Professional Documents

Culture Documents

Bir Revenue Regulation

Uploaded by

Martin EspinosaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Revenue Regulation

Uploaded by

Martin EspinosaCopyright:

Available Formats

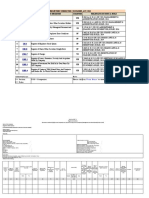

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

Date Filed

14-Dec-10

Ref. No.

10-445

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Subject No.

Subject Title

Date Adopted

Rev. Regs. No. 11-2010

Further Clarifying the Term "Managerial and

Technical Positions" Under Sec. 2.57.1 (D) of

Revenue Regulations (RR) No. 2-98, as

Amended by RR No. 12-2001, Implementing

Section 25 (C) of the NIRC of 1997 (Tax Code),

as Amended and Modifying for this Purpose

Revenue Memo Cir. (RMC) No. 41-09 including

Guidelines on Availment of the Fifteen Percent

(15%) Preferential Income Tax Rate for Qualified

Filipino Personnel Employed by Regional or Area

Headquarters (RHQs) and Regional Operating

Headquartes (ROHQs of Multinational Companies

26-Oct-10

14-Dec-10

10-445

Rev. Regs. No. 12-2010

14-Dec-10

10-445

Rev. Memo Cir. No. 822010

14-Dec-10

10-445

Rev. Memo Cir. No. 862010

14-Dec-10

10-445

Rev. Memo Cir. No. 912010

Regulations Providing for the Policies,

Guidelines and Procedures in the

Implementation of the Tax Subsidy to be

Granted by the Fiscal Incentives Review Board

to the Millennium Challenge Account-Philippines

for the Philippine Compact Program

Clarification on the filing of BIR Form No. 1947

Pursuant to the Provisions of Rev. Reg. No. 112010 dated October 28, 2010

Publshing the Full Text of Opinion No. 48, S.

2010 of the Department of Justice

Provides Basic Questions and Answers to Clarify

on the Increase in the Statutory Minimum Wage

and Other Concerns in Relation to the Income

Tax Exemption Given to Mimimum Wage Earner

under RA No. 9504, as Implemented by Revenue

Regulations 10-2008

1

18-Oct-10

05-Nov-10

15-Nov-10

02-Dec-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

3-Nov-10

09-406

Rev. Regs. No. 7-2009

20-Oct-10

10-385

Rev. Regs. No. 10-2010

20-Oct-10

10-385

Rev. Memo Ord. No. 722010

20-Oct-10

10-385

Rev. Memo Ord. No. 762010

14-Sep-10

10-343

Rev. Regs. No. 8-2010

14-Sep-10

10-343

Rev. Regs. No. 9-2010

14-Sep-10

10-343

14-Sep-10

10-343

14-Sep-10

10-343

Rev. Memo Cir. No. 702010

22-Jul-10

10-286

Rev. Regs. No. 6-2010

Rev. Memo Cir. No. 632010

Rev. Memo Cir. No. 672010

Implementing the Electronic Documentary

Stamp Tax System to Replace the Doc. Stamp

Tax Electronic Imprinting Machine

Exchange of Information Regulations

Guidelines on the Processing of Tax Treaty Relief

Applications (TTRA) Pursuant to Existing Phil.

Tax Treaties

Prescribing the Policies and Guidelines in the

Issuance of Certificate of Tax Exemption of

Cooperatives and the Monitoring Thereof

Amending Rev. Regulations No. 7-2010

Implementing the Tax Privileges Provisions of RA

No. 9994, Otherwise Known as the "Expanded

Senior Citizens Act of 2010"

Providing for Policies and Guidelines for the

Abatement of Surcharges and/or Compromise

Penalties in Relation to the Filing of Tax Returns

and Payment of Taxes Under Certain Conditions

Value Added Tax on Tollway Operators

Circularizing Revocation of BIR Ruling No. DA

722-206

Revocation of BIR Ruling Nos. DA 413-04 and

DA 436-04, and Clarification of the Basis in

Computing Depreciation of Property, Plant and

Equipment

Regulations Providing for the Policies, Guidelines

and Procedures in the Implementaion of the Tax

Subsidy Granted Under Sections 17 (c) of RA

3591 (Phil. Deposit Insurance Corporation

[PDIC] Charter), as Amended by RA 9576

2

29-Jun-09

06-Oct-10

25-Aug-10

27-Sep-10

03-Sep-10

13-Sep-10

19-Jul-10

10-Aug-10

09-Aug-10

29-Jun-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

22-Jul-10

10-286

Rev. Regs. No. 7-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 45-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 46-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 47-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 49-2010

Implementing the Tax Privileges Provisions of RA

9994, Otherwise Known as the "EXPANDED

SENIOR CITIZENS ACT OF 2010" and

Prescribing the Guidelines for the Availment

Thereof

Circularizing Sec. 4 of RA 9994, An Act Creating

Additional Benefits and Privileges to Senior

Citizens, Further Amending RA 7432, as

Amended, Otherwise Known as "An Act to

Maximize the Contribution of Senior Citizens to

Nation Building, Grant Benefits and Special

Privileges and for Other Purposes

Circularizing Sec. 35 of RA No. 10066 entitled

"An Act Providing for the Protection and

Conservation of the National Cultural Heritage,

Strengthening the National Commission for

Culture and Arts (NCAA) and Its Affiliated

Cultural Agencies, and For Other Purposes

Circularizing Sec. 14 of RA No. 10028, an Act

Expanding the Promotion of Breastfeeding,

Amending for the Purpose of RA No. 7600,

Otherwise Known as "An Act Providing

Incentives to All Gov't and Private Health

Institutions with Rooming-in and Breastfeeding

Practices, and For Other Purposes

Further Amending Certain Portions of RMC No.

30-2008 as Amended by RMC No. 59-2008, on

the Subject of the Taxability of Insurance

Companies for Minimum Corporate Income Tax

(MCIT), Business Tax and Doc.Stamp Tax

Purposes

3

20-Jul-10

02-Jun-10

02-Jun-10

02-Jun-10

03-Jun-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

22-Jul-10

10-286

Rev.Memo Cir. No. 52-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 53-2010

22-Jul-10

10-286

Rev.Memo Cir. No. 57-2010

22-Jul-10

10-286

Rev.Memo Cir. N0. 58-2010

22-Jul-10

10-286

Rev.Memo Cir. N0. 59-2010

Publishing the Full Text of JOINT ORDER No. 12010 dated April 5, 2010 by the Secretary of the

Department of Finance (DOF) and

Commissioners of Bureau of Customs (BOC) and

Bureau of Internal Revenue (BIR), respectively,

entitled Valuation of Motor Vehicles

Circularizing Sec. 23 of RA No. 10086 entitled

"An Act Strengthening People's Nationalism

through Philippine History by Changing the

Nomenclature of the National Historical Institute

into the National Historical Commission of the

Phils., Strengthening Its Powers and Functions,

and for Other Purposes"

Circularizing Secs. 3, 4 and 7 of RA No. 10083,

An Act Amending RA No. 9490, Otherwise

Known as the "Aurora Special Economic Zone

Act of 2007"

Circularizing Secs. 10,11,12,13,14,15,16,17 and

18 of RA No. 9856 entitled "An Act Providing the

Legal Framework for Real Estate Investment

Trust and for Other Purposes"

Circularizing Sec. 5 and 6 of RA No. 10072

entitled "An Act Recognizing the Phil. National

Red Cross as an Independent Autonomous NonGovernment Organization Auxiliary to the

Authorities of the Republic of the Philippines in

the Humanitarian Field, to be Known as the

Philippine Red Cross"

22-Jun-10

12-May-10

no date

no date

20-Apr-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

22-Jul-10

10-286

3-Jun-10

10-224

3-Jun-10

10-224

3-Jun-10

10-224

3-Jun-10

10-224

Publishing the Full Text of Department Order

No. 18-2010 dated June 25, 2010 of the

Rev.Memo Cir. N0. 62-2010

Department of Finance on the Nationwide

Coverage of the Mandatory Marking of Kerosene

Amending Section 3(D) and 12 of RR No. 112008 Pertaining to the Provisions on the

