Professional Documents

Culture Documents

Financial Modeling

Uploaded by

Bishaw Deo MishraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Modeling

Uploaded by

Bishaw Deo MishraCopyright:

Available Formats

TM

Investment Banking Institute

Providing Financial Training Solution to Capital Market Aspirants

Certification in

Financial Modeling and Company Valuation

From Investment Banking Institute

Basic and Advance Excel Specialist

from MICROSOFT (USA)

IBInstitute

Investment Banking Institute

Tel:. 011-42244126

www.globalresearch.org.in

www.ibinstitute.in

47/16, Rajendra Park Marg,

Opp. Rajendra Place Metro Station,

New Delhi-110060

-1-

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Investment Banking Institute (IB Institute) is an "independent and autonomous training institute which offers advanced level

practical training on Advance Excel, Fundamental Analysis, Equity Research, Financial Modeling, Project appraisal, Company

Valuation, Mergers and Acquisition and Advance Macro (VBA) to Working professionals and students.

IB Institute was founded in 2009 by the ex-consultants and investment bankers having experience from top notch Investment

Banking and consulting firms in the World. IB Institute provides instructor-led (Live) training and e-learning (Online) courses

which develops the competitive profiles of the students for the interview and the working professionals on the job.

After two years of successful completion, IB Institute is proud of training over 600 students in over 40 batches. The reason for

success is the passion for teaching as well as exceptional experience of our trainers who are imparting their best and sharing their

live experience. We ensure to make the session more live, provide more exposure with real issues to make a great learning

experience for everyone.

Our teaching methods ensure maximum comprehension in the shortest possible time. We provide a dynamic learning

environment with lots of practical hands on exercises and real world examples.

In general, all high-paying finance jobs will require knowledge and skills found in our syllabus for the interview and on the job.

Reading the annual report, Financial Statement analysis, Forecasting, Valuation and financial modeling are an integral part of the

day-to-day responsibilities of any professional working in the main stream Finance.

We offer our training program in the workshop format. All these workshop are interactive based on real life

situation.

Beside, we make full use of, Participatory Exercises, Case Studies, and Practice Sessions. The Participant

are given Comprehensive Reference Material & workbook witch is used by them during the workshop. The

material also serves as a useful guide in future.

Note: Candidate well be designing these models from scratch .

Course Highlights:1.Basic and Adv. Excel

2.Financial Accounting and Financial Statement Analysis

3.Navigating the Annual Report

4.Financial Modeling using Adv. Excel

5.Valuation Techniques (DCF, Relative Valuation, Transaction)

6.Mergers and Acquisition

7.Visual Basic of Application (Macro in Excel)

Industries where Financial Modeling is Used:1. Investment Banking

6. Corporate Finance

2. Project Appraisal

7. Knowledge Process Outsourcing

3. Private Equity

8. Asset Management

4. Hedge Funds

9. Rating Agencies

5. Equity Research

10. Consultancy

Companies:1. Copal Partners

2. Evalueserve

3. Adventity

4. Ernst & Young

5.Amba Research

6. Aranca

7. SBI Capital

8. Barclays Capital

9. Cians Anlytics

10. Crisil

11. D E Shaw

12. ICRA

13. Analec Research

14. pipal Research

15. Smart Cube

16. Transparent Value

17. Morning Star

18. McKinesy

19. JP Morgan

20. Gridstone Research

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 1 & 2 Basic and Advanced Excel

Here at IB Institute, we are specialists in offering expert level training

courses for you to learn Advanced Excel and other great features of Excel.

As part of our Advanced Excel training you will gain the necessary

knowledge required for the efficient use of the tools and other exciting

features which this outstanding software has to offer.

Program is not about the basic of Adv Excel. However, it covers an

Astonishing level of depth and width. On successful completion the

participant will be able to perform complex calculations, build

multifaceted models, and perform complex data analysis and present

outputs with very powerful user interfaces.

