Professional Documents

Culture Documents

Ebook 3 Top BigData UseCase in Financial Services

Uploaded by

kumar_007111Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ebook 3 Top BigData UseCase in Financial Services

Uploaded by

kumar_007111Copyright:

Available Formats

F I N A N C I A L S E RV I C ES US E CASE EBO O K

3 Top Big Data Use Cases

in Financial Services

How Financial Services Companies are Gaining Momentum

in Big Data Analytics and Getting Results

I NT RODUCT I ON

Helping Financial Services Companies

with Big Data

Datameer has been working with some of the most progressive companies in financial services to

rapidly deploy big data analytics that drive customer acquisition, increase customer loyalty, predict

and prevent fraud and deliver more targeted advertisement.

The top three credit card companies in the world, top global banks, wealth management and

insurance companies are now understanding their customer behavior by combining both structured

data such as CRM, transaction and point of sales, with unstructured data such as Web logs, social

media and mobile interaction to get new insights that drive customer acquisition.

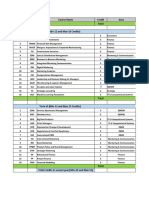

Top High Impact Big Data Use Cases in Financial Services

I NT RODUCT I ON

Get a Competitive Advantage

with Big Data

Financial services companies generate and compile exabytes of data a year, including structured

data such as customer demographics and transaction history and also unstructured data such as

customer behavior on websites and social media.

Starting with the financial crisis in 2009, financial institutions have increased their focus on customer

risk management. Around the globe, financial organizations continue to lay down rules for credit risk

and liquidity ratio levels, including regulatory acts such as AML, Basel III and FACTA that increase the

amount of customer data available for analysis.

In addition, financial institutions now have to filter through much more data to identify fraud.

Analyzing traditional customer data is not enough as most customer interactions now occur through

the Web, mobile apps and social media.

To gain a competitive edge, financial services companies need to leverage big data to better comply

with regulations, detect and prevent fraud, determine customer behavior, increase sales, develop

data-driven products and much more.

This e-book outlines the three top financial services use cases of big data as well as provides a

number of real-life case studies. We hope this generates some ideas on how you can leverage big

data analytics in your organization.

1

2

http://www.researchandmarkets.com/research/xz3zpz/global_big_data

http://www.information-management.com/news/banks-urged-to-focus-on-it-rather-than-cost-cuts-10025282-1.html

Top High Impact Big Data Use Cases in Financial Services

CUSTOM ER A NA LY T I CS

Understanding Your Customer

Interactions

As a CMO, digital marketing, or customer loyalty executive responsible for optimizing customer

acquisition and loyalty campaigns, you need greater visibility into the customer buying journey. Why?

Because deeper, data-driven customer insights are critical to tackling challenges like improving

customer conversion rates, personalizing campaigns to increase revenue, predicting and avoiding

customer churn, and lowering customer acquisition costs.

But consumers today interact with companies through lots of interaction points mobile, social

media, stores, e-commerce sites, and more which dramatically increases the complexity and variety

of data types you have to aggregate and analyze. Think Web logs, transaction and mobile data.

Advertising social media and marketing automation data. Product usage and contact center

interactions. CRM and mainframe data. And even publicly available demographic data. When all of

this data is aggregated and analyzed together, it can yield insights you never had before for

example, who are your high-value customers, what motivates them to buy more, how they behave,

and how and when to best reach them. Armed with these insights, you can improve customer

acquisition and drive customer loyalty.

Big Data Analytics at Work

Big data analytics is the key to unlocking the insights from your customer behavior data structured

and unstructured because you can combine, integrate and analyze all of your data at once to

generate the insights needed to drive customer acquisition and loyalty. For example, you can use

insights about the customer acquisition journey to design campaigns that improve conversion rates.

Or you can identify points of failure along the customer acquisition path or the behavior of

customers at risk of churn to proactively intervene and prevent losses. And you can better

understand high-value customer behavior beyond profile segmentation (for example, what other

companies they shop from, so you can make your advertisements even more targeted).

