Professional Documents

Culture Documents

Memorial For SEBI

Uploaded by

Zahid HashmiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memorial For SEBI

Uploaded by

Zahid HashmiCopyright:

Available Formats

TEAM CODE- N-024

IN THE HONBLE

SUPREME COURT OF INDIA,

AT NEW DELHI.

SPECIAL LEAVE PETITION NO.

Of 2013

MS. SUSHMA & MR. SANJAY BANSAL

APPELLANTS

VS.

SECURITIES AND EXCHANGE BOARD OF INDIA

RESPONDENT

29th

BAR COUNCIL OF INDIA TRUST INTER UNIVERSITY,

MOOT COURT COMPETITION

2013-2014

SUBMITTED IN THE REGISTRY OF THE COURT

ON BEHALF OF THE APPELLANTS

-MS. SUSHMA AND MR. SANJAY BANSAL

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

TABLE OF CONTENTS

LIST OF ABBREVIATIONS..... III

INDEX OF AUTHORITY.......................................................................................................IV

STATEMENT OF JURISDICTION........................................................................................VI

STATEMENT OF FACTS.....................................................................................................VII

STATEMENT OF ISSUES.....................................................................................................IX

SUMMARY OF ARGUMENTS..............................................................................................X

DETAILED PLEADING...1

ISSUE NO. 1: Whether the Petition is maintainable?...............................................................1

ISSUE NO.2 - Whether the telephonic conversation amounted to Inside Information?...........3

ISSUE NO.3 - Whether Suresh Agarwal acted on the said Information and made profit

Thereof?.....................................................................................................................................4

PRAYER....................................................................................................................................6

Page | II

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

LIST OF ABBREVIATIONS

SEBI

Securities and Exchange Board of India.

SAT

Securities and appellate tribunal.

AIR

All India Reporter.

SC

Supreme Court.

CIT

Commissioner of Income Tax.

SEC

Securities Exchange Commission.

US

United States.

SCC

Supreme Court Cases.

Sec.

Section.

u/s

under section.

Page | III

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

INDEX OF AUTHORITY

S.NO.

PARTICULARS

STATUTORY COMPILATIONS

1. THE SECURITIES AND EXCHANGE BOARD OF INDIA ACT, 1992.

2. PROHIBITION OF INSIDER TRADING REGULATIONS, 1992.

3. CONSTITUTION OF INDIA.

4.

COMPANIES ACT, 1956.

BOOKS REFERRED

1. Dr. J.N. Pandey, The Constitutional Law of India, Central Law Agency, 48th

Edition.

2. M.P. Jain, Indian Constitutional Law, 256, (LexisNexis Butterworths

Wadhwa, Nagpur, 2010).

3. A K Majumdar, G K Kapoor, Company Law, Taxmann Publications Pvt.

Ltd., 15th Edition

4. H. Nejat Seyhun, Investment Intelligence from Insider Trading, The MIT

Press; First Edition edition

DICTIONARIES & LAW LEXICONS:

i.

Oxford Dictionary, 6th Ed., Oxford University Press, London, 2003.

ii.

GARNER, BRYAN A.: A Dictionary Of Modern Legal Usage, Oxford

University Press 2nd ed. Oxford (1995)

iii.

Greenberg, Daniel & Alexandra, Millbrook: Strouds Judicial Dictionary Of

Words & Phrases, VOL. 2, 6th ed., London: Sweet & Maxwell (2000).

WEBSITES REFERRED:

i.

www.findlaw.com

ii.

www.indiankanoon.com

iii.

www.indlawinfo.org

iv.

www.jstor.org.

Page | IV

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

v.

www.judis.nic.in

vi.

www.lawsofindia.org

vii.

www.manupatra.com

viii.

www.scconline.com

ix.

www.supremecourtcaselaw.com

CASES REFERRED

1. Bhikaji Keshao v. Brij Lal Nandlal, AIR 1955 SC 610.

2. Siemens Eng. & Manufacturing Co. v. Union of India, AIR 1976 SC 1785.

3. Manoj Kumar Rai v. Union of India, AIR 1993 SC 882.

4. D.C. Mills v. CIT, AIR 1955 SC 65.

5. Mohan Lal v. Management, Bharat Electronics Ltd. AIR 1981 SC 1253.

6. Mehar Singh v. Shri Moni Gurudwara Prabandhak Committee, AIR 2000 SC

492.

7. Dhirajlal Girdharilal v. I.T. Commr., AIR 1955 SC 271.

8. Dirks v. SEC 463 U.S 646(1983).

9. SEC v. Texas Gulf Sulphur Co., 401 F.2d 833, 848 (2d Cir.1968), cert,

denied, 394 U.S 976 (1969).

