Professional Documents

Culture Documents

Simon TBR - Grant's Conference - 2014

Uploaded by

ValueWalkCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSimon TBR - Grant's Conference - 2014

Uploaded by

ValueWalkTocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

The Oldest Idea Whose Time Has Come (Again).

n

n n

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

"You think the odds look right, that they are in your favor?

This is a billiard table. An easy, flat, green billiard table. And you have hit your white ball and it

is traveling easily and quietly towards the red. The pocket is alongside. Fatally, inevitably you

are going to hit the red and the red is going into that pocket. It is the law of the billiard table,

the law of the billiard room. But, outside the orbit of these things, a jet pilot has fainted and his

plane is diving straight at that billiard room, or a gas main is about to explode, or lightning is

about to strike. And the building collapses on top of you and on top of the billiard table. Then

what has happened to that white ball that could not miss the red ball, and to the red ball that

could not miss the pocket? The white ball could not miss according to the laws of the billiard

table. But the laws of the billiard table are not the only laws in this particular game.

From Russia With Love, Ian Fleming

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Western Investors Keep Playing Financial Game

that Has Worked Since WWII

n n n

New laws now apply but few realize it

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Why did the system collapse in 2008 but not during previous crises?

A large and levered pool assets was priced by a model with uniform assumptions;

Key institutions had unprecedented levels of gross leverage but focused on net leverage.

Then assumptions changed and gross became net:

New assumptions triggered across-the-board re-pricing;

All key institutions faced massive margin calls;

Liquidity evaporated; hedging counterparties could not perform;

Financial system collapsed requiring massive overnight bailouts.

In every broker-dealer bankruptcy, customers assets were lost and/or sequestered Lehman, MF Global, Refco.

(Leverage + Model Dependence + Concentration) => IIliquidity => Counterparty Failure

4

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Is the financial system more sound today than it was in 2007?

Leverage global debts are up 40% since 2007;

Opacity - at over $700 T, the derivatives complex is larger than ever;

Model Dependence all financial assets rely on the all-time low discount rates;

Concentration TBTFs are larger then ever;

Liquidity there are fewer market makers and less prop capital (Dodd Frank).

The risks may be higher but consensus feels better a classic set up for a perfect storm.

5

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Concentration Risk the TBTFs are Bigger Than Ever.

In 20 years, 37 major liquidity providers have become 4 TBTFs.

6

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Old Laws:

Structural:

Free market prices; safe custody and bank deposits; corporate books fairly represent financial condition;

Hard currency.

Property rights:

Private property cannot be taken without due process;

Legitimate capital can flow freely across borders.

Geopolitics:

Cold war has been won peace dividend;

Mono-polar world with the US calling the shots.

Rules of the game are key assumptions in all investment strategies and valuations.

7

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

New Laws:

Structural:

Price controls, custodial risks, TBTFs, derivatives complex, opaque accounting, hidden leverage.

Property rights:

Financial assets are being taken without due process:

US GM and Chrysler bankruptcies; Cyprus depositors expropriated overnight; private pension assets taken by the Polish government.

Capital and currency controls:

FATCA: mapping global assets of US citizens; Swiss banks freeze US accounts until holders prove tax compliance (no due process).

Argentina, Venezuela, Ukraine, Iceland, Cyprus capital and currency controls.

Geopolitics:

US weaponizes payment networks against Russian entities; uses US$ clearing to gain jurisdiction over foreign banks.

Russia cyber attacks US banks; joins with BRICS to challenge US$ as reserve currency.

Persistent wars; US hegemony under pressure on multiple fronts.

New realities require new model assumptions systemic risks are no longer trivial.

8

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Current Market Consensus:

Debacles Happen Elsewhere;

Financial System is Sound.

n

n n

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

The US Financial System Has Collapsed Twice in 80 years.

No bailouts

Full bailouts

10

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

The Dollar Has Been Devalued Twice in 37 years.

US has defaulted in the past - de facto, if not de jure.

Gold nationalization and closing of the gold window led to two dollar devaluations.