Increase

Customer Acquisition

Increase Revenue

per Customer

Decrease Customer

Acquisition Cost

Top High Impact Big Data Use Cases in Financial Services

Reduce

Customer Churn

Product

Enhancement

F RAU D A ND COM P L I A NCE

Fraud and Compliance

If you are responsible for security, fraud prevention, or compliance, then data is your best friend if

you can use it to identify and address issues before they become problems. The fact is, security

landscapes and compliance requirements are constantly evolving, as are the methods that the bad

guys are using to defraud your business and customers.

Data-driven insights can help you uncover whats hidden and suspicious and in time to mitigate

risks. For example, analyzing data can help you reduce the operational costs of fraud investigation,

anticipate and prevent fraud, streamline regulatory reporting and compliance (for instance, for

HIPPA), identify and stop rogue traders, and protect your brand. But this requires aggregating and

analyzing data from a myriad of sources and types and analyzing it all at once no small task. Think

financial transaction data, geo-location data from mobile devices, merchant data, and authorization

and submission data. Throw in data from lots of social media channels and your mainframe data, and

you have a significant challenge on your hands. However, with the right tools, this melting pot of data

can yield insights and answers you never had before insights you can use to dramatically improve

security, fraud prevention, and compliance.

Big Data Analytics at Work

Big data analytics enables you to combine, integrate and analyze all of your data at once regardless

of source, type, size, or format to generate the insights and metrics needed to address fraud and

compliance-related challenges. For example, you can perform time series analysis, data profiling and

accuracy calculations, data standardization, root cause analysis, breach detection, and fraud scoring.

You can also run identity verifications, risk profiles, and data visualizations and perform master data

management.

Credit Card

Fraud Detection

Criminal Behavior

Top High Impact Big Data Use Cases in Financial Services

Regulatory

Compliance

Cyber Attack

Prevention

EDW OPT I M I ZAT I ON

EDW Optimization

Enterprise data warehouses (EDW) are critical for enabling operational reports for businesses but

as the size and complexity of the data to be analyzed increases, youll eventually hit the limits of

traditional data warehouses. Youll know it when your processing times take too long to meet business

needs, your costs get out of control, or you struggle to process and analyze new data types. For both

IT executives and key stakeholders responsible for analytics, business intelligence and enterprise

data, this is a serious problem. Todays business decision makers simply cant afford delays in

insights anymore.

The solution is to offload the most challenging data management and analytics activities to new

technologies and management approaches designed to handle them. For example, do you need to cut

the costs of data preparation and cleansing? Reduce time to insight by offloading the most

time-consuming analytical tasks? Support a variety of new data types, especially unstructured data?

Or better manage rapidly growing log, sensor and other unstructured data?

Traditional EDWs were never designed to solve these types of challenges. First, they make it

prohibitively expensive to manage the ever-increasing volumes of transaction and interaction, mobile

data, website click stream data, ad click through, log data, sensor data, and unstructured machine

data. At second, theyre slow to produce analytics from unstructured data because they dont

support it. This forces technicians to manually give this data structure before analyzing it.

Big Data Analytics at Work

The good news is, big data analytics solutions that run on Hadoop can solve these challenges. Big

data analytics solutions running on Hadoop make it easy to overcome these challenges because they

allow you to cost effectively scale to any volume of data and store and analyze any and all data types

together both structured and unstructured. You can also use them to extract structured data from

your EDW into Hadoop for cheaper storage and then send back into EDW for analytics. All data can be

analyzed as is, eliminating costly data preparation activities. At the same time, big data analytics is so

powerful because it enables you to combine, integrate and quickly analyze all of your data at once

regardless of source, type, size, or format to generate the insights your business needs. In addition,

you can parse, clean, profile, match, enrich, aggregate, and normalize data, as well as manage ETL

workloads and generate master data.

