. .=111

3 0 39

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

EB% 3091:Q2d0usting entries.

Reed 6o. <is$es to enter receipts and pa"ments in suc$ a manner t$at ad0ustments at t$e end o-

t$e period <ill not re&uire reversing entries at t$e !eginning o- t$e next period. Record t$e

-ollo<ing transactions in t$e indicated manner and give t$e ad0usting entr" on (ecem!er 31=

2114. (T<o entries -or eac$ part.)

1. 2n insurance polic" -or t<o "ears <as ac&uired on 2pril 1= 2114 -or E1+=111.

2. Rent o- E12=111 -or six mont$s -or a portion o- t$e !uilding <as received on Novem!er 1=

2114.

Solution 3091:

1. ,repaid Insurance .................................................................... 1+=111

6as$ ............................................................................. 1+=111

Insurance 3xpense ................................................................... '=)51

,repaid Insurance ......................................................... '=)51

2. 6as$ ....................................................................................... 12=111

9nearned Rent Revenue............................................... 12=111

9nearned Rent Revenue........................................................... 4=111

Rent Revenue ............................................................... 4=111

EB% 3091;

T$e ad0usted trial !alance o- R"an Financial ,lanners appears !elo<. 9sing t$e in-ormation -rom

t$e ad0usted trial !alance= "ou are to prepare -or t$e mont$ ending (ecem!er 31>

1. an income statement.

2. a retained earnings statement.

3. a !alance s$eet.

RI2N FIN2N6I2 ,2NN3R*

2d0usted Trial 4alance

(ecem!er 31= 2114

(e!it 6redit

6as$ ............................................................................................... E 2=.11

2ccounts Receiva!le....................................................................... 2=211

*upplies.......................................................................................... 1=+11

3&uipment ....................................................................................... 1'=111

2ccumulated (epreciationQ3&uipment.......................................... E 4=111

2ccounts ,a"a!le............................................................................ 3=311

9nearned *ervice Revenue............................................................ 5=111

6ommon *toc#................................................................................ 11=111

Retained 3arnings........................................................................... 4=411

(ividends........................................................................................ 2=111

*ervice Revenue............................................................................. 4=211

*upplies 3xpense............................................................................ '11

(epreciation 3xpense..................................................................... 2=511

Rent 3xpense.................................................................................. 2=.11 HHHHHH

E31=.11 E31=.11

3 0 31

T$e 2ccounting In-ormation *"stem

Solution 3091; (21 min)

1. RI2N FIN2N6I2 ,2NN3R*

Income *tatement

For t$e :ont$ 3nded (ecem!er 31= 2114

Revenues

*ervice revenue......................................................................... E 4=211

3xpenses

Rent expense............................................................................ E2=.11

(epreciation expense................................................................ 2=511

*upplies expense...................................................................... '11

Total expenses........................................................................ '=111

Net loss........................................................................................... E(1=+11)

2. RI2N FIN2N6I2 ,2NN3R*

Retained 3arnings *tatement

For t$e :ont$ 3nded (ecem!er 31= 2114

Retained earnings= (ecem!er 1...................................................... E 4=411

ess> Net loss.................................................................................. E1=+11

(ividends............................................................................... 2=111 3=+11

Retained earnings= (ecem!er 31.................................................... E '11

3. RI2N FIN2N6I2 ,2NN3R*

4alance *$eet

(ecem!er 31= 2114

2ssets

6as$................................................................................................ E 2=.11

2ccounts receiva!le........................................................................ 2=211

*upplies ....................................................................................... 1=+11

3&uipment ................................................................................... E1'=111

ess> 2ccumulated depreciationQe&uipment.................................. 4=111 12=111

Total assets.............................................................................. E1+=.11

ia!ilities and *toc#$olders% 3&uit"

ia!ilities

2ccounts pa"a!le...................................................................... E 3=311

9nearned service revenue......................................................... 5=111

Total lia!ilities................................................................. E +=311

*toc#$olders% 3&uit"

6ommon stoc#........................................................................... 11=111

Retained earnings..................................................................... '11 11='11

Total lia!ilities and stoc#$olders% e&uit"......................... E1+=.11

3 0 33

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

=EB% 3091<Q6as$ !asis vs. accrual !asis o- accounting.

6ontrast t$e cas$ !asis o- accounting <it$ t$e accrual !asis o- accounting.

=Solution 3091<

T$e essential di--erence !et<een t$e cas$ !asis and t$e accrual !asis o- accounting relates to

t$e timing o- t$e recognition o- revenues and expenses. 9nder t$e cas$ !asis o- accounting= t$e

e--ects o- transactions and ot$er events are recogni;ed and reported onl" <$en cas$ is received

or paid. 9nder t$e accrual !asis o- accounting= t$ese e--ects are recogni;ed and reported in t$e

time periods to <$ic$ t$e" relate= regardless o- t$e time o- t$e receipt or pa"ment o- cas$.