A brief of Functions covered

Financial Function:Date & Time:Math & Trig:-

SLN,SYD, DB,DDB, VBD, PPMT,IPMT,IRR,NPV,RATE, XIRR,MIRR, FV,PV

Date, Day, Year, Days360, EDATE, EOMONTH, TODAY, YEARFRAC

ABS, EVEN, RAND, RANDBETWEEN, ROUND, ROUNDUP, ROUNDDOWN, SUM, SUMIF,

SUMIFS, TRUNC.

Statistical Functions:Average, Averageifs, Count, Counta, Countif, Countifs, Max, Min, Median, Mod, Rank, Large

Lookup & Reference Functions:- Address, Choose, Hlookup, Index, Indirect, Vlookup, lookup, Hyperlink, Match, Offset,

Transpose.

Database Functions:Dcount, Dcounta, Dmax, Dmin, Dsum

Text Functions:Right, Left, Mid, Find, Search, Cell, Len, Lower, Upper, Proper, Replace, Rept, substitute,

trim etc.

Logical:IF, If within if (Nesting IF), If with and & or,

Information:cell, isblank, iferror, iserror, isnumber, iseven, isna

Not only this but much more:- There is lot more to go.

Day 3

Navigating the Annual Reports

Reading and Navigating the Financial Statements:

Financial reports such as the AR, 10-K, 10-Q, 8-K and various others are the communication tools of business for spreading

the information to the share holders and other analysts. Having proper knowledge of navigating the reports is a

fundamental facet of efficient financial analysis. It is very crucial to be an expert in indentifying the important and right

information in the latest reports available.

The Financial reports may be quite different from each other but they do follow a standard format and presentation with

some differences.

IB Institute's Reading and navigating financial reports course is designed to accelerate the finance professional's comfort

level with the most important financial reports, and serves as an important tool for finance professionals and students to

gain more insight to the Financial Statements and gain knowledge about various types of report and press releases.

Objective of the Course:

To increase the efficiency, accuracy and speed to find the right information in the reports.

Learn to interpret the various schedule and find various hidden information

Learn various types and layout and composition of financial reports like 10-K, 10-Q, AR, 8-K,20-F etc.

Gain insight into the financial statements

Learn to recognize the structure of the various financial reports to improve efficiency and accuracy on the job.

Taught using clear, easy-to-follow materials that bridge academic concepts with how they are presented in

financial reports.

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 4 Financial Statements Analysis and Accounting

Financial and Valuation Modeling requires a solid understanding of accounting and financial statement interaction.

Accordingly, IB Institute has developed Crash Course in Accounting & Financial Statement Analysis, which is very

important for students with a limited knowledge of accounting or who wants to refresh their accounting concepts in a fast

track mode without leaving the important concepts behind.

If you are looking for a Debit / Credit discussion, then this is not the right place for you. We shall focus more on inter linkages

between the Financial statements and analytical perspective.

Our in-depth course in Financial Statements helps you learn and master the subject which is actually very critical to the start

of your finance career. This course will make you a Future Finance Professional not an accountant as the focus is on analysis,

proper interpretation and check manipulation of accounting numbers to get closer to the real No's required for analysis and

valuation.

1. Introduction to Income Statements:

- Understand various heads of IS like:- (Revenue, COGS, Gross Profit, SG&A, Operating Income (EBIT) & EBITDA, Interest

Expense and Income, Pre-Tax Income, Taxes (Current & Deferred, Permanent and Temporary)

- EPS using Treasury method and incorporate the effects of Dilutive Securities: Shares Outstanding (Basic and

Diluted), Earnings per Share, Dividend per share, Various forms of Dividend

- Effects of Various dilutive securities, simple and complex capital structure.