10. Rakesh Agarwal v. SEBI (2004) 1 CompLJ 193 SAT, 2004.

Page | V

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

STATEMENT OF JURISDICTION

The Honble Supreme Court has the jurisdiction to try and entertain the present appeal under

Article 136 of the Indian Constitution. Article 136 of the Indian Constitution reads as

hereunder:

Notwithstanding anything in this Chapter, the Supreme Court may, in its discretion, grant

special leave to appeal from any judgment, decree, determination, sentence or order in any

cause or matter passed or made by any court or tribunal in the territory of India.

Page | VI

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

STATEMENT OF FACTS

Fortune India Ltd., is a Company incorporated under the Indian Companies Act, 1956,

having its registered office at No.5, Avenue road, Bazaar Street, Mumbai was engaged in the

business of Cotton yarn, manufacturing and trading. It was a listed Company, and its equity

was listed in the Bombay Stock Exchange. The Company has been declaring dividend from

the last ten years. One of the independent directors, Mr. Sanjay Bansal was a nominee of a

Central Co-operative Bank.

DISCUSION OF THE BOARD OF DIRECTORS IN SEPTEMBER- 2012 MEETING.

Business proposal of either acquiring or merging with a Company engaged in the forward

trading to effectively control over the periodical supply of high quality long staple cotton for

the plant of the Company and to effectively meet demand for the garment industry engaged in

supply of quality product for US / EU market.

Delta Future Trading Co. Ltd., also a listed Company with NSE having its registered office

at No. 25, Avenue road, Bazaar Street, Mumbai was engaged in the business of forward

trading of cotton, wheat and maize. The company has Mr. Mahesh Agarwal and Mr. Suresh

Agarwal in its Board of Directors.

DECISSION OF THE BOARD OF DIRECTORS IN SEPTEMBER- 2012 MEETING.

The Board decided to acquire shares of a company engaged in business of manufacturing

yarn.

The driver of the car overheard the proposal, while the two Agarwal brothers were discussing

the pros and cons of the proposal while driving the car back home. Thereafter, next day, Mr.

Suresh used his wifes cell to talk to one Mrs. Susma, a sharebroker asking for the price of

Fortune for the last about a month. There was no further discussion.

DRIVER ACQUAINTANCE

The driver of Agarwal brothers had acquaintance with the driver of Mrs. Susma. They in

between their discussion, in the drivers club about Fortunes idea of sale or buy were loud

enough to be heard by the driver of Mr. Bansal of Fortune. Mrs. Susma started acquiring

shares of those two companies and Bansal started buying Deltas shares after they got this

scoop from their respective drivers.

Page | VII

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

ADVERTISEMNT FOR PUBLIC AUCTION

After about two months, Fortune went for giving an advertisement for public auction for

acquiring 60% shares of Delta. Mrs. Susma by the time held 30% shares and Bansal another

20%. Naturally, they made a fall through.

DECISSION OF SEBI TO AN ANONYMOUS COMPLAINT

SEBI, on an anonymous complaint issued notice to:1. Fortune, its directors.

2. Delta, its directors.

3. Mrs. Susma.

SEBI after enquiry found that charge of insider trading was established against Sanjay

Bansal, Agarwal brothers and Mrs. Susma and imposed penalty equal to double of the gains

made by the parties.

APPEALS TO APPELLATE SECURITY TRIBUNAL

Aggrieved, by the orders of SEBI, Agarwal brothers, Bansal and Susma in separate appeals

went to the Appellate Security Tribunal. The Tribunal found charges against Agarwal

brothers not justified and exonerated them but upheld the order of the SEBI against Bansal

and Susma.

Susma and Bansal submitted an SLP to the Supreme Court of India.

Hence the present dispute.

Page | VIII

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

STATEMENT OF ISSUES

ISSUE NO.1-WHETHER THE PETITION IS MAINTAINABLE?

ISSUE NO.2-WHETHER THE TELEPHONIC CONVERSATION AMOUNTED TO

INSIDE INFORMATION?

ISSUE NO.3-WHETHER SURESH AGARWAL ACTED ON THE SAID INFORMATION

AND MADE PROFIT THEREOF?

Page | IX

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

SUMMARY OF ARGUMENTS

ISSUE No. 1: WHETHER THE PETITION IS MAINTAINABLE?

Article 136(1) empowers the Supreme Court to grant special leave to appeal in its discretion.

The provision is couched in very wide terms. The main consideration on which the Supreme

Court acts is that under Article 136, it is its duty to see that injustice is not perpetrated or

perpetuated by the tribunals. One of the pre-requisites to entertain an appeal under Article

136(1) is that the order of the tribunal must be erroneous or unjust. Under the facts and

circumstances of the instant case the Appellate Security Tribunal acted erroneously on the

following

Mr. Sanjay Bansal did not possess any unpublished price sensitive information about

Delta, as the drivers in the Drivers Club were merely discussing about the Fortune's

idea of sale or buy, which he was already aware of because of his position. Mr. Sanjay

Bansal did not have any pecuniary relationship with the company. he could not have

influenced the decision of the Board of directors to acquire Delta Future Trading Ltd.

