Professional Documents

Culture Documents

Trend 20140808

Uploaded by

nikaro1989Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trend 20140808

Uploaded by

nikaro1989Copyright:

Available Formats

File <Finan

Sheet <TTK-comm,Trend>

ROW85

Shareholders equity

No point in looking at this.

ROW92

NCL

Growth rates are significantly different. In first 2 years, it had borrowed for

new projects and then repaid

ROW94

Current Liabilities:

Reducing

1. OCL is not important

2. Trade Creditors, growth rate is coming. This confirms what we saw int he comm

on-size.

ROW101

Assets

FAs (ROW104) increasing faster than total assets (ROW 103)

! Check Fixed-Asset T/o ratio is increasing / decreasing

ROW110

Cash Equivalents

Not important

ROW114

Inventories

Inventories is coming down over the previous year. we are adding inventories at

slower rate. However in Common trend, % of total was increasing.

In this case, we're able to forecast.

Inv (as % assets) increasing

Inv Growth rate decreasing

When will additons to inventory come down?

1. Adjusting prod to demand better

2. Could be offering discounts to customers

<Refer Pg3 of phy notes 20140808>

ROW114 vs ROW124

Inventory growth rate > Sales growth rate

Acceptability of products are detoritating over time

ROW115

Receivables

Drastically reducing

I've actually offered lesser credit period to my customer.

In 1st year, Sales 56%, Recivables24%.

Next year roughly the same.

This means that bargaining period has coming down

Similarly refer 3rd and 4th years.

Over the last 3 years, I'm increasing the credit period given to my customers. M

y bargaining power with the customer has been reducing over the years (common si

ze statements didn't capture this)

Our bargaining power is actually coming down

ROW94 and ROW124

Creditors growth rate and Sales growth rate

Ideally, We want creditors > Sales Longer credit from supplier. Ideally we would

like this or atleast remain constant

In 2014, -4% sales < Creditors -2% bargaining power is increased

Grand final summary:

Poor acceptability of its products

1. when looking [OPM-NPM], look at taxes etc.

Income tax is growing slower my sales. This confirms what we saw in the common s

ize.

Income tax expense is coming down. Growth rate IT < Growth rate of sales.

2. The most year, there have been sharp reduction in fina cost, and sharp increa

se in your other income. Other income is relatively easy to manipulate. Companie

s try to maintain their net profit by tinkering with other income. Results are c

onsidered less reliable when GP, OP is reducing, but NP is growing

3. Finance cost can come down because:

a. Rate of int is coming down

Good, funding cost is coming down. Take more and more projects.

b. Amt of borrowed is coming down

Can't definitely say, there could be impact of ROE because of low levera

ge. The more the business borrows, the more risky it becomes for

shareholders.

We can't conclude now

Super-Grand-Final Summary:

Its facing problem with core business. Unable to maintain its profitablilty, bar

gaining power with Cust and suppliers. This deterioration has been steadily happ

ening over time.

Its going to show up in lower asset efficiency

<Refer phy notes 20140808 Pg3>

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Guest SlidesDocument474 pagesGuest Slidesnikaro1989No ratings yet

- Total Quality Management - TQMBH14-5: Session 06 Benchmarking (Case) + QC Tools (Old & New)Document8 pagesTotal Quality Management - TQMBH14-5: Session 06 Benchmarking (Case) + QC Tools (Old & New)nikaro1989No ratings yet

- Managerial Ethics End Term Exam (Academic Year 2015-16)Document8 pagesManagerial Ethics End Term Exam (Academic Year 2015-16)nikaro1989No ratings yet

- Total Quality Management - TQMBH14-5: Session 05 COPQ (Cases) + Benchmarking (Concepts)Document14 pagesTotal Quality Management - TQMBH14-5: Session 05 COPQ (Cases) + Benchmarking (Concepts)nikaro1989No ratings yet

- ISDCS Outline - 2015Document5 pagesISDCS Outline - 2015nikaro1989No ratings yet

- Session 9 21Document20 pagesSession 9 21nikaro1989No ratings yet

- Total Quality Management - TQMBH14-5: Session 01 Concepts + Organizational Issues & Quality CultureDocument16 pagesTotal Quality Management - TQMBH14-5: Session 01 Concepts + Organizational Issues & Quality Culturenikaro1989No ratings yet

- TQMBH14-5 - Session 04Document28 pagesTQMBH14-5 - Session 04nikaro1989No ratings yet

- Quality ProblemsDocument7 pagesQuality Problemsnikaro1989No ratings yet

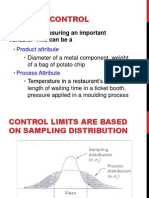

- Process Control: Starts With Measuring An Important Variable. This Can Be ADocument40 pagesProcess Control: Starts With Measuring An Important Variable. This Can Be Anikaro1989No ratings yet