(Also understand various accounting methods used and their implication to the Financial Statements)

2. Introduction to Balance Sheet:

- Learn the various heads and formats of Balance Sheet: Current Assets (Cash, Marketable securities (Trading Securities,

Hold to maturity, Available), Inventories, Accounts Receivables, Pre-paid Expenses)

- Valuation issues of Fixed Assets (PPE), Long-Term Assets (Equity Investments)

- Method to calculate Goodwill and Intangibles and the calculation of good and capitalization and expensing issues

- Current Liabilities (Accounts Payable and Deferred Revenue, unearned income, Other accrued exp)

- Long-Term Liabilities (Debt and Capital Leases)

- What is Minority Interest ( Why does this item come in Balance sheet, and income statement (Methods of Inter-corporate

investments)

- Equity components: Equity (Common Stock, Additional Paid in Capital, Retained Earnings, Treasury Stock and Other

Comprehensive Income)

3. Introduction to Cash Flow Statements

- Learn about various Heads of Cash Flow Statements with Numerical examples.

Review of Cash Flow Statement including definition, importance and application of:

- CFO: Cash Flow from Operations How changes in Working capital effects the Cash FLow

- CFI: Cash Flow from Investing (Capital Expenditures, Acquisitions, Divestitures)

- CFF: Cash Flow from Financing (Dividends, Stock Issuances, Repurchases, Debt Borrowings & Paydown)

- Understand why the Cash Flow Statement is the "ultimate balancer and equalizer"

4. Methods of Consolidation

1. Equity Method, Consolidation method, Proportionate method, Market or Cost method

2. Methods of consolidation after merger, good will calculation, treasury method for dilution calculation, purchase

method vs pooling of interest method

5. Financial Reporting vs Tax reporting

Reasons for Deferred tax, items which are treated differently in Financial Reporting and tax reporting treatment

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 6 Advance Financial Modeling Using Excel

Overview of the Program

Financial Modeling refers to the process of building a structure that integrates the Balance Sheet, Income Statement, Cash

Flow Statement and supporting schedules to enable decision making in areas like, Business Planning and Forecasting, Equity

Valuation, Credit Analysis/Appraisal, Merger/acquisition analysis, Project Appraisal etc. Trainees learn how to build full,

dynamic Financial Statement Projection models in Excel from scratch, using real case studies and sensitivity analyses.

Participants develop a model completely from scratch, inputting historical data and assumptions to project financial

statements using step-by-step instruction on selecting and developing appropriate projection drivers. At completion,

participants will have developed a complete and comprehensive three-statement model using various supporting

schedules.

Interactive, Step-by-Step Learning Approach:

Participants are given step by step instructions to build comprehensive models from scratch, the way it is done

on the job by the Investment Banker. They are directed to external documents and resources (like Annual

Report, Press Release, Quarter filings etc) needed for more information to make the model more accurate.

Key Learning Outcomes

Building comprehensive financial models from scratch for a Listed Company and Generic company.

Learn to define assumptions and make forecast for Income statement, Balance sheet and Cash Flow statements

with robust and highly complicated schedules.

Learn to integrate assumptions and drivers into financial models based on the information available in the

Annual report.

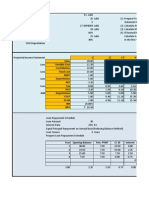

Design various supporting schedules of: Working Capital, Deferred Taxes, Property, plant and equipments /

Depreciation, Intangible Assets, Retained Earnings , and Debt & Interest

Financial Ratios Output Sheet

Perform sensitivity analysis using data tables, Spinners, Scroll bars

Perform scenario analysis using data validation, offset and choose

Excel techniques and shortcuts for financial modeling

Note: Candidate well be designing these models from scratch .

Day 5 Case study for Financial Projections and Various schedule and Assumptions:

This part deals with the excel application of what has been covered on day 1,2 and 3:

Project Income Statement, Balance sheet and cash flow statement with help

of assumption and schedules:

Learn to prepare waterfall schedule of Depreciation

Learn to Prepare Sales projection, schedules of working capital, capital

expenditures schedule

Project Deferred Tax, Intangible assets, Debt (Short term and Long term)

Learn to create scenarios and do sensitivity analysis

Objective of this session is to learn multiple ways of forecasting Financial Statements under

different situations and assumptions and how it is done in real life by Practitioners.

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 7 & 8 Discounted Cash Flow model (DCF) Modeling

Overview of the Program

Once the Financial Model is designed and Projections are made for the

Company. Now we learn the use of Financial Models in Valuations.