Rev. Regs. No. 5-2010

Issuance of TIN Card and the Transfer of

Registration

Value-Added Tax on Toll Fees Paid by Private

Rev. Memo Cir No.30- 2010

Motor Vehicles

Verification of VAT Compliance of Health

Rev. Memo Cir No.39- 2010

Maintenance Organizations

25-May-10

Prohibition on the Issuance of Temporary

Restraining Orders on the Collection of Taxes

Against the BIR by Courts other than the Court

of Tax Appeals, the Issuance of Warrants of

Distraint and Garnishment and/or Levy on Final

Decisions of the BIR on Disputed Assessments,

Cases Filed Before the Court of Tax Appeals, and

the Sale of Property Distrained and Garnished

04-May-10

Rev. Memo Ord. No. 422010

6-Apr-10

10-146

Rev. Regs. No. 2-2010

6-Apr-10

10-146

Rev. Regs. No. 3-2010

Amendment to Secs. 6 and 7 of RR No. 16-2008

with Respect to the Determination of the

Optional Standard Deduction (OSD) of General

Professional Partnerships (GPPs) and the

Partners thereof, as well as the Manner and

Period for making the Election to Claim OSD in

the Income Tax Returns

Submission of the Statement of Management

Responsibility

5

15-Jul-10

26-May-10

21-May-10

18-Feb-10

24-Feb-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

6-Apr-10

10-146

Rev. Regs. No. 4-2010

6-Apr-10

10-146

Rev. Memo Cir. No. 122010

6-Apr-10

10-146

Rev. Memo Cir. No. 182010

6-Apr-10

6-Apr-10

6-Apr-10

Amending Rev. Regs. No.11-2006 on the

Accreditation of Tax Practitioners/Agents as a

Prerequisite to Their Practice or Representation

Before the BIR

Circularizing the Full Text of Joint Rules and

Regulations Implementing Articles 60, 61 and

144 of RA No. 9520, Otherwise Known as the

"Phil. Cooperative Code of 2008" in Relation to

RA No. 8424 of the NIRC, as Amended

Clarification on the Coverage and Taxability of

Amusement Places under Section 125(b) of the

NIRC (Tax Code) of 1997, as Amended

24-Feb-10

11-Feb-10

01-Mar-10

10-146

Rev. Memo Cir. No. 212010

Reiteration of the Applicable Penalties for

Employers who Fail to Withhold, Remit, Do the

Year-End Adjustment and Refund of Employees

of the Excess Witholding Taxes on Compensation

10-146

Rev. Memo Cir. No. 222010

Publishing the Full Text of RA No. 10001 entitled

"An Act Reducing the Taxes on Life Insurance

Policies, Amending for this Purpose Sections 123

and 183 of the NIRC Code of 1997, as Amended"

08-Mar-10

Rev. Memo Cir. No. 292010

Publishing the Full Text of RA No. 10021 entitled

"An Act to Allow the Exchange of Information by

the Bureau of Internal Revenue on Tax Matters

Pursuant to Internationally-Agreed Tax

Standards, Amending Sections 6(F), And 270 of

the NIRC of 1997, as Amended, and for Other

Purposes"

19-Mar-10

10-146

08-Mar-10

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Circularizing the Full Text of RA No. 10026

entitled "An Act Granting Income Tax Exemption

to Local Water Districts by Amending Sec. 27(C)

of the NIRC Code of 1997, as Amended, and

Adding Sec. 289-A to the Code, for the Purpose"

6-Apr-10

10-146

Rev. Memo Cir. No. 282010

2-Feb-10

10-053

Rev. Regs. No. 9-2009

2-Feb-10

10-053

Rev. Regs. No. 10-2009

2-Feb-10

10-053

Rev. Memo Cir. No. 632009

2-Feb-10

10-053

Rev. Memo Cir. No. 722009

VAT Liability of the Tollway Operators

21-Dec-09

Rev. Regs. No. 1-2010

Amending Further Sec. 3 of RR No. 9-2001, as

last Amended by RR No. 10-2007, Expanding

the Coverage of Taxpayers Required to File

Returns and Pay Taxes Through the Electronic

Filing and Payment System (EFPS) of the BIR

21-Jan-10

2-Feb-10

10-053

Maintenance, Retention, and Submission of

Electronic Records

Amending Further Secs. 2.57.2 and 2.58 of RR

No. 2-98, as Amended, Clarifying that SubParagraph (W) as Recently Issued Under RR No.

8-2009 should be Sub-Paragraph (X), and Other

Concerns

Primer on Creditable Withholding Tax on

Campaign Expenditures Prescribed in RR No. 82009

22-Mar-10

23-Dec-09

no date

12-Nov-09

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

3-Nov-09

09-406

Rev. Memo Cir. No. 512009

3-Nov-09

09-406

Rev. Memo Cir. No. 572009

3-Nov-09

09-406

Rev. Memo Ord. No. 312009

3-Nov-09

09-406

Rev. Regs. No. 8-2009

Clarification on the Requirement for the

Submission of Summary Lists of Sales(SLS)/

Summary Lists of Purchases (SLP); the

Imposition of Penalties for Their NonSubmission; the Issusance of Subphoena Duces

Tecum; and the Imposition of Penalties for

Failure to Obey Summons, Pursuant to RR 82002, as Incorporated in RR No. 16-2005, and

RMO No.12-2009

Publishing the Full Text of the Memo of

Secretary of Finance Margarito B. Teves

Directing the BIR to Stop Issuing Tax

Assessments for Taxable Year 2009 Against

Cooperatives Registered with the Cooperative

Development Authority based on the Old

Cooperative Law

Policies and Guidelines for the Reporting of

Casualty Losses

Amending Further Secs. 2.57.2 and 2.57.3 of RR

No. 2-98, as Amended, Subjecting to Creditable

Withholding Tax the Income Payments Made by

Political Parties and Candidates of Local and

National Elections of All Their Campaign

Expenditures and Income Payments Made by an

Individual or Juridical Person Forming Part of

their Campaign Contributions to Candidates of

Local and National Elections and to Political

Parties

15-Sep-09

05-Oct-09

16-Oct-09

22-Oct-09

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

3-Nov-09

09-406

Rev. Regs. No. 7-2009

24-Jul-09

09-272

Rev. Regs. No. 6-2009

24-Jul-09

09-272

Rev. Memo Cir. No. 262009

24-Jul-09

09-272

Rev. Memo Cir. No. 292009

24-Jul-09

09-272

Rev. Memo Cir. No. 312009

Implementing the Electronic Documentary

Stamp Tax System to Replace the Documentary

Stamp Tax System to Replace the Documentary

Stamp Tax Electronic Imprinting Machine

Amending Further Pertinent Provisions of RR No.

2-98, as Amended, Providing for an Additional

Criteria in the Determination of Top 20,000

Private Corporations, Including the Threshold on

their Purchases of Agricultural Products, and

Additional Transactions Subject to Creditable

Withholding Tax on Income Payments Made by

the Top 5,000 Individual Taxpayers Engaged in

Trade/Business or Pratice of Profession

Revocation/Cancellation of BIR RR 7 Ruling No.

RR 7-003-876 dated Sept. 13, 2006 Addressed

to Trendset Manpower Services Relative to its

Request for Exemption from the 2% Creditable

Withholding Tax, Prescribed in RR No. 17-2003,

On the Sale of Services for Purposes of

Computing its Gross Receipts

Clarifying Certain Issues Relative to the

Processing of Claims for Tax Credit/Refund

Circularizing the Memorandum of the

Commissioner Disallowing Bangko Sentral ng

Pilipinas Claimed Interest Expense for Taxable

Year 2005

29-Jun-09

03-Jun-09

11-May-09

16-Apr-09

15-Jun-09

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

24-Jul-09

09-272

Rev. Memo Ord. No. 182009

27-May-09

09-186

Rev. Memo Cir. No. 182009

27-May-09

09-186

Rev. Memo Cir. No. 222009

27-May-09

09-186

Rev. Memo Cir. No. 242009

27-May-09

09-186

Rev. Regs. No. 5-2009

An Order Dispensing the Necessity of Securing a

Ruling from the BIR as A Requisite for the

Issuance of CAR/TCL on the Conveyance of Land

and Common Areas by the Real Estate

Developer to the Condominium Corporation

Organized in Accordance with the Provisions of

RA No. 4726 for the Purpose of Holding Title to

and Managing and Maintaining the Land and the

Common Areas for the Benefit of the

Condominium Unit Owners, as well as

Prescribing the Policies and Guidelines to be

Observed in the Issuance of CAR/TCL in Respect

Thereto

Acceptance and Reporting of Tax Returns and

Payments

Clarifying the Allowable Claims for Personal and

Additional Exemptions and Optional Standard

Deductions (OSD) Pursuant to RR Nos. 10-2008

and 16-2008 Respectively

Circularization of the Relevant Excerpts from the

Supreme Court Decision in GR No. 171138, on

the Issue of the Imposition of Doc. Stamps Tax

on Pawn Tickets

Reverting the Venue for the Filing of Returns and

Payment of Capital Gains Tax, Creditable

Withholding Tax and Doc. Stamp Tax Due on

Sale, Transfer or Exchange of Real Property of

Large Taxpayers to the Place Where the Property

is Located

10

26-Apr-09

27-Mar-09

12-Apr-09

05-May-09

16-Mar-09

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

27-May-09

09-186

27-May-09

09-186

27-May-09

09-186

20-Mar-09

09-114

20-Mar-09

09-114

20-Mar-09

09-114

Amending the Provisions of Sec. 24 of RR No. 32006 Pertaining to the Incremental Revenue

Under RA No. 9334

Amending Further RR No. 9-2001, as Amended

by RR No. 2-2002, RR No. 9-2002, RR No. 262002, RR-5-2004, and RR-10-2007 Expanding

Rev. Reg. No.3-2009

the EFPS Coverage to Include the Top 20,000

Private Corporations Duly Identified Under RR

No. 14-2008

Enjoining the Strict Implementation of the

Rev. Memo Ord. No. 12Penalty Provisions for the Non-submission of

2009

Quarterly Summary Lists of Sales and Purchases

Clarifying the Instruments Embraced by the

Rev. Memo Cir. No. 16Term "Deposit Substitutes" Under RR No. 82009

2008

Circularizing the Full text of Dept. Order No. 409 dated Jan. 5, 2009 Entitled "Lifting of the

Rev. Memo Cir. No. 9-2009

Suspension of Effectivity of Dept Order Nos. 3505 and 36-05"

Rules and Regulations Implementing RA No.

