Professional Documents

Culture Documents

Chapter 48 P.L. 1999

Uploaded by

RCCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

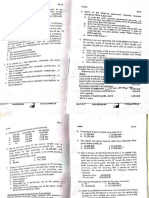

Chapter 48 P.L. 1999

Uploaded by

RCCopyright:

Available Formats

HR-0426-0610

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

DIVISION OF PENSIONS AND BENEFITS

STATE HEALTH BENEFITS PROGRAM

SCHOOL EMPLOYEES HEALTH BENEFITS PROGRAM

PO BOX 299

TRENTON, NEW JERSEY

08625-0299

CHAPTER 48, P.L. 1999

SHBP/SEHBP PARTICIPATING EMPLOYER PAYMENT

OF POST-RETIREMENT MEDICAL COSTS

Chapter 48, P.L. 1999, provides eligible participating local employers* considerable flexibility in

managing their post-retirement medical costs. It also brings State Health Benefits Program

(SHBP) and School Employees Health Benefits Program (SEHBP) eligibility standards for

employer-paid coverage into alignment with local government laws.

Chapter 48, P.L. 1999, essentially does the following:

(1)

It gives eligible employers greater flexibility in defining which employees qualify for

post-retirement medical benefits.

(2)

It allows an eligible local employer to negotiate payment obligations for post-retirement medical coverage.

It is important to note that Chapter 48, P.L. 1999 applies only to post-retirement

medical coverage. It does not allow the SHBP or SEHBP participating employer to

negotiate payment obligations for coverage of its active employees.

A Resolution form is provided in this packet, should your location be interested in adopting the provisions

of Chapter 48, P.L. 1999. Both the Resolution and Resolution Addendum must be completed and submitted to the Health Benefits Bureau of the Division of Pensions and Benefits in order to take advantage

of the provisions of this law. Additionally, copies of all applicable contracts, ordinances, and resolutions

requiring or authorizing post-retirement medical payments must be submitted with the Resolution.

To submit your Resolution, you must enter the name of the employer, the county, the employers

SHBP/SEHBP identification number, the month and year the Resolution will be effective, and the identifying information requested on the bottom of the form. You must also complete the attached Resolution

Addendum (instructions are on the reverse side of the addendum).

Mail the Resolution, the Resolution Addendum, and copies of all applicable contracts, ordinances, and resolutions requiring or authorizing post-retirement medical payments to the Health

Benefits Bureau, Division of Pensions and Benefits, PO Box 299, Trenton, NJ 08625-0299.

If you have any further questions concerning this resolution, you may write to us at the address shown

above or send e-mail to: pensions.nj@treas.state.nj.us Please be sure to include your name, telephone

number, e-mail address, employing location, and your specific question in the corespondence.

*The State, State colleges and universities, State agencies and authorities, the Palisades Interstate Park

Commission, and the New Jersey Commerce and Economic Growth Commission are not eligible.

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

HR-0426-0610

DIVISION OF PENSIONS AND BENEFITS

STATE HEALTH BENEFITS PROGRAM

SCHOOL EMPLOYEES HEALTH BENEFITS PROGRAM

PO BOX 299

TRENTON, NEW JERSEY

08625-0299

RESOLUTION

A RESOLUTION to adopt the provisions of Chapter 48 (N.J.S.A. 52:14.17.38) under which a public

employer may agree to pay for the State Health Benefits Program (SHBP) and/or School Employees

Health Benefits Program (SEHBP) coverage of certain retirees.

BE IT RESOLVED:

1. The ______________________________________________________ ____________________

CORPORATE NAME OF EMPLOYER - COUNTY

SHBP/SEHBP ID NUMBER

hereby elects to adopt the provisions of N.J.S.A. 52:14-17.38 and adhere to the rules and regulations

promulgated by the State Health Benefits Commission and School Employees Health Benefits

Commission to implement the provisions of that law.

2. This resolution affects employees as shown on the attached Chapter 48 Resolution Addendum.

It is effective on the 1st day of __________________________ , ____________.