Valuation represents the heart of the investment banking and corporate

finance skill set. A solid foundation of Valuation tools is laid before

building valuation models. Participants are required to have the deep

knowledge of Valuation issues.

Following are the various conceptual issues of the valuation framework

Enterprise valuation vs. market valuation

Intrinsic valuation vs. relative valuation

Participants identify and analyze the important issues to the value

of an enterprise.

Understand and identify the treatment of Dilutive Securities

(Options, preferred stock, Warrants, Convertible Debt) to Enterprise

value.

Understand the impact of minority interests, debt, cash and

marketable securities

Comparable Company analysis Vs Comparable Transaction analysis

Key Learning Outcomes

When the theoretical frame work is laid down, the participants start learning to build a robust Discounted Cash Flow

(DCF) model which includes the calculations of FCFF, WACC, Terminal Value, Levered and un-levered Beta and Intrinsic

Value.

Participants learn how to build a professional, robust discounted cash flow (DCF) model in Excel from scratch, using

real case studies and sensitivity analyses.

Learn the difference between un-levered and levered free cash flows, and the implication on Enterprise value and

implied share price.

Learn to Project levered & unlevered Free cash flows in Excel of a given listed company by normalizing operating

profits.

Project working capital items (Accounts payables, Inventory, account payables etc), deferred taxes, capital expenditures,

and short term and long-term debt.

Calculate the projected terminal value using both the exit multiple and the growth in perpetuity approach and

implication to share price.

Use of CAPM to calculate the discount rate by deriving the cost of debt of equity.

Understand the role of capital structure in determining beta, the cost of equity, and ultimately WACC.

Understand use of beta and how to de-lever and re-lever beta and implication on WACC.

Calculate shares outstanding using the treasury stock method when Dilutive securities are ITM (In-the-Money)

Utilize the enterprise value to determine implied share prices.

Calculating net debt and treatment of debt equivalents such as preferred stock, convertible securities , capital leases ,

and minority interest

Calculating options and convertible securities using both the standard and treasury stock methods

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 9 & 10 Relative valuation modeling in Excel

Comparable Company Trading Analysis ('Comps') is the most basic but effective valuation tool used by investment

bankers and analyst. This technique used in all kinds of valuations. For example:- Private market valuation, IPO

valuation, comparative analysis, identifying potential targets for M&A etc

Establishes value of A Company and measures its performance vis--vis the operating and trading statistics of

company's peer group

Training Methodology:

Leaning Outcomes:

The participants are first explained how to select the Participants learn to select appropriate comparable

companies by evaluating operational, financial, size, and

Peer Group (Comparables) before building the

other

similarities

Models for Relative Valuation. In this part of the

Program, we shall learn to design the real Template Set evaluation benchmarks & select comparable

for Trading Combs which is actually used various

companies

Research companies.

Gather appropriate financial history and projections

Then we shall take 10 companies from world over for

Normalizing operating results and calculating LTM

relative valuations.

operating results

Then participants are directed to build superb comps

Exclude nonrecurring charges, normalize for stock option

models in Excel from scratch, using real case studies,

expense

industry best practices, and sensitivity analyses.

This model includes Switches, Output sheet, Standardize various expense classifications including

FIFO to LIFO inventory accounting

Valuations sheets, Currency Converter and forecasts.

Calculate shares outstanding using the treasury stock

method

Input financial data & calculate and interpret financial and

market ratios

Presenting trading comps by structuring output schedule

Selecting and Evaluating Appropriate Multiples (P/E Trailing

and forward, EBIT Multiple, EBITDA Multiple, P/B Multiple,

Revenue Multiple, PEG)

Calculate and interpret financial and market ratios Common

analytical challenges including Calandarization, nonrecurring

items, dilutive securities, and classification issues are addressed

using industry best practices.

Day 11 Transaction Valuation Techniques

The Comparable Transaction Analysis or Comparable Acquisition Analysis is based on the premise that

the value of a company or an asset can be estimated by analyzing the prices paid by purchasers of ownership

interests in reported comparable acquisitions.