9442, Entitled "An Act Amending RA 7277,

Otherwise Known as the Magna Carta for

Rev. Regs. No. 1-2009

Persons with Disability," Relative to the Tax

Privileges of Persons with Disability and Tax

Incentives for Establishments Granting Sales

Discounts

Rev. Regs. No. 4-2009

11

03-Apr-09

09-Feb-09

28-Apr-09

09-Feb-09

09-Feb-09

09-Dec-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

20-Mar-09

09-114

Rev. Regs. No. 2-2009

9-Jan-09

09-017

Rev. Regs. No. 14-2008

9-Jan-09

09-017

Rev. Regs. No. 15-2008

9-Jan-09

09-017

Rev. Regs. No. 16-2008

9-Jan-09

09-017

Rev. Memo Cir. No. 772008

9-Jan-09

09-017

Rev. Memo Cir. No. 822008

Amending Further Secs. 2.57.2 and 2.58 of RR

No. 2-98, as Amended, Subjecting to Creditable

Withholding Tax the Interest Portion of the

Refund of Meter Deposits by Meralco and Other

Distribution Utilities to Residential and NonResidential Electricity Consumers/Customers

Amending Further Section 2.57.2(M) of RR No. 298, as Amended, Increasing the Coverage of

Withholding Tax Agents Required to Withhold

1% from Regular Suppliers of Goods and 2%

from Regular Suppliers of Services from the Top

10,000 Private Corporations to Top 20,000

Private Corporations

Prescribing the Manner of Computing the

Incremental Revenue to be Used as Basis of the

Fifteen Percent (15%) Share of the Beneficiary

Provinces Producing Burley and Native Tobacco

in the Excise Tax Collection from Tobacco

Products Under RA No. 8240

Implementing the Provisions of Section 34 (L) of

the Tax Code of 1997, as Amended by Section 3

of RA 9504, Dealing on the Optional Standard

Deduction (OSD) Allowed to Individuals and

Corporations in Computing their Taxable Income

Taxability of Director's Fees Received by

Directors Who are not Employees of the

Corporation for VAT or Percentage Tax Purposes

as Espoused Under RMC No. 34-2008

Registration of Manual Books of Accounts

12

04-Feb-09

26-Nov-08

21-Nov-08

26-Nov-08

24-Nov-08

13-Nov-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

25-Nov-08

08-429

Rev. Memo Cir. No. 722008

25-Nov-08

08-429

Rev. Memo Cir. No. 742008

25-Nov-08

08-429

Rev. Memo Cir. No. 732008

5-Nov-08

08-400

Rev. Regs. No. 13-2008

30-Sep-08

08-352

Rev. Regs. No. 10-2008

Prescribes and Clarifies the Guidelines and

Procedures in the Issuance of Taxpayer

Identification Number (TIN) to Securities and

Exchange Commission's (SEC) Registrants

Pursuant to MOA Between the SEC and BIR in

the Implementation of the Electronic Exchange

of Information Among Gov't Agencies, in

Relation to the Implementation of RMO No. 302005

Publishing the Full Text of Joint Cir. No. 200801, Guidelines and Procedure for the Release of

the LGU Shares from the VAT in Lieu of

Franchise Tax Collected from Racetrack

Operations of the Manila Jockey Club, Inc.

(MJCI) and Phil. Racing Club, Inc (PRCI)

Publishing the Full Text of the Records

Disposition Schedule of the BIR which was

Approved by the Acting Executive Director of the

National Archives of the Phils. (NAP) on June

05,2008

Consolidated Regulations on Advance Value

Added Tax on the Sale of Refined Sugar;

Amendng and/or Revoking All Revenue

Issuances Issued to this Effect, and for Other

Related Purposes

Implementing Pertinent Provisions of RA 9504

"An Act Amending Secs. 22, 24, 34, 35, 51 and

79 of RA 8424, as Amended, Otherwise Known

as the NIRC" Relative to Withholding of Income

Tax on Compensation and Other Concerns

13

03-Nov-08

02-Oct-08

02-Oct-08

19-Sep-08

08-Jul-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

30-Sep-08

08-352

30-Sep-08

08-352

30-Sep-08

08-352

30-Sep-08

08-352

30-Sep-08

08-352

30-Sep-08

08-352

4-Sep-08

08-322

Consolidated Revenue Regulations on Primary

Registration, Its Updates, and Cancellation

Filing and Payment of Tax Returns of Newly

Rev. Memo Cir. No. 66-08

Transferred Taxpayers

Acceptance and Reporting of Tax Returns and

Rev. Memo Cir. No. 67-08

Payments

Basis of the 15% Share of the Beneficiary

Provinces in the Excise Tax Collection from

Rev. Regs. No. 9-2008

Locally Manufactured Virginia-type Cigarettes

under RA 7171

Basis of the Fifteen Percent (15) Share of the

Beneficiary Provinces in the Excise Tax Collection

Rev. Regs. No. 12-2008

from Locally Manufactured Virginia-type

Cigarettes Under RA 7171

Clarifying the Business Taxation on the Activities

Undertaken by the Bangko Sentral ng Pilipinas

Rev. Memo Cir. No. 65-08

(BSP) in Pursuance of its Mandate as the

Independent Central Monetary Authority of the

Republic of the Phils.

Supplementing RR No. 09-2004, as Amended by

RR 10-2004 Clarifying that the Transactions of

the BSP Entered Into in the Exercise of Its

Rev. Regs. No. 8-2008

Governmental/Regulatory Authority are Outside

of the Coverage of the Gross Receipts Tax

Imposed Under Secs.121 and 122 of the 1997

NIRC Code, as Last Amended by RA 9337

Rev. Regs. No. 11-2008

14

15-Aug-08

12-Aug-08

14-Aug-08

09-Sep-08

23-Sep-08

05-Sep-08

20-Aug-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

4-Sep-08

08-322

Rev. Memo Cir. No.44-2008

4-Sep-08

08-322

Rev. Memo Cir. No.46-2008

4-Sep-08

08-322

Rev. Memo Cir. No. 472008

4-Sep-08

08-322

Rev. Memo Cir. No 49-2008

4-Sep-08

08-322

Rev. Memo Cir. No.55-2008

4-Sep-08

08-322

Rev. Memo Cir. No.58-2008

Publishing the Full Text of Dept. Order No. 9-08,

"Implementing Rules and Regulations on the

Accessibility of Information on Taxpayers

Between the BIR and the Local Government

Units for Tax Collection Purposes Pursuant to EO

No. 646"

Clarification of Issues Concerning Common

Carriers by Air and Their Agents Relative to the

Revenue and Receipt from Transport of

Passengers, Goods/Cargoes and Mail, and from

Excess Baggage

Procedures in Handling Taxpayers' Request for

Transfer of Registration

Composition of the National Evaluation Board

Contemplated in Sec. 204 of the Tax Code of

1997

Deadline of Corporate Taxpayers for the Filing of

the 2nd Quarter Income Tax Return,

Clarification on the Procedure in the Filing of Tax

Returns and Enunciating Revised Rules on

Remittance of Collection and Submission of

Collection Reports by Accredited Collection

Agents

Clarifying the Time Within Which to Reckon the

Redemption Period on the Foreclosed Asset and

the Period Within which to Pay Capital Gains Tax

on Creditable Withholding Tax and Doc. Stamp

Tax on the Foreclosure of Real Estate Mortgage

by those Governed by the General Banking Law

of 2000 (RA No. 8791), as well as the Venue

for the Payment of These Taxes

15

05-May-08

01-Feb-08

19-Jun-08

18-Jun-08

12-Aug-08

15-Aug-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

4-Sep-08

08-322

4-Sep-08

08-322

26-May-08

08-195

6-May-08

08-161

24-Apr-08

08-155

22-Apr-08

08-149

21-Apr-08

08-147

Amending Certain Portions of RMC No 30-2008

on the Subject of the Taxability of Insurance

Rev. Memo Cir. No.59-2008 Companies for Minimum Corporate Income Tax

(MCIT), Business Tax and Documentary Stamp

Tax Purposes

Procedure on the Handling of Taxpayer's

Application for Cancellation of Business

Rev. Memo Cir. No.56-2008 Registration, and Warning on the Use of Official

Receipts/Sales Invoices of Dissolved Businesses

for Purposes of Claiming Input Taxes

Taxation on the Sale to the Bangko Sentral ng

Pilipinas of Gold and Other Metallic Mineral

Rev. Regs. No.7-2008

Products Extracted or Produced by Small-Scale

Miners, and Further Amending Section 2.57.2

(T) of RR 2-98, as Amended

Consolidated Regulations Prescribing the Rules

on the Taxation of Sale, Barter, Exchange or

Rev. Regs. No.6-2008

Other Disposition of Shares of Stock Held as

Capital Assets

Further Amendments to RR Nos. 2-98 and 3-98,

Rev. Regs. No.5-2008

as Last Amended by RR No. 10-2000, with

Respect to "De Minimis Benefits"

Tax treatment of Director's Fees for Income Tax

Rev. Memo Cir. No.34-2008

and Business Tax Purposes

Amending the Venue for the Payment of Capital

Gains Tax, Creditable Withholding Tax and Doc.