MONTH

YEAR

3. We are aware that adoption of this resolution does not free us of the obligation to pay for post-retirement medical benefits of retirees or employees who qualified for those payments under any Chapter

88 Resolution or Chapter 48 Resolution adopted previously by this governing body.

4. We agree that this Resolution will remain in effect until properly amended or revoked with the SHBP

and/or SEHBP. We recognize that, while we remain in the SHBP and/or SEHBP, we are responsible

for providing the payment for post-retirement medical coverage as listed in the attached Chapter 48

Resolution Addendum for all employees who qualify for this coverage while this Resolution is in

force.

5. We understand that we are required to provide the Division of Pensions and Benefits complete

copies of all contracts, ordinances, and resolutions that detail post-retirement medical payment obligations we undertake. We also recognize that we may be required to provide the Division with information needed to carry out the terms of this Resolution.

I hereby certify that the foregoing is a true and

correct copy of a resolution duly adopted by the

________________________________________

______________________________________

CORPORATE NAME OF EMPLOYER

ADDRESS

on the ______ day of _______________ , 20____

______________________________________

________________________________________

______________________________________

SIGNATURE

________________________________________

OFFICIAL TITLE

CITY

STATE

ZIP CODE

______________________________________

AREA CODE

TELEPHONE NUMBER

HR-0426-0610

DIVISION OF PENSIONS AND BENEFITS

STATE HEALTH BENEFITS PROGRAM SCHOOL EMPLOYEES HEALTH BENEFITS PROGRAM

RESOLUTION ADDENDUM CHAPTER 48, P.L. 1999

Please read instructions on reverse side BEFORE completing this form.

Effective date of Resolution

1,

MONTH

Form to be used for : Medical

Dental

BOTH

CHECK APPROPRIATE BOX

YEAR

Employer Name

Premium

Payment

Surviving

Spouses

If Y

Sho es

w%

Do Benefits

Apply To

Current

Retiree's

No

If Y

Sho es

w%

No

If Ye

Sho s,

w%

or individual(s)

No

unit (PBA,CWA), nonaligned,

Medicare

Reimbursement

Premium

Payment

Dependents

If Ye

Sho s,

w%

clerical workers, bargaining

Premium

Payment

Retiree's

No

Examples: police officers,

N.J.S.A. 52:14-17.38 Provisions Adopted

1) R

etir

Disa ed on a

bility

Pen

sion

2) R

etire

d

w

year

s of /25 or +

serv

ice

2a)

Num

ber

serv

ice w years

/em

3) R

ploy

er

etire

w/25 d age

year 65 +

s se

rvice

3a)

Num

ber

serv

y

ice w ears

/em

4) R

ploy

etir

er

w/15 ed 62 o

r

y

o

e

l

d

a

serv

e

ice w rs or mo r

r

/em

ploy e

er

If Ye

Sho s,

w%

CLASS OF EMPLOYEES

If Be

to C nefits d

o

u

Effe rrent R not Ap

ctive

ply

et

Date iree's G

ive

CORPORATE NAME OF EMPLOYER, COUNTY, SHBP/SEHBP IDENTIFICATION NUMBER

NOTE: An age requirement is not permitted on option 1, or 2, option 3 and 4 already have an age requirement.

DATE RESOLUTION SUBMITTED

NAME OF CERTIFYING OFFICER

AREA CODE AND PHONE NUMBER

HR-0426-0610

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

DIVISION OF PENSIONS AND BENEFITS

STATE HEALTH BENEFITS PROGRAM

SCHOOL EMPLOYEES HEALTH BENEFITS PROGRAM

PO BOX 299

TRENTON, NEW JERSEY

08625-0299

RESOLUTION ADDENDUM INSTRUCTIONS

You must complete the Resolution Addendum along with the Resolution to adopt the provisions of

Chapter 48, P.L. 1999. The following information is requested on the Resolution Addendum:

1.

Enter the month and year the Resolution will become effective (must agree with the month and year

shown on the Resolution).

2.

Check appropriate box indicating the coverage(s) that form is being used for. (medical, dental,both).

3.

Enter the corporate name of the employer, the county, and the employers SHBP or SEHBP

Identification Number.

4.

Enter the following information in the corresponding columns:

Class of Employees (i.e., police officers, clerical workers, bargaining unit (i.e., PBA, CWA),

Nonaligned, Individual(s), etc.

Explanation of N.J.S.A. 52:14-17.38 Provisions:

1 = Retired on a disability pension;

2 = Retired with 25 or more years of service

2a = Number of years of service with the employer not greater than 25 years;

3 = Retired upon or after the age of 65 or older with 25 years of service.

