Professional Documents

Culture Documents

Canadian Value Fund: Performance Summary

Uploaded by

jai6480Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Canadian Value Fund: Performance Summary

Uploaded by

jai6480Copyright:

Available Formats

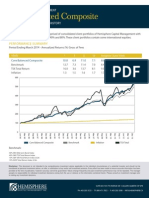

HEMISPHERE CAPITAL MANAGEMENT

Canadian Value Fund

PERFORMANCE SUMMARY AND HISTORY

The Canadian Value Fund invests primarily in high quality Canadian companies. Through a qualitative, valuebased investment approach, the Fund is managed to achieve above average long-term capital appreciation,

while protecting capital during periods of significant market weakness.

PERFORMANCE SUMMARY

Period Ending September 2014 - Annualized Returns (%) Net of Fees

YEARS

Canadian Value

10

Inception (May/2007)

14.0

8.5

9.5

5.9

Benchmark

20.4

12.1

8.7

3.9

Inflation

2.1

1.6

1.7

1.7

180

160

140

120

100

80

60

40

20

0

Sep 14

May 14

Jan 14

Sep 13

May 13

Jan 13

Sep 12

May 12

Benchmark

Jan 12

Sep 11

May 11

Jan 11

Sep 10

May 10

Jan 10

Sep 09

May 09

Jan 09

Sep 08

May 08

Jan 08

Sep 07

May 07

Canadian Value Fund

Inflation

Benchmark:

100% S&P/TSX Total Return Index

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

CANADIAN VALUE FUND

PERFORMANCE HISTORY

Year

2007

JAN

FEB

MAR

APR

Cdn Value

Benchmark

2008

2009

2010

2011

2012

2013

2014

MAY

JUN

JUL

-1.2%

-0.9%

-1.5%

AUG

-0.8%

SEP

0.9%

OCT

1.8%

NOV

-3.3%

DEC

0.0%

0.3%

-0.8%

-0.1%

-1.3%

3.5%

3.9%

-6.2%

1.3%

3.5%

0.3%

-3.0%

-0.6%

-6.9%

-9.9%

-2.9%

-1.9%

4.6%

5.8%

-1.4%

-5.9%

1.5%

-14.4%

-16.7%

-4.7%

-2.6%

2.3%

4.5%

4.8%

0.5%

2.6%

2.4%

0.2%

3.2%

1.2%

0.9%

5.1%

-4.0%

5.2%

2.9%

2.4%

2.1%

2.4%

2.5%

2.3%

1.9%

4.1%

2.7%

2.4%

4.1%

2.0%

-0.9%

-3.4%

5.0%

0.3%

0.3%

-3.3%

-2.5%

-1.2%

-8.7%

5.6%

-0.2%

-1.7%

-2.0%

-0.9%

1.4%

1.4%

1.1%

0.5%

-0.4%

0.8%

-0.6%

-6.1%

1.1%

0.8%

2.6%

3.4%

1.1%

-1.3%

1.9%

-0.8%

-1.4%

2.4%

-1.6%

2.4%

-0.6%

-0.1%

1.5%

1.1%

1.6%

1.3%

-0.2%

-2.1%

1.8%

-3.8%

0.4%

4.4%

1.4%

4.7%

0.5%

2.0%

0.6%

3.1%

1.4%

2.8%

1.2%

2.0%

0.7%

1.0%

-3.7%

0.8%

3.9%

1.2%

2.4%

-0.2%

4.1%

1.4%

2.1%

-4.0%

Cdn Value

-1.8%

1.3%

0.6%

Benchmark

Cdn Value

4.2%

-4.7%

3.4%

-1.4%

0.7%

-0.7%

3.4%

Benchmark

-3.0%

-6.3%

7.8%

7.3%

11.5%

0.3%

4.2%

Cdn Value

-1.2%

1.9%

5.0%

-0.3%

-1.4%

0.3%

1.1%

Benchmark

-5.3%

5.0%

3.8%

1.7%

-3.5%

-3.7%

4.0%

Cdn Value

2.5%

2.2%

-0.6%

-0.1%

0.8%

-2.5%

Benchmark

1.0%

4.4%

0.1%

-1.0%

-0.9%

Cdn Value

1.2%

2.1%

-0.4%

-2.1%

Benchmark

4.4%

1.7%

-1.6%

Cdn Value

2.3%

1.0%

Benchmark

2.3%

Cdn Value

Benchmark

*Investment returns for May 2007 correspond to the period May 11, 2007 to May 31, 2007.

