Professional Documents

Culture Documents

Suggestion To PM of India 23-Banking-Sector

Uploaded by

Kishor kumar BhatiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggestion To PM of India 23-Banking-Sector

Uploaded by

Kishor kumar BhatiaCopyright:

Available Formats

Suggestion to PM of India

Regularising terms and condition in banking sector

Banking sector should have service oriented mind set. When they are playing as

business point and implementing unwanted charges to increase profit then penalty

clause should be there

Frame work required in banking terms regulatory compliance

Net Banking

Mobile SMS Charges

KYC norms as per RBI.

Mobile number linking from bank a/c.

Email linking from bank a/c.

SLA Service level agreement for each process Time bonded activity

No additional Charges for SMS , ATM,

Penalty clause for bank also if they are deducting any unwanted charges and not reacting on time.

Suggestion:

Looking for action on SBI or other bank Policies amendment that

1. Public can be submit request at any branch in India.

2. Approval should be on mail or mobile one time password authentication . this is security requirement

and bank should not be charge any thing extra as a social responsibility as a government bank . if they

also behaving like other private bank (profit center / Business) then for bank also penalty clause should

be mention .

3 For adding third party name we should not be able visit again and again home branch for approval it

should be approved on registered mail on a/c . this is loop pole at SBI process.

4 I know I required ATM debit card but process is too tough in a fist visit I have to apply then need to

visit branch for password , do you really thing policies in the name of security is user friendly and as per

market trend this should be online generated or on mail. request should be online or on mail or

customer care.

5 check book request should be online or on mail or customer care.

6 SMS . I have requested to stopped this facility because SBI charging 15/- + service charge =17 /per quarter but this does not mean that bank will removed my mobile number this is against KYC and

Banking security Policy.

RTI Filed By Consumer

Suggestion to PM of India

Case- 1: I have asked for net banking, so they have given only view only what is it mean ..next time after six month

during my home town visit again i requested for third party transaction then they have given , today I want to add

benefice again i need to visit home SBI Branch that is not user friendly

Case-2: Mobile SMS Charges: I have requested to stopped this because mobile SMS Charges bank are charging 17 /per quarter but it does not means to removed Mobile number linking from bank a/c.

SBI -failing in online connectivity - and KYC nomes as per RBI.

Case-3: I have also requested 2 time in written application in bank to update my e- mail ID but still it is not updated

otherwise it is really helpful during the add benefice to check and full fill security related requirement.

I have my personal feeling SBI bank is fail in security related requirement feature . as concern as security related

feature it is banking requirement so no charges has to be deducted for e-mail alert or mobile SMS alert. this should be

as per RBI security requirement. SBI only difficult the process but really not working in public benefit. SBi also behaving

like other private banks for their own benefit only. but i feel banking should have some social responsibility they should

not establish charges for everything.

Case-4: Debit card was damage so I have requested to closed on 4th Feb2014 but still bank has charge 112/- on 10

Feb 2014 how this kind of mistakes done buy banking. there should be penalty clause on bank also.

You might also like

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- E-Mandate 01102021Document3 pagesE-Mandate 01102021Djxjfdu fjedjNo ratings yet

- SBCollect FAQsDocument3 pagesSBCollect FAQsShubham PatelNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- IBS - MBS - BHIM PNB FAQs - Revised (1) - CompressedDocument14 pagesIBS - MBS - BHIM PNB FAQs - Revised (1) - CompressedCrazy BoyNo ratings yet

- IBReg FormDocument3 pagesIBReg Formsampath_ask88No ratings yet

- Mobile Banking FaqDocument4 pagesMobile Banking FaqSenthil KumarNo ratings yet

- IBS - MBS - BHIM PNB FAQs - Revised-CompressedDocument13 pagesIBS - MBS - BHIM PNB FAQs - Revised-Compressedemraan KhanNo ratings yet

