Professional Documents

Culture Documents

Paper Writeup - Honest Tea

Uploaded by

kamalesh1234Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper Writeup - Honest Tea

Uploaded by

kamalesh1234Copyright:

Available Formats

Kamalesh Saha: MBAF 698 - Entrepreneurial Finance

Honest Tea

1. How is Honest Tea doing? Give me SPECIFICS.

Response: They are doing pretty well. Sales increased 349% between 1998 and 1999. However, sales

seem to be flat in 2000 (2 quarter results) which can be a result of the cold spell of 2000 December.

They invested a lot in R&D, SG&A, and Marketing activities in 1999 (explains their net loss) which is the

right strategy for a growing company since they want to take advantage of the growing market. The only

minor concern is their COGS is 60% and 58% of their sales in 1999 and 2000 respectively.

2. What does Honest Tea need to do to become a successful company?

Response: They should continue doing what they were doing successfully so far making a healthy

beverage, one that provides genuine natural taste without artificial sweeteners. They should look at the

organic bottled tea since it goes with the company objective. They should start looking different varieties

of tea on top of the 8 bottled varieties that already have. They should look at non-tea products as well,

lemonade for example. They should not go for venture capital firm initially and stick with individual

investors. They should avoid manufacturing the tea themselves and instead, should work on building

their brand.

3. How was the past financing structured between the founders and why?

Response: Honest Tea was launched with $300,000 start-up investment by Goldman and Nalebuff.

Though the founders had done a financial projection and were pretty confident of their success, they

were entering uncharted waters. The investors were not certain the company would take off since the

target market did not exist at that time. Thus the founders went ahead with warrants that will give them

greater fraction of the company if they did well. If they didnt do so well, the investors would own a larger

piece of the company. Since the funders were confident of their success, warrants made more sense.

4. Whom should Goldman and Nalebuff explore for financing in the current round?

Response: They should not go for the venture capital firm that offered them $5 million dollars with a

pre-money valuation of $5 to $7 million. The VC will get 40 to 50% of the company. They will be giving

up a major part of the company and also may have to compromise their principles as well. They need to

carefully explore taking funds from his customers. Even though the customers love the product and want

to invest, they may not have the financial knowledge of running a business and will need a significant

amount of handholding. The best option is to gather funds from angel investors who have some

knowledge in the industry. They will not only need less explanation, they can also help them in making

better business decisions.

5. Does the current proposed valuation by Goldman make sense and why? Why might it be

on the high side? (Use P/E and P/S ratios with the data given for other companies in the

industry.)

Response: The current proposed valuation of Goldman doesnt make sense. Its on the higher side.

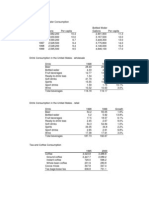

The comparable for the 4 companies are as follow:

P/S

P/E

Avg P/S

Avg P/E

TRIARC COS INC

-0.195

-16.475

SARATOGA BEVERAGE

0.236

6.890

0.2275

6.895

NATIONAL BEVERAGE CORP

0.219

6.899

CLEARLY CANADIAN BEVERAGE INC

0.646

-2.382

Clearly Triarc and Clearly Canadian Beverage are not doing so well. Leaving them aside, Saratoga and

National beverage corp have almost identical P/E and P/S ratio. The average P/S and P/E ratio is

mentioned in the table above. In 2001, their projected earning is negative. In 2002, their projected

earning is $1,105,100. Thus the value of the company in 2001 is negative, while in 2002 it is around

$7.5 million ($7,619,664 = 6.895*1,105,100). Based on P/S ratio, their 2001 valuation ~= $1.9 million

and 2002 valuation ~= $3.6 million. This is much less than their post-money valuation of $15 million.

The venture capital firm offered to invest $5 million dollars with a pre-money valuation of $5 to $7

million. This gives them a post-money valuation of $10 to $12 million, which is also high looking at the

projected financials.

Kamalesh Saha: MBAF 698 - Entrepreneurial Finance

Takeaways:

- Value for H. T.: (1) New segment (concept), (2) Niche brand need for distribution. Valuation of $7.5

M based on average P/E ratio and earnings (Goldman said $15 M).

