Professional Documents

Culture Documents

Financial Accounting 3 Topic 1 Revenue 1420

Uploaded by

Lee Jih Kai0 ratings0% found this document useful (0 votes)

205 views20 pagesCompany Accounting ( Revenue Recognition )

Original Title

Financial Accounting 3 Topic 1 Revenue 1420 (5)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompany Accounting ( Revenue Recognition )

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

205 views20 pagesFinancial Accounting 3 Topic 1 Revenue 1420

Uploaded by

Lee Jih KaiCompany Accounting ( Revenue Recognition )

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 20

1

Educating Professionals Creating and Applying Knowledge Engaging our Communities

Financial Accounting 3

Unless otherwise stated all slides were prepared by John Medlin

2

Assessment

Assignment 10%

Essay 25%

Exam 65%

Must achieve at least 50% in the final exam to

pass the course

4

Prepared for UniSA 2014

Prepared for UniSA 2014

2

Prerequisites

Must pass FA2 to do FA3, cannot do them at the same

time.

Students who have failed FA 2 will be unenrolled after

enrolment add deadline. By then, the chance to enrol in

a different course will be gone.

Students sitting deferred or supplementary exams may

maintain their enrolment.

Fail grades as a result of the deferred or supplementary

exams will also result in them being unenrolled.

5

Success Rates

80% of first timers pass the

course

60% of repeat students pass

Lets see if we can get this higher!!!

If you re-run a race you need to

work harder and smarter

If work, personal issues,

illness etc. affect your study then

withdraw

6

Gym UniSA

Paying University fees is like

paying for Gym membership

Your lecturers & tutors are

like personal trainers at the

Gym

They provide guidance and

encouragement but you

have to do all the

work

7

If the personal trainer does all

the exercise

While you just play with

your mobile phone

The trainer gets fit

while you remain

8

Prepared for UniSA 2014

Prepared for UniSA 2014

3

Education is not a spectator sport: it

is a transforming encounter. It

demands active engagement; not

passive submission; personal

participation, not listless attendance.

(Rhodes, 2001, 65 cited in Gump,

2005).

http://w3.unisa.edu.au/counsellingser

vices/balance/workload.asp

9

CARTOON

11 12

Prepared for UniSA 2014

Prepared for UniSA 2014

4

CARTOON

13

What do you expect?

What do you expect to achieve by doing FA3?

What have you heard about the course?

Aspire to be great accountant, not

an average one!!!

http://www.charteredaccountants.com.au/Students

/Working-as-a-Chartered-Accountant

http://www.cpaaustralia.com.au/

14

Financial Accounting 3

Topic 1: Revenue

15

You have probably bought something in the

last week or two.

So how does the company account for your

purchase?

It is income but is it revenue or a gain?

AASB118 / IAS18

16

Prepared for UniSA 2014

Prepared for UniSA 2014

5

Objectives

1. Explain the nature of income, revenue and

other gains

2. Apply recognition criteria as they apply to

revenue

3. Account for revenues arising from various

types of transactions or other events in

accordance with AASB118 / IAS18: Revenue

4. Apply the requirements of AASB111 / IAS 11

5. Apply the requirements for disclosure of

revenue in accordance with AASB118 / IAS 18

17

Reading

Chapter 15, Revenue recognition

Deegan (2012) Australian Financial Accounting, 7

th

edition

Available on course learnonline site under eReadings

link within Course Essentials

AASB118 / IAS18: Revenue

AASB111 / IAS11: Construction Contracts

Framework

18

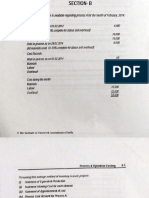

Real Company example of Revenue

What determines whether

Income is recorded

here?

or here?

20Y2 20Y1

19

Revenues

Gains

20Y2 20Y1

20

Prepared for UniSA 2014

Prepared for UniSA 2014

6

Definition of Income, Revenue &

Gains

Income defined (par. 70 of the AASB Framework) as

Income is divided into revenues and gains

21

CARTOON

22

Definition of Revenue & Gains

Revenues generally relate to the ordinary

income-generating activities of an entity

Gains relate to other incomenot necessarily

part of the ordinary activities of an entity

Differentiation between revenue and gains in

Framework para 74 & 75

23

Definition of Revenue & Gains

Scope of AASB 118 / IAS18 Revenue is fairly

restrictedapplies to accounting for revenue

arising from transactions and events relating to

(par. 1)

a) the sale of goods

b) the rendering of services

c) the use by others of entity assets

yielding interest, royalties and dividends

Recognition criteria provided for each of the

above categories of revenue, e.g. sale of goods

(par. 14)

24

Prepared for UniSA 2014

Prepared for UniSA 2014

7

Definition of Revenue & Gains

Revenue is measured at the fair value of the

consideration or contributions received or

receivable (par. 9)

if cash is received

if cash is not to be received for some period

of time

(refer to AASB 118 / IAS18, par. 11)

What if consideration is not cash?

