Professional Documents

Culture Documents

Core Balanced Composite: Performance Summary

Uploaded by

jai6480Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Core Balanced Composite: Performance Summary

Uploaded by

jai6480Copyright:

Available Formats

HEMISPHERE CAPITAL MANAGEMENT

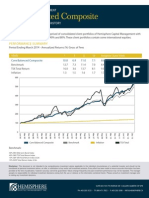

Core Balanced Composite

PERFORMANCE SUMMARY AND HISTORY

The Core Balanced Composite is comprised of consolidated client portfolios of Hemisphere Capital Management with

an equity asset mix weight between 40% and 80%. These client portfolios contain some international equities.

PERFORMANCE SUMMARY

Period Ending September 2014 - Annualized Returns (%) Gross of Fees

YEARS

10

Inception (June/1994)

Core Balanced Composite

13.0

8.5

9.1

7.5

8.7

Benchmark

12.7

10.0

8.0

7.2

8.3

Inflation

2.1

1.6

1.7

1.8

1.8

600

500

400

300

200

100

0

Sep 14

Dec 13

Mar 13

Jun 12

Sep 11

Dec 10

Mar 10

Jun 09

Sep 08

Benchmark

Dec 07

Mar 07

Jun 06

Sep 05

Dec 04

Mar 04

Jun 03

Core Balanced Composite

Sep 02

Dec 01

Mar 01

Jun 00

Sep 99

Dec 98

June 1994 - December 2013

40% DEX Mid-term Bond Index

40% S&P/TSX Total Return Index

10% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

Mar 98

Jun 97

Sep 96

Dec 95

Mar 95

Jun 94

Benchmark:

Inflation

January 2014 - Current

20% DEX Short-term Bond Index

20% DEX Mid-term Bond Index

30% S&P/TSX Total Return Index

20% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

CORE BALANCED COMPOSITE

PERFORMANCE HISTORY

3Q

4Q

YTD

# of

Port

2.6%

2.0%

4.6%

Net Fee

2.5%

1.8%

4.3%

Net Fee

Benchmark

5.6%

-0.2%

5.3%

Benchmark

1Q

Year

2Q

1994 Gross Fee

1995 Gross Fee

Net Fee

Benchmark

1996 Gross Fee

Net Fee

Benchmark

1997 Gross Fee

Net Fee

4.5%

5.6%

3.1%

1.8%

15.8%

4.2%

5.3%

2.9%

1.5%

14.6%

4.7%

5.1%

2.3%

5.4%

18.6%

3.6%

2.3%

8.7%

10.5%

27.2%

3.3%

2.0%

8.4%

10.2%

25.8%

3.0%

2.3%

4.5%

7.8%

18.9%

-2.2%

3.1%

9.8%

-3.4%

7.0%

-2.4%

2.8%

9.5%

-3.7%

5.9%

13

Year

2006 Gross Fee

-0.2%

3.9%

-6.0%

-6.2%

-8.6%

Net Fee

-0.4%

3.6%

-6.2%

-6.5%

-9.5%

Benchmark

-0.7%

2.6%

-9.8%

-8.9%

-16.2%

1.6%

7.2%

5.0%

3.9%

18.9%

Net Fee

1.4%

6.9%

4.8%

3.7%

17.8%

Benchmark

-1.7%

10.9%

7.3%

1.8%

19.0%

Gross Fee

3.0%

0.3%

5.7%

5.1%

14.7%

Net Fee

2.8%

0.0%

5.4%

4.9%

13.7%

-0.6%

Benchmark

9.1%

0.8%

-9.9%

11.4%

10.4%

1.4%

4.1%

0.2%

-0.3%

5.5%

Net Fee

1.2%

3.8%

-0.1%

-0.5%

4.4%

Benchmark

1.5%

2.7%

-0.4%

10.8%

15.0%

4.5%

6.2%

4.1%

1.4%

17.1%

Net Fee

4.2%

5.9%

3.8%

1.1%

15.8%

Benchmark

6.6%

3.7%

1.2%

-5.3%

6.0%

2.8%

2.4%

-2.8%

5.6%

8.0%

Net Fee

2.5%

2.1%

-3.0%

5.3%

6.8%

Net Fee

Benchmark

-6.7%

0.1%

-4.5%

7.7%

-3.9%

Benchmark

3.8%

-2.9%

-1.3%

3.6%

3.1%

Gross Fee

Net Fee

3.4%

-3.1%

-1.6%

3.3%

1.9%

Net Fee

Benchmark

0.7%

-4.4%

-6.3%

5.4%

-4.8%

Benchmark

-1.9%

5.5%

2.6%

6.0%

12.6%

Net Fee

-2.1%

5.2%

2.3%

5.7%

11.4%

Benchmark

-4.1%

8.1%

4.2%

6.7%

15.3%

3.9%

-1.7%

2.2%

3.1%

7.6%

3.7%

-1.9%

1.9%

2.8%

6.5%

Benchmark

4.3%

-0.3%

0.7%

5.6%

10.5%

1.2%

4.8%

4.0%

1.4%

11.7%

Net Fee

0.9%

4.6%

3.7%

1.1%

10.6%

Benchmark

2.0%

3.6%

4.9%

1.9%

13.0%

2005 Gross Fee

Benchmark

2011 Gross Fee

Net Fee

Benchmark

2012 Gross Fee

Net Fee

Benchmark

43

48

12.8%

3.6%

2.8%

Net Fee

6.7%

7.1%

-0.2%

-9.0%

2004 Gross Fee

2.6%

3.7%

0.7%

1.4%

37

2.8%

-2.7%

1.4%

4.8%

2003 Gross Fee

-2.3%

4.4%

1.7%

2009 Gross Fee

2013 Gross Fee

2014

3.5%

Benchmark

Net Fee

20

51

1.2%

0.4%

2002 Gross Fee

7.8%

2.2%

14.8%

18

2.8%

0.5%

3.0%

2001 Gross Fee

3.1%

0.7%

-1.1%

19

-2.1%

0.1%

6.5%

2000 Gross Fee

3.8%

-0.2%

-8.8%

18

# of

Port

1.0%

8.8%

1999 Gross Fee

YTD

1.2%

2008 Gross Fee

2010

4Q

0.1%

1.6%

14

3Q

-0.1%

0.2%

1998 Gross Fee

2Q

Net Fee

2007 Gross Fee

5.1%

Benchmark

1Q

1.9%

-2.6%

7.7%

4.4%

11.6%

2.7%

0.2%

-1.3%

3.7%

5.3%

2.6%

0.0%

-1.5%

3.4%

4.5%

2.6%

-0.9%

-4.4%

3.3%

0.4%

2.7%

-3.3%

3.5%

0.7%

3.5%

2.5%

-3.5%

3.3%

0.5%

2.6%

3.7%

-1.7%

4.0%

1.6%

7.6%

3.9%

-0.4%

1.9%

4.5%

10.1%

3.7%

-0.6%

1.7%

4.3%

9.2%

4.0%

-1.8%

3.9%

5.4%

11.9%

4.5%

3.4%

0.1%

4.3%

3.2%

-0.1%

3.5%

2.3%

0.9%

53

52

55

58

80

87

101

108

Benchmark:

June 1994 - December 2013

40% DEX Mid-term Bond Index

40% S&P/TSX Total Return Index

10% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

January 2014 - Current

20% DEX Short-term Bond Index

20% DEX Mid-term Bond Index

30% S&P/TSX Total Return Index

20% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

You might also like

- Solution Manual For Financial Analysis With Microsoft Excel 7th EditionDocument9 pagesSolution Manual For Financial Analysis With Microsoft Excel 7th EditionToni Johnston100% (28)

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Guide To Managerial AccountingDocument23 pagesGuide To Managerial AccountingTai LeNo ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite 2QTR 2013Document2 pagesCore Balanced Composite 2QTR 2013Jason BenteauNo ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite - 2QTR 2014Document2 pagesCore Balanced Composite - 2QTR 2014jai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite - 4QTR 2012-5Document2 pagesConservative Composite - 4QTR 2012-5Jason BenteauNo ratings yet