- Internet Banking FormLIMTDDocument3 pagesInternet Banking FormLIMTDVivek SharmaNo ratings yet

- Bank Terms and ConditionDocument5 pagesBank Terms and ConditionLibin VargheseNo ratings yet

- IBReg FormDocument3 pagesIBReg FormSekhar BishnuNo ratings yet

- 4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiDocument2 pages4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiAafiya AafiyaNo ratings yet

- Comm Training MatDocument8 pagesComm Training MatVadivel NattarayanNo ratings yet

- My Account Number (S) Single/ Joint Accounts (Branch Use) Transaction Rights (Y/N) (Branch Use) Limited Transaction Rights (Y/N)Document3 pagesMy Account Number (S) Single/ Joint Accounts (Branch Use) Transaction Rights (Y/N) (Branch Use) Limited Transaction Rights (Y/N)anaga1982No ratings yet

- IBReg FormDocument3 pagesIBReg FormMadan MaharanaNo ratings yet

- Emandate at Merchant TNCDocument4 pagesEmandate at Merchant TNCgoldstein500No ratings yet

- CP AssociatiDocument55 pagesCP AssociatiHansNo ratings yet

- Recurring Transaction or SI On Debit Card FAQDocument10 pagesRecurring Transaction or SI On Debit Card FAQCA Mithilesh Kr YadavNo ratings yet

- Online Sbi Registration Form To The Branch Manager State Bank of India Khambhalia, MainDocument3 pagesOnline Sbi Registration Form To The Branch Manager State Bank of India Khambhalia, MainvivekmajithiyaNo ratings yet

- Online Sbi Registration Form To The Branch Manager State Bank of India .Document3 pagesOnline Sbi Registration Form To The Branch Manager State Bank of India .Gautam GuptaNo ratings yet

- Faqs Rbi Guideline On e MandateDocument2 pagesFaqs Rbi Guideline On e Mandateziya 7575100% (1)

- ECS Direct Debit Mandate FormDocument3 pagesECS Direct Debit Mandate FormManish KumarNo ratings yet

- Gistration Form To The Branch Manager State Bank of Hyderabad .Document3 pagesGistration Form To The Branch Manager State Bank of Hyderabad .Akram AhmedNo ratings yet

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- What Is Banking OmbudsmanDocument7 pagesWhat Is Banking OmbudsmanThanga pandiyanNo ratings yet

- Sbi Reality Home LoanDocument3 pagesSbi Reality Home LoanSatpal SinghNo ratings yet

- FAQ Mobile BankingDocument5 pagesFAQ Mobile BankingAshif RejaNo ratings yet

- Citizens Charter Cbi19Document20 pagesCitizens Charter Cbi19Movies BlogNo ratings yet

- RegistrationForm Southeast BankDocument2 pagesRegistrationForm Southeast BankAbdullah Al Jahid100% (1)

- 0 - 12992153 (1) Ex Servicemen Jawahar NagarDocument7 pages0 - 12992153 (1) Ex Servicemen Jawahar NagarRajender BandiNo ratings yet

- Chap 2Document9 pagesChap 2SHOAIB AKHTARNo ratings yet

- Casa StrategyDocument2 pagesCasa StrategyS.s.SubramanianNo ratings yet

- Activities Perform During Internship: Special Category of AccountDocument3 pagesActivities Perform During Internship: Special Category of AccountChoudheryShahzadNo ratings yet

- Features of Allbank Advantage Salary PremiumDocument1 pageFeatures of Allbank Advantage Salary PremiumsambitNo ratings yet

- The Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountDocument6 pagesThe Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountEr Mosin ShaikhNo ratings yet

- MBanking FAQs-EnglishDocument21 pagesMBanking FAQs-EnglishMugenyiNo ratings yet

- Arvind 190101010048 State Bank of India. What Is Online SBI ?Document2 pagesArvind 190101010048 State Bank of India. What Is Online SBI ?arvind singhalNo ratings yet