25

Income & revenue recognition

current practice

AASB 118 / IAS18 (Illustrative Examples) provide

guidance in relation to the recognition of different

types of revenues.

26

Prepared for UniSA 2014

Prepared for UniSA 2014

1

Revenue?

Revenue

Gain

Sale of non-current asset

Sale of inventory

Provision of service

Revaluation of assets

Goods & Services Tax

Dividends

Revaluation of fin. Instru.

Interest

Royalties

Rent

27

Accounting for sales with

associated conditions

Transactions involving the sale of assets with

conditions attached should be reviewed to assess

whether

control of the future economic benefits has

passed from the seller to the purchaser;

and

it is probable that the inflow of economic

benefits to the seller has occurred

28

Prepared for UniSA 2014

Prepared for UniSA 2014

1

Accounting for sales with associated

conditions revenue recognition when

right of return exists

Alternative treatments available when the seller

is exposed to continued risks of ownership

through return of the product

not record sale until all return privileges have

expired

record sale but reduce sales by an estimate of

future returns

record sale and account for returns as they

occur

29 30

Sale not recorded until

Unlikely land will be

returned

Accounting for sales with associated

conditions sale and leaseback

ownership transferred to purchaser/lessor, but

vendor/lessee normally retains control

financing arrangementleased property used as

collateral for a loan

Transaction does not constitute a sale and does

not give rise to revenue

31

Interest & dividends interest

revenue

Interest revenue recognisedover time

Prepayment of interest not regarded as revenue

to lender

Interest revenue might be implicit in the terms of

a transaction

for example, where goods are sold on

extended credit, vendor is effectively financing

the purchaser

32

Prepared for UniSA 2014

Prepared for UniSA 2014

2

Interest & dividends

dividend revenue

Dividend revenue recorded once it is considered

probable that inflow of future economic benefits

has occurred and when these benefits can be

measured reliably

in most cases this will be at the time the board

of directors or other governing body proposed

the dividend

33

Dividends

recognised once

right to payment

established

34

Usually once

dividend

declared

35

House Proud Pty Ltd is operating a promotion selling furniture

under the following conditions:

Initial deposit of 20% of purchase price.

Immediate delivery of furniture.

Interest rate of 12.5%pa charged on the outstanding balance.

Repayment of the balance (including the interest) over 24 equal

monthly installments.

House Proud retains legal title to the furniture until the final

monthly payment has been made.

House Proud would recognise revenue as follows:

a)Recognise interest as it is received (monthly) and recognise

the revenue on the sale of the goods upfront.

b)Recognise the whole amount of revenue upfront

c)Recognise interest as it is received (monthly) and recognise

the revenue on the sale of the goods once the final payment has

been received.

d)Recognise all revenue as it is received

a) Recognise interest as it is received (monthly) and

recognise the revenue on the sale of the goods upfront.

b) Recognise the whole amount of revenue upfront

c) Recognise interest as it is received (monthly) and

recognise the revenue on the sale of the goods once the

final payment has been received.

d) Recognise all revenue as it is received

36

Prepared for UniSA 2014

Prepared for UniSA 2014

3

Unearned Revenue

Recorded when payment is received in advance

The receipts have not been earned

Considered to be liabilities

Refer to Worked Example 15.3 on page 534

Revenue received in advance

37

CARTOON

38

Educating Professionals Creating and Applying Knowledge Engaging our Communities

39

Accounting for construction

contracts

Accounting issues result from some construction

projects taking a number of financial periods to

complete

40

Prepared for UniSA 2014

Prepared for UniSA 2014

4

Deferral of revenue recognition until

completion of project would result in greater

volatility of reported revenues and of related

profits or losses

Currently, governed by AASB 111 / IAS11

Construction Contracts

41

AASB 111 / IAS11 requires use the percentage-

of-completion method to account for construction

contracts

Profit on construction contract is recognisedin

proportion to the work performed in each

reporting period in which construction occurs

42

Construction costs plus gross profit earned to

date accumulated in (debited to) an inventory

account (Construction in progress)

Progress billings are credited to the Construction

in progress account.

