Professional Documents

Culture Documents

Munis Flyin' High But May Be Over Their Skis: Quick Read

Uploaded by

api-245850635Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Munis Flyin' High But May Be Over Their Skis: Quick Read

Uploaded by

api-245850635Copyright:

Available Formats

Copyright 2014 Arbor Research & Trading, LLC. All rights reserved.

This material is for your private information, and we are not soliciting any action based upon it. This material should not be redistributed or replicated in

any form without the prior consent of Arbor. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such.

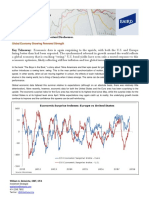

Munis flyin high but may be over their skis

The Barclays Municipal Bond Index has produced a YTD gain

through October of +8.3%, which almost doubles high yield

corporate debt at +4.2%.

1

Munis have seen ten consecutive

months of gains even as US high yield, MBS, and the S&P 500

encountered bumps in the road due to rate hike talk. Munis

took the reins from US high yield this August in our list as

the top risk-adjusted performer according to rolling 60-day

reward-to-risk ratios. However munis relative performance

reached a crescendo on October 15

th

to the following total

return indices:

Barclays Aggregate Bond Index

Barclays MBS Index

iBoxx $ High Yield Index

S&P 500

DJ Commodities Index

We review spreads between the Barclays

Municipal Bond Index and key benchmarks

reward-to-risk ratios. Many of these spreads

are nearly as high as they have been since

2000. Next we calculate percentiles for each

spread to gauge overbought/oversold

conditions. The average of these percentiles

just recently exceeded its 95

th

percentile.

1

iBoxx $ High Yield

11/3/2014

Quick Read Ten consecutive months of strong risk-adjusted returns are shining a spot-light on munis, however extreme

relative performance to other asset classes is of concern.

Copyright 2014 Arbor Research & Trading, LLC. All rights reserved. This material is for your private information, and we are not soliciting any action based upon it. This material should not be redistributed or replicated in

any form without the prior consent of Arbor. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such.

Interestingly, drops by this average percentile below 90%

have been followed by relative muni underperformance.

Since 2001 the muni index has underperformed 60 days

later the Aggregate Bond Index and S&P 500 in 4 of 6

instances (67%) and High Yield in 5 of 6 (83%) instances.

Below are signal dates:

September 20

th

, 2001

October 16

th

, 2009

March 8

th

, 2010

October 6

th

, 2010

August 24

th

, 2011

February 14

th

, 2012

This percentile fell below 90% on October 24

th

, 2014.

Please see below for a history of signals expecting relative underperformance by the Barclays Municipal

Bond Index:

You might also like

- US Corporate High Yield Reaching Extreme Reward / Risk RatioDocument3 pagesUS Corporate High Yield Reaching Extreme Reward / Risk Ratioapi-245850635No ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- September Monthly LetterDocument3 pagesSeptember Monthly LetterTheLernerGroupNo ratings yet

- Bond Market Perspectives 03032015Document4 pagesBond Market Perspectives 03032015dpbasicNo ratings yet

- April 2016 LetterDocument2 pagesApril 2016 LetterTheLernerGroupNo ratings yet

- July Monthly LetterDocument3 pagesJuly Monthly LetterTheLernerGroupNo ratings yet

- Pro Shares Fact Sheet KruDocument2 pagesPro Shares Fact Sheet Krumorucha_chicleNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- AprilDocument3 pagesAprilTheLernerGroupNo ratings yet

- Weekly Market Commentary: Two and ADocument2 pagesWeekly Market Commentary: Two and Aapi-234126528No ratings yet

- Where To Invest 2011Document32 pagesWhere To Invest 2011Talgat VanderbiltNo ratings yet

- A View On Banks FinalDocument22 pagesA View On Banks FinaljustinsofoNo ratings yet