Offload Expensive

Analytics

Offload Expensive

Data Preparation

to Lower Cost

Top High Impact Big Data Use Cases in Financial Services

Data Discovery

Deal with Various

Data Types

F I NA NCI A L S ERVI CES US E CAS E

Datameer Delivers Faster Insights

from Big Data

Datameer provides a one-stop-solution for getting all of your Web, advertising, mobile, social media,

transaction, marketing automation, and CRM data into Hadoop; enriching it with third-party data;

analyzing your data; and visualizing results using wizard-led data integration, point-and-click

analytics functions, and drag-and-drop visualizations. Our broad set of 60+ data connectors and

analytic functions make it easy to:

Rapidly combine and enrich existing data sets with third-party, customer, and other data

Perform ad-hoc analytics to test what-if scenarios

Better understand your customer interactions and identify the most effective campaigns

Identify the behaviors of customers at risk of churn

As a result, you can answer questions like:

Whats really happening across the customer journey?

Which campaign combinations accelerate revenue?

Which offers drive customer loyalty?

What credit card behavior signals potential fraud?

How can we assess customer risk before extending credit?

How can create more targeted campaigns?

The following case studies outline how some of the most progressive financial services companies are

using big data for a competitive advantage.

Top High Impact Big Data Use Cases in Financial Services

F I NA NCI A L S ERVI CES US E CAS E

Predict and Prevent Customer Churn

The Need for Insight into Customer Behavior

Company Profile:

A leading financial

services company

offering retirement

planning, IRAs,

mutual funds, life

insurance, and more.

As part of a strategic initiative to reduce the amount of funds being transferred to competitors, this

financial services company wanted to understand the client behaviors that might signal movement of

funds. With a growing number of clients retiring, they realized that it was important to provide better

wealth management services to retain them. They also wanted to identify and track specific

behaviors so they could focus on the people who might consider moving their money. This is

important because historically, 50% of the time, they can retain a customer if they know the

customer is considering moving their pension. They leveraged Datameer to gain insight on what

customer behavior signals that a customer is likely to transfer their investment.

Analyzing Customer Activity Leading Up to a Withdrawal

Using Datameer, the company first integrated data of customer activities that might indicate that the

client was considering moving their funds elsewhere. Examples of such activities included: the client

had recently called in for information with an outside financial consultant on the line; a change in

address, workplace, or power of attorney; or the client had recently been browsing on the company

site for forms. They pulled multiple data sources together to build out activity paths for each client.

For example, they tracked clients specific activities and whether these activities ultimately led to a

transfer or withdrawal. By correlating this data, they were able to determine the statistical relevance

of each activity, or combination of activities that predicted customer churn.

Result:

By identifying patterns of customers at risk of churn and

proactively reaching out to offer their wealth management

products, the company has reduced customer churn by 50%.

Top High Impact Big Data Use Cases in Financial Services

F I NA NCI A L S ERVI CES US E CAS E

Analyzing Effectiveness of a New

Sales Tool with Behavior Analytics

Company Profile:

A major provider of

worldwide investment

management

services.

Measuring the Impact of a New iPad Application

In the United States, the asset management industry oversees the allocation of approximately $53

trillion in financial assets3. This company wanted to increase sales to get a bigger piece of this large

market. They also needed a way to measure the effectiveness of different sales tools to accomplish

this goal. The product management team created an iPad application that explained the various fund

options and each funds historical performance. The sales reps used the iPad application during

meetings with financial advisers (wholesalers) to help describe the fund details. Product

management wanted to measure the value of the new iPad application by analyzing the impact of its

use on new trades (sales).

Analyzing Behavior

Using Datameer, the team integrated structured and unstructured data from multiple internal and

external data sources. This included data from the CRM system logs, iPad application JSON logs, web

activity, and the sales database. The CRM system logs recorded the actual date and time of the

meeting, along with details of what products were discussed. The JSON logs showed whether the

application was in use at the specific time of a meeting between a sales rep and a financial adviser.

The JSON logs also showed the actual fund details that were viewed on the iPad application during

the meeting. Weblogs showed if the sales rep browsed through the company website during the

meeting. The sales database showed whether a specific meeting resulted in the client performing a

trade within two weeks. The sales database also showed if the trade was for the same funds that were

browsed during the meeting.