Exclusively.

During the conversation between Mrs. Sushma and Mr. Suresh Agarwal, there was no

exchange of insider information as he merely asked her for the prices of Fortune for

last about a month as this sole piece of information is not material enough to

commence insider trading in any practical possibility.

The conversation between the drivers in the Driver's Club is nothing but hearsay, on

which reliance cannot be placed for conviction. The legitimacy of information is

questionable hence not concrete in nature.

ISSUE NO.2 - WHETHER

THE

TELEPHONIC CONVERSATION AMOUNTED

TO

INSIDE

INFORMATION?

The telephonic conversation between Mr. Suresh Agarwal and Mrs. Sushma was general in

nature and no unpublished price sensitive information was disclosed or shared amongst the

two, as the discussion was merely restricted to price of the Fortune. Stock brokers often

render good tips, which is usually beneficial in the investment process and that is why Mr.

Suresh Agarwal had a conversation with Mrs. Sushma. The conversation between Mr. Suresh

Agarwal & Mrs. Sushma does not fall within the ambit of "price sensitive information"

Page | X

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

defined under S.2[(ha)] of the SEBI regulations on Prohibition of Insiders Trading Act, 1992.

The telephonic conversation was pertaining to "price of Fortune for the last about a month".

This information is not a non-public information, as it is generally available to the investing

public. For that matter, even the price sensitive information should be unpublished in order to

constitute insider trading as per Regulation 3 of SEBI (Prohibition of Insider Trading

Regulations) 1992. Merely asking the Price of Shares for about a month does not even in the

remotest of sense constitute unpublished price sensitive information.

ISSUE NO.3 - WHETHER SURESH AGARWAL ACTED

ON

THE SAID INFORMATION AND

MADE PROFIT THEREOF?

Agarwal Brothers were merely two of the board of directors of a company who chose only to

acquire another company, in their meeting. Being merely two of the board of directors of

Delta, Agarwal brothers were not solely in the position to change the company's idea of

acquiring, but the company ended up being acquired. This fact further clarifies that Agarwal

brothers and especially Suresh Agarwal restricted his conversation merely to official and

legal talk. There was no exchange of insider information whatsoever and Suresh Agarwal did

not make any profit.

Page | XI

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

DETAILED PLEADINGS

ISSUE No. 1: WHETHER THE PETITION IS MAINTAINABLE?

It is most humbly submitted that, the present petition has been filed under Article 136 of the

Constitution by way of a Special Leave Petition (hereinafter referred to as SLP), aggrieved by

the order of the Appellate Security Tribunal. It is an outstanding feature of Article 136(1)1

that it empowers the Supreme Court of India to hear appeals not only from courts but also

from tribunals in any cause or matter2, though at its discretion. Article 136(1) empowers the

Supreme Court to grant special leave to appeal in its discretion. The provision is couched in

very wide terms. The constitutional provision lays down no norms to regulate Court's

discretion in the matter of hearing appeals, but acts as a check upon the unfettered powers of

the Tribunals and Courts.

That, one of the pre-requisites to entertain an appeal under Article 136(1) is that the order of

the tribunal must be erroneous3 or unjust4. Generally the main consideration on which the

Supreme Court acts is that under Article 136, it is its duty to see that injustice is not

perpetrated or perpetuated by the tribunals5. The Court would interfere with the finding of a

fact if there are special circumstances, e.g. absence of consideration of important piece of

legal evidence6 or when the findings are based on irrelevant considerations7.

Under the facts and circumstances of the instant case the Appellate Security Tribunal acted

erroneously, which this Hon'ble Court may graciously be pleased to note are the following:

That Mr. Sanjay Bansal (Independent Director of Fortune India Ltd.), did not possess any

unpublished price sensitive information8 about Delta, as the drivers in the Drivers Club

were merely discussing about the Fortune's idea of sale or buy, which he was already

aware of because of his position. So he did not get any scoop from his driver. Furthermore,

in the September 2012 meeting of Fortune India Ltd. there was no proposal of acquiring

Delta Future Trading Co. Ltd. in particular.

Article 136(1): Notwithstanding anything in this Chapter, the Supreme Court may, in its discretion, grant

special leave to appeal from any judgment, decree, determination, sentence or order in any cause or matter

passed or made by any court or tribunal in the territory of India.

2

M.P. Jain, Indian Constitutional Law, 256, (LexisNexis Butterworths Wadhwa, Nagpur, 2010).