- File 1Document10 pagesFile 1Alberto VillalpandoNo ratings yet

- Yield IncomeDocument22 pagesYield IncomejNo ratings yet

- 2017 Q3 MC LetterDocument9 pages2017 Q3 MC LetterAnonymous Ht0MIJNo ratings yet

- Samson Corporate Strategy BulletinDocument5 pagesSamson Corporate Strategy BulletinAnonymous Ht0MIJNo ratings yet

- AltFi 2016 Prosper Presentation by Ron SuberDocument27 pagesAltFi 2016 Prosper Presentation by Ron SuberCrowdfundInsider100% (1)

- Opportunities in Times of Adversity!: Event UpdateDocument3 pagesOpportunities in Times of Adversity!: Event UpdateJanani SubramanianNo ratings yet

- Callan Periodoc Table of Investment ReturnsDocument2 pagesCallan Periodoc Table of Investment Returnsambasyapare1No ratings yet

- Investments House ViewDocument13 pagesInvestments House ViewjNo ratings yet

- May Monthly LetterDocument2 pagesMay Monthly LetterTheLernerGroupNo ratings yet

- MUNI-OPIN-FEB February Muni Opinion 2012Document6 pagesMUNI-OPIN-FEB February Muni Opinion 2012Anonymous Feglbx5No ratings yet

- MF ArielPortfolioCommentaryApril2016Document4 pagesMF ArielPortfolioCommentaryApril2016Ankur MittalNo ratings yet

- CMO BofA 02-12-2024 AdaDocument8 pagesCMO BofA 02-12-2024 AdaAlejandroNo ratings yet

- Q1 2023 Investor Letter - FINAL 030823Document4 pagesQ1 2023 Investor Letter - FINAL 030823saravanan aNo ratings yet

- Third Point Q109 LetterDocument4 pagesThird Point Q109 LetterZerohedgeNo ratings yet

- Macro UpdateDocument5 pagesMacro UpdateAnonymous Ht0MIJNo ratings yet

- The Zacks Analyst BlogDocument3 pagesThe Zacks Analyst BlogPaul KlussmannNo ratings yet

- Berkshire Hathaway Research PaperDocument8 pagesBerkshire Hathaway Research PaperDennis KimNo ratings yet

- SP Securities Lending Index Series FactsheetDocument3 pagesSP Securities Lending Index Series FactsheetqtipxNo ratings yet

- Arlington Value 2006 Annual Shareholder LetterDocument5 pagesArlington Value 2006 Annual Shareholder LetterSmitty WNo ratings yet

- Responding To A Crisis - Harris AssociatesDocument4 pagesResponding To A Crisis - Harris AssociatesceojiNo ratings yet

- August Monthly LetterDocument2 pagesAugust Monthly LetterTheLernerGroupNo ratings yet

- Why Do Companies Issue Debt When They Don't Seem To Need The MoneyDocument3 pagesWhy Do Companies Issue Debt When They Don't Seem To Need The MoneythebigpicturecoilNo ratings yet

- October Monthly LetterDocument2 pagesOctober Monthly LetterTheLernerGroupNo ratings yet

- Investor LetterDocument3 pagesInvestor LetterRichard LiuNo ratings yet

- Corn Private Wealth Program1Document11 pagesCorn Private Wealth Program1Jeff CrawfordNo ratings yet

- Corsair Capital Q4 2011Document3 pagesCorsair Capital Q4 2011angadsawhneyNo ratings yet

- Lane Asset Management Stock Market Commentary February 2014Document8 pagesLane Asset Management Stock Market Commentary February 2014Edward C LaneNo ratings yet

- T Rident: Municipal ResearchDocument4 pagesT Rident: Municipal Researchapi-245850635No ratings yet

- JCR-VIS Credit Rating Co. LTD: Criteria For Rating WatchDocument3 pagesJCR-VIS Credit Rating Co. LTD: Criteria For Rating WatchghazalaNo ratings yet

- August Monthly LetterDocument2 pagesAugust Monthly LetterTheLernerGroupNo ratings yet