- A01 REND6289 10 IM FM JLDocument4 pagesA01 REND6289 10 IM FM JLRicardo Martínez CortésNo ratings yet

- Prasanna Chandra Chapter 6 SolutionDocument14 pagesPrasanna Chandra Chapter 6 Solutionnikaro198983% (6)

- National Rail Passenger Corporation (Amtrak)Document2 pagesNational Rail Passenger Corporation (Amtrak)nikaro1989No ratings yet

- Intaglio 2015 GIC Roud 2Document5 pagesIntaglio 2015 GIC Roud 2nikaro1989No ratings yet

- 3SEM07Document18 pages3SEM07nikaro1989No ratings yet

- Application GuidelinesDocument5 pagesApplication Guidelinesnikaro1989No ratings yet

- Marketing Research: Questionnaire Construction Process: Gregory J. Baleja Alma CollegeDocument24 pagesMarketing Research: Questionnaire Construction Process: Gregory J. Baleja Alma Collegenikaro1989No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CFA Program Exam Results: Your Performance On The ExamDocument2 pagesCFA Program Exam Results: Your Performance On The ExamVaibhav BhatiaNo ratings yet

- Project ReportDocument21 pagesProject Reportmasif_janooNo ratings yet

- Business Operations Manager in Dallas TX Resume Natasha EdwardsDocument2 pagesBusiness Operations Manager in Dallas TX Resume Natasha EdwardsNatashaEdwardsNo ratings yet

- Praktiker ThesisDocument5 pagesPraktiker Thesis1238912No ratings yet

- Objection Preliminary Objection of The Ad H - ObjectionDocument18 pagesObjection Preliminary Objection of The Ad H - ObjectionDistressedDebtInvestNo ratings yet

- Paper 7Document10 pagesPaper 7mknatoo1963No ratings yet

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaNo ratings yet

- Fortis HealthcareDocument13 pagesFortis HealthcarePrithvi AcharyaNo ratings yet

- Conflict Full TextDocument392 pagesConflict Full TextAlvin PateresNo ratings yet

- Solution To Workshop No. 1Document10 pagesSolution To Workshop No. 1Bryan PazNo ratings yet

- CHAPTER-2 Business Plan.Document40 pagesCHAPTER-2 Business Plan.mohammedkasoNo ratings yet

- Wec14 01 Que 20240113Document32 pagesWec14 01 Que 20240113randyrengaoleiNo ratings yet

- UPASDocument3 pagesUPASimteaj39730% (1)

- ACFM - Outline - Semester 7 - 2020-21Document6 pagesACFM - Outline - Semester 7 - 2020-21Nishit KalawadiaNo ratings yet

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButDocument18 pagesCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshNo ratings yet

- Spouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsDocument4 pagesSpouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsdenNo ratings yet

- Investment Banking Origination & Advisory TrendsDocument29 pagesInvestment Banking Origination & Advisory TrendsNabhan AhmadNo ratings yet

- Chapter - 5Document9 pagesChapter - 5Maruf AhmedNo ratings yet

- The Hartford Provision Company v. United States, 579 F.2d 7, 2d Cir. (1978)Document7 pagesThe Hartford Provision Company v. United States, 579 F.2d 7, 2d Cir. (1978)Scribd Government DocsNo ratings yet

- 12.5 - Practice Test SolutionsDocument15 pages12.5 - Practice Test SolutionsCamilo ToroNo ratings yet

- Hire PurchaseDocument49 pagesHire PurchasePriya SinghNo ratings yet

- Landlord Tenant Frequently Asked Questions CLC 11 1Document3 pagesLandlord Tenant Frequently Asked Questions CLC 11 1api-477465158No ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoAnthony Yap67% (3)

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- Strategic Management Chap008Document60 pagesStrategic Management Chap008rizz_inkays100% (2)

- Power GridDocument397 pagesPower Gridrajesh.bhagiratiNo ratings yet

- Pay Revision Circular of Executives W.E.F. 01.01.2017Document10 pagesPay Revision Circular of Executives W.E.F. 01.01.2017RJ Laxmikaant100% (1)

- Description: Tags: 0527ApplicReceivSchbySource0203Sept03Document170 pagesDescription: Tags: 0527ApplicReceivSchbySource0203Sept03anon-244892No ratings yet

- Common Stock Financing ProblemsDocument7 pagesCommon Stock Financing ProblemsSoo CealNo ratings yet

- Confirmation PDFDocument4 pagesConfirmation PDFAnonymous Oe0eyXyWENo ratings yet