4ecause no attempt is made under t$e cas$ !asis o- accounting to matc$ revenues and t$e

expenses associated <it$ t$ose revenues= cas$ !asis -inancial statements are not in accordance

<it$ generall" accepted accounting principles.

=EB% 3091>Q2ccrual !asis.

*ales salaries paid during 2114 <ere E+5=111. 2dvances to salesmen <ere E1=111 on 8anuar" 1=

2114= and E+11 on (ecem!er 31= 2114. *ales salaries accrued <ere E1=3'1 on 8anuar" 1= 2114=

and E1=++1 on (ecem!er 31= 2114. *$o< t$e computation o- sales salaries on an accrual !asis

-or 2114.

=Solution 3091>

E+5=111 O E1=111 M E+11 M E1=3'1 O E1=++1 ? E+5=+21.

=EB% 3093?Q2ccrual !asis.

T$e records -or Todd Inc. s$o<ed t$e -ollo<ing -or 2114>

8an. 1 (ec. 31

2ccrued expenses E1=311 E2=151

,repaid expenses )21 +)1

6as$ paid during t$e "ear -or expenses= E42=511

*$o< t$e computation o- t$e amount o- expense t$at s$ould !e reported on t$e income

statement.

=Solution 3093?

E42=511 M E1=311 O E2=151 O E)21 M E+)1 ? E43=211.

3 0 35

T$e 2ccounting In-ormation *"stem

=EB% 30939Q2ccrual !asis.

T$e records -or Rile" 6ompan" s$o<ed t$e -ollo<ing -or 2114>

8an. 1 (ec. 31

9nearned revenue E1=111 E2=1'1

2ccrued revenue 1=2'1 .21

6as$ collected during t$e "ear -or revenue= E'5=111

*$o< t$e computation o- t$e amount o- revenue t$at s$ould !e reported on t$e income

statement.

=Solution 30939

E'5=111 O E1=111 M E2=1'1 M E1=2'1 O E.21 ? E'3='11.

=EB% 30931Q6as$ !asis.

Revenue on t$e income statement <as E125=+11. 2ccounts receiva!le <ere E3=511 on 8anuar" 1

and E3=541 on (ecem!er 31. 9nearned revenue <as E1=151 on 8anuar" 1 and E1=')1 on

(ecem!er 31.

*$o< t$e computation o- revenue -or t$e "ear on a cas$ !asis.

=Solution 30931

E125=+11 O E3=511 M E3=541 M E1=151 O E1=')1 ? E12'=3+1.

PRO+'EMS

Pr% 30933Q2d0usting entries and account classi-ication.

*elected amounts -rom Trent 6ompan"As trial !alance o- 12@31@14 appear !elo<>

1. 2ccounts ,a"a!le E 1'1=111

2. 2ccounts Receiva!le 151=111

3. 2ccumulated (epreciationQ3&uipment 211=111

4. 2llo<ance -or (ou!t-ul 2ccounts 21=111

5. 4onds ,a"a!le 511=111

'. 6as$ 151=111

). 6ommon *toc# '1=111

+. 3&uipment .'1=111

.. ,repaid Insurance 31=111

11. Interest 3xpense 11=111

11. Inventor" 311=111

12. Notes ,a"a!le (due '@1@15) 211=111

13. ,repaid Rent 211=111

14. Retained 3arnings +1+=111

15. *alaries and Cages 3xpense 32+=111

(2ll o- t$e a!ove accounts $ave t$eir standard or normal de!it or credit !alance.)

3 0 36

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

,art 2. ,repare ad0usting 0ournal entries at "ear end= (ecem!er 31= 2114= !ased on t$e

-ollo<ing supplemental in-ormation.

a. T$e e&uipment $as a use-ul li-e o- 15 "ears <it$ no salvage value. (*traig$t5line met$od !eing

used.)

!. Interest accrued on t$e !onds pa"a!le is E15=111 as o- 12@31@14.

c. ,repaid insurance at 12@31@14 is E25=111.

d. T$e rent pa"ment o- E1+1=111 covered t$e six mont$s -rom Novem!er 31= 2114 t$roug$ :a"

31= 2115.

e. *alaries and <ages earned !ut unpaid at 12@31@14= E22=111.