3a = Number of years of service with the employer not greater than 25 years;

4 = Retired upon or after the age of 62 with 15 or more years of service with the employer.

NOTE: If no minimum years of service are required please indicate with an N/A in appropriate box.

NOTE: An age requirement in not permitted under provisions 1 or 2, provisions 3 and 4 already have

an age requirement.

5.

Check Yes or No to indicate if the employees are:

Premium Payment Retiree's;

Premium Payment Dependents;

Medicare Reimbursement;

Premium Payment Surviving Spouses;

If Benefits apply to current Retirees;

If Benefits do not apply to current Retirees give effective date

For items that are answered Yes, indicate % the employer is paying 0% to 100%).

6.

Enter the date on which the Resolution is being submitted, the name and phone number of the

Certifying Officer, and name and address of the adopting employer.

7.

Attach copies of all applicable contracts, ordinances, and resolutions requiring or authorizing postretirement medical payments.

You might also like

- Sedgwick Logo - Certification of Health Care Provider For Family Member's Serious Health Condition (FMLA)Document4 pagesSedgwick Logo - Certification of Health Care Provider For Family Member's Serious Health Condition (FMLA)teamirNo ratings yet

- Test Bank For Biology 7th Edition Neil A CampbellDocument36 pagesTest Bank For Biology 7th Edition Neil A Campbellpoupetonlerneanoiv0ob100% (31)

- 1010EZ FillableDocument5 pages1010EZ FillableFilozófus ÖnjelöltNo ratings yet

- Edi FormDocument2 pagesEdi Formapi-240084111No ratings yet

- Lodi Superintendent of Schools Contract 2017-2022Document24 pagesLodi Superintendent of Schools Contract 2017-2022RCNo ratings yet

- The Apollo Parachute Landing SystemDocument28 pagesThe Apollo Parachute Landing SystemBob Andrepont100% (2)

- Official Seal or Stamp of Service/Employing Agency (If None, ADocument2 pagesOfficial Seal or Stamp of Service/Employing Agency (If None, Aมดน้อย ผู้น่ารักNo ratings yet

- Voluntary SssDocument5 pagesVoluntary SssRaissa Anjela Carman-JardenicoNo ratings yet

- Texas Employees Group Benefits Program (GBP) Supplemental Information Form For EmployeesDocument2 pagesTexas Employees Group Benefits Program (GBP) Supplemental Information Form For EmployeesBhargav Teja NukalaNo ratings yet

- ESISDocument28 pagesESISDhananjaySalgaonkarNo ratings yet

- Sample Evergreen Open Enrollment Notice.04!03!2018Document2 pagesSample Evergreen Open Enrollment Notice.04!03!2018Xiao ZhanNo ratings yet

- Employers Guide CurrentDocument62 pagesEmployers Guide Currentglamom100% (3)

- Doctor Statement Ssa 787Document3 pagesDoctor Statement Ssa 787Richard GuthNo ratings yet

- The Employees State Insurance Act, 1948Document30 pagesThe Employees State Insurance Act, 1948Yogesh ChaudhariNo ratings yet

- Instructions For Completing Enrollment Application For Health BenefitsDocument5 pagesInstructions For Completing Enrollment Application For Health BenefitsDonna Mae RafolNo ratings yet

- Employee Handbook: Home To Office Cleaning, LLCDocument12 pagesEmployee Handbook: Home To Office Cleaning, LLCAntwain Utley100% (1)

- SSS LawDocument13 pagesSSS LawDanny LabordoNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Assurant Health Access: in Force Underwriting Change PacketDocument10 pagesAssurant Health Access: in Force Underwriting Change PacketSwisskelly1No ratings yet

- Medical Coverage PlanDocument30 pagesMedical Coverage PlanjnaguNo ratings yet

- Claim FormDocument3 pagesClaim FormInvestor ProtegeNo ratings yet

- APRNDocument6 pagesAPRNAnjali NaudiyalNo ratings yet

- Seattle PaidSick Safe Days Ordinance Summary Provisions 102711Document2 pagesSeattle PaidSick Safe Days Ordinance Summary Provisions 102711SeaLinc2No ratings yet