11

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Wont Happen Here

is Not a Plan B

n n n

Conventional Wisdom Never Sees it Coming

12

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

US HY CCC or Below Effective Yield

St Louis Fed Financial Stress Index

1999-2003

Normal yields and stress preceded a natural credit cycle without systemic crisis.

2007-2009

Historically low yields and stress preceded massive credit crash and systemic crisis.

2009-2014

Yields and stress index are at all-time lows: the calm before the STORM.

Extreme complacency tends to precede extreme volatility.

13

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Gold vs SP500 vs Long-dated Treasuries

01/07-03/08

Gold up ~50% and peaks on Bear Stearns bailout. Consensus: The Fed saved the day.

03/08-10/08

Gold down ~30%. Consensus: Systemic risk is off the table.

10/08-08/11

Gold up ~160% and peaks as debt ceiling disappears. Consensus: Fed has it all under control.

08/11-09/14

Gold declines ~30%. Consensus: Systemic risk is off the table.

Markets ability to discount catastrophic risks is poor.

Demand for insurance and its cost soar AFTER the storm, not before.

14

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Implementing a Thesis

If the Problem is About the Money

Solution is About Something Else

15

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Which Brings Us to Bitcoin

16

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

Bitcoin is Symptomatic of Disaffection with the Current Financial System

Differences vs Financial Assets

Bitcoin & Crypto-currencies

Gold Bullion

Strictly Limited Supply

Yes

Yes

No Ones Liability

Yes

Yes

Decentralized Structure, Custody

Yes

Yes

Independence from Banks

Yes

Yes

Accounting Transparency

Yes

Yes

Individual Privacy

Yes

Yes

Key attributes of Bitcoin mirror those of gold but

Cybercurrencies are not yet ready for prime time

17

Tocqueville

Bullion

!

Cryptocurrency vs Gold

TERA

management

Reserve!

real assets. real ownership.

Cryptocurrency

Gold Bullion

Digital Only

Physical + Digital

Not Yet

Yes

Invulnerable to Hacking, Elec. Supply

No

Yes

Volatility vs US$

Yes

Yes

Deep Universal Liquidity

Not Yet

Yes

Difficult/Impossible to Fake

Difficult

Impossible

Digital Wallet

Yes

Possible

Distributed Ledger

Yes

Possible

Form of Existence

Universally Established Brand

James Grant: Gold is Natures Bitcoin

18

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Which Brings Us (Back) to Gold

19

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

Gold vs Financial Instruments During Systemic Crises

Key Technical Attributes

Financial Instruments

Physical Gold

Uncertain

Abundant and universal

No

Yes

Correlation

Unpredictable

Inverse correlation to confidence

Asymmetry

Unpredictable

Yes

Volatility

Problematic

No permanent impairment

Time Value Decay

Problematic

Never worthless

Counterparty Risk

High

None

Nominal Prices; correlations

Loss of confidence for any reason

Liquidity

Optionality, i.e. flexibility

Performance Drivers

Technical attributes of physical gold make it uniquely effective as systemic insurance;

Insurance is an asymmetric bet on an outcome considered unlikely.

20

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Big Opportunities Are Born out of Disagreements

Gold is Inversely Correlated to Confidence in Financial System

Utility and Value Depend on Whether Financial Assets are Sound

East and West Disagree

21

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Western Financial Investors Perspective:

(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it

down, dig another hole, bury it again and pay people to stand around

guarding it. It has no utility. Anyone watching from Mars would be scratching

their head.

Warren Buffett

Absence of utility is the key ASSUMPTION in the Western Investors model for valuing gold.

22

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

In the West gold is a speculation: investors buy on the way up and sell on the way down.

23

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

Alan Greenspans Perspectives:

ORIGINAL THESIS:

The financial policy of the welfare state requires that there be no way for the owners of

wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is

simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious

process. It stands as a protector of property rights.

Alan Greenspan, 1966

EXPERIMENT GONE AWRY:

The U.S. can pay any debt it has because we can always print money to do that.