The analysis provides a history of selected transactions either in one particular industry or in one area

where acquired companies have relatively similar characteristics in terms of economic drivers such as

business mix, customer base, distribution channels, industry dynamics, etc.

Transaction multiples define the prices which acquirers are willing to pay for control of the target company in

the context of an acquisition transaction. By applying transaction multiples to the financial results of the

company being analyzed, it is possible to determine a range of value.

Learning objective:

1. Company Description

2. Identification of Comparable companies

3. Computation of Equity Value

4.

5.

6.

7.

Determination of Net Debt Assumed

Calculation of Firm Value and share price

Calculation of LTM Net Income, EBITDA and EBIT

Computation of transaction multiples

Certification in Financial Modeling & Company Valuation

Using Excel and VBA 2 Months / 16 Days

Day 12 & 13 Mergers and Acquisition Analysis

Overview of the Program:

The participant are first explained the concepts of Merger and

acquisition.

Participant build a model of M&A to see the pro forma impact of

various scenario post merger

Understand the allocation of purchase price with Purchase

method of accounting post merger

Under the accretion-dilution in EPS after the merger in various

scenario after adjustments

Various methods for the payments (Stock based or cash based)

Prepare a comprehensive Merger Model

Design and Set up a control area for assumptions and drivers

Learn to deal with deal assumptions and various issues like (% cash vs. stock considerations, Purchase premium,

Asset write-ups, Advisory fees, Financing fees, and severance fees)

Use of Treasury method to calculate shares outstanding

Appropriate treatment of convertible securities like Options, Warrants, Convertible debt and Preferred stock

Calculate Goodwill while allocating Purchase price to assets after re-evaluation of the assets of the target company

Adjust the Balance sheet and prepare the pro-forma Balance Sheet

Calculating Sources & Uses of funds with making the operating & synergy projections

Calculate the EPS post merger after making the adjustments to Income statement and prepare the pro-forma Income

statements

Synergies required to break-even before and after tax if premium is paid

Sensitivity analysis: EPS accretion/dilution in stock vs. cash deal; interest rate assumptions, premium paid.

Analysis of contribution of Revenue, EBITDA, and Net Income post merger

This model is designed with very practical approach to see the impact of acquisition of one company by

another company after the real adjustments have been made to Financial Statements.

M&A Accretion/Dilution Modeling

Superb exhaustive accretion-dilution analysis

Buy side and sell side processes

Project the Consolidated Financial statements post merger and do the various adjustments for goodwill calculation

Handle the Fair market value write ups, advisory fees and financing fees and debt refinancing

Learn the proper treatment of various items like deferred taxes created in M&A and convertible securities and options.

Day 14 & 15 Basic and Advanced Macro (VBA)

1. Introduction to Macro

2. Recording Macro

3. Assigning Shortcuts to Macro Programs

4. Commands Do While, Do Until, Input Box, Msg Box, For Next, Looping

5. Worksheet Objects: Adding, Deleting, Renaming, Protection with Macro

6. Workbook Objects: Creating and Opening Workbooks, Saving and Closing Workbook

7. User Forms, User Defined Functions, Addins

Note: Practice Various Power full Macro Program in the Class.

You might also like

- Microsoft Power BI Cookbook by Greg DecklerDocument655 pagesMicrosoft Power BI Cookbook by Greg Decklermoisesramos100% (8)

- Keller SME 12e PPT CH01Document19 pagesKeller SME 12e PPT CH01NAM SƠN VÕ TRẦN100% (1)

- Financial ModellingDocument3 pagesFinancial ModellingSakshi Lodha100% (1)

- FCF Ch02 Excel Master StudentDocument24 pagesFCF Ch02 Excel Master Studentannu technologyNo ratings yet

- Course Pack For Actuarial Sciences and InsuranceDocument245 pagesCourse Pack For Actuarial Sciences and InsuranceZahra EjazNo ratings yet

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedtanhaitanhaNo ratings yet

- Corporate Ratings - 2006Document126 pagesCorporate Ratings - 2006dongavinoNo ratings yet