- General Banking Faqs: S. No. Faqs AnswersDocument16 pagesGeneral Banking Faqs: S. No. Faqs AnswersSupriya DuttaNo ratings yet

- E-Circular: Mobile Banking Service (MBS) Fraud ReportedDocument3 pagesE-Circular: Mobile Banking Service (MBS) Fraud Reportedmevrick_guyNo ratings yet

- Ecs New Form LicDocument4 pagesEcs New Form LicAtul Thakur0% (1)

- Faq RetailDocument3 pagesFaq Retailshiv2108No ratings yet

- Retail Internet BankingDocument87 pagesRetail Internet Bankingmevrick_guyNo ratings yet

- Loan FAQDocument5 pagesLoan FAQNitin BNo ratings yet

- Sbi New Ecs FormDocument1 pageSbi New Ecs FormzampakNo ratings yet

- Consumer Report Reliance Communications Limited: Consumer Satisfaction Level (CSL)Document14 pagesConsumer Report Reliance Communications Limited: Consumer Satisfaction Level (CSL)Shivang SethiyaNo ratings yet

- Sbi Internet Banking FormDocument3 pagesSbi Internet Banking Formrajandtu93No ratings yet

- DOP - Training On Internet BankingDocument26 pagesDOP - Training On Internet Bankingvital polityNo ratings yet

- Mobilebanking Application 01Document2 pagesMobilebanking Application 01sibiNo ratings yet

- How To Apply For New SBI Debit CardDocument1 pageHow To Apply For New SBI Debit CardsanketNo ratings yet

- FAQ On ATMsDocument3 pagesFAQ On ATMsWaseem Basha MdNo ratings yet

- AllDocument21 pagesAllmanojkumar235100% (1)

- Oao OnlineAccOpenAccountInfoSectionDocument3 pagesOao OnlineAccOpenAccountInfoSectionYogesh2013No ratings yet

- Bank of BarodaDocument12 pagesBank of BarodaShweta VaghelaNo ratings yet

- Levy of Penal Charges On Non-Maintenance of Minimum Balances in Savings BankDocument3 pagesLevy of Penal Charges On Non-Maintenance of Minimum Balances in Savings BankShety bhaiNo ratings yet

- 7.5 Procedures of Opening The Letter of Credit (LC)Document16 pages7.5 Procedures of Opening The Letter of Credit (LC)ঘুম বাবুNo ratings yet

- Frequently Asked QuestionsDocument7 pagesFrequently Asked Questionsmevrick_guyNo ratings yet

- Indian Banking Industry-Customer Satisfaction & PreferencesDocument12 pagesIndian Banking Industry-Customer Satisfaction & PreferencesakankaroraNo ratings yet

- Class 6 Level 1 Imo 2020 Set ADocument7 pagesClass 6 Level 1 Imo 2020 Set AKishor kumar BhatiaNo ratings yet

- Class 6 Level 1 Imo 2021 Set BDocument8 pagesClass 6 Level 1 Imo 2021 Set BKishor kumar BhatiaNo ratings yet

- Class 6 Level 1 Imo 2022 Set BDocument8 pagesClass 6 Level 1 Imo 2022 Set BKishor kumar BhatiaNo ratings yet

- Asset 2022-23 Class 5 MathsDocument19 pagesAsset 2022-23 Class 5 MathsKishor kumar Bhatia100% (1)

- Class 6 Level 1 Imo 2022 Set BDocument8 pagesClass 6 Level 1 Imo 2022 Set BKishor kumar BhatiaNo ratings yet

- Class 6 Level 1 Imo 2018 Set ADocument7 pagesClass 6 Level 1 Imo 2018 Set AKishor kumar BhatiaNo ratings yet

- IMO Class 6 - 2023-24 Set ADocument8 pagesIMO Class 6 - 2023-24 Set AKishor kumar Bhatia100% (1)