These data sets were integrated and analyzed to show the percentage of the overall meetings where

the iPad application was used, and which meetings where the iPad application was used resulted in

trades facilitated by specific financial advisers within two weeks. After the initial analysis, the

company conducted a further analysis to determine whether the most successful sales reps used the

iPad application more consistently than others.

Result:

The analysis through Datameer showed that using the iPad

application resulted in a significant increase in sales within two

weeks of meetings. It also showed many of the most successful

sales reps used the application.

http://www.treasury.gov/initiatives/ofr/research/Documents/OFR_AMFS_FINAL.pdf

Top High Impact Big Data Use Cases in Financial Services

F I NA NCI A L S ERVI CES US E CAS E

Analyze 7x More Customer Attributes

96% Faster

Company Profile:

A major worldwide

bank, serving

individual consumers,

businesses of all sizes,

governments, and

other organizations

Process Billions of Data Points

Banks need to be able to quickly identify potentially fraudulent credit card transactions. This requires

the ability to swiftly prepare data regarding these transactions and historical spending patterns. This

leading bank has billions of data points to process. Their previous analytic environment had limits in

computational power and in the ability to handle large volumes of data. The company wanted to

increase the speed, agility and capacity to build, refine, and calibrate analytic models with three

specific goals: eliminate sampling bias by building models with more data; test and iterate models

faster and increase overall performance as compared to existing models while improving modeler

efficiency and productivity.

Ultimately, the bank wanted to accelerate customer spend pattern signature detection, a

computationally expensive analytic process. The goal was to analyze historical transactions to create

signature vectors for different entities (customers, clients, industries, branches, economies, etc.) that

capture the norms observed in prior behavior. In addition, they wanted to identify changes in

behavior by classifying current transactions and comparing them to the relevant signature vector.

Analyzing Millions of Credit Card Transactions

The company built a query as a Datameer workbook for millions of credit card accounts, encompassing

almost three billion transactions; 5 billion customer attributes; 50 spending categories; and 55

attributes per category.

Result:

Using Datameer, the company now analyzes 5 billion customer

attributes in 51 minutes. In comparison, the company using their

existing EDW solution, could only analyze 700 million customer

attributes in 36 hours.

The Datameer solution provided a significant improvement in

performance, reducing processing time by 96 percent while

processing 7 times the number of customer attributes.

Top High Impact Big Data Use Cases in Financial Services

F I NA NCI A L S ERVI CES US E CAS E

Reducing Customer Acquisition Costs

with Targeted Promotions

Company Profile:

A leading

multinational

financial services

provider based in

the United States

The High Cost of Acquiring New Customers

A McKinsey Global Institute Report shows that marketing and sales consume about 15 percent of

costs for bank and insurance companies. Institutions spend hundreds of dollars to acquire each new

customer. Credit card issuers spend billions of dollars annually on direct mail and mass-market

advertising to get new accounts.4 This company realized that it needed to find a way to target

customers and promote to them more effectively to reduce customer acquisition costs.

Using Insight for More Targeted Promotions

This company used Datameer to correlate customer purchase history, customer profile data, and

customer behavior on public social media sites that indicated areas of interest (for example liking

something on Facebook). Using the insight gained, the company could offer special promotions to an

individual based on their interests. For example, if a person made a number of transactions at Whole

Foods and liked the Food Network, the company could send a credit card with a special promotion for

Whole Foods or the Food Network.

Result:

Using the insight provided through the Datameer analysis, the company created special targeted

promotions, reducing the cost of new customer acquisitions by 30%.

The social economy: Unlocking value and productivity through social technologies, July 2012

Top High Impact Big Data Use Cases in Financial Services

10

F I NA NCI A L S ERVI CES US E CAS E

Ensuring Compliance with Basel III

through Analysis of Trillions of Records

Company Profile:

A leading retail bank

The Importance of Data Accuracy and Quality

Basel III has introduced a number of challenges to banks. An Accenture report states, The technical

challenges of Basel III implementation includes data availability, data completeness, data quality and

data consistency to calculate the new ratios.5

This bank integrated data from multiple sources for over 300 attributes. The data sources included

sub-prime loans data, acquired wealth management data, and data from legacy retail banking

systems. To comply with Basel III, the bank needs to ensure quality of the data, through a

scorecarding process. The scorecarding process includes subjecting the data to hundreds of data

quality checks. The results of those checks are trended over time to ensure that the tolerances for

data corruption and data domains arent changing adversely. In addition, they want to make sure that

the risk profiles being reported to investors and regulatory agencies are prudent and in compliance

with regulatory requirements.