Stamps Tax Due on Onerous Transfers of Real

Rev. Regs. No.4-2008

Properties Owned by Taxpayers Classified as

Large Taxpayers Pursuant to RR 1-98 as

Amended, Thereby Amending for this Purpose

Pertinent Provisions of RR-8-98

16

23-Aug-08

25-Jul-08

25-Mar-08

22-Apr-08

17-Apr-08

15-Apr-08

19-Feb-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

15-Apr-08

10-Apr-08

08-141

Clarification of Issues Concerning Common

Rev. Memo Cir. No.31-2008 Carriers by Sea and Their Agents Relative to the

Transport of Passengers, Goods or Cargoes

30-Jan-08

08-132

Amending Certain Provisions of Existing Revenue

Regulations on the Granting of Outright Excise

Tax Exemption on Removal of Excisable Articles

Intended for Export or Sale/Delivery to

International Carriers or to Tax-Exempt

Entities/Agencies and Prescribing the Provisions

for Availing Claims for Product Replenishment

22-Jan-08

10-Apr-08

08-132

10-Apr-08

08-132

10-Apr-08

08-132

10-Apr-08

08-132

Rev. Regs. No.3-2008

Clarification on the Persons Liable to the Tax

Imposed Under Sec. 127 of the Tax Code and

Rev. Memo Cir. No.21-2008

the Crediting of Tax Collection to the Appropriate

Office of the BIR

Clarifying the Scope of the Term "Direct Costs

and Expenses" that Should Comprise the "Cost

of Services" for Purposes of Computing the

Rev. Memo Cir. No. 24Gross Income Subject to the 2% Minimum

2008

Corporate Income Tax (MCIT) under Sec. 27(E)

and Sec. 28 (A) (2) of the 1997 National

Internal Revenue Code, as Amended

Doc. Stamp Tax (DST) on Certificates Issued by

Rev. Memo Cir. No.25-2008

Educational Institutions

Publishing the Full Text of Dept Order No. 11-08

Dated March 18, 2008 "Clarification on the Last

Rev. Memo Cir. No.29-2008 Day for Availing of the Benefits under RA No.

9480, Otherwise Known as, the Tax Amnesty Act

of 2007"

17

29-Feb-08

18-Mar-08

17-Mar-08

02-Apr-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

10-Apr-08

08-132

10-Apr-08

08-132

4-Apr-08

08-130

4-Apr-08

08-130

7-Mar-08

08-095

7-Mar-08

08-095

7-Mar-08

08-095

Clarification on the Last Day for Availing of the

Benefits Under RA No. 9480, Otherwise Known

as, the Tax Amnesty Act of 2007

Clarifying the Taxability of Insurance Companies

Rev. Memo Cir. No.30-2008

for MCIT, Business Tax, and Doc. Stamp Tax

Purposes

Implementing Rules and Regulations on the

Accessibility of Information on Taxpayers

Dept. Ord. No. 09--08

Between the BIR and the LGU for Tax Collection

Purposes Pursuant to EO No. 646

Clarification on the Last Day for Availing of the

Dept. Ord. No. 11-08

Benefits Under RA No. 9480, Otherwise Known

as, the Tax Amnesty Act of 2007

Circularizing the Full Text of "A Basic Guide on

the Tax Amnesty Act of 2007" for Taxpayers

Rev. Memo Cir. No.19-2008

Who Wish to Avail of the Tax Amnesty Pursuant

to RA 9480 (Tax Amnesty Act of 2007)

Reiterating the Requirement for the Submission

of Tax Identification Number (TIN) and Other

BIR - Prescribed Returns/Documents as

Rev. Memo Cir. No.12-2008

Conditions for the Issuance/Renewal of Mayor's

Permit/License/Privilege Tax Receipt by the

Concerned Local Government Unit

Amending Certain Rules and Regulations

Relative to the Collection and Remittance of

Taxes Paid to Authorized Agent Banks (AABS)

Rev. Regs. No.2-2008

thru Over-The-Counter (OTC) and Electronic

Filing and Payment System (EFPS) and

Amending Further the MOA Relative to

Accreditation of the AABS

Dept. Ord. No. 11-08

18

18-Mar-08

01-Apr-08

26-Mar-08

18-Mar-08

22-Feb-08

08-Jan-08

10-Jan-08

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

7-Mar-08

08-095

7-Mar-08

08-095

3-Jan-08

08-003

3-Jan-08

08-003

3-Jan-08

08-003

3-Jan-08

08-003

3-Jan-08

08-003

Amending Certain Provisions of RR No. 10-2006

Prescribing the Guidelines and Conditions for the

Tax Treatment of Securities Borrowing and

Rev. Regs. No.1-2008

Lending Transactions Involving Shares of Stock

and Securities Listed in the Phil. Stock

Exchange

Regulations Allowing for the Abatement of

Rev. Regs. No.15-2007

Penalties/Surcharges and Interest on

Disputed/Litigated Assessments

Tax on Non-Governmental Organizations (NGOs)

Rev. Regs. No.14-2007

and Cooperatives Engaged in Microfinance

Activities

Prescribing the Rules on the Advance Payment of

Rev. Regs. No.13-2007

VAT/Percentage Tax on the Transport of

Naturally Grown and Planted Timber Products

Amending the Provisions of Question and Answer

(Q & A) No. 28 of the Previously Issued RMC 69Rev. Memo Cir. No.90-2007 2007 which Clarify Issues Concerning the Tax

Amnesty Program Under RA No. 9480 as

Implemented by Dept Order No. 29-07

Publishing the Full Text of EO No. 671 Dated

October 22, 2007 - "Designating Entities that

Rev. Memo Cir. No.88-2007 will Certify and Accredit Charitable Organization

as Donee-Institutions Relative to the

Deductibility of the Tax Reform Act of 1997

Supplemental Provision to the Previously Issued

RMC 69-2007 on Issues Pertaining to the Tax

Rev. Memo Cir. No.77-2007

Amnesty Program Under RA No. 9480 as

Implemented by Dept. Order No. 29-07

19

01-Feb-08

29-Nov-07

11-Dec-07

15-Oct-07

03-Dec-07

07-Dec-07

16-Nov-07

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

3-Jan-08

08-003

Rev. Memo Cir. No.76-2007

3-Jan-08

08-003

Rev. Memo Cir. No.73-2007

3-Jan-08

08-003

Rev. Memo Cir. No.72-2007

3-Jan-08

08-003

Rev. Memo Cir. No.71-2007

3-Jan-08

08-003

Rev. Memo Cir. No.70-2007

3-Jan-08

08-003

Rev. Memo Cir. No.69-2007

23-Oct-07

07-369

Rev. Memo Cir. No.59-2007

Prescribing Additional Mandatory Documentary

Requirements for One-Time Transactions

involving Transfers of Real Property

Re-issuing the Guidelines on the Proper

Treatment of Block Sale of Shares of Stock

Disposed of in the Stock Exchange

Circularizing the Full Text of AO No. 186,

Directing the City Assessor, Municipal Assessor

and Provincial Assessor to Annotate in All Tax

Declarations the Serial Number of the Certificate

Authorizing Registration Issued by BIR

Circularizing the Full Text of EO No. 646, on the

Accessibility of Information on Taxpayers

Between the BIR and LGU for Tax Collection

Purposes

Clarification on the Proper Treatment of Cases

under Administrative or Judicial Protest for

Amnesty Tax Purposes

Clarification of Issues Concerning the Tax

Amnesty Program Under RA 9480 as

Implemented by Dept. Order No. 29-07

Clarifying the Effect of Suspension of RR No. 62007 Otherewise Known as the "Consolidated

Regulations on Advance Value-Added Tax on the

Sale of Refined Sugar, Amending and/or

revoking all Revenue Issuances Issued to this

Effect and for Other Related Purposes

20

25-Oct-07

12-Nov-07

09-Oct-07

09-Oct-07

07-Nov-07

05-Nov-07

12-Sep-07

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

23-Oct-07

07-369

23-Oct-07

07-369

23-Oct-07

07-369

23-Oct-07

07-369

23-Oct-07

07-369

7-Aug-07

07-283

Publishing the Full Text of Dept. Order No. 23-07

Dated July 26, 2007 Entitled "Mandating the

Marking of Imported Kerosene and Fuel Oils

Rev. Memo Cir. No.56-2007

which are entered Tax and Duty Free to Prevent

the Unauthorized Diversion Thereof Into the

Domestic Market and for Other Purposes

Publishing the Full Text of Dept. Order No. 29-07

dated August 15, 2007, "Implementing Rules

Rev. Memo Cir. 55-2007

and Regulations (IRR) of RA No. 9480,"

Otherwise Known as "Tax Amnesty Act of 2007"

Reiteration of the Amendment Made by RA 9337

Imposing VAT on the Sale of Non-Food

Rev. Memo Cir. No.53-2007

Agricultural Products, Marine and Forest

Products and on the Sale of Cotton and Cotton

Seeds in their Original State

Amending Certain Provisions of RR 9-98 Relative

to the Due Date Within Which to Pay Minimum

Corporate Income Tax (MCIT) Imposed on

Rev. Regs. No.12-2007

Domestic Corporations and Resident Foreign

Corporations Pursuant to Sec. 27(E) and Sec.