Alan Greenspan, 2011

24

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

FINAL CONCLUSION:

gold has special properties that no other currency, with the possible exception of silver, can claim. For more than

two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit

guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an

obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II

was drawing to a close. Today, the acceptance of fiat money -- currency not backed by an asset of intrinsic value -rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis

conditions has not always matched the universal acceptability of gold.

If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to

hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Of the 30

advanced countries that report to the International Monetary Fund, only four hold no gold as part of their reserve

balances. Indeed, at market prices, the gold held by the central banks of developed economies was worth $762

billion as of December 31, 2013, comprising 10.3 percent of their overall reserve balances. (The IMF held an

additional $117 billion.) If, in the words of the British economist John Maynard Keynes, gold were a barbarous

relic, central banks around the world would not have so much of an asset whose rate of return, including storage

costs, is negative.

Alan Greenspan, Foreign Affairs, September 2014

Western governments are not selling their gold; Western financial investors are.

25

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Eastern Perspective:

Gold is the world's only monetary asset that has no counter-party risk, and is the only cross-nation, crosslanguage, cross-ethnicity, cross-religion and cross-culture globally recognized monetary asset.

Currently, there are more and more people recognizing that the gold is useless story contains too many

lies. Gold now suffers from a smokescreen designed by the US, which stores 74% of global official gold

reserves, to put down other currencies and maintain the US Dollar hegemony. Going to the source, the rise

of the US dollar and British pound, and later the euro currency was supported by their huge gold

reserves.

we should encourage individual investment demand for gold. Practice shows that gold possession by

citizens is an effective supplement to national reserves and is very important to national financial security.

Song Xin, General Manager of the China National Gold Corp., Party Secretary and President of the China Gold Association

China and Russia continue to aggressively accumulate the bullion being sold by the Western investors.

26

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

China and Russia see gold as essential to financial continuity.

27

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

China: Give us your hungry, your poor gold bars

28

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Gold-Based Finance:

the Oldest Idea Whose Time has Come (Again).

n

n n

Significant Upside without Counterparty Risk;

Liquid Buying Power; Independent Transfer System.

29

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Golds proven intrinsic value the only unimpeachable fiduciary asset.

Gold is universally liquid and can be used as payment without conversion into fiat currencies.

Gold is not tied to any country, financial system or counterparty - it is no ones liability.

Gold bullion is the most widely recognized and universally accepted valuable in the world.

The only tangible, liquid non-financial asset that is practical to own outside the financial system.

Bullion is liquid at transparent prices across the worlds financial centres, without exception.

Universal liquidity and independence from financial assets, currencies and financial systems

make gold an ideal basis for setting up backup financial arrangements.

30

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Gold Bullion Cheap Asymmetric Option without Counterparty Risks

No margin calls, no counterparty risks, no expiration. Bullion has never been worthless.

Derivatives track specific nominal prices; gold tracks confidence and purchasing power.

Annual costs are attractive versus negative real rates or shorting risks.

Gold has soared during deflation (1930s), inflation (1970s) and systemic instability (2000s).

Price is levered to systemic concerns when demand soars, supply dries up.

Bullion is heavily under-owned in the West; the East is aggressively accumulating.

Overwhelmingly bearish sentiment creates asymmetry at current levels.

Gold bullion has potential to deliver compelling upside without risk of a permanent loss of capital.

31

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Liquidity liquid purchasing power, i.e. negotiability without haircuts.

Financial Instruments:

Lesson of 2008 all financial markets are liquid until they are not.

Gold Bullion:

Universal liquidity under any market conditions.

Gold bullion is more liquid than stocks; liquidity is global and prices are available 22/5.

32

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

Gold Bullion is uniquely feasible as a liquid but tangible store of value.

1 Liter Bottle

1 Liter Bottle

Filled With:

Weight

Lbs.