- Quickbooks Payroll Qs Section 3Document7 pagesQuickbooks Payroll Qs Section 3Noorullah0% (1)

- Health Statement Form PDFDocument1 pageHealth Statement Form PDFAnonymous H1lWZBPQGzNo ratings yet

- The Employees State Insurance Act, 1948Document24 pagesThe Employees State Insurance Act, 1948Pawan KumarNo ratings yet

- CPS Benefits Guide 2014Document29 pagesCPS Benefits Guide 2014Brandon ChavezzNo ratings yet

- EPFO - MiscDocument20 pagesEPFO - MiscJc Duke M EliyasarNo ratings yet

- Salary and BenefitsDocument10 pagesSalary and BenefitsMiguel Valdivia RosasNo ratings yet

- Fillable How To Check Payslips Online As Fidelity Security Worker FormDocument20 pagesFillable How To Check Payslips Online As Fidelity Security Worker FormBang YehNo ratings yet

- Membership Update FormDocument4 pagesMembership Update FormbmapiraNo ratings yet

- PA Infotypes: Infotype Code DescriptionDocument12 pagesPA Infotypes: Infotype Code DescriptionKukuku76No ratings yet

- Application For Provident BenefitDocument2 pagesApplication For Provident BenefitcaesarbaNo ratings yet

- Salary and Medal New Form2Document3 pagesSalary and Medal New Form2diamajolu gaygons100% (1)

- TPD ApplicationDocument7 pagesTPD ApplicationAyman HawariNo ratings yet

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationFrom EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNo ratings yet

- Know Your Retirement BookletDocument21 pagesKnow Your Retirement BookletPushparajan GunasekaranNo ratings yet

- Phased Retirement FAQsDocument5 pagesPhased Retirement FAQsFedSmith Inc.No ratings yet

- Member Enrollment FormDocument3 pagesMember Enrollment FormVishnu Dev DeeviNo ratings yet

- Research Paper On New Pension SchemeDocument5 pagesResearch Paper On New Pension Schemehozul1vohih3100% (1)

- Assignment in Agri LawDocument21 pagesAssignment in Agri LawjulesyvesNo ratings yet

- Employer Employee RequirementsDocument5 pagesEmployer Employee Requirementskevior2No ratings yet

- V:Philippine Health Insurance Corporation: Remittances of Philhealth Premium ContributionsDocument3 pagesV:Philippine Health Insurance Corporation: Remittances of Philhealth Premium ContributionspogirtNo ratings yet

- UFCW Local 1262 - Redacted Bates HWDocument13 pagesUFCW Local 1262 - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Health Care Provider ReportDocument2 pagesHealth Care Provider ReportsiskjereNo ratings yet

- IF10483Document3 pagesIF10483chichponkli24No ratings yet

- Safeguarding Pensioners' RightsDocument6 pagesSafeguarding Pensioners' RightsegahmuliaNo ratings yet

- Frequently Asked Questions and Answers About Vermont'S "Earned Sick Time Law,"Document6 pagesFrequently Asked Questions and Answers About Vermont'S "Earned Sick Time Law,"Will PearsallNo ratings yet

- Retirement PserDocument60 pagesRetirement PsershuxuelaoshiNo ratings yet

- Chapter 1 HomeworkDocument3 pagesChapter 1 Homeworkdustintaylor67467No ratings yet

- Separation Notice: (Mm/dd/yy) (Mm/dd/yy)Document2 pagesSeparation Notice: (Mm/dd/yy) (Mm/dd/yy)batambintanNo ratings yet

- G 740sDocument2 pagesG 740sapi-167123914No ratings yet

- 6065 Hca DL Ip1 Gen PKT PDFDocument17 pages6065 Hca DL Ip1 Gen PKT PDFAlayssia CanoraNo ratings yet

- Who Are Covered Under The Social Security System?Document6 pagesWho Are Covered Under The Social Security System?Mervic Al Tuble-NialaNo ratings yet

- KKHJGHFDocument26 pagesKKHJGHFTasnim AmaniNo ratings yet

- Employee Handbook June 2008mlDocument17 pagesEmployee Handbook June 2008mlCari JenkinsNo ratings yet