- 2010 Recruitment Day One: Banking Track Case StudyDocument25 pages2010 Recruitment Day One: Banking Track Case StudySimar DhillonNo ratings yet

- Quantitative Investment Analysis CFA Institute Investment SeriesDocument159 pagesQuantitative Investment Analysis CFA Institute Investment SeriesMuhamad ArmawaddinNo ratings yet

- BookDocument210 pagesBookapi-26992355No ratings yet

- VCSB - Financial Modelling Series (Apr & May 2021)Document9 pagesVCSB - Financial Modelling Series (Apr & May 2021)Via Commerce Sdn BhdNo ratings yet

- Artificial Intelligence Applied To Stock Market Trading A ReviewDocument20 pagesArtificial Intelligence Applied To Stock Market Trading A ReviewAbdellatif Soklabi100% (1)

- Accenture CFO Research Global PDFDocument47 pagesAccenture CFO Research Global PDFDeepak SharmaNo ratings yet

- Financial ModelingDocument16 pagesFinancial ModelingNidhy KhajuriaNo ratings yet

- ZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Document85 pagesZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Dylan AdrianNo ratings yet

- ITC Analysis FMDocument19 pagesITC Analysis FMNeel ThobhaniNo ratings yet

- Artificial Intelligence in FinanceDocument8 pagesArtificial Intelligence in FinancealainvaloisNo ratings yet

- Investments & RiskDocument20 pagesInvestments & RiskravaladityaNo ratings yet

- National Open University of Nigeria: Course Code:Mbf 716Document114 pagesNational Open University of Nigeria: Course Code:Mbf 716mentor_muhaxheriNo ratings yet

- Stock Prediction Using Twitter Sentiment Analysis: Anshul Mittal Anmittal@stanford - Edu Arpit Goel Argoel@stanford - EduDocument5 pagesStock Prediction Using Twitter Sentiment Analysis: Anshul Mittal Anmittal@stanford - Edu Arpit Goel Argoel@stanford - Edujbsimha3629No ratings yet

- Finance ProfilesDocument24 pagesFinance ProfilesHarveyNo ratings yet

- W Sharpe Full Course and ExamsDocument928 pagesW Sharpe Full Course and Examsmzubair42No ratings yet

- AFM Study Guide 2115Document15 pagesAFM Study Guide 2115RENJiiiNo ratings yet

- Financial Modeling NotesDocument191 pagesFinancial Modeling NotesPrajesh Aithal100% (1)

- ETF Flows and Market ReturnsDocument7 pagesETF Flows and Market ReturnstwilgaalNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- Facebook - Equity Research ReportDocument4 pagesFacebook - Equity Research Reportshubhashish sharmaNo ratings yet

- HeteroskedasticityDocument30 pagesHeteroskedasticityallswellNo ratings yet

- Pharmaceuticals Industry Comps TemplateDocument6 pagesPharmaceuticals Industry Comps TemplateManoj KumarNo ratings yet

- Excel Financial Modelling Examples Chapter 1Document20 pagesExcel Financial Modelling Examples Chapter 1sachin_chawlaNo ratings yet

- Writing A Journal Article: Guidance For Novice Authors: Continuing Professional DevelopmentDocument8 pagesWriting A Journal Article: Guidance For Novice Authors: Continuing Professional DevelopmentRajkumar35No ratings yet

- FM Ebook - Part 2-Financial ModellingDocument36 pagesFM Ebook - Part 2-Financial ModellingtejaasNo ratings yet

- Importing Text File in RDocument28 pagesImporting Text File in RRajkumar35No ratings yet

- AC2091 Commentary 2019Document31 pagesAC2091 Commentary 2019duong duongNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingPrashant Dhage100% (2)

- Corporate Finance Institute: Financial Modeling & Valuation Analyst (FMVA) Program OverviewDocument39 pagesCorporate Finance Institute: Financial Modeling & Valuation Analyst (FMVA) Program OverviewVictor CharlesNo ratings yet