28(A) (2) of the 1997 NIRC, as Amended

Suspension of the Implementation of RR No. 6Rev. Regs. No 11-2007

2007

Clarifyng the Taxability of Agricultural Suppliers

for Withholding Tax Purposes In Respect to

Sales Made to Top 10,000 Corporations and to

the Government in Relation to RR No. 3-2004

Rev. Memo Cir. No.44-2007

Which Suspended the Implementation of

Withholding Tax on Income Payments Made to

Suppliers of Agricultural Products Under Sec.

2.57.2 (S) of RR No. 2-98, as Amended

21

10-Aug-07

21-Aug-07

07-Aug-07

10-Oct-07

15-Aug-07

06-Jul-07

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

7-Aug-07

7-Aug-07

07-283

Compliance with the Requirements of RR No. 3Rev. Memo Cir. No.43-2007 2005 for Contractors Applying for Tax Clearance

Certificate for Bidding and Collection Purposes

02-Jul-07

07-283

Clarifying the Income Tax and VAT Treatment of

Rev. Memo Cir. No.39-2007 Agency Fees/Gross Receipts of Security Agencies

Including the Withholding of Taxes Due thereon

22-Jan-07

7-Aug-07

07-283

7-Aug-07

07-283

7-Aug-07

07-283

7-Aug-07

07-283

7-Aug-07

07-283

Amending Further Sec. 3 of RR No. 9-2001, as

Last Amended by RR 5-2004, Expanding the

Rev. Regs. No 10-2007

Coverage on Taxpayers Required to File Returns

and Pay Taxes Through the Electronic Filing and

Payment System (EFPS) of the BIR

Prescribing the Updated Minimum

Monthly/Quarterly Gross Receipts in Computing

Rev. Regs. No 9-2007

the Percentage Tax of Domestic Carriers and

Keepers of Garages

Tax Treatment of Sale, Barter or Exchange of

Goods or Properties or Sale or Exchange of

Services Made by Suppliers from the Customs

Territory to Registered Freeport Zone

Rev. Memo Cir. No.50-2007 Enterprises in the Subic Freeport Zone (SPZ),

the Clark Freeport Zone (CFZ) as well as Poro

Point Freeport Zone (PPFZ), and Vice-Versa

under Secs. 12 & 15 of RA No. 7227, as

Amended by RA No. 9400

Lifting the Suspension of Certain Provisions of

Rev. Memo Cir. No.49-2007

RR No. 3-2006 Provided under RMC 10-2006

Additional Compliance Requirements of

Concerned Taxpayers in the light of Mandatory

Rev. Regs. No 8-2007

Adoption of the Phil. Financial Reporting

Standards

22

18-Jul-07

04-Jul-07

30-Jul-07

16-Jul-07

03-Jul-07

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

7-Aug-07

07-283

Rev. Regs. No 7-2007

18-Jul-07

07-261

Rev. Regs. No.06-2007

18-Jul-07

07-261

Rev. Regs. No.05-2007

18-Jul-07

07-261

Rev. Regs. No.04-2007

18-Jul-07

07-261

Rev. Regs. No.03-2007

Amending Certain Provisions of RR 21-2002,

Implementing Sec. 6 (H) of the Tax Code of

1997, Authorizing the Commissioner of Internal

Revenue to Prescribe Additional Procedural

and/or Documentary Requirements in

Connection with Preparation and Submission of

Financial Statements Accompanying the Tax

Returns

Consolidated Regulations on Advance Value

Added Tax on the Sale of Refined Sugar,

Amending and/or Revoking All Revenue

Issuances Issued to this Effect, and for Other

Related Purposes

Prescribing the Guidelines and Conditions for the

Tax Treatment of Securities Borrowing and

Lending (SBL) or Securities Lending Transactions

(SLTs) involving the Fixed-Income Securities

Lending Program of the Phil. Dealing and

Exchange Corp.(PDEx)

Amending Certain Provisions of RR No. 16-2005,

as Amended, Otherwise Known as the

"Consolidated Value-Added Tax Regulations of

2005

Regulations Providing for the Policies, Guidelines

and Procedures in the Implementation of the

Expanded One-Time Administrative Abatement

of All Penalties/Surcharges and Interest on

Delinquent Accounts and Assessments

23

09-Jul-07

21-Mar-07

06-Mar-07

07-Feb-07

16-Jan-07

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

18-Jul-07

07-261

Rev. Regs. No. 01-2007

18-Jul-07

07-261

Rev. Regs. No.02-2007

8-Jan-07

07-009

Rev. Regs. No 18-2006

25-Oct-06

06-421

Rev. Regs. No 17-2006

25-Oct-06

06-421

Rev. Regs. No 16-2006

25-Oct-06

06-421

Rev. Regs. No 15-2006

25-Oct-06

06-421

Rev. Regs. No 14-2006

Amending RR No. 4-2006 Implementing the Tax

Privileges Provisions of RA 9257, Otherwise

Known as the "Expanded Senior Citizens Act of

2003"

Amending Certain Provisions of RR 16-2005

Otherwise Known as the Consolidated ValueAdded Tax Regulation of 2005

Improved Voluntary Assessment Program (IVAP)

for Taxable Year 2005 and Prior Years under

Certain Conditions

Prescribing the Rules on the Accreditation,

Registration, and Use of Taximeter Issuing

Receipts (TIR) Systems and /or Models and

Other Similar Types of Machines Generating

Official Receipts

Submission by Taxpayers of Electronic Books of

Accounts and other Accounting Records in the

Course of a Tax Audit/Investigation

Implementing a One-Time Administrative

Abatement of All Penalties/Surcharges and

Interest on Delinquent Accounts and

Assessments (Preliminary or Final, Disputed or

not) as of June 30, 2006

Providing for the Revised Implementing Rules of

Executive Order No. 399 (EO 399) as Amended

by Executive Order No. 422 (EO 422) Directing

the BIR to Established "No Audit Program (NAP)"

for the Purpose of Enhancing Tax Compliance

and Increasing Tax Collections with Extension of

the Deadline for Availment Thereof

24

04-Dec-06

22-Dec-06

26-Sep-06

06-Sep-06

15-Aug-06

18-Aug-06

31-Jul-06

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

25-Oct-06

06-421

16-Aug-06

06-329

16-Aug-06

06-329

16-Aug-06

06-329

16-Aug-06

06-329

16-Aug-06

06-329

16-Aug-06

06-329

Amendment to Sub-paragraph 3.3 of RR No. 403-Apr-06

2005

Rules and Regulations Implementing the Tax

Subsidy Granted by Fiscal Incentives Review

Rev. Regs. No 12- 2006

20-Jun-06

Board (FIRB) to the Phil. National Police Service

Store System (PNPSSS)

Consolidated Regulations on the Accreditation of

Tax Practitioners/Agents as a Pre-requisite to

Rev. Regs. No 11-2006

their Practice or Representation Before the BIR

15-Jun-06

and Further Simplifying and Superseding RR No.

15-99

Prescribing the Guidelines and Conditions for the

Tax Treatment of Securities Borrowing and

Rev. Regs. No 10-2006

23-Jun-06

Lending Transactions Invovling Shares of Stock

or Securities Listed in the Phil. Stock Exchange

Amending Further Certain Provisions of RR No. 62005 as Amended, Implementing the Provisions

Rev. Regs. No 09-2006

of EO No. 399 as Amended by EO No. 422,

27-Jun-06

Otherwise Known as the "No Audit Program

(NAP)"

Prescribing the Implementing Guidelines on the

Taxation and Monitoring of the Raw Materials

Rev. Regs. No 08-2006

Used and the Bioethanol-Blended Gasoline (E09-May-06

Gasoline) Produced under the Fuel Bioethanol

Program of the Department of Energy (DOE)

Clarifying the Proper VAT and EWT Treatment of

Rev. Memo.Cir.No. 35-2006 Freight and Other Incidental Charges Billed by

21-Jun-06

Freight Forwarders

Rev. Regs No 13-2006

25

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

16-Aug-06

06-329

Publishing the Full Text of R.A. No. 9343, An Act

Amending RA 9182, Otherwise Known as the

Rev.Memo.Cir.No. 44-2006

SPV of 2010 for the Purpose of Allowing the

Establishment and Registration of New SPVs and

for Other Purposes

19-Jun-06

06-248

Rev. Memo Cir. No.31-2006

19-Jun-06

06-248

Rev. Memo Cir. No.22-2006

19-Jun-06

06-248

Rev. Regs. No 07-2006

19-Jun-06

06-248

Rev. Regs. No 06-2006

7-Apr-06

06-158

Rev. Memo Cir. No.17-2006

7-Apr-06

06-158

Rev. Memo Cir. No.16-2006

7-Apr-06

06-158

Rev. Memo Cir. No.10-2006

VAT on the Construction or Renovation of Official

Buildings or Properties of the USA Embassy

14-Jul-06

29-May-06

Clarifying Certain Issues Relating to the

Implementation of the Increase in the VAT Rate

05-Apr-06

from 10% to 12% on the Sale of Goods Pursuant

ot RA No. 9337

Further Amending Certain Provisions of RR No. 62005, as Amended by RR No. 10-2005,