- VCs gave Pre-Money at $5 or $7 w/$5 M investment. Went with customers at 1.2 M/4 M valuation

You might also like

- Honest Tea Case StudyDocument5 pagesHonest Tea Case StudyBogdanBanica100% (1)

- Honest Tea - Help SpreadsheetDocument12 pagesHonest Tea - Help Spreadsheetvirgin51100% (1)

- Honest Tea Case StudyDocument28 pagesHonest Tea Case StudySusana GarciaNo ratings yet

- Honest Tea FinalDocument41 pagesHonest Tea FinalSafdar Ali50% (2)

- What Has Happened at Honest TeaDocument4 pagesWhat Has Happened at Honest TeaMuhammad Muneeb0% (1)

- Case AnalysisDocument17 pagesCase AnalysisAmmar KhanNo ratings yet

- Honest TeaDocument24 pagesHonest TearuwangaNo ratings yet

- Case StudyDocument2 pagesCase StudyYannisSfNo ratings yet

- Just Dial IpoDocument14 pagesJust Dial IpoSantosh SwamyNo ratings yet

- Course HeroDocument23 pagesCourse HeroMajed Abou AlkhirNo ratings yet

- Just DialDocument50 pagesJust Dialsili core100% (1)

- Entrepreneurial Finance - Cachet CaseDocument5 pagesEntrepreneurial Finance - Cachet CaseRoderick0% (1)

- Radio OneDocument23 pagesRadio Onepsu0168100% (1)

- Midland Energy Resources Inc SolutionDocument2 pagesMidland Energy Resources Inc SolutionAashna MehtaNo ratings yet

- Midland Energy A1Document30 pagesMidland Energy A1CarsonNo ratings yet

- Honest Tea Invstmt AnalysisDocument1 pageHonest Tea Invstmt AnalysisUyen HoangNo ratings yet

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Hertz IPO CaseDocument6 pagesHertz IPO CaseHamid S. Parwani100% (1)

- SIEMENSDocument7 pagesSIEMENSGian Carlos Avila100% (1)

- Midland FinalDocument8 pagesMidland Finalkasboo6No ratings yet

- Midland Case CalculationsDocument24 pagesMidland Case CalculationsSharry_xxx60% (5)

- Transworld Xls460 Xls EngDocument6 pagesTransworld Xls460 Xls EngAman Pawar0% (1)

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- Debt Policy at Ust Case SolutionDocument2 pagesDebt Policy at Ust Case Solutiontamur_ahan50% (2)

- Radio OneDocument1 pageRadio OneTommy Choi100% (1)

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Lady M Exercises-3Document6 pagesLady M Exercises-3MOHIT MARHATTANo ratings yet

- Midland CaseDocument8 pagesMidland CaseDevansh RaiNo ratings yet

- Body Shop International PLC 2001 Case Study SolutionDocument1 pageBody Shop International PLC 2001 Case Study SolutionMahi Reddy67% (3)

- Tire City CaseDocument14 pagesTire City CaseXRiloXNo ratings yet

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaresatherbd21100% (4)

- Identify The Industry - Case 5Document2 pagesIdentify The Industry - Case 5yuki_akitsu0% (1)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Alta Fox Capital 2019 Q1 LetterDocument7 pagesAlta Fox Capital 2019 Q1 LetterSmitty WNo ratings yet

- Ben & JerryDocument6 pagesBen & JerrySachin SuryavanshiNo ratings yet

- IM Assignment4Document5 pagesIM Assignment4Sanket AndhareNo ratings yet

- Task - Content Writing - 03 PDFDocument4 pagesTask - Content Writing - 03 PDFSaad ShakilNo ratings yet

- Panrico: 1. Identify The Strengths and Weaknesses of The Company. StrengthsDocument3 pagesPanrico: 1. Identify The Strengths and Weaknesses of The Company. StrengthsAndres GonzalezNo ratings yet

- Gad Partner 1Q-2012Document8 pagesGad Partner 1Q-2012Sww WisdomNo ratings yet

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Groupon Inc Case AnalysisDocument8 pagesGroupon Inc Case Analysispatrick wafulaNo ratings yet

- Problem StatementDocument3 pagesProblem StatementLeo Pratama GaniNo ratings yet

- BBMF2023 Tutorial Group 3 Power Root BerhadDocument35 pagesBBMF2023 Tutorial Group 3 Power Root BerhadKar EngNo ratings yet

- SLA No. 1: Subject Code/Number: ABM08 Subject Title: Business Finance Teachers: IDocument13 pagesSLA No. 1: Subject Code/Number: ABM08 Subject Title: Business Finance Teachers: IKENJ ABELLANo ratings yet

- Holly DazzleDocument3 pagesHolly DazzleIqra Jawed100% (1)

- Institute of Business ManagementDocument16 pagesInstitute of Business ManagementAbdullah ZubairNo ratings yet

- Final ProjectDocument10 pagesFinal ProjectAmna AhmedNo ratings yet

- 2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)Document5 pages2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)royaviNo ratings yet

- Financial ManagementDocument32 pagesFinancial ManagementMarkus Bernabe Davira100% (2)

- 2017 Customers: Analysis of The 50 Companies AllottedDocument4 pages2017 Customers: Analysis of The 50 Companies Allottedharsh shahNo ratings yet

- Sara Lee Corporation in 2011: Has Its Retrenchment Strategy Been Successful?Document4 pagesSara Lee Corporation in 2011: Has Its Retrenchment Strategy Been Successful?Kamani PereraNo ratings yet