- Tufts Enrollment FormDocument2 pagesTufts Enrollment FormgeorgeNo ratings yet

- Vha 10 10ezr FillDocument4 pagesVha 10 10ezr Fillcicin8190No ratings yet

- Kertas Kerja PinjamanDocument18 pagesKertas Kerja PinjamanWan AzmanNo ratings yet

- Application For Membership Form: Application No.: Effectivity Date: Contract No.Document2 pagesApplication For Membership Form: Application No.: Effectivity Date: Contract No.Lizeth QuerubinNo ratings yet

- Letter To Pontiac Nursing HomeDocument7 pagesLetter To Pontiac Nursing HomeJames MulderNo ratings yet

- Lodi LedgerDocument4 pagesLodi LedgerRCNo ratings yet

- Kwapniewski/Oxfeld Response To Frivolous FilingDocument6 pagesKwapniewski/Oxfeld Response To Frivolous FilingRCNo ratings yet

- 2018-19 School BudgetDocument53 pages2018-19 School BudgetRCNo ratings yet

- "Sidebar Agreement" - February 25, 2015Document2 pages"Sidebar Agreement" - February 25, 2015RCNo ratings yet

- Lodi Public Schools - Legal Services ReviewDocument4 pagesLodi Public Schools - Legal Services ReviewRCNo ratings yet

- BOE Addendum: September 13, 2017Document16 pagesBOE Addendum: September 13, 2017RCNo ratings yet

- BOE Agenda: September 13, 2017Document3 pagesBOE Agenda: September 13, 2017RCNo ratings yet

- July 25 2017 MinutesDocument4 pagesJuly 25 2017 MinutesRCNo ratings yet

- August Bills 2017 (Borough)Document33 pagesAugust Bills 2017 (Borough)RCNo ratings yet

- Addendum - Superintendent's Report (August 29th)Document2 pagesAddendum - Superintendent's Report (August 29th)RCNo ratings yet

- Lodi Public Schools - Legal Services ReviewDocument4 pagesLodi Public Schools - Legal Services ReviewRCNo ratings yet

- Ethics Answer: Debra Kwapniewski V Ryan CurioniDocument10 pagesEthics Answer: Debra Kwapniewski V Ryan CurioniRCNo ratings yet

- Ciofalo's "Pitt Bull Secure Technologies"Document17 pagesCiofalo's "Pitt Bull Secure Technologies"RCNo ratings yet

- Lodi Board of Education BylawsDocument78 pagesLodi Board of Education BylawsRCNo ratings yet

- Email Between Dominic Miller & Anthony SciarrilloDocument21 pagesEmail Between Dominic Miller & Anthony SciarrilloRCNo ratings yet

- Cima's Email On BOE IssueDocument3 pagesCima's Email On BOE IssueRCNo ratings yet

- "Sarlo Resolutions" 183 Garibaldi AveDocument5 pages"Sarlo Resolutions" 183 Garibaldi AveRCNo ratings yet

- July Bills 2017Document55 pagesJuly Bills 2017RCNo ratings yet

- Licata Bamboo OrdinanceDocument2 pagesLicata Bamboo OrdinanceRCNo ratings yet

- Answer To Councilwoman Licata's Ethics ComplaintDocument15 pagesAnswer To Councilwoman Licata's Ethics ComplaintRCNo ratings yet

- November Ballot Question (Vincent Caruso & Alan Spiniello Letters)Document7 pagesNovember Ballot Question (Vincent Caruso & Alan Spiniello Letters)RCNo ratings yet

- "Building and Grounds" ContractDocument23 pages"Building and Grounds" ContractRCNo ratings yet

- Patricia Licata Ethics ComplaintDocument8 pagesPatricia Licata Ethics ComplaintRCNo ratings yet

- Board Attorney Contract - Alisa DichiaraDocument3 pagesBoard Attorney Contract - Alisa DichiaraRCNo ratings yet

- Answer To Dominic Miller's Ethics ComplaintDocument31 pagesAnswer To Dominic Miller's Ethics ComplaintRCNo ratings yet

- June 2016 Borough BillsDocument67 pagesJune 2016 Borough BillsRCNo ratings yet

- Answer To Ethics Complaint (Carafa, Miller, Nardino)Document4 pagesAnswer To Ethics Complaint (Carafa, Miller, Nardino)RC100% (1)