- Solution IMT-120 3Document8 pagesSolution IMT-120 3Kishor kumar BhatiaNo ratings yet

- Imo Class 5 2022-23 Set-B Level-1Document8 pagesImo Class 5 2022-23 Set-B Level-1Kishor kumar BhatiaNo ratings yet

- Suggestion To PM of India 32 Post OfficeDocument4 pagesSuggestion To PM of India 32 Post OfficeKishor kumar BhatiaNo ratings yet

- Suggestion To PM of India 27 Personal-Information-PrivacyDocument3 pagesSuggestion To PM of India 27 Personal-Information-PrivacyKishor kumar BhatiaNo ratings yet

- Class 2 Imo Paper 2014 Set ADocument8 pagesClass 2 Imo Paper 2014 Set AKishor kumar BhatiaNo ratings yet

- Chemistry Class 11th and 12th For School, Mains Level, IIT Advance & NEETDocument3 pagesChemistry Class 11th and 12th For School, Mains Level, IIT Advance & NEETKishor kumar BhatiaNo ratings yet

- DMRCDocument1 pageDMRCKishor kumar BhatiaNo ratings yet

- Pattern CastingDocument17 pagesPattern CastingKishor kumar Bhatia100% (1)

- Geometrical Dimensioning & Tolerancing - Review of Indian StandardsDocument43 pagesGeometrical Dimensioning & Tolerancing - Review of Indian StandardsKishor kumar Bhatia100% (3)

- Advance English Language - LearningDocument114 pagesAdvance English Language - LearningKishor kumar Bhatia100% (1)

- Suggestion To PM of India - Banking SectorDocument1 pageSuggestion To PM of India - Banking SectorKishor kumar BhatiaNo ratings yet

- Geometrical Tolerancing (GD&T)Document12 pagesGeometrical Tolerancing (GD&T)Kishor kumar BhatiaNo ratings yet

- Coplanarity & Symmetry - GD&TDocument9 pagesCoplanarity & Symmetry - GD&TKishor kumar BhatiaNo ratings yet

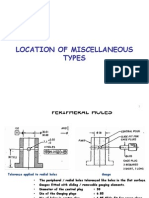

- Projected Tolerance Zone Concept-GD&TDocument24 pagesProjected Tolerance Zone Concept-GD&TKishor kumar Bhatia100% (6)

- Location of Miscellaneous Types - GD&TDocument9 pagesLocation of Miscellaneous Types - GD&TKishor kumar Bhatia100% (1)

- Tolerance Accumulation and Analysis (GD&T)Document80 pagesTolerance Accumulation and Analysis (GD&T)Kishor kumar Bhatia50% (4)

- AVERENGING Manok ForexDocument11 pagesAVERENGING Manok ForexSari UlisNo ratings yet

- Sitecore Developers CookbookDocument52 pagesSitecore Developers CookbookKiran Kumar PNo ratings yet

- PYNQ-Z2 Setup Guide - Python Productivity For Zynq (Pynq) v1.0Document3 pagesPYNQ-Z2 Setup Guide - Python Productivity For Zynq (Pynq) v1.0ahmed khazalNo ratings yet

- InterLink BrochureDocument8 pagesInterLink BrochurePetyo GeorgievNo ratings yet

- CCNP SWITCH Chapter 5 Lab 5-2 - DHCP (Version 7)Document20 pagesCCNP SWITCH Chapter 5 Lab 5-2 - DHCP (Version 7)abu aboNo ratings yet

- CF Lecture 10 - Email ForensicsDocument55 pagesCF Lecture 10 - Email ForensicsFaisal ShahzadNo ratings yet

- Industrial Cellular VPN Router NR300 User Manual: Guangzhou Navigateworx Technologies Co, LTDDocument71 pagesIndustrial Cellular VPN Router NR300 User Manual: Guangzhou Navigateworx Technologies Co, LTDMauricio SuarezNo ratings yet