Current Value

$ US

Volume/Value

Gold = 1

Gold

42.56

847,906.90

Silver

23.15

7,146.62

119X

Copper

19.76

59.58

14,230X

Zinc

15.74

14.38

58,964X

Sugar

3.51

1.03

820,423X

Gasoline

1.63

0.68

1,243,767X

Texas Crude

1.92

0.53

1,608,653X

Prices as of 3-13-2014

Note: Diamonds, art and real estate are not uniform and, therefore, cannot have transparent pricing required for universal liquidity.

33

Tocqueville

Bullion

!

Reserve!

TERA

management

TERA

management

real assets. real ownership.

Tocqueville Bullion Reserve

n n n

Global Solution for Non-Financial Banking and Transfers

Redundancy that Ensures Financial Continuity

34

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

TBR Highlights:

What it is:

A global vehicle for owning gold without exposure to financial intermediaries and securities markets.

What it does:

Offers liquid, fully-reserved, non-financial accounts de-correlated from financial system;

Enables exchange of value between clients without reliance on conventional payment systems;

Ensures security, compliance, transparency, daily liquidity and universal deliverability of the bullion;

Provides a choice of non-financial vaults in Hong Kong, Singapore, Switzerland and the U.S.

Who is behind it:

TBR co-founders: John Hathaway, Robert Kleinschmidt, Simon Mikhailovich.

5 of the 10 largest gold mining companies are TBRs lead clients:

Agnico Eagle, Goldcorp, Gold Fields, Royal Gold, Yamana.

TBR uses a non-financial instrument to offer liquid fully-reserved accounts and

value transfer capabilities that do not rely on banks or securities markets.

35

Tocqueville

Bullion

!

TERA

management

Reserve!

real assets. real ownership.

TBR vs ETF = Simplicity vs Complexity

The ETF Model

The TBR Model

Exchange-traded indirect claims against an

allocated gold bank account.

Directly redeemable warehouse receipts fully

backed by gold held in insured non-bank vaults.

Investors

Investors

Broker Dealer

TBR

Stock Exchange

Commercial Vaults

Authorized Participants

ETF Trust

Bank

36

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

TBR Balance Sheet Liquidity, Transparency, Simplicity

Assets

Liabilities

Operating Expenses (Administration, Storage, Audits)

Management Fees

Partners Capital

37

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Clients leverage TBRs global B2B relationships and wholesale pricing.

38

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

TBR Has Assembled a Global Team of Premier Service Providers

Cash Custody

Secure Gold Custody

Administration,

Accounting, Reporting

Legal

Financial Audit

Full Value Insurance

Inventory Audit

39

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

Parting Thoughts

40

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

The West may prove right or the East may prove right.

Those without gold reserves cannot afford for the East to be right.

Gold offers the cheapest option on either outcome:

Heads - you win, tails - you dont lose.

41

Tocqueville

Bullion

!

Reserve!

TERA

management

real assets. real ownership.

TERA Management LLC!

41 West 57th Street, 7th Floor

New York, NY 10019

Contact:

Simon A. Mikhailovich

sm@bullionreserve.com

Telephone: (212) 792-2172

This presentation was prepared by TERA Management LLC and is for information purposes only. Neither the information nor any opinion contained in this presentation or

any appendices constitutes a solicitation or offer by TERA Management LLC or any affiliates to buy or sell any securities or other financial instruments or provide any

investment advice or service. An offer or solicitation to buy or sell securities will only be made to eligible investors by means of an offering memorandum and related

subscription materials. The information contained herein is qualified in its entirety, please refer to the offering materials for specific and complete terms and conditions.

TERA Management LLC does not undertake to advise of changes in its opinions or information contained in this presentation. Any data included in this presentation is

obtained from sources believed to be reliable but cannot be, and is not guaranteed by TERA Management LLC. Any opinions or projections expressed herein are those

of the TERA Management LLC and cannot and should not be relied upon as representations of fact or investment advice. Past returns cannot be relied upon as a

predictor of future performance.

No material from this presentation may be used, reproduced or otherwise disseminated in any form to any person or entity without the explicit prior written consent of

TERA Management LLC.