- Broyhill Portfolio Update 2020.Q3 PDFDocument49 pagesBroyhill Portfolio Update 2020.Q3 PDFhamsNo ratings yet

- Blog - Anti Quality BubbleDocument6 pagesBlog - Anti Quality BubbleOwm Close CorporationNo ratings yet

- Ank Otes: February 2018Document22 pagesAnk Otes: February 2018Michael HeidbrinkNo ratings yet

- Eros International PLC - Wells FargoDocument4 pagesEros International PLC - Wells FargoGuneet Singh SahniNo ratings yet

- Wells Fargo Market CommentaryDocument2 pagesWells Fargo Market CommentaryAceNo ratings yet

- Third Point Q1'09 Investor LetterDocument4 pagesThird Point Q1'09 Investor LetterDealBook100% (2)

- Infosys Revenue To Hit A Snag On Its Sales AimDocument3 pagesInfosys Revenue To Hit A Snag On Its Sales AimSubham MazumdarNo ratings yet

- International Credit Rating Agencies - by Shivam Jaiswal Word FileDocument8 pagesInternational Credit Rating Agencies - by Shivam Jaiswal Word Fileshivam jaiswalNo ratings yet

- Bond Market Perspectives 06092015Document4 pagesBond Market Perspectives 06092015dpbasicNo ratings yet

- Market Analysis Feb 2024Document17 pagesMarket Analysis Feb 2024Subba TNo ratings yet

- March Monthly LetterDocument2 pagesMarch Monthly LetterTheLernerGroupNo ratings yet

- Dollar Cost Averaging vs. Lump Sum Investing: Benjamin FelixDocument17 pagesDollar Cost Averaging vs. Lump Sum Investing: Benjamin FelixCláudioNo ratings yet

- The Benefits and Risks of Corporate Bonds Oct - 13 - 2010 ReportDocument11 pagesThe Benefits and Risks of Corporate Bonds Oct - 13 - 2010 ReportstefijNo ratings yet

- March 2016Document2 pagesMarch 2016TheLernerGroupNo ratings yet

- September Monthly LetterDocument2 pagesSeptember Monthly LetterTheLernerGroupNo ratings yet

- Midyear Outlook: Five Distinct Macro Disconnects: InsightsDocument28 pagesMidyear Outlook: Five Distinct Macro Disconnects: Insightsastefan1No ratings yet

- The Truth About Ebix, Robin Raina, and The Robin Raina FoundationDocument46 pagesThe Truth About Ebix, Robin Raina, and The Robin Raina Foundationgothamcityresearch100% (1)

- UST Snapshot: On/Off-the-runs, Coupon Strips, and PrincipalsDocument3 pagesUST Snapshot: On/Off-the-runs, Coupon Strips, and Principalsapi-245850635No ratings yet

- US High Yield's Sharpe Ratio Has Fallen As We Expected Since Late June 2014. However It's Now Nearing An Oversold LevelDocument1 pageUS High Yield's Sharpe Ratio Has Fallen As We Expected Since Late June 2014. However It's Now Nearing An Oversold Levelapi-245850635No ratings yet

- Bullish 5 Day Period For Global RatesDocument5 pagesBullish 5 Day Period For Global Ratesapi-245850635No ratings yet

- Newsclips/Daily Commentary: Bianco Research, L.L.CDocument1 pageNewsclips/Daily Commentary: Bianco Research, L.L.Capi-245850635No ratings yet

- US High Yield's Sharpe Ratio Has Fallen As We Expected Since Late June 2014. However It's Now Nearing An Oversold LevelDocument1 pageUS High Yield's Sharpe Ratio Has Fallen As We Expected Since Late June 2014. However It's Now Nearing An Oversold Levelapi-245850635No ratings yet

- June Seasonality - Global Interest Rates: Changes Since The Close of The Prior MonthDocument3 pagesJune Seasonality - Global Interest Rates: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- July Seasonality - Global Equity Indices: Changes Since End of JuneDocument3 pagesJuly Seasonality - Global Equity Indices: Changes Since End of Juneapi-245850635No ratings yet