- E Commerce Question Bank (NEW)Document7 pagesE Commerce Question Bank (NEW)Aamir100% (1)

- FundamentalsDocument102 pagesFundamentalsMunib MogalNo ratings yet

- Tourism Questionnaire Lake Como 2013Document2 pagesTourism Questionnaire Lake Como 2013PRANUNo ratings yet

- Nokia 7250 IXR e Series Interconnect Routers Data Sheet ENDocument8 pagesNokia 7250 IXR e Series Interconnect Routers Data Sheet ENdkmgapkgNo ratings yet

- Swami 3+ ResumeDocument4 pagesSwami 3+ ResumeMahesh KumarNo ratings yet

- Understanding Crowdsourcing Effects of Motivation and Rewards On Participation and Performance in Voluntary Online ActivitiesDocument226 pagesUnderstanding Crowdsourcing Effects of Motivation and Rewards On Participation and Performance in Voluntary Online Activities"150" - Rete socialeNo ratings yet

- The Internet - Form 2Document27 pagesThe Internet - Form 2Nirvana SuggieNo ratings yet

- Lesson Plan-2Document5 pagesLesson Plan-2api-464424894No ratings yet

- Users Manual For VRP Spreadsheet Solver v3Document18 pagesUsers Manual For VRP Spreadsheet Solver v3judeson mNo ratings yet

- STS GW2 5 630 PreDocument2 pagesSTS GW2 5 630 PreChristian MirandoNo ratings yet

- m330 31 Oms v100 A4 e ScreenDocument545 pagesm330 31 Oms v100 A4 e ScreenBoonsub ThongwichitNo ratings yet

- Automatically Trigger OnEnter Event After Selec..Document10 pagesAutomatically Trigger OnEnter Event After Selec..abhilashNo ratings yet

- Handlingpro: Intelligent 3D Simulation For HandlingDocument2 pagesHandlingpro: Intelligent 3D Simulation For HandlingkiNo ratings yet

- Javascript For BreakfastDocument227 pagesJavascript For Breakfastapi-3699342100% (1)

- Do Not Delete This Graphic Elements in Here:: 7750 Service Router Alcatel-Lucent Services Implementation CourseDocument51 pagesDo Not Delete This Graphic Elements in Here:: 7750 Service Router Alcatel-Lucent Services Implementation CourseCem Sina Kalkan100% (3)

- Winsteel ManualDocument102 pagesWinsteel ManualjoseNo ratings yet

- XML BasicsDocument13 pagesXML BasicsArjun DomleNo ratings yet

- VirusDocument20 pagesVirusamuljuneNo ratings yet

- R S CMW500 SpecDocument56 pagesR S CMW500 SpecSaral JainNo ratings yet

- Spip User Manual Public PDFDocument124 pagesSpip User Manual Public PDFJoel FNo ratings yet

- IVI 2032 Asd Essential 8 WP - A4Document13 pagesIVI 2032 Asd Essential 8 WP - A4Andrew HNo ratings yet

- D-Link DHP-W311AVDocument3 pagesD-Link DHP-W311AVCartimex S.A.No ratings yet

- 1.1 Overview: Figure 1.1 An Unknow N AP Is Connected To Company's NetworkDocument58 pages1.1 Overview: Figure 1.1 An Unknow N AP Is Connected To Company's NetworkKarthik PatkarNo ratings yet

- The Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellFrom EverandThe Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellRating: 5 out of 5 stars5/5 (6)

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityFrom EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityRating: 5 out of 5 stars5/5 (1)

- React.js Design Patterns: Learn how to build scalable React apps with ease (English Edition)From EverandReact.js Design Patterns: Learn how to build scalable React apps with ease (English Edition)No ratings yet

- The Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowFrom EverandThe Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowNo ratings yet