Benchmark:

100% S&P/TSX Total Return Index

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

You might also like

- Canadian Value Fund 1QTR 2013Document2 pagesCanadian Value Fund 1QTR 2013Jason BenteauNo ratings yet

- Canadian Value Fund 2QTR 2013Document2 pagesCanadian Value Fund 2QTR 2013Jason BenteauNo ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund - 4QTR 2012-3Document2 pagesCanadian Value Fund - 4QTR 2012-3Jason BenteauNo ratings yet

- Canadian Value Fund 1QTR 2012Document2 pagesCanadian Value Fund 1QTR 2012Jason BenteauNo ratings yet

- Select Shares US Fund 1QTR 2013Document2 pagesSelect Shares US Fund 1QTR 2013Jason BenteauNo ratings yet

- Select Shares US Fund - 4QTR 2012-4Document2 pagesSelect Shares US Fund - 4QTR 2012-4Jason BenteauNo ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Value Partners Classic Fund Q1 2015 CommentaryDocument8 pagesValue Partners Classic Fund Q1 2015 CommentaryCharlie TianNo ratings yet

- Top 50 Mutual FundsDocument2 pagesTop 50 Mutual Fundsgovandlaw4671No ratings yet

- Banking Secrets: Measuring Risk and Driving the Business CycleDocument59 pagesBanking Secrets: Measuring Risk and Driving the Business CycleTREND_7425100% (1)

- ECFP December 2014Document1 pageECFP December 2014dpbasicNo ratings yet

- q2 2014 Client Newsletter FinalDocument4 pagesq2 2014 Client Newsletter Finalapi-265511218No ratings yet

- Value Partners Q4 2014 CommentaryDocument26 pagesValue Partners Q4 2014 CommentaryCanadianValueNo ratings yet

- August 2011Document7 pagesAugust 2011stephen_wood_36No ratings yet

- VA Investing: The Safe Strategy for Higher ReturnsDocument27 pagesVA Investing: The Safe Strategy for Higher Returnsfbxurumela100% (1)

- Conservative Composite - 4QTR 2012-5Document2 pagesConservative Composite - 4QTR 2012-5Jason BenteauNo ratings yet

- PLTVF Factsheet February 2014Document4 pagesPLTVF Factsheet February 2014randeepsNo ratings yet

- Pfif PDFDocument1 pagePfif PDFcrystal01heartNo ratings yet

- EDGE Product Note - September 2013Document6 pagesEDGE Product Note - September 2013rajeshmanjunathNo ratings yet

- Dalma Unifed Return Fund Annual ReportDocument3 pagesDalma Unifed Return Fund Annual ReportDalma Capital ManagementNo ratings yet

- A Consistent Outperformer: MutualDocument1 pageA Consistent Outperformer: MutualFrank HayesNo ratings yet

- Equity / Growth Fund Debt/ Income FundDocument6 pagesEquity / Growth Fund Debt/ Income FundChiunnu JanuNo ratings yet

- 2015 Annual Report ANZDocument200 pages2015 Annual Report ANZgfdsa121No ratings yet

- IG Beutel Goodman Canadian Small Cap FundDocument1 pageIG Beutel Goodman Canadian Small Cap FundMasakik86No ratings yet

- 20YR Track Record Balanced FundDocument4 pages20YR Track Record Balanced FundJ.K. GarnayakNo ratings yet