,art 4. Indicate t$e proper !alance s$eet classi-ication o- eac$ o- t$e 15 num!ered accounts

in t$e 12@31@14 trial !alance before adjustments !" placing appropriate num!ers a-ter

eac$ o- t$e -ollo<ing classi-ications. I- t$e account title <ould appear on t$e income

statement= do not put t$e num!er in an" o- t$e classi-ications.

a. 6urrent assets

!. ,ropert"= plant= and e&uipment

c. 6urrent lia!ilities

d. ong5term lia!ilities

e. *toc#$oldersA e&uit"

Solution 30933

,art 2.

a. (epreciation 3xpense (E.'1=111 M 1) 15 .................................... '4=111

2ccumulated (epreciationQ3&uipment ............................. '4=111

!. Interest 3xpense ............................................................................ 15=111

Interest ,a"a!le .................................................................. 15=111

c. Insurance 3xpense ......................................................................... 5=111

,repaid Insurance (E31=111 5 E25=111) .............................. 5=111

d. Rent 3xpense (E211=111 ').......................................................... 35=111

,repaid Rent ....................................................................... 35=111

e. *alaries and Cages 3xpense ......................................................... 22=111

*alaries and Cages ,a"a!le .............................................. 22=111

,art 4.

a. 6urrent assetsQ2= 4= '= .= 11= 13

!. ,ropert"= plant= and e&uipmentQ3= +

c. 6urrent lia!ilitiesQ1= 12

d. ong5term lia!ilitiesQ5

e. *toc#$oldersA e&uit"Q)= 14

3 0 3:

T$e 2ccounting In-ormation *"stem

Pr% 30935Q2d0usting entries.

(ata relating to t$e !alances o- various accounts a--ected !" ad0usting or closing entries appear

!elo<. (T$e entries <$ic$ caused t$e c$anges in t$e !alances are not given.) Iou are as#ed to

suppl" t$e missing 0ournal entries <$ic$ <ould logicall" account -or t$e c$anges in t$e account

!alances.

1. Interest receiva!le at 1@1@14 <as E1=111. (uring 2114 cas$ received -rom de!tors -or interest

on outstanding notes receiva!le amounted to E5=111. T$e 2114 income statement s$o<ed

interest revenue in t$e amount o- E'=411. Iou are to provide t$e missing ad0usting entr" t$at

must $ave !een made= assuming reversing entries are not made.

2. 9nearned rent at 1@1@14 <as E5=311 and at 12@31@14 <as E+=111. T$e records indicate cas$

receipts -rom rental sources during 2114 amounted to E55=111= all o- <$ic$ <as credited to

t$e 9nearned Rent Revenue account. Iou are to prepare t$e missing ad0usting entr".

3. 2ccumulated depreciationQe&uipment at 1@1@14 <as E231=111. 2t 12@31@14 t$e !alance o-

t$e account <as E2+1=111. (uring 2114= one piece o- e&uipment <as sold. T$e e&uipment

$ad an original cost o- E41=111 and <as 3@4 depreciated <$en sold. Iou are to prepare t$e

missing ad0usting entr".

4. 2llo<ance -or dou!t-ul accounts on 1@1@14 <as E51=111. T$e !alance in t$e allo<ance

account on 12@31@14 a-ter ma#ing t$e annual ad0usting entr" <as E'5=111 and during 2114

!ad de!ts <ritten o-- amounted to E31=111. Iou are to provide t$e missing ad0usting entr".

5. ,repaid rent at 1@1@14 <as E2.=111. (uring 2114 rent pa"ments o- E121=111 <ere made and

c$arged to Srent expense.S T$e 2114 income statement s$o<s as a general expense t$e item

Srent expenseS in t$e amount o- E145=111. Iou are to prepare t$e missing ad0usting entr" t$at

must $ave !een made= assuming reversing entries are not made.

'. Retained earnings at 1@1@14 <as E131=111 and at 12@31@14 it <as E211=111. (uring 2114=

cas$ dividends o- E51=111 <ere paid and a stoc# dividend o- E41=111 <as issued. 4ot$

dividends <ere properl" c$arged to retained earnings. Iou are to provide t$e missing closing

entr".

Solution 30935

1. Interest Receiva!le ................................................................... 2=411

Interest Revenue ........................................................... 2=411

Interest revenue per !oo#s E'=411

Interest revenue received related to 2114

(E5=111 M E1=111) 4=111

Interest accrued E2=411

2. 9nearned Rent Revenue .......................................................... 52=311

Rent Revenue ............................................................... 52=311

6as$ receipts E55=111

4eginning !alance 5=311

3nding !alance (+=111)

Rent revenue E52=311

3 0 3;

Test +an, "or Inter-e!iate A##ountin./ Fi"teent E!ition

Solution 30935 (cont.)

3. (epreciation 3xpense .............................................................. +1=111

2ccumulated (epreciationQ3&uipment ........................ +1=111

3nding !alance E2+1=111

4eginning !alance 231=111

(i--erence 51=111

Crite5o-- at time o- sale 3@4 G E41=111 31=111

E +1=111

4. 4ad (e!t 3xpense .................................................................... 45=111

2llo<ance -or (ou!t-ul 2ccounts ................................... 45=111

3nding !alance E'5=111

4eginning !alance 51=111

(i--erence 15=111

Critten o-- 31=111

E45=111

5. Rent 3xpense ........................................................................... 25=111

,repaid Rent ................................................................. 25=111

Rent expense E145=111

ess cas$ paid 121=111

Reduction in prepaid rent account E 25=111

'. Income *ummar" ..................................................................... 1)1=111