42

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Soal Pengantar AkuntansiDocument10 pagesSoal Pengantar Akuntansiakid windrayaNo ratings yet

- The Lessons of Oil - Unlocked Howard MarksDocument7 pagesThe Lessons of Oil - Unlocked Howard MarksValueWalkNo ratings yet

- Kasus Sesi 2Document3 pagesKasus Sesi 2Kevin Ismael Manaf PutraNo ratings yet

- L2 - Structure Conduct Performance ParadigmDocument66 pagesL2 - Structure Conduct Performance Paradigmgamerneville90% (30)

- Marcato Capital 4Q14 Letter To InvestorsDocument38 pagesMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- Order GRANTING Defendants' Motion To Dismiss (Docket No. 60)Document14 pagesOrder GRANTING Defendants' Motion To Dismiss (Docket No. 60)theskeptic21No ratings yet

- Corsair Capital Management 4Q 2014 LetterDocument7 pagesCorsair Capital Management 4Q 2014 LetterValueWalk100% (1)

- IPR2015-00720 (Petition)Document70 pagesIPR2015-00720 (Petition)Markman AdvisorsNo ratings yet

- Evaluation December 2014Document35 pagesEvaluation December 2014ValueWalkNo ratings yet

- Champouse CRMZCaseDocument22 pagesChampouse CRMZCaseValueWalkNo ratings yet

- Warren Buffet's 1982 Letter To John Dingell Warning About DerivativesDocument4 pagesWarren Buffet's 1982 Letter To John Dingell Warning About DerivativesForbes100% (3)

- TPRE Investor Presentation Nov 2014 FINAL v2 v001 M5ih35Document29 pagesTPRE Investor Presentation Nov 2014 FINAL v2 v001 M5ih35ValueWalkNo ratings yet

- Ackman SuitDocument34 pagesAckman SuitValueWalkNo ratings yet

- Why I'm Long SodaStream-Whitney Tilson-10!21!14Document32 pagesWhy I'm Long SodaStream-Whitney Tilson-10!21!14CanadianValueNo ratings yet

- 2014 11 November Monthly Report TPOIDocument1 page2014 11 November Monthly Report TPOIValueWalkNo ratings yet

- Jeff Gundlach - This Time It's DifferentDocument73 pagesJeff Gundlach - This Time It's DifferentCanadianValueNo ratings yet

- A Google Skeptic Eats Crow-Whitney Tilson-11!21!14Document16 pagesA Google Skeptic Eats Crow-Whitney Tilson-11!21!14ValueWalkNo ratings yet

- 12.02.14 TheStreet LetterDocument3 pages12.02.14 TheStreet LetterZerohedgeNo ratings yet

- Profiles in Investing - Leon Cooperman (Bottom Line 2004)Document1 pageProfiles in Investing - Leon Cooperman (Bottom Line 2004)tatsrus1No ratings yet

- Performance Report November 2014Document1 pagePerformance Report November 2014ValueWalkNo ratings yet

- MW Superb Summit 11202014Document18 pagesMW Superb Summit 11202014ValueWalkNo ratings yet

- Ackman Pershing Square Holdings Ltd. Q3 Investor Letter Nov 25Document14 pagesAckman Pershing Square Holdings Ltd. Q3 Investor Letter Nov 25ValueWalk100% (1)

- 2014 q3 International Value Webcast Final7789C3B7080ADocument14 pages2014 q3 International Value Webcast Final7789C3B7080AValueWalkNo ratings yet

- Denali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicDocument36 pagesDenali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicValueWalk83% (6)

- The Malone Complex Presentation - 2014.11.19 VPublicDocument43 pagesThe Malone Complex Presentation - 2014.11.19 VPublicValueWalk100% (7)

- Grey Owl Letter Q 32014Document9 pagesGrey Owl Letter Q 32014ValueWalkNo ratings yet

- 2014 FPA q3 Crescent Webcast FinalDocument28 pages2014 FPA q3 Crescent Webcast FinalValueWalkNo ratings yet