3

Bhikaji Keshao v. Brij Lal Nandlal, AIR 1955 SC 610; Siemens Eng. & Manufacturing Co. v. Union of India,

AIR 1976 SC 1785.

4

Manoj Kumar Rai v. Union of India, AIR 1993 SC 882.

5

D.C. Mills v. CIT, AIR 1955 SC 65; Mohan Lal v. Management, Bharat Electronics Ltd. AIR 1981 SC 1253.

6

Mehar Singh v. Shri Moni Gurudwara Prabandhak Committee, AIR 2000 SC 492.

7

Dhirajlal Girdharilal v. I.T. Commr., AIR 1955 SC 271.

8

Regulation 2(ha) & 2(k) of the SEBI(Insiders Trading Prohibition Regulations) 1992.

Page | 1

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

That Mr. Sanjay Bansal, being merely an independent director of Fortune India Ltd. does

not have any pecuniary relationship with the company, its promoters, senior management

or affiliate companies, therefore he could not have influenced the decision of the Board of

directors to acquire Delta Future Trading Ltd. exclusively, as Fortune was even intending

to merge. Furthermore, there was no breach of Regulation 3 of the SEBI regulations on

prohibition of Insider Trading.

That Mrs. Sushma is a professional analyst, who analyses the information available in the

market and advices the clients, therefore the proof of trading based on non public

information cannot be established under the given facts and circumstances. In the instant

case Mr. Suresh merely asked for the price for fortune for the last about a month and no

further discussion took place between them. This information cannot be called as insiders

information as this sole piece of information is not material enough to commence insider

trading in any practical possibility. Under similar circumstances it is merely the expertise

and efficiency of the analysts, not the materiality of the information9.

Furthermore, the conversations between the drivers in the Driver's Club is nothing but

hearsay, on which reliance cannot be placed for conviction. The legitimacy of information is

questionable hence not concrete in nature. For instance, an individual who is sitting in a

restaurant or on an aircraft can overhear a conversation. It is at his disposal to believe the

information or to ignore it. This does not constitute insider's information. The same has been

iterated in Dirks v. SEC10. In this case Mr.Dirk was visited by former Equity Funding

employee, he did not know whether the information he received was authentic. Therefore, if

the authenticity of the information was never confirmed, he cannot be said to act on material

information.

Therefore, in light of the above proposition, it is most humbly prayed, that the Appellate

Security Tribunal committed grave injustice to the Appellants by misinterpreting the facts

and evidence available at their disposal. There was no exchange of any unpublished price

sensitive information which could be material enough to constitute insider trading. Mr.

Sanjay Bansal acted responsibly, fulfilling his fiduciary duty towards his company. Hence the

Hon'ble Court may graciously be pleased to allow the petition under Article 136, in order to

render justice to the Appellants.

9

Desari, Santhi, "Insider or Price Sensitive Information in Insider Trading of Securities: An analysis of English,

U.S, And Indian Laws", Indian Social Legal Journal, 39(1&2), 2013.

10

463 U.S 646(1983).

Page | 2

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

ISSUE NO.2 - WHETHER

THE

TELEPHONIC CONVERSATION AMOUNTED

TO

INSIDE

INFORMATION?

It is most humbly submitted that, the telephonic conversation between Mr. Suresh Agarwal

and Mrs. Sushma was general in nature and no unpublished price sensitive information was

disclosed or shared amongst the two, as the discussion was merely restricted to price of the

Fortune. In this regard it is pertinent to note that stock brokers are professionals who buy and

sell stocks as well as other securities in the stock market. They know the trend of the stock

market and keep a check on the financial developments of various companies. Stock brokers

often render good tips which is usually beneficial in the investment process.

That, the above mentioned conversation between Mr. Suresh Agarwal & Mrs. Sushma

does not fall within the ambit of "price sensitive information" defined under S.2[(ha)]

of the SEBI regulations on Prohibition of Insiders Trading Act, 1992, which include :-

(i) Periodical financial results of the company;

(ii) Intended declaration of dividends (both interim and final);

(iii) Issue of securities or buy-back of securities;

(iv) Any major expansion plans or execution of new projects.

(v) Amalgamation, mergers or takeovers;

(vi) Disposal of the whole or substantial part of the undertaking;

(vii) and significant changes in policies, plans or operations of the company;

Therefore, the conversation between the two could not have possibly amounted to disclosure

of price sensitive information, as no further discussion took place between the two after that

point of time.

That, To substantiate the above preposition, reference maybe made to the celebrated

case of Texas Gulf Sulphur11, where it was discussed that it is important to determine

(i) when the information in question became material as it is to determine (ii)whether

the information was material. With reference to Texas Gulf Sulphur, the answer to

both the tests is negative. Telephonic conversation as previously discussed was not

material or immaterial in nature as far as insiders trading is concerned.