- Fidelity Investment Managers: All-Terrain Investing: November 2010Document26 pagesFidelity Investment Managers: All-Terrain Investing: November 2010art10135No ratings yet

- ALFM Money Market Fund Key Facts and PerformanceDocument3 pagesALFM Money Market Fund Key Facts and Performanceippon_osotoNo ratings yet

- FT Global Total ReturnDocument2 pagesFT Global Total ReturnxninesNo ratings yet

- Fairholme Fund Annual Report 2014Document36 pagesFairholme Fund Annual Report 2014CanadianValueNo ratings yet

- European Monthly SummaryDocument2 pagesEuropean Monthly SummaryEma EmNo ratings yet

- Fact Sheet MT PR UscDocument2 pagesFact Sheet MT PR Uscdonut258No ratings yet

- Element Global Value - 3Q13Document4 pagesElement Global Value - 3Q13FilipeNo ratings yet

- Pitchbook StrategyDocument25 pagesPitchbook Strategydfk1111No ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetMayukh RoyNo ratings yet

- Portfolio Management ReportDocument35 pagesPortfolio Management Reportfarah_hhrrNo ratings yet

- U Ethical Australian Equities Trust - Wholesale March 2023 - Quarterly Performance ReviewDocument3 pagesU Ethical Australian Equities Trust - Wholesale March 2023 - Quarterly Performance ReviewPaul GraceNo ratings yet

- Bank Windhoek Investment Fund Fact Sheet Nov 2014Document1 pageBank Windhoek Investment Fund Fact Sheet Nov 2014poiqweNo ratings yet

- JF Asia New Frontiers: Fund ObjectiveDocument1 pageJF Asia New Frontiers: Fund ObjectiveMd Saiful Islam KhanNo ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Sgreits 020911Document18 pagesSgreits 020911Royston Tan Keng SanNo ratings yet

- Ackman Letter Dec 2015Document17 pagesAckman Letter Dec 2015Zerohedge100% (2)

- Generate Income from DividendsDocument5 pagesGenerate Income from DividendsSwamiNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JuneDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Juneapi-237717884No ratings yet

- January 2012Document8 pagesJanuary 2012stephen_wood_36No ratings yet

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet FebruaryDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Februaryapi-237717884No ratings yet

- Bond Market Perspectives 03242015Document4 pagesBond Market Perspectives 03242015dpbasicNo ratings yet

- File 1Document10 pagesFile 1Alberto VillalpandoNo ratings yet

- CIMB-Principal Australian Equity Fund (Ex)Document2 pagesCIMB-Principal Australian Equity Fund (Ex)Pei ChinNo ratings yet

- Aaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet JanuaryDocument1 pageAaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet Januaryapi-237717884No ratings yet

- FPA Crescent Fund 2019 Year-End Commentary ReviewDocument22 pagesFPA Crescent Fund 2019 Year-End Commentary ReviewKan ZhouNo ratings yet

- IVA Funds Newsletter Letter From The Portfolio Managers May 2015Document3 pagesIVA Funds Newsletter Letter From The Portfolio Managers May 2015CanadianValueNo ratings yet

- Why Invest in Mutual Fund AMFIDocument30 pagesWhy Invest in Mutual Fund AMFIsrammohanNo ratings yet

- 2013 WBC Annual ReportDocument316 pages2013 WBC Annual ReportMaiNguyenNo ratings yet

- Q4 2010 GlenviewDocument22 pagesQ4 2010 GlenviewaviNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Beating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)From EverandBeating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Core Balanced Composite - 2QTR 2014Document2 pagesCore Balanced Composite - 2QTR 2014jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Canadian Value Fund - 3QTR 2013Document2 pagesCanadian Value Fund - 3QTR 2013jai6480No ratings yet

- Nemalux BrochureDocument15 pagesNemalux Brochurejai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Canadian Value Fund 2QTR 2012Document2 pagesCanadian Value Fund 2QTR 2012jai6480No ratings yet

- Marketing Plan ProposalDocument2 pagesMarketing Plan ProposalRachel Phoon QianweiNo ratings yet