- Bruce Greenwald Fall 2015Document24 pagesBruce Greenwald Fall 2015ValueWalk100% (1)

- Fpa International Value TranscriptDocument52 pagesFpa International Value TranscriptCanadianValueNo ratings yet

- Denali Investors - Columbia Business School Presentation 2008 Fall v3Document28 pagesDenali Investors - Columbia Business School Presentation 2008 Fall v3ValueWalkNo ratings yet

- 2014 q3 Fpa Crescent TranscriptDocument49 pages2014 q3 Fpa Crescent TranscriptCanadianValueNo ratings yet

- Ame Research Thesis 11-13-2014Document890 pagesAme Research Thesis 11-13-2014ValueWalkNo ratings yet

- Chapter 5 - Modern Portfolio ConceptsDocument41 pagesChapter 5 - Modern Portfolio ConceptsShahriar HaqueNo ratings yet

- Cash Budget PDFDocument4 pagesCash Budget PDFRiteshHPatelNo ratings yet

- Switching Cost ScaleDocument15 pagesSwitching Cost Scalenaveed100% (1)

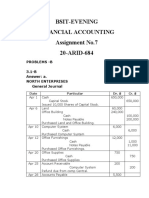

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- E CommerceDocument10 pagesE CommerceDev TiwariNo ratings yet

- Audit Observation TemplateDocument10 pagesAudit Observation TemplateJoseph SalidoNo ratings yet

- Ebo VS MboDocument4 pagesEbo VS MbotdarukaNo ratings yet

- Pertemuan 10Document7 pagesPertemuan 10jennifer christieNo ratings yet

- Capital Market Capital Markets Are: Financial Markets Debt Equity SecuritiesDocument10 pagesCapital Market Capital Markets Are: Financial Markets Debt Equity SecuritiesAnand ChavanNo ratings yet

- CHAPTER 2 Types of Strategies FormatDocument22 pagesCHAPTER 2 Types of Strategies FormatShermaine VenturaNo ratings yet

- Measurement of Cost BehaviourDocument43 pagesMeasurement of Cost BehaviourArie Widyastuti100% (4)

- Mkt500 Student GuideDocument5 pagesMkt500 Student GuideMoshNo ratings yet

- Retail Unit2Document40 pagesRetail Unit2Harnam RainuNo ratings yet

- B2B - FRESHWORKS - Group4Document24 pagesB2B - FRESHWORKS - Group4Aditya JaiswalNo ratings yet

- Production Analysis: UNIT-3Document21 pagesProduction Analysis: UNIT-3Rishab Jain 2027203No ratings yet

- Farm2Table Idea SketchPadDocument1 pageFarm2Table Idea SketchPadahmed.sakran92No ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument12 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceShane TorrieNo ratings yet

- Adjusting THE AccountsDocument51 pagesAdjusting THE AccountsShai Anne Cortez100% (1)

- Customer Relationship ManagementDocument13 pagesCustomer Relationship ManagementAkhil AwasthiNo ratings yet

- V Mart MallDocument93 pagesV Mart MallPranjal GuptaNo ratings yet

- Hyper Profit Maximization SOPDocument3 pagesHyper Profit Maximization SOPJanis MarabouNo ratings yet

- Exercises Yield To MaturityDocument2 pagesExercises Yield To MaturityJohnNo ratings yet

- Application Letter Cover Letter - Ilmi Amalia Saleh - XII MIPA 3Document12 pagesApplication Letter Cover Letter - Ilmi Amalia Saleh - XII MIPA 3Ilmi AmaliaNo ratings yet

- ct12010 2013Document144 pagesct12010 2013nigerianhacksNo ratings yet

- Tata Motors DVRDocument3 pagesTata Motors DVRJatin SharmaNo ratings yet

- Business and Management: Second-Round Sample TasksDocument4 pagesBusiness and Management: Second-Round Sample TasksFaisal HakimkNo ratings yet

- Chapter4 Feasibility of Idea ContinueDocument27 pagesChapter4 Feasibility of Idea ContinueCao ChanNo ratings yet