Implementing the Provisions of EO No. 399 as

18-May-06

Amended by EO No. 422, Otherwise Known as

the "No Audit Program (NAP)"

Regulating the Use of Functional Currency other

than the Phil. Peso in Financial Statements that

will be Submitted and in the Books of Accounts

16-Mar-06

that will be Maintained for Internal Revenue Tax

Purposes

Clarifying Certain Provisions of RR No. 16-2005,

Particulary on the 70 % Cap or Limitation on the 21-Feb-06

Deductible Input Tax for VAT Purposes

Application and Computation of the 32% and

35% Income Tax Rates for Taxable Year 2005 in 21-Feb-06

the Light of the Effectivity of RA 9337

Suspension of the Implementation of Certain

11-Jan-06

Provisions of Section 20 B of RR No. 3-2006

26

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

7-Apr-06

06-158

7-Apr-06

06-158

7-Apr-06

06-158

7-Apr-06

06-158

Clarifying the Amount Subject to VAT and

Expanded Witholding Tax (Income Tax) of

Rev. Memo Cir. No.09-2006

Brokers and Others Similarly Situated and the

Other Parties with whom They Transact Business

Clarifying Certain Issues Relating to the

Rev. Memo Cir. No.08-2006 Implementation of the Increase in the VAT Rate

from 10% to 12% Pursuant to RA No. 9337

Publishing the Full Text of the Memorandum

from Exec. Sec. Eduardo R. Ermita Dated Jan.

Rev. Memo Cir. No.07-2006 31, 2006 Approving the Recommendation of the

Sec. of Finance to Increase the VAT Rate from

Ten Percent to Twelve Percent

Rev. Regs. No 05-2006

Implementation of RR 17-2005

25-Jan-06

31-Jan-06

31-Jan-06

08-Mar-06

7-Apr-06

06-158

Rev. Regs. No 04-2006

Implementing the Tax Privileges Provisions of RA

No. 9257, Otherwise Known as the "Expanded

Senior Citizens Act of 2003" and Prescribing the

Guidelines in the Availment Thereof

26-Jan-06

06-054

Rev. Memo Cir. No. 6-2006

Clarification to RR No. 14-2005, as last Amended

by RR No. 16-2005, Implementing RA No. 9337

03-Jan-06

06-054

Prescribing the Use of the Gov't Money Payment

Chart Implementing Secs. 2.57.2 , 4.114 and

5.116 of RR No. 2-98 as Amended by RR No. 16Rev. Memo Cir. No.5-2006

2005 in Relation to Secs. 57 (B) 114(C) and 116

to 123 of RA No. 8424 as Amended by RA No.

9337

02-Nov-05

26-Jan-06

27

02-Dec-05

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

26-Jan-06

06-054

Rev. Regs. No 03-2006

26-Jan-06

06-054

Rev. Regs. No 02-2006

26-Jan-06

06-054

Rev. Regs. No 01-2006

25-Nov-05

05-461

Rev. Regs. No 19-2005

25-Nov-05

05-461

Rev. Regs. No 18-2005

25-Nov-05

05-461

Rev. Regs. No 17-2005

25-Nov-05

05-461

Rev. Regs. No 16-2005

Prescribing the Implementing Guidelines on the

Revised Tax Rates on Alcohol and Tobacco

Products, Pursuant to the Provisions of RA No.

9334, and Clarifying Certain Provisions of

Existing Revenue Regulations Relative Thereto

Mandatory Attachment of the Summary Alphalist

of Withholding Agents of Income Payments

Subjected to Tax Withheld at Source (SAWT) to

Tax Returns with Claimed Tax Credits Due to

Creditable Tax Witheld at Source and of the

Monthly Alphalist of Payees Whose Income

Received Have Loan Subjected to Withholding

Tax Remittance Return Filed by the Withholding

Agent/Payor of Income Payments

Amendments to Sections 2.78.1 (B), Sec.

2.79(A) and (F) 2.83.4 (C) and 2.83.5 of RR No.

2-98 as Amended

Temporary Deferment of the Implementation of

Rev. Regs. No. 17-2005

Enhanced Voluntary Assessment Program

(EVAP) for Taxable Year 2004 and Prior Years

Under Certain Conditions

Regulations Providing for the Policies, Guidelines

and Procedures in the Implementation of the Tax

Subsidy Granted by the Fiscal Incentives

Review Board (FIRB) to the Bases Conversion &

Development Authority (BCDA) for the SubicClark-Tarlac Expressway Project

Consolidated VAT Regulations of 2005

28

03-Jan-06

01-Dec-05

29-Dec-05

07-Nov-05

12-Oct-05

29-Jul-05

01-Sep-05

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

25-Nov-05

05-461

Rev. Memo Cir. No.62-2005

25-Nov-05

05-461

Rev. Memo Cir. No.61-2005

25-Nov-05

05-461

Rev. Memo Cir. No.59-2005

25-Nov-05

05-461

Rev. Memo Cir. No 52-2005

5-Aug-05

05-321

Rev. Memo Cir. No 29 2005

5-Aug-05

05-321

Rev. Regs. No 15-2005

5-Aug-05

05-321

Rev. Regs. No 14-2005

5-Aug-05

05-321

Rev. Regs. No 13-2005

Revised Guidelines in the Registration and

Invoicing Requirements Including Clarification on

Common Issues Affecting VAT Taxpayers

Pursuant to RA 9337 (An Act Amending Sections

27, 28, 34, 106, 108, 109, 110, 111, 112, 113,

114, 116, 117, 119, 121, 148, 151, 236, 237

and 288 of the NIRC of 1997, as Amended, and

for Other Purposes)

Clarifying the VAT Provisions of RA 9337

Applicable to the Power Industry

Clarification on the Tax Treatment of Petroleum

Products Sold to International Marine Vessels

VAT Liability of the Tollway Industry

Clarifying the Provisions of RA No. 9337 (VAT

Law of 2005) Applicable to the Petroleum

Industry

Providing for Policies and Guidelines for the

Abatement of Surcharges in Relation to the

Filing of Amended Tax Returns Filed under

Certain Conditions

Consolidated VAT Regulations of 2005

Regulations Defining "Gross Income Earned" to

Implement the Tax Incentive Provision Under

Par. (c) of Sec. 12 of RA No. 7227, Otherwise

Known as "The Bases Conversion Dev. Act of

1992" Revoking Section 7 of RR No.2-2005, and

Suspending the Effectivity of Certain Provisions

of RR No. 2-2005

29

18-Oct-05

27-Oct-05

21-Oct-05

28-Sep-05

29-Jun-05

09-Jun-05

22-Jun-05

25-Apr-05

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

5-Aug-05

5-Aug-05

05-321

05-321

Rev. Regs. No 12-2005

Regulations Defining "Gross Income" to

Implement the Tax Incentives Provision Under

Par. (c) of Sec. 4 of RA No. 7922, Otherwise

Known as the "Cagayan Special Economic Zone

Act of 1995" and Par. (f) of Sec. 4 of RA No.

7903, Otherwise Known as "Zamboanga City

Special Economic Zone Act of 1995, Revoking

Sec. 7 of RR No. 2-2005 and Suspending the

Effectivity of Certain Provisions of RR No. 2-2005

25-Apr-05

Rev. Regs. No 11-2005

Regulations Defining "Gross Income Earned" to

Implement the Tax Incentive Provision in Sec.

24 of RA 7916, Otherwise Known as "The

Special Economic Zone Act of 1995" Revoking

Sec. 7 of RR No. 2-2005, and Suspending the

Effectivity of Certain Provisions of RR No. 2-2005

25-Apr-05

21-Jun-05

05-255

Rev. Regs. No 10-2005

21-Jun-05

05-255

Rev. Regs. No 09-2005

Amending Certain Provisions of RR No. 6-2005

Resulting from the Amendment of Sec. 2 of EO

No. 399, Directing the BIR to Establish the "No.

Audit Program" (NAP) for the Purpose of

Enhancing Tax Compliance and Increasing Tax

Collections

Amending Pertinent Provisions of RR No. 6-04

Relative to the Tax Exemptions and Privileges

Granted Under RA No. 9182, Otherwise Known

as "The Special Purpose Vehicle (SPV) Act of

2002 ("The Act")

30

18-May-05

19-Mar-05

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

21-Jun-05

05-255

Rev. Regs. No 08-2005

11-May-05

05-198

Rev. Regs. No 07-2005

11-May-05

05-198

Rev. Regs. No 06-2005

11-May-05

05-198

Rev. Regs. No 05-2005

11-May-05

05-198

Rev. Regs. No 04-2005

11-May-05

05-198

Rev. Regs. No 03-2005

Amending Further Pertinent Provisions of RR No.