- NielsenDocument17 pagesNielsenCanadianValue0% (1)

- 4Q11 Earnings Release: Conference Call PresentationDocument23 pages4Q11 Earnings Release: Conference Call PresentationMultiplan RINo ratings yet

- Company Visit Q1 11 ThaiDocument49 pagesCompany Visit Q1 11 ThaiMeghna GuptaNo ratings yet

- Canadian Value Fund 1QTR 2012Document2 pagesCanadian Value Fund 1QTR 2012Jason BenteauNo ratings yet

- REITs WatchlistDocument9 pagesREITs WatchlistKhriztopher PhayNo ratings yet

- PT Garuda Indonesia (Persero) TBKDocument30 pagesPT Garuda Indonesia (Persero) TBKburungtweetyNo ratings yet

- Cfa Research PaperDocument5 pagesCfa Research Paperfvey0xan100% (1)

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Bukit Sembawang EstatesDocument7 pagesBukit Sembawang EstatesNicholas AngNo ratings yet

- ES - Avalon Presentation - May 2014Document34 pagesES - Avalon Presentation - May 2014macconsa0% (1)

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- Atlas BankDocument145 pagesAtlas BankWaqas NawazNo ratings yet

- Financial Analysis (Detail)Document68 pagesFinancial Analysis (Detail)Paulo NascimentoNo ratings yet

- 5 TomCollier SPEE Annual Parameters SurveyDocument20 pages5 TomCollier SPEE Annual Parameters SurveymdshoppNo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Q2FY2013 InvestorsDocument31 pagesQ2FY2013 InvestorsRajesh NaiduNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- 2015-2025 MRO Forecast Trends - MRO Middle East Presentation - 20160202 PDFDocument30 pages2015-2025 MRO Forecast Trends - MRO Middle East Presentation - 20160202 PDFIslam Ahmed Shafik100% (1)

- 7jul11 - Tiger AirwaysDocument3 pages7jul11 - Tiger AirwaysmelyeapNo ratings yet

- Weekend Market Summary Week Ending 2015 February 8Document3 pagesWeekend Market Summary Week Ending 2015 February 8Australian Property ForumNo ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- Transnet Annual Report 2003 - 2004Document126 pagesTransnet Annual Report 2003 - 2004cameroonwebnewsNo ratings yet

- 2007-08 Annual ReoprtDocument116 pages2007-08 Annual ReoprtParas PalNo ratings yet

- SSP Templates: Business Name: Last Completed Fiscal YearDocument23 pagesSSP Templates: Business Name: Last Completed Fiscal YearMee TootNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarNo ratings yet

- Lanka Floortiles PLC - (Tile) - q4 Fy 15 - BuyDocument9 pagesLanka Floortiles PLC - (Tile) - q4 Fy 15 - BuySudheera IndrajithNo ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNo ratings yet

- Master Report 2....... Thru NetDocument76 pagesMaster Report 2....... Thru NetChetan ParmarNo ratings yet

- Goldman Sachs Basic Materials Conference: June 2-4, 2010Document26 pagesGoldman Sachs Basic Materials Conference: June 2-4, 2010FibriaRINo ratings yet

- Security Analysis and Portfolio ManagementDocument48 pagesSecurity Analysis and Portfolio Managementmanishsingh6270No ratings yet

- Presentation 3Q13Document19 pagesPresentation 3Q13Multiplan RINo ratings yet

- CB Ratio AnalysisDocument33 pagesCB Ratio AnalysisSiva UdNo ratings yet

- A Study On Asset Management of Shanthigram Dairy Promotion at NathamDocument35 pagesA Study On Asset Management of Shanthigram Dairy Promotion at Nathamramohan2121No ratings yet

- Balance Sheet StatementDocument8 pagesBalance Sheet StatementsantasantitaNo ratings yet

- Weekend Market Summary Week Ending 2014 September 14 PDFDocument3 pagesWeekend Market Summary Week Ending 2014 September 14 PDFAustralian Property ForumNo ratings yet