- NVC Sample 1Document25 pagesNVC Sample 1Daniel CrumpNo ratings yet

- BenDocument5 pagesBenSaad JavedNo ratings yet

- 1 Main Capital Quarterly LetterDocument10 pages1 Main Capital Quarterly LetterYog MehtaNo ratings yet

- Big Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Document11 pagesBig Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Luis Fernando EscobarNo ratings yet

- AthletaDocument2 pagesAthletaJean-Michel PareNo ratings yet

- Procter & GambleDocument22 pagesProcter & GambleMahedi Hasan100% (3)

- CB ProjectDocument6 pagesCB ProjectKayzad MadanNo ratings yet

- The Philip Fisher Screen That Fishes Quality StocksDocument3 pagesThe Philip Fisher Screen That Fishes Quality StocksMartinNo ratings yet

- EXCERSE 1. What Are The Internal Incentives For Choosing An Unrelated Diversification Strategy (At Corporate-Level) ?Document3 pagesEXCERSE 1. What Are The Internal Incentives For Choosing An Unrelated Diversification Strategy (At Corporate-Level) ?Nhi TuyếtNo ratings yet

- Chapter 4 Cash Flow Financial PlanningDocument63 pagesChapter 4 Cash Flow Financial PlanningThenivaalaven VimalNo ratings yet

- Examples of Credit InstrumentsDocument35 pagesExamples of Credit Instrumentsjessica anne100% (1)

- Project Topics On FinanceDocument50 pagesProject Topics On Financepnarona83% (23)

- Asia International Auctioneers Vs CIR: Full TextDocument21 pagesAsia International Auctioneers Vs CIR: Full TextJeanne Pabellena DayawonNo ratings yet

- BA Final PrepDocument136 pagesBA Final PrepRonald AlexanderNo ratings yet

- Fixed - Income CfaDocument21 pagesFixed - Income CfaSophy ThweNo ratings yet

- Long Exam Part1 LETRANDocument1 pageLong Exam Part1 LETRANMark Darrell Aricheta MendozaNo ratings yet

- MAXIS-Cover To Page 192 (2.3MB)Document219 pagesMAXIS-Cover To Page 192 (2.3MB)Eddie LewNo ratings yet

- What Is Financial Management?Document4 pagesWhat Is Financial Management?Ellaine Pearl AlmillaNo ratings yet

- Naseer SwiftDocument67 pagesNaseer SwiftNaseeruddin MohdNo ratings yet

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalNo ratings yet

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- Financial ManagementDocument51 pagesFinancial Managementamish rajNo ratings yet

- Session 3 Financial Management - Kurnadi GularsoDocument43 pagesSession 3 Financial Management - Kurnadi GularsoDjong Surya AtmandraNo ratings yet

- BALIC Annual ReportDocument143 pagesBALIC Annual ReportGopal Krishan MithraniNo ratings yet

- Buy Side Representation AgreementDocument6 pagesBuy Side Representation AgreementArif ShaikhNo ratings yet

- Notice of Buyer'S Termination of Contract: TREC No.38-5Document1 pageNotice of Buyer'S Termination of Contract: TREC No.38-5Michell RivNo ratings yet

- Part 02 - Equasaun-KontabilidadeDocument3 pagesPart 02 - Equasaun-KontabilidadeMetodio Caetano MonizNo ratings yet

- Outline For Negotiable Instruments LawDocument7 pagesOutline For Negotiable Instruments LawferosiacNo ratings yet

- AnnualReport2016 17Document244 pagesAnnualReport2016 17RiteshRajputNo ratings yet

- Ttmygh 2016-12-11 Get It Got It Good SDocument63 pagesTtmygh 2016-12-11 Get It Got It Good SZerohedge91% (11)

- Week 1 IntroductionDocument28 pagesWeek 1 IntroductionAbhijit ChokshiNo ratings yet

- An Intro To Bussiness AccountingDocument57 pagesAn Intro To Bussiness AccountingNadia AnuarNo ratings yet

- Teresita Buenaflor ShoesDocument23 pagesTeresita Buenaflor ShoesRonnie Lloyd Javier78% (32)

- FMS Nia PPT 3Document11 pagesFMS Nia PPT 3kushalNo ratings yet

- Google Advanced Search Preference S: Search: The Web Pages From IndiaDocument4 pagesGoogle Advanced Search Preference S: Search: The Web Pages From IndiaamitrathiNo ratings yet

- Cash Flow AnalysisDocument38 pagesCash Flow AnalysisDragan100% (5)

- 2015 Fingertip DirectoryDocument44 pages2015 Fingertip DirectorycwmediaNo ratings yet

- HSBC Privacy AgreementDocument2 pagesHSBC Privacy Agreementajay0005No ratings yet