2-98, as last Amended by RR No. 3-2004, as

Amended, Providing for the Inclusion of Income

Payments Subject to Creditable Withholding Tax

under Sec. 2.57.2 (U) on MERALCO Refund

Arising from SC Case G.R. No. 14814 of April

09, 2003 to Customers under Phase IV as

Approved by Energy Regulatory Commission

(ERC)

Amending Pertinent Provision of RR No. 4-2000,

by Providing a New Format for the Notice to the

Public to be Exhibited at Place of Business

Providing for the Implementing Rules for EO No.

399 Directing the BIR to Establish the "No Audit

Program" (NAP) for the Purpose of Enhancing

Tax Compliance and Increasing Tax Collections

Monthly Submission of Sales Report and Other

information Generated by Cash Register

Machines (CRMs) and Point of Sales Machines

(POS) and/or any Machine Sales Generating

Receipt/Invoice Registered with the BIR

Rules and Regulations Implementing BSP Cir.

No. 472 s. 2005 Sec.1 Requiring All Bank

Borrowers and Co-makers to Submit Latest ITR

and Financial Statements Received by BIR

Rules and Regulations Implementing EO No. 398

and Requiring Timely and Complete Payment of

Taxes as a Precondition for Entering Into and as

a Continuing Obligation in Contracts with

Government.

31

23-Feb-05

31-Mar-05

04-Mar-05

16-Feb-05

16-Feb-05

16-Feb-05

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

11-May-05

05-198

Rev. Regs. No 02-2005

11-May-05

05-198

Rev. Regs. No 01-2005

11-Feb-05

05-071

Rev. Regs. No. 13-2004

11-Feb-05

05-071

Rev. Regs. No. 12-2004

11-Feb-05

05-071

Rev. Regs. No. 11-2004

Consolidated Revenue Regulations Implementing

Relevant Provisions of RA No. 7227 Otherwise

Known as "Bases Conversion and Development

Act of 1992", RA No. 7916 as Amended

Otherwise Known as "Special Economic Zone Act

of 1995", RA No. 7903 Otherwise Known as

"Zamboanga City Special Economic Zone Act of

1995" and RA No. 7922 Other wise Known as

"Cagayan Special Economic Zone Act of 1995"

Thereby Amending RR No. 1-95 as Amended by

RR No. 16-99

Amending Further Pertinent Provisions of RR No.

7-95, as Amended by RR No. 8-2002

Implementing the Provisions of RA No. 9243, An

Act Rationalizing the Provisions on the

Documentary Stamp Tax of the NIRC of 1997, as

Amended, and for Other Purposes

Providing for the Revised Tax Rates on Alcohol

and Tobacco Products Introduced on or Before

December 31, 1996, and for those Alcohol and

Tobacco Products Covered by RR Nos. 22-2003

and 23-2003. Implementing RA No. 9334,

Otherwise Known as "An Act Increasing the

Excise Tax Rates Imposed on Alcohol and

Tobacco Products, Amending for the Purpose

Sections 131, 141, 142, 143, 144,, 145, and 288

of the NIRC OF 1997, as Amended"

Rules and Regulations on the Accreditation,

Registration and Use of Cash Register Machines

(CRM), Point-of-Sale (POS) Machines and/or

Business Machines Generating Receipts/Invoices

32

08-Feb-05

28-Dec-04

23-Dec-04

28-Dec-04

15-Dec-04

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

11-Feb-05

05-071

Rev. Regs. No. 10-2004

16-Aug-04

04-274

Rev. Regs. No 09-2004

16-Aug-04

04-274

Rev. Regs. No 08-2004

16-Aug-04

04-274

Rev. Regs. No 07-2004

16-Aug-04

04-274

Rev. Regs. No 06-2004

To Further Implement the Provisions of Sec. 4 of

RA No. 9238 Re-imposing the Gross Receipts

Tax on Other Non-Bank Financial Intermediaries

Beginning Jan. 1, 2004 and Hereby Amending

for the Purpose Sec. 4 or RR No. 9-2004 by

Including Pawnshops Under the Classification of

Other Non-Bank Financial Intermediaries

Implementing Certain Provisions of RA No. 9238,

Re- Imposing the Gross Receipt Tax on Banks

and Non-Bank Financial Intermediaries

Performing Quasi-Banking Functions and Other

Non-Bank Financial Intermediaries Beginning

Jan.-01-04

Rev. Regs. Implementing Sec. 7 , 204 (A) and

290 of the NIRC of 1997 on Compromise

Settlement of Internal Revenue Tax Liabilities

Superseding RR Nos. 7-2001 and 30-2002

Implementing Sec. 109 (bb) and (cc) of the

NIRC, as Amended by RA No. 9238, Excluding

Services Rendered by Doctors of Medicine Duly

Registered with the Professional Regulatory

Commission (PRC), and Services Rendered by

Lawyers duly Registered with the IBP from the

Coverage of VAT

Implementing theTax Exemptions and Privileges

Granted Under RA No. 9182, Otherwise Known

as the "The Special Purpose Vehicle (SPV) Act

of 2002"

33

18-Oct-04

21-Jun-04

19-May-04

07-May-04

31-Mar-04

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

16-Aug-04

04-274

Rev. Regs. No 05-2004

12-May-04

04-141

Rev. Memo Cir. No 22 2004

12-May-04

04-141

Rev. Memo Cir. No 10 2004

12-May-04

04-141

Rev. Memo Cir. No 09 2004

Amending Further RR No. 9-2001, as Amended

by RR No. 2-2002, RR No. 9-2002 and RR No.

26-2002, Providing for Additional Tax

Returns/Forms which shall be Filed thru the

Electronic Filing and Payment System (EFPS),

Revising the Requirements for Enrolment of

Taxpayers, and Expanding the Coverage Thereof

to Include the Top 10,000 Private Corporations

Duly Identified Under RR No. 17-2003

Supplement to RMC No. 44-2002 on Acctn'g

Methods to be Used by Taxpayers for Internal

Revenue Tax Purposes

Guidelines and Policies to Supplement RMC No.

9-2004 Issued in Relation to the Implementation

of RA No. 9238 for Banks and Non-Bank

Financial Intermediaries, Specifically for the ReImposition of Gross Receipts Tax

Guidelines and Policies Applicable to the

Business Tax Applicable to Banks and Non-Bank

Financial Intermediaries Performing QuasiBanking Functions and Other Non-Bank Financial

Intermediaries As A Result of the Enactment and

Effectivity of RA No. 9238, An Act Amending

Certain Provisions of the NIRC of 1997, as

Amended, by Excluding Several Services from

the Coverage of the VAT and Re-Imposing the

Gross Receipt Tax on Banks and Non-Bank

Financial Intermediaries Performing QuasiBanking Functions and Other Non-Bank Financial

Intermediaries Beginning January 1, 2004

34

26-Apr-04

12-Apr-04

19-Feb-04

19-Feb-04

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

12-May-04

04-141

Rev. Memo Cir. No 02 2004

12-May-04

04-141

Rev. Memo Ord. No 05 2004

12-May-04

04-141

Rev. Memo Ord. No 04 2004

12-May-04

04-141

Rev. Regs. No 4-2004

12-May-04

04-141

Rev. Regs. No 03-2004

12-May-04

04-141

Rev. Regs. No 02-2004

Clarifying the Issues on VAT Taxable

Transactions of Philippine Ports Authority

Amending RMC No. 20-88, Pursuant to RA No.

7716 as Implemented by RR 7-95

Prescribing the Guidelines and Procedures in the

Implementation of RR No. 29-2003 on the

Advance Payment of VAT on the Sale of Flour

Defining Guidelines Relating to Registration of

Agricultural Supplier as Marginal Income

Earners and their Exemption from the 1%

Creditable Withholding Tax on Payments Made

by Hotels, Restaurants, Resorts, Caterers, Food

Processors, Canneries, Supermarkets, Livestock,

Poultry, Fish and Marine Product Dealers,

Hardwares, Factories, Furnitures Shops, and All

Other Establishment

Supplementing the Rules on the Advance

Payment of VAT on Sale of Refined Sugar as

Provided for in RR 2-2004

Suspending the Implementation of Withholding

Tax on Income Payments Made to Suppliers of

Agricultural Products under Sec. 2.57.2 (S) of

RR 2-98, as Amended by RR 17-2003, Further

Amended by RR 30-2003 and 1-2004

Further Enhancing the Rules on the Advance

Payment of VAT on Sale of Refined Sugar,

Amending Revenue Regulations No. 7-89 and

29-2002

35

26-Dec-03

29-Dec-03

30-Jan-04

22-Mar-04

01-Mar-04

02-Jan-04

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

18-Feb-04

04-053

18-Feb-04

04-053

18-Feb-04

04-053

18-Feb-04

04-053

18-Feb-04

04-053

Clarifying the Issues on VAT Taxable

Transactions of Philippine Ports Authority

Rev. Memo Cir. No. 2-2004

Amending RMC No. 20-88, Pursuant to RA No.