- Grokking Algorithms: An illustrated guide for programmers and other curious peopleFrom EverandGrokking Algorithms: An illustrated guide for programmers and other curious peopleRating: 4 out of 5 stars4/5 (16)

- How to Do Nothing: Resisting the Attention EconomyFrom EverandHow to Do Nothing: Resisting the Attention EconomyRating: 4 out of 5 stars4/5 (421)

- Ten Arguments for Deleting Your Social Media Accounts Right NowFrom EverandTen Arguments for Deleting Your Social Media Accounts Right NowRating: 4 out of 5 stars4/5 (388)

- Practical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTFrom EverandPractical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTNo ratings yet

- More Porn - Faster!: 50 Tips & Tools for Faster and More Efficient Porn BrowsingFrom EverandMore Porn - Faster!: 50 Tips & Tools for Faster and More Efficient Porn BrowsingRating: 3.5 out of 5 stars3.5/5 (24)

- HTML5 and CSS3 Masterclass: In-depth Web Design Training with Geolocation, the HTML5 Canvas, 2D and 3D CSS Transformations, Flexbox, CSS Grid, and More (English Edition)From EverandHTML5 and CSS3 Masterclass: In-depth Web Design Training with Geolocation, the HTML5 Canvas, 2D and 3D CSS Transformations, Flexbox, CSS Grid, and More (English Edition)No ratings yet

- Nine Algorithms That Changed the Future: The Ingenious Ideas That Drive Today's ComputersFrom EverandNine Algorithms That Changed the Future: The Ingenious Ideas That Drive Today's ComputersRating: 5 out of 5 stars5/5 (7)

- Branding: What You Need to Know About Building a Personal Brand and Growing Your Small Business Using Social Media Marketing and Offline Guerrilla TacticsFrom EverandBranding: What You Need to Know About Building a Personal Brand and Growing Your Small Business Using Social Media Marketing and Offline Guerrilla TacticsRating: 5 out of 5 stars5/5 (32)

- Tor Darknet Bundle (5 in 1): Master the Art of InvisibilityFrom EverandTor Darknet Bundle (5 in 1): Master the Art of InvisibilityRating: 4.5 out of 5 stars4.5/5 (5)

- Evaluation of Some Websites that Offer Virtual Phone Numbers for SMS Reception and Websites to Obtain Virtual Debit/Credit Cards for Online Accounts VerificationsFrom EverandEvaluation of Some Websites that Offer Virtual Phone Numbers for SMS Reception and Websites to Obtain Virtual Debit/Credit Cards for Online Accounts VerificationsRating: 5 out of 5 stars5/5 (1)

- Microservices Patterns: With examples in JavaFrom EverandMicroservices Patterns: With examples in JavaRating: 5 out of 5 stars5/5 (2)

- The Internet Con: How to Seize the Means of ComputationFrom EverandThe Internet Con: How to Seize the Means of ComputationRating: 5 out of 5 stars5/5 (6)

- Summary of Traffic Secrets: by Russell Brunson - The Underground Playbook for Filling Your Websites and Funnels with Your Dream Customers - A Comprehensive SummaryFrom EverandSummary of Traffic Secrets: by Russell Brunson - The Underground Playbook for Filling Your Websites and Funnels with Your Dream Customers - A Comprehensive SummaryNo ratings yet

- Curating Content Bundle, 2 in 1 Bundle: Content Machine and Manage ContentFrom EverandCurating Content Bundle, 2 in 1 Bundle: Content Machine and Manage ContentRating: 5 out of 5 stars5/5 (6)

- TikTok Algorithms 2024 $15,000/Month Guide To Escape Your Job And Build an Successful Social Media Marketing Business From Home Using Your Personal Account, Branding, SEO, InfluencerFrom EverandTikTok Algorithms 2024 $15,000/Month Guide To Escape Your Job And Build an Successful Social Media Marketing Business From Home Using Your Personal Account, Branding, SEO, InfluencerRating: 4 out of 5 stars4/5 (4)