11

SEC v. Texas Gulf Sulphur Co., 401 F.2d 833, 848 (2d Cir.1968), cert, denied, 394 U.S 976 (1969).

Page | 3

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

That, the telephonic conversation was pertaining to "price of Fortune for the last

about a month". This information is not a non-public information, as it is generally

available to the investing public. For that matter, even the price sensitive information

should be unpublished in order to constitute insider trading as per Regulation 3 of

SEBI (Prohibition of Insider Trading Regulations) 1992. Merely asking the Price of

Shares for about a month does not even in the remotest of sense constitute

unpublished price sensitive information.

Therefore, in light of the above-mentioned proposition it is most humbly prayed the court to

consider the materiality of information which was discussed, which was nothing but a

professional communication between the two alleged accused.

ISSUE NO.3 - WHETHER SURESH AGARWAL ACTED

ON

THE SAID INFORMATION AND

MADE PROFIT THEREOF?

It is most humbly submitted that, Mr. Suresh Agarwal did not act on the said information, as

previously discussed. Apart from the non-material telephonic conversation, no further

discussion was done about Fortune.

That in this regard it is pertinent to observe that in India an insider trader is made

criminally liable by the virtue of section 24 of the Securities and Exchange Board of

India Act, 1992 read with Securities and Exchange Board of India (Prohibition of

Insider Trading) Regulations, 2002 ('Insider Trading Regulations'). The insider

trading regulations in India prohibits dealing in securities of a listed public company

while in possession of unpublished price-sensitive information. Therefore if any

unpublished price sensitive information is leaked, the penetrator of such information

can be held liable. Therefore, the motive and intention should be established to

prosecute the alleged offenders as held by The Securities Appellate Tribunal in

Rakesh Agarwal v. SEBI12. It is pertinent to highlight the relevant ratio decidendi

which is read as "...looking from the gravity of the charge and penal consequences

that could visit the insider for indulging in insider trading, it is difficult to accept the

preposition that the intention or motive of the person indulging in insider trading is

irrelevant. It is true that regulation 3 and 4 perse are pure vanila sections without

specific mention of the requirement of motive or the intention but these regulations, if

12

(2004) 1 CompLJ 193 SAT, 2004

Page | 4

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

read with the objective of Prohibiting the insider trading makes clear that motive is

built in and the insider trading without establishing the motive factor is not

punishable...".

That, from the above extract it is unambiguous that motive and intention also attains

importance if the guilt it to be established. Furthermore, under the facts and

circumstances of the instant case Agarwal Brothers were merely 2 of the board of

directors of a company who chose ONLY to acquire another company, in their

meeting. Had there been any conclusive conversation with Sushma, or leak of any

material information about Delta's intention to merge with Fortune, Sushma would

have only purchased Delta's share as the price of the target company's stock generally

increases during the takeover, while the acquiring company stock reduces. It was

merely the "guess work" on part of Sushma, as she was an expert.

Furthermore, being merely 2 of the board of directors of Delta, Agarwal brothers were not

solely in the position to change the company's idea of acquiring, but the company ended up

being acquired. This fact further clarifies that Agarwal brothers and especially Suresh

Agarwal restricted his conversation merely to official and legal talk.

That, Section 6 of the Indian Evidence Act which incorporates Doctrine of Res Gestae

which talks about facts forming the part of same transaction lays down that there

should be a proximate nexus between the events to prove the guilt. In the instant case

the actions and reactions of Mr. Suresh Agarwal are nothing but prudent and natural

in nature and hence has made no profit at all. The discussions in the meetings of the

company and the subsequent events which are completely different very

unambiguously exhibit that no possible insider information was ever exchanged

between anyone.

Therefore, in light of the above mentioned proposition it is most humbly prayed that Mr.

Suresh Agarwal did not act on inside information hence no profit was made either. He acted

well within his fiduciary duty by not disclosing any material fact to anybody.

Page | 5

MEMORIAL ON BEHALF OF THE APPELLANTS

29th BCI Moot Court Competition.

PRAYER

Wherefore in the light of the issues raised, arguments advanced and authorities cited, it is

most humbly prayed that this Honorable Court may be pleased to:

TO HOLD

That the present petition under Article 136 of the Indian Constitution is maintainable.

That the telephonic conversation did not amount to inside information.

That Mr. Suresh Agarwal acted on the said information and made profits thereof.

TO SET ASIDE

The order passed by the Security Appellate Tribunal against Mrs. Sushma and Mr.

Sanjay Bansal.

MISCELLANEOUS

Any other relief that this Honble Court may be pleased to grant in the interest of

equity, justice and good conscience.