43

Percentage of

completion method

Reliable

measurement

Real Company Example

44

Prepared for UniSA 2014

Prepared for UniSA 2014

5

Percentage of

completion method

45

Percentage-of-completion method should be

used provided that certain conditions are met that

enable the outcome of the contract to be reliably

estimated

Revenue and expenses are recognisedby

reference to the stage of completion of the

contract activity at the reporting date

46

CARTOON

47

If conditions are not satisfied

- no profit is to be brought to account until they are

satisfied

- at the extreme, no profit to be recognised until project

completion

Note

When outcome of construction contract

cannot be estimated reliably (AASB 111 /

IAS11, par. 32)

(a) revenue is to be recognised only to the extent of

contract costs incurred that it is probable will be

recoverable; and

(b) contract costs are to be recognised as an

expense in the period in which they are incurred

48

Prepared for UniSA 2014

Prepared for UniSA 2014

6

Measuring progress towards completion

Percentage of completion can be measured

in a number of ways

may include

(a)the proportion that contract costs incurred

for work performed to date bear to the

estimated total contract costs;

(b)surveys of work performed; or

(c) completion of physical proportion of the

contract work.

Progress payments and advances received from customers

often do not reflect the work performed

49

Measuring progress towards completion

Cost basis

Costs incurred to the end of the current period

Most recent estimate of total costs

Current period revenue or gross profit

=estimated total revenue or gross profit

multiplied by percentage complete

less total revenue or gross profit already

recognised

50

51

Disclosure requirements

AASB 111 / IAS11 requires that the balance sheet

or accompanying notes

disclose the gross amount of work in progress (or

contract costs incurred)

the related aggregate billings deducted from the

work in progress

52

Application of percentage-of-completion method

to account for construction contracts

Refer to Worked Example 15.4 on pp. 539

Percentage-of-completion method

Prepared for UniSA 2014

Prepared for UniSA 2014

53

Illustration accounting for construction contract

Big Builder signed a contract on J anuary 1, 20Y1, agreeing to

build a warehouse for Storage Solutions at a contract price of

$20,000,000. Big Builder estimated that construction costs would

be as follows

20Y1 $5,000,000

20Y2 $8,000,000

20Y3 $3,000,000

$16,000,000

The contract provided that Storage Solutions would make

payments on December 31 of each year as follows

20Y1 $ 4,000,000

20Y2 $10,000,000

20Y3 $ 6,000,000

$20,000,000

The contract was completed and accepted on December 31,

20Y3. Assume that actual costs and cash collections coincided

with expectations.

Prepared for UniSA 2014

Prepared for UniSA 2014

54

Illustration accounting for a construction contract

Income recognised each year

20Y1 20Y2 20Y3

Contract price $20 000 000 $20 000 000 $ 20 000 000

Less estimated cost:

Costs to date 5 000 000 13 000 000 16 000 000

Estimated costs to complete 11 000 000 3 000 000 ___________

Estimated total cost 16 000 000 16 000 000 16 000 000

Estimated total gross profit/(loss) $ 4 000 000 $ 4 000 000 $ 4 000 000

Per cent complete 31.25% 81.25% 100%

Gross profit: $4m * 31.25% = $1 250 000

$4m * 81.25% - $1.25m = $2 000 000

$4m * 100% - $1.25m - $2m = $750 000

Prepared for UniSA 2014

Prepared for UniSA 2014

55

(b) J ournal Entries P.O.C. Method

20Y1 20Y2 20Y3

(i) To record costs incurred

Dr Construction in progress

(contract asset) 5 8 3

Cr Cash, a/c pay., dep

n

etc 5 8 3

(ii) To record billings to customers

Dr Accounts receivable 4 10 6

Cr Construction in progress

(contract asset) 4 10 6

Prepared for UniSA 2014

Prepared for UniSA 2014

56

(iii) To record cash collections 20Y1 20Y2 20Y3

Dr Cash 4 10 6

Cr Accounts receivable 4 10 6

(iv) To record periodic income recognised

Dr Construction in progress

(contract asset) 1.25 2 0.75

Dr Construction expenses

(Statement of comp. income) 5 8 3

Cr Revenue from LT Contract

(Statement of comp. income) 6.25 10 3.75

Prepared for UniSA 2014

Prepared for UniSA 2014

1

57

Long term

contracts

20Y2 20Y1

Refer to Worked Example 15.5 on pp.

541Construction contract where outcome

cannot be reliably estimated

59

Accounting for long-term contract losses

When current estimates indicate that a loss is

probable

provision should be made for any foreseeable

loss on the contract

loss is to be brought to account as soon as it

is foreseeable

AASB 111 / IAS11 (par. 36)

Refer to Worked Example 15.6 on page 542

Percentage of completion with recognition of a

loss

60

Expected Loss on

Contract

Prepared for UniSA 2014

Prepared for UniSA 2014

2

61

The future

Comprehensive reform

IFRS 15 Revenue from Contracts with Customers .

J oint release with the US Financial Accounting Standards

Board, which has issued a corresponding Accounting

Standards Update of the same name.