- Ethics Complaint Filed by Dominic MillerDocument25 pagesEthics Complaint Filed by Dominic MillerRCNo ratings yet

- Ethic Complaint Against Miller, Carafa, and NardinoDocument8 pagesEthic Complaint Against Miller, Carafa, and NardinoRCNo ratings yet

- Annex E - Part 1Document1 pageAnnex E - Part 1Khawar AliNo ratings yet

- PRTC Tax Final Preboard May 2018Document13 pagesPRTC Tax Final Preboard May 2018BonDocEldRicNo ratings yet

- Solution pdf-51Document68 pagesSolution pdf-51Tanmay GoyalNo ratings yet

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Document4 pagesAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfNo ratings yet

- Presentation2 Norman FosterDocument10 pagesPresentation2 Norman FosterAl JhanNo ratings yet

- Gonzales v. Court of Appeals, G.R. No. L-37453, (May 25, 1979), 179 PHIL 149-177)Document21 pagesGonzales v. Court of Appeals, G.R. No. L-37453, (May 25, 1979), 179 PHIL 149-177)yasuren2No ratings yet

- Products of Modern BiotechnologyDocument23 pagesProducts of Modern BiotechnologyZ M100% (1)

- Two Dimensional Flow of Water Through SoilDocument28 pagesTwo Dimensional Flow of Water Through SoilMinilik Tikur SewNo ratings yet

- 22 Habits of Unhappy PeopleDocument2 pages22 Habits of Unhappy PeopleKlEər OblimarNo ratings yet

- Silo - Tips - Datex Ohmeda S 5 Collect Users Reference ManualDocument103 pagesSilo - Tips - Datex Ohmeda S 5 Collect Users Reference Manualxiu buNo ratings yet

- Corporation True or FalseDocument2 pagesCorporation True or FalseAllyza Magtibay50% (2)

- Essential Real AnalysisDocument459 pagesEssential Real AnalysisPranay Goswami100% (2)

- IPASO1000 - Appendix - FW Download To Uncurrent SideDocument11 pagesIPASO1000 - Appendix - FW Download To Uncurrent SidesaidbitarNo ratings yet

- Dirac Equation Explained at A Very Elementary LevelDocument16 pagesDirac Equation Explained at A Very Elementary Levelsid_senadheera100% (2)

- Cookery Week 7 - 8 FinalDocument18 pagesCookery Week 7 - 8 FinalJay CachoNo ratings yet

- Skans Schools of Accountancy CAF-8: Product Units RsDocument2 pagesSkans Schools of Accountancy CAF-8: Product Units RsmaryNo ratings yet

- Specifications: Back2MaintableofcontentsDocument31 pagesSpecifications: Back2MaintableofcontentsRonal MoraNo ratings yet

- Aristotle Metaphysics Book V-Delta SachsDocument10 pagesAristotle Metaphysics Book V-Delta Sachsvmishka100% (1)

- Chapter One: China Civil Engineering Construction Coorperation (Ccecc) WasDocument24 pagesChapter One: China Civil Engineering Construction Coorperation (Ccecc) WasMoffat KangombeNo ratings yet

- Soal Passive VoiceDocument1 pageSoal Passive VoiceRonny RalinNo ratings yet

- CASE STUDY GGHDocument4 pagesCASE STUDY GGHSanthi PriyaNo ratings yet

- Ansr Definitionofex Gay PDFDocument10 pagesAnsr Definitionofex Gay PDFAlexandria Firdaus Al-farisyNo ratings yet

- Lesson10 Sacraments of InitiationDocument76 pagesLesson10 Sacraments of InitiationInsatiable CleeNo ratings yet

- Taxation During Commonwealth PeriodDocument18 pagesTaxation During Commonwealth PeriodLEIAN ROSE GAMBOA100% (2)

- Nursery Rhymes Flip ChartDocument23 pagesNursery Rhymes Flip ChartSilvana del Val90% (10)

- The Impact of Social Media: AbstractDocument7 pagesThe Impact of Social Media: AbstractIJSREDNo ratings yet

- X-by-Wire: Fred SeidelDocument9 pagesX-by-Wire: Fred SeidelHồng TháiNo ratings yet

- Rubrics For Movie AnalysisDocument1 pageRubrics For Movie AnalysisJnnYn PrettyNo ratings yet