- UST Snapshot: On/Off-the-runs, Coupon Strips, and PrincipalsDocument3 pagesUST Snapshot: On/Off-the-runs, Coupon Strips, and Principalsapi-245850635No ratings yet

- TIPS Breakevens - Potential For Narrowing: Decomposing Real and Nomial Yield CurvesDocument3 pagesTIPS Breakevens - Potential For Narrowing: Decomposing Real and Nomial Yield Curvesapi-245850635No ratings yet

- July Seasonality - Major Currency Pairs: Changes Since The End of JuneDocument3 pagesJuly Seasonality - Major Currency Pairs: Changes Since The End of Juneapi-245850635No ratings yet

- UntitledDocument3 pagesUntitledapi-245850635No ratings yet

- July Seasonality - Global Interest Rates: Changes Since End of JuneDocument3 pagesJuly Seasonality - Global Interest Rates: Changes Since End of Juneapi-245850635No ratings yet

- Spx-Closed: 1944 High: 1949 Low: 1940: Red 70% or 30% To Hit or HoldDocument1 pageSpx-Closed: 1944 High: 1949 Low: 1940: Red 70% or 30% To Hit or Holdapi-245850635No ratings yet

- May Seasonality - Global Interest Rates: Changes Since The Close of The Prior MonthDocument3 pagesMay Seasonality - Global Interest Rates: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- June Seasonality - Major Currency Pairs: Changes Since The Close of The Prior MonthDocument3 pagesJune Seasonality - Major Currency Pairs: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- June Seasonality - Global Equity Indices: Changes Since The Close of The Prior MonthDocument3 pagesJune Seasonality - Global Equity Indices: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- UntitledDocument3 pagesUntitledapi-245850635No ratings yet

- UPDATE: 10y US/Bund and 10y Gilt/Bund Aiming at High Spreads From 2005Document4 pagesUPDATE: 10y US/Bund and 10y Gilt/Bund Aiming at High Spreads From 2005api-245850635No ratings yet

- US 10 Year Note Breaking Out of Trading RangeDocument2 pagesUS 10 Year Note Breaking Out of Trading Rangeapi-245850635No ratings yet

- May Seasonality - Global Interest Rates: Changes Since The Close of The Prior MonthDocument3 pagesMay Seasonality - Global Interest Rates: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- UntitledDocument3 pagesUntitledapi-245850635No ratings yet

- May Seasonality - Major Currency Pairs: Changes Since The Close of The Prior MonthDocument3 pagesMay Seasonality - Major Currency Pairs: Changes Since The Close of The Prior Monthapi-245850635No ratings yet

- T Rident: Municipal ResearchDocument4 pagesT Rident: Municipal Researchapi-245850635No ratings yet

- Bullish Breakout (Break Bottom of Range)Document1 pageBullish Breakout (Break Bottom of Range)api-245850635No ratings yet

- Bullish Breakout (Break Bottom of Range)Document1 pageBullish Breakout (Break Bottom of Range)api-245850635No ratings yet

- Bullish Breakout (Break Bottom of Range)Document1 pageBullish Breakout (Break Bottom of Range)api-245850635No ratings yet

- US 10 Yr Note & US 30 Yr Bond - Bullish Sentiment and Economic Data SurprisesDocument3 pagesUS 10 Yr Note & US 30 Yr Bond - Bullish Sentiment and Economic Data Surprisesapi-245850635No ratings yet

- US 10 Yr Note & US 30 Yr Bond - Bullish Sentiment and Economic Data SurprisesDocument3 pagesUS 10 Yr Note & US 30 Yr Bond - Bullish Sentiment and Economic Data Surprisesapi-245850635No ratings yet

- Advanced Financial Management by ICPAP PDFDocument265 pagesAdvanced Financial Management by ICPAP PDFjj0% (1)