- Unit 2. Investment Companies and Unit TrustDocument10 pagesUnit 2. Investment Companies and Unit TrustCLIVENo ratings yet

- Empirical Studies in FinanceDocument8 pagesEmpirical Studies in FinanceAhmedMalikNo ratings yet

- Financial ModelingDocument6 pagesFinancial Modelingrajeshdhnashire100% (1)

- Rose Mwaniki CVDocument10 pagesRose Mwaniki CVHamid RazaNo ratings yet

- Asset Management PresentationDocument27 pagesAsset Management PresentationSamer KahilNo ratings yet

- Financial Markets ModuleDocument248 pagesFinancial Markets ModuleTrường Nguyễn100% (2)

- Kyle Market Microstructure SyllabusDocument7 pagesKyle Market Microstructure SyllabusssdebNo ratings yet

- Actuary in BankDocument23 pagesActuary in BankAqilNo ratings yet

- Excel As A Tool in Financial ModellingDocument5 pagesExcel As A Tool in Financial Modellingnikita bajpaiNo ratings yet

- Banking Profitability DeterminantsDocument22 pagesBanking Profitability DeterminantsHussain Mohammed SaqifNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- Institute of Actuaries of India: Subject CT2 - Finance and Financial ReportingDocument6 pagesInstitute of Actuaries of India: Subject CT2 - Finance and Financial ReportingVignesh Srinivasan0% (1)

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- Investment Banking Investment Banking2122Document16 pagesInvestment Banking Investment Banking2122vishal13889100% (2)

- Investments and Risks For Sustainable Development - Curs ASEDocument280 pagesInvestments and Risks For Sustainable Development - Curs ASEluiza StefNo ratings yet

- Sector Specific Ratios and ValuationDocument10 pagesSector Specific Ratios and ValuationAbhishek SinghNo ratings yet

- Financial Econometrics-Mba 451F Cia - 1 Building Research ProposalDocument4 pagesFinancial Econometrics-Mba 451F Cia - 1 Building Research ProposalPratik ChourasiaNo ratings yet

- EDA Credit Case StudyDocument21 pagesEDA Credit Case Studykamesh008100% (1)

- Lecture 1Document67 pagesLecture 1Rochana RamanayakaNo ratings yet

- Guidelines IRRBB 000Document19 pagesGuidelines IRRBB 000Sam SinhaNo ratings yet

- 10 Must-Know Topics To Prepare For A Financial Analyst InterviewDocument3 pages10 Must-Know Topics To Prepare For A Financial Analyst InterviewAdilNo ratings yet

- Limitations of Ratio AnalysisDocument9 pagesLimitations of Ratio AnalysisThomasaquinos Gerald Msigala Jr.No ratings yet

- Financial Modeling & Analysis Course, Ottawa - The Vair CompaniesDocument4 pagesFinancial Modeling & Analysis Course, Ottawa - The Vair CompaniesThe Vair CompaniesNo ratings yet

- Financial Risk Modelling and Portfolio Optimization with RFrom EverandFinancial Risk Modelling and Portfolio Optimization with RRating: 4 out of 5 stars4/5 (2)

- A Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBAFrom EverandA Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBARating: 3 out of 5 stars3/5 (1)

- Cpfa Curriculum PDFDocument4 pagesCpfa Curriculum PDFBishaw Deo MishraNo ratings yet

- Education: Karthick JaganathanDocument3 pagesEducation: Karthick JaganathanBishaw Deo MishraNo ratings yet

- Ob& HRDDocument30 pagesOb& HRDBishaw Deo MishraNo ratings yet

- Lta FundamentalsDocument2 pagesLta FundamentalsBishaw Deo MishraNo ratings yet

- Acc ProjectDocument131 pagesAcc ProjectBishaw Deo MishraNo ratings yet

- Bdmishra Sap Resume 1Document3 pagesBdmishra Sap Resume 1Bishaw Deo MishraNo ratings yet

- Stock Fusion PluginDocument25 pagesStock Fusion PluginKrishnamurthy HegdeNo ratings yet