ALL OF WHICH IS RESPECTFULLY SUBMITTED

COUNSELS FOR APPELLANT

Page | 6

You might also like

- MemorialDocument17 pagesMemorialZahid HashmiNo ratings yet

- Intra Moot PetDocument18 pagesIntra Moot Petkrishnagautam6731No ratings yet

- 3 Gnlu M S I, 2017: BeforeDocument21 pages3 Gnlu M S I, 2017: BeforeShivam DalmiaNo ratings yet

- TC18 - Respondent (15335)Document27 pagesTC18 - Respondent (15335)Suman sharmaNo ratings yet

- MOOT PROBLEM - Final PDFDocument6 pagesMOOT PROBLEM - Final PDFBar & BenchNo ratings yet

- Memorial For Petitioner PDFDocument28 pagesMemorial For Petitioner PDFdevil_3565No ratings yet

- Moot Court MemorialDocument23 pagesMoot Court MemorialAnkit KumarNo ratings yet

- Moot Memo FinalDocument16 pagesMoot Memo Final112:Sweta BehuraNo ratings yet

- Plaintiff Roll No 29Document20 pagesPlaintiff Roll No 29atipriyaNo ratings yet

- Defendant Roll No 29Document26 pagesDefendant Roll No 29atipriyaNo ratings yet

- Moot Preposition - 3Document4 pagesMoot Preposition - 3Mugambo MirzyaNo ratings yet

- Symbiosis Memorial RespondentDocument32 pagesSymbiosis Memorial RespondentMozhiNo ratings yet

- Project TopicsDocument4 pagesProject TopicsAkshay SarjanNo ratings yet

- IRACDocument2 pagesIRACDiya MalNo ratings yet

- Moot Arguments 2 - Fam LawDocument8 pagesMoot Arguments 2 - Fam LawJUBARAJ MUKHERJEE 2247259No ratings yet

- MOHD. HANIF QUARESHI and OTHERS V STATEDocument18 pagesMOHD. HANIF QUARESHI and OTHERS V STATEpernaNo ratings yet

- MemoDocument6 pagesMemojissy rajishNo ratings yet

- Jamuna Das Vs Ram AutarDocument12 pagesJamuna Das Vs Ram AutarviraatNo ratings yet

- Dhanraj Pillay and Others V Hockey IndiaDocument4 pagesDhanraj Pillay and Others V Hockey IndiaEswar StarkNo ratings yet

- 13TH KIIT INTRA RespoDocument20 pages13TH KIIT INTRA RespoDinesh PatraNo ratings yet

- Memorial Appeal PDFDocument12 pagesMemorial Appeal PDFJay Tamakuwala0% (1)

- IBC Notes PDFDocument46 pagesIBC Notes PDFbhioNo ratings yet

- Moot For RespondentDocument14 pagesMoot For RespondentASangeetha PriyaNo ratings yet

- Before The Hon'Ble Supreme Court of Odisha: Internal Assignment Madhusudan Law University, CuttackDocument17 pagesBefore The Hon'Ble Supreme Court of Odisha: Internal Assignment Madhusudan Law University, CuttackRISHITA RAJPUT SINGHNo ratings yet

- Petitioner Cover Page For PrintDocument1 pagePetitioner Cover Page For Printrikitasshah100% (1)

- 3 Ouster From CoparcenaryDocument10 pages3 Ouster From CoparcenaryRadheyNo ratings yet

- Defendant Memorial PDFDocument15 pagesDefendant Memorial PDFbbbbbNo ratings yet

- Moot Memorial Rough On Medical Negligence and State Vicarious LiabilityDocument26 pagesMoot Memorial Rough On Medical Negligence and State Vicarious LiabilitySambhav PatelNo ratings yet

- Case LawDocument15 pagesCase LawPridhi SinglaNo ratings yet

- Memorial For RespondentDocument26 pagesMemorial For RespondentharjasNo ratings yet

- 1st Shri Nirmala Devi Bam Respondent SideDocument17 pages1st Shri Nirmala Devi Bam Respondent Sideuttkarsh singhNo ratings yet

- Campus Law Centre Freshers Induction Moot 2015Document13 pagesCampus Law Centre Freshers Induction Moot 2015Shubham Nath33% (3)

- Moot Memorial - Case 3 - RespondentDocument25 pagesMoot Memorial - Case 3 - RespondentAbhi0% (1)

- Moot ProblemDocument16 pagesMoot ProblemPrishu SharmaNo ratings yet

- Public Interest Litigation No. /2021 - Sanjeev Kumar SinghDocument44 pagesPublic Interest Litigation No. /2021 - Sanjeev Kumar SinghSanjeev SinghNo ratings yet