- Balance SheetDocument15 pagesBalance SheetBhumit GalaNo ratings yet

- Eclectica Agriculture Fund Feb 2015Document2 pagesEclectica Agriculture Fund Feb 2015CanadianValueNo ratings yet

- Deloitte GCC PPT Fact SheetDocument22 pagesDeloitte GCC PPT Fact SheetRakawy Bin RakNo ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- Finders Valves and Controls Inc.Document4 pagesFinders Valves and Controls Inc.raulzaragoza0422100% (1)

- Otp - Dec 11Document3 pagesOtp - Dec 11ngbharadwajNo ratings yet

- Ascendas REIT 040413Document9 pagesAscendas REIT 040413Paul NgNo ratings yet

- Still A Long Way To Go: Otto MarineDocument6 pagesStill A Long Way To Go: Otto MarineckyeakNo ratings yet

- Financial HighlightsDocument6 pagesFinancial Highlightsangels_birdsNo ratings yet

- Sembawang Marine 3 August 2012Document6 pagesSembawang Marine 3 August 2012tansillyNo ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Statement 20140508Document2 pagesStatement 20140508franraizerNo ratings yet

- AFAR 8918. Business Combination-Date of AcquisitionDocument4 pagesAFAR 8918. Business Combination-Date of AcquisitionTineNo ratings yet

- DuPont Financial Analysis Nestle 1709006894Document4 pagesDuPont Financial Analysis Nestle 170900689482rnkgr7p4No ratings yet

- CF AssignmentDocument112 pagesCF AssignmentAbhijit DileepNo ratings yet

- DateienDocument7 pagesDateienياسين البيرنسNo ratings yet

- Procter and GambleDocument29 pagesProcter and Gamblepanchitoperez2014No ratings yet

- Excel of Corporate FinanceDocument3 pagesExcel of Corporate FinanceRafia TasnimNo ratings yet

- BF BinderDocument7 pagesBF BinderShane VeiraNo ratings yet

- Fair Value Measurement and ImpairmentDocument2 pagesFair Value Measurement and Impairmentyonatan tesemaNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- ManagementDocument195 pagesManagementFahad KhalidNo ratings yet

- Creditors Reconciliation WorksheetDocument23 pagesCreditors Reconciliation WorksheetMuto riroNo ratings yet

- SFM PDFDocument328 pagesSFM PDFZainNo ratings yet

- Dess Ch05 PPT FinalDocument34 pagesDess Ch05 PPT FinalIqram IqramNo ratings yet

- Module - 2 Informal Risk Capital & Venture CapitalDocument26 pagesModule - 2 Informal Risk Capital & Venture Capitalpvsagar2001No ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Channel Trading StrategyDocument51 pagesChannel Trading StrategyVijay86% (7)

- Additional Information: Ratio AnalysisDocument7 pagesAdditional Information: Ratio Analysisashokdb2kNo ratings yet

- 01 Valuation ModelsDocument24 pages01 Valuation ModelsMarinaGorobeţchiNo ratings yet

- Stock Market: Presented by Zaid ShahsahebDocument16 pagesStock Market: Presented by Zaid ShahsahebZaid Ismail ShahNo ratings yet

- Four Sons EnterpriseDocument2 pagesFour Sons EnterpriseNur Aqilah Fatonah Binti Ahmad RasidiNo ratings yet

- GMR Enterprises Private Limited: Yogindu KhajuriaDocument3 pagesGMR Enterprises Private Limited: Yogindu KhajuriaJohn SmithNo ratings yet

- Investment Services Agreement For ClientsDocument37 pagesInvestment Services Agreement For ClientsPetar I. StijovicNo ratings yet

- Module 1Document27 pagesModule 1bhumiNo ratings yet

- Strategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirDocument24 pagesStrategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirPragya patelNo ratings yet

- United Tractors (UNTR IJ) : Regional Morning NotesDocument5 pagesUnited Tractors (UNTR IJ) : Regional Morning NotesAmirul AriffNo ratings yet

- Final DataDocument63 pagesFinal Dataaurorashiva1No ratings yet