- PSRTI Sustainable Development Goals Seminar 4Document3 pagesPSRTI Sustainable Development Goals Seminar 4Nejema Perualila100% (1)

- Office Assistant ResumeDocument7 pagesOffice Assistant Resumeafjzcgeoylbkku100% (2)

- DC-SIM User Guide PDFDocument117 pagesDC-SIM User Guide PDFSri Nithin KolliparaNo ratings yet

- PowerShare Products GuideDocument50 pagesPowerShare Products GuidescriNo ratings yet

- G3335-90158 MassHunter Offline Installation GCMSDocument19 pagesG3335-90158 MassHunter Offline Installation GCMSlesendreNo ratings yet

- Excel-Based Simulation On Problems of Two-Stage Assembly Line QueuingDocument5 pagesExcel-Based Simulation On Problems of Two-Stage Assembly Line QueuingYeoh KhNo ratings yet

- Stoichiometry Manual PDFDocument32 pagesStoichiometry Manual PDFAbdi Putra RamadhanNo ratings yet

- PSSE 34 Webinar Q ADocument7 pagesPSSE 34 Webinar Q Achandv7100% (1)

- Excel Derby User ManualDocument8 pagesExcel Derby User ManualyaffewebNo ratings yet

- Expense Sheet Irf317Document3 pagesExpense Sheet Irf317Basavaraj GadadavarNo ratings yet

- How To Extract Text Based On Font Color From A Cell in ExcelDocument13 pagesHow To Extract Text Based On Font Color From A Cell in ExcelJohn Vladimir A. BulagsayNo ratings yet

- Global Financial Modeling Guidelines: Developing Best-In-Class Financial ModelsDocument29 pagesGlobal Financial Modeling Guidelines: Developing Best-In-Class Financial ModelsDodge OnaNo ratings yet

- Documents - Pub - bsc6900 Umts v900r015c00spc500 Used Reserved Parameter ListDocument420 pagesDocuments - Pub - bsc6900 Umts v900r015c00spc500 Used Reserved Parameter ListMyo Lwin SoeNo ratings yet

- Tabular and Graphical Descriptive Techniques Using MS-ExcelDocument20 pagesTabular and Graphical Descriptive Techniques Using MS-ExcelVarun LalwaniNo ratings yet

- Project Complexity and Risk Assessment Excel TemplateDocument9 pagesProject Complexity and Risk Assessment Excel TemplateenesNo ratings yet

- SmartPlant 3D Curriculum Path Training Guidelines V2011 R1Document26 pagesSmartPlant 3D Curriculum Path Training Guidelines V2011 R1pingu365No ratings yet

- MS Access 2007 TutorialDocument108 pagesMS Access 2007 TutorialMohammad Shaniaz IslamNo ratings yet

- Power Shell Scripts 1Document8 pagesPower Shell Scripts 1Peter TatNo ratings yet

- Empowerment Technologies Final ExamDocument2 pagesEmpowerment Technologies Final ExamWenely I. CuaresNo ratings yet

- Syllabus - FIRE 626 - Spring 2012Document8 pagesSyllabus - FIRE 626 - Spring 2012blitzkreeigjayNo ratings yet

- SPRD How To Add Components For SP3DDocument45 pagesSPRD How To Add Components For SP3Dgiorivero100% (2)

- PI DataLink User Guide PrintableDocument128 pagesPI DataLink User Guide PrintableJoeyNo ratings yet

- Centum VP - Using Centun VPDocument42 pagesCentum VP - Using Centun VPsilva_rrdsNo ratings yet

- Driveworks Feature Comparison PDFDocument2 pagesDriveworks Feature Comparison PDFKoen BidlotNo ratings yet

- How To Track Employee Training Progress With Excel or SoftwareDocument7 pagesHow To Track Employee Training Progress With Excel or SoftwareIsaac F. RosatiNo ratings yet

- Export To Mars2000Document5 pagesExport To Mars2000Cua TranNo ratings yet

- Questions SOAtest Tips and BestPractices Part2Document3 pagesQuestions SOAtest Tips and BestPractices Part2parasoftNo ratings yet