Prior to Datameer, the bank used a SAS application to analyze data quality. They also were using

Teradata and a mainframe solution. The process was time consuming and complex.

Quick Analysis of Trillions of Records

Using Datameer, the Data Quality Initiative team analyzes trillions of records that result in

approximately 1 terabyte of reports per month. The team puts the results of the analysis in a data

quality dashboard that the company uses to ensure accuracy of regulatory compliance reporting. In

addition, using Datameer, they are able to reduce the time it takes to determine the impact of the

data on risk metric calculations and accelerate time to market of their risk analyses.

Result:

With Datameer, the bank has dramatically reduced the time

to analyze hundreds of attributes and terabytes of data.

http://www.accenture.com/SiteCollectionDocuments/PDF/Accenture_Basel_III_and_its_ Consequences.pdf

Top High Impact Big Data Use Cases in Financial Services

11

L EA R N M OR E

To learn more about big data analytics, visit

www.datameer.com

Download Free Trial at

www.datameer.com/Datameer-trial.html

San Francisco

New York

Halle

1550 Bryant Street, Suite 490

San Francisco, CA 94103 USA

Tel: +1 415 817 9558

Fax: +1 415 814 1243

9 East 19th Street, 5th floor

New York, NY 10003 USA

Tel: +1 646 586 5526

Datameer GmbH

Groe Ulrichstrae 7 - 9

06108 Halle (Saale), Germany

Tel: +49 345 279 5030

Website

Twitter

www.datameer.com

@Datameer

Download free trial at

datameer.com/Datameer-trial.html

2014 Datameer, Inc. All rights reserved. Datameer is a trademark of Datameer, Inc. Hadoop and the Hadoop elephant logo are trademarks of the Apache

Software Foundation. Other names may be trademarks of their respective owners.

You might also like

- IBM PCTY 13 April Dan Tabor How To Deliver Measurable Business Value With The Enterprise CMDBDocument16 pagesIBM PCTY 13 April Dan Tabor How To Deliver Measurable Business Value With The Enterprise CMDBkumar_007111No ratings yet

- Everything As A Service - Cloud ComputingDocument26 pagesEverything As A Service - Cloud Computingkumar_007111No ratings yet

- AWS Well-Architected FrameworkDocument86 pagesAWS Well-Architected FrameworkPoss2019No ratings yet

- Qi Monetizing Digital ServicesDocument22 pagesQi Monetizing Digital Serviceskumar_007111No ratings yet

- BAIN BRIEF The Cloud Reshapes The Business of Software PDFDocument8 pagesBAIN BRIEF The Cloud Reshapes The Business of Software PDFkumar_007111No ratings yet

- Everything As A Service - Cloud ComputingDocument26 pagesEverything As A Service - Cloud Computingkumar_007111No ratings yet

- E-Book The Digitization of EverythingDocument22 pagesE-Book The Digitization of Everythingkumar_007111No ratings yet

- Mckinsey & Co. Managing Knowledge and LearningDocument15 pagesMckinsey & Co. Managing Knowledge and LearningVibhorSrivastava100% (1)

- Kings of The CloudDocument8 pagesKings of The Cloudkumar_007111No ratings yet

- Principles of The A Good SalesmanDocument2 pagesPrinciples of The A Good SalesmanJemeia Mae Eslabon100% (1)

- Financial InsitutionsDocument30 pagesFinancial Insitutionskumar_007111No ratings yet

- CSM Content Outline Learning ObjectivesDocument9 pagesCSM Content Outline Learning ObjectivesnayarismaelNo ratings yet