- Minimizing The Impact of Organizational Distress On Intellectual and Social Capital Through Development of Collaborative CapitalDocument12 pagesMinimizing The Impact of Organizational Distress On Intellectual and Social Capital Through Development of Collaborative CapitalshuvoertizaNo ratings yet

- Deterministic Cash Flows and The Term Structure of Interest RatesDocument15 pagesDeterministic Cash Flows and The Term Structure of Interest RatesC J Ballesteros MontalbánNo ratings yet

- 06 Chapter 37 (Complete)Document61 pages06 Chapter 37 (Complete)Jian JieNo ratings yet

- CRD The Use and Application of Epoxy Resin Vs Vinylester Vs PolyesterDocument4 pagesCRD The Use and Application of Epoxy Resin Vs Vinylester Vs PolyesterArjun PrasadNo ratings yet

- 9 - Bonds and Their ValuationDocument1 page9 - Bonds and Their Valuationjasminn_2No ratings yet

- MATH3075 3975 Course Notes 2012Document104 pagesMATH3075 3975 Course Notes 2012ttdbaoNo ratings yet

- Econ 202: Chapter 14Document24 pagesEcon 202: Chapter 14Thomas WooNo ratings yet

- Lab ManualDocument19 pagesLab ManualFatimah SukimanNo ratings yet

- Bond Pricing and Bond Yield New - 1Document66 pagesBond Pricing and Bond Yield New - 1Sarang Gupta100% (1)

- 6254 01 Rms 20060125Document11 pages6254 01 Rms 20060125chemking79No ratings yet

- Tutorial 6 AnsDocument4 pagesTutorial 6 AnsFirdaus LasnangNo ratings yet

- American Barrick Case Study SolutionDocument4 pagesAmerican Barrick Case Study SolutionNicholas MurryNo ratings yet

- Chromium ComplexesDocument3 pagesChromium ComplexesNitty MeYa100% (1)

- Archives of Biochemistry and BiophysicsDocument12 pagesArchives of Biochemistry and BiophysicssekharurlaNo ratings yet

- Bloomberg ReferenceDocument111 pagesBloomberg Referencerranjan27No ratings yet

- lct8 PDFDocument14 pageslct8 PDFSeanMarxAdanzaNo ratings yet

- Metal Organic FrameworkDocument20 pagesMetal Organic FrameworkgertyusajNo ratings yet

- Polyethylene - Chemistry and Production ProcessesDocument26 pagesPolyethylene - Chemistry and Production Processeschiuchan888No ratings yet

- Comparison Between PAM1998 and PAM 2006Document31 pagesComparison Between PAM1998 and PAM 2006meishann67% (9)

- Chapter 12Document64 pagesChapter 12kgeorges27No ratings yet

- CH 10Document64 pagesCH 10José BritesNo ratings yet

- Exam QuizbowlersDocument7 pagesExam QuizbowlersJohnAllenMarillaNo ratings yet

- Data Analysis & Interpretation 23Document23 pagesData Analysis & Interpretation 23kaushalNo ratings yet

- Chapter FiveDocument46 pagesChapter Fivejayaram234No ratings yet

- Self-Study Worksheet III Isomerism ANSWERSDocument2 pagesSelf-Study Worksheet III Isomerism ANSWERSkjjkimkmkNo ratings yet

- ACC 210P - Chapter 9 Lab Exercise SolutionsDocument3 pagesACC 210P - Chapter 9 Lab Exercise SolutionscyclonextremeNo ratings yet

- Notice: Municipal Bonds and Coupons, State and Local Governments Noncash Collection Service Withdrawal ApprovalDocument3 pagesNotice: Municipal Bonds and Coupons, State and Local Governments Noncash Collection Service Withdrawal ApprovalJustia.comNo ratings yet

- EFB334 Lecture01, IntroductionDocument31 pagesEFB334 Lecture01, IntroductionTibet LoveNo ratings yet

- Helen Bloore - E BondDocument2 pagesHelen Bloore - E BondHelen Bloore100% (1)