- Gender, Civil Society and Cross-Border DialogueDocument22 pagesGender, Civil Society and Cross-Border DialogueAlex Sandu100% (1)

- La Causa: Civil Rights, Social Justice and The Struggle For Equality in The MidwestDocument223 pagesLa Causa: Civil Rights, Social Justice and The Struggle For Equality in The MidwestArte Público PressNo ratings yet

- Diversity in HollywoodDocument8 pagesDiversity in Hollywoodapi-352024638No ratings yet

- Inclusive SocietyDocument1 pageInclusive SocietyJohnNo ratings yet

- No To SOGIE BillDocument1 pageNo To SOGIE BillAiyesh SachiNo ratings yet

- Nalsa Summary DanishDocument3 pagesNalsa Summary DanishPulkit AggarwalNo ratings yet

- Document Analysis 4Document4 pagesDocument Analysis 4api-322143619No ratings yet

- Dialectical Journal - A Leson Before Dying by GainesDocument9 pagesDialectical Journal - A Leson Before Dying by Gainescrodriguez96100% (1)

- HR Planning Critical for Organizational SuccessDocument11 pagesHR Planning Critical for Organizational SuccessMarissa AdraincemNo ratings yet

- Consumerism and Marketing EthicsDocument51 pagesConsumerism and Marketing EthicsNB Thushara HarithasNo ratings yet

- Essay Six Prompt 1Document4 pagesEssay Six Prompt 1Sarah T.No ratings yet

- Social Workers and The MediaDocument16 pagesSocial Workers and The MediabrandbrainNo ratings yet

- Storming The Discursive FortDocument73 pagesStorming The Discursive FortPam WilsonNo ratings yet

- Characteristics of Middle School StudentsDocument4 pagesCharacteristics of Middle School StudentsShivana AllenNo ratings yet

- A Detailed Lesson Plan in English 9Document4 pagesA Detailed Lesson Plan in English 9kirsty jane rodriguez100% (1)

- Inclusive Education ReportDocument12 pagesInclusive Education ReportRose BrewNo ratings yet

- II Semester NotesDocument11 pagesII Semester Noteskingsley_psbNo ratings yet

- Op EdDocument7 pagesOp EdAlix PowerzNo ratings yet

- Complaint Filed Against ManleyDocument5 pagesComplaint Filed Against ManleyAnonymous Pb39klJNo ratings yet

- 548 Mandla Sewa Singh and Another Appellants V Dowell Lee and Others RespondentsDocument23 pages548 Mandla Sewa Singh and Another Appellants V Dowell Lee and Others RespondentsHadi AlnaherNo ratings yet

- Apartments? Not in My Backyard. Stouffville & Affordable Housing. Presentation To Public HearingDocument14 pagesApartments? Not in My Backyard. Stouffville & Affordable Housing. Presentation To Public HearingArnold Neufeldt-FastNo ratings yet

- Bswe 002Document5 pagesBswe 002Melwin DsouzaNo ratings yet

- BOOK SingaporeDocument439 pagesBOOK SingaporeCua TraiNo ratings yet

- Madonna-Plantation Mistress or Soul SisterDocument4 pagesMadonna-Plantation Mistress or Soul Sisterlarinawong02No ratings yet

- Beyond The BinaryDocument52 pagesBeyond The BinarytransgenderlawcenterNo ratings yet

- Establishes VAW Desk and OfficersDocument3 pagesEstablishes VAW Desk and OfficersHana Navalta Soberano100% (1)

- Florida State University LibrariesDocument247 pagesFlorida State University LibrariesOpolot John AlfredNo ratings yet

- GM Handbook for Community Play DayDocument9 pagesGM Handbook for Community Play DayMusic AvenueNo ratings yet

- Corporate Social Responsibility - A Necessity Not A ChoiceDocument20 pagesCorporate Social Responsibility - A Necessity Not A ChoiceDinos Marcou100% (1)