- Datacenter Network AutomatationDocument5 pagesDatacenter Network Automatationkumar_007111No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FLI 2010 Annual Report Provides Details on Festival Supermall, PBCom Tower, and Northgate CyberzoneDocument129 pagesFLI 2010 Annual Report Provides Details on Festival Supermall, PBCom Tower, and Northgate Cyberzonechloe_lopezNo ratings yet

- WI-1231373 QEL03 Audit Plan Letter CobrandDocument4 pagesWI-1231373 QEL03 Audit Plan Letter Cobrandjohn jNo ratings yet

- How Thought Leadership Drives Demand Generation: 2019 Edelman-Linkedin B2B Thought Leadership Impact StudyDocument27 pagesHow Thought Leadership Drives Demand Generation: 2019 Edelman-Linkedin B2B Thought Leadership Impact StudyDiego TellezNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- IBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleDocument2 pagesIBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleIBMTransportationNo ratings yet

- SKF Group10Document21 pagesSKF Group10Shashikumar UdupaNo ratings yet

- Food Bill 21-07-23Document2 pagesFood Bill 21-07-23ankit goenkaNo ratings yet

- Somera ProjMgtExer3Document2 pagesSomera ProjMgtExer3john johnNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- Course: Leading Change For Sustainable Futures Case Study: Electric Vehicles in India Project Submission Template Student Name (Full Name)Document15 pagesCourse: Leading Change For Sustainable Futures Case Study: Electric Vehicles in India Project Submission Template Student Name (Full Name)anju antonyNo ratings yet

- Sample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyDocument33 pagesSample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyPrathamesh ChawanNo ratings yet

- Technical Delivery Manager IT EDM 040813Document2 pagesTechnical Delivery Manager IT EDM 040813Jagadish GaglaniNo ratings yet

- Assignment On Mid-Term ExamDocument12 pagesAssignment On Mid-Term ExamTwasin WaresNo ratings yet

- Emergency Preparedness & Business ContinuityDocument28 pagesEmergency Preparedness & Business ContinuityMuhammad IshaqNo ratings yet

- Apparel Merchandising - Types of BuyersDocument24 pagesApparel Merchandising - Types of BuyersNithyaprakashNo ratings yet

- Demantra and ASCP Presentation PDFDocument54 pagesDemantra and ASCP Presentation PDFvenvimal1No ratings yet

- Supply Chain Management Part 1 Lecture OutlineDocument17 pagesSupply Chain Management Part 1 Lecture OutlineEmmanuel Cocou kounouhoNo ratings yet

- Security AdministrationDocument24 pagesSecurity AdministrationShame BopeNo ratings yet

- CPA licensure exam syllabus management accountingDocument3 pagesCPA licensure exam syllabus management accountingLouie de la TorreNo ratings yet

- GROSS INCOME and DEDUCTIONSDocument10 pagesGROSS INCOME and DEDUCTIONSMHERITZ LYN LIM MAYOLANo ratings yet

- Organisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaDocument62 pagesOrganisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaSasikumar R Nair79% (19)

- The Impact of Effective Public Relations On Organizational Performance in Micmakin Nigeria LimitedDocument8 pagesThe Impact of Effective Public Relations On Organizational Performance in Micmakin Nigeria LimitedBajegbo OluwadamilareNo ratings yet

- Co OperativeSocietiesAct12of1997Document49 pagesCo OperativeSocietiesAct12of1997opulitheNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Foreign Capital As A Source of FinanaceDocument8 pagesForeign Capital As A Source of FinanaceD KNo ratings yet

- Week 6-7 Let's Analyze Acc213Document5 pagesWeek 6-7 Let's Analyze Acc213Swetzi CzeshNo ratings yet

- BP Steve FlynnDocument11 pagesBP Steve Flynngeorgel.ghitaNo ratings yet

- Case Study BookDocument106 pagesCase Study BookshubhaomNo ratings yet

- Open Cut Coal XpacDocument4 pagesOpen Cut Coal XpacAlessandro SignoriNo ratings yet

- Chithambara College Past Students Association AccountsDocument61 pagesChithambara College Past Students Association Accountsapi-140426513No ratings yet