Professional Documents

Culture Documents

Genghis Capital Daily Fixed Income & Money Market Update - 24th November 2014

Uploaded by

PhilipGandleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Genghis Capital Daily Fixed Income & Money Market Update - 24th November 2014

Uploaded by

PhilipGandleCopyright:

Available Formats

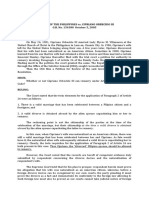

Daily Fixed Income & Money Market Update 24th November 2014

Secondary Market Activity

27 Jul 14

26 Aug 14

25 Sep 14

25 Oct 14

Volumes

Source: NSE,Genghis Research

*Derived from market demand and supply

Source: CBK,Genghis Research

9.21%

125.69%

10.21%

120.78%

5-Nov -14

2-Jul-14

23-Jul-14

11-Jun-14

source: Bloomberg, Genghis Research

90.18

89

88

87

86

85

84

Disclaimer: The content provided on this document is provided as general information and does not constitute advice or recommendation by Genghis Capital Ltd and should not be relied upon for investment

decisions or any other matter and that this document does not constitute a distribution recommending the purchase or sale of any security or portfolio. Please note that past performance is no indication of

future results. The ideas expressed in the document are solely the opinions of the author at the time of publication and are subject to change without notice. Although the author has made every effort to

provide accurate information at the date of publication all information available in this report is provided without any express or implied warranty of any kind as to its correctness. You should consult your own

independent financial adviser to obtain professional advice before exercising any decisions based on the information present in this document. Any action that you take as a result of this information, analysis,

or advertisement is ultimately your responsibility.

Nov-14

83

Oct-14

Source: globalrates.com

USD/KES Exchange Rate

90

Oct-14

0.55%

0.05%

8.50%

91

0.23%

0.56%

0.05%

Oct-14

UK BoE Rate

EU ECB Rate

Kenya CBK Rate

US Libor

Euribor

UK Libor

Sep-14

LIBOR Rates

0.25%

Sep-14

Global Benchmark Rates

US Fed Rate

Source: FED, BoE, ECB, CBK

21-May-14

th

9-Apr-14

11.92%

12.15%

12.66%

27 November 20143 - KES 3.0 Bn 91-day T-bills

30-Apr-14

11.81%

12.23%

12.71%

123

118

113

108

103

98

93

11-Sep-13

31st October

10.50%

11.00%

Tomorrow - KES 4.0 Bn 182-day T-bills & KES 5.0 Bn

364-day T-bills.

Aug-14

10-Year

15-Year

20-Year

24th October

10.55%

10.95%

21-Aug-13

Benchmark Rates

9.20%

28.81%

10.24%

81.96%

FTSE NSE Government Bond Perfomance Index Performance:

+15.22% (LTM) +15.49% (YTD)

Source: CBK,Genghis Research

Tenor

2-Year

5-Year

Prev. Auction

8.70%

370.58%

Source: CBK,Genghis Research

Up-coming Auctions:

19-Mar-14

5-Feb-14

26-Feb-14

5.00

Subscription

364-Day

Subscription

Sep-14

Term Deposits

Volumes (KES Billions)

182-Day

15-Jan-14

14.28

4-Dec-13

6.88%

11.97

25-Dec-13

6.75%

Volumes (KES Billions)

Repo Rate

Volumes (KES Billions)

Latest Auction

8.60%

150.10%

91-Day

Subscription

13-Nov-13

Interbank Rate

Money Market: The monetary regulator offered KES 5

billion worth REPOs and TADs yesterday in order to mop

up excess liquidity as the USD/KES exchange slipped to a

low of 90.18 (12:30pm GMT) following fresh militant

attacks over the weekend.

2-Oct-13

24th November

-

Sep-14

21st November

-

Overnight Window

Volumes (KES Billions)

Prime Rates

Prime Rates

23-Oct-13

Money Market News

Interbank

15-Oct-14

Avg. Traded Yields

12.11%

10.98%

35000

30000

25000

20000

15000

10000

5000

0

24 Nov 14

3-Sep-14

Volumes

300,000,000

414,500,000

16%

14%

12%

10%

8%

6%

4%

2%

0%

27 Jun 14

24-Sep-14

24th November

749,500,000

Oct-14

24th November

Highest traded bonds

FXD 1/2014/10Yr

IFB 1/2014/12Yr

21st November

2,452,800,000

13-Aug-14

Bond turnover

Money Market Activity

Secondary Market: Bond trading in the secondary market

remained somber at the start of the trading week as

LIBORby

Rates

turnover contracted

69% to KES 749.5 million from

Fridays KES 2.45 billion. The dip may be owed to the

ongoing African Securities Exchanges Association (ASEA)

conference which has shifted investor focus temporarily.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- I. Performance Rating Scale: 5 4 3 2 1 Quality of WorkDocument7 pagesI. Performance Rating Scale: 5 4 3 2 1 Quality of WorkPhilipGandleNo ratings yet

- Selection Criteria TemplateDocument1 pageSelection Criteria TemplatePhilipGandleNo ratings yet