- Memorial RespondentDocument27 pagesMemorial RespondentChirag YadavNo ratings yet

- Transfer of PropertyDocument5 pagesTransfer of PropertyVishrut KansalNo ratings yet

- Case 5 Satish Chander Ahuja v. Sneha AhujaDocument18 pagesCase 5 Satish Chander Ahuja v. Sneha AhujaNitin GoyalNo ratings yet

- State of UP v. Ram SwarupDocument16 pagesState of UP v. Ram SwarupShadan SyedNo ratings yet

- Mayadevi Vs Jagdish PrasadDocument9 pagesMayadevi Vs Jagdish PrasadKishan PatelNo ratings yet

- Civil Suit Under THE Section 20 OF THE Code OF Civil ProcedureDocument12 pagesCivil Suit Under THE Section 20 OF THE Code OF Civil ProcedureShubham YadavNo ratings yet

- Retracted ConfessionDocument19 pagesRetracted ConfessionMohd YasinNo ratings yet

- 5TH Novice Moot Court CompetitionDocument16 pages5TH Novice Moot Court Competitionajay narwalNo ratings yet

- Kharak Singh Vs Cockroch LTD Plaintiff MOOT CaseDocument12 pagesKharak Singh Vs Cockroch LTD Plaintiff MOOT CaseRiddhi FuriaNo ratings yet

- Moot Court 3rd - Sampat v. Phad Behalf of PetitionerDocument13 pagesMoot Court 3rd - Sampat v. Phad Behalf of Petitionersampat phad100% (1)

- Moot 3 - JaiyDocument18 pagesMoot 3 - JaiyJaiy ChandharNo ratings yet

- Contract MemorialDocument15 pagesContract MemorialPriya100% (1)

- I T H Supreme Court of India at D: M B AppellantDocument12 pagesI T H Supreme Court of India at D: M B AppellantAmit kayallNo ratings yet

- Moot Problem (7th Sem)Document5 pagesMoot Problem (7th Sem)36 Mohd AnasNo ratings yet

- Air 2006 SC 3275Document3 pagesAir 2006 SC 3275Anant KulkarniNo ratings yet

- 5th Year Moot 1 PropsDocument9 pages5th Year Moot 1 PropsSarthak SharmaNo ratings yet

- Case Comment Thulia Kali v. State of Tamil NaduDocument4 pagesCase Comment Thulia Kali v. State of Tamil NaduVivek Gutam0% (1)

- Moot 1 Respondent - DeepaliDocument13 pagesMoot 1 Respondent - DeepalideepaliNo ratings yet

- Whether The Amended Sections 354 and 375 of The Sindhian Penal Code, 1860, Are Violative of Articles 14 and 15 of The Constitution of Sindhia?Document5 pagesWhether The Amended Sections 354 and 375 of The Sindhian Penal Code, 1860, Are Violative of Articles 14 and 15 of The Constitution of Sindhia?Db DbNo ratings yet

- Final Memorial)Document16 pagesFinal Memorial)Tushar Bhardwaj0% (1)

- Nopany Limited Vs Santokh SinghDocument9 pagesNopany Limited Vs Santokh SinghpranjalNo ratings yet

- Surjit Kaur V Garja Singh PDFDocument4 pagesSurjit Kaur V Garja Singh PDFAbhimanyu Singh100% (1)

- Project Topics On Conflict of LawsDocument3 pagesProject Topics On Conflict of Lawsalam amarNo ratings yet

- Code-A1: Civil Appeal No. of 2019Document23 pagesCode-A1: Civil Appeal No. of 2019Suryanshi GuptaNo ratings yet

- Company Law 2021bcl0001 Memorial-1Document12 pagesCompany Law 2021bcl0001 Memorial-1Akankshya Kaushik MishraNo ratings yet

- S B Lal PlaintDocument9 pagesS B Lal PlaintZahid HashmiNo ratings yet

- CaveatDocument4 pagesCaveatZahid HashmiNo ratings yet

- RIL's Application To File Additional DocumentsDocument5 pagesRIL's Application To File Additional DocumentsZahid Hashmi0% (1)

- Memorial For The PetitionerDocument44 pagesMemorial For The PetitionerZahid Hashmi0% (1)

- Application For Additional Documents - 05.05.2014 (Execution Version - App. No. 1)Document5 pagesApplication For Additional Documents - 05.05.2014 (Execution Version - App. No. 1)Zahid Hashmi100% (1)

- ArrestDocument26 pagesArrestZahid HashmiNo ratings yet

- Criminal CourtsDocument22 pagesCriminal CourtsZahid HashmiNo ratings yet

- Memorial On Behalf of AppellantDocument37 pagesMemorial On Behalf of AppellantZahid Hashmi64% (14)