IFRS 15 represents 12 years of work

1500 comment letters as the project has progressed.

Significant enhancements to the quality and consistency of

how revenue is reported. (ICAA ANT March 2014)

IFRS 15 from1 J anuary 2017, early adoption is permitted.

62

The main objectives of the new standard are to:

single revenue recognition model based on the transfer of

goods and services.

remove inconsistencies and weaknesses in existing

revenue recognition standards

simplify the preparation of financial statements

enhance disclosures about revenue, providing guidance

for transactions that were not previously addressed

comprehensively (for example, service revenue and

contract modifications) and improving guidance for

multiple-element arrangements. (ICAA ANT March 2014)

Prepared for UniSA 2014

Prepared for UniSA 2014

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Aka FinDocument28 pagesAka FinSadman SakibNo ratings yet

- ch14 Kieso IFRS4 PPTDocument75 pagesch14 Kieso IFRS4 PPT1234778No ratings yet

- ACCT3563 Revision Workshop Slides + QuestionsDocument9 pagesACCT3563 Revision Workshop Slides + QuestionsstephanieNo ratings yet

- LECTURE NOTES FOR Revaluation Model PDFDocument10 pagesLECTURE NOTES FOR Revaluation Model PDFFilip SlavchevNo ratings yet

- Transcom Annual Report 2022Document56 pagesTranscom Annual Report 2022John ProticNo ratings yet

- Score Report - Cibil DashboardDocument29 pagesScore Report - Cibil DashboardRealm PhangchoNo ratings yet

- List of FormulaDocument2 pagesList of FormulaMidas Troy VictorNo ratings yet

- 6 Audit of Intangible Asset and Related Accounts Feu RevDocument5 pages6 Audit of Intangible Asset and Related Accounts Feu RevHanze MacasilNo ratings yet

- Operation and Maintenance of The ERP System: ERP Demystified (Second Edition) by Alexis Leon (2008)Document66 pagesOperation and Maintenance of The ERP System: ERP Demystified (Second Edition) by Alexis Leon (2008)aninandhuNo ratings yet

- Fundamentals of Accounting ReviewerDocument3 pagesFundamentals of Accounting ReviewerRandy ParasNo ratings yet

- Warren Sports Supply Worksheet - Amber GarnerDocument8 pagesWarren Sports Supply Worksheet - Amber Garnerapi-456188291100% (1)

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDocument8 pagesDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNo ratings yet

- Louie Anne R. Lim - 03 Activity 1Document3 pagesLouie Anne R. Lim - 03 Activity 1Louie Anne LimNo ratings yet

- Process and Operating CostingDocument20 pagesProcess and Operating CostingBHANU PRATAP SINGHNo ratings yet

- Mukesh GarmentsDocument2 pagesMukesh GarmentsPARASHAR GULSHANNo ratings yet

- Pallavi ShettyDocument81 pagesPallavi ShettyAnonymous Lg4oUyEPONo ratings yet

- Strategies Affecting Stock MarketDocument9 pagesStrategies Affecting Stock MarketAditya Kanchan BarasNo ratings yet

- Acc7 Perf MeasuresDocument7 pagesAcc7 Perf MeasuresZerjo CantalejoNo ratings yet

- Inventory ManagementDocument118 pagesInventory ManagementJessabelle EchemNo ratings yet

- Topic:: Accounts of Holding CompaniesDocument19 pagesTopic:: Accounts of Holding CompaniesCharu LataNo ratings yet

- Depreciation Methods: (Example, Straight Line Depreciation)Document5 pagesDepreciation Methods: (Example, Straight Line Depreciation)munnag01No ratings yet

- Maf March 2017 Q3 Diana SelamatDocument2 pagesMaf March 2017 Q3 Diana SelamatSITI NUR DIANA SELAMATNo ratings yet

- Chapter 2 - Capital StructureDocument19 pagesChapter 2 - Capital StructureNguyễn Ngàn NgânNo ratings yet

- Tugas Financial Planning and Analysis The Master Budget (Irga Ayudias Tantri - 12030124100011)Document11 pagesTugas Financial Planning and Analysis The Master Budget (Irga Ayudias Tantri - 12030124100011)irga ayudiasNo ratings yet

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- Capital Budgeting AssignmentDocument3 pagesCapital Budgeting AssignmentRobert JohnsonNo ratings yet

- Holoease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseDocument11 pagesHoloease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseJacob SheridanNo ratings yet

- Chap 2 - Business ExpensesDocument185 pagesChap 2 - Business Expenseshippop kNo ratings yet

- Module 3 Acctg. For Special TransactionsDocument25 pagesModule 3 Acctg. For Special TransactionsTanNo ratings yet