- Probationary ReviewDocument3 pagesProbationary ReviewPhilipGandle100% (2)

- Plan Purchase Summary: Purchasing Your Plans..Document1 pagePlan Purchase Summary: Purchasing Your Plans..PhilipGandleNo ratings yet

- Genghis Capital - Daily Market Report - 4th November 2014Document7 pagesGenghis Capital - Daily Market Report - 4th November 2014PhilipGandleNo ratings yet

- 3 MFUStaffIncenUserGuideDocument6 pages3 MFUStaffIncenUserGuidePhilipGandleNo ratings yet

- Mergetool Brochure v1 5Document2 pagesMergetool Brochure v1 5PhilipGandleNo ratings yet

- A Remittance Is Money Sent by A Person in A Foreign Land To His or Her Home CountryDocument3 pagesA Remittance Is Money Sent by A Person in A Foreign Land To His or Her Home CountryPhilipGandleNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Longman Communication 3000Document37 pagesLongman Communication 3000irfanece100% (5)

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Bhagavad Gita Ch.1 Shlok 4++Document1 pageBhagavad Gita Ch.1 Shlok 4++goldenlion1No ratings yet

- ComeniusDocument38 pagesComeniusDora ElenaNo ratings yet

- Cinderella: From The Blue Fairy Book of Andrew LangDocument7 pagesCinderella: From The Blue Fairy Book of Andrew LangnizamianNo ratings yet

- "The Grace Period Has Ended": An Approach To Operationalize GDPR RequirementsDocument11 pages"The Grace Period Has Ended": An Approach To Operationalize GDPR RequirementsDriff SedikNo ratings yet

- Prof Chase B. Wrenn - The True and The Good - A Strong Virtue Theory of The Value of Truth-Oxford University Press (2024)Document196 pagesProf Chase B. Wrenn - The True and The Good - A Strong Virtue Theory of The Value of Truth-Oxford University Press (2024)Mihaela DodiNo ratings yet

- Task 12 - Pages 131-132 and Task 13 - Pages 147-148 (Bsma 2c - Zion R. Desamero)Document2 pagesTask 12 - Pages 131-132 and Task 13 - Pages 147-148 (Bsma 2c - Zion R. Desamero)Zion EliNo ratings yet

- Position Paper On Sexual Orientation, Gender Identity and Expression (SOGIE)Document3 pagesPosition Paper On Sexual Orientation, Gender Identity and Expression (SOGIE)SYDNEY MARASIGANNo ratings yet

- Articol de CercetareDocument3 pagesArticol de CercetareLuiza Carmen PîrvulescuNo ratings yet

- Trust Is The Coin of The Realm by George P. ShultzDocument13 pagesTrust Is The Coin of The Realm by George P. ShultzHoover Institution100% (2)

- CMAR Vs DBBDocument3 pagesCMAR Vs DBBIbrahim BashaNo ratings yet

- Compilation 2Document28 pagesCompilation 2Smit KhambholjaNo ratings yet

- TARA FrameworkDocument2 pagesTARA Frameworkdominic100% (1)

- Sanjay Seth - Once Was Blind But Now Can See Modernity and The Social SciencesDocument16 pagesSanjay Seth - Once Was Blind But Now Can See Modernity and The Social SciencesQuelen GuedesNo ratings yet

- HaDocument15 pagesHaNicole Easther GabilangosoNo ratings yet

- Who Di 31-4 Atc-DddDocument6 pagesWho Di 31-4 Atc-DddHenderika Lado MauNo ratings yet

- Project BBADocument77 pagesProject BBAShivamNo ratings yet

- Calderon de La Barca - Life Is A DreamDocument121 pagesCalderon de La Barca - Life Is A DreamAlexandra PopoviciNo ratings yet

- Fairy Rebel PDFDocument2 pagesFairy Rebel PDFSamuel0% (1)

- Spotify Strategig Possining and Product Life Cycle Four Basic Stages.Document5 pagesSpotify Strategig Possining and Product Life Cycle Four Basic Stages.Jorge YeshayahuNo ratings yet

- People vs. Orbecido Iii Case DigestDocument2 pagesPeople vs. Orbecido Iii Case DigestCristine LabutinNo ratings yet

- The Holy See: Benedict XviDocument4 pagesThe Holy See: Benedict XviAbel AtwiineNo ratings yet

- Whats New PDFDocument74 pagesWhats New PDFDe Raghu Veer KNo ratings yet

- I. Inversion: Grammar: Expressing EmphasisDocument7 pagesI. Inversion: Grammar: Expressing EmphasisSarah BenraghayNo ratings yet

- Bca NotesDocument3 pagesBca NotesYogesh Gupta50% (2)

- Fanuc 10t Parameter Manual PDFDocument1 pageFanuc 10t Parameter Manual PDFadil soukri0% (2)

- A Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalDocument6 pagesA Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalJoko Cahyo BaskoroNo ratings yet

- Draft Cavite MutinyDocument1 pageDraft Cavite MutinyaminoacidNo ratings yet

- The University of Southern Mindanao VisionDocument9 pagesThe University of Southern Mindanao VisionNorhainie GuimbalananNo ratings yet