7716 as Implemented by RR 7-95

Tax Exemptions of Non-Stock, Non-Profit

Corporations Under Sec., 30 Tax Code of 1997

Rev. Memo Cir. No 76 and Non-Stock, Non-Profit Educational

2003

Institutions under Par. 3, Sec. 4 Art. XIV of the

Constitution

Prescribing Additional Guidelines Governing the

Rules on Assessment of National Internal

Rev. Memo Ord. No 42 Revenue Taxes Covered by a Letter of Notice

2003

(LN) Issued under the RELIEF System as Defined

in RMO No. 30-2003 and Other Data Matching

Processes

Amending Further Sec. 2.57.2 (S) of RR No. 298, as Last Amended by RR No. 30-2003,

Exempting Marginal Income Earners from

Creditable Withholding Tax on Payments Made

Rev. Regs. No. 1-2004

by Hotels, Restaurants, Resorts, Caterers, Food

Processors, Canneries, Supermarkets, Livestock,

Poultry, Fish and Marine Product Dealers,

Hardwares, Factories, Furniture Shops, and

Other Establishments

Regulations Providing for the Policies, Guidelines

and Procedures in the Implementation of the

Tax Subsidy Granted by the Fiscal Incentives

Rev. Regs. No 31-2003

Review Board (FIRB) to the Armed Forces of

the Philippines Commissary and Exchange

Services (AFPCES)

36

26-Dec-03

14-Nov-03

23-Oct-03

14-Jan-04

22-Sep-03

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

18-Feb-04

04-053

Rev. Regs. No 30-2003

18-Feb-04

04-053

Rev. Regs. No 29-2003

18-Feb-04

04-053

Rev. Regs. No 28-2003

9-Dec-03

03-575

Rev. Memo Order. No 382003

9-Dec-03

03-575

Rev. Memo Cir. No 72 2003

9-Dec-03

03-575

Rev. Memo Cir. No 69 2003

9-Dec-03

03-575

Rev. Memo Cir. No 66 2003

Amending Further Pertinent Provisions of RR No.

2-98, as Last Amended by RR No. 17-2003, and

RR No. 8-98, as Amended, Providing for the

Imposition of Final Withholding Tax on the Sale,

Exchange or Other Disposition of Real Property

Classified as Capital Assests by Non-Resident

Aliens, Increasing the Withholding Tax Rates on

Certain Income Payments, Inclusion of Certain

Income Payments, Sanctions to be Imposed on

Payees who Refuse the Withholding of Tax on

Their Income/Receipts and for other purposes

Advance Payment of VAT on the Sale of Flour

Amending Further Pertinent Provisions of RR

No. 2-98 as Amended, Relative to the Issuance

of Cert. of VAT Withheld at Source, thereby

Amending RR 4-2002, and for Other Purposes

Prescribing Uniform Guidelines and Procedures in

the Processing of Various Permits for Excise Tax

Purposes

Tax Implications of Electric Cooperatives

Registered with the National Electrification

Administration and Cooperative Development

Authority

Clarifying the Tax Base for Purposes of the

Percentage (Gross Receipts) Tax Imposed under

Sec. 121 & 122 of the Tax Code

Clarifying the Taxability of Philippine Airlines

(PAL) for Income Tax Purposes as well as Other

Franchise Grantees Similarly Situated

37

12-Nov-03

30-Oct-03

15-Oct-03

24-Oct-03

20-Oct-03

13-Oct-03

14-Oct-03

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

9-Dec-03

03-575

Rev. Memo Cir. No 62 2003

9-Dec-03

03-575

Rev. Memo Cir. No 61 2003

9-Dec-03

03-575

Rev. Memo Cir. No 60 2003

9-Dec-03

03-575

Rev. Memo Cir. No. 582003

9-Dec-03

03-575

Rev. Regs. No 27-2003

Providing Guidelines for Doc. Stamp Tax

Evaluation on Cash-Settled Securities Swap

Transactions under the Memo of Agreement for

Cash-Settled Securities Swap Transactions

(CSST) among the Bangko Sentral ng Pilipinas,

Bureau of Treasury, Bankers Association of the

Phils. and Investment Houses Association of the

Phils..

Issuance of VAT Invoice/Receipt for NonVAT/Exempt Sale of Goods, Properties or

Services

Clarifying Certain Issues Raised Relative to the

Implementation of RR 25-2003 Governing the

Imposition of Excise Tax on Automobiles

Pursuant to RA 9224

Prescribing the Formats to be Used in the

Preparation of Sworn Statement and Official

Register Books by Manufacturers/Assemblers,

Importers and Dealers of Automobiles Pursuant

to the Provisions of RR No. 25-2003, Amended

Rev. Regulations Governing the Imposition of

Excise Tax on Automobiles Pursuant to RA No.

9224

Regulations Further Amending the Transitory

Provisions of RR 18-99 as Amended by RR 122003, Pertaining to the Deadline for the Usage

of Properly Stamped Unused Non-VAT Invoices

or Receipts

38

no date

06-Oct-03

06-Oct-03

30-Sep-03

30-Jun-03

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

9-Dec-03

03-575

9-Dec-03

03-575

5-Sep-03

03-429

5-Sep-03

03-429

5-Sep-03

03-429

Modified Procedures of Registering Manually

Printed Receipts or Sales/Commercial Invoices

Rev. Regs. No 26-2003

Prior to their Use Amending the Requirement of

Stamping the BIR-Registration Thereon

Amended Revenue Regulations Governing the

Imposition of Excise Tax on Automobiles

Pursuant to the Provisions of RA 9224, An Act

Rev. Regs. No 25-2003

Rationalizing the Excise Tax on Automobiles,

Amending for the Purpose the NIRC of 1997, and

for Other Purposes

Clarifying the Venue for Payment of Capital

Gains Tax/Creditable Expanded Withholding Tax

Rev. Memo Cir. No 50 and Corresponding Documentary Stamp Tax

2003

Relative to the Sale of Real Properties by

Insurance Companies

Guidelines Regarding Revalidation and

Rev. Memo Ord No 23-2003

Conveyance of Tax Credit Certificates

Policies, Guidelines & Procedures in the

Processing and Monitoring of One-time

Transactions (ONETT) and the Issuance of

Certificates Authorizing Registration (CARs)

Covering Transactions Subject to Final Capital

Gains Tax on Sale of Real Properties Considered

Rev. Memo Ord. No 15 as Capital Assets as Well as Capital Gains Tax

2003

on the Net Capital Gain on Sale, Transfer or

Assignment of Stocks not Traded in the Stock

Exchange(s), Expanded Withholding Tax on Sale

of Real Properties Considered as Ordinary

Assets, Donors Tax, Estate Tax and Other Taxes

Including Doc. Stamp tax Related to the

Sale/Transfer of Properties

39

18-Sep-03

16-Sep-03

22-Aug-03

23-Jun-03

08-May-03

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

5-Sep-03

03-429

Rev. Memo Cir. No 49 2003

5-Sep-03

03-429

Rev. Memo Cir. No 47 2003

5-Sep-03

03-429

Rev. Memo Cir. No 46 2003

5-Sep-03

03-429

Rev. Memo Cir. No 45 2003

Amending Answer to Question 17 of RMC 422003 and Providing Additional Guidelines on

Issues Relative to the Processing of Claims for

VAT Credit/Refund, Including Those Filed with

the Tax and Revenue Group, One-Stop Shop

Inter-Agency Tax Credit & Duty Drawback

Center, Department of Finance (OSS-DOF) by

Direct Exporters

Publishing Dept. Ord. 19-03 dated July 18,

2003, of the Department of Finance Directing

the One-Stop Shop Inter-Agency Tax Credit and

Duty Draw back Center (Center) to Conduct a

Special Revalidation of All Outstanding TCCs

Issued Prior to Oct. 1, 2003 in Order to

Safeguard the Integrity of the Tax Credit System

being Administered by said Center

Publishing the Full Text of Department Ord. 2003. Dated July 18, 2003, of the Department of

Finance Providing for Measures to Safeguard the

Integrity of the Tax Credit System Being

Administered by the One-Stop Shop InterAgency Tax Credit and Drawback Center

Use of Head Office Receipts/Invoices by

Branches

40

15-Aug-03

30-Jul-03

30-Jul-03

11-Aug-03

OFFICE OF THE NATIONAL ADMINISTRATIVE REGISTER

Inventory of Administrative Issuances

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

5-Sep-03

03-429

Rev. Memo Cir. No 43 2003

5-Sep-03

03-429

Rev. Memo Cir. No 42 2003

5-Sep-03

03-429

Rev. Memo Cir. No 40 2003

5-Sep-03

03-429

Rev. Memo Cir. No 39 2003

Amending Certain Provisions of RMC No. 132003, Regarding the Issuance of Letters of

Authority(LA) /Audit Notices (AN), Tax

Verification Notice (TVN) Covering the

Audit/Verification of Taxpayers' Tax Return/Tax

Liabilities and Providing for Clarificatory

Guidelines on the Submission of Reports of

Investigation and Status Reports of Pending

Cases as well as on the Handling of Cases

Issued under RMC 13-2003

Clarifying Certain Issues Raised Relative to the

Processing of Claims for VAT Credit/Refund,

Including Those Filed with the Tax & Revenue