- CPC AssignmentDocument24 pagesCPC AssignmentZahid HashmiNo ratings yet

- IosDocument32 pagesIosZahid HashmiNo ratings yet

- Memorial On Behalf of The PetitionerDocument17 pagesMemorial On Behalf of The PetitionerZahid HashmiNo ratings yet

- Security CouncilDocument35 pagesSecurity CouncilZahid Hashmi0% (1)

- Memorial On Behalf of The RespondentDocument17 pagesMemorial On Behalf of The RespondentZahid Hashmi100% (1)

- Data Cleaning With SSISDocument25 pagesData Cleaning With SSISFreeInformation4ALLNo ratings yet

- Argidius Call For BDS ProposalDocument8 pagesArgidius Call For BDS ProposalEmmanuel Alenga MakhetiNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- Broker Name Address SegmentDocument6 pagesBroker Name Address SegmentabhaykatNo ratings yet

- Inventory Control KaizenDocument32 pagesInventory Control KaizenAriel TaborgaNo ratings yet

- Creating A Winning Day Trading Plan by Jay WiremanDocument43 pagesCreating A Winning Day Trading Plan by Jay WiremanlowtarhkNo ratings yet

- 116Document20 pages116Nikhil JainNo ratings yet

- Myers & Briggs' 16 Personality Types: Infp EnfpDocument4 pagesMyers & Briggs' 16 Personality Types: Infp Enfpmyka ella jimenezNo ratings yet

- OHSA Field Safety Manual PDFDocument265 pagesOHSA Field Safety Manual PDFNaeem IqbalNo ratings yet

- Industrial Relations Act 1967 MalaysiaDocument5 pagesIndustrial Relations Act 1967 MalaysiaSeekHRHelp.comNo ratings yet

- Jetro Restaurant Depot AgreementDocument28 pagesJetro Restaurant Depot AgreementUFCW770No ratings yet

- Gem Procurement ManualDocument16 pagesGem Procurement ManualHari AnnepuNo ratings yet

- Leading Through Digital Disruption AmazonDocument13 pagesLeading Through Digital Disruption AmazonMaham Tariq0% (1)

- Shiny Hill Farms Case StudyDocument2 pagesShiny Hill Farms Case StudyDana WilliamsNo ratings yet

- Final COP-Section 1Document86 pagesFinal COP-Section 1Arbaz KhanNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

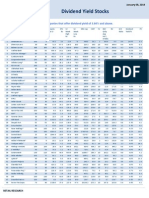

- High Dividend Yield StocksDocument3 pagesHigh Dividend Yield StockskaizenlifeNo ratings yet

- Indoco Annual Report FY16Document160 pagesIndoco Annual Report FY16Ishaan MittalNo ratings yet

- Chapter 7 Correction of Errors (II) TestDocument6 pagesChapter 7 Correction of Errors (II) Test陳韋佳No ratings yet

- ORR TemplateDocument13 pagesORR TemplateDel Valle MauroNo ratings yet

- CBOK 2015 Stakeholder Overview For Institutes - June 2014Document10 pagesCBOK 2015 Stakeholder Overview For Institutes - June 2014danielaNo ratings yet

- Kaizen Definition & Principles in Brief: A Concept & Tool For Employees InvolvementDocument5 pagesKaizen Definition & Principles in Brief: A Concept & Tool For Employees InvolvementMuna EyobNo ratings yet

- Deloitte Uk Deloitte Financial Advisory Global Brand Guidelines and Toolkit PDFDocument73 pagesDeloitte Uk Deloitte Financial Advisory Global Brand Guidelines and Toolkit PDFDavor BudimirNo ratings yet

- SBI ProjectDocument82 pagesSBI Projectchandan sharmaNo ratings yet

- Application For Leave CSC Form No. 6: 1. Agency 2. Name (Last) (First) (Middle) Deped Cabanatuan CityDocument1 pageApplication For Leave CSC Form No. 6: 1. Agency 2. Name (Last) (First) (Middle) Deped Cabanatuan CityJean Claudine MandayNo ratings yet

- Group Asignment Questions LawDocument3 pagesGroup Asignment Questions LawKcaj WongNo ratings yet

- Design Technology Project Booklet - Ver - 8Document8 pagesDesign Technology Project Booklet - Ver - 8Joanna OlszańskaNo ratings yet

- Test Case DesignDocument30 pagesTest Case Designapi-19979194No ratings yet

- Dear Customer Welcome To JS Bank E-Statement !Document3 pagesDear Customer Welcome To JS Bank E-Statement !Murtaza AhmedNo ratings yet

- Twofour54 Tadreeb Corporate Overview PDFDocument17 pagesTwofour54 Tadreeb Corporate Overview PDFSolo PostNo ratings yet